Global Residential Outdoor Storage Products Market

Market Size in USD Billion

CAGR :

%

USD

1.62 Billion

USD

2.14 Billion

2024

2032

USD

1.62 Billion

USD

2.14 Billion

2024

2032

| 2025 –2032 | |

| USD 1.62 Billion | |

| USD 2.14 Billion | |

|

|

|

|

Residential Outdoor Storage Products Market Size

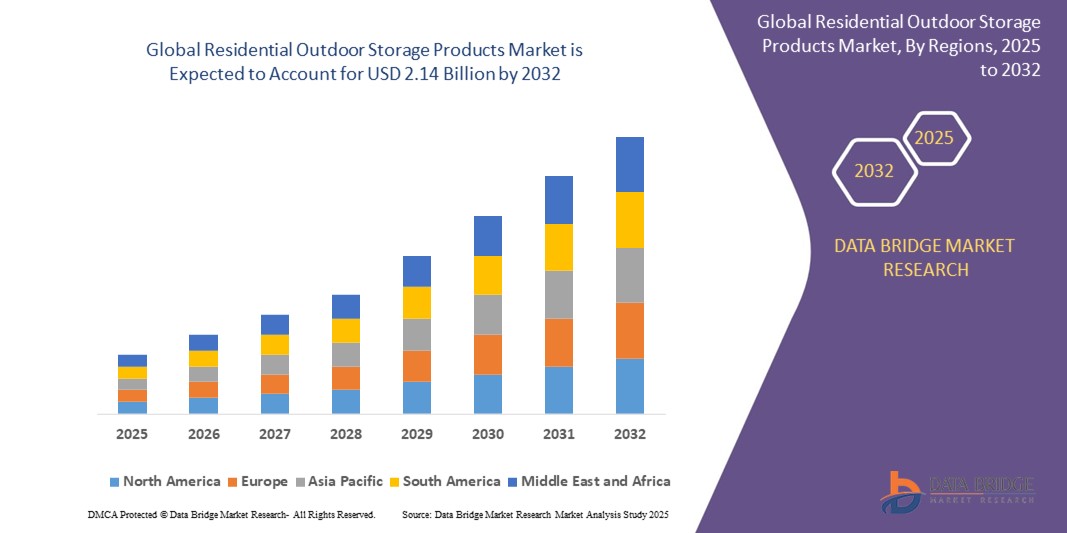

- The global residential outdoor storage products market size was valued at USD 1.62 billion in 2024 and is expected to reach USD 2.14 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is primarily driven by increasing demand for organized outdoor spaces, the rise in DIY and gardening activities, and the growing trend of enhancing outdoor living areas among homeowners

- Rising urbanization, increasing disposable incomes, and consumer preference for durable, weather-resistant, and aesthetically pleasing storage solutions are further accelerating market expansion

Residential Outdoor Storage Products Market Analysis

- Residential outdoor storage products, such as sheds, deck boxes, storage benches, and cabinets, are designed to provide organized, weather-resistant storage solutions for outdoor spaces, catering to homeowners seeking to maximize functionality and aesthetics

- The market is fueled by growing homeownership rates, particularly in suburban areas, increased consumer spending on home improvement, and the rising popularity of outdoor leisure activities such as gardening and landscaping

- North America dominated the market with a revenue share of 56.8% in 2024, driven by high homeownership rates, a strong DIY culture, and widespread adoption of outdoor living trends, particularly in the U.S. and Canada

- Europe is the fastest-growing region during the forecast period, propelled by increasing consumer focus on improving storage facilities, rising residential construction, and growing demand for tools and equipment for gardening and home maintenance

- The steel covered sheds segment dominated a significant market revenue share of 35.1% in 2024, primarily driven by their superior durability, security, and resistance to harsh weather conditions, making them a preferred choice for long-term outdoor storage

Report Scope and Residential Outdoor Storage Products Market Segmentation

|

Attributes |

Residential Outdoor Storage Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Residential Outdoor Storage Products Market Trends

“Increasing Integration of Smart Technology and Customization”

- The residential outdoor storage products market is experiencing a notable trend toward the integration of smart technology and customization options

- Smart technologies, such as IoT-enabled locks, integrated lighting, and remote monitoring systems, enable homeowners to manage and secure their outdoor storage units more effectively, providing real-time alerts and enhanced security features

- Customization is gaining traction, with consumers seeking storage solutions such as deck boxes, fabric-covered sheds, steel-covered sheds, and wood-covered sheds that align with their aesthetic preferences and specific storage needs

- For instance, companies are offering modular designs and 3D shed designing tools that allow consumers to personalize size, material, and features, such as shelving or weather-resistant coatings, to optimize functionality

- These advancements enhance the appeal of outdoor storage products, making them more attractive to homeowners aiming to maximize the utility and aesthetics of their outdoor spaces.

- Smart storage solutions can track usage patterns, monitor environmental conditions and provide maintenance alerts to ensure longevity and optimal performance.

Residential Outdoor Storage Products Market Dynamics

Driver

“Rising Demand for Organized Outdoor Spaces and Aesthetic Appeal”

- Increasing consumer interest in enhancing outdoor living spaces, such as patios, gardens, and backyards, is a key driver for the residential outdoor storage products market

- Storage solutions such as deck boxes, fabric-covered sheds, steel-covered sheds, and wood-covered sheds provide organized storage for vehicles, garden tools & equipment, refuse containers, and other items, improving both functionality and visual appeal

- The rise in homeownership, particularly in suburban and rural areas, coupled with a growing trend of DIY home improvement projects, is fueling demand for durable and stylish storage options

- Government incentives and local regulations promoting sustainable landscaping and organized outdoor spaces in some regions, particularly in North America and Europe, are encouraging the adoption of these products

- The expansion of e-commerce platforms and improved online accessibility through distribution channel are facilitating easier access to a wide range of storage products, further driving market growth

Restraint/Challenge

“High Installation Costs and Regulatory Constraints”

- The high initial costs associated with purchasing and installing outdoor storage products, such as steel-covered sheds or customized wood-covered sheds, can be a barrier for cost-sensitive consumers, particularly in emerging markets

- Installation of larger storage solutions, such as sheds, often requires professional services, permits, or compliance with local zoning and building codes, adding to the overall expense and complexity

- Environmental regulations concerning material usage and manufacturing processes pose challenges for manufacturers, potentially increasing production costs or limiting material options

- The varying regulatory landscape across regions, especially in Europe and North America, regarding property modifications and environmental standards, complicates market expansion for manufacturers operating internationally

- These factors may deter potential buyers, particularly in regions with lower disposable incomes or stringent regulatory environments, limiting market growth in certain areas

Residential Outdoor Storage Products market Scope

The market is segmented on the basis of product type, application, and distribution channel.

- By Product Type

On the basis of product type, the global residential outdoor storage products market is segmented into deck boxes, fabric covered sheds, steel covered sheds, and wood covered sheds. The steel covered sheds segment dominated a significant market revenue share of 35.1% in 2024, primarily driven by their superior durability, security, and resistance to harsh weather conditions, making them a preferred choice for long-term outdoor storage. Their robust construction and low maintenance also contribute to their widespread adoption.

The deck boxes segment is expected to witness the fastest growth rate from 2025 to 2032. This growth is driven by their versatility, aesthetic appeal, and ability to blend seamlessly with outdoor living spaces. Increasing consumer demand for functional and decorative storage for patio cushions, garden tools, and recreational items is fueling their rapid adoption.

- By Application

On the basis of application, the global residential outdoor storage products market is segmented into vehicles, garden tools & equipment, refuse containers, and others. The garden tools & equipment segment is expected to hold the largest market revenue share, driven by the increasing popularity of gardening and landscaping activities among homeowners, leading to a high demand for dedicated storage solutions for various tools, lawnmowers, and other equipment.

The vehicles segment is anticipated to experience robust growth from 2025 to 2032. This is due to the rising trend of households owning multiple vehicles, including bicycles, ATVs, and small recreational vehicles, which necessitates convenient and secure outdoor storage options. The need to protect these assets from weather and theft is a key driver.

- By Distribution Channel

On the basis of distribution channel, the global residential outdoor storage products market is segmented into offline and online. The offline distribution channel is expected to hold the largest market revenue share, owing to consumers' preference for physically inspecting products, receiving immediate assistance, and benefiting from in-store services such as assembly and delivery.

The online distribution channel is expected to witness the fastest growth rate from 2025 to 2032. This is driven by the increasing e-commerce penetration, convenience of Browse a wide range of products from home, competitive pricing, and growing availability of detailed product information and customer reviews. The shift towards digital shopping experiences further accelerates its adoption.

Residential Outdoor Storage Products Market Regional Analysis

- North America dominated the market with a revenue share of 56.8% in 2024, driven by high homeownership rates, a strong DIY culture, and widespread adoption of outdoor living trends, particularly in the U.S. and Canada

- Consumers prioritize outdoor storage products for enhancing property organization, protecting tools and equipment from weather, and improving the aesthetic appeal of outdoor spaces, particularly in regions with varied climates

- Growth is supported by advancements in material technology, such as weather-resistant resins and durable metals, alongside rising adoption in both new home constructions and aftermarket installations

U.S. Residential Outdoor Storage Products Market Insight

The U.S. residential outdoor storage products market captured the largest revenue share of 72.9% in 2024 within North America, fueled by robust aftermarket demand and growing consumer awareness of durable and aesthetically pleasing storage solutions. The trend towards home improvement and DIY projects, coupled with increasing regulations promoting sustainable materials, further boosts market expansion. Manufacturers’ integration of customizable sheds and deck boxes complements aftermarket sales, creating a diverse product ecosystem..

Europe Residential Outdoor Storage Products Market Insight

The Europe residential outdoor storage products market is expected to witness the fastest growth rate, supported by a strong emphasis on home improvement and efficient space management. Consumers seek products that enhance outdoor functionality while offering durability and aesthetic appeal. The growth is prominent in both new home installations and retrofit projects, with countries such as Germany and the U.K. showing significant uptake due to rising environmental concerns and urbanization trends.

U.K. Residential Outdoor Storage Products Market Insight

The U.K. market for residential outdoor storage products is expected to witness rapid growth, driven by demand for organized outdoor spaces and enhanced property aesthetics in urban and suburban settings. Increased interest in gardening and outdoor living, along with rising awareness of weather-resistant storage benefits, encourages adoption. Evolving regulations on sustainable materials and space efficiency influence consumer choices, balancing functionality with compliance.

Germany Residential Outdoor Storage Products Market Insight

Germany is expected to witness rapid growth in the residential outdoor storage products market, attributed to its advanced home improvement sector and high consumer focus on durability and eco-friendly materials. German consumers prefer technologically advanced products such as steel and resin sheds that offer weather resistance and contribute to sustainable living. The integration of these products in premium homes and aftermarket options supports sustained market growth.

Asia-Pacific Residential Outdoor Storage Products Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding homeownership and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of organized outdoor spaces, weather protection, and property aesthetics is boosting demand. Government initiatives promoting sustainable living and efficient space management further encourage the use of advanced storage products.

Japan Residential Outdoor Storage Products Market Insight

Japan’s residential outdoor storage products market is expected to witness rapid growth due to strong consumer preference for high-quality, durable storage solutions that enhance property functionality and aesthetics. The presence of major manufacturers and integration of storage products in new home constructions accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Residential Outdoor Storage Products Market Insight

China holds the largest share of the Asia-Pacific residential outdoor storage products market, propelled by rapid urbanization, rising homeownership, and increasing demand for efficient storage solutions. The country’s growing middle class and focus on modern living support the adoption of advanced storage products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Residential Outdoor Storage Products Market Share

The residential outdoor storage products industry is primarily led by well-established companies, including:

- Harwal Group of Companies (UAE)

- Palram Industries Ltd. (India)

- Cedarshed USA (U.S.)

- Porta-King Building Systems (U.S.)

- Keter (Israel)

- Absco Sheds. (Australia)

- Leisure Season Ltd. (Canada)

- Backyard Products, LLC (U.S.)

- Newell Brands (U.S.)

- CRAFTSMAN (U.S.)

- ShelterLogic Corp. (U.S.)

- Suncast Corporation (U.S.)

What are the Recent Developments in Global Residential Outdoor Storage Products Market?

- In July 2025, the outdoor storage and home improvement market continues to embrace smart design innovations that prioritize user convenience and product longevity. While not as tech-heavy as smart locks or home automation systems, new storage solutions are increasingly incorporating hydraulic pistons for smooth lid operation, easy assembly mechanisms, and weather-resistant materials. These enhancements reflect a broader trend toward intuitive, low-maintenance products that blend functionality with modern aesthetics—especially in compact or multi-use spaces

- In April 2025, Modus Furniture International issued a recall for its Kentfield Solid Wood Eight-Drawer Dressers, also sold under the names Eliza, Elyza, and Westmont. The recall was prompted by tip-over and entrapment hazards when the dressers are not anchored to the wall, posing serious risks of injury or death—particularly to children. These units violate federal safety regulations under the STURDY Act for clothing storage units

- In October 2024, the home storage market continues to evolve with a strong emphasis on multi-functional and space-saving designs. Consumers are increasingly drawn to products that serve dual purposes—such as storage benches that double as seating, coffee tables with hidden compartments, and vertical storage units ideal for compact living spaces. These innovations reflect a growing demand for efficiency, style, and adaptability, particularly in urban environments where space is at a premium

- In May 2024, Keter, a global innovator in resin-based outdoor living solutions, introduced its Signature Collection—a premium range of outdoor products designed to blend style with durability. The collection includes spacious sheds, elegant deck boxes, and versatile garden beds, all enhanced with Keter’s proprietary DecoCoat™ technology. This innovation delivers the rich, natural look of wood while maintaining the weather-resistant, low-maintenance benefits of resin. Built with sustainability in mind, each product is crafted from recyclable materials, offering long-lasting performance and timeless appeal for modern outdoor spaces

- In October 2022, Suncast, a leading name in outdoor storage solutions, introduced a groundbreaking line of residential outdoor storage units. This new collection showcases advanced materials and innovative design features that significantly enhance durability and weather resistance. Engineered for modern outdoor living, the lineup includes sheds, deck boxes, and cabinets that combine functionality with long-lasting performance—ideal for homeowners seeking reliable and stylish storage options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.