Global Rice Beer Market

Market Size in USD Billion

CAGR :

%

USD

4.08 Billion

USD

5.76 Billion

2024

2032

USD

4.08 Billion

USD

5.76 Billion

2024

2032

| 2025 –2032 | |

| USD 4.08 Billion | |

| USD 5.76 Billion | |

|

|

|

|

Rice Beer Market Size

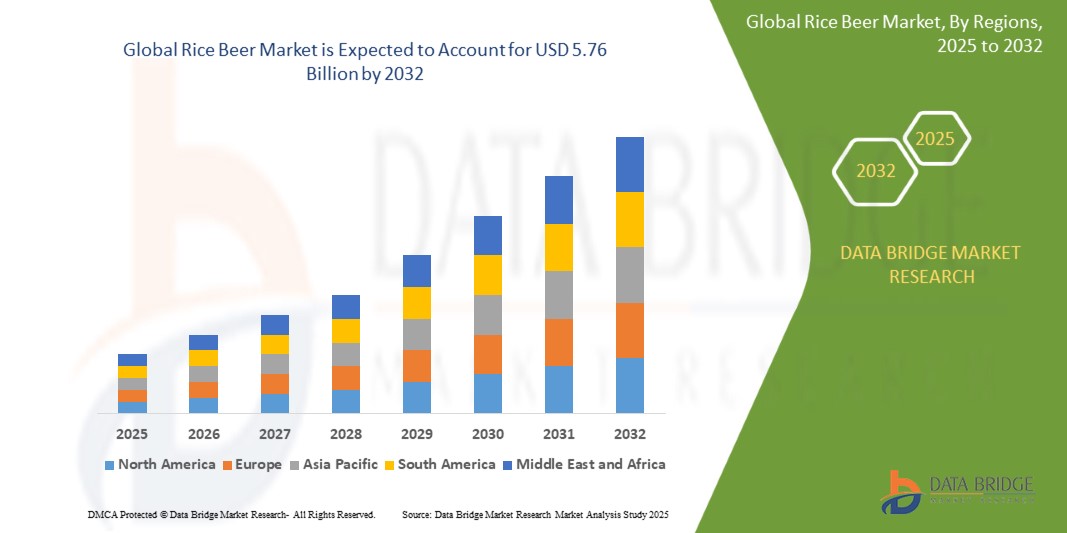

- The global rice beer market size was valued at USD 4.08 billion in 2024 and is expected to reach USD 5.76 billion by 2032, at a CAGR of 4.4% during the forecast period

- The market growth is largely fueled by the rising consumer interest in craft and premium alcoholic beverages, coupled with increasing awareness of rice-based beers as a lighter, culturally authentic alternative to conventional beers

- Furthermore, growing experimentation by breweries with indigenous rice varieties and innovative brewing techniques is expanding the variety and availability of rice beers. These converging factors are driving higher consumer adoption, thereby significantly boosting the industry’s growth

Rice Beer Market Analysis

- Rice beer is an alcoholic beverage brewed using rice as a primary ingredient, offering unique taste profiles ranging from light and crisp to rich and malty. It is gaining popularity for its cultural significance, lower gluten content, and compatibility with both traditional and craft brewing methods

- The escalating demand for rice beer is primarily driven by consumers seeking premium, authentic, and experimental alcoholic beverages, along with the rising trend of craft brewing and regional product commercialization in markets such as India, Japan, and Southeast Asia

- North America dominated the rice beer market with a share of 37.5% in 2024, due to the growing popularity of craft brewing and the rising demand for unique, ethnic alcoholic beverages

- Asia-Pacific is expected to be the fastest growing region in the rice beer market during the forecast period due to its deep cultural roots, increasing commercialization, and rising disposable incomes across countries such as China, Japan, and India

- Glutinous rice segment dominated the market with a market share of 59.8% in 2024, due to its widespread use in traditional brewing practices and the rich, slightly sweet taste it imparts to beer. Glutinous rice has cultural importance in Asian regions, especially in Northeast India and Southeast Asia, where it is preferred for crafting authentic rice beers. Its high starch content contributes to a smoother texture and fuller body, which enhances the sensory appeal. Furthermore, local communities continue to favor glutinous rice-based beer due to its established familiarity and ceremonial value

Report Scope and Rice Beer Market Segmentation

|

Attributes |

Rice Beer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rice Beer Market Trends

Increasing Gluten Free Trend

- The growing demand for gluten-free alcoholic beverages is a significant trend driving the popularity of rice beer. As more consumers adopt gluten-free diets due to health-conscious choices or conditions such as celiac disease, rice beer is emerging as a preferred alternative to traditional barley or wheat-based beers

- For instance, Anheuser-Busch has tapped into this trend through its gluten-free offerings such as the Redbridge beer brewed from sorghum, while regional craft brewers in Asia and North America are exploring rice-based beer formulations to strengthen their positioning in the gluten-free segment

- The craft beer revolution has created a fertile ground for rice beer innovation. Microbreweries and independent producers are experimenting with rice as a base ingredient to appeal to consumers looking for distinct flavors, lighter textures, and gluten-free attributes that set rice beer apart from conventional beverages

- Growing consumer curiosity about traditional and indigenous beverages is boosting rice beer consumption in many regions. Countries such as India, Japan, and China already have a heritage of brewing rice-based drinks, and globalization of food and beverage culture is opening new opportunities for these products in international markets

- In addition, rice-based beer is being positioned as a lower-calorie and more easily digestible alternative to regular beer. This aligns with the broader consumer movement towards healthier drinking options, particularly among millennials and young professionals seeking moderation without compromising taste

- Sustainability considerations are also influencing rice beer adoption as breweries emphasize the use of locally sourced rice varieties and traditional brewing techniques. This trend appeals strongly to eco-conscious consumers who value authenticity, natural ingredients, and reduced environmental impact in their purchasing decisions

Rice Beer Market Dynamics

Driver

Growing Diversity in Flavour Profiles

- The market for rice beer is being driven by increasing demand for diverse flavor profiles. Rice provides a versatile base that can be blended with fruit infusions, traditional herbs, or spices, enabling brewers to deliver unique taste experiences for consumers seeking novelty in beverages

- For instance, Kiuchi Brewery in Japan has gained traction with its Hitachino Nest Red Rice Ale, which blends traditional Japanese brewing with globally appealing flavors. This showcases how rice beer can resonate with both domestic markets and international craft enthusiasts by offering differentiated products

- The influence of the premiumization trend in the alcohol industry is expanding opportunities for rice beer producers. Consumers are showing greater willingness to experiment with distinctive flavors, heritage-inspired ingredients, and unique brewing methods, encouraging innovation in the segment

- In addition, the rising global acceptance of Asian-inspired beverages is serving as a catalyst for rice beer growth. With cuisines from Japan, Korea, and Southeast Asia gaining worldwide popularity, rice beer is increasingly seen as a complementary beverage within fusion dining and culinary experiences

- The alignment of rice beer products with seasonal and limited-edition launches also enhances consumer engagement. Breweries experimenting with locally sourced fruit flavors or festival-based variants are tapping into consumer desires for novelty and exclusivity within the beverage landscape

Restraint/Challenge

Limited Global Awareness

- A key challenge for the rice beer market is limited awareness among global consumers who are more familiar with traditional barley, wheat, and lager-based beers. The niche status of rice beer makes it less visible within mainstream markets outside of Asia

- For instance, despite the success of regional breweries in countries such as Japan and India, rice beer remains underrepresented in Western markets with limited shelf space compared to premium lagers and craft beers. This lack of exposure restricts both consumer trials and repeat purchases

- The relatively small marketing budgets of local and craft rice beer producers further constrain global awareness. While global beer giants dominate advertising and sponsorship, rice beer brands often lack platform visibility, making it difficult for them to scale international recognition

- In addition, regulatory hurdles and trade complexities in the alcoholic beverage sector present expansion difficulties for smaller rice beer producers wanting to enter broader markets. Navigating labeling requirements, tariffs, and distribution networks adds another layer of challenge

- The perception barrier also persists as some consumers associate rice beer with being a niche or traditional drink rather than a modern lifestyle choice. Overcoming such misperceptions requires sustained investment in education, branding, and premium product positioning for global acceptance

Rice Beer Market Scope

The market is segmented on the basis of flavor, type, rice variety, category, and distribution channel.

• By Flavor

On the basis of flavor, the rice beer market is segmented into rice lager, rice ale, rice IPA, and others. The rice lager segment dominated the largest market revenue share in 2024, owing to its lighter taste profile, crisp texture, and widespread consumer acceptance across both urban and rural markets. Rice lagers are particularly popular among first-time beer consumers due to their smoothness and lower bitterness compared to other variants. Their versatility in pairing with diverse cuisines and growing presence in restaurants and bars has further cemented their stronghold. In addition, large-scale breweries focus on rice lager production because of its broad appeal and cost-effective brewing process.

The rice IPA segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for bold and innovative flavors among younger consumers and urban millennials. Rice IPAs offer a distinctive balance of bitterness and smoothness derived from rice, appealing to craft beer enthusiasts seeking unique experiences. The segment benefits from expanding microbreweries experimenting with rice-based hops combinations to create differentiated offerings. Its growing presence in premium outlets and increasing adoption in Western markets further contribute to its rapid expansion.

• By Type

On the basis of type, the rice beer market is segmented into traditional rice beer and craft rice beer. The traditional rice beer segment dominated the largest market revenue share in 2024, driven by its cultural significance and deep-rooted consumption in several Asian regions, particularly in India, China, and Japan. Traditional rice beer is often linked to festivals, rituals, and community gatherings, which sustains strong local demand. Its minimal processing, indigenous brewing methods, and perception as a natural and healthier option attract consumers preferring authenticity. In addition, the low production cost and easy availability of raw materials support its large-scale presence in local markets.

The craft rice beer segment is projected to witness the fastest growth rate from 2025 to 2032, supported by the rising influence of the craft beer movement globally. Consumers are increasingly exploring artisanal and premium beverages, leading to heightened demand for innovative rice beer variants with customized flavors and brewing techniques. Craft rice beer appeals strongly to urban consumers and international markets where experimentation with exotic ingredients is trending. Microbreweries and independent labels are key contributors to this growth, leveraging marketing strategies that highlight authenticity, innovation, and cultural heritage.

• By Rice Variety

On the basis of rice variety, the rice beer market is segmented into glutinous rice and non-glutinous rice. The glutinous rice segment dominated the largest market revenue share of 59.8% in 2024, attributed to its widespread use in traditional brewing practices and the rich, slightly sweet taste it imparts to beer. Glutinous rice has cultural importance in Asian regions, especially in Northeast India and Southeast Asia, where it is preferred for crafting authentic rice beers. Its high starch content contributes to a smoother texture and fuller body, which enhances the sensory appeal. Furthermore, local communities continue to favor glutinous rice-based beer due to its established familiarity and ceremonial value.

The non-glutinous rice segment is expected to register the fastest growth rate from 2025 to 2032, driven by the increasing adoption of lighter, more refreshing beer varieties suitable for global palates. Non-glutinous rice enables brewers to create beers with a cleaner finish, making them highly marketable in urban centers and export-oriented markets. Rising experimentation with premium and hybrid beer styles using non-glutinous rice further fuels its demand. Its adaptability to large-scale brewing technologies also positions it as a preferred choice for international breweries aiming for mass production and global distribution.

• By Category

On the basis of category, the rice beer market is segmented into Chuwak, Apong, Chhaang, Zutho, and others. The Apong segment dominated the largest market revenue share in 2024, primarily due to its widespread consumption in Northeastern India and its cultural attachment as a traditional community beverage. Apong is often consumed during festivals and family occasions, keeping demand steady and deeply rooted in heritage. Its distinctive brewing methods and mild flavor profile make it popular among local consumers. Regional support for promoting indigenous drinks and rising awareness of ethnic beverages also strengthen the growth of Apong.

The Chhaang segment is projected to witness the fastest growth rate from 2025 to 2032, driven by its rising popularity among tourists and urban populations seeking authentic Himalayan beverages. Chhaang, traditionally brewed in regions such as Sikkim, Bhutan, and Nepal, has gained recognition for its unique taste and association with mountain culture. Increasing efforts by tourism boards and local entrepreneurs to commercialize Chhaang in packaged formats are further boosting its visibility. Its positioning as a cultural and exotic beverage is appealing to premium and international markets, accelerating its future growth.

• By Distribution Channel

On the basis of distribution channel, the rice beer market is segmented into traditional channel and online retail. The traditional channel segment dominated the largest market revenue share in 2024, supported by the strong presence of local brewing practices, cultural consumption, and easy availability in rural and semi-urban markets. Traditional channels such as local vendors, community gatherings, and festivals remain central to rice beer distribution, particularly in regions where rice beer is an integral part of heritage. The affordability and direct accessibility of these channels ensure sustained dominance.

The online retail segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the rapid expansion of e-commerce platforms and rising consumer preference for doorstep delivery of alcoholic beverages. Online retail provides access to niche and premium rice beer varieties that are otherwise unavailable in local stores. The convenience of browsing diverse options and increasing penetration of digital payment systems are accelerating adoption. Global consumers exploring ethnic and craft beverages through online platforms are also fueling the growth of this channel, making it a critical distribution driver for the future.

Rice Beer Market Regional Analysis

- North America dominated the rice beer market with the largest revenue share of 37.5% in 2024, driven by the growing popularity of craft brewing and the rising demand for unique, ethnic alcoholic beverages

- Consumers in the region are increasingly attracted to rice beer for its lighter taste profile and cultural novelty, positioning it as an alternative to mainstream lagers. The availability of rice beer through breweries, restaurants, and retail chains is supporting wider adoption

- The presence of established craft breweries experimenting with rice-based formulations also boosts the market. High disposable incomes and openness to diverse beverage options further strengthen the region’s dominance

U.S. Rice Beer Market Insight

The U.S. rice beer market captured the largest revenue share in 2024 within North America, fueled by strong consumer demand for premium and innovative alcoholic beverages. The growth of microbreweries and craft beer culture is driving experimentation with rice-based beers, particularly among millennials seeking lighter, gluten-friendly alternatives. Increasing distribution through both offline and online retail, along with rising restaurant and bar offerings, is expanding market visibility. Furthermore, the multicultural influence and rising acceptance of Asian beverages in the U.S. contribute significantly to the segment’s growth.

Europe Rice Beer Market Insight

The Europe rice beer market is projected to expand at a substantial CAGR during the forecast period, supported by the growing craft beer movement and rising consumer curiosity about Asian-inspired beverages. European consumers are shifting toward artisanal and premium offerings, creating demand for rice beer as an exotic alternative. Rising urbanization and the increasing presence of Asian restaurants across major cities are also driving interest. The market is seeing expansion across both specialty retail outlets and e-commerce platforms, as rice beer gains popularity in residential consumption and hospitality sectors.

U.K. Rice Beer Market Insight

The U.K. rice beer market is anticipated to grow at a noteworthy CAGR, driven by the increasing popularity of Asian cuisine, paired with a well-developed craft beer culture. Consumers are increasingly open to experimenting with non-traditional brewing ingredients, and rice beer is gaining traction as a niche product in pubs, breweries, and premium retail stores. Rising concerns over gluten intolerance are also making rice-based beverages more appealing. The U.K.’s robust hospitality and tourism industry provides further opportunities for rice beer penetration.

Germany Rice Beer Market Insight

The Germany rice beer market is expected to expand at a considerable CAGR during the forecast period, fueled by the nation’s strong beer culture and openness to experimental brewing. While traditional barley-based beers dominate, the growing craft beer trend has created space for rice beer as a premium and novel option. German breweries are exploring rice-based blends that align with consumer expectations of quality, sustainability, and innovation. Moreover, the rising interest in low-alcohol and light beers supports rice beer’s positioning as a health-conscious alternative.

Asia-Pacific Rice Beer Market Insight

The Asia-Pacific rice beer market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by its deep cultural roots, increasing commercialization, and rising disposable incomes across countries such as China, Japan, and India. The region’s large population and strong traditional consumption patterns provide a strong base for market expansion. Government initiatives supporting local brewing industries, coupled with growing international exposure to indigenous beverages, are boosting demand. The rise of urban microbreweries and craft beer startups in APAC further accelerates growth.

Japan Rice Beer Market Insight

The Japan rice beer market is gaining momentum due to the country’s long-standing association with rice-based alcoholic beverages such as sake, making rice beer a natural extension of consumer preference. The emphasis on premiumization and innovation is fueling adoption, as consumers seek modern beer styles while retaining cultural authenticity. The rise of urban craft breweries is expanding product offerings, while the integration of rice beer into restaurants and retail channels enhances accessibility. Japan’s aging population is also driving demand for lighter, smoother alcohol options, which supports rice beer consumption.

China Rice Beer Market Insight

The China rice beer market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to the country’s massive beer consumption base, rapid urbanization, and increasing acceptance of alternative beer types. The expanding middle class is showing growing interest in premium and ethnic alcoholic beverages, positioning rice beer as a popular choice in both urban and semi-urban markets. China’s strong domestic production capabilities, coupled with government support for regional breweries, enable widespread availability of rice beer. Furthermore, the rising trend of smart cities and modern retail networks accelerates its commercialization and market penetration.

Rice Beer Market Share

The rice beer industry is primarily led by well-established companies, including:

- Otsuka Holdings Co., Ltd. (Japan)

- Asahi Group Holdings, Ltd. (Japan)

- Hite Jinro Co., Ltd. (South Korea)

- Dharohar Breweries (India)

- Craft Brew Alliance (U.S.)

- United Breweries Limited (India)

- AB InBev (Belgium/USA)

- Oriental Brewery Co., Ltd. (South Korea)

- Kirin Holdings Co., Ltd. (Japan)

- Carlsberg Group (Denmark)

- SABMiller PLC (U.K.)

- Heineken NV (Netherlands)

Latest Developments in Global Rice Beer Market

- In January 2025, Aroz Beer made a significant mark on the Indian rice beer market by introducing the country’s first bottled Basmati rice beer. This pioneering launch by SM and PM Beverages Pvt Ltd is redefining premium rice beer offerings in India, bringing a high-quality, widely accessible product to consumers. The innovation is expected to attract urban and craft beer enthusiasts seeking a unique fusion of traditional Indian rice with modern brewing, potentially accelerating adoption of rice-based beers across mainstream retail and hospitality channels

- In September 2024, the Seven Sisters of India collaborated to launch 7 United, the first-ever hand-crafted canned carbonated rice beer celebrating Northeast India’s rice beer heritage. Produced in Garo Hills, Meghalaya, and distributed initially at music festivals and pop-up events, this launch showcases the potential of localized, culturally authentic rice beers in driving regional brand recognition. The product highlights the growing trend of canned craft rice beers, offering convenience while promoting indigenous ingredients, which is likely to stimulate interest and demand in urban centers such as Guwahati, Assam

- In July 2023, the creation of Itanji Ale, a black Belgian porter made with Okinawa’s enhanced Churaotome rice, marked a notable advancement in craft rice beer innovation. Developed in collaboration with AgVenture Lab and the Agricultural Cooperative Association of Okinawa Prefecture, the product demonstrates the commercial potential of using specially researched rice varieties to produce premium craft beers. This launch, presented in Naha City, emphasizes Okinawa’s role in specialty rice beer production and also positions rice beer as a versatile ingredient capable of creating unique global-style craft brews

- In December 2022, Bira 91 expanded India’s premium beer landscape with the launch of RISE, the nation’s first-ever premium rice strong lager. Featuring local Indian rice, the dry, light, and sparkling beer exemplifies how mainstream breweries are leveraging rice as a key differentiator. This introduction strengthens consumer awareness of rice beer’s premium positioning, particularly among urban millennials seeking lighter, gluten-friendly alternatives, and is likely to encourage other breweries to explore rice-based beer innovations in India

- In December 2021, Suraj Shenai’s launch of rice beer in Goa highlighted the cultural and historical significance of rice-based brewing, connecting modern beer consumption with over 500 years of regional grain heritage. The introduction emphasized the market potential of locally inspired rice beers, demonstrating that consumers value authenticity and cultural storytelling in their beverage choices. This move is seen as an early driver of the artisanal and heritage-focused rice beer trend in India, paving the way for subsequent craft and premium rice beer launches

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rice Beer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rice Beer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rice Beer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.