Global Risk Analytics Market

Market Size in USD Billion

CAGR :

%

USD

44.67 Billion

USD

116.26 Billion

2024

2032

USD

44.67 Billion

USD

116.26 Billion

2024

2032

| 2025 –2032 | |

| USD 44.67 Billion | |

| USD 116.26 Billion | |

|

|

|

|

Global Risk Analytics Market Size

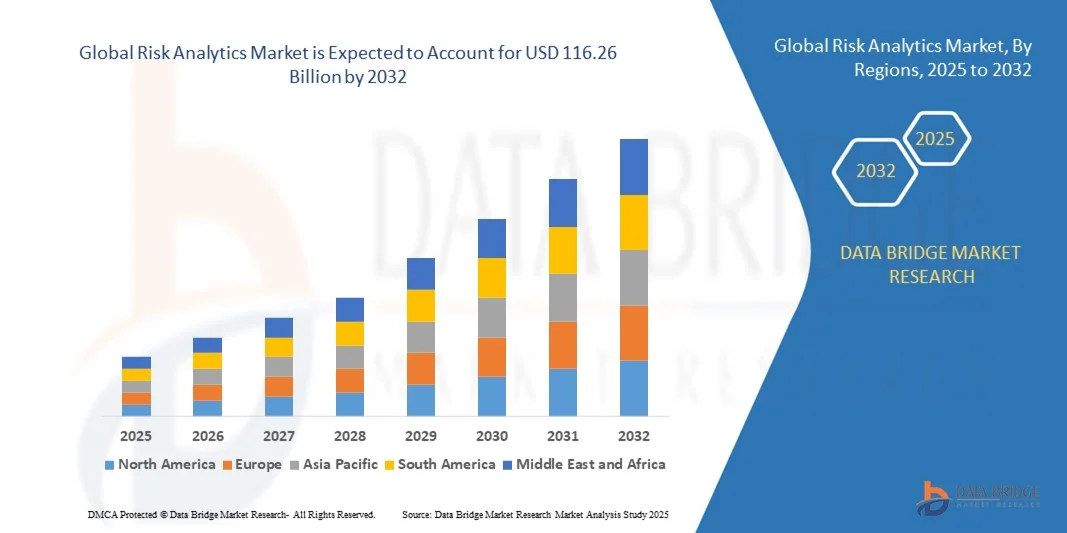

- The global risk analytics market size was valued at USD 44.67 billion in 2024 and is projected to reach USD 116.26 billion by 2032, growing at a CAGR of 12.70% during the forecast period.

- The market growth is primarily driven by increasing adoption of advanced data analytics and AI technologies across various industries, enhancing risk management capabilities and decision-making processes.

- Additionally, the rising need for real-time risk assessment and compliance monitoring in sectors such as finance, healthcare, and insurance is fueling demand for comprehensive risk analytics solutions, further propelling market expansion.

Global Risk Analytics Market Analysis

- Global Risk Analytics solutions, which leverage advanced data analysis and predictive modeling to identify and mitigate potential risks, are becoming essential tools for businesses across industries such as finance, healthcare, and manufacturing due to their ability to enhance decision-making, compliance, and operational efficiency.

- The rising demand for real-time risk assessment, increasing regulatory requirements, and growing awareness of cyber threats are major factors driving the adoption of risk analytics solutions globally.

- North America dominated the global risk analytics market with the largest revenue share of 39.0% in 2024, supported by early adoption of big data technologies, stringent regulatory frameworks, and the presence of major technology vendors and financial institutions investing heavily in risk management capabilities.

- Asia-Pacific is projected to be the fastest-growing region in the Global Risk Analytics Market during the forecast period, driven by rapid digital transformation, expanding financial services, and increased focus on risk mitigation in emerging economies like China and India.

- The banking and financial services segment dominated the market with the largest revenue share of 41.3% in 2024, driven by stringent regulatory requirements and the necessity for sophisticated risk management to prevent fraud, credit defaults, and market volatility.

Report Scope and Global Risk Analytics Market Segmentation

|

Attributes |

Risk Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Risk Analytics Market Trends

Enhanced Capabilities Through AI and Advanced Analytics Integration

- A significant and accelerating trend in the global Global Risk Analytics Market is the increasing integration of artificial intelligence (AI) and advanced analytics with traditional risk management frameworks. This fusion of technologies is vastly improving the accuracy, speed, and predictive power of risk assessment and mitigation processes.

- For Instance, platforms like SAS Risk Management incorporate machine learning algorithms to detect complex patterns and emerging risks, enabling organizations to respond proactively. Similarly, IBM’s Watson for Risk uses AI to analyze vast datasets for enhanced fraud detection and compliance monitoring.

- AI integration in risk analytics enables features such as predictive modeling to forecast potential risk events, anomaly detection to flag unusual activity, and automated reporting that streamlines regulatory compliance. For instance, Moody’s Analytics employs AI to refine credit risk scoring models and generate intelligent alerts for portfolio managers.

- The seamless integration of risk analytics platforms with enterprise data systems and cloud infrastructure facilitates centralized risk monitoring across diverse business units. Through unified dashboards, users can oversee financial, operational, and cyber risks in real-time, enabling holistic risk governance.

- This trend towards more intelligent, automated, and interconnected risk analytics solutions is fundamentally transforming how organizations manage uncertainty and compliance. Consequently, companies such as Accenture and Capgemini are investing heavily in AI-driven risk analytics offerings that provide actionable insights and improve decision-making speed.

- The demand for AI-enhanced risk analytics is growing rapidly across industries such as banking, insurance, and healthcare, as businesses increasingly seek to mitigate risks proactively while optimizing operational efficiency.

Global Risk Analytics Market Dynamics

Driver

DGrowing Need Due to Rising Regulatory Pressure and Risk Awareness

- The increasing complexity of regulatory environments and heightened awareness of financial, operational, and cyber risks are significant drivers fueling the demand for advanced Global Risk Analytics solutions.

- For instance, in early 2024, Moody’s Analytics launched enhanced risk modeling tools designed to help financial institutions comply with evolving Basel III requirements and stress testing protocols. Such innovations by key players are expected to accelerate market growth during the forecast period.

- As organizations face growing scrutiny from regulators and investors, risk analytics platforms provide critical capabilities such as real-time risk monitoring, predictive insights, and automated compliance reporting, representing a substantial upgrade over traditional manual risk management methods.

- Furthermore, the increasing adoption of digital transformation initiatives across industries is driving the integration of risk analytics into broader enterprise systems, enabling more comprehensive and interconnected risk management frameworks.

- The demand for solutions that offer centralized risk dashboards, scenario analysis, and risk mitigation recommendations is rising across sectors such as banking, insurance, and healthcare. The shift towards cloud-based and user-friendly risk analytics tools also supports wider adoption in small and medium enterprises (SMEs).

Restraint/Challenge

Concerns Regarding Data Privacy, Cybersecurity Risks, and High Implementation Costs

- Concerns about data privacy and cybersecurity vulnerabilities in risk analytics platforms pose significant challenges to broader market adoption. As these solutions rely heavily on sensitive data and complex IT infrastructure, fears of data breaches and cyberattacks create hesitation among potential users.

- For Instance, reports of security incidents targeting financial data analytics systems have made some organizations cautious in deploying fully integrated risk analytics solutions.

- Addressing these concerns through robust encryption, secure data governance frameworks, and regular software updates is essential for building trust. Companies such as IBM and SAS emphasize their comprehensive security protocols and compliance certifications in marketing to reassure clients. Additionally, the relatively high initial investment required for advanced risk analytics platforms, including software licenses, integration, and training, can be a barrier for smaller organizations or those in developing regions. While more affordable cloud-based offerings from providers like BRIDGEi2i are emerging, premium enterprise solutions often come with substantial costs.

- Although pricing models are evolving to include subscription and SaaS options, the perceived expense and complexity of implementation still limit rapid adoption, especially among organizations with limited risk management maturity.

- Overcoming these challenges through enhanced cybersecurity measures, client education on data protection best practices, and the development of scalable, cost-effective analytics solutions will be critical for sustained market growth.river

Global Risk Analytics Market Scope

The market is segmented on the basis of component, deployment, enterprise, risk type application, and end-user.

- By Component

On the basis of component, the Global Risk Analytics Market is segmented into software solutions and services. The software solutions segment dominated the market with the largest revenue share of 55.8% in 2024, driven by the growing demand for advanced analytics platforms that enable real-time risk identification and mitigation across various industries. Software solutions offer customizable dashboards, predictive analytics, and integration with enterprise systems, making them essential for proactive risk management. Additionally, continuous advancements in AI and machine learning are enhancing software capabilities, further fueling adoption.

The services segment, including consulting, implementation, and support, is expected to witness the fastest CAGR of 22.3% from 2025 to 2032. Increasing demand for expert guidance in deploying complex risk analytics systems and ongoing maintenance to ensure compliance and optimization is driving growth in this segment, particularly among organizations lacking in-house expertise.

- By Deployment

On the basis of deployment, the Global Risk Analytics Market is segmented into on-premises and cloud-based solutions. The on-premises segment held the largest market share of 60.4% in 2024, favored by enterprises requiring full control over sensitive risk data and compliance with strict regulatory standards. Many large organizations prefer on-premises deployment for enhanced security, customization, and integration with legacy systems.

The cloud segment is anticipated to witness the fastest CAGR of 24.1% from 2025 to 2032, driven by the increasing adoption of scalable, cost-effective, and flexible cloud platforms. Cloud deployment facilitates real-time analytics, remote accessibility, and faster implementation, making it attractive for small and medium-sized enterprises (SMEs) and organizations pursuing digital transformation initiatives.

- By Enterprise

On the basis of enterprise size, the Global Risk Analytics Market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprises segment dominated the market with a revenue share of 68.7% in 2024, benefiting from substantial IT budgets, sophisticated risk management frameworks, and stringent regulatory obligations. Large organizations typically invest in comprehensive risk analytics platforms to manage complex risk profiles and multi-jurisdictional compliance.

The SMEs segment is projected to exhibit the fastest growth rate of 25.5% from 2025 to 2032, driven by increasing awareness of risk management benefits and the availability of affordable, cloud-based analytics solutions. SMEs are gradually adopting risk analytics to enhance decision-making, safeguard assets, and compete more effectively in dynamic markets.

- By Risk Type Application

The market by risk type application includes financial risk, strategic risk, operational risk, and others. In 2024, financial risk held the dominant position with a 45.9% market share, owing to the critical need for accurate credit scoring, regulatory compliance, fraud detection, and market risk analysis in the financial services sector. Financial institutions and investment firms rely heavily on advanced risk analytics to mitigate potential losses and manage complex portfolios in volatile markets.

However, the strategic risk segment is projected to experience the fastest CAGR of 23.4% from 2025 to 2032. This growth is fueled by increasing uncertainty in global markets, driven by geopolitical tensions, market competition, technological disruption, and ESG considerations. Businesses are leveraging strategic risk analytics to assess external threats, model future scenarios, and align long-term planning with evolving trends, enabling proactive responses to shifts in the global business environment.

- By End-User

By end-user, the market is segmented into several industries, with banking and financial services dominating in 2024, capturing a 41.3% market share. The sector faces intense regulatory scrutiny and complex risk scenarios, such as fraud, credit defaults, and market volatility, necessitating robust analytics platforms. Financial institutions use risk analytics for regulatory compliance, fraud prevention, credit assessments, and investment risk forecasting, making them the leading adopters of such technologies.

The insurance sector is forecasted to be the fastest-growing segment, with a CAGR of 22.8% from 2025 to 2032. Insurers are leveraging AI and predictive analytics to assess risk profiles, improve underwriting, and enhance claims processing accuracy. Additionally, rising demand for personalized policies and automation is accelerating the integration of risk analytics into insurance operations. This technological evolution is enhancing customer experience while optimizing profitability and operational efficiency across the insurance value chain.

Global Risk Analytics Market Regional Analysis

- North America dominated the global risk analytics market with the largest revenue share of 39.0% in 2024, driven by stringent regulatory requirements, advanced technological infrastructure, and widespread adoption of big data and AI technologies.

- Organizations in the region prioritize robust risk management solutions to ensure compliance, enhance operational efficiency, and mitigate financial and cyber risks across industries such as banking, insurance, and healthcare.

- The strong presence of key market players, high IT investment budgets, and increasing awareness of the benefits of predictive analytics and real-time risk monitoring are further fueling adoption. These factors collectively establish North America as the leading market for comprehensive risk analytics solutions in both large enterprises and SMEs.

U.S. Risk Analytics Market Insight

The U.S. Global Risk Analytics Market captured the largest revenue share of 79% in 2024 within North America, driven by stringent regulatory compliance requirements, rapid digital transformation across industries, and increasing cyber threats. Financial institutions, healthcare providers, and government agencies are investing heavily in advanced risk analytics solutions to enhance fraud detection, improve operational resilience, and meet evolving regulatory standards. The widespread adoption of AI, machine learning, and big data analytics, combined with strong IT infrastructure and availability of skilled talent, further accelerates market growth. Moreover, the rising need for real-time risk monitoring and predictive insights is propelling demand for integrated risk analytics platforms across various sectors.

Europe Risk Analytics Market Insight

The Europe Global Risk Analytics Market is projected to expand at a robust CAGR during the forecast period, fueled by stringent regulations such as GDPR and Basel III, which necessitate sophisticated risk management frameworks. Growing awareness of cyber risks, coupled with increasing digitalization across banking, insurance, and manufacturing sectors, is driving adoption. European enterprises are leveraging risk analytics to ensure compliance, enhance operational efficiency, and mitigate financial and strategic risks. Additionally, the region’s focus on sustainability and governance is encouraging the integration of environmental, social, and governance (ESG) factors into risk management strategies, broadening the market’s scope.

U.K. Risk Analytics Market Insight

The U.K. Global Risk Analytics Market is expected to witness significant growth, driven by the country’s strong regulatory environment and proactive adoption of digital risk management tools. Businesses across finance, healthcare, and public sectors are increasingly prioritizing comprehensive risk analytics to comply with evolving regulations and safeguard against cyber threats. The U.K.’s mature financial services industry and the rise of fintech companies contribute to the high demand for advanced risk analytics platforms. Furthermore, government initiatives to bolster data security and encourage innovation are anticipated to sustain market momentum.

Germany Risk Analytics Market Insight

The Germany Global Risk Analytics Market is forecast to grow steadily, propelled by a focus on industrial digitalization and stringent compliance standards in sectors such as manufacturing, automotive, and finance. German enterprises are adopting risk analytics solutions to optimize operational risk management, ensure regulatory compliance, and improve strategic decision-making. The country’s emphasis on data privacy and cybersecurity drives demand for secure, transparent risk analytics platforms. Additionally, Germany’s commitment to Industry 4.0 and smart manufacturing integrates risk analytics into broader digital ecosystems, supporting market expansion.

Asia-Pacific Risk Analytics Market Insight

The Asia-Pacific Global Risk Analytics Market is poised to register the fastest CAGR of 25% during 2025 to 2032, driven by rapid economic growth, increasing digital transformation, and rising regulatory pressure across emerging economies such as China, India, Japan, and Australia. The region’s expanding financial services sector, coupled with growing awareness of cyber and operational risks, is driving demand for AI-powered, cloud-based risk analytics solutions. Government initiatives promoting smart cities and digital governance further accelerate adoption. Additionally, increasing investments in IT infrastructure and the growing presence of global risk analytics vendors contribute to the region’s robust market growth.

Japan Risk Analytics Market Insight

The Japan Global Risk Analytics Market is gaining traction due to the country’s advanced technological ecosystem, strong regulatory framework, and emphasis on risk mitigation in financial and manufacturing sectors. Japan’s aging population and increasing digitization are boosting demand for automated risk analytics solutions that enhance operational efficiency and reduce human error. Integration of risk analytics with IoT and AI technologies is expanding use cases across industries. Furthermore, government policies promoting cybersecurity and data protection stimulate market growth, positioning Japan as a key market in Asia-Pacific.

China Risk Analytics Market Insight

The China Global Risk Analytics Market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding financial and insurance sectors, and robust technological adoption. China’s push towards digital transformation and smart city initiatives is increasing demand for comprehensive risk analytics platforms capable of managing financial, operational, and cyber risks. Domestic vendors, supported by government policies and investments in AI and big data, are enhancing the availability and affordability of advanced solutions. The growing middle class and increasing business complexity further stimulate market expansion across commercial and government sectors.

Global Risk Analytics Market Share

The Risk Analytics industry is primarily led by well-established companies, including:

- Capgemini (France)

- BRIDGEi2i Analytics (India)

- Accenture plc (Ireland)

- SAP SE (Germany)

- Moody’s Analytics, Inc. (U.S.)

- International Business Machines Corporation (U.S.)

- Risk Edge Solutions (U.S.)

- Oracle Corporation (U.S.)

- Fidelity National Information Services Inc. (FIS) (U.S.)

- SAS Institute Inc. (U.S.)

- Gurucul (U.S.)

- IBM (USA)

- Moody's Analytics (U.S.)

- OneSpan (U.S.)

- Risk Edge Solutions (India)

- Verisk Analytics (U.S.)

What are the Recent Developments in Global Risk Analytics Market?

- In April 2023, RiskVision Inc., a global leader in risk analytics solutions, launched a comprehensive risk assessment platform tailored for financial institutions in Europe. This platform integrates advanced AI-driven analytics to provide real-time insights into market volatility and operational risks. The initiative demonstrates RiskVision’s commitment to delivering innovative, precise risk management tools that address the evolving needs of the financial sector, reinforcing its position in the expanding Global Risk Analytics Market.

- In March 2023, Quantify Analytics, a US-based firm specializing in predictive risk modeling, introduced its latest machine learning-powered risk forecasting tool designed for the insurance industry. This technology enhances the accuracy of underwriting and claims management by analyzing vast datasets for emerging risk patterns. The launch reflects Quantify Analytics' focus on developing cutting-edge solutions that help insurers mitigate risk proactively, boosting their competitiveness in the global market.

- In March 2023, Tata Consultancy Services (TCS) deployed a next-generation enterprise risk analytics solution for a major telecom operator in India, aimed at minimizing cyber and operational risks. Utilizing big data and AI, the solution enables comprehensive risk monitoring and rapid response capabilities. This project highlights TCS’s expertise in applying innovative risk analytics technologies to support the digital transformation of large enterprises, contributing to safer and more resilient business operations worldwide.

- In February 2023, RiskMinds Analytics partnered with the International Association of Insurance Supervisors (IAIS) to develop a standardized risk analytics framework for emerging markets. This collaboration focuses on enhancing regulatory compliance and risk transparency for financial institutions operating in diverse economies. The partnership underscores RiskMinds Analytics’ dedication to fostering global risk management best practices, thereby strengthening market confidence and stability.

- In January 2023, SAS Institute introduced its advanced risk analytics software at the Global Financial Technology Summit 2023. Equipped with enhanced predictive modeling and scenario analysis features, the software empowers organizations to identify, assess, and mitigate risks more effectively. This innovation reaffirms SAS Institute’s leadership in the risk analytics domain, providing enterprises worldwide with robust tools to navigate complex risk environments.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL RISK ANALYTICS MARKET

1.4 CURRENCY AND PRICING

1.5 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

1.5.1 PRICE IMPACT

1.5.2 IMPACT ON DEMAND

1.5.3 IMPACT ON SUPPLY CHAIN

1.5.4 CONCLUSION

1.6 LIMITATION

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL RISK ANALYTICS MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL RISK ANALYTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 TECHNOLOGY TRENDS

5.3 REGULATORY STANDARDS

5.4 COMPANY COMPARATIVE ANALYSIS

5.5 VALUE CHAIN ANALYSIS

6 GLOBAL RISK ANALYTICS MARKET, BY COMPONENTS

6.1 OVERVIEW

6.2 SOFTWARE

6.2.1 EXTRACT, TRANSFORM & LOAD TOOLS

6.2.2 RISK CALCULATION ENGINES

6.2.3 SCORECARD & VISUALIZATION TOOLS

6.2.4 DASHBOARD ANALYTICS & RISK REPORTING TOOLS

6.2.5 GRC SOFTWARE

6.2.6 OPERATIONAL RISK MANAGEMENT

6.2.7 HUMAN RESOURCE RISK MANAGEMENT

6.2.8 PROJECT RISK MANAGEMENT

6.2.9 OTHERS

6.3 SERVICES

6.3.1 PROFESSIONAL SERVICES

6.3.2 MANAGED SERVICES

7 GLOBAL RISK ANALYTICS MARKET, BY RISK TYPE

7.1 OVERVIEW

7.2 STRATEGIC RISK

7.3 OPERATIONAL RISK

7.4 FINANCIAL RISK

7.5 REPUTATIONAL RISK

7.6 ENVIRONMENTAL RISK

7.7 THIRD-PARTY RISK

7.8 OTHERS

8 GLOBAL RISK ANALYTICS MARKET, BY DEPLOYMENT

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISES

9 GLOBAL RISK ANALYTICS MARKET, BY ORGANISATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.2.1 BY COMPONENTS

9.2.1.1. SOFTWARE

9.2.1.2. SERVICES

9.3 SMALL ENTERPRISES

9.3.1 BY COMPONENTS

9.3.1.1. SOFTWARE

9.3.1.2. SERVICES

9.4 MEDIUM ENTERPRISES

9.4.1 BY COMPONENTS

9.4.1.1. SOFTWARE

9.4.1.2. SERVICES

10 GLOBAL RISK ANALYTICS MARKET, BY PRICING MODEL

10.1 OVERVIEW

10.2 ONE-TIME PAYMENT

10.3 SUBSCRIPTION

10.3.1 ANNUAL

10.3.2 MONTHLY

11 GLOBAL RISK ANALYTICS MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BFSI

11.2.1 BY RISK TYPE

11.2.1.1. STRATEGIC RISK

11.2.1.2. OPERATIONAL RISK

11.2.1.3. FINANCIAL RISK

11.2.1.4. REPUTATIONAL RISK

11.2.1.5. ENVIRONMENTAL RISK

11.2.1.6. THIRD-PARTY RISK

11.2.1.7. OTHERS

11.3 MANUFACTURING

11.3.1 BY RISK TYPE

11.3.1.1. STRATEGIC RISK

11.3.1.2. OPERATIONAL RISK

11.3.1.3. FINANCIAL RISK

11.3.1.4. REPUTATIONAL RISK

11.3.1.5. ENVIRONMENTAL RISK

11.3.1.6. THIRD-PARTY RISK

11.3.1.7. OTHERS

11.4 TRANSPORTATION & LOGISTICS

11.4.1 BY RISK TYPE

11.4.1.1. STRATEGIC RISK

11.4.1.2. OPERATIONAL RISK

11.4.1.3. FINANCIAL RISK

11.4.1.4. REPUTATIONAL RISK

11.4.1.5. ENVIRONMENTAL RISK

11.4.1.6. THIRD-PARTY RISK

11.4.1.7. OTHERS

11.5 RETAIL & CONSUMER GOODS

11.5.1 BY RISK TYPE

11.5.1.1. STRATEGIC RISK

11.5.1.2. OPERATIONAL RISK

11.5.1.3. FINANCIAL RISK

11.5.1.4. REPUTATIONAL RISK

11.5.1.5. ENVIRONMENTAL RISK

11.5.1.6. THIRD-PARTY RISK

11.5.1.7. OTHERS

11.6 IT & TELECOM

11.6.1 BY RISK TYPE

11.6.1.1. STRATEGIC RISK

11.6.1.2. OPERATIONAL RISK

11.6.1.3. FINANCIAL RISK

11.6.1.4. REPUTATIONAL RISK

11.6.1.5. ENVIRONMENTAL RISK

11.6.1.6. THIRD-PARTY RISK

11.6.1.7. OTHERS

11.7 GOVERNMENT & DEFENSE

11.7.1 BY RISK TYPE

11.7.1.1. STRATEGIC RISK

11.7.1.2. OPERATIONAL RISK

11.7.1.3. FINANCIAL RISK

11.7.1.4. REPUTATIONAL RISK

11.7.1.5. ENVIRONMENTAL RISK

11.7.1.6. THIRD-PARTY RISK

11.7.1.7. OTHERS

11.8 HEALTHCARE & LIFE SCIENCES

11.8.1 BY RISK TYPE

11.8.1.1. STRATEGIC RISK

11.8.1.2. OPERATIONAL RISK

11.8.1.3. FINANCIAL RISK

11.8.1.4. REPUTATIONAL RISK

11.8.1.5. ENVIRONMENTAL RISK

11.8.1.6. THIRD-PARTY RISK

11.8.1.7. OTHERS

11.9 ENERGY & UTILITIES

11.9.1 BY RISK TYPE

11.9.1.1. STRATEGIC RISK

11.9.1.2. OPERATIONAL RISK

11.9.1.3. FINANCIAL RISK

11.9.1.4. REPUTATIONAL RISK

11.9.1.5. ENVIRONMENTAL RISK

11.9.1.6. THIRD-PARTY RISK

11.9.1.7. OTHERS

11.1 TRAVEL & HOSPITALITY

11.10.1 BY RISK TYPE

11.10.1.1. STRATEGIC RISK

11.10.1.2. OPERATIONAL RISK

11.10.1.3. FINANCIAL RISK

11.10.1.4. REPUTATIONAL RISK

11.10.1.5. ENVIRONMENTAL RISK

11.10.1.6. THIRD-PARTY RISK

11.10.1.7. OTHERS

11.11 ACADEMIA AND RESEARCH

11.11.1 BY RISK TYPE

11.11.1.1. STRATEGIC RISK

11.11.1.2. OPERATIONAL RISK

11.11.1.3. FINANCIAL RISK

11.11.1.4. REPUTATIONAL RISK

11.11.1.5. ENVIRONMENTAL RISK

11.11.1.6. THIRD-PARTY RISK

11.11.1.7. OTHERS

11.12 MEDIA AND ENTERTAINMENT

11.12.1 BY RISK TYPE

11.12.1.1. STRATEGIC RISK

11.12.1.2. OPERATIONAL RISK

11.12.1.3. FINANCIAL RISK

11.12.1.4. REPUTATIONAL RISK

11.12.1.5. ENVIRONMENTAL RISK

11.12.1.6. THIRD-PARTY RISK

11.12.1.7. OTHERS

11.13 OTHERS

11.13.1 BY RISK TYPE

11.13.1.1. STRATEGIC RISK

11.13.1.2. OPERATIONAL RISK

11.13.1.3. FINANCIAL RISK

11.13.1.4. REPUTATIONAL RISK

11.13.1.5. ENVIRONMENTAL RISK

11.13.1.6. THIRD-PARTY RISK

11.13.1.7. OTHERS

12 GLOBAL RISK ANALYTICS MARKET, BY GEOGRAPHY

12.1 GLOBAL RISK ANALYTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

12.2 NORTH AMERICA

12.2.1 U.S.

12.2.2 CANADA

12.2.3 MEXICO

12.3 EUROPE

12.3.1 GERMANY

12.3.2 FRANCE

12.3.3 U.K.

12.3.4 ITALY

12.3.5 SPAIN

12.3.6 RUSSIA

12.3.7 TURKEY

12.3.8 BELGIUM

12.3.9 NETHERLANDS

12.3.10 NORWAY

12.3.11 FINLAND

12.3.12 SWITZERLAND

12.3.13 DENMARK

12.3.14 SWEDEN

12.3.15 POLAND

12.3.16 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 JAPAN

12.4.2 CHINA

12.4.3 SOUTH KOREA

12.4.4 INDIA

12.4.5 AUSTRALIA

12.4.6 NEW ZEALAND

12.4.7 SINGAPORE

12.4.8 THAILAND

12.4.9 MALAYSIA

12.4.10 INDONESIA

12.4.11 PHILIPPINES

12.4.12 TAIWAN

12.4.13 VIETNAM

12.4.14 REST OF ASIA PACIFIC

12.5 SOUTH AMERICA

12.5.1 BRAZIL

12.5.2 ARGENTINA

12.5.3 REST OF SOUTH AMERICA

12.6 MIDDLE EAST AND AFRICA

12.6.1 SOUTH AFRICA

12.6.2 EGYPT

12.6.3 SAUDI ARABIA

12.6.4 U.A.E

12.6.5 OMAN

12.6.6 BAHRAIN

12.6.7 ISRAEL

12.6.8 KUWAIT

12.6.9 QATAR

12.6.10 REST OF MIDDLE EAST AND AFRICA

12.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

13 GLOBAL RISK ANALYTICS MARKET,COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: GLOBAL

13.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.3 COMPANY SHARE ANALYSIS: EUROPE

13.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13.5 MERGERS & ACQUISITIONS

13.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

13.7 EXPANSIONS

13.8 REGULATORY CHANGES

13.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 GLOBAL RISK ANALYTICS MARKET , SWOT & DBMR ANALYSIS

15 GLOBAL RISK ANALYTICS MARKET, COMPANY PROFILE

15.1 DELLOITE

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 GEOGRAPHIC PRESENCE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SAS INSTITUTE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 GEOGRAPHIC PRESENCE

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 IBM

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 GEOGRAPHIC PRESENCE

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 ACCENTURE

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 GEOGRAPHIC PRESENCE

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 EY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 GEOGRAPHIC PRESENCE

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 PWC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 GEOGRAPHIC PRESENCE

15.6.4 PRODUCT PORTFOLIO

15.6.5 RECENT DEVELOPMENTS

15.7 KPMG

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 GEOGRAPHIC PRESENCE

15.7.4 PRODUCT PORTFOLIO

15.7.5 RECENT DEVELOPMENTS

15.8 PROTIVITI

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 GEOGRAPHIC PRESENCE

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 GROUPE OXIAL

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 GEOGRAPHIC PRESENCE

15.9.4 PRODUCT PORTFOLIO

15.9.5 RECENT DEVELOPMENTS

15.1 MARSH SAS

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 GEOGRAPHIC PRESENCE

15.10.4 PRODUCT PORTFOLIO

15.10.5 RECENT DEVELOPMENTS

15.11 SCOR

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 GEOGRAPHIC PRESENCE

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 JUMP TECHNOLOGY

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 GEOGRAPHIC PRESENCE

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 FACTSET

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 GEOGRAPHIC PRESENCE

15.13.4 PRODUCT PORTFOLIO

15.13.5 RECENT DEVELOPMENTS

15.14 AMPLELOGIC

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 GEOGRAPHIC PRESENCE

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 MILLIMAN, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 GEOGRAPHIC PRESENCE

15.15.4 PRODUCT PORTFOLIO

15.15.5 RECENT DEVELOPMENTS

15.16 ORACLE

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 GEOGRAPHIC PRESENCE

15.16.4 PRODUCT PORTFOLIO

15.16.5 RECENT DEVELOPMENTS

15.17 SAP

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 GEOGRAPHIC PRESENCE

15.17.4 PRODUCT PORTFOLIO

15.17.5 RECENT DEVELOPMENTS

15.18 FIS

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 GEOGRAPHIC PRESENCE

15.18.4 PRODUCT PORTFOLIO

15.18.5 RECENT DEVELOPMENTS

15.19 MOODY ANALYTICS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 GEOGRAPHIC PRESENCE

15.19.4 PRODUCT PORTFOLIO

15.19.5 RECENT DEVELOPMENTS

15.2 VERISK ANALYTICS

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 GEOGRAPHIC PRESENCE

15.20.4 PRODUCT PORTFOLIO

15.20.5 RECENT DEVELOPMENTS

15.21 GURUCUL

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 GEOGRAPHIC PRESENCE

15.21.4 PRODUCT PORTFOLIO

15.21.5 RECENT DEVELOPMENTS

15.22 PROVENIR

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 GEOGRAPHIC PRESENCE

15.22.4 PRODUCT PORTFOLIO

15.22.5 RECENT DEVELOPMENTS

15.23 RISK EDGE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 REVENUE ANALYSIS

15.23.3 GEOGRAPHIC PRESENCE

15.23.4 PRODUCT PORTFOLIO

15.23.5 RECENT DEVELOPMENTS

15.24 RECORDED FUTURE

15.24.1 COMPANY SNAPSHOT

15.24.2 REVENUE ANALYSIS

15.24.3 GEOGRAPHIC PRESENCE

15.24.4 PRODUCT PORTFOLIO

15.24.5 RECENT DEVELOPMENTS

15.25 BEINEX

15.25.1 COMPANY SNAPSHOT

15.25.2 REVENUE ANALYSIS

15.25.3 GEOGRAPHIC PRESENCE

15.25.4 PRODUCT PORTFOLIO

15.25.5 RECENT DEVELOPMENTS

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.