Global Robotic Endoscopy Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.49 Billion

USD

7.46 Billion

2024

2032

USD

2.49 Billion

USD

7.46 Billion

2024

2032

| 2025 –2032 | |

| USD 2.49 Billion | |

| USD 7.46 Billion | |

|

|

|

|

Robotic Endoscopy Devices Market Size

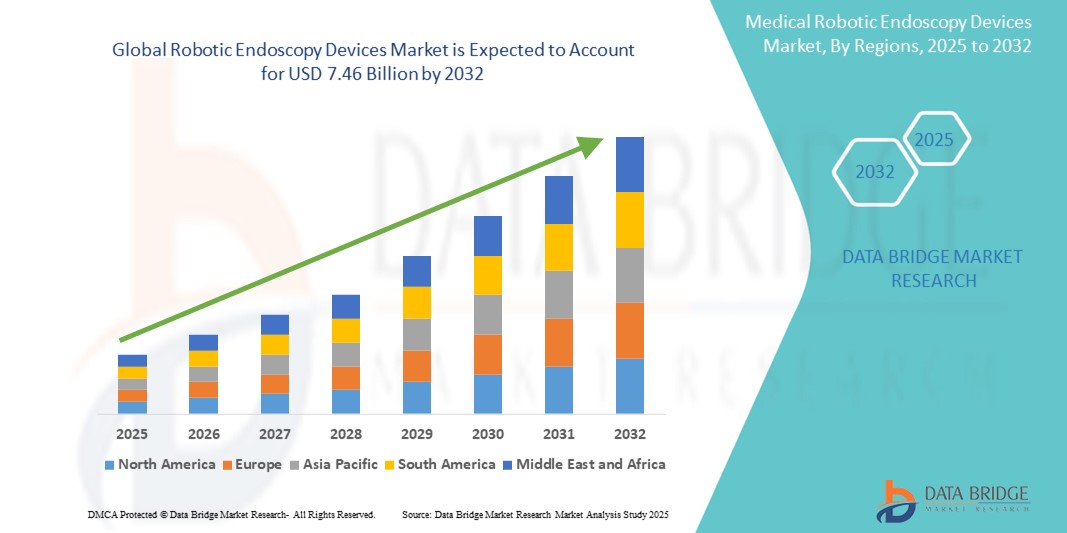

- The global robotic endoscopy devices market size was valued at USD 2.49 billion in 2024 and is expected to reach USD 7.46 billion by 2032, at a CAGR of 14.65% during the forecast period

- The market growth is largely fueled by the increasing demand for minimally invasive surgical procedures and the integration of robotics and AI for enhanced precision and outcomes in endoscopic interventions

- Furthermore, rising investments in healthcare automation and the push for improved patient recovery times are positioning robotic endoscopy systems as an essential advancement in surgical technology. These converging factors are accelerating the adoption of robotic endoscopy solutions, thereby significantly boosting the industry's growth

Robotic Endoscopy Devices Market Analysis

- Robotic endoscopy devices, designed to enhance visualization, precision, and control during minimally invasive procedures, are becoming essential in modern surgical suites across gastroenterology, urology, and general surgery due to their improved dexterity, 3D imaging, and reduced surgeon fatigue

- The growing demand for robotic endoscopy systems is primarily fueled by increasing incidences of chronic diseases requiring diagnostic and therapeutic endoscopy, surgeon preference for precision-based systems, and ongoing advancements in robotic-assisted technologies

- North America dominated the robotic endoscopy devices market with the largest revenue share of 42.2% in 2024, driven by the presence of leading medical robotics firms, favorable reimbursement frameworks, and rapid adoption of advanced surgical technologies, particularly in the U.S., where hospitals are increasingly investing in next-generation robotic platforms to enhance surgical outcomes

- Asia-Pacific is expected to be the fastest growing region in the robotic endoscopy devices market during the forecast period due to growing healthcare investments, rising awareness of robotic-assisted surgeries, and increasing procedural volumes

- High Definition (HD) segment dominated the robotic endoscopy devices market with a market share of 63.9% in 2024, driven by its superior image clarity and enhanced precision in minimally invasive procedures, enabling better diagnostic and surgical outcomes

Report Scope and Robotic Endoscopy Devices Market Segmentation

|

Attributes |

Robotic Endoscopy Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Robotic Endoscopy Devices Market Trends

“Technological Advancements in Robotics and Imaging Precision”

- A significant and growing trend in the global robotic endoscopy devices market is the integration of advanced robotics with high-definition imaging, AI, and machine learning algorithms to improve procedural accuracy, visualization, and outcomes in minimally invasive surgeries. These innovations are revolutionizing diagnostic and therapeutic endoscopy

- For instance, Medtronic’s GI Genius module uses AI to enhance colorectal polyp detection during colonoscopy, providing real-time image analysis. Similarly, Intuitive Surgical continues to evolve its da Vinci platform with improved robotic-assisted endoscopic capabilities for precise tissue dissection and suturing

- AI-assisted systems can now analyze live video feeds to assist in real-time decision-making, flag abnormalities, and suggest optimal navigation paths, helping clinicians perform more efficient procedures with enhanced safety. These developments are particularly impactful in complex applications such as bronchoscopy and laparoscopy

- The use of robotics also reduces human error and operator fatigue during prolonged or technically demanding procedures, allowing for enhanced consistency and repeatability in outcomes

- The seamless integration of robotic endoscopy platforms with hospital information systems, imaging archives, and remote consultation tools is facilitating more connected, data-driven surgical environments. This supports a shift toward personalized and precision medicine by combining robotics with patient-specific insights

- This trend toward intelligent, AI-powered robotic systems is transforming clinical workflows and setting new standards in endoscopic diagnostics and interventions. As a result, companies such as EndoMaster and Medrobotics are increasingly focusing on flexible, autonomous robotic platforms tailored for specialized endoscopic applications.

Robotic Endoscopy Devices Market Dynamics

Driver

“Rising Demand for Minimally Invasive Procedures and Precision Surgery”

- The increasing global demand for minimally invasive surgeries, driven by the need for faster recovery times, reduced hospital stays, and fewer complications, is a major driver of growth in the robotic endoscopy devices market

- For instance, in January 2024, Intuitive Surgical introduced an upgraded endoscopic robotic system with advanced force feedback and image stabilization capabilities aimed at enhancing surgeon performance and patient safety

- As patient awareness grows and healthcare providers seek solutions that improve efficiency and clinical outcomes, robotic endoscopy systems are becoming integral tools for precision-based diagnostics and treatment

- The ability of robotic systems to enable finer movements, greater stability, and enhanced visualization is especially beneficial in procedures such as colorectal surgery, lung biopsies, and gynecological endoscopy

- Moreover, growing investments in healthcare infrastructure and the increasing availability of robotic systems in hospitals and specialty clinics worldwide are facilitating their broader adoption

- The combination of advanced robotics, data integration, and ergonomic design is driving the transition toward next-generation surgical practices

Restraint/Challenge

“High Cost and Technical Complexity of Robotic Systems”

- The high initial cost of robotic endoscopy systems and ongoing maintenance expenses pose a significant barrier to adoption, particularly in low- and middle-income countries and smaller healthcare facilities with limited capital budgets

- For instance, the procurement and operational costs of systems such as the da Vinci Surgical System or the Flex Robotic System can be prohibitive without substantial institutional investment or favorable reimbursement policies

- In addition, the steep learning curve and need for specialized training to operate robotic platforms can hinder widespread clinical adoption, especially among surgeons unfamiliar with robotics

- Interoperability issues and the lack of standardized protocols for integrating robotic endoscopy systems into existing healthcare IT infrastructure also present challenges

- While robotic platforms offer significant long-term benefits, the up-front investment and resource requirements can delay implementation, particularly in emerging markets

- Overcoming these hurdles through cost-effective innovations, scalable training programs, and improved system interoperability will be crucial to expanding the global footprint of robotic endoscopy devices

Robotic Endoscopy Devices Market Scope

The market is segmented on the basis of type, product, application, end users, technology, and indication.

- By Type

On the basis of type, the robotic endoscopy devices market is segmented into Standard Definition (SD) Visualization Systems, High Definition (HD) Visualization Systems, and Others. The High Definition (HD) visualization systems segment dominated the market with the largest revenue share of 63.9% in 2024, driven by its superior image clarity, which enables surgeons to detect abnormalities with higher accuracy and perform more precise interventions. HD systems are becoming the standard in advanced healthcare facilities due to their critical role in enhancing outcomes for complex endoscopic procedures.

The standard definition (SD) visualization systems segment, is expected to witness fastest growth during forecast period, due to its lower cost and sufficient performance for routine procedures.

- By Product

On the basis of product, the robotic endoscopy devices market is segmented into therapeutic and diagnostic robotic endoscopy devices. The Therapeutic segment dominated the market with a revenue share of 57.9% in 2024, attributed to the growing use of robotic platforms in interventional procedures such as tumor resection, polyp removal, and stent placement. The precision, stability, and minimally invasive nature of these systems make them highly effective in complex surgeries.

The diagnostic segment is projected to grow steadily during forecast period, due to the increasing demand for early detection of gastrointestinal and pulmonary disorders using robotic-assisted techniques that provide enhanced visibility and control.

- By Application

On the basis of application, the robotic endoscopy devices market is segmented into colonoscopy, bronchoscopy, laparoscopy, and others. Colonoscopy led the application segment with a market share of 35.2% in 2024, driven by the rising prevalence of colorectal cancer and the adoption of robotic platforms for precise polyp detection and removal. Robotic colonoscopy offers improved navigation, real-time visualization, and lower discomfort, encouraging its use in both diagnostics and treatment.

Bronchoscopy is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by rising incidences of lung disorders and the growing use of robotic-assisted navigation for biopsies in hard-to-reach areas of the lungs.

- By End Users

On the basis of end users, the robotic endoscopy devices market is segmented into hospitals, ambulatory surgical centers, and others. Hospitals held the largest market revenue share of 68.1% in 2024, supported by higher surgical volumes, availability of advanced infrastructure, and the ability to invest in high-cost robotic systems. Hospitals also serve as training hubs, fostering widespread adoption of robotic platforms.

Ambulatory surgical centers are projected to grow at the fastest rate during forecast period, driven by the shift towards outpatient procedures and demand for cost-effective, efficient treatment settings that still leverage robotic precision.

- By Technology

On the basis of technology, the robotic endoscopy devices market is segmented into Immunoassay, Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Flow Cytometry, and Other technologies. Polymerase Chain Reaction (PCR) dominated the market with a share of 32.7% in 2024, owing to its widespread use in real-time molecular diagnostics during robotic-guided procedures, particularly for cancer detection and staging.

NGS is expected to experience the fastest growth rate during forecast period, due to its capability to provide comprehensive genomic insights during endoscopic tumor profiling, enhancing the precision of robotic-assisted cancer treatments

- By Indication

On the basis of indication, the robotic endoscopy devices market is segmented into lung cancer, colorectal cancer, melanoma, and other cancers. Colorectal cancer was the dominant indication in 2024, accounting for 38.9% of the market share. This is largely due to the global emphasis on early screening and treatment, with robotic colonoscopy offering significant improvements in detection rates and surgical outcomes.

Lung cancer is projected to witness notable growth during forecast period, driven by the increasing adoption of robotic bronchoscopy platforms for early biopsy and localization of lung nodules.

Robotic Endoscopy Devices Market Regional Analysis

- North America dominated the robotic endoscopy devices market with the largest revenue share of 42.2% in 2024, driven by the presence of leading medical robotics firms, favorable reimbursement frameworks, and rapid adoption of advanced surgical technologies, particularly in the U.S., where hospitals are increasingly investing in next-generation robotic platforms to enhance surgical outcomes

- Healthcare providers in the region increasingly prefer robotic endoscopy systems due to their enhanced precision, shorter patient recovery times, and integration with digital health platforms for better clinical outcomes

- This widespread adoption is further supported by favorable reimbursement policies, a rising elderly population requiring frequent diagnostic procedures, and substantial investments in research and development, positioning North America as a key driver of innovation and growth in robotic endoscopy technologies

U.S. Robotic Endoscopy Devices Market Insight

The U.S. robotic endoscopy devices market captured the largest revenue share of 79.5% in 2024 within North America, driven by a high demand for minimally invasive procedures and rapid adoption of advanced surgical technologies. Leading manufacturers, well-established healthcare infrastructure, and favorable reimbursement policies further support market expansion. Increased utilization of robotic-assisted colonoscopies and bronchoscopies, coupled with ongoing R&D investments, position the U.S. as a global leader in robotic endoscopy innovation.

Europe Robotic Endoscopy Devices Market Insight

The Europe robotic endoscopy devices market is projected to grow at a substantial CAGR during the forecast period, supported by the rising prevalence of gastrointestinal and pulmonary conditions and growing investment in healthcare robotics. The region's emphasis on early disease detection and precision medicine, coupled with stringent regulatory standards, is driving demand. Robotic endoscopy adoption is especially prominent in Germany, France, and the U.K., where hospital systems are modernizing surgical procedures to improve patient outcomes and operational efficiency.

U.K. Robotic Endoscopy Devices Market Insight

The U.K. robotic endoscopy devices market is anticipated to grow at a notable CAGR, fueled by increased awareness of early cancer screening, especially for colorectal and lung cancers. The country's strong public healthcare system (NHS) and partnerships with medtech firms are encouraging adoption of robotic-assisted diagnostics. In addition, the U.K.'s focus on reducing surgical backlogs and improving patient outcomes post-pandemic has driven increased investment in robotic platforms within major hospitals.

Germany Robotic Endoscopy Devices Market Insight

The Germany robotic endoscopy devices market is expected to expand at a significant CAGR during the forecast period, driven by the country’s leading position in medical technology innovation. High healthcare spending, growing demand for automated surgical tools, and a well-established hospital network support robust adoption. Emphasis on minimally invasive techniques and precision in oncology diagnostics and interventions are further propelling demand for robotic endoscopy devices in both public and private healthcare settings.

Asia-Pacific Robotic Endoscopy Devices Market Insight

The Asia-Pacific robotic endoscopy devices market is forecast to grow at the fastest CAGR from 2025 to 2032, propelled by expanding healthcare access, increasing disease burden, and rising investment in medical infrastructure across countries such as China, Japan, and India. Government-led digital health initiatives and a growing preference for advanced surgical tools are fueling adoption. The presence of cost-efficient manufacturing capabilities also supports affordability and wider adoption of robotic endoscopy systems across the region.

Japan Robotic Endoscopy Devices Market Insight

The Japan robotic endoscopy devices market is growing steadily, supported by the country’s focus on advanced healthcare technologies and high rates of colorectal cancer screening. Japan's aging population and strong emphasis on patient safety are encouraging the adoption of robotic-assisted endoscopy systems for enhanced precision and reduced procedural risks. In addition, Japan’s strong medtech ecosystem supports the development of compact, user-friendly robotic platforms suited to local hospital needs.

India Robotic Endoscopy Devices Market Insight

The India robotic endoscopy devices market held the largest revenue share in Asia-Pacific in 2024, driven by a rising middle class, rapid urbanization, and increasing investment in private healthcare. The country is witnessing growing awareness about early cancer detection and minimally invasive surgeries. Supportive government programs such as Ayushman Bharat and increasing penetration of medical robotics in tier-1 and tier-2 cities are accelerating market growth, with both domestic and international players expanding their presence.

Robotic Endoscopy Devices Market Share

The robotic endoscopy devices industry is primarily led by well-established companies, including:

- Intuitive Surgical, Inc. (U.S.)

- Medtronic (Ireland)

- Olympus Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Asensus Surgical, Inc. (U.S.)

- Fujifilm Holdings Corporation (Japan)

- Brainlab AG (Germany)

- EndoMaster Pte Ltd (Singapore)

- Avateramedical GmbH (Germany)

- Medrobotics Corporation (U.S.)

- Karl Storz SE & Co. KG (Germany)

- CMR Surgical Ltd. (U.K.)

- Smith & Nephew (U.K.)

- Shanghai MicroPort Endoscopy Co., Ltd. (China)

- Ambu A/S (Denmark)

- Boston Scientific Corporation (U.S.)

- Think Surgical, Inc. (U.S.)

- Veran Medical Technologies, Inc. (U.S.)

- Richard Wolf GmbH (Germany)

- Scivita Medical Technology Co., Ltd. (China)

What are the Recent Developments in Global Robotic Endoscopy Devices Market?

- In April 2024, Medtronic plc expanded its AI-powered endoscopy platform, GI Genius, across multiple global markets, including Asia-Pacific and Europe. The expansion aims to enhance colorectal cancer screening capabilities by integrating AI-assisted polyp detection with robotic endoscopic procedures. This development reinforces Medtronic’s strategy to combine artificial intelligence and robotics for more accurate and efficient diagnostics in minimally invasive procedures

- In March 2024, Intuitive Surgical Inc. announced the next-generation enhancements to its robotic-assisted endoscopic systems, particularly within its da Vinci platform. The updates include improved articulation for endoscopic arms and real-time tissue recognition using machine learning. These upgrades are designed to improve surgical outcomes and expand the usability of robotic endoscopy in complex procedures such as bronchoscopy and thoracic interventions

- In February 2024, Olympus Corporation launched the EVIS X1 endoscopy system with robotic support functionality in select European markets. This platform integrates AI-driven features with robotic navigation tools to enhance visualization and procedural efficiency in gastrointestinal diagnostics. The launch demonstrates Olympus’s continued focus on advancing precision and automation in endoscopic technology

- In January 2024, Asensus Surgical, Inc. announced new clinical partnerships to expand the adoption of its Senhance Surgical System, a digital laparoscopic platform that combines haptic feedback and robotic assistance. These collaborations are aimed at increasing system deployment in hospitals across Latin America and Eastern Europe, promoting robotic-assisted endoscopic surgery in emerging markets

- In December 2023, Brainlab AG introduced a novel robotic-assisted platform for endoscopic neurosurgery, combining high-definition visualization, real-time navigation, and robotic stability. This launch marks Brainlab’s entry into the robotic endoscopy space, with a focus on improving accuracy and minimizing risk in brain tumor and spinal endoscopic procedures, signaling growing diversification in robotic endoscopy applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.