Global Robinow Syndrome Market

Market Size in USD Billion

CAGR :

%

USD

1.85 Billion

USD

3.31 Billion

2024

2032

USD

1.85 Billion

USD

3.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.85 Billion | |

| USD 3.31 Billion | |

|

|

|

|

Robinow Syndrome Market Size

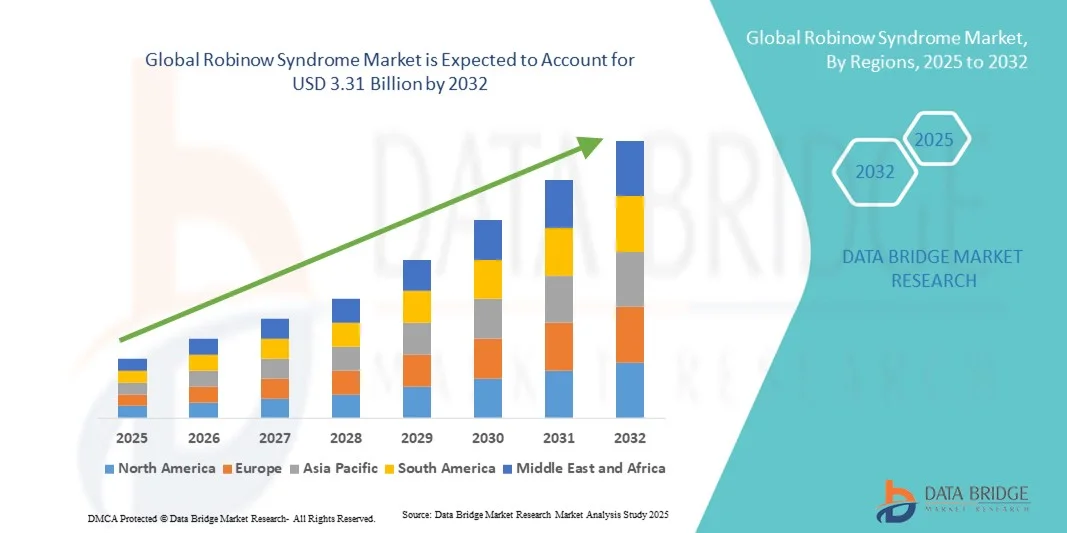

- The global robinow syndrome market size was valued at USD 1.85 billion in 2024 and is expected to reach USD 3.31 billion by 2032, at a CAGR of 7.55% during the forecast period

- The market growth is largely fueled by the rising advancements in genetic testing, molecular diagnostics, and clinical research focused on rare congenital disorders, enabling earlier and more accurate diagnosis of Robinow Syndrome. Growing awareness among healthcare professionals and patient advocacy groups is contributing to better identification and management of the condition across global healthcare systems

- Furthermore, the development of targeted therapies and supportive treatment approaches—such as orthopedic care, hormone therapy, and craniofacial surgery—combined with increasing government and private funding for rare disease research, is establishing a strong foundation for the expansion of Robinow Syndrome solutions. These converging factors are accelerating innovation, improving patient outcomes, and significantly boosting the industry's overall growth

Robinow Syndrome Market Analysis

- Robinow Syndrome, a rare genetic disorder characterized by skeletal dysplasia and distinctive facial features, is witnessing increasing research and clinical attention due to advancements in genomics, molecular diagnostics, and rare disease registries. Growing awareness among healthcare professionals, coupled with improved diagnostic capabilities, is fostering early detection and better management outcomes for patients globally

- The expanding investment in rare disease research, increasing collaborations between biopharmaceutical companies and research institutions, and rising focus on gene-based therapies are major drivers propelling the growth of the Robinow Syndrome market

- North America dominated the Robinow Syndrome market with the largest revenue share of 44.6% in 2024, attributed to advanced healthcare infrastructure, a strong presence of genetic research organizations, and supportive government initiatives for orphan drug development. The United States leads the region due to robust clinical research programs and growing participation in rare disease clinical trials

- Asia-Pacific is projected to be the fastest-growing region in the Robinow Syndrome market during the forecast period, expanding at a CAGR, driven by rising healthcare expenditure, improving genetic testing capabilities, and increasing awareness of rare congenital disorders across emerging economies such as China and India

- The Autosomal Recessive Robinow Syndrome (ARRS) segment dominated the largest market revenue share of 61.4% in 2024, driven by the higher clinical severity and increased diagnostic awareness of recessive genetic mutations associated with the ROR2 gene

Report Scope and Robinow Syndrome Market Segmentation

|

Attributes |

Robinow Syndrome Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Robinow Syndrome Market Trends

Advancements in Genetic Research and AI-driven Diagnosis Enhancing Precision Care

- A significant and accelerating trend in the global Robinow Syndrome market is the deepening integration of artificial intelligence (AI), advanced genetic sequencing, and precision medicine tools to improve early detection, phenotypic classification, and personalized treatment planning. This technological convergence is transforming the accuracy and speed of diagnosis for rare congenital disorders

- For instance, AI-assisted genetic screening platforms now analyze complex ROR2 and WNT5A mutations, helping clinicians identify Robinow Syndrome subtypes with greater precision. Similarly, machine-learning algorithms are being integrated with 3D craniofacial imaging systems to evaluate bone deformities and facial morphology, significantly reducing diagnostic errors

- The adoption of next-generation sequencing (NGS) and AI-enabled clinical decision support systems is also enabling faster interpretation of variant pathogenicity, guiding early therapeutic interventions and better management outcomes. Moreover, data-driven insights from global rare disease registries are improving genotype-phenotype correlations, contributing to more standardized care protocols

- The seamless integration of genomic data with digital health platforms and AI-driven analytics supports multi-disciplinary case review and remote consultation for complex Robinow Syndrome cases. Through a single interface, healthcare providers can collaborate globally, share patient data securely, and align diagnostic and treatment strategies

- This shift towards data-centric, intelligent, and connected diagnostic ecosystems is fundamentally reshaping expectations for rare disease management. Consequently, key research institutions and biotechnology firms are developing AI-powered gene-mapping and therapeutic modeling tools tailored for Robinow Syndrome, supporting precision diagnostics and future drug discovery

- The demand for advanced diagnostic solutions and personalized treatment frameworks is growing rapidly across both developed and emerging healthcare systems, as clinicians and families increasingly prioritize accurate diagnosis, early intervention, and long-term disease monitoring for Robinow Syndrome patients

Robinow Syndrome Market Dynamics

Driver

Rising Awareness, Genetic Advancements, and Expansion of Rare Disease Research Networks

- The increasing global awareness of congenital skeletal dysplasias, coupled with major advancements in genomic medicine, is a key driver fueling the growth of the Robinow Syndrome market

- For instance, in June 2023, the National Organization for Rare Disorders (NORD) expanded its Rare Disease Patient Registry Program to include Robinow Syndrome, improving access to shared data and clinical support for affected families. Such initiatives are expected to drive sustained growth in the forecast period

- As healthcare systems prioritize early diagnosis and precision therapies for rare diseases, investments in genetic testing infrastructure and patient registries are expanding worldwide. Genetic sequencing platforms now allow clinicians to identify Robinow-associated mutations more efficiently, providing a crucial step toward personalized management

- Furthermore, the growing collaboration among global research consortia and hospitals is enabling data pooling for phenotypic pattern analysis, which supports both early diagnosis and future clinical trial design

- The increasing adoption of advanced imaging, molecular diagnostics, and telehealth consultations is improving patient access to specialists, particularly in regions with limited rare disease expertise. The overall trend toward integrating multi-disciplinary genetic and clinical data platforms continues to accelerate market development

Restraint/Challenge

High Diagnostic Costs, Limited Treatment Options, and Data Privacy Concerns

- Despite technological advances, the high cost of genetic sequencing and limited availability of specialized testing centers remain major barriers to wider market accessibility. Many patients, especially in developing regions, face challenges in obtaining accurate diagnoses due to financial constraints or lack of awareness among healthcare professionals

- Moreover, Robinow Syndrome currently lacks disease-modifying therapies, with management primarily focused on symptomatic and surgical interventions. This restricts therapeutic innovation and limits the commercial potential of new entrants in the market

- Concerns surrounding the privacy and security of genomic data also pose a critical challenge. As AI-driven diagnostic platforms rely on large-scale patient datasets, ensuring compliance with global data protection regulations such as GDPR and HIPAA is essential for maintaining trust

- For instance, recent reports have emphasized the need for ethical genomic data sharing and stricter encryption protocols to safeguard patient information across cross-border research collaborations

- In addition, limited funding for ultra-rare diseases, combined with the long timelines required for clinical research and validation, continues to slow market progress

- Overcoming these challenges through affordable genetic testing, transparent data governance frameworks, and increased public-private research funding will be vital to unlocking the full potential of the Robinow Syndrome market in the coming years

Robinow Syndrome Market Scope

The market is segmented on the basis of type, symptoms, treatment, and end user.

- By Type

On the basis of type, the Robinow Syndrome market is segmented into Autosomal Recessive Robinow Syndrome (ARRS) and Autosomal Dominant Robinow Syndrome (ADRS). The Autosomal Recessive Robinow Syndrome (ARRS) segment dominated the largest market revenue share of 61.4% in 2024, driven by the higher clinical severity and increased diagnostic awareness of recessive genetic mutations associated with the ROR2 gene. ARRS often presents with more pronounced skeletal deformities, vertebral segmentation anomalies, and craniofacial dysmorphism, which leads to more frequent medical consultations and diagnostic testing. The demand for molecular testing and clinical management for ARRS cases continues to grow due to enhanced accessibility of next-generation sequencing (NGS) and specialized pediatric genetic centers. Furthermore, international rare disease networks and patient advocacy groups have contributed to improved early diagnosis and better tracking of ARRS prevalence worldwide. The segment’s dominance is further strengthened by increasing clinical trials focused on genetic and supportive therapies tailored toward recessive mutations.

The Autosomal Dominant Robinow Syndrome (ADRS) segment is projected to witness the fastest growth, with a CAGR of 10.6% from 2025 to 2032, owing to growing awareness among clinicians about WNT5A and DVL1 mutations and their milder yet clinically significant presentations. ADRS typically shows more variable expressivity and is often underdiagnosed, but improvements in exome sequencing and phenotype-based algorithms are boosting detection rates. The rise in adult genetic consultations, coupled with family screening programs, is also contributing to the growing identification of ADRS cases. Additionally, the expanding application of genetic counseling and inclusion of ADRS in global rare disease registries are expected to further accelerate segment growth over the forecast period.

- By Symptoms

On the basis of symptoms, the Robinow Syndrome market is segmented into Dysmorphic Facial Features, Segmental Spine Defects, Short Stature, Brachymesomelia, and Genital Hypoplasia. The Dysmorphic Facial Features segment accounted for the largest market share of 38.9% in 2024, driven by its universal manifestation across most Robinow Syndrome cases and its crucial role in clinical diagnosis. Characteristic features such as a broad forehead, wide-set eyes, short upturned nose, and midface hypoplasia often prompt initial genetic testing referrals. These distinct craniofacial phenotypes enable early suspicion and diagnosis, leading to the dominance of this segment. The increasing adoption of AI-driven facial recognition and morphometric diagnostic software in rare disease assessment also supports segment growth. Furthermore, multidisciplinary management involving craniofacial surgery and orthodontic interventions has led to consistent demand within this category.

The Segmental Spine Defects segment is projected to record the fastest growth, registering a CAGR of 9.8% from 2025 to 2032, fueled by the rising incidence of spinal deformities such as hemivertebrae and kyphoscoliosis in Robinow patients. Advances in 3D imaging and spinal reconstruction techniques have improved detection and correction outcomes, increasing clinical attention to this manifestation. The growing integration of orthopedic, radiologic, and genetic teams in tertiary centers is enhancing diagnostic precision for vertebral segmentation defects. Moreover, innovations in pediatric orthopedic implants and postoperative care are driving increased demand for surgical interventions targeting spinal deformities linked to Robinow Syndrome.

- By Treatment

On the basis of treatment, the Robinow Syndrome market is segmented into Surgery, Supportive Therapy, Physical Therapy, and Others.The Surgery segment dominated the market with a revenue share of 46.2% in 2024, driven by the high prevalence of skeletal, craniofacial, and genitourinary deformities requiring surgical correction. Procedures such as spinal fusion, craniofacial reconstruction, and genital repair remain critical in improving quality of life and functional outcomes. The expansion of pediatric surgical programs and availability of multidisciplinary centers with expertise in congenital deformities have further boosted this segment. Technological advancements such as minimally invasive and image-guided surgeries are also enhancing treatment precision and recovery rates for Robinow patients.

The Supportive Therapy segment is expected to witness the fastest CAGR of 11.3% from 2025 to 2032, driven by the increasing emphasis on holistic care and quality-of-life management. This includes long-term medical follow-up, developmental support, orthodontic care, and psychological counseling. As genetic research progresses, supportive care frameworks are becoming more personalized, with therapies tailored to symptom severity and growth parameters. The growing role of multidisciplinary rehabilitation clinics and integration of telehealth consultations for rare disease management are further accelerating segment expansion.

- By End User

On the basis of end user, the Robinow Syndrome market is segmented into Hospitals, Clinics, Ambulatory Surgical Centers, and Others. The Hospitals segment held the dominant market revenue share of 57.8% in 2024, primarily due to the concentration of advanced diagnostic, surgical, and genetic testing facilities in tertiary hospitals. Hospitals remain the primary treatment centers for complex Robinow cases requiring coordinated care across multiple specialties, including pediatrics, orthopedics, maxillofacial surgery, and genetics. The availability of next-generation sequencing laboratories and dedicated rare disease departments within hospital networks further strengthens this segment’s leadership. In addition, government-supported hospital initiatives for rare diseases, such as the NIH Rare Diseases Clinical Research Network, continue to enhance access to diagnosis and treatment for Robinow Syndrome.

The Clinics segment is projected to grow at the fastest rate, recording a CAGR of 10.2% from 2025 to 2032, supported by the increasing number of outpatient genetic and pediatric clinics offering early screening and family counseling services. Clinics provide more accessible and cost-effective diagnostic pathways, particularly in developed regions with established healthcare infrastructure. The growing integration of digital health platforms, remote consultations, and personalized care programs within clinical practices is also contributing to segment growth. Furthermore, the rising adoption of point-of-care genetic testing and the inclusion of Robinow Syndrome in clinical research initiatives are expanding the role of specialized clinics globally.

Robinow Syndrome Market Regional Analysis

- North America dominated the Robinow Syndrome market with the largest revenue share of 44.6% in 2024, attributed to advanced healthcare infrastructure, a strong presence of genetic research organizations, and supportive government initiatives for orphan drug development

- Increasing investments in precision medicine and next-generation sequencing technologies are further improving early diagnosis and disease management. The region also benefits from a well-established network of rare disease registries and advocacy groups that facilitate patient identification and access to emerging therapies

- Moreover, collaborations between academic research institutions and biotechnology companies are accelerating the development of targeted treatments for Robinow Syndrome and related congenital disorders

U.S. Robinow Syndrome Market Insight

The U.S. Robinow Syndrome market captured the largest revenue share within North America in 2024, driven by robust clinical research programs and growing participation in rare disease clinical trials. The country’s strong healthcare infrastructure, extensive use of genetic testing, and advanced data integration platforms support accurate diagnosis and patient monitoring. Federal support through the FDA’s Orphan Drug Designation program and initiatives by the National Institutes of Health (NIH) are promoting innovation in rare disease therapeutics. Additionally, the presence of leading pharmaceutical and biotech firms investing in gene therapy and regenerative medicine is further strengthening the U.S. market outlook.

Europe Robinow Syndrome Market Insight

The Europe Robinow Syndrome market is projected to expand steadily during the forecast period, driven by the increasing adoption of genetic screening programs, growth in clinical research collaborations, and strong regulatory frameworks supporting orphan drug approvals. Several European nations are investing in genomic medicine and establishing specialized centers for the study of congenital and skeletal disorders. Patient-focused initiatives and partnerships between public health organizations and biotech firms are fostering better disease awareness, earlier diagnosis, and improved access to treatments.

U.K. Robinow Syndrome Market Insight

The U.K. Robinow Syndrome market is anticipated to grow significantly during the forecast period, supported by national genomic initiatives such as Genomics England and rare disease strategy programs. Government funding for genetic research and partnerships with academic institutions are enhancing the country’s capabilities in early diagnosis and clinical management of rare skeletal dysplasias. Moreover, the NHS framework’s integration of precision medicine and genetic counseling is facilitating improved patient outcomes and expanding the potential for targeted therapeutic development.

Germany Robinow Syndrome Market Insight

The Germany Robinow Syndrome market is expected to expand at a substantial CAGR during the forecast period, driven by advanced biomedical research infrastructure and an emphasis on translational genetics. Germany’s strong collaboration between research institutions, hospitals, and biotech companies has enabled the rapid adoption of molecular diagnostics and the identification of genetic variants linked to Robinow Syndrome. Additionally, government initiatives supporting orphan drug research and funding programs for rare diseases are fueling continued market growth.

Asia-Pacific Robinow Syndrome Market Insight

Asia-Pacific is projected to be the fastest-growing region in the Robinow Syndrome market during the forecast period, driven by rising healthcare expenditure, improving genetic testing capabilities, and increasing awareness of rare congenital disorders across emerging economies such as China and India. Governments in the region are investing in healthcare modernization and rare disease policy development, facilitating better diagnosis and patient care. The growing number of collaborations between regional hospitals and international research organizations is promoting knowledge exchange and access to advanced treatment options. Furthermore, the development of local biopharmaceutical manufacturing capabilities is expected to enhance affordability and accessibility of future therapies.

Japan Robinow Syndrome Market Insight

The Japan Robinow Syndrome market is experiencing steady growth, supported by the country’s focus on precision medicine and integration of genetic testing into clinical practice. Government-funded initiatives targeting rare and congenital diseases, combined with academic and industrial research collaborations, are improving diagnosis rates and advancing therapy development. Japan’s advanced healthcare infrastructure and technological innovation make it a leading hub for rare disease research within the Asia-Pacific region.

China Robinow Syndrome Market Insight

The China Robinow Syndrome market accounted for the largest revenue share within the Asia-Pacific region in 2024. Growth is primarily driven by increasing healthcare investments, national genomics programs, and expanding access to genetic diagnostics across both urban and regional healthcare facilities. The Chinese government’s efforts to strengthen rare disease registries, along with partnerships between local biotech firms and global research organizations, are accelerating progress in disease identification and clinical trial activity. Additionally, improvements in healthcare affordability and domestic pharmaceutical R&D capacity are positioning China as a key driver of growth in the regional Robinow Syndrome market.

Robinow Syndrome Market Share

The Robinow Syndrome industry is primarily led by well-established companies, including:

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Genentech, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- AstraZeneca (U.K.)

- Amgen Inc. (U.S.)

- Biomarin Pharmaceutical Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Sanofi S.A. (France)

- Lilly (U.S.)

- GlaxoSmithKline plc (U.K.)

- Vertex Pharmaceuticals Incorporated (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- UCB S.A. (Belgium)

Latest Developments in Global Robinow Syndrome Market

- In April 2021, Archana Rai et al. published a clinical and molecular case series describing four patients from different families and reporting pathogenic variants in ROR2, DVL1 and DVL3, expanding the known mutational spectrum and radiographic phenotype of Robinow syndrome

- In December 2021, Chaofan Zhang and colleagues published a large genotype–phenotype study that reported novel pathogenic variants across RS genes (including the first reported DVL2 variant) and provided quantitative phenotypic clustering showing how WNT-pathway gene variants map to distinct clinical patterns

- In April 2022, focused reports and preprints (ROR2-related analyses) further consolidated ROR2’s role in autosomal-recessive Robinow syndrome and highlighted diagnostic radiographic markers used in clinical practice (ROR2-associated case reports and reviews circulated in 2022)

- In July 2023, a case report and literature review documented a Robinow syndrome patient with a WNT5A variant who responded to growth-hormone therapy, showing meaningful height improvement — an important clinical observation for management of short stature in some RS patients

- In March 2024, experimental work on DVL1 C-terminal variants (preprint) reported differential effects of C-terminal deletions and frameshift variants on craniofacial development and non-canonical WNT signaling, clarifying pathogenic mechanisms behind autosomal-dominant Robinow syndrome

- In November 2024, a bioRxiv preprint (Akarsu et al.) provided mechanistic evidence that specific DVL1 frameshifting variants disrupt morphogenesis in model systems — strengthening the functional link between DVL mutations and the Robinow phenotype and informing future therapeutic-target research

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.