Global Renewable Plastic Packaging Market

Market Size in USD Billion

CAGR :

%

USD

13.20 Billion

USD

20.41 Billion

2025

2033

USD

13.20 Billion

USD

20.41 Billion

2025

2033

| 2026 –2033 | |

| USD 13.20 Billion | |

| USD 20.41 Billion | |

|

|

|

|

Renewable Plastic Packaging Market Size

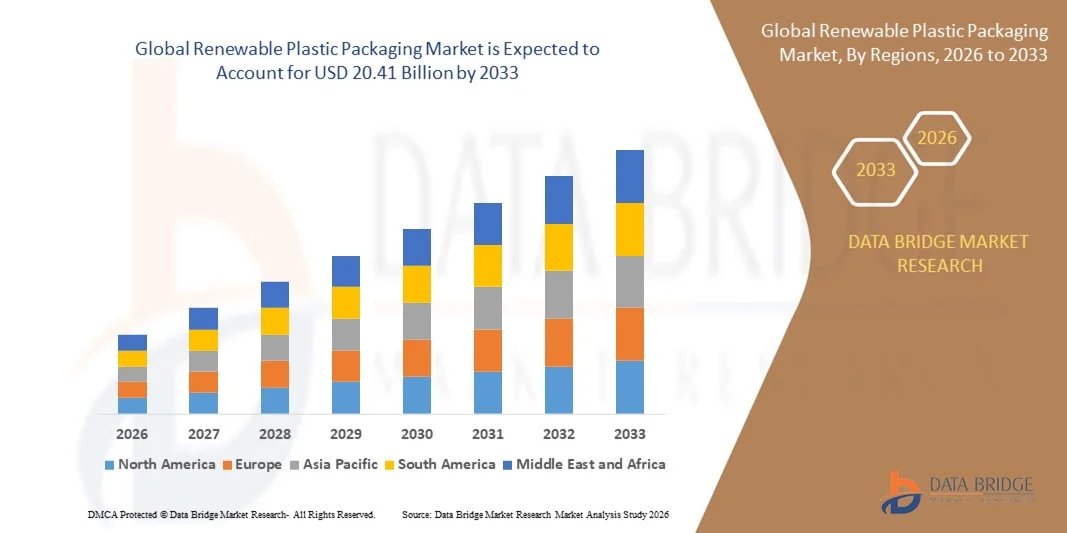

- The global renewable plastic packaging market size was valued at USD 13.20 billion in 2025 and is expected to reach USD 20.41 billion by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fuelled by the rising demand for sustainable packaging solutions such as bio-based plastics and compostable materials, driven by increasing environmental awareness among consumers

- Strong government regulations targeting single-use plastics and carbon reduction goals are further accelerating adoption across food & beverages, personal care, and industrial applications

Renewable Plastic Packaging Market Analysis

- The renewable plastic packaging market is experiencing steady growth as brands across various industries shift toward eco-friendly packaging to meet sustainability commitments and consumer expectations

- The adoption of renewable packaging is further supported by increasing corporate ESG initiatives, the rapid development of recyclable and biodegradable materials, and expanding retail demand for low-carbon footprint products

- North America dominated the global renewable plastic packaging market with the largest revenue share of 38.75% in 2025, driven by increasing regulatory pressure to reduce single-use plastics, rising consumer preference for sustainable packaging, and strong adoption of eco-friendly packaging solutions across food, beverage, and personal care sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global renewable plastic packaging market, driven by government initiatives promoting sustainable production, growing environmental awareness, expanding food and beverage and personal care sectors, and rising investments in bio-based polymer manufacturing

- PET held the largest market revenue share in 2025 driven by its strong mechanical properties, high recyclability, and widespread use across food, beverage, and consumer goods applications. Its compatibility with existing recycling streams and ability to meet sustainability requirements continue to support its dominance

Report Scope and Renewable Plastic Packaging Market Segmentation

|

Attributes |

Renewable Plastic Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Renewable Plastic Packaging Market Trends

Rise of Bio-Based And Compostable Packaging Solutions

- The increasing demand for eco-friendly materials is accelerating the transition toward bio-based and compostable renewable plastic packaging. These solutions offer reduced environmental impact and support global sustainability goals such as carbon reduction and waste minimization. Growing consumer preference for green alternatives is further encouraging brands to adopt plant-derived packaging

- Growing regulatory pressure to reduce carbon emissions and restrict traditional plastics is further boosting investment in renewable polymers. Governments across major economies are enforcing strict circular economy frameworks that promote biodegradable materials. As a result, manufacturers are shifting toward compliant, low-impact packaging to maintain market competitiveness

- Brands are increasingly integrating renewable packaging into their sustainability roadmaps, supported by advancements in biopolymer performance and durability. Improved strength, flexibility, and barrier properties are helping bridge performance gaps with conventional plastics. This enables widespread application across diverse product categories while enhancing environmental stewardship

- For instance, in 2024, several major FMCG companies in Europe announced a phased transition from conventional plastics to bio-based packaging materials in response to EU-wide circular economy directives. These initiatives reflect a broader regional push toward reducing landfill waste and enhancing recyclability. The move is expected to influence global supply chains and accelerate bioplastic adoption

- While renewable packaging adoption is rising, scalability, cost competitiveness, and raw material availability remain key factors shaping long-term market expansion. Manufacturers must optimize production processes to match the pricing of petroleum-based plastics. Expanding feedstock sources and improving supply chain efficiency will be crucial for sustained growth

Renewable Plastic Packaging Market Dynamics

Driver

Rising Environmental Regulations And Increasing Consumer Demand For Sustainable Packaging

- Stringent global policies restricting single-use plastics are compelling manufacturers to switch to renewable plastic packaging. Governments are enforcing high compliance standards through bans, levies, and extended producer responsibility schemes. These regulatory frameworks are reshaping material sourcing, production, and packaging design strategies

- Environmentally conscious consumers are prioritizing biodegradable, recyclable, and plant-derived packaging, driving demand for renewable solutions. Rising awareness of ocean pollution, carbon emissions, and landfill waste is influencing purchase decisions. This has pushed companies to innovate and differentiate through sustainable packaging formats

- Corporations are adopting renewable packaging as part of net-zero and circular economy commitments, resulting in higher investment in bioplastics manufacturing and innovation. Large enterprises are partnering with bio-material developers to expand product portfolios. These efforts are accelerating technological advancements and creating scalable commercial opportunities

- For instance, in 2023, North American retailers launched large-scale initiatives to replace petroleum-based packaging with bio-based alternatives to meet corporate sustainability targets. Such programs include deploying renewable materials across private-label brands. These transitions are contributing to rising bioplastic production capacity across the region

- While regulations and consumer awareness are driving the market, cost considerations and recycling system limitations continue to challenge widespread adoption. Infrastructure gaps and inconsistent composting standards hinder efficient waste management. Addressing these constraints will be essential for maximizing environmental benefits

Restraint/Challenge

High Production Costs And Limited Industrial Composting Infrastructure

- The cost of producing renewable plastic packaging remains higher than conventional plastics due to expensive feedstocks, specialized processing requirements, and limited economies of scale. Manufacturers face high capital expenditure for equipment and biopolymer technologies. These cost barriers slow adoption in price-sensitive industries

- Many regions lack industrial composting facilities capable of handling biodegradable plastics, limiting their effectiveness and slowing adoption despite environmental benefits. Without adequate infrastructure, renewable packaging often ends up in landfills. This reduces compostability performance and undermines sustainability goals

- Inconsistent global standards for compostability and recyclability create confusion among manufacturers and consumers, affecting proper waste management and lowering market penetration. Certification processes vary widely across regions, complicating product labeling. These inconsistencies hinder international trade and slow regulatory harmonization

- For instance, in 2024, several APAC countries reported slow adoption of compostable packaging due to inadequate waste segregation and processing infrastructure. Local governments noted insufficient investments in composting facilities. This gap is prompting calls for public-private partnerships to strengthen circular ecosystem capabilities

- While the industry continues to innovate, expanding composting networks and optimizing production costs are essential for unlocking the full market potential. Developing uniform global standards can improve clarity and adoption rates. Strategic investments in infrastructure and scaling biopolymer production will further accelerate market growth

Renewable Plastic Packaging Market Scope

The market is segmented on the basis of material, product, packaging, packaging format, process, and end-use sector.

- By Material

On the basis of material, the renewable plastic packaging market is segmented into Polyethylene Terephthalate (PET), Polyethylene (PE), Starch Blends, Polylactic Acid (PLA), Polybutyrate Adipate Terephthalate (PBAT), Polybutylene Succinate (PBS), and Others. PET held the largest market revenue share in 2025 driven by its strong mechanical properties, high recyclability, and widespread use across food, beverage, and consumer goods applications. Its compatibility with existing recycling streams and ability to meet sustainability requirements continue to support its dominance.

PLA is expected to witness the fastest growth rate from 2026 to 2033, fuelled by increasing demand for compostable and plant-derived polymers and rising adoption in packaging formats such as cups, trays, and flexible films. PLA’s favourable environmental profile and expanding production capacity across major regions are further accelerating its penetration in renewable packaging solutions.

- By Product

On the basis of product, the renewable plastic packaging market is segmented into Biodegradable and Bio-Based categories. The bio-based segment held the largest market revenue share in 2025 supported by high usage in mass-market applications and strong consumer preference for renewable, petroleum-free packaging solutions. Its ability to integrate into existing manufacturing processes also drives wide adoption among brand owners.

The biodegradable segment is expected to witness the fastest growth rate from 2026 to 2033 owing to increasing demand for compostable packaging driven by regulatory pressure and sustainability goals. Its expanding use in single-use items, food service applications, and certified compostable products is boosting market momentum during the forecast period.

- By Packaging

On the basis of packaging, the market is segmented into Rigid Packaging, Flexible Packaging, and Industrial Packaging. Flexible packaging held the largest market revenue share in 2025 due to its lightweight nature, reduced material usage, and increasing adoption across food and personal care industries. Its compatibility with bio-based and biodegradable materials is further enhancing its market presence.

Rigid packaging is expected to witness the fastest growth rate from 2026 to 2033 driven by rising demand for renewable bottles, containers, and thermoformed products. Improvements in strength, durability, and heat resistance of bio-polymers are supporting wider use in durable consumer packaging applications.

- By Packaging Format

On the basis of packaging format, the market is segmented into Primary, Secondary, and Tertiary. Primary packaging held the largest market revenue share in 2025 owing to its direct contact with products and high consumption in food, beverage, pharmaceutical, and personal care sectors. The push toward sustainable primary materials is fast-tracking the adoption of renewable plastics.

Secondary packaging is expected to witness the fastest growth rate from 2026 to 2033 as brands shift toward recyclable and renewable options for cartons, wraps, and protective layers. The rising focus on circular economy targets and reduced carbon emissions is further amplifying this trend.

- By Process

On the basis of process, the renewable plastic packaging market is segmented into Recyclable, Reusable, and Biodegradable. The recyclable segment held the largest market revenue share in 2025 due to widespread industrial infrastructure supporting recycling and strong regulatory emphasis on reducing landfill waste. Its compatibility with PET and PE renewable variants strengthens segment leadership.

The biodegradable process segment is expected to witness the fastest growth rate from 2026 to 2033 driven by increased demand for compostable packaging aligned with global waste-management goals. Its expanding adoption in food service, retail, and e-commerce packaging is shaping long-term market expansion.

- By End Use Sector

On the basis of end-use sector, the market is segmented into Food and Beverages, Personal Care, Healthcare, and Other End-Use Sectors. Food and beverages held the largest market revenue share in 2025 owing to high consumption of bottles, films, pouches, and containers made from renewable materials. Growing focus on sustainability, safety, and reduced packaging waste is driving broad adoption.

The personal care sector is expected to witness the fastest growth rate from 2026 to 2033 as brands rapidly transition to renewable plastics to meet consumer expectations and corporate sustainability commitments. The rise of eco-friendly product lines and refillable packaging formats is strengthening growth prospects.

Renewable Plastic Packaging Market Regional Analysis

- North America dominated the global renewable plastic packaging market with the largest revenue share of 38.75% in 2025, driven by increasing regulatory pressure to reduce single-use plastics, rising consumer preference for sustainable packaging, and strong adoption of eco-friendly packaging solutions across food, beverage, and personal care sectors

- Consumers in the region highly value the environmental benefits, recyclability, and compostability offered by renewable plastic packaging, as well as the ability to align with corporate sustainability and ESG goals

- This widespread adoption is further supported by robust infrastructure for recycling and industrial composting, high disposable incomes, and increasing corporate investment in circular economy initiatives, establishing renewable plastic packaging as a preferred choice for manufacturers and brands

U.S. Renewable Plastic Packaging Market Insight

The U.S. renewable plastic packaging market captured the largest revenue share in 2025 within North America, fueled by growing environmental awareness and strict federal and state-level regulations on plastic waste. Manufacturers and retailers are increasingly prioritizing biodegradable and bio-based packaging materials to meet sustainability mandates and consumer expectations. The expanding use of renewable polymers in food and beverage, personal care, and healthcare products, combined with technological advancements in biopolymer performance, is driving market growth. Moreover, partnerships between bioplastic producers and major FMCG companies are accelerating adoption and scaling of eco-friendly packaging solutions.

Europe Renewable Plastic Packaging Market Insight

The Europe renewable plastic packaging market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent EU regulations such as the Single-Use Plastics Directive and ambitious circular economy initiatives. The increasing consumer demand for sustainable, recyclable, and compostable packaging, coupled with corporate commitments to net-zero targets, is fostering market adoption. The region is witnessing rapid deployment of bio-based packaging across food, beverage, personal care, and industrial sectors, supported by innovation in biodegradable polymers and advanced recycling technologies.

U.K. Renewable Plastic Packaging Market Insight

The U.K. renewable plastic packaging market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising awareness of environmental issues and governmental policies promoting sustainable packaging alternatives. Retailers and manufacturers are adopting bio-based and compostable packaging solutions to comply with regulatory requirements and meet eco-conscious consumer demand. The robust e-commerce sector and strong distribution networks further support large-scale deployment of renewable packaging across multiple industries, including food, beverages, and healthcare.

Germany Renewable Plastic Packaging Market Insight

The Germany renewable plastic packaging market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strong government initiatives supporting circular economy practices and the reduction of plastic waste. Increasing demand for high-performance biodegradable packaging and bio-based polymers in industrial and consumer goods sectors is driving adoption. Germany’s emphasis on innovation, sustainability, and waste management infrastructure facilitates the integration of renewable plastics into packaging solutions, particularly in food, beverage, and personal care applications.

Asia-Pacific Renewable Plastic Packaging Market Insight

The Asia-Pacific renewable plastic packaging market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and growing environmental awareness in countries such as China, India, and Japan. Government initiatives promoting sustainable production and consumption, coupled with strong industrial development, are accelerating adoption. As the region emerges as a major manufacturing hub for bio-based polymers and renewable packaging solutions, affordability and accessibility are expanding across small and large-scale enterprises.

Japan Renewable Plastic Packaging Market Insight

The Japan renewable plastic packaging market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high environmental awareness, advanced industrial infrastructure, and strong regulatory framework supporting sustainable packaging. Increasing adoption of compostable and recyclable packaging solutions in the food and beverage, healthcare, and personal care sectors is driving growth. Integration of renewable plastics with smart packaging technologies and eco-friendly design initiatives further supports market expansion.

China Renewable Plastic Packaging Market Insight

The China renewable plastic packaging market accounted for the largest revenue share in Asia Pacific in 2025, attributed to the country’s massive manufacturing base, rapid urbanization, and growing consumer awareness of environmental issues. China is one of the largest markets for renewable packaging materials, with significant adoption across food, beverage, healthcare, and personal care products. Government policies encouraging bio-based packaging, coupled with strong domestic production capabilities and competitive pricing, are key factors propelling market growth.

Renewable Plastic Packaging Market Share

The Renewable Plastic Packaging industry is primarily led by well-established companies, including:

- Arkema (France)

- BASF SE (Germany)

- Dow (U.S.)

- Novamont S.p.A. (Italy)

- Corbion NV (Netherlands)

- Solvay (Belgium)

- Toray Plastics (America), Inc. (U.S.)

- Braskem (Brazil)

- NatureWorks LLC (U.S.)

- DSM (Netherlands)

- Amcor plc (U.K.)

- Sonoco Products Company (U.S.)

- Sealed Air (U.S.)

- Huhtamaki (Finland)

- Berry Global Inc. (U.S.)

- Smurfit Kappa (Ireland)

- Mondi (Austria)

- Uflex Limited (India)

- Constantia Flexibles (Austria)

- Genpak, LLC (U.S.)

- PLASTIC SUPPLIERS, INC. (U.S.)

- Gerresheimer AG (Germany)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Renewable Plastic Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Renewable Plastic Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Renewable Plastic Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.