Global Retractable Needle Safety Syringes Market

Market Size in USD Billion

CAGR :

%

USD

1.86 Billion

USD

2.72 Billion

2025

2033

USD

1.86 Billion

USD

2.72 Billion

2025

2033

| 2026 –2033 | |

| USD 1.86 Billion | |

| USD 2.72 Billion | |

|

|

|

|

Retractable Needle Safety Syringes Market Size

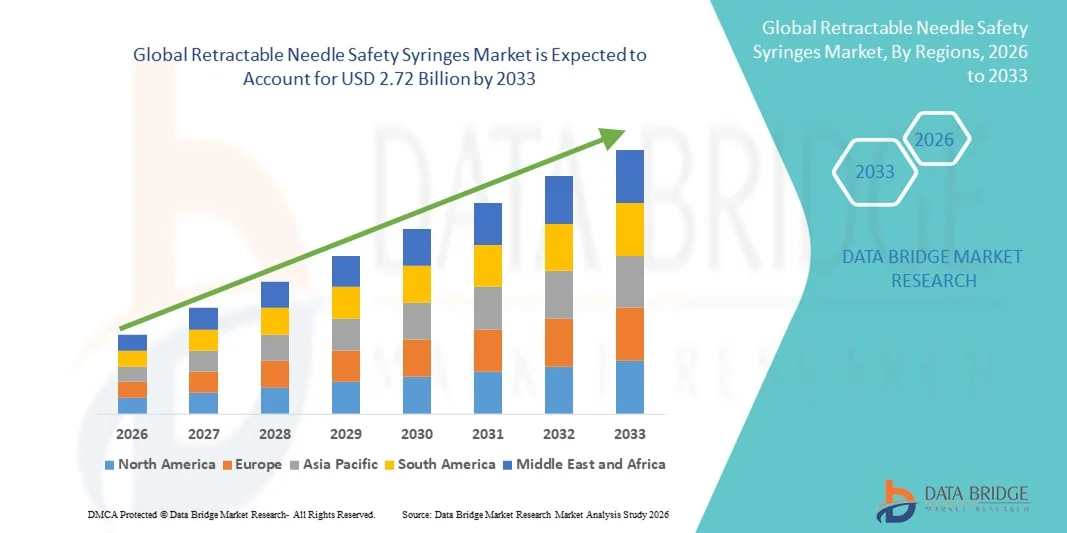

- The global retractable needle safety syringes market size was valued at USD 1.86 billion in 2025 and is expected to reach USD 2.72 billion by 2033, at a CAGR of 4.87% during the forecast period

- The market growth is largely fueled by increasing awareness of needlestick injuries and occupational hazards among healthcare workers, along with stringent safety regulations and mandates pushing adoption of safety‑engineered medical devices in hospitals, clinics, and homecare settings

- Furthermore, rising chronic disease prevalence, ongoing global vaccination campaigns, and demand for safer, user‑friendly injection solutions are establishing retractable needle safety syringes as critical components of modern healthcare safety protocols. These converging factors are accelerating the uptake of retractable safety syringe solutions, thereby significantly boosting the industry’s growth

Retractable Needle Safety Syringes Market Analysis

- Retractable needle safety syringes, designed to automatically retract the needle after use, are becoming essential in modern healthcare settings, including hospitals, clinics, and homecare environments, due to their ability to prevent needlestick injuries and ensure safe disposal

- The growing adoption of these syringes is primarily driven by increasing awareness of occupational hazards among healthcare workers, stringent government regulations on injection safety, and rising global vaccination programs that demand safe and reliable injection devices

- North America dominated the retractable needle safety syringes market with the largest revenue share of 40.7% in 2025, supported by well-established healthcare infrastructure, strict regulatory mandates on needle safety, and high adoption rates in hospitals and outpatient clinics, particularly in the U.S., where awareness campaigns and safety initiatives are boosting uptake

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period due to increasing healthcare expenditure, rapid urbanization, and growing demand for safe injection devices in emerging economies such as China and India

- Auto-retractable Safety Syringe segment dominated the market with a share of 43.9% in 2025, driven by their superior safety features, ease of use, and ability to integrate seamlessly into existing medical protocols, making them the preferred choice for both routine injections and mass immunization programs

Report Scope and Retractable Needle Safety Syringes Market Segmentation

|

Attributes |

Retractable Needle Safety Syringes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Retractable Needle Safety Syringes Market Trends

Advancements in Safety Mechanisms and User-Friendly Designs

- A key and growing trend in the global retractable needle safety syringes market is the development of autoretractable and passive safety mechanisms, designed to minimize needlestick injuries while enhancing ease of use for healthcare professionals

- For instance, BD SafetyGlide syringes feature a one-handed retraction mechanism that automatically shields the needle after injection, reducing the risk of accidental injuries

- Innovations in ergonomic designs and smaller form factors are enabling easier handling, particularly for high-volume vaccination campaigns and home-based self-administration

- Advanced retractable syringes with color-coded safety indicators and transparent barrels allow healthcare workers to monitor dosage while ensuring safety, thereby streamlining clinical workflow

- This trend towards smarter, safer, and more user-friendly syringe designs is transforming healthcare provider expectations, prompting companies such as Terumo and Retracta to develop devices with integrated safety and usability enhancements

- The demand for retractable needle syringes with enhanced safety and operational efficiency is rising rapidly in hospitals, clinics, and homecare settings as occupational safety and compliance standards gain greater emphasis

- Digital tracking and smart injection systems with RFID or barcode-enabled syringes are being developed for better inventory management and patient safety monitoring in large healthcare facilities

Retractable Needle Safety Syringes Market Dynamics

Driver

Increasing Need Due to Occupational Safety and Vaccination Programs

- The growing awareness of needlestick injuries among healthcare workers, coupled with large-scale vaccination initiatives, is a significant driver of demand for retractable needle safety syringes

- For instance, in March 2025, Terumo Corporation launched a new range of passive safety syringes in India aimed at reducing occupational hazards during mass immunization campaigns

- Healthcare facilities are increasingly mandating the use of safety-engineered injection devices to comply with OSHA and WHO guidelines, creating steady demand for retractable syringes

- The rise of self-administration for chronic disease management, including insulin and biologics, further fuels adoption as safer, user-friendly syringes are preferred by patients at home

- Ease of use, automatic needle retraction, and integration with standard injection protocols make these syringes essential tools for both healthcare providers and patients

- Growing emphasis on occupational health, infection control, and regulatory compliance continues to propel the global market forward, ensuring widespread adoption in both developed and emerging economies

- Expansion of homecare services and telemedicine programs is creating new avenues for safe injection devices for patients outside hospital settings

- Collaborations between public health organizations and manufacturers for large-scale immunization campaigns are boosting demand for standardized safety syringes in emerging markets

Restraint/Challenge

High Costs and Regulatory Approval Barriers

- The relatively high cost of advanced retractable needle syringes compared to conventional syringes poses a significant challenge to market expansion, particularly in price-sensitive regions

- For instance, the adoption of safety-engineered syringes in low- and middle-income countries is often constrained by budget limitations in public health programs

- Regulatory compliance, including approvals from FDA, CE, and local authorities, can be time-consuming and delay product launches in new markets, limiting rapid expansion

- Variations in safety standards across regions require manufacturers to adapt designs and documentation, adding complexity and cost to production and commercialization

- While prices are gradually becoming more competitive, high upfront costs for premium safety syringes may still restrict adoption in some healthcare settings

- Overcoming cost and regulatory challenges through strategic partnerships, local manufacturing, and simplified approval pathways will be essential for sustained market growth

- Limited awareness and training among healthcare workers in some regions can reduce the effective adoption of safety syringes

- Supply chain disruptions and raw material shortages, particularly for medical-grade plastics and polymers, can affect timely production and market availability of retractable syringes

Retractable Needle Safety Syringes Market Scope

The market is segmented on the basis of product type, application, and end user.

- By Product Type

On the basis of product type, the market is segmented into manual retractable safety syringe and auto-retractable safety syringe. The auto-retractable safety syringe segment dominated the market in 2025 with the largest revenue share of 43.9%, driven by its superior safety features that automatically retract the needle after use, significantly reducing the risk of needlestick injuries among healthcare professionals. Hospitals and vaccination centers prefer auto-retractable syringes for mass immunization programs and high-volume injection settings due to their reliability, ease of use, and compliance with stringent regulatory safety standards. The automatic mechanism also minimizes human error, ensures proper disposal, and enhances workflow efficiency in clinical environments. Leading manufacturers such as Terumo and BD have heavily promoted auto-retractable syringes through awareness programs targeting healthcare safety. Furthermore, rising demand for user-friendly and ergonomic designs strengthens their dominance in both developed and emerging markets.

The manual retractable safety syringe segment is expected to witness the fastest growth from 2026 to 2035, driven by increasing adoption in homecare and outpatient settings where affordability and controlled retraction mechanisms are prioritized. Manual retractable syringes offer cost advantages while still providing a high level of safety, making them attractive for self-administration of medications such as insulin. Their simplicity and lower dependence on mechanical components reduce maintenance needs, appealing to healthcare providers in regions with constrained budgets. Growth is further fueled by rising awareness of occupational safety in clinics and small-scale healthcare facilities. The manual variant is also being innovated with improved ergonomic designs and visual safety indicators to enhance usability for both professionals and patients.

- By Application

On the basis of application, the market is segmented into subcutaneous (Sub-Q), intramuscular (IM), and intravenous (IV). The subcutaneous segment dominated the market in 2025 due to the widespread use of Sub-Q injections for chronic disease management, including insulin for diabetes, biologics, and vaccines. Subcutaneous syringes are preferred for their ease of self-administration, minimal discomfort, and suitability for frequent dosing. Healthcare providers and patients alike benefit from retractable Sub-Q syringes, which reduce the risk of accidental injuries while allowing precise dosing. The increasing prevalence of chronic diseases globally, combined with homecare trends, drives the consistent demand for Sub-Q retractable syringes. In addition, regulatory emphasis on safe injection practices in hospitals and clinics further strengthens this segment’s market position.

The intramuscular (IM) segment is expected to witness the fastest growth during the forecast period, driven by expanding immunization programs and routine vaccination campaigns worldwide. IM syringes are essential in hospitals, clinics, and mass vaccination centers, where auto-retractable and safety-engineered designs prevent accidental injuries while ensuring compliance with health standards. Increasing government initiatives and NGO programs in emerging economies are significantly contributing to demand for IM retractable syringes. Pharmaceutical companies are also actively designing IM syringes with improved safety and ergonomics to cater to large-scale immunization efforts. The rising focus on adult and pediatric vaccination programs is expected to sustain high growth rates for this application segment.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgery centers, and others. The hospitals segment dominated the market in 2025, accounting for the largest revenue share, due to high patient throughput, strict adherence to occupational safety regulations, and frequent use of injections across various departments. Hospitals prefer auto-retractable syringes for inpatient care, vaccination drives, and surgical procedures, where reducing needlestick injuries is critical. The high adoption is also driven by government mandates and accreditation requirements that encourage the use of safety-engineered devices. Hospitals also benefit from economies of scale when procuring retractable syringes for multiple departments, which reinforces their dominant market position.

The clinics segment is expected to witness the fastest growth from 2026 to 2035, fueled by the rapid expansion of outpatient care services, primary healthcare centers, and home-based medical services. Clinics increasingly adopt retractable needle syringes for cost-effective safety, especially for immunizations, minor procedures, and chronic disease management. Rising awareness among clinic staff about occupational hazards and growing patient demand for safe injections are key factors driving growth. Furthermore, partnerships with syringe manufacturers to provide training and supply chains for safety devices are expanding adoption in smaller healthcare settings. The segment also benefits from innovations in compact, portable, and user-friendly syringe designs suited for clinic environments.

Retractable Needle Safety Syringes Market Regional Analysis

- North America dominated the retractable needle safety syringes market with the largest revenue share of 40.7% in 2025, supported by well-established healthcare infrastructure, strict regulatory mandates on needle safety, and high adoption rates in hospitals and outpatient clinics, particularly in the U.S., where awareness campaigns and safety initiatives are boosting uptake

- Healthcare facilities in the region prioritize the use of retractable syringes to comply with OSHA and CDC guidelines, ensuring protection for healthcare workers while maintaining high standards of patient safety during injections, vaccinations, and minor procedures

- This strong adoption is further supported by advanced healthcare infrastructure, high healthcare spending, and initiatives promoting safe injection practices, establishing retractable needle safety syringes as a standard in hospitals, clinics, and outpatient care centers across the U.S. and Canada

U.S. Retractable Needle Safety Syringes Market Insight

The U.S. retractable needle safety syringes market captured the largest revenue share of 40% in 2025, driven by stringent OSHA and CDC guidelines, high awareness of needlestick injury prevention, and well-established healthcare infrastructure. Hospitals, clinics, and outpatient care centers are increasingly adopting auto-retractable and manual safety syringes to enhance healthcare worker safety and ensure compliance with regulatory standards. The rising prevalence of chronic diseases requiring frequent injections, combined with the growing trend of home-based self-administration of insulin and biologics, further supports market growth. Moreover, government-led vaccination campaigns and immunization programs continue to drive demand for high-volume, safety-engineered syringes across the country.

Europe Retractable Needle Safety Syringes Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, primarily driven by stringent EU regulations on occupational safety and the need for safer injection practices in hospitals, clinics, and vaccination centers. Increasing urbanization and modernization of healthcare infrastructure are fostering the adoption of retractable needle safety syringes. European healthcare providers prefer syringes that reduce needlestick injuries while maintaining dosing accuracy, particularly in high-volume immunization programs. The emphasis on infection control, compliance with WHO guidelines, and integration of safety devices in new healthcare facilities are key factors supporting growth.

U.K. Retractable Needle Safety Syringes Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing awareness of occupational hazards, stringent healthcare regulations, and demand for safer injection practices in hospitals and outpatient clinics. Healthcare facilities are adopting auto-retractable syringes to minimize needlestick injuries among professionals, while government initiatives supporting immunization campaigns also contribute to rising demand. The U.K.’s focus on patient safety, coupled with a strong regulatory framework and advanced healthcare infrastructure, is expected to sustain market growth.

Germany Retractable Needle Safety Syringes Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by high awareness of healthcare worker safety, advanced healthcare infrastructure, and strong regulatory compliance standards. Hospitals and clinics prefer safety-engineered syringes for daily clinical procedures, vaccination programs, and outpatient care. The country’s focus on innovation in medical devices and infection control practices is promoting the adoption of both auto-retractable and manual safety syringes. Growing demand for environmentally friendly and ergonomic syringe designs also supports market expansion in Germany.

Asia-Pacific Retractable Needle Safety Syringes Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period, driven by increasing urbanization, rising healthcare expenditure, and growing prevalence of chronic diseases in countries such as China, India, and Japan. Expanding vaccination campaigns, government initiatives to improve healthcare worker safety, and modernization of healthcare facilities are driving adoption. The availability of cost-effective, locally manufactured retractable syringes is also enhancing accessibility, particularly in emerging economies. Rapid growth in homecare services and outpatient clinics further contributes to market expansion in the region.

Japan Retractable Needle Safety Syringes Market Insight

The Japanese market is gaining momentum due to high technological adoption in healthcare, increasing elderly population, and demand for convenient and safe injection solutions. Hospitals and homecare services are adopting auto-retractable syringes to reduce the risk of needlestick injuries among healthcare professionals and patients. The integration of safety syringes with patient monitoring and digital inventory systems is fueling growth. Furthermore, government initiatives to improve occupational health and safety, combined with ongoing vaccination programs, are sustaining strong demand in Japan.

India Retractable Needle Safety Syringes Market Insight

The Indian market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, rising healthcare awareness, and increasing adoption of safe injection devices in hospitals, clinics, and vaccination centers. Government vaccination campaigns and public health programs are key drivers of demand for retractable needle syringes. The availability of affordable syringes from domestic manufacturers, along with growing homecare and outpatient services, supports market expansion. Increasing prevalence of chronic diseases and rising self-administration of biologics further propel growth in India.

Retractable Needle Safety Syringes Market Share

The Retractable Needle Safety Syringes industry is primarily led by well-established companies, including:

- BD (U.S.)

- Retractable Technologies, Inc. (U.S.)

- Terumo Corporation (Japan)

- Smiths Medical (U.K.)

- NIPRO CORPORATION (Japan)

- B. Braun SE (Germany)

- Cardinal Health (U.S.)

- Sol Millennium Medical Group (U.S.)

- Medline Industries, Inc. (U.S.)

- Axel Bio Corporation (U.S.)

- Globe Medical Tech, Inc. (U.S.)

- Revolutions Medical Corporation (U.S.)

- Hindustan Syringes & Medical Devices (India)

- DMC Medical Ltd. (U.K.)

- UltiMed, Inc. (U.S.)

- Numedico Technologies Pty Ltd. (Australia)

- Henke Sass, Wolf GmbH + Co. KG (Germany)

- Ypsomed AG (Switzerland)

- Shanghai Weigao Group Medical Polymer Co., Ltd. (China)

- Owen Mumford Ltd. (U.K.)

What are the Recent Developments in Global Retractable Needle Safety Syringes Market?

- In June 2025, Sharps Technology, Inc. commenced commercial shipments of its SecureGard™ and SoloGard™ smart safety syringes, marking the company’s transition to a revenue‑generating, commercial stage with major orders under strategic agreements, including a supply arrangement valued at up to USD 50 million. This milestone demonstrates strong global demand and operational scaling in safety syringe production

- In May 2025, Retractable Technologies, Inc. reported operational results and strategic updates for the first quarter of 2025, reflecting ongoing financial performance and market positioning for a company focused on safety syringe products such as VanishPoint® retractable syringes, underscoring the company’s continued activity and industry presence

- In June 2024, Sharps Technology, Inc. shipped its first commercial orders of SecureGard® disposable smart safety syringes (1 mL and 3 mL) to a strategic distribution partner in Colombia, marking a key step in expanding the availability of safety‑engineered syringes in the Latin American healthcare market. This collaboration aims to enhance safe injection practices in hospitals and pharmacies across the region

- In February 2023, Zephyrus Innovations announced that its Aeroject™ 3ml safety syringe a single‑use, auto‑retractable safety syringe with needle retraction to prevent reuse and accidental needlestick injuries received 510(k) marketing clearance from the U.S. Food and Drug Administration (FDA), marking a significant regulatory milestone for safety syringe adoption

- In October 2021, Roncadelle Operations and Datwyler collaborated to create a new safety syringe featuring a needle retraction mechanism engineered to avoid needlestick injuries, emphasizing early cross‑company innovation in safe injection devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.