Global Residential Hobs Market

Market Size in USD Billion

CAGR :

%

USD

17.85 Billion

USD

30.10 Billion

2024

2032

USD

17.85 Billion

USD

30.10 Billion

2024

2032

| 2025 –2032 | |

| USD 17.85 Billion | |

| USD 30.10 Billion | |

|

|

|

|

Global Residential Hobs Market Size

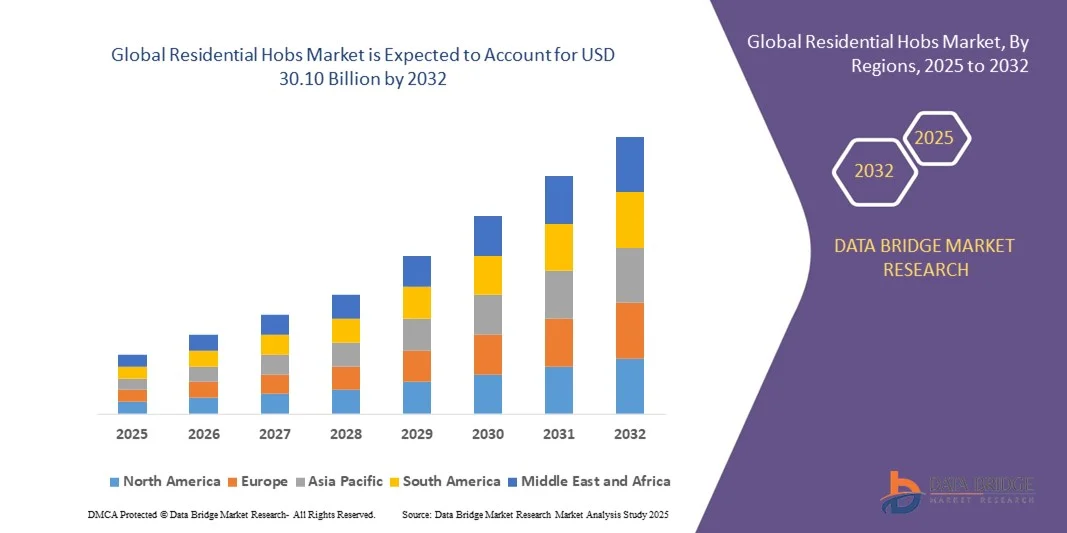

- The Global Residential Hobs Market size was valued at USD 17.85 billion in 2024 and is projected to reach USD 30.10 billion by 2032, growing at a CAGR of 6.75% during the forecast period.

- The market growth is primarily driven by the increasing adoption of smart kitchen appliances, technological advancements, and the rising trend of modern modular kitchens across residential spaces worldwide.

- Additionally, growing consumer preference for energy-efficient, aesthetically designed, and easy-to-maintain cooking solutions is propelling demand for residential hobs, thereby significantly boosting the market’s expansion globally.

Global Residential Hobs Market Analysis

- Residential hobs, serving as essential cooking appliances integrated into kitchen countertops, are becoming increasingly important in modern households due to their sleek design, efficient functionality, and compatibility with contemporary kitchen layouts and smart home systems.

- The rising demand for residential hobs is primarily driven by the growing popularity of modular kitchens, advancements in cooking technology such as induction and smart hobs, and a strong consumer preference for energy-efficient and user-friendly appliances.

- North America dominated the Global Residential Hobs Market with the largest revenue share of 38.5% in 2024, supported by high consumer spending on premium kitchen appliances, strong urbanization trends, and a growing focus on energy efficiency, with countries like Germany, the U.K., and Italy leading in smart and induction hob adoption.

- Asia-Pacific is expected to be the fastest-growing region in the Global Residential Hobs Market during the forecast period, driven by rapid urbanization, rising disposable incomes, and increasing penetration of modern kitchen designs in emerging economies such as China and India.

- The Gas hobs segment dominated the market with the largest revenue share of 45.7% in 2024, attributed to its affordability, widespread availability, and strong consumer familiarity, particularly in developing economies

Report Scope and Global Residential Hobs Market Segmentation

|

Attributes |

Residential Hobs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Residential Hobs Market Trends

Enhanced Convenience Through AI and Smart Connectivity

- A significant and accelerating trend in the Global Residential Hobs Market is the deepening integration of artificial intelligence (AI) and smart connectivity features, enabling advanced control, automation, and personalization in modern cooking environments. This convergence of technologies is significantly enhancing user convenience, energy efficiency, and overall cooking experiences.

- For instance, Bosch and Samsung have introduced AI-powered hobs capable of automatically adjusting heat levels based on the type of cookware and recipe requirements. Similarly, Siemens offers smart hobs that connect seamlessly with mobile apps and smart home platforms, allowing users to monitor and control their appliances remotely.

- AI integration in residential hobs enables features such as intelligent temperature management, predictive maintenance alerts, and adaptive cooking modes that learn user preferences over time. Some advanced models can even recommend cooking settings or recipes, optimizing both time and energy use while ensuring consistent results.

- The seamless integration of hobs with broader smart kitchen and home ecosystems allows centralized control of multiple appliances. Through a single interface or voice assistant, users can manage their hob, oven, hood, and lighting systems—creating an interconnected, automated, and efficient kitchen environment.

- This trend toward more intelligent, intuitive, and connected cooking systems is transforming consumer expectations for modern kitchens. Consequently, leading brands such as Bosch, LG, and Samsung are developing AI-enabled hobs with enhanced connectivity and automation, ensuring compatibility with platforms like SmartThings and Home Connect.

- The demand for smart hobs offering AI-driven precision, voice control, and remote operation is growing rapidly across urban households globally, as consumers increasingly prioritize convenience, safety, and smart home integration in their daily cooking routines.

Global Residential Hobs Market Dynamics

Driver

Growing Demand Driven by Modern Kitchen Trends and Smart Home Adoption

- The increasing preference for modern, space-efficient, and technology-driven kitchen designs, coupled with the accelerating adoption of smart home ecosystems, is a significant driver for the rising demand for residential hobs.

- For instance, in March 2024, Bosch launched its new Series 8 induction hobs integrated with Home Connect technology, allowing users to control cooking settings via smartphones and voice assistants. Such innovations by key players are expected to fuel the growth of the residential hobs market during the forecast period.

- As consumers increasingly value convenience, safety, and energy efficiency, modern hobs offer advanced features such as precise temperature control, automatic shut-off, child safety locks, and remote monitoring—making them an attractive upgrade over traditional gas stoves.

- Furthermore, the growing popularity of modular kitchens and connected home appliances is positioning residential hobs as a central component of smart kitchen systems, enabling seamless synchronization with ovens, chimneys, and digital cooking assistants.

- The convenience of touch controls, smart connectivity, multiple cooking zones, and voice or app-based operation are key factors driving adoption across urban households globally. The trend toward eco-friendly, easy-to-clean, and aesthetically integrated appliances is further contributing to the market’s expansion.

Restraint/Challenge

High Initial Costs and Power Infrastructure Limitations

- Despite growing consumer interest, the high initial cost of premium induction and smart hobs poses a challenge to wider market penetration, particularly in developing economies where price sensitivity remains high. Advanced features such as AI-based heat control, Wi-Fi connectivity, and premium design finishes often come with a higher price tag compared to conventional cooking appliances.

- Additionally, limitations in power infrastructure and inconsistent electricity supply in certain regions hinder the adoption of induction and electric hobs, as these appliances rely heavily on stable power sources for optimal performance.

- For instance, many households in emerging markets continue to prefer gas-based cooking due to its affordability and reliability, despite the growing awareness of the benefits of electric and induction hobs.

- Addressing these challenges through cost reduction, product localization, and improved energy efficiency will be critical for expanding market reach. Companies such as Whirlpool and Haier are focusing on introducing mid-range models that balance affordability with smart functionality, aiming to appeal to a broader consumer base.

- While technological advancements are helping reduce manufacturing costs, continued efforts in infrastructure development, consumer education, and pricing strategies will be essential to ensure sustainable growth in the global residential hobs market.

Global Residential Hobs Market Scope

The residential hobs market is segmented on the basis of product type, size, application, price range, and sales channel.

- By Product Type

On the basis of product type, the Global Residential Hobs Market is segmented into Induction, Gas, and Mix (Hybrid) hobs. The Gas hobs segment dominated the market with the largest revenue share of 45.7% in 2024, attributed to its affordability, widespread availability, and strong consumer familiarity, particularly in developing economies. Gas hobs remain the preferred choice for users who value flame-based cooking precision and cost efficiency.

The Induction hobs segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing adoption of energy-efficient and smart kitchen appliances. Induction hobs are increasingly favored for their safety, speed, and compatibility with modern modular kitchens, while hybrid models are gaining traction among consumers seeking versatility in their cooking experience.

- By Size

On the basis of size, the Global Residential Hobs Market is segmented into 2 Burner, 3 Burner, 4 Burner, and 5 Burner. The 4 Burner segment held the largest market share of 39.4% in 2024, owing to its suitability for medium to large households and its balanced combination of performance, size, and energy efficiency. This configuration is especially popular in urban households where multi-dish cooking is common.

The 3 Burner segment is projected to witness the fastest CAGR from 2025 to 2032, driven by rising demand among small to mid-sized families and the growing adoption of compact modular kitchens. Its space-saving design, affordability, and efficient functionality make it a preferred choice for apartments and smaller homes.

- By Application

On the basis of application, the Global Residential Hobs Market is segmented into Hotel, Apartment, Luxury Villa, and Others. The Apartment segment dominated the market with a market share of 46.8% in 2024, fueled by rapid urbanization, growing housing projects, and increased preference for modern modular kitchens. Apartments increasingly integrate smart and energy-efficient appliances, driving consistent hob adoption.

The Luxury Villa segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for premium and high-performance hobs featuring advanced features such as Wi-Fi connectivity, touch controls, and AI-based temperature regulation. The segment benefits from a growing focus on luxury living and smart home integration.

- By Price Range

On the basis of price range, the Global Residential Hobs Market is segmented into Low Range, Medium Range, and High Range. The Medium Range segment held the largest market share of 41.6% in 2024, as consumers increasingly seek products offering a balance between affordability, aesthetics, and advanced features. These hobs cater to middle-income households upgrading to modular kitchen setups.

The High Range segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing demand for premium designs, advanced digital controls, and AI-enabled features. Rising disposable incomes and consumer preference for luxury kitchen appliances are fueling this segment’s expansion, particularly in urban and high-income demographics.

- By Sales Channel

On the basis of sales channel, the Global Residential Hobs Market is segmented into Exclusive Stores, Multi-Brand Stores, Online Stores, Independent Stores, and Others. The Multi-Brand Stores segment dominated the market with a market share of 37.9% in 2024, as consumers prefer physical stores offering brand variety, after-sales support, and product demonstrations.

The Online Stores segment is anticipated to grow at the fastest CAGR from 2025 to 2032, fueled by the rapid expansion of e-commerce, attractive discounts, and the convenience of home delivery. The increasing digitalization of retail and rising consumer confidence in purchasing large appliances online are major factors driving this growth.

Global Residential Hobs Market Regional Analysis

- North America dominated the Global Residential Hobs Market with the largest revenue share of 38.5% in 2024, driven by growing demand for modern kitchen appliances, smart home integration, and energy-efficient cooking solutions.

- Consumers in the region highly value convenience, advanced features such as induction cooking, touch controls, and seamless integration with smart home systems, including app-based monitoring and remote control of hobs.

- This widespread adoption is further supported by high disposable incomes, a tech-savvy population, and increasing awareness of safety and energy efficiency, establishing smart and modern hobs as a preferred choice for both urban households and high-end residential projects.

U.S. Residential Hobs Market Insight

The U.S. residential hobs market captured the largest revenue share of 81% in 2024 within North America, driven by increasing demand for modern, energy-efficient kitchen appliances and the rising trend of smart kitchens. Consumers are prioritizing convenience, advanced cooking features such as induction and touch controls, and seamless integration with smart home systems. The growing preference for DIY kitchen upgrades, coupled with robust demand for app-controlled and voice-enabled hobs, further propels market growth. Moreover, high disposable incomes, urbanization, and awareness of energy efficiency are significantly contributing to the market’s expansion.

Europe Residential Hobs Market Insight

The Europe residential hobs market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing adoption of energy-efficient appliances and the rising trend of smart kitchens. Stringent safety and efficiency regulations in countries such as Germany and France, along with growing urbanization, are fostering hob adoption. Consumers in the region are drawn to modern cooking solutions that combine aesthetics, functionality, and technology, with significant uptake in both new constructions and kitchen renovation projects.

U.K. Residential Hobs Market Insight

The U.K. residential hobs market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising popularity of modular kitchens and smart cooking appliances. Increasing awareness about energy efficiency, convenience, and safety features is encouraging households to replace traditional gas or electric stoves with advanced hobs. The country’s strong retail and e-commerce infrastructure, combined with a tech-savvy population, is expected to continue stimulating market growth.

Germany Residential Hobs Market Insight

The Germany residential hobs market is expected to expand at a considerable CAGR during the forecast period, fueled by consumer preference for energy-efficient and technologically advanced cooking solutions. Germany’s focus on sustainability, innovation, and high-quality appliances promotes the adoption of induction and hybrid hobs. Smart kitchen integration, along with the availability of hobs featuring advanced controls, timers, and safety features, is further driving demand in both residential and high-end apartment segments.

Asia-Pacific Residential Hobs Market Insight

The Asia-Pacific residential hobs market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing adoption of modern kitchen appliances in countries such as China, Japan, and India. The region’s shift towards energy-efficient cooking solutions, coupled with government initiatives promoting digitalization and smart home adoption, is accelerating hob demand. Additionally, APAC’s role as a manufacturing hub for home appliances is improving affordability and accessibility, expanding the consumer base.

Japan Residential Hobs Market Insight

The Japan residential hobs market is gaining momentum due to the country’s tech-driven culture, urbanization, and demand for convenience. Japanese consumers increasingly favor induction and hybrid hobs that integrate with smart home ecosystems and offer precise temperature control. Compact designs suitable for apartments, along with advanced safety and energy-efficient features, are driving adoption. The country’s aging population is also expected to spur demand for user-friendly, safe, and reliable cooking solutions in residential and commercial kitchens.

China Residential Hobs Market Insight

The China residential hobs market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, rising disposable incomes, and widespread adoption of modern kitchen appliances. The expanding middle class and growing awareness of energy-efficient cooking solutions are fueling market demand. Additionally, government initiatives promoting smart homes and affordable local manufacturing are making high-quality induction, gas, and hybrid hobs more accessible, further propelling market growth across residential and multi-family housing segments.

Global Residential Hobs Market Share

The Residential Hobs industry is primarily led by well-established companies, including:

• Bosch (Germany)

• Siemens (Germany)

• Whirlpool Corporation (U.S.)

• Electrolux (Sweden)

• Samsung Electronics (South Korea)

• LG Electronics (South Korea)

• Miele (Germany)

• Haier Group (China)

• Panasonic Corporation (Japan)

• Smeg (Italy)

• Elica S.p.A. (Italy)

• Glen Dimplex (Ireland)

• Faber (Italy)

• Teka Group (Germany)

• Arçelik A.Ş. (Turkey)

• Fisher & Paykel Appliances (New Zealand)

• ROBAM Appliances (China)

• V-Guard Industries (India)

• Bajaj Electricals Ltd. (India)

• Franke Home Solutions (Switzerland)

What are the Recent Developments in Global Residential Hobs Market?

- In April 2023, Bosch Home Appliances, a global leader in kitchen and home appliances, launched a strategic initiative in South Africa to promote energy-efficient and smart residential hobs. This initiative emphasizes the company’s commitment to delivering innovative, reliable cooking solutions tailored to local consumer needs. By leveraging its global expertise and advanced induction and gas hob technologies, Bosch is addressing regional demand for modern kitchens while strengthening its position in the rapidly growing global residential hobs market.

- In March 2023, Faber Appliances introduced its Smart Touch Induction Hob in India, designed to enhance cooking efficiency and safety for modern households. The product features touch controls, AI-assisted cooking presets, and app-based remote monitoring, reflecting Faber’s dedication to developing advanced kitchen solutions that combine convenience, precision, and energy savings for consumers.

- In March 2023, Electrolux deployed its Smart Kitchen Project in Bengaluru, India, aimed at upgrading urban kitchens with connected cooking solutions. The initiative integrates advanced induction hobs with IoT-enabled monitoring, improving energy efficiency and user control. Electrolux’s project highlights the growing significance of smart kitchen appliances in urban development and modern living.

- In February 2023, IFB Appliances, a leading home appliance manufacturer, announced a partnership with major real estate developers in India to provide smart hobs in new residential and luxury apartment projects. The collaboration is designed to enhance user convenience, safety, and energy efficiency, reflecting IFB’s commitment to modernizing kitchens and improving the cooking experience for homeowners.

- In January 2023, Samsung Home Appliances unveiled the Samsung Smart Induction Hob at the CES 2023 event, featuring Wi-Fi connectivity, AI-assisted cooking, and voice control integration. This innovative appliance allows users to manage cooking functions remotely via a dedicated app, highlighting Samsung’s focus on combining advanced technology, energy efficiency, and convenience in modern residential kitchens.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.