Global Robotic Process Health Automation Rpa Market

Market Size in USD Billion

CAGR :

%

USD

4.29 Billion

USD

33.93 Billion

2024

2032

USD

4.29 Billion

USD

33.93 Billion

2024

2032

| 2025 –2032 | |

| USD 4.29 Billion | |

| USD 33.93 Billion | |

|

|

|

|

Robotic Process Health Automation (RPA) Market Size

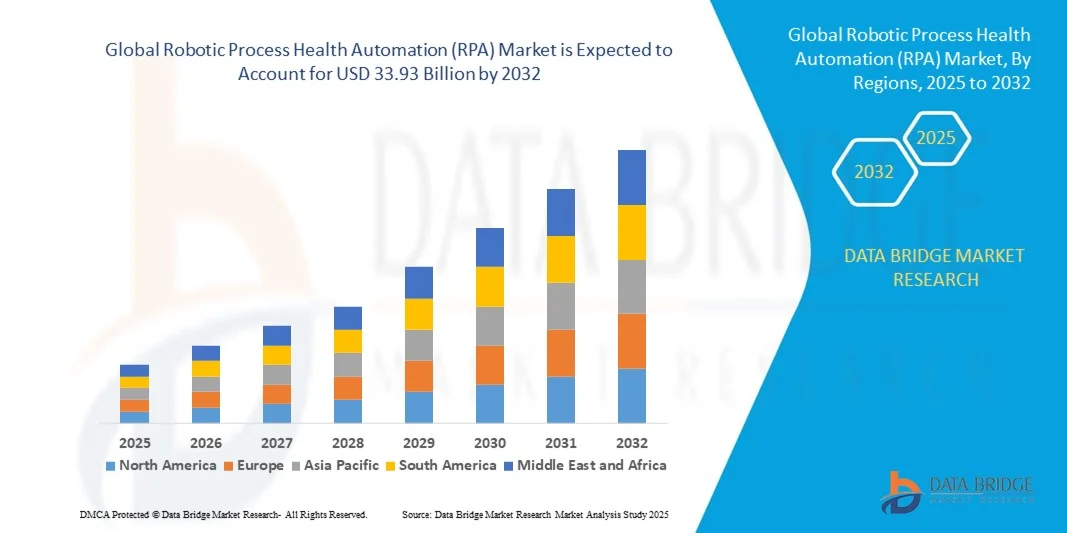

- The global robotic process health automation (RPA) market size was valued at USD 4.29 billion in 2024 and is expected to reach USD 33.93 billion by 2032, at a CAGR of 29.5% during the forecast period

- The market growth is largely fuelled by the increasing adoption of automation technologies in healthcare processes, rising demand for efficiency and accuracy in patient care, and the growing integration of AI and machine learning with RPA platforms

- The expansion of digital healthcare infrastructure, coupled with the need to reduce operational costs and optimize administrative workflows, is driving the adoption of RPA solutions across hospitals, clinics, and insurance providers

Robotic Process Health Automation (RPA) Market Analysis

- The RPA market in healthcare is witnessing significant adoption due to its ability to automate repetitive administrative tasks such as patient registration, claims processing, billing, and data entry, reducing human errors and improving operational efficiency

- Integration of AI, natural language processing (NLP), and machine learning with RPA is enhancing the capability to handle complex healthcare workflows, enabling predictive analytics and personalized patient care

- North America dominated the RPA market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of automation technologies across healthcare, finance, and enterprise operations

- Asia-Pacific region is expected to witness the highest growth rate in the global robotic process health automation (RPA) market, driven by expanding industrial automation, government initiatives supporting AI and digital transformation, and rising demand for cost-effective and scalable automation solutions across key sectors

- The Software segment held the largest market revenue share in 2024, driven by the increasing adoption of AI-powered RPA platforms that enable healthcare organizations and enterprises to automate repetitive tasks, improve workflow efficiency, and enhance accuracy. Software solutions often offer advanced analytics, integration with existing IT systems, and real-time monitoring, making them a preferred choice for large-scale automation deployments

Report Scope and Robotic Process Health Automation (RPA) Market Segmentation

|

Attributes |

Robotic Process Health Automation (RPA) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Robotic Process Health Automation (RPA) Market Trends

Rise of AI-Driven and Cloud-Enabled RPA in Healthcare

- The growing adoption of AI-driven and cloud-enabled RPA solutions is transforming the healthcare sector by automating repetitive administrative and operational tasks. These solutions allow real-time patient data processing, streamline billing, claims, and appointment management, improving operational efficiency and reducing errors. Hospitals and clinics benefit from faster workflows and improved patient satisfaction

- The increasing need for process standardization and compliance in healthcare is accelerating the deployment of RPA solutions. These tools are particularly effective in large hospitals, insurance companies, and multi-location clinics where centralized monitoring and automation help reduce manual errors and enhance reporting accuracy. Government initiatives promoting digital healthcare infrastructure further support adoption

- The scalability, cost-efficiency, and ease of integration of modern RPA platforms make them attractive for healthcare organizations of all sizes. Providers can automate critical workflows without heavy capital investment, improving resource utilization and operational efficiency

- For instance, in 2023, several U.S. and European hospitals implemented AI-powered RPA to automate patient registration, claims processing, and data entry, resulting in significant reductions in operational costs, faster service delivery, and improved patient experiences

- While AI and cloud-based RPA solutions are enhancing operational efficiency, their impact depends on continued technological innovation, employee training, and secure integration with existing IT systems. Vendors must focus on localized deployment and compliance to maximize market adoption

Robotic Process Health Automation (RPA) Market Dynamics

Driver

Increasing Adoption of Automation and AI in Healthcare Operations

- The rising need to reduce administrative burdens, streamline workflows, and improve accuracy is driving healthcare providers to adopt RPA solutions. Hospitals, clinics, and insurance companies are increasingly automating repetitive tasks to optimize resource utilization and enhance operational efficiency

- Organizations are recognizing the financial and operational risks associated with manual processes, including errors in billing, claims, and patient data management. This awareness is prompting investment in AI-powered RPA solutions for real-time monitoring, reporting, and predictive analytics

- Industry frameworks and government initiatives promoting digital healthcare transformation are further accelerating adoption. Providers are leveraging RPA to achieve regulatory compliance, improve patient outcomes, and reduce operational costs

- For instance, in 2022, several European and North American healthcare institutions integrated AI-powered RPA for claims management and patient data automation, leading to faster service delivery, fewer errors, and enhanced operational efficiency

- While growing awareness and institutional support are driving adoption, integrating RPA with legacy healthcare systems and ensuring sufficient technical expertise remain challenges

Restraint/Challenge

High Implementation Costs and Limited Skilled Workforce

- The high cost of implementing advanced RPA solutions, especially AI-enabled platforms, limits adoption among smaller healthcare providers and clinics. These systems are often deployed primarily by large hospitals and insurance companies with sufficient IT budgets, making cost a key barrier

- Many healthcare organizations face a shortage of trained IT and RPA professionals capable of deploying, managing, and maintaining complex automated workflows. This reduces operational efficiency and slows the adoption of RPA

- Infrastructure constraints and legacy system compatibility further restrict deployment, particularly in smaller clinics or rural healthcare facilities. Lack of consistent IT support and secure connectivity limits the effectiveness of automation

- For instance, in 2023, several hospitals in Sub-Saharan Africa reported that over 60% of smaller clinics could not implement RPA solutions due to high costs and insufficient skilled personnel

- While RPA technology continues to evolve, addressing cost, workforce, and infrastructure challenges is critical. Vendors must focus on scalable, affordable solutions and training initiatives to bridge the gap and unlock long-term market growth in the global RPA healthcare market

Robotic Process Health Automation (RPA) Market Scope

The market is segmented on the basis of component, deployment model, operations, process, and organization size.

- By Component

On the basis of component, the global RPA market is segmented into Software and Service. The Software segment held the largest market revenue share in 2024, driven by the increasing adoption of AI-powered RPA platforms that enable healthcare organizations and enterprises to automate repetitive tasks, improve workflow efficiency, and enhance accuracy. Software solutions often offer advanced analytics, integration with existing IT systems, and real-time monitoring, making them a preferred choice for large-scale automation deployments.

The Service segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for consulting, implementation, and managed RPA services. Service providers help organizations deploy, customize, and maintain RPA solutions, ensuring smooth integration with existing systems and maximizing operational efficiency. Services are particularly popular among small and medium-sized enterprises seeking cost-effective automation solutions.

- By Deployment Model

On the basis of deployment model, the market is segmented into On-Premise and Cloud. The On-Premise segment held the largest revenue share in 2024 due to healthcare and large enterprise organizations preferring direct control over sensitive data and integration with internal IT infrastructure.

The Cloud segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the scalability, affordability, and ease of deployment offered by cloud-based RPA solutions. Cloud deployment allows organizations to automate operations across multiple locations without significant upfront investment.

- By Operations

On the basis of operations, the market is segmented into Rule-Based and Knowledge-Based. The Rule-Based segment dominated in 2024, as it is widely adopted for automating repetitive and structured tasks such as claims processing, data entry, and billing, delivering consistent results and reducing human error.

The Knowledge-Based segment is expected to witness the fastest growth rate from 2025 to 2032, driven by AI and machine learning integration. These solutions can handle complex, unstructured tasks requiring decision-making and pattern recognition, making them valuable for advanced healthcare, finance, and enterprise applications.

- By Process

On the basis of process, the market is segmented into Automated Solution, Decision Support and Management Solutions, and Interaction Solutions. The Automated Solution segment held the largest revenue share in 2024, supported by its ability to streamline routine administrative and operational workflows across industries, reducing costs and enhancing efficiency.

Decision Support and Management Solutions is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing need for AI-driven insights, predictive analytics, and enhanced decision-making capabilities in healthcare, finance, and large enterprises. Interaction Solutions are also gaining traction due to their role in automating customer and employee interactions.

- By Organization Size

On the basis of organization size, the market is segmented into Large Enterprises and Small & Medium Sized Enterprises (SMEs). Large Enterprises held the largest market share in 2024, driven by their ability to invest in advanced RPA platforms and deploy them across multiple business units to optimize processes and reduce operational costs.

The SME segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing availability of cost-effective, cloud-based RPA solutions that allow smaller organizations to automate workflows and compete efficiently with larger enterprises.

Robotic Process Health Automation (RPA) Market Regional Analysis

- North America dominated the RPA market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of automation technologies across healthcare, finance, and enterprise operations

- Organizations in the region highly value the efficiency, accuracy, and cost savings offered by RPA solutions, as well as the integration capabilities with existing IT systems and cloud platforms

- This widespread adoption is further supported by strong IT infrastructure, a technologically skilled workforce, and government initiatives promoting digital transformation, establishing RPA as a preferred solution for enterprise process automation

U.S. RPA Market Insight

The U.S. RPA market captured the largest revenue share in 2024 within North America, fueled by the rapid deployment of AI-enabled and cloud-based automation solutions. Enterprises are increasingly prioritizing digital process optimization, error reduction, and operational efficiency through RPA adoption. The growing preference for scalable, cloud-integrated automation platforms, combined with robust demand in healthcare, BFSI, and IT services, is significantly propelling the market. Furthermore, the integration of RPA with analytics and machine learning tools is driving smarter, data-driven process automation.

Europe RPA Market Insight

The Europe RPA market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by increasing digital transformation initiatives, regulatory compliance requirements, and the demand for process efficiency across industries. Countries such as Germany, the U.K., and France are witnessing strong adoption in healthcare, banking, and manufacturing sectors. The region is experiencing significant growth in both large enterprises and SMEs, with RPA being incorporated into both new operations and legacy system upgrades.

U.K. RPA Market Insight

The U.K. RPA market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising focus on automation to reduce operational costs and improve service delivery. Government initiatives encouraging digital innovation, alongside increased adoption in healthcare and BFSI sectors, are supporting market expansion. The demand for AI-augmented RPA platforms, capable of handling complex workflows, is further boosting adoption among enterprises seeking enhanced operational efficiency.

Germany RPA Market Insight

The Germany RPA market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s strong emphasis on industrial automation, digital efficiency, and process optimization. Germany’s well-established manufacturing and enterprise infrastructure, combined with technological innovation, promotes the adoption of RPA across healthcare, finance, and public sector organizations. The integration of RPA with AI and advanced analytics is becoming increasingly prevalent, with a focus on achieving cost savings and improved compliance.

Asia-Pacific RPA Market Insight

The Asia-Pacific RPA market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing digitization, expanding IT infrastructure, and rising adoption of cloud-based automation solutions in countries such as India, China, and Japan. The region’s growing inclination towards AI-enabled and hybrid RPA platforms, supported by government initiatives promoting digital transformation and smart enterprises, is accelerating adoption. In addition, APAC emerging as a hub for technology development and outsourcing is enhancing the affordability and accessibility of RPA solutions.

Japan RPA Market Insight

The Japan RPA market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech culture, emphasis on operational efficiency, and demand for digital transformation. Japanese enterprises are increasingly adopting RPA to optimize administrative processes, reduce human error, and improve service delivery across industries. The integration of RPA with AI, machine learning, and IoT is driving intelligent automation adoption. Moreover, Japan's aging workforce is further motivating the implementation of RPA to maintain productivity in both large enterprises and SMEs.

China RPA Market Insight

The China RPA market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, a growing IT services sector, and increased enterprise investment in digital process automation. China’s enterprises are implementing RPA to streamline workflows, reduce operational costs, and enhance compliance. The push toward smart manufacturing, government-backed digital initiatives, and availability of cost-effective automation solutions are key factors propelling the RPA market in China.

Robotic Process Health Automation (RPA) Market Share

The Robotic Process Health Automation (RPA) industry is primarily led by well-established companies, including:

- Celaton (U.K.)

- UiPath (U.S.)

- Verint (U.S.)

- REDWOOD TECHNOLOGIES GROUP LIMITED (U.K.)

- IBM Corporation (U.S.)

- NICE Robotic Automation (U.S.)

- THOUGHTONOMY (U.K.)

- KOFAX INC. (U.S.)

- Jacada Inc. (U.S.)

- Kryon Systems (U.S.)

- OpenConnect Systems Incorporated (U.S.)

- Cicero Inc. (U.S.)

- Atos SE (U.K.)

- Daythree Business Services sdn bhd (U.K.)

- IPsoft Inc. (U.S.)

- Softomotive (U.K.)

- Automation Anywhere Inc. (U.S.)

- Blue Prism (U.K.)

- Pegasystems Inc. (U.S.)

Latest Developments in Global Robotic Process Health Automation (RPA) Market

- In December 2024, UiPath, through a strategic partnership with the UAE government’s AI, Digital Economy, and Remote Work End Uses Office, launched an AI-powered Agentic Automation initiative. The program aims to implement AI-driven automation solutions across government entities while upskilling UAE talent in AI and automation. It includes a specialized training program for 100 students and government employees as part of the National AI Strategy and Coders HQ initiatives. This development is expected to enhance operational efficiency within government agencies, accelerate AI adoption, and strengthen the UAE’s position as a leader in intelligent automation

- In November 2024, Automation Anywhere Inc. introduced a generative AI-powered automation partnership with PwC India to enhance enterprise efficiency. The collaboration focuses on developing AI-driven solutions across sectors such as financial services, retail, and healthcare. By integrating Automation Anywhere’s technology with PwC India’s industry expertise, the initiative aims to optimize costs, improve process efficiency, and elevate customer experiences. This partnership is anticipated to drive the adoption of AI-based automation, transform business operations, and generate significant value in a competitive market landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 BY PRODCT TYPE

6.2.1.1. SOFTWARE AS A SERVICES

6.2.1.2. TOOLS

6.2.1.2.1. BY TYPE

6.2.1.2.1.1 ATTENDED AUTOMATION TOOLS

6.2.1.2.1.2 UNATTENDED AUTOMATION TOOLS

6.2.1.2.1.3 HYBRID RPA TOOLS

6.3 SERVICES

6.3.1 IMPLEMENTING

6.3.2 CONSULTING

6.3.3 TRAINING

7 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 CLOUD BASED

7.2.1 PUBLIC CLOUD

7.2.2 PRIVATE CLOUD

7.2.3 HYBRID CLOUD

7.3 ON-PREMISES

8 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.2.1 BY DEPLOYMENT MODE

8.2.1.1. CLOUD BASED

8.2.1.2. ON-PREMISE

8.3 SMALL & MEDIUM ENTERPRISE

8.3.1 BY DEPLOYMENT MODE

8.3.1.1. CLOUD BASED

8.3.1.2. ON-PREMISE

9 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY PROCESS

9.1 OVERVIEW

9.2 AUTOMATED SOLUTION

9.3 DECISION SUPPORT MANAGEMENT SOLUTION

9.4 INTERACTION SOLUTION

10 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY OPERATION

10.1 OVERVIEW

10.2 RULE BASED

10.3 KNOWLEDGE BASED

11 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY OPERATING SYSTEM

11.1 OVERVIEW

11.2 WINDOWS

11.3 MAC

11.4 LINUX

11.5 OTHERS

12 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 CLAIMS MANAGEMNET

12.3 BILLING & COMPLIANCE MANAGEMENT

12.4 APPOINTMENT SCHEDULING

12.5 WORKFLOW MANAGEMENT

12.6 CLINICAL DOCUMENTATION

12.7 OTHERS

13 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, BY GEOGRAPHY

13.1 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1.1 NORTH AMERICA

13.1.1.1. U.S.

13.1.1.2. CANADA

13.1.1.3. MEXICO

13.1.2 EUROPE

13.1.2.1. GERMANY

13.1.2.2. FRANCE

13.1.2.3. U.K.

13.1.2.4. ITALY

13.1.2.5. SPAIN

13.1.2.6. RUSSIA

13.1.2.7. TURKEY

13.1.2.8. BELGIUM

13.1.2.9. NETHERLANDS

13.1.2.10. NORWAY

13.1.2.11. FINLAND

13.1.2.12. SWITZERLAND

13.1.2.13. DENMARK

13.1.2.14. SWEDEN

13.1.2.15. POLAND

13.1.2.16. REST OF EUROPE

13.1.3 ASIA PACIFIC

13.1.3.1. JAPAN

13.1.3.2. CHINA

13.1.3.3. SOUTH KOREA

13.1.3.4. INDIA

13.1.3.5. AUSTRALIA

13.1.3.6. NEW ZEALAND

13.1.3.7. SINGAPORE

13.1.3.8. THAILAND

13.1.3.9. MALAYSIA

13.1.3.10. INDONESIA

13.1.3.11. PHILIPPINES

13.1.3.12. TAIWAN

13.1.3.13. VIETNAM

13.1.3.14. REST OF ASIA PACIFIC

13.1.4 SOUTH AMERICA

13.1.4.1. BRAZIL

13.1.4.2. ARGENTINA

13.1.4.3. REST OF SOUTH AMERICA

13.1.5 MIDDLE EAST AND AFRICA

13.1.5.1. SOUTH AFRICA

13.1.5.2. EGYPT

13.1.5.3. SAUDI ARABIA

13.1.5.4. U.A.E

13.1.5.5. OMAN

13.1.5.6. BAHRAIN

13.1.5.7. ISRAEL

13.1.5.8. KUWAIT

13.1.5.9. QATAR

13.1.5.10. REST OF MIDDLE EAST AND AFRICA

13.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, SWOT & DBMR ANALYSIS

16 GLOBAL ROBOTIC PROCESS HEALTH AUTOMATION (RPA) MARKET, COMPANY PROFILE

16.1 AUTOMATION ANYWHERE, INC.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 IBM

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 UIPATH

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENT

16.4 NICE

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENT

16.5 BLUE PRISM LIMITED

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 PEGASYSTEMS INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENT

16.7 KOFAX INC

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENT

16.8 NTT ADVANCED TECHNOLOGY CORPORATION

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENT

16.9 EDGEVERVE SYSTEMS LIMITED

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENT

16.1 FPT SOFTWARE

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENT

16.11 ONVISOURCE, INC

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENT

16.12 NAVIANT

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENT

16.13 MICROSOFT

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENT

16.14 WORKFUSION, INC

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENT

16.15 SALESFORCE, INC

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.15.5 RECENT DEVELOPMENT

16.16 FORTRA, LLC

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENT

16.17 CELATON

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.17.5 RECENT DEVELOPMENT

16.18 ROCKETBOT SPA

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENT

16.19 NINTEX UK LTD

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENT

16.2 CYCLONE ROBOTICS

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENT

16.21 APPIAN

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 GEOGRAPHIC PRESENCE

16.21.4 PRODUCT PORTFOLIO

16.21.5 RECENT DEVELOPMENT

16.22 DATAMATICS GLOBAL SERVICES LIMITED

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 GEOGRAPHIC PRESENCE

16.22.4 PRODUCT PORTFOLIO

16.22.5 RECENT DEVELOPMENT

16.23 ROBOCORP

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 GEOGRAPHIC PRESENCE

16.23.4 PRODUCT PORTFOLIO

16.23.5 RECENT DEVELOPMENT

16.24 QUALE INFOTECH INC.

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 GEOGRAPHIC PRESENCE

16.24.4 PRODUCT PORTFOLIO

16.24.5 RECENT DEVELOPMENT

16.25 EPSOFT TECHNOLOGIES

16.25.1 COMPANY SNAPSHOT

16.25.2 REVENUE ANALYSIS

16.25.3 GEOGRAPHIC PRESENCE

16.25.4 PRODUCT PORTFOLIO

16.25.5 RECENT DEVELOPMENT

16.26 LASERFICHE

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 GEOGRAPHIC PRESENCE

16.26.4 PRODUCT PORTFOLIO

16.26.5 RECENT DEVELOPMENT

16.27 ELECTRONEEK ROBOTICS INC.

16.27.1 COMPANY SNAPSHOT

16.27.2 REVENUE ANALYSIS

16.27.3 GEOGRAPHIC PRESENCE

16.27.4 PRODUCT PORTFOLIO

16.27.5 RECENT DEVELOPMENT

16.28 HYLAND SOFTWARE, INC.

16.28.1 COMPANY SNAPSHOT

16.28.2 REVENUE ANALYSIS

16.28.3 GEOGRAPHIC PRESENCE

16.28.4 PRODUCT PORTFOLIO

16.28.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Robotic Process Health Automation Rpa Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Robotic Process Health Automation Rpa Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Robotic Process Health Automation Rpa Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.