Global Robotic Vision Market

Market Size in USD Billion

CAGR :

%

USD

3.13 Billion

USD

6.02 Billion

2024

2032

USD

3.13 Billion

USD

6.02 Billion

2024

2032

| 2025 –2032 | |

| USD 3.13 Billion | |

| USD 6.02 Billion | |

|

|

|

|

Robotic Vision Market Size

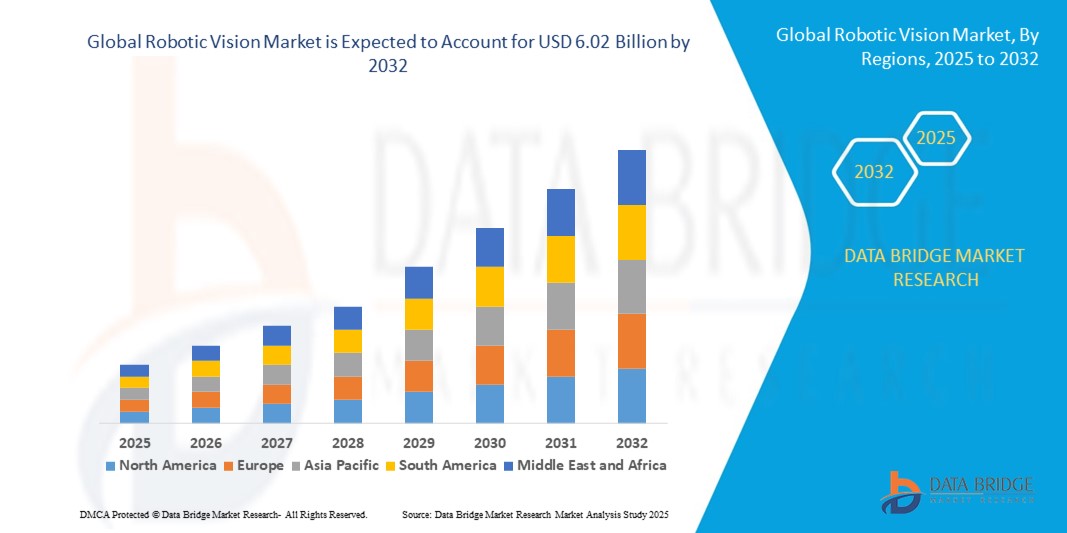

- The global robotic vision market size was valued at USD 3.13 billion in 2024 and is expected to reach USD 6.02 billion by 2032, at a CAGR of 8.50% during the forecast period

- The market growth is primarily driven by increasing demand for automation, enhanced precision in manufacturing, and advancements in AI-driven vision technologies, along with rising adoption in diverse industries for improved productivity and efficiency

- Growing awareness of the benefits of robotic vision systems in improving quality control, reducing operational costs, and enabling real-time decision-making is further propelling demand across industrial and commercial applications

Robotic Vision Market Analysis

- The robotic vision market is experiencing robust growth as industries increasingly adopt automation to enhance operational efficiency and precision in tasks such as assembly, bin picking, and material handling

- The rising demand for advanced vision systems in both high-tech and traditional industries is encouraging manufacturers to innovate with high-resolution cameras, deep learning software, and 3D/4D vision solutions for complex applications

- North America dominated the robotic vision market with the largest revenue share of 34.7% in 2024, driven by a mature industrial automation sector and significant investments in AI and machine vision technologies

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid industrialization, increasing adoption of automation in manufacturing, and growing investments in smart factories, particularly in countries such as China, Japan, and India

- The 2D vision systems segment dominated the largest market revenue share of 55% in 2024, driven by their cost-effectiveness, ease of integration, and widespread use in industrial applications such as barcode reading, presence detection, and basic inspection tasks. Their reliability and maturity make them ideal for large-scale automation in industries such as automotive, electronics, and packaging

Report Scope and Robotic Vision Market Segmentation

|

Attributes |

Robotic Vision Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Robotic Vision Market Trends

Increasing Integration of AI and Deep Learning Software

- The global robotic vision market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and deep learning software, enhancing the capabilities of robotic vision systems

- These technologies enable advanced image processing and analysis, providing deeper insights into object recognition, scene understanding, and task optimization

- AI-powered robotic vision solutions facilitate proactive decision-making, identifying potential defects or inefficiencies in manufacturing processes before they escalate, reducing downtime and costs

- For instances, companies are developing AI-driven vision platforms that analyze complex workpieces in real-time to optimize tasks such as bin picking, quality inspection, and assembly, particularly in automotive and electronics industries

- This trend enhances the precision and adaptability of robotic vision systems, making them more appealing to industrial and commercial end-users

- Deep learning algorithms can process vast datasets from cameras and sensors, enabling robots to detect intricate patterns, such as surface defects, irregular shapes, or dynamic object movements

Robotic Vision Market Dynamics

Driver

Rising Demand for Automation and Precision in Manufacturing

- The increasing demand for automation in industries, driven by the need for precision, efficiency, and high-quality production, is a major driver for the global robotic vision market

- Robotic vision systems enhance manufacturing processes by enabling tasks such as automated assembly, bin picking, and material handling with high accuracy and repeatability

- Government initiatives, such as China’s “Made in China 2025” and India’s “Make in India” campaigns, are promoting industrial automation, further boosting the adoption of robotic vision systems

- The proliferation of Industry 4.0 and advancements in IoT and 5G technologies enable faster data processing and real-time feedback, supporting sophisticated vision-guided robotic applications

- Manufacturers are increasingly integrating 3D and 4D vision systems as standard features to meet stringent quality standards and enhance operational efficiency across industries such as automotive, electronics, and food & beverages

Restraint/Challenge

High Implementation Costs and Data Security Concerns

- The high initial investment required for hardware components and software integration, such as deep learning algorithms, poses a significant barrier to adoption, particularly for small and medium-sized enterprises in emerging markets

- Integrating robotic vision systems into existing manufacturing setups can be complex and costly, requiring specialized expertise and infrastructure upgrades

- Data security and privacy concerns are a major challenge, as robotic vision systems collect and process large volumes of sensitive data, such as production metrics and operational patterns, raising risks of breaches or misuse

- The fragmented regulatory landscape across regions regarding data privacy and cybersecurity complicates compliance for global manufacturers and service providers

- These factors may deter adoption in cost-sensitive markets or regions with heightened awareness of data privacy, limiting market growth in certain segments

Robotic Vision market Scope

The market is segmented on the basis of offering type, component, application, end user, end-user industry, and deployment.

- By Offering Type

On the basis of offering type, the global robotic vision market is segmented into 2D vision systems, 3D vision systems, and 4D vision systems. The 2D vision systems segment dominated the largest market revenue share of 55% in 2024, driven by their cost-effectiveness, ease of integration, and widespread use in industrial applications such as barcode reading, presence detection, and basic inspection tasks. Their reliability and maturity make them ideal for large-scale automation in industries such as automotive, electronics, and packaging.

The 3D vision systems segment is expected to register the fastest growth rate from 2025 to 2032, fueled by advancements in AI, spatial analysis, and machine learning. These systems provide depth perception and spatial awareness, enabling complex tasks such as bin picking, object tracking, and precision assembly, particularly in automotive and pharmaceutical industries. Despite higher costs and implementation complexity, their ability to handle variable object orientations and surface conditions drives adoption. The 4D vision systems segment, though emerging, remains niche due to ongoing research and limited commercial applications.

- By Component

On the basis of component, the global robotic vision market is segmented into cameras, LED lighting, optics, processors & controllers, frame grabbers, and deep learning software. The hardware segment, particularly cameras, accounted for the largest revenue share 70% in 2024, due to the critical role of advanced imaging technologies such as CMOS sensors in robotic vision systems. The demand for high-resolution, smart cameras with integrated processing capabilities supports their dominance in applications requiring precision and real-time analysis.

The deep learning software segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by the integration of AI and machine learning for advanced object recognition, real-time decision-making, and adaptive inspection. Software advancements enable robotic vision systems to handle complex and dynamic environments, boosting efficiency in industries such as electronics and logistics. The increasing affordability of smart cameras and powerful software packages further accelerates this trend.

- By Application

On the basis of application, the global robotic vision market is segmented into assembly, bin picking, and material handling. The material handling segment captured the largest revenue share, driven by its widespread use in reducing labor costs, increasing production uptime, and enhancing safety across industries such as automotive, logistics, and food & beverages. Robotic vision systems streamline tasks such as sorting, picking, and palletizing, ensuring operational efficiency.

The bin picking segment is anticipated to grow at the fastest CAGR from 2025 to 2032, propelled by advancements in 3D vision and AI that enable robots to handle unstructured environments and randomly oriented objects. This is particularly valuable in automotive and electronics manufacturing, where precision and flexibility are critical for tasks such as object tracking and product profiling.

- By End User

On the basis of end user, the global robotic vision market is segmented into industrial and commercial end users. The industrial segment dominated with the largest revenue share, attributed to the widespread adoption of robotic vision systems in manufacturing for quality control, inspection, and automation. Industries such as automotive and electronics rely heavily on these systems to ensure zero-defect production and high efficiency.

The commercial segment is expected to exhibit the fastest growth rate from 2025 to 2032, driven by increasing applications in logistics, healthcare, and intelligent transportation systems. The demand for robotic vision in commercial settings is fueled by the need for automation in warehousing, real-time inventory management, and autonomous navigation, particularly in North America and Asia-Pacific.

- By End-User Industry

On the basis of end user industry, the global robotic vision market is segmented into automotive, electrical & electronics, aerospace & defense, and food & beverages. The automotive segment held the largest revenue share in 2024, driven by high automation levels in manufacturing for tasks such as precision welding, part alignment, and quality inspection. Major automakers such as Toyota and Tesla integrate advanced vision systems to enhance production efficiency and ensure quality.

The food & beverages segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising global demand for packaged foods, stringent safety standards, and the adoption of vision systems for grading, sorting, and quality checks. The need for hygiene, consistency, and compliance in food production accelerates the deployment of robotic vision systems.

- By Deployment

On the basis of deployment, the global robotic vision market is segmented into robotic guidance systems and robotic cells. Robotic guidance systems dominated the market share due to their flexibility and integration with vision-guided robots for tasks such as navigation, pick-and-place, and assembly across industries. These systems enhance precision and reduce errors in dynamic environments.

The robotic cells segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by their use in highly automated, self-contained environments for complex manufacturing processes. Robotic cells, equipped with advanced vision systems, are increasingly adopted in automotive and electronics industries for tasks requiring high precision and repeatability.

Robotic Vision Market Regional Analysis

- North America dominated the robotic vision market with the largest revenue share of 34.7% in 2024, driven by a mature industrial automation sector and significant investments in AI and machine vision technologies

- Consumers and industries prioritize robotic vision systems for enhancing automation precision, improving quality control, and ensuring safety in manufacturing processes, particularly in regions with advanced technological infrastructure

- Growth is supported by advancements in AI, deep learning, and 3D vision technologies, alongside increasing adoption in both industrial and commercial applications, including assembly, bin picking, and material handling

U.S. Robotic Vision Market Insight

The U.S. robotic vision market captured the largest revenue share of 74.9% in 2024 within North America, fueled by strong demand for automation in automotive and electronics manufacturing and growing awareness of robotic vision benefits for quality inspection and process optimization. The trend towards smart manufacturing and supportive government initiatives, such as the National Robotics Initiative, further boost market expansion. The integration of robotic vision in both OEM and aftermarket robotic systems creates a robust market ecosystem.

Europe Robotic Vision Market Insight

The Europe robotic vision market is expected to witness significant growth, supported by stringent quality standards and a strong emphasis on industrial automation. Industries seek vision systems that enhance precision in applications such as assembly and material handling while ensuring compliance with safety regulations. Growth is prominent in both new robotic installations and retrofit projects, with countries such as Germany and France showing significant uptake due to advanced manufacturing sectors and environmental concerns.

U.K. Robotic Vision Market Insight

The U.K. market for robotic vision systems is expected to witness rapid growth, driven by demand for enhanced automation in manufacturing and logistics. Increased interest in precision applications such as bin picking and quality inspection, along with rising awareness of safety and efficiency benefits, encourages adoption. Evolving industrial automation regulations influence the deployment of vision systems, balancing technological advancements with compliance.

Germany Robotic Vision Market Insight

Germany is expected to witness rapid growth in robotic vision systems, attributed to its advanced manufacturing sector and high consumer focus on automation efficiency and precision. German industries prefer technologically advanced vision systems, such as 3D and 4D systems, that enhance assembly accuracy and contribute to energy-efficient production. The integration of these systems in premium manufacturing and aftermarket solutions supports sustained market growth.

Asia-Pacific Robotic Vision Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding industrial automation and rising investments in countries such as China, Japan, and South Korea. Increasing awareness of quality control, safety, and efficiency in applications such as material handling and assembly is boosting demand. Government initiatives promoting Industry 4.0 and smart manufacturing, such as China’s “Made in China 2025,” further encourage the adoption of advanced robotic vision systems.

Japan Robotic Vision Market Insight

Japan’s robotic vision market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced vision systems that enhance manufacturing precision and safety. The presence of major automation companies such as FANUC and KEYENCE, along with the integration of vision systems in OEM robotic solutions, accelerates market penetration. Rising interest in aftermarket automation solutions also contributes to growth.

China Robotic Vision Market Insight

China holds the largest share of the Asia-Pacific robotic vision market, propelled by rapid industrialization, rising robot density, and increasing demand for automation solutions in automotive and electronics sectors. The country’s growing manufacturing base and focus on smart factories support the adoption of advanced vision systems. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Robotic Vision Market Share

The robotic vision industry is primarily led by well-established companies, including:

- Cognex Corporation (US)

- KEYENCE CORPORATION (Japan)

- Teledyne Technologies Inc. (US)

- Omron Corporation (Japan)

- FANUC CORPORATION (Japan)

- SICK AG (Germany)

- Atlas Copco AB (Sweden)

- Emerson Electric Co. (US)

- Zebra Technologies Corp. (US)

- ABB (Switzerland)

- Tordivel AS (Norway)

- Advantech (Taiwan)

- ISRA Visio (Germany)

- Basler AG (Germany)

- National Instruments Corporation (U.S.)

- Hexagon AB (Sweden)

- Yaskawa America, Inc (U.S.)

What are the Recent Developments in Global Robotic Vision Market?

- In November 2024, AMETEK, Inc. announced the acquisition of Virtek Vision International, a Canadian company renowned for its 3D laser projectors, smart cameras, and AI-powered quality control systems. This strategic move expands AMETEK’s portfolio of machine vision solutions, enhancing its capabilities in automated assembly, precision inspection, and manufacturing efficiency across industries such as aerospace, defense, and other high-tech sectors. Virtek’s technologies complement AMETEK’s existing offerings, particularly within its Creaform business, and will operate under AMETEK’s Electronic Instruments Group (EIG)

- In September 2024, Ricoh North America and Agility Robotics announced a strategic partnership to advance automated warehouse solutions and support humanoid robot fleets. Ricoh extended its Service Advantage program to assist Agility Robotics—creator of the bipedal Mobile Manipulation Robot (MMR) Digit®—in expanding its service capabilities across North America. The collaboration focuses on maintaining and deploying Digit robots and Agility Arc™, Agility’s cloud automation platform, which streamlines robot fleet management. This partnership enhances uptime, safety, and scalability for logistics operations, marking a significant step in commercializing humanoid robotics for industrial applications

- In May 2024, Nikon Corporation launched a new industrial robot vision system, including models NSP-150-1, NSP-250-1, and NSP-500-1. This system, which attaches to an industrial robot arm, utilizes a combination of 2D and 3D cameras with high-speed image processing technology to enable "bin picking" and other high-precision tasks at speeds of up to 250 frames per second (fps). The system is designed to improve productivity and reduce labor in various industries, including manufacturing.

- In May 2024, Omron Automation and NEURA Robotics GmbH announced a strategic partnership to enhance manufacturing efficiency through advanced AI-driven cognitive automation technologies. The collaboration was highlighted with the introduction of the new Omron intelligent Cognitive Robot (iCR) series at the Automate trade show. The iCR, based on NEURA's MAiRA line, features an integrated 3D vision sensor and an intuitive user interface, demonstrating a 3D bin-picking capability

- In January 2024, Techman Robot introduced its TM AI Cobot series, an all-in-one collaborative robot that integrates a precise robot arm, an AI inferencing engine, and an advanced smart vision system. This series is designed to accelerate Industry 4.0 by offering capabilities such as pick and place, Automated Optical Inspection (AOI), and welding. The cobot's AI-Vision eliminates the need for third-party cameras and is capable of seamless integration into existing workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Robotic Vision Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Robotic Vision Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Robotic Vision Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.