Global Retail Media Platform Market

Market Size in USD Billion

CAGR :

%

USD

20.71 Billion

USD

41.21 Billion

2025

2033

USD

20.71 Billion

USD

41.21 Billion

2025

2033

| 2026 –2033 | |

| USD 20.71 Billion | |

| USD 41.21 Billion | |

|

|

|

|

Retail Media Platform Market Size

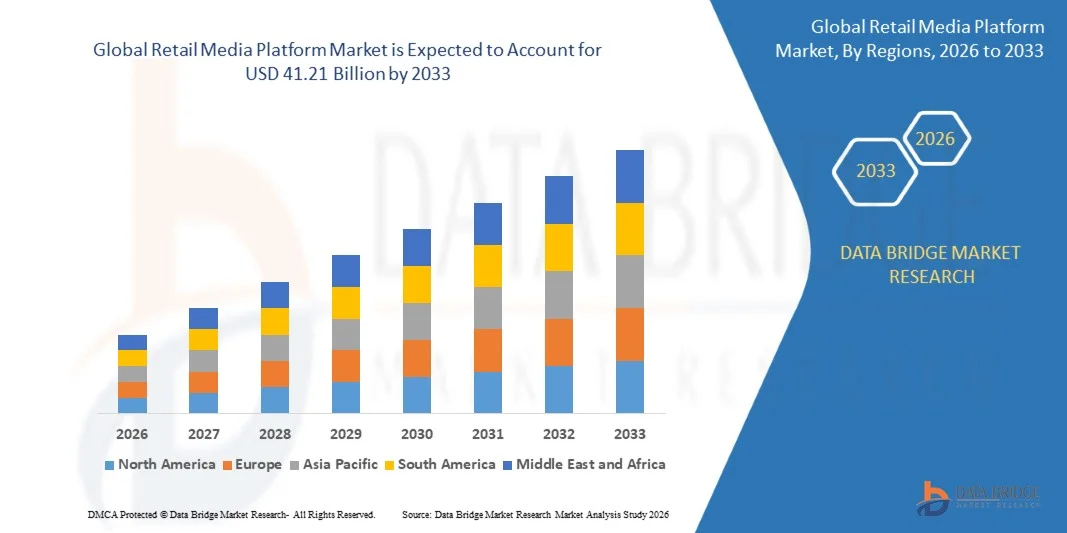

- The global retail media platform market size was valued at USD 20.71 billion in 2025 and is expected to reach USD 41.21 billion by 2033, at a CAGR of 8.98% during the forecast period

- The market growth is largely fueled by the rapid expansion of e-commerce ecosystems and the increasing shift of advertising budgets toward performance-driven, data-centric digital channels, enabling retailers to monetize first-party shopper data more effectively

- Furthermore, rising demand from brands for measurable return on ad spend, precise audience targeting, and closed-loop attribution is positioning retail media platforms as a preferred alternative to traditional digital advertising channels, collectively accelerating overall market growth

Retail Media Platform Market Analysis

- Retail media platforms, which enable brands to advertise directly within retailer-owned digital properties, have become a critical component of modern digital marketing strategies due to their ability to influence consumers at the point of purchase and deliver conversion-focused outcomes

- The growing adoption of retail media platforms is primarily driven by increased reliance on first-party data, declining effectiveness of third-party cookies, and the need for transparent, sales-linked advertising measurement across omnichannel retail environments

- North America dominated the retail media platform market with a share of 37.1% in 2025, due to the strong presence of advanced e-commerce ecosystems, high digital advertising spending, and early adoption of data-driven marketing technologies

- Asia-Pacific is expected to be the fastest growing region in the retail media platform market during the forecast period due to rapid e-commerce expansion, rising digital advertising spend, and increasing smartphone penetration

- Cloud segment dominated the market with a market share of 64.5% in 2025, due to its scalability, lower infrastructure costs, and ability to process large volumes of real-time shopper data. Cloud-based platforms enable faster campaign optimization, seamless integration with analytics tools, and continuous feature updates. Retailers and advertisers favor cloud deployment for its flexibility in managing fluctuating traffic and ad demand. Enhanced data security frameworks offered by leading cloud providers further support adoption

Report Scope and Retail Media Platform Market Segmentation

|

Attributes |

Retail Media Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Retail Media Platform Market Trends

“Growing Use of First-Party Data–Driven Retail Advertising”

- A prominent trend in the retail media platform market is the growing use of first-party data–driven advertising models as retailers increasingly monetize their owned digital properties. This trend is driven by brands seeking more accurate targeting and measurable outcomes at the point of purchase, positioning retail media as a core performance marketing channel within digital commerce ecosystems

- For instance, Amazon Advertising leverages its extensive first-party shopper data to enable brands to target consumers based on real purchase behavior and browsing patterns across its marketplace. This capability enhances campaign relevance and strengthens advertiser confidence by directly linking ad exposure to conversion outcomes

- Retailers are expanding on-site and off-site retail media offerings to support full-funnel engagement while maintaining data ownership and transparency. This is encouraging brands to reallocate budgets from traditional digital channels toward retail environments with stronger attribution capabilities

- The increasing decline of third-party cookies is further accelerating reliance on retailer-owned data assets. Retail media platforms are emerging as resilient alternatives that support privacy-compliant targeting while maintaining campaign effectiveness

- Brands are also adopting sponsored search and sponsored product formats within retail platforms to capture high-intent shoppers during active purchasing moments. This behavior reinforces the role of retail media as a critical driver of incremental sales

- Overall, the rising integration of first-party data into retail advertising strategies is strengthening platform adoption and reshaping how brands engage consumers across digital retail touchpoints

Retail Media Platform Market Dynamics

Driver

“Rising Shift of Ad Budgets Toward Performance-Focused Retail Media”

- The retail media platform market is strongly driven by the rising shift of advertising budgets toward performance-focused channels that deliver measurable return on ad spend. Brands are increasingly prioritizing platforms that connect advertising directly with sales outcomes, driving sustained investment in retail media solutions

- For instance, Walmart Connect has expanded its retail media capabilities to attract both endemic and non-endemic brands by offering closed-loop measurement and in-store attribution tools. These capabilities enable advertisers to assess campaign effectiveness across online and offline retail environments

- Retail media platforms provide advertisers with access to high-intent audiences already in a shopping mindset, improving conversion efficiency compared to traditional display or social advertising. This performance advantage is accelerating budget reallocation across major brand portfolios

- The growing adoption of programmatic retail media further enhances scalability and automation, making it easier for brands to manage campaigns across multiple retailer networks. This supports higher spending volumes and long-term advertiser commitment

- As marketing teams face increased pressure to justify ad spend with tangible results, retail media platforms continue to gain traction as reliable, outcome-driven advertising channels. This sustained focus on performance and accountability is reinforcing retail media as one of the fastest-growing segments within the digital advertising landscape

Restraint/Challenge

“Data Privacy Compliance and Measurement Complexity”

- The retail media platform market faces challenges related to data privacy compliance and increasing complexity in standardizing measurement across platforms. Retailers must balance monetization of shopper data with strict adherence to evolving data protection regulations across regions

- For instance, European retailers operating retail media networks must comply with GDPR requirements, which can limit data usage and complicate audience targeting strategies. These regulatory constraints increase operational complexity and require ongoing investment in compliance frameworks

- Measurement inconsistency across different retail media platforms presents challenges for brands managing multi-retailer campaigns. Variations in attribution models and reporting standards make cross-platform performance comparison difficult

- Smaller retailers entering the retail media space may struggle to match the data sophistication and analytics capabilities of larger platforms. This creates uneven market maturity and adoption levels

- Collectively, data privacy obligations and fragmented measurement standards continue to act as constraints, requiring industry-wide efforts to improve transparency, interoperability, and trust across retail media ecosystems

Retail Media Platform Market Scope

The market is segmented on the basis of ad format, platform type, deployment, and end use.

• By Ad Format

On the basis of ad format, the retail media platform market is segmented into display ads, search ads, sponsored content, and others. The search ads segment dominated the market in 2025, driven by their high purchase-intent targeting, strong conversion rates, and direct placement at the point of product discovery on retail platforms. Brands increasingly allocate higher budgets to search ads as they deliver measurable ROI through keyword-level performance tracking and closed-loop attribution. Retailers benefit from search ads due to premium pricing and minimal disruption to the shopping experience. The ability to align ads with real-time shopper queries further strengthens the dominance of this segment across large e-commerce ecosystems.

The sponsored content segment is expected to register the fastest growth from 2026 to 2033, supported by rising demand for native, context-driven advertising formats. Sponsored content enables brands to engage consumers through product stories, comparisons, and recommendations embedded within the shopping journey. This format supports upper- and mid-funnel objectives while maintaining a non-intrusive experience. Increasing use of data-driven personalization and rich media formats continues to accelerate adoption among premium and emerging brands.

• By Platform Type

On the basis of platform type, the market is segmented into retailer-owned media networks, third-party media networks, and integrated media platforms. Retailer-owned media networks accounted for the largest revenue share of 59.5% in 2025, supported by first-party shopper data, direct control over ad inventory, and strong relationships with brand advertisers. Major retailers leverage transaction-level insights to offer highly targeted campaigns with closed-loop measurement, enhancing advertiser confidence. These platforms also benefit from higher margins as retailers monetize their digital real estate. Growing investments in in-house ad tech capabilities further reinforce their market leadership.

The integrated media platforms segment is projected to witness the fastest growth during the forecast period, driven by demand for unified campaign management across multiple retail and digital touchpoints. Integrated platforms allow advertisers to plan, execute, and measure campaigns across owned and partner networks through a single interface. This approach improves scalability, operational efficiency, and cross-channel attribution. Increasing adoption by multinational brands seeking consistent reach across fragmented retail ecosystems supports rapid growth.

• By Deployment

On the basis of deployment, the retail media platform market is segmented into cloud and on-premises. The cloud segment dominated the market with the largest share of 64.5% in 2025, owing to its scalability, lower infrastructure costs, and ability to process large volumes of real-time shopper data. Cloud-based platforms enable faster campaign optimization, seamless integration with analytics tools, and continuous feature updates. Retailers and advertisers favor cloud deployment for its flexibility in managing fluctuating traffic and ad demand. Enhanced data security frameworks offered by leading cloud providers further support adoption.

The on-premises segment is expected to grow at a faster pace in specific enterprise environments, particularly among large retailers with strict data governance requirements. On-premises deployment provides greater control over proprietary shopper data and internal systems. This model is preferred in regions with stringent data localization regulations. Increasing hybrid architectures that combine on-premises control with cloud scalability also contribute to segment growth momentum.

• By End Use

On the basis of end use, the market is segmented into consumer packaged goods, electronics and technology, apparel and fashion, grocery and food delivery, beauty and personal care, and others. The consumer packaged goods segment held the largest revenue share in 2025, driven by high competition for digital shelf visibility and frequent product launches. CPG brands rely heavily on retail media to influence purchase decisions at the point of sale and to support promotional campaigns. The ability to link ad exposure directly to sales outcomes strengthens continued spending from this segment. High campaign volumes and recurring ad investments sustain its dominance.

The grocery and food delivery segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising online grocery penetration and increasing use of sponsored placements during routine purchases. Advertisers leverage retail media to promote private labels, new products, and limited-time offers in high-frequency shopping environments. Data-driven personalization and real-time promotions enhance effectiveness in this segment. Expanding quick-commerce and hyperlocal delivery platforms further accelerate adoption across urban markets.

Retail Media Platform Market Regional Analysis

- North America dominated the retail media platform market with the largest revenue share of 37.1% in 2025, driven by the strong presence of advanced e-commerce ecosystems, high digital advertising spending, and early adoption of data-driven marketing technologies

- Retailers and brands in the region actively leverage first-party shopper data to improve targeting accuracy, campaign measurement, and return on ad spend across digital touchpoints

- This dominance is further supported by mature cloud infrastructure, widespread use of AI-powered analytics, and strong demand for closed-loop attribution models, positioning retail media platforms as a core component of omnichannel marketing strategies

U.S. Retail Media Platform Market Insight

The U.S. retail media platform market captured the largest revenue share within North America in 2025, fueled by the rapid expansion of e-commerce, digital grocery, and direct-to-consumer channels. Major retailers increasingly monetize their digital properties through in-house media networks, attracting significant brand investments. Advertisers in the U.S. prioritize retail media due to its ability to link ad exposure directly to purchase behavior. Strong adoption of programmatic advertising and advanced personalization tools continues to accelerate market growth.

Europe Retail Media Platform Market Insight

The Europe retail media platform market is expected to expand at a steady CAGR during the forecast period, driven by rising digital retail penetration and growing demand for privacy-compliant advertising solutions. Retailers across the region are focusing on first-party data strategies in response to stricter data protection regulations. Increasing investments in omnichannel retailing and digital transformation are supporting adoption. Retail media platforms are gaining traction across both large retail chains and emerging online marketplaces.

U.K. Retail Media Platform Market Insight

The U.K. retail media platform market is anticipated to grow at a notable CAGR, supported by the country’s well-developed e-commerce infrastructure and strong brand participation in digital advertising. Retailers are increasingly launching proprietary media networks to diversify revenue streams and strengthen brand partnerships. High consumer engagement with online shopping and mobile commerce enhances campaign effectiveness. The integration of retail media with loyalty programs and personalization tools further supports market expansion.

Germany Retail Media Platform Market Insight

The Germany retail media platform market is projected to grow at a considerable CAGR, driven by increasing digitalization of retail operations and a strong focus on data security and transparency. German retailers are gradually adopting retail media solutions to enhance monetization while maintaining compliance with stringent privacy standards. Growth in omnichannel shopping and digital advertising budgets supports adoption. The emphasis on measurable performance outcomes is encouraging brands to increase spending on retail media platforms.

Asia-Pacific Retail Media Platform Market Insight

The Asia-Pacific retail media platform market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid e-commerce expansion, rising digital advertising spend, and increasing smartphone penetration. Growing adoption of online marketplaces and super-app ecosystems is accelerating demand for retail media solutions. Retailers in the region are increasingly investing in data analytics and AI-driven targeting capabilities. The combination of large consumer bases and fast-growing digital economies supports strong regional growth momentum.

Japan Retail Media Platform Market Insight

The Japan retail media platform market is gaining traction due to high digital adoption, advanced retail technology infrastructure, and strong demand for precision marketing. Japanese retailers are increasingly integrating retail media with loyalty programs and in-store digital channels. Brands value the ability to engage consumers across online and offline touchpoints with measurable outcomes. The focus on personalization and seamless customer experiences continues to drive market growth.

China Retail Media Platform Market Insight

The China retail media platform market accounted for the largest revenue share in Asia-Pacific in 2025, driven by the dominance of large e-commerce ecosystems and high digital advertising intensity. Retail media is deeply embedded within super-apps and online marketplaces, enabling direct conversion-driven advertising. Strong adoption of AI, big data analytics, and real-time bidding enhances campaign effectiveness. The rapid growth of digital commerce and brand competition continues to propel market expansion across China.

Retail Media Platform Market Share

The retail media platform industry is primarily led by well-established companies, including:

- Target Brands, Inc. (U.S.)

- Criteo (France)

- Amazon Advertising (U.S.)

- Walgreen Co. (U.S.)

- The Trade Desk (U.S.)

- Instacart Ads (U.S.)

- Ulta Beauty, Inc. (U.S.)

- Google Ads (U.S.)

- Best Buy (U.S.)

- PubMatic, Inc. (U.S.)

- Kroger Precision Marketing (U.S.)

- Meta Ads (U.S.)

- CVS Health (U.S.)

- Walmart Connect (U.S.)

- Wayfair LLC (U.S.)

Latest Developments in Global Retail Media Platform Market

- In September 2024, Instacart strengthened the retail media platform market by partnering with independent grocers to scale Carrot Ads, enabling smaller and regional retailers to launch on-site advertising capabilities. This development expanded retail media access beyond large chains, increasing overall market penetration and creating new monetization opportunities for local grocery stores. By simplifying advertiser access across a fragmented grocery landscape, the collaboration enhanced inventory availability and reinforced retail media as a performance-driven channel for CPG brands

- In April 2024, Walmart Connect accelerated market expansion by announcing enhanced advertising solutions focused on marketplace sellers and non-endemic brands. The introduction of programmatic on-site display ads, international expansion, and in-store attribution tools improved measurement accuracy and omnichannel reach. Strategic partnerships with Roku and TikTok strengthened cross-platform visibility, while self-service tools lowered entry barriers for advertisers, increasing adoption across mid-sized and emerging brands

- In March 2024, Lowe’s collaboration with Google significantly advanced data-driven retail media by integrating first-party customer insights with Google’s advertising technology. This development improved precision targeting across search and shopping environments, increasing campaign effectiveness for home improvement brands. The partnership strengthened the convergence of retail media and search advertising, reinforcing retail media platforms as critical performance marketing assets

- In February 2024, Amazon Ads enhanced its retail media capabilities by expanding sponsored ad formats and improving AI-driven targeting across its e-commerce ecosystem. These advancements increased advertiser efficiency by linking shopper intent more closely with real-time purchase behavior. The move further solidified Amazon’s role as a benchmark for closed-loop measurement, intensifying competition and innovation across the retail media platform market

- In January 2024, Target expanded its Roundel retail media network by introducing advanced analytics and off-site advertising integrations. This development enabled brands to activate Target’s first-party data beyond owned platforms while maintaining measurement transparency. The expansion supported higher advertiser spend and reinforced the importance of integrated media strategies, contributing to sustained growth across the retail media platform landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.