Global Robotically Assisted Surgical Devices Market

Market Size in USD Billion

CAGR :

%

USD

5.44 Billion

USD

7.00 Billion

2025

2033

USD

5.44 Billion

USD

7.00 Billion

2025

2033

| 2026 –2033 | |

| USD 5.44 Billion | |

| USD 7.00 Billion | |

|

|

|

|

Robotically Assisted Surgical Devices Market Size

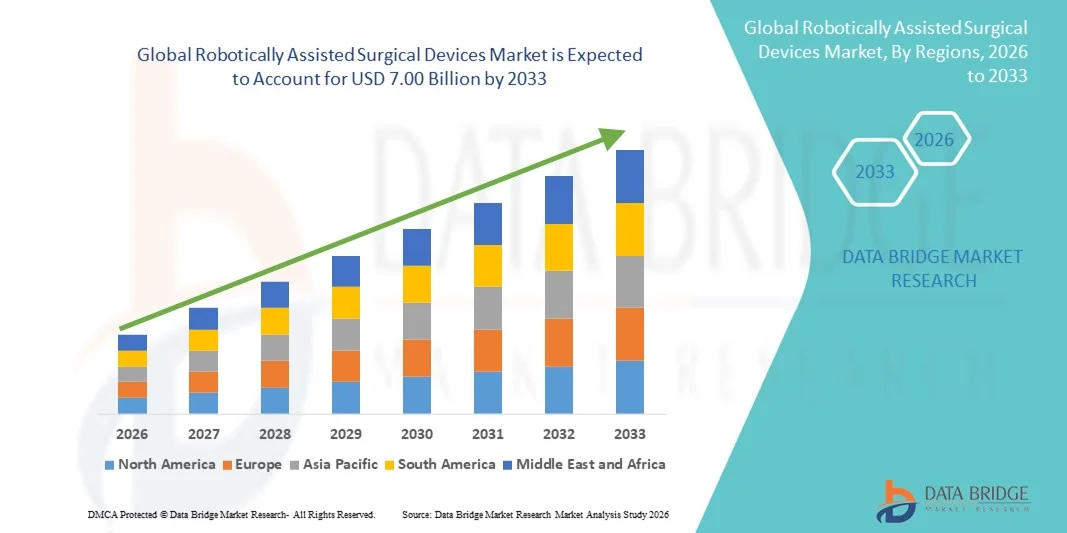

- The global robotically assisted surgical devices market size was valued at USD 5.44 billion in 2025 and is expected to reach USD 7.00 billion by 2033, at a CAGR of 3.21% during the forecast period

- The market growth is largely fueled by the rapid adoption of minimally invasive surgical procedures and continuous technological advancements in robotic systems, leading to improved surgical precision, reduced complication rates, and faster patient recovery across multiple clinical specialties

- Furthermore, rising demand for enhanced surgical outcomes, shorter hospital stays, and better ergonomics for surgeons is establishing robotically assisted surgical devices as a preferred solution in modern operating rooms. These converging factors are accelerating the uptake of Robotically Assisted Surgical Devices, thereby significantly boosting the overall market growth

Robotically Assisted Surgical Devices Market Analysis

- Robotically assisted surgical devices, which enable surgeons to perform complex procedures with enhanced precision, flexibility, and control, are becoming integral to modern surgical practice across specialties such as urology, gynecology, orthopedics, cardiothoracic, and general surgery due to their ability to support minimally invasive interventions

- The escalating demand for robotically assisted surgical devices is primarily driven by the growing preference for minimally invasive surgeries, rising incidence of chronic diseases requiring surgical intervention, improved clinical outcomes, reduced hospital stays, and increasing adoption of advanced surgical technologies by hospitals worldwide

- North America dominated the robotically assisted surgical devices market with the largest revenue share of approximately 45.6% in 2025, supported by high healthcare expenditure, early adoption of advanced surgical technologies, strong reimbursement frameworks, and the presence of leading market players. The U.S. accounted for a major share of regional revenue due to high surgical volumes and continuous investments in robotic surgery platforms

- Asia-Pacific is expected to be the fastest growing region in the robotically assisted surgical devices market during the forecast period, registering a CAGR of around 12.4%, driven by improving healthcare infrastructure, increasing medical tourism, rising awareness of minimally invasive procedures, and growing investments in advanced surgical technologies across countries such as China, India, and Japan

- The Hardware segment accounted for the largest market revenue share of 64.1% in 2025, driven by high costs associated with robotic arms, control systems, sensors, and imaging components

Report Scope and Robotically Assisted Surgical Devices Market Segmentation

|

Attributes |

Robotically Assisted Surgical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Robotically Assisted Surgical Devices Market Trends

Growing Adoption of Minimally Invasive and Precision-Guided Robotic Surgery

- A significant and accelerating trend in the global robotically assisted surgical devices market is the increasing shift toward minimally invasive surgical procedures that offer enhanced precision, reduced trauma, and faster patient recovery

- Robotic systems are increasingly being adopted across complex procedures such as urology, gynecology, orthopedics, and general surgery due to their ability to improve surgical accuracy and outcomes

- For instance, in 2024, several leading hospitals in North America and Europe expanded the use of robotic-assisted platforms for prostatectomy and gynecological surgeries, resulting in shorter hospital stays and reduced postoperative complications

- Technological advancements such as enhanced visualization systems, improved robotic arms with greater dexterity, and motion-scaling capabilities are enabling surgeons to perform highly complex procedures with increased confidence and control

- Furthermore, the integration of robotic systems with advanced imaging and navigation tools is improving intraoperative decision-making and procedural consistency

- This trend toward precision-driven and minimally invasive surgery is reshaping surgical standards globally, prompting healthcare providers to invest in robotic platforms to remain competitive and improve patient care quality

- The growing acceptance of robotic surgery among surgeons and patients alike is expected to further accelerate market adoption across both developed and emerging healthcare systems

Robotically Assisted Surgical Devices Market Dynamics

Driver

Rising Demand for Advanced Surgical Outcomes and Growing Surgical Volumes

- The increasing global burden of chronic diseases, cancer, and age-related conditions requiring surgical intervention is a major driver fueling demand for robotically assisted surgical devices

- Rising surgical volumes, coupled with the need for improved clinical outcomes, are encouraging hospitals to adopt robotic technologies

- For instance, in 2025, healthcare institutions across Asia-Pacific increased investments in robotic surgery systems to manage growing patient volumes while maintaining high procedural accuracy and efficiency

- Robotically assisted procedures offer benefits such as reduced blood loss, lower infection rates, and quicker recovery times, making them attractive to both patients and healthcare providers

- The expanding availability of trained robotic surgeons and specialized surgical training programs is further supporting market growth

- In addition, increasing healthcare expenditure and government initiatives aimed at modernizing hospital infrastructure are contributing to the steady expansion of the robotically assisted surgical devices market

Restraint/Challenge

High Capital Investment and Limited Accessibility in Developing Regions

- The high initial cost associated with acquiring, installing, and maintaining robotically assisted surgical systems remains a significant challenge, particularly for small and mid-sized hospitals. The cost of equipment, maintenance contracts, and disposable instruments can limit widespread adoption

- For instance, many healthcare facilities in Latin America, Africa, and parts of Southeast Asia face budget constraints that restrict access to advanced robotic surgical platforms

- The requirement for extensive surgeon training and skilled technical support can further slow adoption, especially in regions with limited healthcare infrastructure

- Concerns related to procedural learning curves and operational complexity may also hinder acceptance among some surgical teams

- Overcoming these challenges through cost-effective system development, expanded training programs, and improved reimbursement frameworks will be essential to ensure sustained growth of the robotically assisted surgical devices market globally

Robotically Assisted Surgical Devices Market Scope

The market is segmented on the basis of type, component, application, and end users.

- By Type

On the basis of type, the Robotically Assisted Surgical Devices market is segmented into Emergency Response and Utility Robots, Surgical Robots, Rehabilitation Robots, and Others. The Surgical Robots segment dominated the largest market revenue share of 52.4% in 2025, driven by the rapid adoption of robotic platforms for minimally invasive surgical procedures. Surgical robots are extensively used in urology, gynecology, orthopedics, and general surgery due to their high precision and enhanced visualization. Hospitals increasingly invest in surgical robotic systems to improve surgical outcomes and reduce complication rates. Growing surgeon preference for robot-assisted techniques supports dominance. Rising volumes of complex surgeries further boost demand. Advanced features such as 3D imaging, tremor filtration, and motion scaling enhance adoption. Favorable reimbursement for robotic procedures in developed markets supports revenue share. Increasing patient preference for minimally invasive procedures strengthens market leadership. Continuous product innovation by key manufacturers contributes to dominance. Training programs and robotic surgery certifications expand usage. High procedural success rates reinforce adoption across healthcare facilities.

The Rehabilitation Robots segment is anticipated to witness the fastest growth, registering a CAGR of 18.9% from 2026 to 2033, driven by rising demand for post-surgical and neurological rehabilitation solutions. Increasing prevalence of stroke, spinal cord injuries, and orthopedic disorders fuels adoption. Rehabilitation robots enable repetitive, controlled movements that enhance patient recovery outcomes. Growing geriatric population increases rehabilitation needs globally. Technological advancements such as AI-driven motion control and real-time feedback systems accelerate growth. Hospitals and rehabilitation centers increasingly adopt robotic therapy systems to improve efficiency. Rising focus on reducing long-term healthcare costs supports adoption. Home-based robotic rehabilitation solutions also contribute to growth. Expanding awareness among physiotherapists boosts usage. Government initiatives supporting rehabilitation technologies further drive expansion. Emerging markets present strong growth opportunities.

- By Component

On the basis of component, the Robotically Assisted Surgical Devices market is segmented into Hardware and Software. The Hardware segment accounted for the largest market revenue share of 64.1% in 2025, driven by high costs associated with robotic arms, control systems, sensors, and imaging components. Surgical robotic hardware forms the core of robotic systems and requires significant capital investment. Hospitals allocate substantial budgets for acquiring advanced robotic platforms. Continuous upgrades of robotic instruments and accessories sustain revenue dominance. Increased installation of new robotic systems globally supports market share. High replacement demand for consumable robotic instruments contributes to growth. Advanced mechanical components enhance precision and durability. Expansion of robotic surgery programs drives hardware procurement. Growing number of surgical procedures performed robotically supports revenue. Strong presence of established manufacturers strengthens dominance. Regulatory approvals for advanced hardware components further support adoption.

The Software segment is expected to witness the fastest growth, with a CAGR of 16.7% from 2026 to 2033, driven by increasing integration of AI and data analytics in robotic systems. Software enhances surgical planning, navigation, and real-time decision support. Growing adoption of machine learning algorithms improves surgical accuracy and outcomes. Software upgrades offer cost-effective system enhancements compared to hardware. Increasing demand for cloud-based robotic platforms supports growth. Hospitals seek advanced visualization and workflow optimization solutions. Continuous software updates extend system lifecycles. Growing cybersecurity and data management requirements boost software investments. Expansion of remote surgery and tele-robotics fuels adoption. Rising focus on personalized surgical solutions supports growth. Regulatory acceptance of AI-based surgical software accelerates expansion.

- By Application

On the basis of application, the Robotically Assisted Surgical Devices market is segmented into Gynaecological Surgery, Non-Invasive Radiosurgery, Urological Surgery, Neurosurgery, Orthopaedic Surgery, Emergency Response Robotic System, General Surgery, Utility Robotic System, and Other Clinical Applications. The Urological Surgery segment held the largest market revenue share of 28.6% in 2025, driven by widespread adoption of robotic systems for prostatectomy and kidney surgeries. Robotic assistance offers superior precision in confined anatomical spaces. High prevalence of prostate cancer globally supports demand. Surgeons prefer robotic systems for improved dexterity and reduced blood loss. Shorter hospital stays increase patient preference. Strong clinical evidence supporting robotic urology procedures drives adoption. Favorable reimbursement policies support growth. Hospitals invest heavily in urology robotic programs. Technological advancements enhance surgical efficiency. Training availability accelerates surgeon adoption. Increasing aging population further drives urological procedure volumes.

The Orthopaedic Surgery segment is expected to register the fastest growth, with a CAGR of 17.4% from 2026 to 2033, driven by rising volumes of joint replacement and spinal surgeries. Robotic systems improve implant alignment and surgical accuracy. Growing incidence of osteoarthritis boosts procedure demand. Aging population fuels orthopedic surgical volumes. Hospitals increasingly adopt robotic orthopedics to reduce revision rates. Technological advancements in navigation systems support growth. Increasing patient awareness of robotic benefits drives demand. Expansion of robotic knee and hip replacement procedures accelerates adoption. Surgeons prefer robotic assistance for reproducibility. Rising healthcare expenditure supports investment. Emerging markets show strong orthopedic robotics adoption potential.

- By End Users

On the basis of end users, the Robotically Assisted Surgical Devices market is segmented into Hospitals, Clinics, Ambulatory Surgical Centres, and Others. The Hospitals segment dominated the largest market revenue share of 61.8% in 2025, driven by high surgical volumes and availability of advanced infrastructure. Hospitals are primary adopters of high-cost robotic systems. Presence of skilled surgeons supports robotic usage. Large patient inflow justifies capital investments. Hospitals perform complex multi-specialty robotic surgeries. Availability of post-operative care supports dominance. Teaching hospitals drive robotic training and adoption. Strong reimbursement frameworks favor hospital-based procedures. Research collaborations boost robotic system installations. Hospitals lead in adopting next-generation robotic platforms. Continuous system upgrades maintain revenue share.

The Ambulatory Surgical Centres segment is projected to witness the fastest growth, registering a CAGR of 15.6% from 2026 to 2033, driven by the shift toward outpatient robotic surgeries. ASCs offer cost-effective alternatives to hospitals. Shorter recovery times increase patient preference. Growing adoption of minimally invasive robotic procedures supports expansion. Technological miniaturization enables ASC adoption. Increasing number of specialty ASCs drives growth. Surgeons prefer ASCs for workflow efficiency. Favorable reimbursement for outpatient procedures supports growth. Rising patient demand for same-day discharge fuels adoption. Expansion of robotic platforms tailored for ASCs accelerates growth. Emerging economies show increasing ASC penetration.

Robotically Assisted Surgical Devices Market Regional Analysis

- North America dominated the robotically assisted surgical devices market with the largest revenue share of approximately 45.6% in 2025, supported by high healthcare expenditure, early adoption of advanced surgical technologies, strong reimbursement frameworks, and the presence of leading market players

- The region benefits from a well-established hospital infrastructure and rapid integration of robotic systems across surgical specialties such as urology, gynecology, cardiothoracic, and general surgery

- Continuous technological advancements and favorable regulatory support have further strengthened market growth

U.S. Robotically Assisted Surgical Devices Market Insight

The U.S. robotically assisted surgical devices market accounted for the major share of the North American market in 2025, driven by high surgical volumes, widespread adoption of minimally invasive procedures, and continuous investments in robotic surgery platforms. The strong presence of leading robotic system manufacturers, combined with increasing surgeon training programs and clinical evidence supporting robotic-assisted outcomes, continues to propel market expansion in the country.

Europe Robotically Assisted Surgical Devices Market Insight

The Europe robotically assisted surgical devices market is projected to expand at a substantial CAGR during the forecast period, supported by increasing adoption of minimally invasive surgical techniques, rising prevalence of chronic diseases, and growing investments in healthcare modernization. Favorable government initiatives, expanding access to advanced surgical care, and increasing acceptance of robotic-assisted procedures across public and private hospitals are key factors driving regional growth.

U.K. Robotically Assisted Surgical Devices Market Insight

The U.K. robotically assisted surgical devices market is anticipated to grow at a noteworthy CAGR, driven by increasing demand for precision-based surgeries, rising focus on reducing hospital stay durations, and growing adoption of robotic systems within the National Health Service (NHS). Ongoing investments in surgical innovation and training programs are further supporting market development.

Germany Robotically Assisted Surgical Devices Market Insight

Germany robotically assisted surgical devices market is expected to witness considerable growth during the forecast period, fueled by its strong medical technology ecosystem, advanced hospital infrastructure, and emphasis on surgical innovation. The country’s leadership in medical engineering and growing adoption of robotic-assisted systems in complex surgical procedures continue to support market expansion.

Asia-Pacific Robotically Assisted Surgical Devices Market Insight

Asia-Pacific robotically assisted surgical devices market is expected to be the fastest-growing region, registering a CAGR of approximately 12.4% during the forecast period. Growth is driven by improving healthcare infrastructure, increasing medical tourism, rising awareness of minimally invasive procedures, and growing investments in advanced surgical technologies across emerging economies. Expanding access to robotic surgery systems in both public and private hospitals is further accelerating market growth.

Japan Robotically Assisted Surgical Devices Market Insight

Japan’s robotically assisted surgical devices market is gaining momentum due to its technologically advanced healthcare system, aging population, and increasing demand for precision and minimally invasive surgical procedures. Strong government support for medical innovation and rapid adoption of robotic systems across specialized surgical applications are key contributors to market growth.

China Robotically Assisted Surgical Devices Market Insight

China robotically assisted surgical devices market accounted for a significant share of the Asia-Pacific market in 2025, driven by rapid expansion of hospital infrastructure, increasing healthcare spending, and growing adoption of advanced surgical technologies. Rising surgical volumes, expanding medical tourism, and increasing investments by both domestic and international players are key factors propelling market growth in the country.

Robotically Assisted Surgical Devices Market Share

The Robotically Assisted Surgical Devices industry is primarily led by well-established companies, including:

• Intuitive Surgical, Inc. (U.S.)

• Medtronic (Ireland)

• Stryker Corporation (U.S.)

• Zimmer Biomet Holdings, Inc. (U.S.)

• Smith & Nephew plc (U.K.)

• Johnson & Johnson (U.S.)

• CMR Surgical Ltd. (U.K.)

• Asensus Surgical, Inc. (U.S.)

• Globus Medical, Inc. (U.S.)

• Renishaw plc (U.K.)

• THINK Surgical, Inc. (U.S.)

• TransEnterix Surgical, Inc. (U.S.)

• Medrobotics Corporation (U.S.)

• Titan Medical Inc. (Canada)

• Accuray Incorporated (U.S.)

• Siemens Healthineers (Germany)

• Fujifilm Holdings Corporation (Japan)

• MicroPort Scientific Corporation (China)

• OMNIlife science (India)

• Avateramedical GmbH (Germany)

Latest Developments in Global Robotically Assisted Surgical Devices Market

- In May 2023, Robocath, a France-based medical robotics company, launched the R-One+ robotic platform aimed at improving precision and safety in interventional procedures such as coronary angioplasty. The R-One+ system uses robotic control via a tablet and joystick interface to reduce radiation exposure for clinicians and improve procedural accuracy in minimally invasive cardiovascular treatments

- In July 2024, SS Innovations International unveiled the SSi Mantra-3 surgical robotic system during an exclusive demonstration event in New York City, showcasing next-generation capabilities with up to five robotic arms and expanded multi-specialty procedural potential. The system was positioned as an affordable and accessible robotic surgery solution aimed at increasing global adoption

- In March 2025, SS Innovations International introduced its Mobile Tele-Surgical Unit at the Second Global Multi-Specialty Robotic Surgery Conference in Gurugram, India, aiming to improve remote surgical access and healthcare delivery by integrating the SSi Mantra robot into a mobile platform. This innovation emphasized telesurgery capability and mobile robotic surgical deployment

- In June 2025, Zimmer Biomet announced it would acquire Monogram Technologies for approximately $177 million to expand its robotic surgical portfolio, including an FDA-approved semi-autonomous knee replacement system, with plans to develop fully autonomous surgical robots by 2027. This acquisition reflected strategic consolidation and expansion of robotic capabilities in orthopedics and broader surgical robotics

- In September 2025, SS Innovations International announced the successful completion of the first robotic telesurgery performed from its MantraM mobile robotic telesurgery unit, where a complex hysterectomy was completed remotely using the SSi Mantra surgical system. The event marked a clinically relevant milestone in remote robotic surgical care delivery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.