Global Renewable Energy Certificate Market

Market Size in USD Billion

CAGR :

%

USD

30.70 Billion

USD

60.74 Billion

2025

2033

USD

30.70 Billion

USD

60.74 Billion

2025

2033

| 2026 –2033 | |

| USD 30.70 Billion | |

| USD 60.74 Billion | |

|

|

|

|

Renewable Energy Certificate Market Size

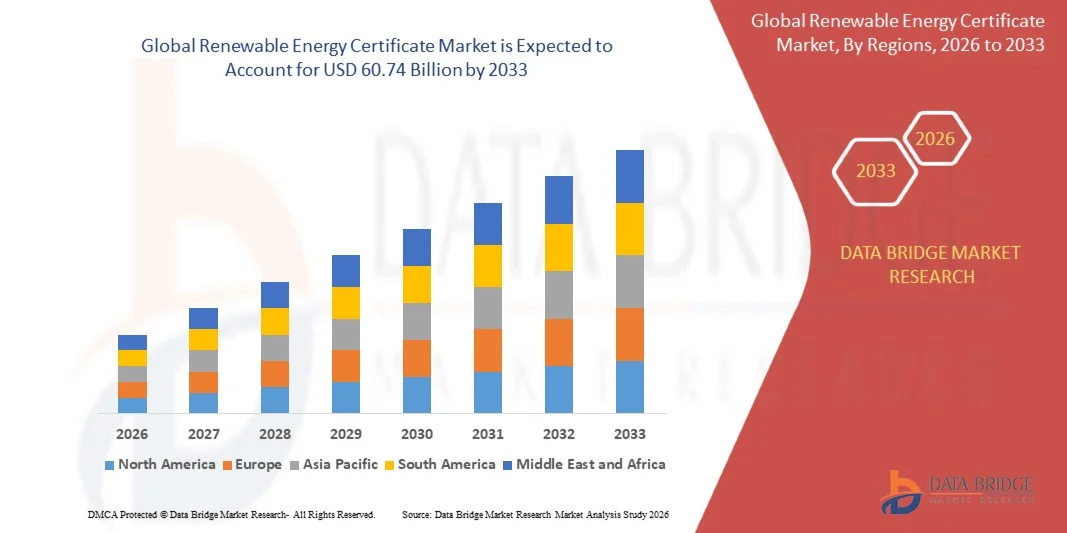

- The global Renewable Energy Certificate (REC) Market size was valued at USD 30.70 billion in 2025 and is projected to reach USD 60.74 billion by 2033, growing at a CAGR of 8.90% during the forecast period.

- The market growth is primarily driven by increasing investments in renewable energy projects and supportive government policies aimed at promoting sustainable energy generation across the globe.

- Additionally, rising corporate commitments toward achieving net-zero emissions and the growing preference for clean energy procurement by businesses and households are boosting demand for RECs, thereby propelling the market expansion during the forecast period.

Renewable Energy Certificate Market Analysis

- Renewable Energy Certificates (RECs), representing proof that electricity has been generated from renewable sources, are increasingly essential tools for corporations, utilities, and governments to meet sustainability targets and regulatory requirements, owing to their role in promoting clean energy adoption and reducing carbon footprints.

- The growing demand for RECs is primarily driven by stringent government regulations on renewable energy consumption, rising corporate commitments to net-zero goals, and an increasing focus on environmental, social, and governance (ESG) initiatives.

- North America dominated the Renewable Energy Certificate Market with the largest revenue share of 35.5% in 2025, supported by strong policy frameworks, early adoption of renewable energy, and significant corporate procurement of clean energy, with the U.S. leading in voluntary REC purchases and compliance-based transactions driven by state-level Renewable Portfolio Standards (RPS).

- Asia-Pacific is expected to be the fastest-growing region in the Renewable Energy Certificate Market during the forecast period due to rapid industrialization, increasing energy demand, and supportive renewable energy policies in countries like China and India.

- The Compliance REC segment dominated the market with the largest revenue share of 55.6% in 2025, driven by mandatory renewable energy targets imposed by governments and regulatory bodies across North America, Europe, and Asia-Pacific.

Report Scope and Renewable Energy Certificate Market Segmentation

|

Attributes |

Renewable Energy Certificate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Renewable Energy Certificate Market Trends

“Enhanced Market Accessibility Through Digital Platforms and Blockchain Integration”

- A significant and accelerating trend in the global Renewable Energy Certificate (REC) Market is the increasing integration of digital platforms and blockchain technology. This fusion of technologies is significantly enhancing transparency, traceability, and efficiency in REC transactions across both voluntary and compliance markets.

- For instance, several REC trading platforms now allow corporates and utilities to buy, sell, and retire certificates seamlessly online, providing real-time tracking of renewable energy generation and certificate issuance. Blockchain-based platforms, such as Energy Web and Power Ledger, ensure immutable records of RECs, reducing fraud and enhancing trust among market participants.

- Blockchain integration enables automated verification of renewable energy generation and certificate issuance, streamlining compliance with regulatory frameworks. Some platforms also provide smart contracts that automatically settle transactions when specific conditions are met, improving operational efficiency and reducing administrative costs.

- The seamless integration of RECs with digital trading platforms allows users to manage certificate portfolios, track carbon reduction targets, and demonstrate ESG compliance through a single interface. This unified approach facilitates easier adoption of renewable energy strategies and improves reporting accuracy for corporates and utilities.

- This trend towards more transparent, efficient, and digitally integrated REC markets is fundamentally reshaping expectations for renewable energy procurement. Consequently, companies such as Enel X and NextEra Energy are developing digital and blockchain-enabled REC solutions that provide real-time tracking, automated verification, and enhanced market accessibility.

- The demand for RECs supported by digital and blockchain technologies is growing rapidly across both developed and emerging markets, as stakeholders increasingly prioritize transparency, efficiency, and reliable reporting in their renewable energy initiatives.

Renewable Energy Certificate Market Dynamics

Driver

“Growing Need Due to Rising Corporate Sustainability Goals and Renewable Energy Mandates”

- The increasing focus on corporate sustainability goals, combined with stringent government mandates on renewable energy consumption, is a significant driver for the heightened demand for Renewable Energy Certificates (RECs).

- For instance, in 2025, several Fortune 500 companies, including Microsoft and Google, committed to sourcing 100% of their electricity from renewable energy, heavily relying on RECs to meet compliance and voluntary sustainability targets. Such initiatives by key market players are expected to drive REC market growth during the forecast period.

- As organizations and utilities become more accountable for their carbon footprints, RECs provide a verifiable mechanism to claim the use of renewable energy, offering a compelling solution for ESG reporting and regulatory compliance.

- Furthermore, the growing popularity of renewable energy procurement and corporate renewable power purchase agreements (PPAs) is making RECs an integral part of clean energy strategies, facilitating seamless integration with broader sustainability initiatives.

- The transparency, traceability, and ease of trading RECs through digital platforms enable companies to meet renewable energy commitments efficiently, while also supporting global carbon reduction efforts. The increasing availability of market-based solutions and simplified access to RECs further contributes to market growth.

Restraint/Challenge

“Concerns Regarding Market Standardization and Pricing Volatility”

- Concerns surrounding inconsistent market standards, verification procedures, and pricing volatility pose significant challenges to broader REC market adoption. As RECs are issued across different jurisdictions with varying rules, uncertainties can arise regarding certificate legitimacy and value.

- For instance, differences in compliance frameworks between regions such as North America, Europe, and Asia-Pacific have led some organizations to hesitate in purchasing RECs due to potential regulatory or reputational risks.

- Addressing these challenges through standardized certification protocols, transparent pricing mechanisms, and blockchain-enabled verification is crucial for building trust among market participants. Companies such as Enel X and NextEra Energy emphasize transparency and traceability in their REC offerings to reassure buyers. Additionally, fluctuations in REC prices, driven by changes in renewable energy generation, policy adjustments, or supply-demand imbalances, can act as a barrier to adoption for risk-averse organizations.

- While market mechanisms are gradually improving, perceived uncertainty and the potential for price volatility can hinder widespread adoption, particularly among smaller enterprises or budget-conscious buyers.

- Overcoming these challenges through global standardization, robust verification systems, and improved market transparency will be vital for sustained growth in the REC market.

Renewable Energy Certificate Market Scope

The market is segmented on the basis of type, Energy Source, end user, distribution channel.

• By Type

On the basis of type, the Renewable Energy Certificate Market is segmented into Compliance RECs and Voluntary RECs. The Compliance REC segment dominated the market with the largest revenue share of 55.6% in 2025, driven by mandatory renewable energy targets imposed by governments and regulatory bodies across North America, Europe, and Asia-Pacific. Compliance RECs are widely purchased by utilities and corporations to meet Renewable Portfolio Standards (RPS) and other statutory requirements, ensuring adherence to regional mandates for renewable energy consumption.

The Voluntary REC segment is expected to witness the fastest growth rate of 23.1% from 2026 to 2033, fueled by increasing corporate sustainability commitments, ESG initiatives, and growing awareness among individual consumers. Voluntary RECs allow organizations and households to procure renewable energy beyond regulatory obligations, creating a flexible and accessible pathway for achieving carbon neutrality and supporting clean energy generation.

• By Energy Source

On the basis of energy source, the Renewable Energy Certificate Market is segmented into Wind, Solar, Hydro, Biomass, and Geothermal. The Solar segment held the largest market revenue share of 43.2% in 2025, supported by the rapid adoption of solar photovoltaic projects globally, declining installation costs, and favorable government incentives. Solar RECs are highly traded due to the predictable output from solar plants and their compatibility with voluntary and compliance markets.

The Wind segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, driven by large-scale onshore and offshore wind projects, technological advancements in turbine efficiency, and supportive renewable energy policies in countries like the U.S., Germany, and China. Wind RECs are increasingly preferred by corporations seeking to diversify their renewable energy procurement and reduce carbon footprints.

• By End-User

On the basis of end-user, the Renewable Energy Certificate Market is segmented into Utilities, Corporations, Government & Municipalities, and Individuals. The Utilities segment dominated the market with the largest revenue share of 48.7% in 2025, driven by statutory renewable energy obligations, RPS compliance requirements, and the need to procure RECs for grid-level renewable energy accounting. Utilities purchase RECs in bulk to meet regulatory mandates and maintain sustainable energy portfolios.

The Corporations segment is expected to witness the fastest CAGR of 22.5% from 2026 to 2033, fueled by increasing voluntary procurement of RECs by companies to achieve net-zero goals, enhance ESG credibility, and support corporate renewable energy strategies. Corporations increasingly leverage RECs to demonstrate sustainability leadership and meet stakeholder expectations for clean energy usage.

• By Distribution Channel

On the basis of distribution channel, the Renewable Energy Certificate Market is segmented into Direct Purchase, REC Marketplaces, and Utility Programs. The Direct Purchase segment dominated the market with the largest revenue share of 51.3% in 2025, as corporates and utilities prefer purchasing RECs directly from renewable energy generators to secure certificates, ensure traceability, and negotiate pricing.

The REC Marketplaces segment is expected to witness the fastest CAGR of 24.0% from 2026 to 2033, driven by digital platforms enabling transparent, efficient, and automated trading of certificates. Marketplaces offer participants greater flexibility, access to multiple REC types, and real-time tracking of certificate ownership, making them increasingly attractive for both voluntary and compliance buyers.

Renewable Energy Certificate Market Regional Analysis

- North America dominated the Renewable Energy Certificate Market with the largest revenue share of 35.5% in 2025, driven by stringent renewable energy regulations, early adoption of clean energy initiatives, and high corporate sustainability commitments.

- Organizations and utilities in the region actively procure RECs to comply with state-level Renewable Portfolio Standards (RPS) and meet voluntary ESG targets, reflecting a strong preference for verified renewable energy solutions.

- This widespread adoption is further supported by robust renewable energy infrastructure, advanced market mechanisms for certificate trading, and high awareness among stakeholders regarding carbon footprint reduction. These factors establish North America as a key hub for both compliance and voluntary REC markets, facilitating steady growth across residential, commercial, and industrial end-users.

U.S. Renewable Energy Certificate Market Insight

The U.S. REC market captured the largest revenue share of 82% in North America in 2025, driven by stringent state-level Renewable Portfolio Standards (RPS), widespread corporate sustainability commitments, and high adoption of renewable energy procurement. Utilities and corporations increasingly rely on RECs to meet compliance mandates and voluntary ESG targets. The growing trend of corporate net-zero initiatives, coupled with the expansion of large-scale renewable energy projects such as solar and wind farms, further propels the market. Advanced digital platforms and marketplaces enabling seamless REC trading are also contributing to growth, making the U.S. a leading hub for both compliance and voluntary REC transactions.

Europe Renewable Energy Certificate Market Insight

The Europe REC market is projected to expand at a substantial CAGR throughout the forecast period, driven by ambitious EU renewable energy targets, carbon reduction mandates, and supportive government policies. Increasing urbanization and industrial electrification are boosting renewable energy consumption, fostering REC adoption among utilities, corporates, and municipalities. European stakeholders are attracted to the transparency and traceability provided by RECs, and the market is witnessing significant activity in both compliance and voluntary segments. Growth is particularly strong in countries such as Germany, France, and Spain, where renewable energy infrastructure is well-developed and digital REC platforms are widely used.

U.K. Renewable Energy Certificate Market Insight

The U.K. REC market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-mandated renewable energy targets, corporate sustainability initiatives, and rising consumer awareness of climate change. Businesses and public institutions are increasingly procuring RECs to achieve net-zero commitments, while utilities leverage compliance RECs to meet RPS obligations. The U.K.’s robust regulatory framework and growing adoption of digital trading platforms for RECs are expected to continue stimulating market growth, particularly in residential, commercial, and industrial segments.

Germany Renewable Energy Certificate Market Insight

The Germany REC market is expected to expand at a considerable CAGR during the forecast period, fueled by strong government incentives, renewable energy policies, and increasing industrial adoption of green energy. Germany’s emphasis on sustainability and innovation supports REC adoption among utilities and corporates seeking verified renewable energy sources. The integration of RECs with corporate ESG reporting and compliance frameworks is becoming increasingly prevalent. Furthermore, advanced digital platforms and blockchain-enabled solutions in Germany enhance transparency and facilitate secure trading, strengthening the overall market outlook.

Asia-Pacific Renewable Energy Certificate Market Insight

The Asia-Pacific REC market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by rapid urbanization, rising industrial electricity demand, and supportive renewable energy policies in countries such as China, India, and Japan. The region’s growing emphasis on clean energy adoption, government incentives for renewable power, and large-scale solar and wind projects are key growth drivers. Digital marketplaces and simplified access to voluntary RECs are expanding adoption across corporates and utilities. Additionally, APAC’s emergence as a hub for renewable energy project development is increasing REC availability and affordability, further accelerating market growth.

Japan Renewable Energy Certificate Market Insight

The Japan REC market is gaining momentum due to ambitious national renewable energy targets, strong corporate sustainability commitments, and increasing integration of RECs into net-zero strategies. Japan’s high-tech infrastructure and emphasis on energy efficiency drive REC adoption among utilities, corporates, and government institutions. The integration of RECs with corporate ESG reporting platforms and voluntary renewable energy procurement is fueling market growth, while government incentives and digital trading platforms enhance accessibility and transparency across residential, commercial, and industrial segments.

China Renewable Energy Certificate Market Insight

The China REC market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing industrial sector, and strong government support for renewable energy deployment. China’s large-scale solar and wind projects generate substantial RECs, which are increasingly used by corporations and utilities to meet compliance and voluntary clean energy goals. The push towards smart grids, smart cities, and digital REC marketplaces, along with competitive domestic renewable energy providers, are key factors propelling the market. Additionally, affordable REC options and widespread awareness of ESG requirements are further boosting adoption across the country.

Renewable Energy Certificate Market Share

The Renewable Energy Certificate industry is primarily led by well-established companies, including:

- NextEra Energy (U.S.)

- Iberdrola (Spain)

- Enel Green Power (Italy)

- Ørsted (Denmark)

- EDF Renewables (France)

- Vattenfall (Sweden)

- SSE Renewables (U.K.)

- Engie (France)

- Brookfield Renewable Partners (Canada)

- Acciona Energía (Spain)

- Tata Power Renewable Energy (India)

- EDP Renewables (Portugal)

- RWE Renewables (Germany)

- China Longyuan Power Group (China)

- China Datang Corporation Renewable Power (China)

- JinkoPower (China)

- ACWA Power (Saudi Arabia)

- Invenergy (U.S.)

- Suzlon Energy (India)

- Thermal Energy Services (U.S.)

What are the Recent Developments in Renewable Energy Certificate Market?

- In April 2024, NextEra Energy, a global leader in renewable energy, launched a strategic initiative in South Africa to expand its solar and wind project portfolio, accompanied by the issuance of locally verified Renewable Energy Certificates (RECs). This initiative underscores the company’s commitment to supporting clean energy adoption and providing verifiable solutions for utilities and corporates in emerging markets. By leveraging its global expertise and innovative renewable technologies, NextEra Energy is addressing regional energy challenges while strengthening its position in the rapidly growing global REC market.

- In March 2024, Enel Green Power introduced a new blockchain-enabled REC trading platform in Europe, designed to enhance transparency, traceability, and efficiency in both voluntary and compliance REC markets. The platform enables real-time verification of renewable energy generation, providing corporates and utilities with secure and reliable certificates. This advancement highlights Enel Green Power’s dedication to leveraging technology to simplify renewable energy procurement and promote market confidence.

- In March 2024, Honeywell International Inc. successfully deployed its REC tracking and management system in Bengaluru, India, as part of the Smart City initiative. The project integrates advanced digital solutions to monitor renewable energy generation and automate REC issuance, contributing to a more transparent and resilient energy ecosystem. Honeywell’s effort emphasizes the increasing significance of digital innovation in accelerating clean energy adoption and supporting sustainable urban growth.

- In February 2024, Brookfield Renewable Partners announced a strategic partnership with the Chesapeake Bay and Rivers Association of Municipal Utilities to facilitate REC procurement for local governments and municipalities. This collaboration aims to streamline the acquisition process, improve access to verified renewable energy, and promote sustainability across public sector operations. The initiative underscores Brookfield’s commitment to enhancing operational efficiency and driving the adoption of renewable energy solutions.

- In January 2024, EDF Renewables launched a new solar REC product in the U.S. market, enabling residential and commercial customers to purchase verified renewable energy certificates directly through an online portal. This digital platform provides real-time tracking, flexible procurement options, and seamless integration with corporate sustainability programs. The EDF REC offering highlights the company’s focus on combining advanced technology with renewable energy solutions, empowering consumers and businesses to meet carbon reduction goals efficiently while supporting clean energy generation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.