Global Returnable Transport Packaging Market

Market Size in USD Billion

CAGR :

%

USD

122.62 Billion

USD

193.97 Billion

2024

2032

USD

122.62 Billion

USD

193.97 Billion

2024

2032

| 2025 –2032 | |

| USD 122.62 Billion | |

| USD 193.97 Billion | |

|

|

|

|

Returnable Transport Packaging Market Size

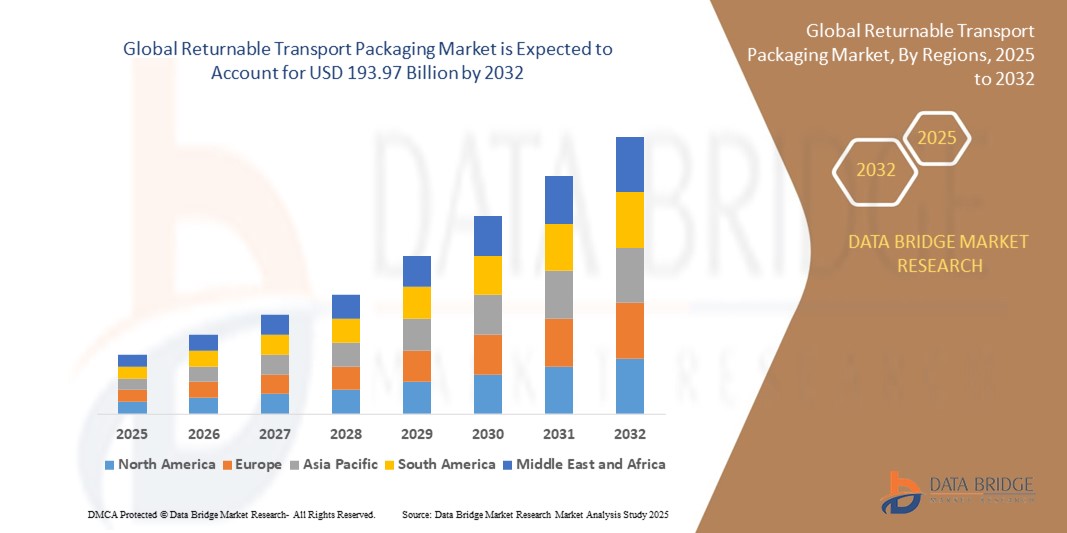

- The global returnable transport packaging market size was valued at USD 122.62 billion in 2024 and is expected to reach USD 193.97 billion by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is primarily driven by the increasing emphasis on sustainability and cost-efficiency in supply chain operations, prompting industries such as automotive, food & beverage, and pharmaceuticals to adopt reusable packaging solutions

- Furthermore, major companies are investing in durable, collapsible, and IoT-enabled returnable packaging systems to reduce environmental impact and enhance asset tracking. For instance, in March 2024, ORBIS Corporation launched a new line of RFID-enabled reusable plastic pallets, enabling real-time supply chain visibility and improving operational efficiency

Returnable Transport Packaging Market Analysis

- Returnable transport packaging (RTP), including reusable containers, pallets, racks, and totes, is increasingly critical in modern supply chain and logistics operations across industries such as automotive, food & beverage, healthcare, and retail, due to its sustainability, cost-saving benefits, and enhanced operational efficiency

- The accelerating demand for RTP solutions is primarily fueled by the global push toward sustainable practices, the need to reduce packaging waste, and the adoption of circular economy models that emphasize reuse and recyclability

- Asia-Pacific dominates the returnable transport packaging market with the largest revenue share of 38.7% in 2025, driven by rapid industrialization, expansion in the manufacturing sector, and increased investments in logistics infrastructure across countries such as China, India, and Japan. The region benefits from strong government support for sustainable packaging and a growing export economy that relies on cost-efficient, reusable solutions

- Middle East and Africa is expected to be the fastest growing region in the returnable transport packaging market during the forecast period due to rising demand for sustainable packaging in emerging industrial hubs, government initiatives to reduce single-use packaging, and growing investments in infrastructure and logistics networks, especially in the UAE, Saudi Arabia, and South Africa

- Plastic material segment is expected to dominate the returnable transport packaging market with a market share of 41.6% in 2025, attributed to its lightweight properties, durability, resistance to chemicals and moisture, and suitability for a wide range of industrial and commercial applications

Report Scope and Returnable Transport Packaging Market Segmentation

|

Attributes |

Returnable Transport Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Returnable Transport Packaging Market Trends

“Digital Tracking and IoT-Enabled Reusability Solutions”

- A significant and accelerating trend in the global returnable transport packaging (RTP) market is the integration of Internet of Things (IoT) technologies to enable real-time tracking, inventory management, and predictive maintenance of reusable packaging assets across the supply chain

- For instance, in March 2024, ORBIS Corporation introduced a line of RFID-enabled reusable plastic pallets, allowing companies to monitor asset movement, enhance visibility, and reduce loss or theft in logistics operations. This advancement has helped improve ROI on RTP systems and increase operational efficiency in warehousing and transportation

- IoT integration in RTP enables features such as automated return tracking, geo-fencing, and temperature monitoring for sensitive goods. Companies can now remotely access data such as asset location, usage frequency, and condition, optimizing asset utilization and extending lifecycle

- Moreover, the rise of digital twins—virtual models of physical packaging assets—has allowed companies to simulate supply chain scenarios and identify bottlenecks or inefficiencies using real-time data captured through sensors embedded in transport packaging

- As a result, RTP solutions are increasingly being linked with cloud-based supply chain management platforms and enterprise resource planning (ERP) systems. This integration allows logistics teams to coordinate RTP cycles with production schedules, reducing downtime and improving order accuracy

- These advancements are reshaping how companies manage packaging logistics, with major firms such as Schoeller Allibert and Tosca developing smart RTP systems that are reusable, traceable, and tailored for circular supply chains. In September 2023, Tosca launched a new intelligent container line featuring condition sensors for perishable food supply chains across Europe

- The rising demand for data-driven, reusable, and sustainable packaging solutions across multiple industries is driving RTP manufacturers to invest in technology-enabled products. This trend is expected to transform returnable packaging from a simple logistical tool into a critical asset in intelligent, sustainable, and automated supply chains

Returnable Transport Packaging Market Dynamics

Driver

“Rising Demand Driven by Sustainability Initiatives and Cost Efficiency in Supply Chains”

- The increasing focus on sustainability and environmental regulations worldwide is significantly driving the demand for returnable transport packaging (RTP) solutions across various industries, including automotive, food & beverage, pharmaceuticals, and electronics

- For instance, in March 2024, Schoeller Allibert launched an innovative range of reusable plastic crates designed to reduce single-use packaging waste and improve supply chain efficiency, reinforcing the market growth for RTP. Such initiatives by leading companies highlight the growing importance of sustainable packaging solutions

- Businesses are adopting RTP to reduce packaging waste, lower carbon footprints, and comply with stricter environmental standards, while also achieving cost savings through multiple reuse cycles compared to single-use alternatives

- The shift towards circular economy models, where materials are reused and recycled within the supply chain, is making returnable transport packaging a critical component in sustainable logistics strategies

- In addition, RTP solutions offer enhanced durability, protection, and traceability for transported goods, supporting efficient inventory management and reducing product damage. The increasing demand for streamlined, cost-effective, and eco-friendly packaging options in global supply chains is thus a key factor fueling the expansion of the returnable transport packaging market

Restraint/Challenge

“Concerns Regarding High Initial Investment and Complex Return Logistics”

- The relatively high upfront costs associated with implementing returnable transport packaging (RTP) systems pose a significant challenge, particularly for small and medium-sized enterprises (SMEs) and companies in developing regions. Initial investments in durable RTP materials, tracking technologies, and reverse logistics infrastructure can be substantial compared to single-use packaging alternatives

- For instance, some manufacturers report hesitancy in transitioning to RTP due to the capital required for procurement and integration of reusable containers, as well as the costs related to managing returns and cleaning processes

- In addition, the complexity of establishing efficient reverse logistics networks to retrieve, inspect, clean, and redistribute RTP can lead to operational challenges and increased costs, particularly across long or fragmented supply chains. This limits the scalability of RTP solutions in certain markets

- Companies such as CHEP and ORBIS have been investing in technology-enabled asset tracking and logistics optimization to mitigate these challenges, but widespread adoption still depends on overcoming logistical inefficiencies

- Furthermore, concerns about potential contamination, damage, or loss of reusable packaging during transport and handling raise questions about cost-effectiveness and supply chain reliability. Addressing these challenges through investment in advanced tracking systems, collaborative logistics models, and cost-effective cleaning solutions will be essential for broader RTP market growth

Returnable Transport Packaging Market Scope

The market is segmented on the basis material, application, and product type.

• By Material

On the basis of material, the returnable transport packaging market is segmented into glass, plastic, metal, wood, paper and paperboard, and others. The plastic segment dominates the largest market revenue share in 2025, driven by its durability, lightweight nature, and cost-effectiveness. Plastic RTP solutions such as reusable crates and pallets are widely preferred for their resistance to moisture and ease of cleaning, making them suitable across diverse industries.

The metal segment is anticipated to witness steady growth due to its high strength and reusability in heavy-duty industrial and automotive applications. Wood also remains significant, particularly in pallets and crates, favored for its recyclability and load-bearing capacity.

By Application

On the basis of application, the returnable transport packaging market is segmented into automotive, food and beverage, consumer goods, industrial, e-commerce, pharmaceutical, logistics and e-commerce, electronics and semiconductors, and construction. The automotive segment accounted for the largest market revenue share in 2024, driven by stringent supply chain requirements for component protection and the sector’s increasing shift towards sustainable packaging solutions.

The food and beverage segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by rising demand for hygienic, reusable packaging that complies with food safety standards and reduces packaging waste in the supply chain.

By Product

On the basis of product, the returnable transport packaging market is segmented into containers, drums and barrels, pallets, crates, protective dunnage, reusable sacks, and racks. The pallets segment holds the largest market revenue share in 2025, owing to their critical role in facilitating efficient handling and transport of goods across industries.

Crates are expected to experience the fastest growth rate during the forecast period, driven by their versatility and suitability for fragile and high-value items, especially in e-commerce and electronics sectors. Protective dunnage is gaining traction as well, as companies emphasize product safety during transit and seek reusable cushioning solutions.

Returnable Transport Packaging Market Regional Analysis

- Asia-Pacific dominates the returnable transport packaging market with the largest revenue share of 38.7% in 2025, driven by rapid industrialization, expanding manufacturing hubs, and growing e-commerce and retail sectors in countries such as China, India, Japan, and South Korea

- The region’s increasing focus on sustainability and environmental regulations is encouraging industries to adopt reusable packaging solutions to minimize waste and reduce logistics costs

- In addition, rising investments in advanced supply chain infrastructure and the expanding automotive and food & beverage industries support the widespread use of returnable transport packaging. The growing awareness of cost-efficiency and circular economy practices further propels market growth across both developed and emerging economies in Asia-Pacific

China Returnable Transport Packaging Market Insight

The China returnable transport packaging market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid industrial growth, increasing manufacturing activities, and the government’s strong emphasis on sustainability and waste reduction. China’s expanding automotive, food & beverage, and electronics sectors are heavily adopting RTP solutions to improve supply chain efficiency and reduce packaging waste. Moreover, the rise of e-commerce and logistics industries, coupled with the presence of key domestic RTP manufacturers, further supports market expansion.

Japan Returnable Transport Packaging Market Insight

The Japan returnable transport packaging market is witnessing steady growth due to the country’s advanced manufacturing base and focus on environmental sustainability. Japanese companies prioritize reusable packaging to comply with stringent regulations and enhance supply chain cost-efficiency. The automotive and electronics industries in Japan are major adopters of RTP, and increasing investments in circular economy practices are further propelling the market. Additionally, Japan’s technological innovation aids in improving RTP tracking and lifecycle management.

North America Returnable Transport Packaging Market Insight

The North America returnable transport packaging market holds a significant revenue share in 2024, supported by the region’s stringent environmental policies and growing demand for sustainable supply chain solutions. Industries such as automotive, pharmaceuticals, and food & beverage are rapidly integrating RTP to minimize waste and optimize logistics costs. The presence of well-developed reverse logistics infrastructure and rising consumer awareness around sustainability are key drivers. Companies in the U.S. and Canada are also investing in IoT-enabled tracking systems to enhance RTP asset management.

U.S. Returnable Transport Packaging Market Insight

The U.S. returnable transport packaging market is expanding steadily, fueled by increasing demand for eco-friendly packaging solutions and operational cost savings. The growing e-commerce sector and the push for sustainability in retail and manufacturing have accelerated RTP adoption. U.S. manufacturers and distributors leverage RTP to reduce packaging waste, comply with regulatory frameworks, and improve product protection during transit. Innovations in lightweight, durable materials and advanced logistics software also enhance market growth.

Middle East and Africa Returnable Transport Packaging Market Insight

The Middle East and Africa returnable transport packaging market is emerging, driven by growing industrialization, expanding logistics networks, and increasing environmental awareness. The region’s focus on infrastructure development and supply chain modernization supports RTP adoption, particularly in the automotive, food & beverage, and pharmaceuticals sectors. Governments in countries such as Saudi Arabia and UAE are encouraging sustainable practices, further stimulating the market’s growth potential.

Saudi Arabia Returnable Transport Packaging Market Insight

The Saudi Arabia returnable transport packaging market is witnessing growth due to rising investments in manufacturing and logistics, combined with the government’s Vision 2030 initiative promoting sustainability. Adoption of RTP solutions is increasing in automotive, food processing, and construction industries to reduce packaging waste and improve supply chain efficiency. The growing presence of regional distribution hubs also enhances the demand for reusable packaging systems.

South Africa Returnable Transport Packaging Market Insight

The South Africa returnable transport packaging market is developing steadily, supported by expanding industrial and agricultural sectors. Increasing environmental regulations and rising cost pressures encourage businesses to shift from single-use to reusable packaging options. The growth of e-commerce and retail sectors further drives RTP adoption. Challenges in logistics infrastructure are being addressed through investments in better reverse logistics capabilities, facilitating broader RTP usage in the region.

Returnable Transport Packaging Market Share

The returnable transport packaging industry is primarily led by well-established companies, including:

- NEFAB GROUP (Sweden)

- IFCO SYSTEMS (Germany)

- Rehrig Pacific Company (U.S.)

- RPS Group (U.S.)

- Schoeller Allibert (Netherlands)

- Schaefer Systems International Inc. (Germany)

- 1stWebbing/Segenhoe Investments Ltd (U.K.)

- Amatech Inc. (U.S.)

- Lamar Packaging Systems (U.S.)

- Polymer Logistics N.V. (Netherlands)

- CABKA Group (Germany)

- Del-Tec Packaging (U.S.)

- CHEP (Australia)

- DS Smith (U.K.)

- Ecopac Power Ltd. (U.K.)

- Eltete TPM Ltd. (Finland)

- Georg Utz Holding AG (Switzerland)

- Greif (U.S.)

- KUEHNE + NAGEL (Switzerland)

- Loadhog (U.K.)

- Monoflo International Inc. (U.S.)

- Smurfit Kappa (Ireland)

Latest Developments in Global Returnable Transport Packaging Market

-

In September 2024, Veritiv announced its acquisition of Orora Packaging Solutions (OPS), strengthening its specialty packaging distribution capabilities. This strategic move allows Veritiv to expand its value-added solutions in North America, while Orora transitions to focus on its beverage packaging business. The acquisition aligns with Veritiv’s commitment to innovation, sustainability, and customer-centric offerings, enhancing its ability to meet complex packaging and supply chain needs

- In October 2024, shareholders of International Paper and DS Smith approved a merger, creating a global leader in sustainable packaging solutions. The combined entity is expected to generate pro forma sales exceeding USD 28 billion, reinforcing its position in the corrugated packaging market across North America and Europe. The merger enhances vertical integration, optimizes supply chains, and expands offerings in fiber-based packaging, aligning with growing demand for eco-friendly solutions

- In February 2024, Logson Group, the UK’s largest independent supplier of corrugated packaging, acquired Challenge Packaging, a leading provider of sustainable packaging solutions. This strategic move enhances Logson’s presence in Southeast England, expanding its offerings in the retail, e-commerce, and fresh food sectors. Challenge Packaging will continue operating as a standalone entity within Logson, maintaining its commitment to innovation and sustainability. The acquisition aligns with Logson’s broader vision of strengthening its RTP market position while diversifying its portfolio

- In April 2023, Brambles Limited completed the merger of CHEP China and LOSCAM China, strengthening its ability to meet the growing demand for returnable packaging solutions in supply chains. This strategic move enhances Brambles' pallet and automotive pooling operations, improving efficiency and sustainability in logistics. The merger, finalized after regulatory approvals, positions Brambles as a leading provider of reusable packaging, supporting businesses in optimizing supply chain management

- In March, 2022, IFCO, a global leader in Reusable Packaging Containers (RPCs), completed the acquisition of Sanko Lease’s RPC pooling services business through its subsidiary IFCO Japan. This strategic move positions IFCO Japan as the largest RPC pooling provider for fresh grocery products in Japan, reinforcing its commitment to sustainability and circular economy principles. The acquisition expands IFCO’s service center network, improves reverse logistics efficiency, and enhances RPC availability for customers. IFCO Japan and Sanko Group also entered a long-term strategic partnership to strengthen their market presence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Returnable Transport Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Returnable Transport Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Returnable Transport Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.