Global Road Safety Market

Market Size in USD Billion

CAGR :

%

USD

5.46 Billion

USD

11.80 Billion

2024

2032

USD

5.46 Billion

USD

11.80 Billion

2024

2032

| 2025 –2032 | |

| USD 5.46 Billion | |

| USD 11.80 Billion | |

|

|

|

|

Road Safety Market Size

- The global road safety market size was valued at USD 5.46 billion in 2024 and is expected to reach USD 11.80 billion by 2032, at a CAGR of 10.1% during the forecast period

- This growth is driven by factors such as the rising number of road accidents, government mandates for vehicle and infrastructure safety, and increasing investments in smart transportation and surveillance technologies

Road Safety Market Analysis

- Road safety systems are essential technologies deployed to reduce traffic collisions and enhance transportation infrastructure, incorporating tools like red light enforcement, speed enforcement, and automatic license plate recognition systems

- The demand for road safety solutions is significantly driven by the increasing number of road accidents, growing urbanization, and government mandates for public safety and vehicle monitoring

- North America is expected to dominate the global road safety market, holding a market share of 38.7% in 2024. This dominance is attributed to robust investments in intelligent transportation systems, increasing adoption of advanced traffic management solutions, and strict government regulations aimed at reducing road fatalities

- Asia-Pacific is expected to be the fastest-growing region in the road safety market during the forecast period, driven by rapid urbanization, government smart city initiatives, and increasing investment in road infrastructure and surveillance technologies.

- The red light enforcement segment is expected to dominate the market, with 9.3% share due to its proven impact in reducing intersection-related collisions and widespread adoption by municipal and regional authorities

Report Scope and Road Safety Market Segmentation

|

Attributes |

Road Safety Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

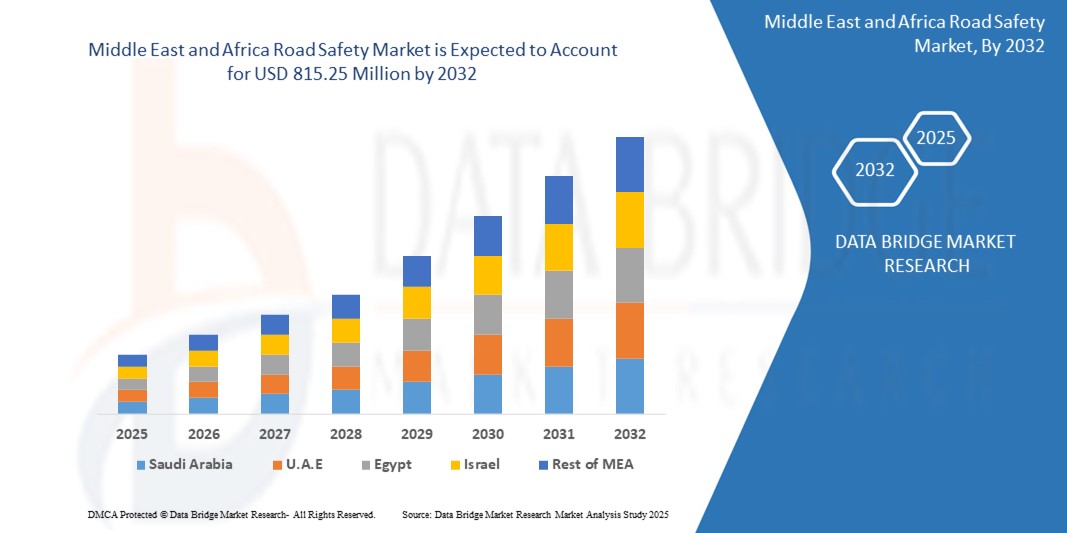

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Road Safety Market Trends

“Integration of AI, IoT, and Smart Infrastructure in Road Safety Systems”

- One prominent trend in the global road safety market is the increasing integration of artificial intelligence (AI), Internet of Things (IoT), and smart infrastructure to enhance traffic monitoring, predictive analysis, and automated enforcement

- These advancements improve situational awareness by providing real-time data analytics, automated detection of traffic violations, and predictive modeling to prevent accidents

- For instance, In February 2024, Jenoptik launched an AI-powered VECTOR-SR speed enforcement solution that provides high-resolution monitoring and automated processing of violations, improving enforcement efficiency and road safety

- These innovations are transforming traditional road safety systems into proactive and intelligent networks, improving response times, reducing human error, and driving the demand for next-generation road safety solutions globally

Road Safety Market Dynamics

Driver

“Rising Traffic Fatalities and Regulatory Push Fueling Demand for Road Safety Solutions”

- The increasing number of road accidents and traffic-related fatalities worldwide is significantly contributing to the rising demand for advanced road safety solutions, including surveillance systems, speed enforcement cameras, and automated traffic control systems

- As urbanization accelerates and vehicle density increases, the need for efficient traffic management and enhanced public safety becomes more critical, prompting governments and city planners to invest in smart road safety technologies

- The implementation of intelligent transportation systems (ITS), real-time traffic monitoring, and AI-based violation detection tools are helping to reduce collisions, improve response times, and enhance compliance with traffic laws

For instance,

- In October 2023, the U.S. Department of Transportation announced over USD82 million in grants for the Safe Streets and Roads for All (SS4A) program, aiming to reduce roadway fatalities and improve pedestrian and cyclist safety through smart infrastructure

- As a result of increasing global awareness and policy efforts to reduce traffic-related injuries and deaths, the demand for comprehensive road safety systems continues to grow steadily

Opportunity

“Smart City Growth Boosting Demand for Road Safety Technologies”

- The global rise in smart city initiatives is opening up significant opportunities for the deployment of integrated road safety technologies such as AI-based surveillance, intelligent traffic management systems, and connected vehicle infrastructure

- As cities aim to enhance urban mobility and reduce congestion, investments in smart intersections, adaptive traffic signal control, and automated incident detection are becoming central to urban planning

- These integrated solutions not only improve commuter safety but also enable data-driven decision-making for long-term urban transport strategies

For instance,

- In March 2024, India’s Ministry of Housing and Urban Affairs announced a push to accelerate smart city projects under the Smart Cities Mission, including the deployment of intelligent traffic systems and AI-powered surveillance cameras in major metropolitan areas

- With governments and municipalities increasingly embracing digital infrastructure, the road safety market is poised to benefit from scalable deployments and new technology use cases in smart urban environments

Restraint/Challenge

“High Infrastructure and Technology Costs Limiting Widespread Adoption”

- The high cost of road safety technologies and infrastructure, including intelligent transportation systems (ITS), automated enforcement systems, and smart traffic management tools, remains a significant challenge for market penetration, particularly in developing regions

- These systems, which are crucial for enhancing traffic safety and reducing accidents, can cost millions of dollars to install and maintain, posing a financial barrier for smaller municipalities or countries with limited budgets

- The substantial investment required to implement and maintain advanced road safety solutions may deter local governments from upgrading their infrastructure or adopting new technologies, resulting in reliance on outdated or less effective systems

For instance,

- In October 2024, the World Bank published a report noting that the high upfront costs of smart traffic management systems in low- and middle-income countries are a significant barrier to improving road safety infrastructure, impacting accessibility and effectiveness of these technologies in such regions

- As a result, this financial hurdle may cause delays in upgrading road safety systems, hindering the market's growth and limiting access to advanced traffic safety solutions in certain areas.

Road Safety Market Scope

The market is segmented on the basis component, technology, road type, and type.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Technology |

|

|

By Road Type |

|

|

By Type |

|

In 2025, the Red Light Enforcement Segment is Projected to Dominate the Market with the Largest Share type segment

The red light enforcement segment is expected to dominate the road safety market with the 9.3% share due to its high impact on reducing intersection-related accidents. Red light running is a significant cause of traffic collisions, and advancements in camera technologies and real-time violation detection systems are improving enforcement accuracy. As governments implement more automated traffic management systems and intelligent transportation solutions, the demand for red light enforcement systems continues to rise. Increased urbanization and government initiatives to improve traffic safety further contribute to the dominance of this segment.

The Sensors-Based Devices Segment is Expected to Account for the Largest Share During the Forecast Period in Technology Segments

In 2025, the sensors-based devices segment is expected to dominate the road safety market with the 9% market share due to their high accuracy in real-time traffic monitoring and incident detection. These devices, such as radar sensors, cameras, and LIDAR, are critical in enhancing traffic enforcement, vehicle tracking, and safety systems in both urban and highway settings. The increasing adoption of smart city infrastructure and connected vehicles is driving demand for sensors-based solutions to improve road safety and prevent accidents. Advancements in sensor technologies and the growing focus on autonomous driving systems further contribute to the dominance of this segment in the road safety market.

Road Safety Market Regional Analysis

“North America Holds the Largest Share in the Road Safety Market”

- North America is expected to dominate the global road safety market, holding a market share of 38.7% in 2024. This dominance is attributed to robust investments in intelligent transportation systems, increasing adoption of advanced traffic management solutions, and strict government regulations aimed at reducing road fatalities

- The U.S. holds a significant share of approximately 41%, driven by initiatives such as the U.S. Department of Transportation’s “Safe Streets and Roads for All” program and the deployment of AI-powered traffic enforcement technologies to improve road user safety

- The presence of supportive regulatory frameworks, including Vision Zero strategies at state and city levels, and ongoing smart city projects with integrated road safety solutions further strengthen market growth

- In addition, the rise in vehicular traffic, along with the growing use of technologies such as automatic number plate recognition (ANPR), red-light enforcement cameras, and vehicle-to-everything (V2X) communication systems, continues to drive the region's leadership in the road safety market

“Asia-Pacific is Projected to Register the Highest CAGR in the Road Safety Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the global road safety market, driven by rapid urbanization, increasing vehicle ownership, and rising investments in intelligent traffic management and infrastructure modernization

- Countries such as China, India, and Japan are emerging as key markets due to growing government focus on reducing road accidents, improving traffic flow, and deploying smart city technologies that integrate road safety measures

- China is a major contributor to the region’s growth, with its government investing heavily in AI-based surveillance, smart traffic lights, and speed enforcement systems as part of broader urban development plans. India is also seeing a surge in road safety initiatives, including the National Road Safety Policy and deployment of real-time traffic violation detection systems in metropolitan areas

- Japan, with its focus on aging population needs and advanced automotive technologies, is investing in vehicle-to-infrastructure (V2I) communication and autonomous vehicle testing zones to enhance road safety. The road safety market in Asia-Pacific is projected to grow at a CAGR of 18.5% by 2025

Road Safety Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- JENOPTIK AG (Germany)

- Sensys Gatso Group AB (Sweden)

- SWARCO (Austria)

- IEG America (Canada)

- Syntell (Pty) Ltd (South Africa)

- Kapsch TrafficCom AG (Austria)

- Redflex Holdings (Australia)

- Teledyne FLIR LLC (U.S.)

- Cubic Corporation (U.S.)

- Truvelo (UK) Limited (U.K.)

- ALTUMINT (U.S.)

- Laser Technology, Inc. (U.S.)

- Motorola Solutions, Inc. (U.S.)

- Verra Mobility (U.S.)

- Siemens (Germany)

- Dahua Technology Co., Ltd (China)

- Clearview Intelligence Limited (U.K.)

- Conduent Business Services, LLC. (U.S.)

- Tattile S.r.l. (Italy)

- Traffic Logix (U.S.)

Latest Developments in Global Road Safety Market

- In November 2024, Abertis introduced the Zero Accidents AI Challenge, a global initiative calling on startups to create AI-powered solutions to eliminate road accidents. This challenge seeks to integrate satellite and vehicle data with artificial intelligence to enhance traffic management and safety. By fostering innovation, Abertis aims to predict, prevent, and manage accidents more effectively, reinforcing its dedication to safer roads. The winning solution will receive financial support for a pilot project, with finalists gaining opportunities to collaborate with Abertis

- In September 2024, SMA Road Safety unveiled three groundbreaking products—Leonidas, Hercules, and Ermes—to enhance road safety. These solutions utilize advanced energy-absorbing technologies to minimize crash impact, improve roadside infrastructure, and reduce fatalities. Designed to absorb kinetic energy upon collision, they aim to protect drivers and pedestrians alike. SMA Road Safety continues to lead in passive road safety innovations, ensuring safer roads worldwide. The Leonidas crash cushions have already been installed on Dubai’s Sheikh Zayed Road to safeguard interchanges

- In May 2024, EFKON-STRABAG partnered with IIT Bombay, IIT Mandi, and IIT Roorkee to advance road safety and transportation innovation across India. This collaboration focuses on intelligent transportation systems (ITS), landslide management solutions (LMS), and road safety awareness programs. IIT Bombay leads research on ITS, fostering knowledge exchange and skill development. IIT Mandi implements LMS for early landslide warnings, enhancing highway safety. IIT Roorkee drives road safety education, targeting young learners. These initiatives aim to reduce accidents and improve infrastructure nationwide

- In May 2023, Nokia introduced new Core network software solutions designed for public safety and power utility sectors, addressing field and wide area network (FAN/WAN) needs. These solutions enhance mission-critical communications, offering secure, carrier-grade capabilities for enterprises and governments. Nokia aims to modernize large-scale networks, improve automation, and boost efficiency. The expansion strengthens its leadership in private wireless solutions, supporting 4G and 5G data, voice, and IoT applications. The market for these solutions is expected to grow significantly by 2027

- In March 2022, Melbourne launched the world’s smartest traffic management system, the Intelligent Corridor, along Nicholson Street, spanning 2.5 kilometers. Developed by the University of Melbourne, Kapsch TrafficCom, and the Victorian Department of Transport, this system integrates sensors, cloud-based AI, and machine learning algorithms to optimize traffic flow. It aims to reduce congestion, enhance road safety, and lower emissions, benefiting drivers, pedestrians, and cyclists. The corridor continuously fine-tunes its performance using real-time data, setting a global benchmark for smart traffic solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.