Global Respiratory Support System Market

Market Size in USD Billion

CAGR :

%

USD

6.94 Billion

USD

14.34 Billion

2025

2033

USD

6.94 Billion

USD

14.34 Billion

2025

2033

| 2026 –2033 | |

| USD 6.94 Billion | |

| USD 14.34 Billion | |

|

|

|

|

Respiratory Support System Market Size

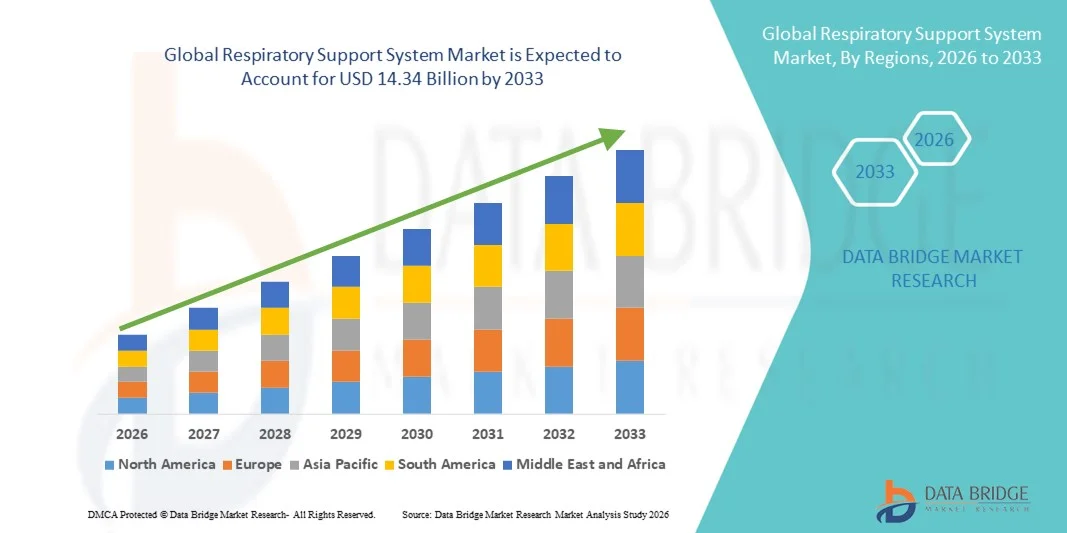

- The global respiratory support system market size was valued at USD 6.94 billion in 2025 and is expected to reach USD 14.34 billion by 2033, at a CAGR of 9.50% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic and acute respiratory diseases, ongoing technological innovations in ventilators, oxygen therapy systems, and integrated digital solutions, and expanded adoption of advanced respiratory care across clinical and home‑healthcare settings

- Furthermore, increasing healthcare expenditure, heightened focus on improving patient outcomes, and expanded access to respiratory support technologies in emerging economies are strengthening demand for effective respiratory support systems, positioning them as essential components of modern respiratory care delivery and significantly driving industry growth

Respiratory Support System Market Analysis

- support systems, including therapeutic devices, monitoring devices, diagnostic devices, and consumables and accessories, are increasingly vital components of modern healthcare, providing critical support for patients with acute and chronic respiratory conditions in both hospital and home care settings due to their effectiveness, portability, and integration with advanced monitoring technologies

- The escalating demand for respiratory support systems is primarily fueled by the rising prevalence of chronic respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), sleep apnea, and infectious respiratory illnesses, along with increasing adoption of home-based and non-invasive respiratory care solutions

- North America dominated the respiratory support systems market with the largest revenue share of 42.5% in 2025, characterized by advanced healthcare infrastructure, high per-capita healthcare spending, and a strong presence of leading industry players

- Asia-Pacific is expected to be the fastest-growing region in the respiratory support systems market during the forecast period due to increasing healthcare investments, rising patient awareness, expanding hospital networks, and growing demand for home-based respiratory care solutions in countries such as China and India

- Chronic obstructive pulmonary disease (COPD) dominated the market with a share of 36.4% in 2025, driven by high global prevalence of COPD, increasing hospitalizations due to acute exacerbations, growing awareness of disease management, and the rising adoption of advanced respiratory support systems for effective long-term care and improved patient outcomes

Report Scope and Respiratory Support System Market Segmentation

|

Attributes |

Respiratory Support System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Respiratory Support System Market Trends

Advancements Through AI-Enabled and Connected Devices

- A significant and accelerating trend in the global respiratory support system market is the integration of AI and IoT-enabled monitoring into ventilators, PAP devices, and oxygen therapy systems, enhancing patient management and predictive care

- For instance, AI-powered ventilators can automatically adjust airflow based on real-time patient data, while connected oxygen concentrators allow remote monitoring of oxygen saturation and device performance by healthcare providers

- AI integration enables features such as predictive alerts for respiratory distress, automated therapy adjustments, and improved device accuracy, while connected platforms allow centralized tracking of multiple patients in hospitals or home-care settings

- The seamless integration of respiratory support systems with telehealth platforms and electronic health records facilitates remote monitoring, early intervention, and data-driven treatment plans, improving clinical outcomes

- This trend toward intelligent, connected, and adaptive respiratory devices is fundamentally transforming healthcare delivery, with companies such as ResMed developing AI-enabled PAP devices that automatically adjust pressure levels and provide real-time reporting to clinicians

- The demand for connected and AI-enhanced respiratory support systems is growing rapidly across hospitals and home-care environments, as healthcare providers increasingly prioritize efficiency, patient safety, and continuous remote monitoring

- Advances in miniaturization and portability are enabling the development of compact, lightweight devices suitable for home care, long-term therapy, and travel

Respiratory Support System Market Dynamics

Driver

Rising Prevalence of Respiratory Diseases and Home-Care Demand

- The increasing incidence of chronic respiratory diseases, including COPD, asthma, and sleep apnea, along with growing awareness of home-based care, is a key driver for respiratory support system adoption

- For instance, in March 2025, ResMed launched enhanced home-use ventilators with connected monitoring, aiming to improve adherence and remote patient management in chronic respiratory care

- As hospitals and home-care providers seek to reduce patient readmissions, respiratory support systems offer advanced features such as real-time monitoring, automated therapy adjustments, and alert notifications, providing superior patient management

- Furthermore, the rising popularity of home healthcare and telehealth services is increasing adoption of connected respiratory devices, allowing patients to receive effective therapy while minimizing hospital visits

- The convenience of remote monitoring, AI-assisted therapy adjustments, and real-time patient data analytics are key factors propelling adoption in hospitals and home-care settings

- Increasing government initiatives and reimbursement policies for home respiratory care are incentivizing healthcare providers and patients to adopt advanced respiratory devices

- Growing awareness campaigns by healthcare organizations about early detection and management of chronic respiratory conditions are driving patient demand for effective respiratory support solutions

- Rising investments by medical device companies in R&D to develop more patient-friendly and efficient respiratory devices are fueling market expansion

Restraint/Challenge

Device Cost and Regulatory Compliance Hurdles

- The high upfront costs of advanced respiratory support systems, particularly AI-enabled or connected devices, can restrict adoption in price-sensitive markets or smaller healthcare facilities

- For instance, some premium home ventilators and PAP devices are priced significantly higher than standard models, limiting access in developing regions or budget-conscious households

- Stringent regulatory requirements for medical devices, including FDA and CE approvals, pose challenges for new product launches and market entry, slowing the introduction of innovative solutions

- Ensuring compliance with cybersecurity standards for connected devices and addressing patient data privacy concerns is critical for building trust among healthcare providers and patients

- Overcoming these challenges through cost-effective designs, streamlined regulatory approvals, and robust cybersecurity protocols will be vital for sustained market growth

- Limited availability of trained personnel to operate advanced respiratory devices in emerging markets can impede adoption and optimal utilization

- Compatibility issues between new smart respiratory devices and existing hospital IT or monitoring systems may slow integration and adoption

- Economic uncertainties and healthcare budget constraints in certain regions may limit large-scale procurement of premium respiratory support systems

Respiratory Support System Market Scope

The market is segmented on the basis of indication, product, and end user.

- By Indication

On the basis of indication, the global respiratory support system market is segmented into chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, and infectious diseases. The Chronic Obstructive Pulmonary Disease (COPD) segment dominated the market with the largest revenue share of 36.4% in 2025, driven by the high global prevalence of COPD, increasing hospitalizations due to acute exacerbations, and growing adoption of advanced respiratory support devices for long-term management. Healthcare providers prioritize COPD patients for non-invasive ventilation, oxygen therapy, and connected monitoring solutions to improve treatment adherence. The market demand is also supported by rising awareness campaigns and government programs for chronic respiratory disease management. COPD management often requires continuous monitoring and device support, which makes therapeutic and monitoring devices integral to patient care. In addition, advances in AI and telehealth-enabled respiratory devices have further increased adoption within this patient segment. The aging global population, which is more susceptible to COPD, is also a major contributor to the segment's dominance.

The Sleep Apnea segment is expected to witness the fastest growth rate of 11.8% CAGR from 2026 to 2033, fueled by increasing awareness of sleep-related disorders, expanding home-based care solutions, and rising adoption of PAP devices. Sleep apnea patients often prefer portable, connected devices that allow monitoring and therapy adjustments in real time. Rising obesity rates and lifestyle changes are increasing the prevalence of sleep apnea globally. Advancements in AI-enabled sleep apnea devices, mobile app integration, and remote monitoring capabilities are driving faster adoption in both developed and emerging regions. Telehealth initiatives and reimbursement policies for home-based treatment further encourage growth in this segment.

- By Product

On the basis of product, the global respiratory support system market is segmented into therapeutic devices, monitoring devices, diagnostic devices, and consumables & accessories. The Therapeutic Devices segment dominated the market with a market share of 45.3% in 2025, driven by its critical role in managing acute and chronic respiratory conditions such as COPD, asthma, and infectious diseases. Therapeutic devices include ventilators, PAP devices, nebulizers, and oxygen concentrators, which are essential for patient care in both hospitals and home settings. Adoption is fueled by technological advancements such as AI-assisted ventilation and remote monitoring capabilities, improving patient outcomes. Healthcare providers and patients increasingly rely on these devices for long-term management and critical care. The growing prevalence of chronic respiratory diseases globally further strengthens the segment’s position. In addition, continuous product innovations, including compact and portable designs, support home-based treatment and therapy adherence.

The Monitoring Devices segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing demand for real-time patient monitoring and remote management solutions. Monitoring devices such as pulse oximeters, connected spirometers, and telemonitoring platforms are gaining adoption due to the rise of telehealth services. Hospitals and home-care providers are leveraging these devices to track patient vitals, detect early signs of deterioration, and adjust therapies promptly. Wearable monitoring devices and mobile app integration make it easier for patients to manage their respiratory health. Regulatory support for remote patient monitoring also contributes to the rapid adoption of monitoring devices. The growth of chronic respiratory conditions and the focus on preventive care are key factors driving this segment.

- By End User

On the basis of end user, the global respiratory support system market is segmented into hospitals, home care settings, and ambulatory care centres. The Hospitals segment dominated the market with the largest revenue share in 2025, due to the high adoption of ventilators, PAP devices, and monitoring systems for acute and chronic respiratory patients. Hospitals require robust, advanced respiratory systems to manage critical care patients efficiently. Adoption is supported by well-established infrastructure, trained staff, and the availability of high-end devices that support AI-assisted ventilation, remote monitoring, and data analytics. The increasing prevalence of respiratory diseases and ICU requirements further drives demand. Hospitals also benefit from integrated respiratory care solutions that connect multiple devices across departments for centralized monitoring. High investment in healthcare infrastructure in North America and Europe ensures continued dominance of the hospital segment.

The Home Care Settings segment is expected to witness the fastest CAGR from 2026 to 2033, driven by rising patient preference for home-based care, telehealth integration, and AI-enabled respiratory devices suitable for self-management. Portable ventilators, oxygen concentrators, and PAP devices are increasingly used at home to reduce hospital readmissions and improve quality of life. The segment is further supported by growing awareness of chronic respiratory conditions, reimbursement policies for home therapy, and the adoption of connected devices for remote monitoring. Technological advancements and increased availability of user-friendly devices make home care solutions more accessible and convenient. The convenience of managing therapy in a familiar environment is a key factor driving rapid adoption in this segment.

Respiratory Support System Market Regional Analysis

- North America dominated the respiratory support systems market with the largest revenue share of 42.5% in 2025, characterized by advanced healthcare infrastructure, high per-capita healthcare spending, and a strong presence of leading industry players

- Healthcare providers and patients in the region highly value the accuracy, connectivity, and AI-enabled monitoring features offered by modern respiratory devices, including ventilators, PAP devices, and oxygen therapy systems

- This widespread adoption is further supported by high healthcare spending, early adoption of home-based care solutions, and a technologically advanced population, establishing connected and AI-enhanced respiratory support systems as the preferred choice across hospitals, ambulatory care centers, and home-care settings

U.S. Respiratory Support System Market Insight

The U.S. respiratory support system market captured the largest revenue share of 43% in 2025 within North America, fueled by the growing prevalence of chronic respiratory diseases such as COPD and sleep apnea. Patients and healthcare providers are increasingly prioritizing home-based and hospital-based respiratory care solutions, including ventilators, PAP devices, and connected monitoring systems. The rising adoption of telehealth, AI-enabled devices, and remote patient monitoring is further propelling market growth. Moreover, the integration of smart, connected respiratory devices with electronic health records and mobile applications is significantly contributing to the market’s expansion.

Europe Respiratory Support System Market Insight

The Europe respiratory support system market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising prevalence of respiratory disorders, stringent healthcare regulations, and increasing awareness of home-based therapy solutions. Urbanization, coupled with expanding healthcare infrastructure and increasing demand for connected devices, is fostering the adoption of advanced respiratory support systems. European healthcare providers are also leveraging these devices to reduce hospitalizations and improve patient outcomes. The region is witnessing significant growth across hospital, ambulatory care, and home care applications, with respiratory devices being incorporated into both new healthcare facilities and modernization projects.

U.K. Respiratory Support System Market Insight

The U.K. respiratory support system market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising burden of respiratory diseases and increasing focus on home-based care. In addition, growing patient awareness regarding early diagnosis and long-term management is encouraging hospitals and caregivers to adopt advanced respiratory devices. The U.K.’s strong healthcare infrastructure, combined with high adoption of connected and AI-enabled devices, is expected to continue to stimulate market growth. Telehealth integration and government initiatives supporting home therapy are also contributing to expanding the market.

Germany Respiratory Support System Market Insight

The Germany respiratory support system market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of respiratory health, technological advancements in ventilators and PAP devices, and the demand for connected and energy-efficient healthcare solutions. Germany’s well-developed healthcare infrastructure, emphasis on innovation, and focus on patient-centric care promote the adoption of advanced respiratory support systems in hospitals, ambulatory care, and home care. Integration of devices with telehealth and monitoring platforms is becoming increasingly prevalent, aligning with local patient and provider expectations.

Asia-Pacific Respiratory Support System Market Insight

The Asia-Pacific respiratory support system market is poised to grow at the fastest CAGR of 12% from 2026 to 2033, driven by increasing prevalence of respiratory disorders, rising healthcare expenditure, and improving healthcare infrastructure in countries such as China, Japan, and India. The region’s growing inclination towards home-based respiratory care, supported by telehealth initiatives and government health programs, is driving adoption. Furthermore, Asia-Pacific is emerging as a hub for manufacturing cost-effective respiratory devices, increasing affordability and accessibility across hospitals and home-care settings.

Japan Respiratory Support System Market Insight

The Japan respiratory support system market is gaining momentum due to high prevalence of sleep apnea and COPD, growing demand for home-based respiratory care, and the country’s technology-oriented healthcare system. Adoption is driven by increasing numbers of connected hospitals and smart home healthcare solutions. Integration of respiratory devices with mobile monitoring applications and AI-assisted therapy is fueling growth. Moreover, Japan’s aging population is likely to increase demand for easy-to-use, effective, and safe respiratory support systems in both residential and clinical settings.

India Respiratory Support System Market Insight

The India respiratory support system market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising prevalence of chronic respiratory diseases, expanding middle class, and rapid urbanization. India is witnessing growing adoption of home-based respiratory care devices, hospitals, and ambulatory care centers. Government initiatives promoting telehealth and digital healthcare solutions, coupled with affordable device options from domestic manufacturers, are key factors propelling market growth. Increasing awareness and adoption of AI-enabled and connected respiratory support systems is also boosting the market in India.

Respiratory Support System Market Share

The Respiratory Support System industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Fisher & Paykel Healthcare Limited (New Zealand)

- GE HealthCare (U.S.)

- ResMed Inc., (U.S.)

- Medtronic (Ireland)

- Drägerwerk AG & Co. KGaA (Germany)

- Hamilton Medical AG, (Switzerland)

- Masimo Corporation (U.S.)

- Inogen Inc., (U.S.)

- CAIRE Inc., (U.S.)

- Invacare Corporation (U.S.)

- O2 Concepts LLC (U.S.)

- Mindray Medical International Limited, (China)

- Vyaire Medical Inc., (U.S.)

- Air Liquide Medical Systems, (France)

- NIHON KOHDEN CORPORATION (Japan)

- PARI Medical Holding GmbH (Germany)

- Apex Medical Corporation (Taiwan)

- Armstrong Medical Ltd (U.K.)

What are the Recent Developments in Global Respiratory Support System Market?

- In December 2025, ResMed received FDA clearance for its AI‑enabled Personalized Therapy Comfort Settings (Smart Comfort) designed to recommend individual comfort adjustments for CPAP therapy to help people with obstructive sleep apnea start and stay on therapy more effectively, using machine‑learning and real‑world sleep data

- In December 2025, Vapotherm partnered with Flight Medical Innovations to bring the new VentO2ux™ ventilator to U.S. hospitals, a compact, advanced ventilator aimed at combining critical care performance with ease of use in emergency and acute settings

- In June 2025, a senior nursing officer at AIIMS Raipur was granted an Indian utility patent for a novel respiratory support device called the Highly Oxygenated Aerosol Controlled (HOAC) Combo, designed as a closed‑system respiratory unit to reduce airborne infection risk during nebulization and other procedures, with plans for clinical validation and wider implementation

- In February 2024, Getinge introduced the Servo‑c mechanical ventilator in India, designed to address diverse respiratory needs across pediatric and adult patient populations with lung‑protective therapeutic features aimed at expanding advanced ventilation access in hospitals

- In March 2023, Vitalograph launched its VitaloPFT Pulmonary Function Testing Series at the Arab Health Exhibition in Dubai, offering advanced respiratory diagnostic solutions for hospitals and other secondary care units requiring complex pulmonary function testing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.