Global Rigid Recycled Plastics Market

Market Size in USD Million

CAGR :

%

USD

697.69 Million

USD

1,087.09 Million

2024

2032

USD

697.69 Million

USD

1,087.09 Million

2024

2032

| 2025 –2032 | |

| USD 697.69 Million | |

| USD 1,087.09 Million | |

|

|

|

|

What is the Global Rigid Recycled Plastics Market Size and Growth Rate?

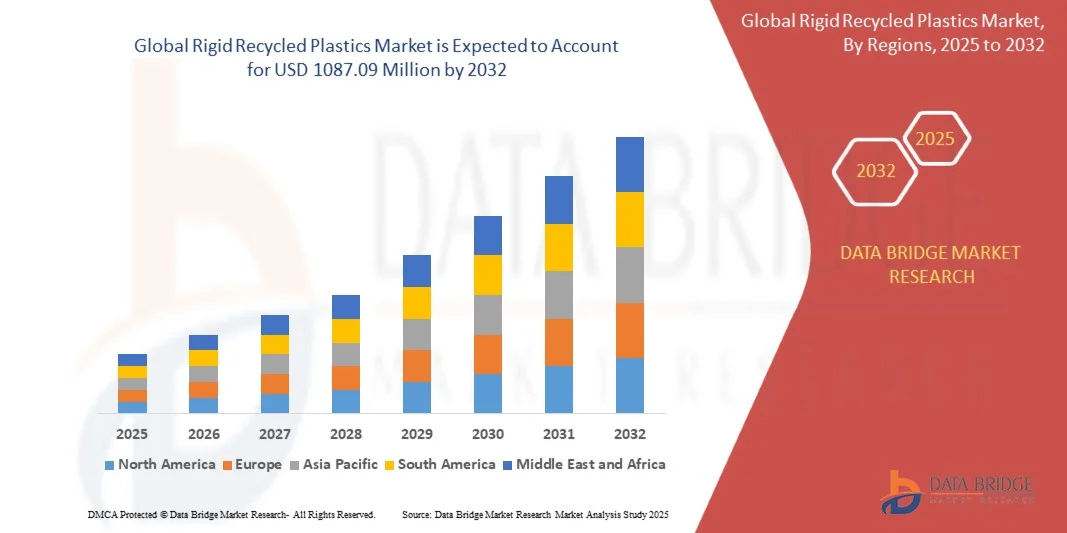

- The global rigid recycled plastics market size was valued at USD 697.69 million in 2024 and is expected to reach USD 1087.09 million by 2032, at a CAGR of 5.70% during the forecast period

- Rise in the concerns for disposing virgin plastic and growing awareness about energy saving is the vital factor escalating the market growth, also easy availability of raw material collection in the form of plastics bottle, rising rapid industrialization, growing manufacturing sector in emerging economies such as China and India

- Rise in the use in packaging, automotive, and electrical & electronics industries, increasing growth in adoption of rigid plastic packaging in the food & beverages industry, and rise in demand from the healthcare industry are the major factors among others driving the rigid recycled plastics market

What are the Major Takeaways of Rigid Recycled Plastics Market?

- Rise in the favorable initiatives to promote the use of recycled plastics in developed countries and rise in the use in textile industry in developing countries of APAC will further create new opportunities for the rigid recycled plastics market

- Asia-Pacific dominated the rigid recycled plastics market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, urbanization, and rising environmental awareness in countries such as China, Japan, and India

- North America is poised to grow at the fastest CAGR of 10.69% during the forecast period of 2025 to 2032, supported by increasing corporate sustainability commitments, regulatory mandates, and rising consumer awareness about environmental impact

- The HDPE segment dominated the market with the largest revenue share of 38.7% in 2024, driven by its widespread use in packaging, bottles, and containers, as well as its high recyclability and robust mechanical properties

Report Scope and Rigid Recycled Plastics Market Segmentation

|

Attributes |

Rigid Recycled Plastics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Rigid Recycled Plastics Market?

Sustainability and Circular Economy Integration

- A significant trend shaping the global rigid recycled plastics market is the increasing emphasis on sustainability and circular economy practices. Manufacturers are progressively adopting recycled feedstocks, eco-friendly production methods, and lifecycle management strategies to reduce environmental impact while meeting regulatory and consumer demands

- For instance, companies such as Veolia and Plastipak Holdings are leveraging advanced sorting and recycling technologies to produce high-quality rigid recycled plastics suitable for packaging, construction, and automotive applications, minimizing reliance on virgin plastics

- Integration of recycled plastics into manufacturing processes allows companies to achieve carbon footprint reductions and align with ESG commitments. Some global packaging brands now mandate that a portion of their rigid plastic components contain recycled content, further driving adoption

- The circular economy trend also supports closed-loop systems, where post-consumer rigid plastics are collected, processed, and reincorporated into new products, creating value while mitigating waste. Initiatives such as Kuusakoski’s advanced material recovery and sorting programs exemplify this approach

- Demand for rigid recycled plastics is increasingly being fueled by sustainability-conscious consumers, regulatory incentives, and corporate ESG mandates, driving innovation in product design, performance, and recyclability

What are the Key Drivers of Rigid Recycled Plastics Market?

- Rising environmental concerns, regulatory pressures on single-use plastics, and growing corporate sustainability commitments are key drivers for the rigid recycled plastics market. These factors are encouraging manufacturers to shift toward recycled feedstocks and circular material usage

- For instance, in 2024, Veolia launched enhanced recycling solutions for rigid plastics in Europe, focusing on high-quality resins suitable for packaging and industrial applications, boosting adoption across multiple sectors

- Corporate ESG mandates and government regulations incentivizing recycled content are propelling demand for rigid recycled plastics in packaging, automotive, and construction industries

- End-users increasingly prefer products with recycled content due to environmental awareness, which is also driving the market in consumer packaging and durable goods segments

- The integration of rigid recycled plastics into new products offers cost-efficiency benefits, reduces dependency on virgin plastics, and supports circular economy initiatives, further accelerating market adoption

Which Factor is Challenging the Growth of the Rigid Recycled Plastics Market?

- One of the main challenges for the market is the inconsistent quality and supply of recycled feedstocks, which can affect performance and reliability in end-use applications. Variability in resin properties can be a concern for manufacturers requiring precise material specifications

- For instance, companies producing high-performance packaging or automotive components face challenges in sourcing recycled plastics that meet strict mechanical, thermal, or safety standards

- Economic factors such as fluctuating virgin plastic prices can also impact the competitiveness of recycled plastics, making manufacturers hesitant to fully switch unless cost parity is achieved

- Investments in advanced sorting, cleaning, and pelletizing technologies are crucial to overcoming these limitations and ensuring high-quality outputs. Companies such as Envision Plastics and Clear Path Recycling emphasize technological improvements to stabilize supply and quality

- In addition, awareness and perception gaps among end-users about the performance of recycled plastics remain a hurdle, particularly in industries demanding stringent compliance or certification standards. Addressing these challenges through technological innovation, quality standardization, and consumer education will be essential for sustained growth

How is the Rigid Recycled Plastics Market Segmented?

The market is segmented on the basis of product type, source, and end-use industry.

• By Product Type

On the basis of product type, the rigid recycled plastics market is segmented into Polyethylene Terephthalate (PET), High Density Polyethylene (HDPE), Low Density Polyethylene (LDPE), Polyvinyl Chloride (PVC), and others. The HDPE segment dominated the market with the largest revenue share of 38.7% in 2024, driven by its widespread use in packaging, bottles, and containers, as well as its high recyclability and robust mechanical properties. HDPE is preferred across multiple end-use industries due to its durability, chemical resistance, and compatibility with extrusion and molding processes.

The PET segment is expected to witness the fastest CAGR of 16.5% from 2025 to 2032, fueled by the increasing use of recycled PET in beverage and food packaging applications. Growing consumer demand for sustainable packaging solutions, along with corporate commitments to include recycled content, is boosting PET adoption. The versatility and transparency of PET also make it a favorable choice for manufacturers seeking environmentally friendly alternatives without compromising product quality.

• By Source

On the basis of source, the rigid recycled plastics market is segmented into plastic bottles, plastic bags & films, synthetic fiber, rigid plastics & foams, and others. The plastic bottles segment accounted for the largest revenue share of 41.2% in 2024, primarily due to the high collection and recycling rates of post-consumer PET bottles. Bottles serve as a consistent and high-quality feedstock, ensuring better material recovery and enabling their use in a wide range of applications from packaging to textiles.

The plastic bags & films segment is projected to grow at the fastest CAGR of 18.1% from 2025 to 2032, driven by increased collection initiatives and technological advancements in processing flexible plastics. Growing regulatory restrictions on single-use plastics and rising awareness among consumers about plastic waste management are further enhancing demand. The trend toward closed-loop recycling systems for both rigid and flexible plastics is also contributing to market growth in this segment.

• By End-Use Industry

On the basis of end-use industry, the rigid recycled plastics market is segmented into building & construction, textiles, automotive, electrical & electronics, packaging, and others. The packaging segment dominated the market with the largest revenue share of 45.5% in 2024, owing to the widespread use of rigid recycled plastics in bottles, containers, and industrial packaging. High demand for sustainable and lightweight packaging solutions, coupled with corporate sustainability goals, continues to drive this segment.

The automotive segment is expected to witness the fastest CAGR of 15.9% from 2025 to 2032, propelled by the growing adoption of recycled plastics in interior panels, trims, and lightweight components to reduce vehicle weight and carbon emissions. Stringent environmental regulations and OEM commitments to increase recycled content are key factors fueling growth. Increasing awareness of sustainable manufacturing practices and circular economy initiatives in automotive production is further accelerating adoption.

Which Region Holds the Largest Share of the Rigid Recycled Plastics Market?

- Asia-Pacific dominated the rigid recycled plastics market with the largest revenue share of 42.5% in 2024, driven by rapid industrialization, urbanization, and rising environmental awareness in countries such as China, Japan, and India

- The widespread adoption of recycled materials in packaging, automotive, and construction industries, along with strong government policies promoting sustainable practices, is bolstering market growth

- Key markets such as China are witnessing significant demand for high-quality rigid recycled plastics due to their integration in consumer goods, building materials, and durable products. Strong domestic manufacturing capabilities and competitive pricing further encourage adoption. The growing inclination toward circular economy initiatives and sustainable manufacturing practices across APAC industries reinforces its dominant position

China Rigid Recycled Plastics Market Insight

The China market accounted for the largest share in APAC in 2024, fueled by urbanization, rising disposable incomes, and industrial demand for eco-friendly materials. Government-led recycling programs, coupled with increasing consumer preference for sustainable packaging and durable products, support the expanding adoption of rigid recycled plastics in residential, commercial, and industrial applications.

Japan Rigid Recycled Plastics Market Insight

Japan’s market growth is driven by high technological adoption, awareness of sustainability, and integration of rigid recycled plastics in advanced manufacturing and consumer goods. Urbanization and the focus on eco-friendly practices, along with consumer interest in high-quality, durable, and recyclable materials, are fueling adoption.

Which Region is the Fastest Growing Region in the Rigid Recycled Plastics Market?

North America is poised to grow at the fastest CAGR of 10.69% during the forecast period of 2025 to 2032, supported by increasing corporate sustainability commitments, regulatory mandates, and rising consumer awareness about environmental impact. The U.S. and Canada are witnessing strong demand for rigid recycled plastics in packaging, automotive, and construction industries, driven by initiatives to reduce plastic waste and promote recycling. Technological advancements in recycling processes, higher availability of post-consumer recycled feedstocks, and growing adoption of circular economy practices are contributing to accelerated growth.

U.S. Rigid Recycled Plastics Market Insight

The U.S. captured a significant revenue share in North America in 2024, with the adoption of advanced recycling technologies and increasing use of recycled plastics in consumer and industrial applications. Rising consumer demand for sustainable products, corporate ESG initiatives, and government incentives promoting circular economy practices are expected to drive further growth.

Canada Rigid Recycled Plastics Market Insight

Canada’s market growth is supported by stringent environmental regulations, increased recycling infrastructure, and a growing preference for sustainable materials in packaging and construction. Both residential and industrial sectors are incorporating rigid recycled plastics into new applications, driving adoption and market expansion.

Which are the Top Companies in Rigid Recycled Plastics Market?

The rigid recycled plastics industry is primarily led by well-established companies, including:

- B & B Plastics Recycling Inc. (U.S.)

- Veolia (France)

- Green Line Polymers (U.S.)

- Clear Path Recycling (U.S.)

- B Schoenberg & Co (U.S.)

- Jayplas (U.K.)

- SUEZ (France)

- CUSTOM POLYMERS (U.S.)

- PLASTIPAK HOLDINGS, INC. AND ITS AFFILIATES (U.S.)

- Shanghai Pret Composites (China)

- Kuusakoski (Finland)

- Envision Plastics (U.S.)

- WTE Corporation (U.S.)

What are the Recent Developments in Global Rigid Recycled Plastics Market?

- In March 2025, LyondellBasell introduced Pro-fax EP649U, a new polypropylene impact copolymer specifically designed for rigid packaging, optimized for thin-walled injection molding and ideal for food containers, enhancing productivity and product quality, and supporting sustainable manufacturing practices

- In February 2025, Berry Global Group Inc. completed the acquisition of CMG Plastics, a specialist in rigid packaging manufacturing, advancing its expansion strategy and paving the way for its forthcoming acquisition by Amcor plc, which is expected to generate significant cost savings and synergies within three years

- In April 2024, Amcor launched a one-liter PET bottle for carbonated soft drinks made entirely from post-consumer recycled material, marking the first of its kind for carbonated beverages and helping brands meet evolving sustainability targets and regulatory requirements

- In June 2022, AVI Global introduced recycled PET packaging made with certified ocean-bound plastic, in collaboration with waste management networks in India to collect and recycle discarded PET bottles, promoting environmental responsibility and circular economy initiatives in packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rigid Recycled Plastics Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rigid Recycled Plastics Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rigid Recycled Plastics Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.