Global Retail Platform Market

Market Size in USD Billion

CAGR :

%

USD

38.51 Billion

USD

140.22 Billion

2025

2033

USD

38.51 Billion

USD

140.22 Billion

2025

2033

| 2026 –2033 | |

| USD 38.51 Billion | |

| USD 140.22 Billion | |

|

|

|

|

Retail Platform Market Size

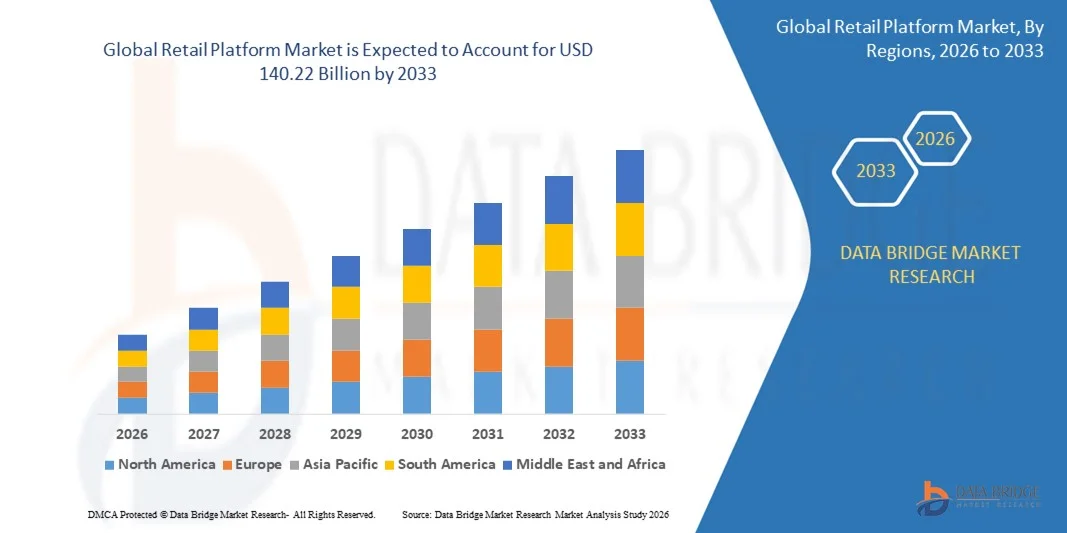

- The global retail platform market size was valued at USD 38.51 billion in 2025 and is expected to reach USD 140.22 billion by 2033, at a CAGR of 17.53% during the forecast period

- The market growth is largely driven by the rapid digital transformation of the retail industry, fueled by the increasing adoption of e-commerce platforms, mobile payment systems, and omnichannel retail strategies that enhance customer engagement and streamline operations across online and offline channels

- Furthermore, the growing integration of advanced technologies such as artificial intelligence, data analytics, and cloud computing is enabling retailers to deliver personalized shopping experiences, optimize inventory management, and improve operational efficiency, thereby accelerating the expansion of digital retail platforms

Retail Platform Market Analysis

- Retail platforms, serving as digital ecosystems that connect buyers and sellers, are becoming essential to modern commerce by enabling seamless product discovery, secure transactions, and enhanced consumer experiences through advanced technological integration across multiple channels

- The increasing demand for retail platforms is being propelled by rising e-commerce penetration, the proliferation of smartphones and internet connectivity, and growing consumer preference for flexible, convenient, and personalized shopping experiences across global markets

- Asia-Pacific dominated the retail platform market with a share of 45.1% in 2025, due to rapid digitalization, increasing e-commerce penetration, and the expansion of mobile payment ecosystems across emerging economies

- North America is expected to be the fastest growing region in the retail platform market during the forecast period due to increasing adoption of cloud-based retail solutions, rising demand for omnichannel integration, and expansion of online marketplaces

- Platforms segment dominated the market with a market share of 69% in 2025, due to the growing adoption of integrated digital platforms that enable real-time inventory management, omnichannel sales, and customer experience optimization. Retailers are investing heavily in advanced platform-based ecosystems that consolidate data across supply chains and stores, enhancing operational efficiency and reducing costs. The demand for scalable, AI-driven, and analytics-integrated platforms continues to expand as businesses prioritize digital transformation and data-centric decision-making to improve competitiveness and profitability

Report Scope and Retail Platform Market Segmentation

|

Attributes |

Retail Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Retail Platform Market Trends

Integration of AI and Data Analytics in Retail Platforms

- The retail platform market is undergoing a major transformation through the integration of artificial intelligence (AI) and advanced data analytics to improve sales operations, customer engagement, and inventory optimization. Retailers are increasingly adopting AI-driven systems that analyze large volumes of consumer data to personalize shopping experiences, forecast demand, and automate marketing efforts in an increasingly digital commerce environment

- For instance, Salesforce and Shopify have incorporated AI-powered analytics tools within their retail ecosystems to deliver insights on customer purchasing behavior, sales performance, and real-time product recommendations. Similarly, Oracle Retail has enhanced its cloud platform with predictive analytics to optimize pricing and inventory strategies based on regional demand and seasonal purchasing trends

- AI and machine learning algorithms allow retail platforms to process structured and unstructured data from multiple channels such as online stores, mobile apps, and in-store systems. These insights empower retailers to improve customer retention through better personalization and reduce stock-outs by predicting demand fluctuation with precision. Retailers are focusing on harnessing data analytics to gain competitive advantages within fast-evolving omnichannel markets

- The integration of visual AI tools and natural language processing is transforming customer interaction by enabling chatbots, voice-based shopping assistants, and automated customer service systems. This improves service efficiency while maintaining consistent brand engagement across digital and physical touchpoints

- Data analytics also enhances marketing automation and revenue management by supporting dynamic pricing, audience segmentation, and campaign performance tracking. These analytics-driven methods help retailers build adaptive strategies that respond to shifting consumer expectations in real time

- Overall, the convergence of AI and analytics within retail platforms is redefining operational efficiency, customer experience, and data-led strategic planning. This technological shift marks a key evolution toward smarter, predictive, and more responsive retail ecosystems capable of sustaining long-term competitiveness in the digital economy

Retail Platform Market Dynamics

Driver

Rapid Expansion of E-Commerce and Omnichannel Retail Ecosystems

- The continuous expansion of e-commerce and the growth of omnichannel retail ecosystems are significant factors driving retail platform evolution. Consumers increasingly expect seamless purchasing experiences across digital, mobile, and physical channels, compelling retailers to adopt integrated platforms that unify sales, logistics, and customer management functions

- For instance, Amazon and Alibaba have expanded their omnichannel retail infrastructures by integrating advanced digital solutions and AI-driven insights to streamline supply chain operations and strengthen personalized shopping recommendations. These platforms demonstrate the global shift toward tech-enabled retail ecosystems catering to evolving consumer expectations for convenience and transparency

- Retailers are investing in scalable digital platforms that connect point-of-sale systems, online marketplaces, and mobile commerce applications through unified databases. This interconnected structure ensures consistency in inventory visibility, pricing accuracy, and order management while enabling real-time customer engagement and loyalty program integration

- The post-pandemic retail environment has reinforced the necessity of hybrid models, merging online convenience with in-store experiential offerings. Retailers leveraging platform-based technologies have improved data synchronization across channels, achieving greater operational agility and responsiveness to sudden market changes

- Growing internet penetration, digital payment adoption, and technological affordability are further expanding opportunities for global retailers to reach diverse consumer bases. As e-commerce continues to surge, integrated retail platforms will remain essential to effectively manage omnichannel operations and enhance customer-centric retail experiences

Restraint/Challenge

Data Privacy and Cybersecurity Concerns

- Data privacy and cybersecurity concerns pose a serious challenge to the retail platform market, particularly with the rising volume of personal and payment information processed through digital retail systems. As platforms evolve to store and analyze vast datasets, they face greater vulnerability to data breaches, ransomware attacks, and unauthorized access incidents

- For instance, in 2024, several leading retailers, including Target Corporation and JD.com, reported elevated cybersecurity investments following incidents of attempted data breaches targeting customer databases and transaction systems. These events have highlighted the growing need for continuous risk management and infrastructure protection within retail ecosystems

- The integration of multiple digital touchpoints across e-commerce, mobile applications, and supply chain networks increases the complexity of maintaining security compliance. Retailers must adhere to evolving privacy frameworks such as GDPR and CCPA, which demand stringent data protection measures and customer consent verification processes

- Cyber threats such as phishing, malware attacks, and credential theft result in financial losses and can also severely erode consumer trust and brand reputation. Retailers therefore face dual challenges of sustaining digital innovation while ensuring robust protection of sensitive customer data across platforms

- Strengthening cybersecurity through AI-enabled threat detection, encrypted data storage, and regulatory compliance systems will be essential for maintaining platform integrity. Building consumer confidence through transparency, secure data management practices, and incident prevention mechanisms remains critical for the sustained success of retail platforms in the digital economy

Retail Platform Market Scope

The market is segmented on the basis of offering, platform, service, and deployment mode.

- By Offering

On the basis of offering, the retail platform market is segmented into platforms and services. The platforms segment dominated the market with the largest revenue share of 69% in 2025, driven by the growing adoption of integrated digital platforms that enable real-time inventory management, omnichannel sales, and customer experience optimization. Retailers are investing heavily in advanced platform-based ecosystems that consolidate data across supply chains and stores, enhancing operational efficiency and reducing costs. The demand for scalable, AI-driven, and analytics-integrated platforms continues to expand as businesses prioritize digital transformation and data-centric decision-making to improve competitiveness and profitability.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, propelled by the rising need for platform customization, system integration, and technical support among retailers. As businesses adopt multiple digital solutions, the demand for managed and professional services has surged to ensure smooth deployment and performance optimization. Service providers offering consulting, maintenance, and cloud migration assistance are gaining traction, particularly among small and medium retailers lacking in-house IT capabilities. The growing complexity of omnichannel retail operations further reinforces the need for continuous service support and upgrades.

- By Platform

On the basis of platform, the retail platform market is segmented into supply chain management solutions, store operations platforms, sales & commerce platforms, customer engagement tools, analytics & insights platforms, post-sale service platforms, and other platforms. The sales & commerce platforms segment dominated the market in 2025, driven by the rapid shift toward e-commerce and digital storefront management. Retailers increasingly rely on these platforms to streamline product listings, pricing strategies, and order fulfillment across physical and online channels. Advanced features such as AI-driven recommendations, automated checkout systems, and integrated payment gateways have significantly enhanced the customer journey, strengthening brand loyalty and sales performance.

The analytics & insights platforms segment is anticipated to record the fastest growth from 2026 to 2033 due to the escalating demand for data-driven decision-making in retail operations. These platforms help retailers analyze consumer preferences, predict demand, and optimize inventory through real-time insights. The growing integration of machine learning and predictive analytics tools enables businesses to enhance personalization, improve sales forecasting, and mitigate operational inefficiencies. Retailers are leveraging analytics solutions to gain a competitive edge by transforming raw data into actionable intelligence for strategic growth.

- By Service

On the basis of service, the retail platform market is segmented into professional services and managed services. The managed services segment held the largest market share in 2025, attributed to the increasing reliance of retailers on third-party providers for continuous system monitoring, maintenance, and optimization. Managed service providers help reduce operational complexities by ensuring platform reliability and cybersecurity, enabling retailers to focus on core business operations. The growing use of cloud-based retail solutions and the need for 24/7 support to prevent downtime have further amplified managed service adoption across global retail chains.

The professional services segment is projected to witness the fastest growth rate from 2026 to 2033, fueled by the growing need for consulting, customization, and integration services. Retailers increasingly seek professional expertise to tailor platforms to their specific business models and ensure seamless integration with existing IT infrastructure. As digital retail ecosystems evolve, demand for data migration, training, and post-deployment optimization services continues to rise. This trend is particularly evident among enterprises expanding into new markets and digital channels.

- By Deployment Mode

On the basis of deployment mode, the retail platform market is segmented into cloud and on-premises. The cloud segment dominated the market in 2025, driven by its scalability, cost-effectiveness, and ease of access across distributed retail networks. Cloud-based retail platforms allow retailers to deploy solutions quickly, manage operations remotely, and enable real-time data synchronization across multiple locations. The increasing shift toward SaaS models and hybrid cloud environments has improved data agility, operational transparency, and disaster recovery capabilities, making cloud deployment the preferred choice for modern retail enterprises.

The on-premises segment is expected to witness steady growth through 2033, primarily in large-scale retail organizations with strict data security and compliance requirements. On-premises deployment provides retailers with enhanced control over sensitive business data and system configurations. Industries handling high-value transactions or regulated environments continue to rely on in-house infrastructure for privacy assurance. However, technological advancements in edge computing and localized analytics are expected to modernize on-premises systems, balancing security with performance.

Retail Platform Market Regional Analysis

- Asia-Pacific dominated the retail platform market with the largest revenue share of 45.1% in 2025, driven by rapid digitalization, increasing e-commerce penetration, and the expansion of mobile payment ecosystems across emerging economies

- The region’s thriving online retail sector, rising consumer preference for omnichannel experiences, and growing investments in retail technology solutions are accelerating market expansion

- The availability of a young, tech-savvy population, supportive government initiatives promoting digital transformation, and strong growth in SMEs adopting online platforms are contributing to regional market growth

China Retail Platform Market Insight

China held the largest share in the Asia-Pacific retail platform market in 2025, supported by its leadership in e-commerce innovation and large digital consumer base. The presence of major players such as Alibaba and JD.com, coupled with advanced logistics and payment infrastructure, drives strong platform adoption. Expanding cross-border e-commerce and the integration of AI and big data analytics in online retail further strengthen China’s market position.

India Retail Platform Market Insight

India is witnessing the fastest growth in the Asia-Pacific retail platform market, fueled by rapid smartphone penetration, affordable internet access, and the rise of digital payment systems. Initiatives such as “Digital India” and growing support for startups are propelling adoption among local retailers and small enterprises. Increasing competition among platforms such as Flipkart and Reliance Retail is also enhancing customer experience and expanding the country’s digital retail ecosystem.

Europe Retail Platform Market Insight

The Europe retail platform market is expanding steadily, supported by the modernization of brick-and-mortar stores, strong regulatory frameworks for data protection, and growing consumer trust in online transactions. The adoption of AI-driven personalization and omnichannel retail strategies is enhancing user engagement. Emphasis on sustainability, transparency, and local sourcing is also shaping platform innovations across European markets.

Germany Retail Platform Market Insight

Germany’s retail platform market is driven by advanced technological integration, efficient logistics networks, and a well-established consumer base embracing online shopping. The country’s focus on automation, data analytics, and digital payment solutions is promoting platform adoption across both B2C and B2B segments. Retailers are increasingly investing in hybrid models combining physical and digital retail experiences.

U.K. Retail Platform Market Insight

The U.K. market benefits from a highly developed e-commerce ecosystem, strong financial infrastructure, and growing preference for online retailing post-Brexit. The rise of direct-to-consumer brands, coupled with the adoption of AI, predictive analytics, and mobile commerce, is enhancing market competitiveness. The country’s emphasis on personalization and customer experience continues to position it as a key hub for digital retail innovation.

North America Retail Platform Market Insight

North America is projected to record robust growth from 2026 to 2033, driven by increasing adoption of cloud-based retail solutions, rising demand for omnichannel integration, and expansion of online marketplaces. Technological advancements such as AI, IoT, and predictive analytics are transforming retail operations. In addition, growing partnerships between retailers and tech firms are strengthening market presence across digital channels.

U.S. Retail Platform Market Insight

The U.S. accounted for the largest share in the North America retail platform market in 2025, owing to its dominant e-commerce ecosystem and high adoption of advanced retail technologies. Major companies such as Amazon, Walmart, and Shopify continue to innovate in logistics, automation, and AI-driven personalization. The focus on enhancing customer engagement, improving operational efficiency, and expanding digital storefronts reinforces the U.S.'s leadership in the retail platform landscape.

Retail Platform Market Share

The retail platform industry is primarily led by well-established companies, including:

- Amazon.com, Inc. (U.S.)

- Alibaba Group Holding Limited (China)

- Walmart Inc. (U.S.)

- Shopify Inc. (Canada)

- eBay Inc. (U.S.)

- Rakuten Group, Inc. (Japan)

- JD.com, Inc. (China)

- Zalando SE (Germany)

- Flipkart Internet Private Limited (India)

- MercadoLibre, Inc. (Argentina)

- Otto Group (Germany)

- Coupang, Inc. (South Korea)

- Best Buy Co., Inc. (U.S.)

- Sainsbury’s Argos (U.K.)

- Tesco PLC (U.K.)

Latest Developments in Global Retail Platform Market

- In June 2025, Snappy Shopper entered into a partnership with Foodhub to integrate their quick-commerce and food delivery networks across the U.K., connecting over 1,000 local retailers. This collaboration enhances both platforms’ market reach, strengthens their competitive positioning in the fast-growing quick-commerce segment, and supports smaller retailers with digital visibility and last-mile delivery infrastructure, thereby fueling regional retail digitization and consumer convenience

- In May 2025, Alibaba Group formed a strategic partnership with Xiaohongshu (Red Note) to integrate Taobao and Tmall products into Xiaohongshu’s lifestyle content ecosystem. This move expands Alibaba’s access to content-driven e-commerce traffic, bolsters user engagement, and reinforces its leadership in China’s retail platform market by blending social interaction with instant retail and accelerated delivery capabilities

- In May 2025, Manhattan Associates expanded its cloud footprint through a go-to-market collaboration with Google Cloud, offering its omnichannel retail and supply chain software suite on the Google Cloud Marketplace. This partnership empowers retailers to scale operations more efficiently, leverage AI-powered analytics, and accelerate digital transformation, significantly strengthening Manhattan’s presence in the global retail technology and SaaS-based platform segment

- In April 2025, Zalando SE acquired DeepAR, a London-based augmented reality startup, to enhance its retail platform with immersive 3D and virtual try-on technology. This acquisition enables Zalando to elevate user experience through advanced visualization tools, driving higher customer engagement and conversion rates, while positioning the company as a frontrunner in the European immersive e-commerce landscape

- In February 2025, Adore Beauty, a leading Australian online beauty retailer, launched its first physical retail store in Melbourne in collaboration with technology firm Zitcha to implement in-store retail media integration. This development marks a major step in the convergence of digital and physical retail, allowing Adore Beauty to strengthen customer engagement, diversify revenue streams, and reinforce its role as an innovator in omnichannel retail experiences within the Asia-Pacific market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.