Global Retail Point Of Sale Market

Market Size in USD Billion

CAGR :

%

USD

35.06 Billion

USD

100.36 Billion

2024

2032

USD

35.06 Billion

USD

100.36 Billion

2024

2032

| 2025 –2032 | |

| USD 35.06 Billion | |

| USD 100.36 Billion | |

|

|

|

|

Retail Point of Sale Market Size

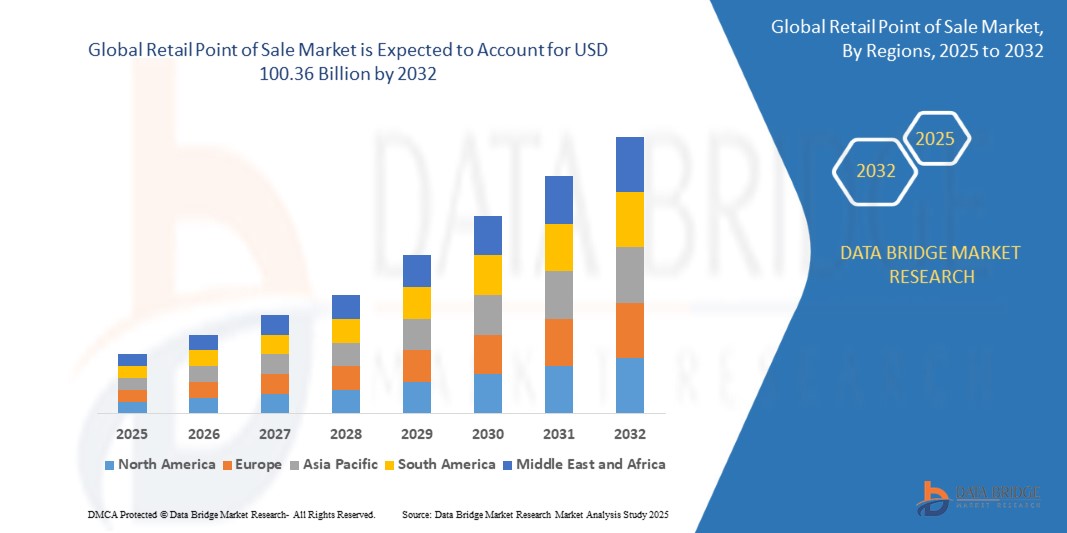

- The global retail point of sale market size was valued at USD 35.06 billion in 2024 and is expected to reach USD 100.36 billion by 2032, at a CAGR of 14.05% during the forecast period

- The market growth is largely fuelled by the increasing adoption of cloud-based point of sale systems, rising demand for contactless payment solutions, and growing integration of analytics and customer relationship management features into retail systems

- The shift toward omnichannel retailing and the need for seamless transaction experiences across in-store, mobile, and online platforms are also accelerating the deployment of advanced point of sale technologies worldwide

Retail Point of Sale Market Analysis

- The market is witnessing a shift from traditional cash registers to advanced digital systems that offer real-time inventory management, sales tracking, and data-driven customer insights.

- The proliferation of mobile point of sale devices across retail chains, supermarkets, and specialty stores is contributing to improved customer experience and enhanced operational efficiency

- North America dominated the retail point of sale (POS) market with the largest revenue share of 38.65% in 2024, driven by the growing need for efficient transaction systems and enhanced customer engagement across retail environments

- Asia-Pacific region is expected to witness the highest growth rate in the global retail point of sale market, driven by increasing urbanization, rising smartphone penetration, and expanding retail infrastructure in emerging economies such as China and India

- The fixed POS segment held the largest market revenue share of 67.4% in 2024, primarily due to its widespread adoption across large retail chains and supermarkets. These systems are valued for their stability, multifunctionality, and ability to handle high transaction volumes efficiently. Retailers continue to prefer fixed POS systems for their integrated hardware solutions, including barcode scanners, receipt printers, and cash drawers, which support smooth and uninterrupted operations

Report Scope and Retail Point of Sale Market Segmentation

|

Attributes |

Retail Point of Sale Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Retail Point of Sale Market Trends

Shift Toward Unified Commerce and Integrated Retail Experiences

The growing integration of online and offline retail channels is accelerating the adoption of unified commerce platforms supported by advanced point of sale systems. These platforms enable real-time inventory synchronization, centralized customer data management, and seamless checkout experiences, driving operational efficiency and customer satisfaction across physical and digital storefronts

The demand for integrated loyalty programs, personalized promotions, and customer-centric insights is pushing retailers to invest in POS systems with customer relationship management (CRM) features. These capabilities enable tailored engagement, improve customer retention, and enhance revenue per user. The trend is gaining traction across grocery chains, specialty retail, and department stores

The proliferation of mobile-based POS terminals is transforming how retailers operate, especially in small-format stores and pop-up retail spaces. These mobile units allow for flexible billing, reduced queue times, and more interactive customer experiences. Growth in contactless payment preferences and digital wallet usage is further propelling the mobile POS trend globally

For instance, in 2024, several apparel brands across the United States integrated cloud POS systems with their e-commerce operations, enabling cross-channel returns and exchanges. This approach not only improved operational efficiency but also led to a notable rise in repeat customer purchases and basket sizes

While unified commerce is redefining retail strategies, its success depends on data accuracy, cybersecurity infrastructure, and consistent omnichannel execution. Vendors must offer scalable and secure POS ecosystems that support dynamic retail environments and fast-changing consumer behaviors

Retail Point of Sale Market Dynamics

Driver

Digital Transformation of Retail Sector and Growing Demand for Real-Time Analytics

- The ongoing digital transformation in the retail sector is driving the need for smart POS systems that offer real-time analytics, inventory insights, and sales forecasting. Retailers are using this data to optimize stocking, improve customer engagement, and personalize product recommendations, resulting in better profitability and reduced wastage

- Shifting consumer expectations for faster, frictionless, and customized checkout processes are encouraging retailers to deploy advanced POS platforms. These systems enable unified operations across physical and digital channels, streamline workflows, and improve transaction speed, directly impacting customer loyalty and satisfaction

- Cloud-based POS platforms are gaining momentum due to their scalability, ease of updates, and low upfront costs. Small and medium enterprises, in particular, are adopting these solutions to modernize operations and stay competitive in the evolving retail landscape

- For instance, in 2023, a global fast-food chain reported a 20% increase in transaction speed after upgrading to a cloud-enabled POS system integrated with AI-based analytics. This upgrade enhanced decision-making and improved customer throughput across outlets

- Although the retail POS market is benefitting from digitalization, successful implementation requires integration with legacy systems, user training, and consistent connectivity. Vendors need to offer tailored solutions based on store size, format, and industry vertical to maximize adoption and return on investment

Restraint/Challenge

Data Privacy Concerns and High Initial Investment in POS Infrastructure

- As POS systems increasingly capture sensitive customer and transaction data, retailers face heightened regulatory scrutiny and growing cybersecurity threats. Concerns over data breaches and compliance with global privacy regulations such as the General Data Protection Regulation and California Consumer Privacy Act act as significant deterrents, especially for small retailers

- Upgrading or deploying a modern POS system requires considerable capital investment in hardware, software, and training. High upfront costs and uncertain return timelines limit adoption, particularly in emerging markets or among independent retailers with tight budgets

- Compatibility issues between new POS solutions and legacy infrastructure often complicate implementation. Retailers must undertake system overhauls, resulting in operational disruptions and increased downtime, which can negatively affect the customer experience and store performance

- For instance, in 2023, several independent grocery chains in Latin America cited integration costs and data migration risks as major challenges in replacing outdated billing systems with cloud-based POS platforms

- To address these challenges, vendors must focus on offering modular and cost-effective POS packages, enhanced cybersecurity protocols, and robust technical support to ensure secure and smooth transitions across retail environments

Retail Point of Sale Market Scope

The retail point of sale market is segmented into three notable segments based on product, component, and end user.

• By Product

On the basis of product, the retail POS market is segmented into fixed POS and mobile POS. The fixed POS segment held the largest market revenue share of 67.4% in 2024, primarily due to its widespread adoption across large retail chains and supermarkets. These systems are valued for their stability, multifunctionality, and ability to handle high transaction volumes efficiently. Retailers continue to prefer fixed POS systems for their integrated hardware solutions, including barcode scanners, receipt printers, and cash drawers, which support smooth and uninterrupted operations.

The mobile POS segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for flexible checkout options and the proliferation of tablet- and smartphone-based solutions. Mobile POS systems enable retailers to serve customers anywhere within the store, reducing queue times and enhancing customer engagement. Their portability, ease of deployment, and compatibility with cloud-based platforms make them an ideal choice for small businesses and pop-up stores.

• By Component

On the basis of component, the retail POS market is segmented into hardware, software, and service. The hardware segment dominated the market in 2024, accounting for the largest revenue share, owing to the essential role of physical infrastructure in POS operations. Cash registers, terminals, and peripherals remain fundamental in retail environments, especially where large-scale transactions and inventory management are involved. Hardware continues to be a key investment area, particularly in grocery and department stores.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising need for analytics, cloud integration, and customer relationship management tools. POS software enables real-time insights, personalized promotions, and inventory tracking, offering retailers a competitive edge. The evolution of software-as-a-service (SaaS) models and frequent updates are further driving adoption across all retail segments.

• By End User

On the basis of end user, the retail POS market is segmented into grocery stores, specialty stores, and gas stations. The grocery store segment captured the largest market share in 2024, supported by consistent demand for fast, reliable, and efficient checkout systems. Retailers in this category require POS solutions capable of managing high transaction volumes, complex inventories, and loyalty programs. Integration with self-checkout systems is also becoming more prevalent in this segment.

The specialty store segment is expected to witness the fastest growth rate from 2025 to 2032, as niche retailers increasingly adopt modern POS systems to enhance customer experience and personalize service. These stores benefit from mobile POS terminals and cloud-based systems that allow for flexible operations and detailed analytics. Specialty retailers are also leveraging POS tools to track inventory trends, customize offerings, and build brand loyalty.

Retail Point of Sale Market Regional Analysis

- North America dominated the retail point of sale (POS) market with the largest revenue share of 38.65% in 2024, driven by the growing need for efficient transaction systems and enhanced customer engagement across retail environments

- The region has witnessed a surge in the adoption of mobile POS systems, supported by widespread smartphone usage and cloud-based software solutions

- The shift toward omnichannel retailing and increasing demand for integrated analytics and inventory tracking are further boosting the market in the region

U.S. Retail Point of Sale (POS) Market Insight

The U.S. retail point of sale (POS) market captured the largest revenue share of 83% within North America in 2024, driven by rapid digital transformation and widespread usage of advanced POS systems in both large retail chains and small businesses. High demand for contactless payments, self-service kiosks, and cloud-based POS platforms are major contributors. The market is also benefiting from evolving consumer preferences for faster checkouts and a seamless retail experience across physical and digital touchpoints.

Europe Retail Point of Sale (POS) Market Insight

The Europe retail point of sale (POS) market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing adoption of cloud-based POS solutions and strict data security regulations. European retailers are prioritizing technology upgrades to offer personalized experiences, and the rise of cashless transactions is further fueling the need for modern POS systems. The market is also expanding due to the digitization of retail operations in grocery chains, fashion outlets, and fuel stations.

U.K. Retail Point of Sale (POS) Market Insight

The U.K. retail point of sale (POS) market is expected to witness the fastest growth rate from 2025 to 2032, propelled by the country’s strong digital payment infrastructure and a growing emphasis on contactless commerce. As e-commerce and in-store shopping increasingly blend, U.K. retailers are deploying cloud-enabled and mobile POS systems to streamline operations and enhance customer service. The robust retail sector, paired with consumer demand for convenience, continues to drive market growth.

Germany Retail Point of Sale (POS) Market Insight

The Germany retail point of sale (POS) market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's emphasis on retail efficiency, automation, and data protection. Demand for integrated POS systems capable of managing inventory, CRM, and analytics is on the rise, particularly among supermarkets and specialty stores. In addition, the shift toward card and mobile payments and the government's digital initiatives are positively impacting the market landscape.

Asia-Pacific Retail Point of Sale (POS) Market Insight

The Asia-Pacific retail point of sale (POS) market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rapid expansion of retail chains, digital payment adoption, and growing smartphone penetration. Markets such as China, India, and Southeast Asia are witnessing a surge in demand for mobile and cloud-based POS solutions. Government-backed cashless economy initiatives and growing retail digitization efforts further strengthen market potential across the region.

Japan Retail Point of Sale (POS) Market Insight

The Japan retail point of sale (POS) market is expected to witness the fastest growth rate from 2025 to 2032, supported by a well-developed retail infrastructure and the country’s commitment to technological innovation. Japanese retailers are embracing modern POS solutions to manage multi-store operations, improve checkout experiences, and enhance data-driven decision-making. The rise in cashless transactions, particularly in convenience and specialty stores, is accelerating the deployment of integrated POS systems across the country.

China Retail Point of Sale (POS) Market Insight

The China retail point of sale (POS) market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by the country's advanced digital payment ecosystem and the explosive growth of e-commerce. Chinese retailers are rapidly transitioning to smart, cloud-based POS platforms to meet the rising expectations of tech-savvy consumers. With major investments in omnichannel retail and the increasing popularity of QR-based payments, the demand for innovative POS solutions continues to soar.

Retail Point of Sale Market Share

The Retail Point of Sale industry is primarily led by well-established companies, including:

- NCR Corporation (U.S.)

- Toshiba Global Commerce Solutions (U.S.)

- Diebold Nixdorf (U.S.)

- Oracle Corporation (U.S.)

- Shopify Inc. (Canada)

- Lightspeed POS Inc. (Canada)

- Verifone, Inc. (U.S.)

- Ingenico Group (France)

- Revel Systems Inc. (U.S.)

- Clover Network, Inc. (U.S.)

- Fujitsu Limited (Japan)

- Squirrel Systems (Canada)

- Toast, Inc. (U.S.)

- Vend Limited (New Zealand)

- EPOS Now (U.K.)

Latest Developments in Global Retail Point of Sale Market

- In January 2021, NCR Corporation announced its plan to acquire Cardtronics, marking a strategic acquisition aimed at strengthening its NCR-as-a-Service business model. The move is expected to expand NCR’s reach in the self-service banking and payment ecosystem. By integrating Cardtronics' global network of ATMs and financial services, NCR aims to deliver enhanced customer value through more comprehensive and connected solutions. This acquisition supports NCR’s efforts to boost recurring revenue streams and digital transformation capabilities, positively impacting its position in the retail and financial services market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.