Global Robotics End Effector Market

Market Size in USD Billion

CAGR :

%

USD

6.97 Billion

USD

22.54 Billion

2025

2033

USD

6.97 Billion

USD

22.54 Billion

2025

2033

| 2026 –2033 | |

| USD 6.97 Billion | |

| USD 22.54 Billion | |

|

|

|

|

Robotics End Effector Market Size

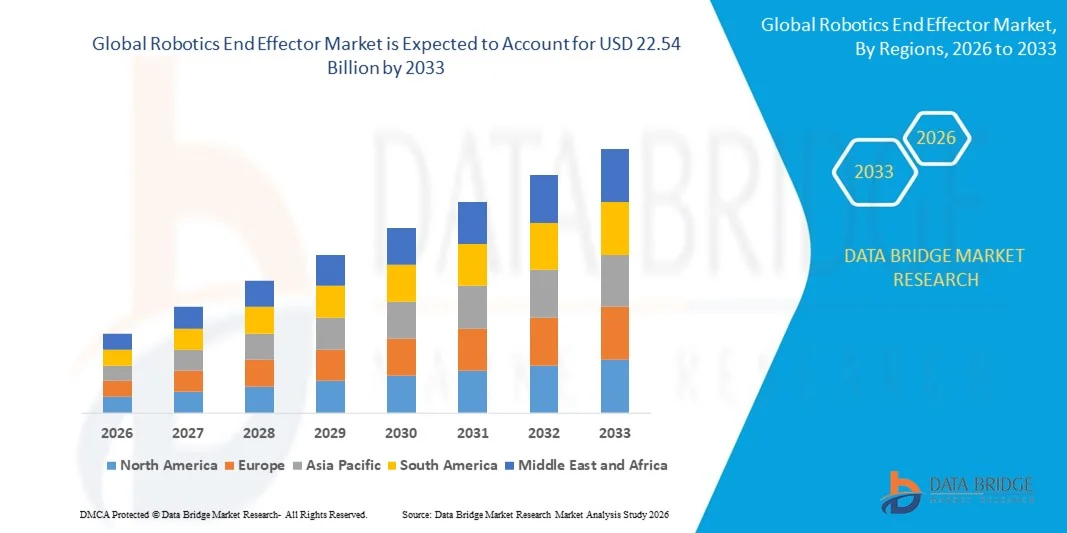

- The global robotics end effector market size was valued at USD 6.97 billion in 2025 and is expected to reach USD 22.54 billion by 2033, at a CAGR of 15.80% during the forecast period

- The market growth is largely fueled by the rising adoption of industrial automation and robotics across manufacturing, automotive, electronics, and logistics sectors, driving increased demand for advanced, precise, and application-specific end-of-arm tools

- Furthermore, continuous technological progress in gripping systems, collaborative robot tooling, and lightweight materials is strengthening integration efficiency and expanding usage across automated production lines, thereby accelerating overall market expansion

Robotics End Effector Market Analysis

- Robotics end effectors, serving as the functional interface between robots and their tasks, are becoming essential components in modern automated operations due to their ability to enhance precision, productivity, and flexibility across handling, welding, assembly, and packaging applications

- The rising demand for end effectors is primarily driven by the rapid adoption of industrial and collaborative robots, growing need for efficient material handling systems, and increasing emphasis on high-accuracy, safe, and adaptable automation solutions

- Asia-Pacific dominated the robotics end effector market with a share of over 62% in 2025, due to the rapid expansion of industrial automation, strong growth in manufacturing activities, and widespread adoption of robotics across automotive and electronics sectors

- North America is expected to be the fastest growing region in the robotics end effector market during the forecast period due to strong demand for automation, expansion of smart manufacturing, and increasing adoption of collaborative robots

- Grippers segment dominated the market with a market share of 38.1% in 2025, due to their widespread adoption across material handling, packaging, and assembly operations. Grippers offer versatility in handling objects of varying shapes, weights, and surface textures, making them indispensable in industries shifting toward automation. Their integration with advanced sensing systems enhances precision and reduces operational errors, supporting high-throughput production environments. The strong demand for electric and adaptive grippers further reinforces market leadership, as manufacturers prioritize energy efficiency and flexibility

Report Scope and Robotics End Effector Market Segmentation

|

Attributes |

Robotics End Effector Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Robotics End Effector Market Trends

Rising Integration of Collaborative Robot-Compatible End Effectors

- A significant trend in the robotics end effector market is the rising integration of end-effectors designed specifically for collaborative robots, driven by the growing deployment of cobots across manufacturing, logistics, and electronics industries. This integration is increasing demand for lightweight, adaptive, and safety-certified tooling that can work in shared workspaces without compromising precision or productivity

- For instance, SCHUNK and OnRobot offer advanced collaborative grippers and tooling systems widely used in assembly and small-part handling operations. Such solutions enhance workflow flexibility and enable robots to safely manage tasks requiring controlled force, reliable gripping, and consistent performance in human-robot environments

- The adoption of collaborative end-effectors is expanding rapidly as industries prioritize automation systems capable of adapting to variable production cycles, diverse product geometries, and frequent changeovers. This is positioning cobot-compatible end-effectors as critical components for next-generation flexible automation platforms

- The manufacturing sector is incorporating advanced grippers, suction systems, and tool changers designed for precision movements and safe interaction, improving task efficiency across assembly lines and packaging stations. This trend is strengthening innovation in user-friendly, plug-and-play tooling solutions

- Industries focused on electronics, automotive components, and warehouse operations are increasing their use of compliant gripping systems to support delicate handling, precise placement, and efficient picking tasks. This is shaping a stronger preference for end-effectors capable of operating reliably in variable production conditions

- The market is witnessing strong interest in adaptive gripping technologies where electric, vacuum, and soft-robotic tools enable robots to handle diverse materials with high accuracy. This rising incorporation of collaborative end-effectors is reinforcing the transition toward flexible, safe, and intelligent automation across global industries

Robotics End Effector Market Dynamics

Driver

Increasing Adoption of Industrial Automation Across Manufacturing Industries

- The increasing reliance on advanced automation across automotive, electronics, metal fabrication, and logistics industries is driving strong demand for robotic end-effectors that support precise, efficient, and high-speed operations. These tools enable robots to perform critical production tasks with greater accuracy and repeatability, improving overall throughput and quality

- For instance, companies such as Zimmer Group supply high-precision grippers and tool changers used extensively in automated assembly and machining processes. These components ensure stable handling, reduce cycle times, and support manufacturers in achieving higher operational efficiency

- The rising deployment of robots across production and material-handling environments is strengthening demand for specialized end-effectors such as multi-finger grippers, welding torches, polishing tools, and vacuum units designed for consistent industrial performance. These tools help facilities optimize workflows and manage complex tasks more effectively

- The shift toward digitalized and highly automated manufacturing systems is accelerating the need for end-effectors that can support advanced handling, inspection, and finishing operations. These technologies enhance productivity and enable companies to meet rising output demands

- The growing expectation for faster production cycles and minimized operational errors continues to strengthen this driver. The requirement for durable, precise, and efficient end-effectors is influencing market growth and positioning these tools as essential components within modern industrial automation frameworks

Restraint/Challenge

High Cost and Technical Complexity of Advanced End-Effectors

- The robotics end effector market faces challenges due to the high cost and technical complexity associated with designing advanced, high-precision tooling systems that must meet demanding industrial performance standards. These requirements increase production difficulties and elevate cost structures for manufacturers

- For instance, companies such as ATI Industrial Automation employ specialized engineering processes and high-grade components to develop force-torque sensors and tool changers. These intricate procedures demand skilled expertise and advanced testing capabilities, raising manufacturing expenses

- Producing end-effectors capable of maintaining accuracy, durability, and consistent performance under challenging industrial conditions requires stringent quality control and precision fabrication steps. These processes extend production timelines and contribute to higher overall costs

- The reliance on specialized materials, sensors, actuators, and electrical components adds pressure to supply chains and affects pricing flexibility. Manufacturers must balance performance requirements with economic feasibility

- Scaling production for complex robotic tooling remains difficult due to the need to maintain reliability while integrating sensors, compliance mechanisms, and adaptive technologies. These challenges collectively place pressure on companies to optimize processes and manage costs while meeting rising demand

Robotics End Effector Market Scope

The market is segmented on the basis of product, application, and end-use.

- By Product

On the basis of product, the robotics end effector market is segmented into welding guns, grippers, tool changers, and suction cups. The grippers segment dominated the market in 2025, holding the largest revenue share of 38.1%, due to their widespread adoption across material handling, packaging, and assembly operations. Grippers offer versatility in handling objects of varying shapes, weights, and surface textures, making them indispensable in industries shifting toward automation. Their integration with advanced sensing systems enhances precision and reduces operational errors, supporting high-throughput production environments. The strong demand for electric and adaptive grippers further reinforces market leadership, as manufacturers prioritize energy efficiency and flexibility.

The tool changers segment is projected to witness the fastest growth rate from 2026 to 2033, driven by the accelerating need for robotic multifunctionality across manufacturing sectors. Tool changers enable robots to switch seamlessly between grippers, welding tools, screwdrivers, and other attachments, reducing downtime and elevating productivity. Their rising adoption aligns with growing demand for flexible automation lines that can accommodate product variations and shorter production cycles. Industries deploying high-mix, low-volume manufacturing rely heavily on tool changers to optimize task diversity, supporting rapid growth in this segment.

- By Application

On the basis of application, the robotics end effector market is segmented into material handling, assembly, welding, and painting. The material handling segment dominated the market in 2025, driven by its extensive use across logistics, warehousing, automotive, and electronics sectors. Robotics end effectors used in material handling enable precise pick-and-place tasks, palletizing, depalletizing, and packaging, supporting high operational efficiency. Improvements in sensor integration, machine vision, and AI-based gripping technologies further enhance reliability and speed. The growing need to streamline supply chain operations and minimize labor-intensive repetitive tasks continues to strengthen the dominance of material handling applications.

The assembly segment is expected to witness the fastest growth from 2026 to 2033, propelled by increasing automation of small-part and micro-component assembly in electronics, medical devices, and automotive manufacturing. Assembly-focused end effectors offer high precision and repeatability, addressing the stringent tolerance requirements of modern production lines. Miniaturization trends and rising demand for complex electronics intensify the need for advanced robotic assembly tools. Continuous innovation in cobot-friendly end effectors and force-controlled gripping technologies further accelerates segment expansion.

- By End-Use

On the basis of end-use, the robotics end effector market is segmented into automotive, metals & machinery, plastics, food & beverage, and electrical & electronics. The automotive segment dominated the market in 2025, supported by large-scale adoption of robots for welding, assembly, material handling, machine tending, and part inspection. Automotive plants rely heavily on specialized end effectors that ensure precision, durability, and consistent performance under high-volume production conditions. The increasing shift toward EV manufacturing has further increased the need for efficient end effectors capable of handling battery modules, lightweight materials, and complex components. High automation maturity and continuous upgrades in robotic tooling reinforce automotive dominance.

The electrical & electronics segment is anticipated to exhibit the fastest growth from 2026 to 2033, fueled by the rapid expansion of semiconductor fabrication, consumer electronics production, and PCB assembly. This industry demands end effectors with extremely high precision and contamination-free handling, supporting tasks involving delicate and miniaturized components. Growth in smart devices, IoT hardware, and high-density chipsets intensifies the need for robotic precision tools. Increasing adoption of collaborative robots in electronics manufacturing further boosts demand for lightweight, adaptive, and sensor-integrated end effectors.

Robotics End Effector Market Regional Analysis

- Asia-Pacific dominated the robotics end effector market with the largest revenue share of over 62% in 2025, driven by the rapid expansion of industrial automation, strong growth in manufacturing activities, and widespread adoption of robotics across automotive and electronics sectors

- The region’s cost-effective production landscape, rising investments in smart factories, and accelerated deployment of industrial robots are strengthening market penetration

- The availability of skilled labor, supportive government initiatives for automation, and fast-paced industrialization across developing economies are contributing to higher consumption of advanced robotic end effectors across key industries

China Robotics End Effector Market Insight

China held the largest share in the Asia-Pacific robotics end effector market in 2025, supported by its dominant manufacturing base, high robot installation rates, and strong presence of electronics and automotive production clusters. The country’s government-driven push for industrial upgrading, expanding smart manufacturing initiatives, and local availability of robotics component suppliers are major growth contributors. Increasing adoption of automation to improve productivity and reduce labor costs further enhances market demand.

India Robotics End Effector Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising automation across automotive, metals, and electronics industries, along with increasing investments in modern manufacturing technologies. The “Make in India” initiative, growth in small and medium-scale manufacturing, and rising adoption of collaborative robots are strengthening demand for robotic end effectors. In addition, increasing use of industrial robots for precision handling and assembly applications is accelerating market expansion.

Europe Robotics End Effector Market Insight

The Europe robotics end effector market is expanding steadily, supported by strong demand for precision automation, advanced manufacturing capabilities, and high adoption of robotics across automotive and machinery sectors. The region emphasizes high-quality production, technological innovation, and sustainable industrial practices, driving the need for advanced grippers, welding tools, and customized end effectors. Increasing integration of robotics in pharmaceuticals, food processing, and electronics is further supporting market growth.

Germany Robotics End Effector Market Insight

Germany’s robotics end effector market is driven by its leadership in industrial automation, strong engineering capabilities, and the presence of major automotive and machinery manufacturers. Well-established research networks, advanced production systems, and high adoption of robotic welding and handling tools propel demand. The country’s focus on precision manufacturing and smart factory implementation continues to support market expansion for high-performance end effectors.

U.K. Robotics End Effector Market Insight

The U.K. market is supported by a growing emphasis on automation in manufacturing, rising investments in robotics R&D, and increasing adoption of advanced robotic tools across aerospace, food processing, and electronics sectors. A strong innovation ecosystem, technological partnerships, and rising demand for flexible automation solutions are enabling the U.K. to maintain a significant position in Europe’s robotics end effector landscape.

North America Robotics End Effector Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for automation, expansion of smart manufacturing, and increasing adoption of collaborative robots. High focus on productivity enhancement, technological advancements in robotics, and rising reliance on precise end-effectors for complex tasks are accelerating market growth. Growing reshoring of manufacturing and strategic partnerships between automation and industrial equipment companies are further supporting demand.

U.S. Robotics End Effector Market Insight

The U.S. accounted for the largest share in the North America robotics end effector market in 2025, supported by its strong industrial robotics ecosystem, extensive R&D infrastructure, and high adoption across automotive, electronics, aerospace, and logistics sectors. The country’s focus on advanced automation, strong presence of key robotics companies, and continuous investment in high-precision manufacturing solutions are driving strong demand for end effectors. Robust technological innovation and a mature industrial base further strengthen its leading position in the region.

Robotics End Effector Market Share

The robotics end effector industry is primarily led by well-established companies, including:

- ZIMMER GROUP (Germany)

- SCHUNK GmbH & Co. KG (Germany)

- Schmalz (Germany)

- DESTACO, A Dover Company (U.S.)

- Robotiq Inc. (Canada)

- Applied Robotics Inc. (U.S.)

- Festo (Germany)

- KUKA AG (Germany)

- Soft Robotics (U.S.)

- strait GmbH (Germany)

- ATI Industrial Automation, Inc. (U.S.)

- Nachi Robotic Systems, Inc. (Japan)

- Rethink Robotics (Germany)

- FANUC Corporation (Japan)

- Robert Bosch GmbH (Germany)

- Precise Automation, Inc. (U.S.)

- MRK-Systeme GmbH (Germany)

- Energid Technologies Corporation (U.S.)

- F&P Robotics AG (Switzerland)

- Productive Robotics, Inc. (U.S.)

- MABI ROBOTIC AG (Switzerland)

- Quanta Storage Inc. (Taiwan)

- Franka Emika GmbH (Germany)

- AUBO Robotics (China)

- Techman Robot (Taiwan)

- Stäubli International AG (Switzerland)

- YASKAWA ELECTRIC CORPORATION (Japan)

- Comau S.p.A. (Italy)

- Teradyne Inc. (U.S.)

- Automatica Kassow Robots (Denmark)

- Vecna (U.S.)

- OMRON Corporation (Japan)

Latest Developments in Global Robotics End Effector Market

- In 2024, Robotiq introduced its PowerPick heavy-duty vacuum gripper, a high-capacity end-effector engineered to support demanding industrial operations that require handling of large, bulky, and heavier materials. This launch significantly enhances Robotiq’s positioning in segments such as warehousing, automotive components, and heavy manufacturing. By enabling robots to manage higher payloads with greater reliability, the solution expands the adoption of automation in industries that previously depended on manual lifting. This innovation directly strengthens the robotics end-effector market by broadening application possibilities and increasing the demand for durable, high-performance gripping technologies

- In 2024, Piab completed the acquisition of Joulin to strengthen its vacuum-based robotic gripping portfolio, marking a major strategic move that integrates Joulin’s expertise in foam-based and large-area grippers. This acquisition allows Piab to offer more versatile and application-specific solutions for packaging, palletizing, and logistics operations. By combining technologies and expanding global reach, the merger enhances product diversification and accelerates adoption of vacuum-based end-effectors across high-growth automation environments. This consolidation boosts market competitiveness and positions Piab as a more dominant supplier in the end-effector industry

- In 2024, SCHUNK launched the EGH Co-act Gripper designed specifically for collaborative robots, aligning with the rising demand for safe, flexible, and user-friendly automation in small-part handling. The electric gripper offers simplified integration, adjustable gripping force, and compliance features essential for human-robot collaboration. This development accelerates the deployment of cobots in electronics, light assembly, and consumer goods manufacturing. By expanding the availability of cobot-compatible gripping solutions, SCHUNK strengthens the market’s transition toward flexible automation and increases the adoption of end-effectors tailored for precision tasks

- In 2024, Zimmer Group expanded its U.S. operations by opening a new North American headquarters in Cincinnati, Ohio, reinforcing the company’s ability to serve integrators, OEMs, and manufacturers across the region. The new facility enhances after-sales support, customization capabilities, and delivery efficiency for robotic end-of-arm tooling. As demand for automation continues to rise in North America, this expansion positions Zimmer Group to capture a larger share of the growing end-effector landscape. The increased regional presence boosts customer accessibility and strengthens the overall supply chain for advanced robotic tooling solutions

- In 2024, OnRobot launched the D:PLOY Palletizing solution to simplify end-of-line automation workflows, offering a system that reduces deployment time from days to hours through its no-code configuration platform. The solution helps manufacturers overcome integration challenges and lowers the cost barrier of adopting robotic palletizing. By making automation more accessible to small and medium-sized enterprises, OnRobot accelerates market expansion and supports broader use of modular end-of-arm systems for packaging and logistics. This launch contributes to increased adoption of user-friendly, plug-and-play end-effector solutions across global manufacturing sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Robotics End Effector Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Robotics End Effector Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Robotics End Effector Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.