Global Robotic Assisted Orthopedic Systems Market

Market Size in USD Billion

CAGR :

%

USD

1.49 Billion

USD

4.33 Billion

2024

2032

USD

1.49 Billion

USD

4.33 Billion

2024

2032

| 2025 –2032 | |

| USD 1.49 Billion | |

| USD 4.33 Billion | |

|

|

|

|

Robotic-Assisted Orthopedic Systems Market Size

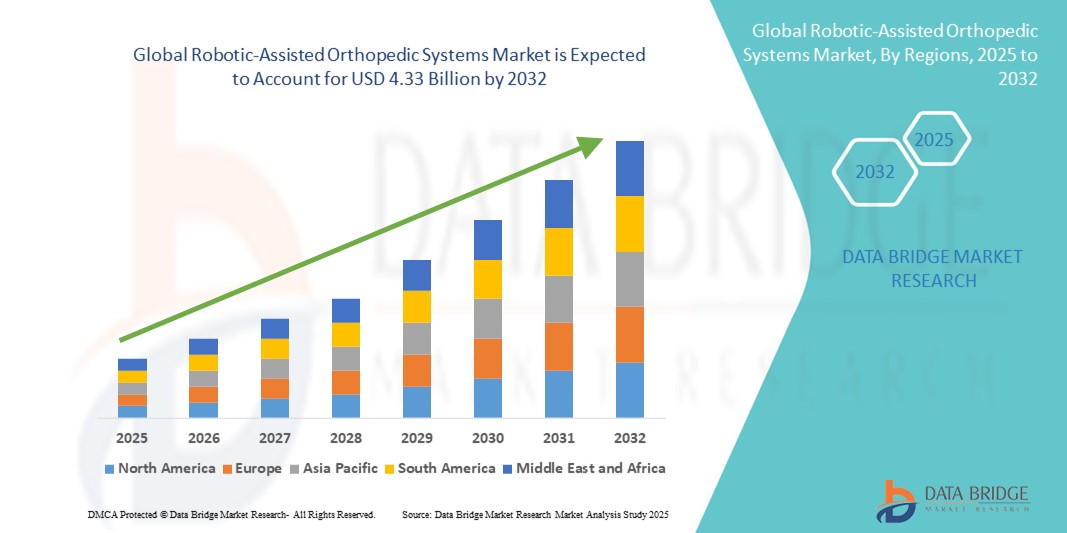

- The global robotic-assisted orthopedic systems market size was valued at USD 1.49 billion in 2024 and is expected to reach USD 4.33 billion by 2032, at a CAGR of 14.30 % during the forecast period

- The market growth is largely driven by increasing technological advancements and innovation in robotic systems designed for orthopedic surgeries, which enhance precision, reduce recovery times, and improve surgical outcomes

- In addition, rising adoption of minimally invasive procedures, growing prevalence of orthopedic disorders, and an aging global population are fueling the demand for robotic-assisted orthopedic systems. These factors collectively are propelling the expansion of the market, as healthcare providers seek to improve patient care with advanced surgical technologies

Robotic-Assisted Orthopedic Systems Market Analysis

- Robotic-Assisted Orthopedic Systems are increasingly becoming essential in modern orthopedic surgeries due to their ability to enhance surgical precision, reduce recovery time, and improve overall patient outcomes across both hospital and outpatient surgical centers

- The rising prevalence of orthopedic disorders, growing geriatric population, and increasing adoption of minimally invasive surgical techniques are primary factors fueling the demand for robotic-assisted orthopedic solutions globally

- North America dominated the robotic-assisted orthopedic systems market with the largest revenue share of approximately 38.5% in 2024, driven by advanced healthcare infrastructure, significant investments in medical robotics, and the presence of key market players investing heavily in research and development. The U.S. continues to lead in system installations due to favorable reimbursement policies and rising awareness among orthopedic surgeons

- Asia-Pacific is projected to be the fastest-growing region in the robotic-assisted orthopedic systems market during the forecast period, with a CAGR of around 12%, supported by increasing healthcare expenditure, rapid urbanization, expanding medical infrastructure, and growing adoption of advanced surgical technologies in countries such as China, Japan, and India

- Semi-Autonomous Operation segment dominated the robotic-assisted orthopedic systems market with a revenue share 55% in 2024, supported by its balance between surgeon control and robotic precision. These systems provide real-time haptic feedback, automated tool guidance, and motion restriction features while allowing the surgeon to make critical adjustments during surgery

Report Scope and Robotic-Assisted Orthopedic Systems Market Segmentation

|

Attributes |

Robotic-Assisted Orthopedic Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Robotic-Assisted Orthopedic Systems Market Trends

Advancements in Precision and Automation Enhancing Surgical Outcomes

- A major and rapidly growing trend in the global robotic-assisted orthopedic systems market is the increased focus on precision and automation capabilities that significantly improve surgical accuracy and patient outcomes. Enhanced robotic arms combined with real-time imaging and navigation systems allow surgeons to perform minimally invasive procedures with greater control and consistency

- For instance, the MAKO robotic system integrates 3D pre-operative planning with intra-operative robotic arm assistance to ensure precise bone preparation during joint replacement surgeries. Similarly, Stryker’s robotic platform leverages haptic feedback and advanced mapping to reduce surgical variability and improve implant positioning

- Automation features such as automated cutting guides, real-time error detection, and adaptive instrument control are increasingly common, reducing surgical time and minimizing complications. These capabilities also allow for personalized surgical plans tailored to patient-specific anatomy, enhancing recovery and long-term function

- Integration with advanced software solutions enables surgeons to simulate procedures preoperatively, optimize implant alignment, and collect data for post-operative evaluation. These tools contribute to continuous improvement in clinical outcomes and support evidence-based practice in orthopedic surgery

- Companies such as Zimmer Biomet and Johnson & Johnson are investing heavily in R&D to enhance AI-driven analytics and robotic autonomy, enabling future generations of systems to perform more complex tasks with limited human intervention

- The growing demand for minimally invasive and outpatient orthopedic surgeries, coupled with increasing adoption of robotic assistance in trauma, sports medicine, and spinal procedures, is fueling market expansion across hospitals, specialty clinics, and ambulatory surgical centers globally

Robotic-Assisted Orthopedic Systems Market Dynamics

Driver

Growing Need Due to Rising Orthopedic Disorders and Technological Advancements

- The increasing prevalence of orthopedic conditions such as osteoarthritis, rheumatoid arthritis, and traumatic injuries, along with an aging global population, is driving the growing demand for advanced orthopedic surgical solutions like robotic-assisted systems. These systems provide enhanced surgical precision, improved implant alignment, and better patient outcomes, making them highly desirable in modern healthcare settings

- For instance, in March 2024, Stryker Corporation announced the launch of an upgraded version of its Mako robotic-arm assisted surgery system, featuring improved software capabilities and greater integration with hospital information systems. Such innovations by leading companies are expected to significantly boost the Robotic-Assisted Orthopedic Systems market during the forecast period

- As healthcare providers increasingly prioritize minimally invasive procedures to reduce patient recovery time and complications, robotic-assisted systems offer surgeons real-time feedback, enhanced visualization, and precise control, establishing themselves as critical tools in orthopedic surgery

- Furthermore, growing investments in healthcare infrastructure, rising healthcare expenditure, and the increasing adoption of digital health technologies across developed and developing regions are facilitating the integration of robotic-assisted orthopedic systems in hospitals and specialized surgical centers worldwide

- The benefits of robotic assistance, including reduced surgical errors, faster rehabilitation, and personalized surgical planning, are encouraging both healthcare professionals and patients to adopt these systems more readily. The expanding pool of trained surgeons proficient in robotic-assisted techniques also supports market growth

Restraint/Challenge

Concerns Regarding High Initial Investment and Regulatory Hurdles

- Despite the clear advantages, the high upfront cost of robotic-assisted orthopedic systems remains a significant challenge, especially for smaller hospitals and healthcare facilities in developing regions. The acquisition, installation, and maintenance expenses can be substantial, potentially limiting the adoption rate in price-sensitive markets

- For instance, the cost of a single robotic surgical system can reach several million dollars, which may be prohibitive for budget-constrained institutions seeking cost-effective orthopedic treatment options

- In addition, stringent regulatory requirements and the need for extensive clinical validation and training can delay the introduction of new robotic systems into the market. Compliance with medical device regulations and obtaining necessary approvals from agencies such as the FDA or CE can be time-consuming and costly

- Addressing these challenges through cost reduction strategies, leasing options, and collaborations between manufacturers and healthcare providers will be essential. Companies are also focusing on developing more compact, modular, and user-friendly robotic systems to reduce barriers to adoption

- Enhancing surgeon training programs and demonstrating clear clinical and economic benefits will be critical to overcoming resistance and ensuring wider acceptance of robotic-assisted orthopedic technologies globally

Robotic-Assisted Orthopedic Systems Market Scope

The market is segmented on the basis of system type, connectivity protocol, operation mode, surgical application and end user facility.

- By System Type

On the basis of system type, the robotic-assisted orthopedic systems market is segmented into robotic surgical systems, navigation and imaging systems, robotic arms, software and services, and others. Robotic Surgical Systems segment dominated the largest market revenue share in 2024, accounting for 42% of the total market, driven by the growing adoption of advanced robotic platforms capable of enhancing surgical precision and reducing procedural variability. These systems are increasingly used for total joint replacements and complex spinal procedures due to their ability to integrate pre-operative planning with real-time surgical execution.

Software and Services segment is projected to witness the fastest CAGR of 14% from 2025 to 2032, fueled by the rising demand for AI-powered analytics, surgical simulation tools, and ongoing technical support. As hospitals and surgical centers focus on optimizing robotic workflows and leveraging data-driven insights, software-enabled service offerings are becoming critical for maximizing system efficiency and patient outcomes.

- By Connectivity Protocol

On the basis of connectivity protocol, the Robotic-assisted orthopedic systems market is segmented into wired connection, wireless (Wi-Fi, Bluetooth), proprietary communication, and others. Wired Connection segment held the largest market revenue share in 2024, representing 48%, owing to its reliability in delivering uninterrupted, high-speed data transfer between robotic components, imaging systems, and surgical consoles. In high-stakes orthopedic procedures, wired connections are preferred for minimizing latency and ensuring real-time responsiveness.

Wireless (Wi-Fi, Bluetooth) segment is expected to witness the fastest CAGR of 15% from 2025 to 2032, driven by increasing adoption of portable and modular robotic systems. Wireless connectivity offers flexibility in operating room layouts, supports remote system diagnostics, and allows integration with hospital-wide data networks without extensive cabling infrastructure.

- By Operation Mode

On the basis of operation mode, the robotic-assisted orthopedic systems market is segmented into manual assistance, semi-autonomous operation, and fully autonomous operation. Semi-Autonomous operation segment accounted for the largest market revenue share in 2024, estimated at 55%, supported by its balance between surgeon control and robotic precision. These systems provide real-time haptic feedback, automated tool guidance, and motion restriction features while allowing the surgeon to make critical adjustments during surgery.

Fully autonomous operation segment is projected to record the fastest CAGR of 18% from 2025 to 2032, as advances in AI, computer vision, and machine learning push the boundaries of robotic independence in orthopedic surgery. Although still in early adoption stages, fully autonomous systems are being trialed for specific repetitive tasks such as bone milling and screw placement, showing potential to reduce human error and surgical time.

- By Surgical Application

On the basis of surgical application, the robotic-assisted orthopedic systems market is segmented into total joint replacement, spinal surgery, trauma and fracture fixation, sports medicine procedures, and others. Total joint replacement segment dominated the market in 2024, accounting for 44% share, driven by the rising incidence of osteoarthritis and the growing preference for minimally invasive techniques that shorten recovery times. Robotic systems enhance implant positioning accuracy, improve joint function, and reduce revision surgery rates.

Spinal surgery segment is anticipated to grow at the fastest CAGR of 15% from 2025 to 2032, as navigation-integrated robotic platforms become increasingly vital for delicate spinal procedures. These systems assist in precise screw placement, vertebral alignment, and minimizing damage to surrounding tissues.

- By End User Facility

On the basis of end user facility, the Robotic-assisted orthopedic systems market is segmented into hospitals, ambulatory surgical centers (ASCs), specialty orthopedic clinics, academic and research institutions, and others. Hospitals segment held the largest market revenue share in 2024 at 62%, owing to their capability to invest in high-cost robotic systems and provide a wide range of orthopedic procedures under one roof. Integration of robotics in large hospital networks is also driven by the push for better patient outcomes and operational efficiency.

Ambulatory Surgical Centers (ASCs) segment is expected to witness the fastest CAGR of 14% from 2025 to 2032, as robotic-assisted minimally invasive orthopedic procedures become more common in outpatient settings. ASCs benefit from quicker patient turnover, reduced hospital stay requirements, and the appeal of same-day surgeries for patients.

Robotic-Assisted Orthopedic Systems Market Regional Analysis

- North America dominated the robotic-assisted orthopedic systems market with the largest revenue share of 38.5% in 2024, driven by the rapid adoption of advanced surgical technologies, strong presence of established medical device manufacturers, and highly developed healthcare infrastructure

- The region benefits from well-trained orthopedic surgeons, supportive reimbursement frameworks, and a high patient awareness of innovative treatment options

- The growing preference for minimally invasive surgeries, coupled with increasing investments in robotic platforms by hospitals and surgical centers, has cemented North America’s leadership position in the market

U.S. Robotic-Assisted Orthopedic Systems Market Insight

The U.S. robotic-assisted orthopedic systems market captured the largest revenue share of 63% in 2024 within North America, supported by a combination of cutting-edge innovation, favorable government healthcare policies, and significant investment in hospital modernization. The country is witnessing an accelerated shift toward robotic-assisted joint replacement surgeries—particularly knee and hip procedures—owing to their improved precision and faster recovery times. The integration of artificial intelligence, real-time imaging, and advanced surgical planning software in these systems is further enhancing procedural outcomes. The presence of industry leaders such as Stryker, Zimmer Biomet, and Medtronic has resulted in continuous technological upgrades and widespread adoption across both large healthcare networks and independent surgical facilities.

Europe Robotic-Assisted Orthopedic Systems Market Insight

The Europe robotic-assisted orthopedic systems market is projected to grow at a substantial CAGR during the forecast period, fueled by the continent’s aging population, rising incidence of musculoskeletal disorders, and an increasing preference for advanced surgical solutions. Many European countries are actively upgrading their healthcare facilities, integrating robotic-assisted platforms to improve surgical precision and patient safety. Public healthcare funding in countries like Germany, France, and the U.K. is supporting large-scale deployments of robotic systems in orthopedic departments. Moreover, collaborations between technology developers and medical universities are fostering innovation and accelerating clinical adoption.

U.K. Robotic-Assisted Orthopedic Systems Market Insight

The U.K. robotic-assisted orthopedic systems market is anticipated to grow at a noteworthy CAGR over the forecast period, underpinned by rising demand for knee and hip arthroplasty procedures and an increasing emphasis on reducing revision surgeries. Hospitals are adopting robotic-assisted technology to improve implant placement accuracy, enhance patient satisfaction, and lower post-operative complications. Government initiatives to modernize healthcare infrastructure, coupled with continuous investment in surgeon training programs, are boosting adoption across both public and private healthcare sectors.

Germany Robotic-Assisted Orthopedic Systems Market Insight

The Germany robotic-assisted orthopedic systems market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s strong focus on precision engineering, high-quality healthcare delivery, and sustainability in medical technology. German hospitals are integrating robotic-assisted surgical platforms into orthopedic departments to streamline workflow efficiency and improve patient outcomes. The country’s robust R&D ecosystem, combined with collaborations between medical device manufacturers and healthcare institutions, is fostering the development of next-generation orthopedic robotics tailored to local market needs.

Asia-Pacific Robotic-Assisted Orthopedic Systems Market Insight

The Asia-Pacific robotic-assisted orthopedic systems market is projected to grow at the fastest CAGR of 12% from 2025 to 2032, propelled by rising healthcare investments, rapid urbanization, and an increasing number of orthopedic surgeries in populous nations such as China, Japan, and India. Growing awareness of the benefits of robotic-assisted surgery—including reduced recovery time, smaller incisions, and lower risk of complications—is prompting hospitals to adopt these systems at an accelerated pace. Government-backed initiatives promoting healthcare modernization, coupled with cost-effective manufacturing capabilities in the region, are further enhancing accessibility for a broader patient population.

Japan Robotic-Assisted Orthopedic Systems Market Insight

The Japan robotic-assisted orthopedic systems market is gaining momentum due to its advanced technological environment, high hospital adoption of minimally invasive surgery techniques, and the nation’s focus on elderly patient care. Robotic systems are being increasingly used for complex orthopedic procedures, particularly in joint replacement surgeries, to improve alignment accuracy and patient mobility. Continuous innovation, such as integrating robotics with augmented reality and AI-driven surgical planning, is expected to further strengthen Japan’s position as a leader in advanced orthopedic care in the Asia-Pacific region.

China Robotic-Assisted Orthopedic Systems Market Insight

The China robotic-assisted orthopedic systems market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid expansion of healthcare infrastructure, a growing middle-class population seeking high-quality medical treatments, and strong government support for domestic medical technology innovation. China has emerged as one of the most dynamic markets for robotic-assisted surgery due to its large patient base, rising incidence of bone and joint disorders, and fast-paced hospital upgrades. Domestic manufacturers are increasingly competing with global brands by offering cost-effective systems, thereby increasing adoption across both metropolitan and regional healthcare facilities.

Robotic-Assisted Orthopedic Systems Market Share

The robotic-assisted orthopedic systems industry is primarily led by well-established companies, including:

- Stryker (U.S.)

- Zimmer Biomet (U.S.)

- Medtronic (Ireland)

- Johnson & Johnson and its affiliates (U.S.)

- Smith + Nephew (U.K.)

- Globus Medical, Inc. (U.S.)

- Brainlab AG (Germany)

- Intuitive Surgical, Inc. (U.S.)

- Exactech, Inc. (U.S.)

- Corin Group (U.K.)

- THINK Surgical, Inc. (U.S.)

- OrthoAlign, Inc. (U.S.)

- B. Braun SE (Germany)

- Renishaw plc (U.K.)

Latest Developments in Global Robotic-Assisted Orthopedic Systems Market

- In November 2024, Johnson & Johnson MedTech received FDA approval for the investigational device exemption (IDE) of its OTTAVA robotic surgical system, enabling the start of clinical trials at U.S. sites, marking a significant step in advancing robotic-assisted orthopedic technology

- In March 2025, at the AAOS 2025 conference, Globus Medical introduced the ExcelsiusFlex surgical robotic navigation system for total knee arthroplasty, Pixee Medical launched its personalized TKA solution Knee NexSight, and ModMed showcased AI-driven orthopedic care tools, underscoring rapid advancements in the market

- In March 2025, Johnson & Johnson unveiled its VELYS robotic-assisted solution at AAOS 2025, a CT-free digital system now FDA-cleared for unicompartmental knee arthroplasty, integrating with the ATTUNE Knee System to enhance surgical workflow and reduce revision risk by 33%

- In Q1 2025, THINK Surgical announced that its TMINI Miniature Robotic System has been used in over 500 total knee arthroplasty procedures in the U.S., highlighting growing adoption of compact, high-precision robotic solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.