Global Robot Cars And Trucks Market

Market Size in USD Million

CAGR :

%

USD

983.10 Million

USD

2,156.92 Million

2024

2032

USD

983.10 Million

USD

2,156.92 Million

2024

2032

| 2025 –2032 | |

| USD 983.10 Million | |

| USD 2,156.92 Million | |

|

|

|

|

Robot Cars and Trucks Market Size

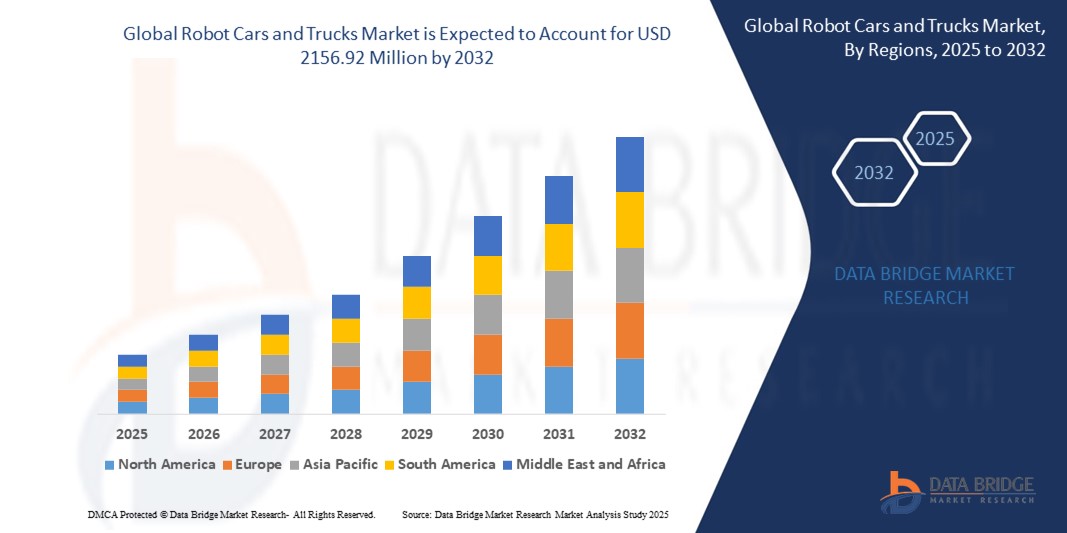

- The global robot cars and trucks market size was valued at USD 983.10 million in 2024 and is expected to reach USD 2156.92 million by 2032, at a CAGR of 10.32% during the forecast period

- The market growth is largely fuelled by the increasing investments in autonomous vehicle technology, rising demand for driverless logistics solutions, and ongoing advancements in artificial intelligence and sensor technologies

- The deployment of robot vehicles is gaining momentum in commercial logistics, last-mile delivery, and ride-hailing services, driving substantial market traction globally

Robot Cars and Trucks Market Analysis

- The growing emphasis on safety, fuel efficiency, and reduced human error is encouraging governments and private players to accelerate research and development of robot cars and trucks

- Major automotive and technology companies are entering strategic partnerships and pilot programs to deploy autonomous fleets across urban and highway settings

- Asia-Pacific dominated the robot cars and trucks market with the largest revenue share of 41.2% in 2024, driven by rapid advancements in automotive technology, growing investments in smart mobility infrastructure, and strong government backing for autonomous vehicle testing and deployment

- North America region is expected to witness the highest growth rate in the global robot cars and trucks market, driven by technological advancements, supportive regulatory frameworks, and expanding deployment of self-driving systems in both industrial and consumer applications

- The passenger vehicles segment accounted for the largest market revenue share of 46.5% in 2024, driven by growing investments in autonomous ride-hailing services and increased consumer interest in self-driving cars. Rising urbanization and congestion in metro cities are accelerating the adoption of robot-enabled mobility solutions for personal use. The integration of advanced driver assistance systems (ADAS) and connectivity features in passenger vehicles is also contributing to their strong market presence

Report Scope and Robot Cars and Trucks Market Segmentation

|

Attributes |

Robot Cars and Trucks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption of Autonomous Logistics in E-Commerce Sector • Expansion of Smart Infrastructure to Support Driverless Vehicle Deployment |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Robot Cars and Trucks Market Trends

“Deployment of Autonomous Vehicles in Last-Mile Delivery Services”

- Companies are increasingly adopting autonomous vehicles for last-mile delivery to reduce operational costs and ensure on-time, contactless deliveries, especially in densely populated areas where human labor costs and delivery delays can significantly impact logistics efficiency

- These vehicles are designed to operate in urban environments, navigating traffic, pedestrians, and various real-time obstacles with minimal human intervention using a combination of sensors and AI-based perception systems

- Logistics providers are utilizing self-driving technology to overcome persistent labor shortages, streamline fleet operations, and enhance consistency in delivery timing during peak e-commerce periods

- Urbanization and the exponential growth of online shopping have intensified the demand for efficient, tech-driven delivery models that can support same-day shipping and personalized logistics services

- For instance, in 2023, Amazon expanded trials of its Scout autonomous delivery robot across several U.S. cities to meet rising last-mile demand, enabling more efficient, low-touch deliveries directly to consumers’ doorsteps

Robot Cars and Trucks Market Dynamics

Driver

“Advancement in Artificial Intelligence and Sensor Technologies”

- AI systems process vast volumes of real-time sensor data, allowing autonomous vehicles to identify traffic patterns, read road signs, and react to dynamic obstacles such as pedestrians or erratic drivers with higher accuracy and speed

- Integration of LiDAR, radar, and advanced camera technologies significantly enhances the safety and reliability of autonomous navigation by enabling a 360-degree view, even in low-light or high-density environments

- Machine learning algorithms are continuously trained using millions of driving scenarios, both real and simulated, which improves predictive decision-making and allows the vehicle to adapt to complex road conditions

- Continuous innovation in sensor miniaturization, energy efficiency, and cost-effectiveness is accelerating the scalable deployment of autonomous systems across commercial and consumer fleets worldwide

- For instance, Waymo’s autonomous vehicles use a combination of high-resolution LiDAR and deep learning to safely operate in complex urban environments, reducing crash risks and optimizing route planning

Restraint/Challenge

“Lack of Regulatory Framework and Public Trust”

- Inconsistent laws and regulatory frameworks across different countries and even states hinder the commercial rollout of autonomous vehicles and create legal uncertainty for manufacturers trying to scale operations globally

- Concerns about liability, insurance coverage, and accident accountability continue to slow down government approvals for mass deployment as policy makers assess long-term safety implications

- Public perception of self-driving technology remains cautious due to fears of software malfunction, hacking, or fatal errors, which negatively affect user confidence and acceptance

- Incidents involving autonomous vehicles have raised ethical concerns related to machine decision-making in life-threatening scenarios and have amplified the need for rigorous safety validations before deployment

- For instance, the 2018 fatal crash involving an Uber self-driving car in Arizona significantly affected public trust and prompted tighter regulatory scrutiny, including paused test programs and revised safety protocols across the U.S.

Robot Cars and Trucks Market Scope

The market is segmented on the basis of vehicle type, classification, technology, and application.

- By Vehicle Type

On the basis of vehicle type, the robot cars and trucks market is segmented into heavy commercial vehicles, light commercial vehicles, and passenger vehicles. The passenger vehicles segment accounted for the largest market revenue share of 46.5% in 2024, driven by growing investments in autonomous ride-hailing services and increased consumer interest in self-driving cars. Rising urbanization and congestion in metro cities are accelerating the adoption of robot-enabled mobility solutions for personal use. The integration of advanced driver assistance systems (ADAS) and connectivity features in passenger vehicles is also contributing to their strong market presence.

The heavy commercial vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for autonomous freight transport and logistics optimization. These vehicles offer higher efficiency, longer operating hours, and reduced human error in long-haul trucking. The sector is also benefiting from pilot programs by logistics firms seeking to automate supply chain operations.

- By Classification

On the basis of classification, the market is segmented into Level 0, Level 1, Level 2, Level 3, Level 4, and Level 5. The Level 2 segment held the largest market share in 2024 due to its widespread implementation in vehicles equipped with partial automation, such as adaptive cruise control and lane-keeping assist. These features offer immediate benefits while complying with existing regulatory norms, making them highly scalable across vehicle types.

Level 4 is expected to witness the fastest growth rate from 2025 to 2032, propelled by advancements in autonomous software, safety validation, and urban testing. Vehicles at this level can operate without human input under specific conditions, making them ideal for commercial deployment in ride-hailing and delivery services.

- By Technology

On the basis of technology, the market is segmented into simultaneous localization and mapping (SLAM) and real-time locating systems (RTLS). The SLAM segment dominated the market in 2024, owing to its critical role in enabling vehicles to map environments while navigating unknown areas. SLAM technology is essential for robots to localize themselves and plan efficient routes, particularly in dynamic urban settings.

The real-time locating systems segment is expected to witness the fastest growth rate from 2025 to 2032, due to its utility in controlled environments such as industrial yards and logistics hubs. RTLS offers accurate positioning data, enabling seamless tracking and coordination of autonomous fleets within defined operational zones.

- By Application

On the basis of application, the robot cars and trucks market is segmented into domestic, commercial, and industrial. The commercial segment led the market in 2024, supported by the growing use of autonomous vehicles in logistics, public transport, and last-mile delivery operations. Businesses are increasingly turning to self-driving technology to cut down labor costs and enhance delivery speed.

The industrial segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the deployment of robot trucks in sectors such as mining, agriculture, and construction. These environments benefit significantly from automation due to safety, productivity, and operational efficiency gains, making them prime candidates for autonomous technology integration.

Robot Cars and Trucks Market Regional Analysis

• Asia-Pacific dominated the robot cars and trucks market with the largest revenue share of 41.2% in 2024, driven by rapid advancements in automotive technology, growing investments in smart mobility infrastructure, and strong government backing for autonomous vehicle testing and deployment

• Countries in the region are adopting self-driving technologies to address challenges such as traffic congestion, labor shortages in logistics, and urban pollution

• The rising demand for autonomous delivery and transport solutions across commercial and industrial sectors, combined with a growing population of tech-savvy consumers, is reinforcing Asia-Pacific’s leadership in the global robot cars and trucks market

China Robot Cars and Trucks Market Insight

The China robot cars and trucks market accounted for the largest revenue share in Asia-Pacific in 2024, driven by large-scale smart city development projects, increasing automation in logistics, and strong investments by both government and private sectors. Chinese companies are rapidly deploying autonomous delivery vehicles in urban areas and expanding trials of robot taxis and self-driving trucks. Favorable regulatory initiatives and a strong presence of technology giants such as Baidu and Pony.ai are accelerating the commercialization of autonomous transport across residential and industrial zones.

Japan Robot Cars and Trucks Market Insight

The Japan robot cars and trucks market is expected to witness the fastest growth rate from 2025 to 2032, owing to the country’s strong focus on robotics, safety technology, and automotive innovation. Japan is actively testing Level 4 autonomous vehicles in designated zones and aims to deploy self-driving buses in rural areas to address labor shortages. The aging population and increasing demand for accessible transportation are further driving adoption. Collaboration between automotive manufacturers, telecom providers, and municipalities is helping Japan establish a leading position in autonomous mobility.

North America Robot Cars and Trucks Market Insight

The North America robot cars and trucks market is expected to witness the fastest growth rate from 2025 to 2032, supported by widespread adoption of self-driving technologies and early regulatory frameworks that facilitate real-world testing. Companies in the U.S. and Canada are increasingly deploying autonomous trucks for logistics and investing in last-mile delivery automation. The region’s strong technological infrastructure and concentration of startups and leading firms in artificial intelligence are creating favorable conditions for autonomous vehicle growth across commercial and industrial applications.

U.S. Robot Cars and Trucks Market Insight

The U.S. robot cars and trucks market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by rapid innovation in AI, increasing trials of driverless vehicles, and rising demand for automated freight and delivery systems. Tech companies and automotive giants are leading partnerships to pilot robotaxi services and autonomous trucks in states such as California, Texas, and Arizona. Consumer acceptance of autonomous mobility solutions and flexible regulatory policies are further advancing market expansion in both urban and rural areas.

Europe Robot Cars and Trucks Market Insight

The Europe robot cars and trucks market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong automotive engineering capabilities, rising demand for emission-reducing transport options, and stringent safety regulations encouraging automation. Autonomous technology is being adopted across logistics, ride-hailing, and shared mobility services. Governments across the region are facilitating testing zones and offering funding for pilot programs, especially in Germany, France, and the Netherlands. The shift toward smart transportation systems in urban hubs is also accelerating deployment of robot vehicles.

Germany Robot Cars and Trucks Market Insight

The Germany robot cars and trucks market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s leadership in the automotive industry and its strategic focus on intelligent transportation systems. Major German automakers are investing in autonomous driving features for passenger and commercial vehicles. Government support for on-road trials and smart infrastructure development is fostering an innovation-friendly environment. Germany’s well-established logistics sector is also adopting robot trucks to improve efficiency and safety in freight transport, enhancing the country's role in the European autonomous vehicle landscape.

U.K. Robot Cars and Trucks Market Insight

The U.K. robot cars and trucks market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong government initiatives, investments in connected vehicle infrastructure, and active public-private partnerships in autonomous vehicle trials. The country is home to various pilot programs focusing on robotaxis, self-driving shuttles, and autonomous delivery vehicles in urban environments. Supportive regulatory frameworks, such as the Automated Vehicles Bill, are creating a conducive environment for testing and commercial rollout. The U.K.’s emphasis on safety, innovation, and reducing urban congestion is expected to further accelerate the adoption of robot cars and trucks across both domestic and commercial applications.

Robot Cars and Trucks Market Share

The Robot Cars and Trucks industry is primarily led by well-established companies, including:

- Bayerische Motoren Werke AG (Germany)

- Ford Motor Company (U.S.)

- TOYOTA MOTOR CORPORATION. (Japan)

- General Motors (U.S.)

- Mercedes-Benz (Germany)

- Tesla (U.S.)

- Volkswagen (Germany)

- IBM (U.S.)

- Kairos Autonomi (U.S.)

- AUDI AG. (Germany)

- Continental AG (Germany)

- DENSO CORPORATION. (Japan)

- Aptiv. (Ireland)

- Waymo LLC (U.S.)

- PACCAR Inc. (U.S.)

- NVIDIA Corporation (U.S.)

- ZF Friedrichshafen AG (Germany)

- AB Volvo (Sweden)

- Robert Bosch GmbH (Germany)

- Fuji Electric Co., Ltd. (Japan)

- Google (U.S.)

- Nissan Motor Co., Ltd. (Japan)

- KONGSBERG (Norway)

- FCA US LLC. (U.S.)

- Porsche India (Germany)

Latest Developments in Global Robot Cars and Trucks Market

- In May 2024, Volvo Autonomous Solutions introduced its first production-ready autonomous truck, showcasing it at the ACT Expo in Las Vegas. The VNS Autonomous Truck combines Volvo’s expertise in commercial vehicles with autonomous driving technology developed by Aurora Innovation Inc

- In December 2023, Kodiak Robotics, Inc., a prominent developer of self-driving technology for the trucking and defense sectors, unveiled its first autonomous test vehicle tailored for the U.S. Department of Defense (DoD). This vehicle, a Ford F-150 modified with Kodiak's autonomous system known as the Kodiak Driver, features both the necessary hardware and software for operating as a military ground vehicle

- In December 2023, ABB announced an expansion of its long-standing partnership with Volvo Cars, committing to supply over 1,300 robots and functional packages for the production of the next generation of electric vehicles. This initiative aims to support Volvo’s ambitious sustainability goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.