Global Roll Trailer Market

Market Size in USD Billion

CAGR :

%

USD

21.24 Billion

USD

34.36 Billion

2024

2032

USD

21.24 Billion

USD

34.36 Billion

2024

2032

| 2025 –2032 | |

| USD 21.24 Billion | |

| USD 34.36 Billion | |

|

|

|

|

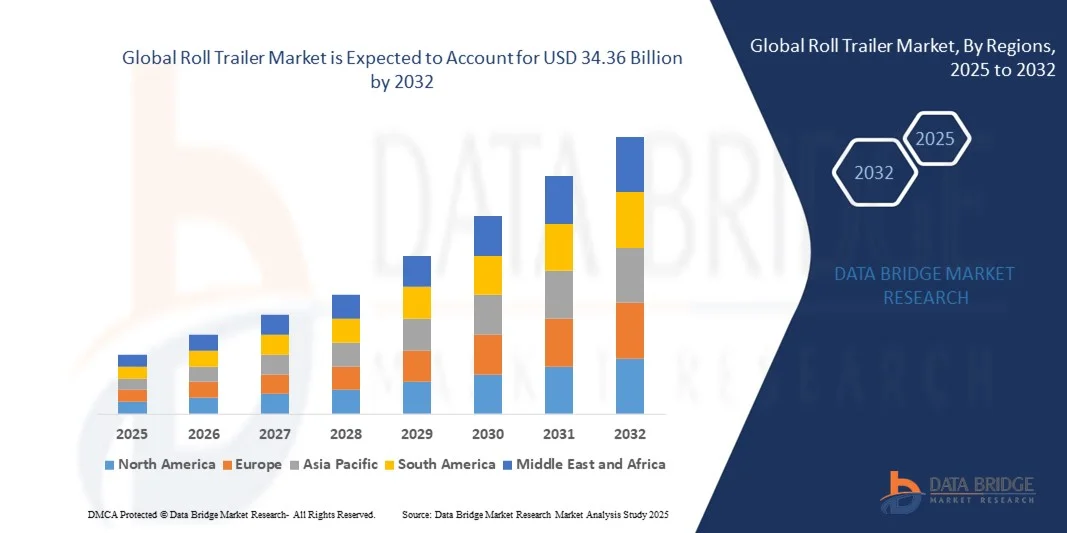

What is the Global Roll Trailer Market Size and Growth Rate?

- The global roll trailer market size was valued at USD 21.24 billion in 2024 and is expected to reach USD 34.36 billion by 2032, at a CAGR of 6.50% during the forecast period

- The growing demand of the trailer for transporting heavy goods and material across the globe, growing number of trade activities worldwide, rising applications of the trailer in shipping as well as in construction industry, increasing usages of the trailer according to the need of the shipment and for various applications which needs efficient operations, surging levels of investment by the government for the development of residential and commercial infrastructure in developing economies are some of the major as well as important factors which will likely to accelerate the growth of the roll trailer market

What are the Major Takeaways of Roll Trailer Market?

- Rising preferences towards the usages of customized trailer according to the customer requirement along with rising demand of the trailer due to their ease of operation which will further contribute by generating immense opportunities that will led to the growth of the roll trailer market in the above-mentioned projected timeframe

- Introduction of cassette systems along with rising number of new entrants which will such asly to act as market restraints factor for the growth of the roll trailer in the above-mentioned projected timeframe. Increasing prices and regulatory pressure which will become the biggest and foremost challenge for the growth of the market

- Asia-Pacific dominated the roll trailer market with the largest revenue share of 43.69% in 2024, driven by rising urbanization, expanding digital infrastructure, and the increasing demand for flexible and cost-effective mobile connectivity solutions

- Asia-Pacific is expected to register the fastest CAGR of 9.24% during the forecast period of 2025 to 2032, driven by rising smartphone penetration, increasing urbanization, and growing disposable incomes in countries such as China, Japan, and India

- The Reseller segment dominated the market in 2024 with a revenue share of 42.5%, benefiting from its simple deployment, lower capital requirements, and flexibility in handling standard container loads efficiently

Report Scope and Roll Trailer Market Segmentation

|

Attributes |

Roll Trailer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Roll Trailer Market?

Adoption of Smart Fleet Management and Digital Logistics Solutions

- A key trend in the global Roll Trailer market is the increasing integration of digital logistics platforms, telematics, and AI-powered fleet management systems to improve operational efficiency, reduce turnaround time, and enhance cargo safety

- For instance, some logistics operators are using IoT-enabled Roll Trailers to monitor real-time location, trailer condition, and cargo load, allowing predictive maintenance and reducing downtime

- AI-based route optimization and automated dispatch systems are being adopted to enhance delivery efficiency, optimize fuel consumption, and lower operational costs across logistics networks

- Integration with mobile apps and online dashboards allows operators to track trailers, schedule maintenance, and manage reservations seamlessly, providing a unified and user-friendly logistics experience

- This trend is reshaping expectations in freight handling and port logistics, prompting companies to adopt digital-first, intelligent, and automated trailer management solutions

- The demand for smart, connected Roll Trailers with real-time monitoring, predictive maintenance, and integration with logistics management platforms is increasing rapidly among shipping, port, and transport operators

What are the Key Drivers of Roll Trailer Market?

- The growing volume of global trade and increasing demand for intermodal transport solutions are major drivers, as roll trailers facilitate efficient container movement in ports, terminals, and warehouses

- For instance, major port operators in North America and Europe are adopting high-capacity Roll Trailers to accelerate container handling and reduce congestion

- Rising investments in logistics infrastructure and smart port initiatives are expanding the market, enabling faster turnaround and improved operational efficiency

- Strategic partnerships between trailer manufacturers and port operators are allowing enhanced customization, better maintenance services, and optimized fleet deployment, strengthening market growth

- Key features such as high payload capacity, low maintenance, modular design, and adaptability to multiple container types are driving adoption in both commercial and industrial logistics operations

Which Factor is Challenging the Growth of the Roll Trailer Market?

- Limited availability of specialized trailers for extreme load capacities or challenging terrains can restrict market expansion in certain regions

- High upfront investment and maintenance costs may discourage smaller logistics operators from adopting modern Roll Trailers

- Operational delays due to infrastructure limitations, such as poorly maintained ports or congested terminals, can reduce trailer efficiency and ROI

- Intense competition from alternative container handling solutions, such as chassis and automated guided vehicles (AGVs), may limit market share growth for traditional Roll Trailers

- Overcoming these challenges through technological innovation, modular design, cost-efficient solutions, and strategic collaborations will be essential for sustained growth in the Roll Trailer market

How is the Roll Trailer Market Segmented?

The Roll Trailer market is segmented on the basis of load capacity, attachment, industry, and sales channel.

- By Load Capacity

On the basis of load capacity, the roll trailer market is segmented into Reseller, Service Operator, Full MVNO, and Enhanced Service. The Reseller segment dominated the market in 2024 with a revenue share of 42.5%, benefiting from its simple deployment, lower capital requirements, and flexibility in handling standard container loads efficiently. Reseller trailers are widely adopted by small logistics operators due to their cost-effectiveness and ease of integration into existing terminal operations.

The Enhanced Service segment is projected to witness the fastest CAGR of 23.1% from 2025 to 2032, driven by the rising demand for high-capacity trailers with AI-enabled monitoring, IoT connectivity, and digital fleet management, appealing to advanced port operators and large logistics service providers.

- By Attachment

On the basis of attachment, the roll trailer market is segmented into Consumer and Enterprise. The Consumer segment held the largest market revenue share of 61.7% in 2024, driven by widespread use in small-scale cargo transport, rental services, and regional logistics solutions. Consumer attachment models are favored for their ease of handling and adaptability for varied container types.

The Enterprise segment is expected to grow at the fastest CAGR of 22.5% from 2025 to 2032, fueled by increasing adoption among large shipping companies, port authorities, and industrial logistics operators who require specialized trailers with integrated monitoring, predictive maintenance, and fleet optimization features.

- By Industry

On the basis of industry, the roll trailer market is segmented into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment dominated in 2024 with a revenue share of 58.3%, as these organizations rely on Roll Trailers to support high-volume operations, intermodal transport, and complex container handling networks. Large enterprises benefit from better scalability, durability, and integration with port automation systems.

The SME segment is anticipated to witness the fastest CAGR of 21.9% from 2025 to 2032, driven by the increasing adoption of modular trailers for small and medium-sized ports, regional logistics hubs, and industrial yards seeking cost-effective, flexible solutions for cargo movement.

- By Sales Channel

On the basis of sales channel, the roll trailer market is segmented into Postpaid MVNO and Prepaid MVNO. The Prepaid MVNO segment held the largest revenue share of 65.4% in 2024, supported by the widespread preference for pay-as-you-go trailer leasing, flexible rental terms, and short-term deployment in ports or terminals. Prepaid trailers are especially popular among seasonal operators and temporary logistics projects.

The Postpaid MVNO segment is projected to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by increasing enterprise contracts, subscription-based trailer leasing services, and the adoption of digital fleet management systems that enable integrated, long-term trailer monitoring and operational efficiency.

Which Region Holds the Largest Share of the Roll Trailer Market?

- Asia-Pacific dominated the roll trailer market with the largest revenue share of 43.69% in 2024, driven by rising urbanization, expanding digital infrastructure, and the increasing demand for flexible and cost-effective mobile connectivity solutions

- Consumers in the region highly value affordable, scalable Roll Trailer options with integrated digital services, fleet management tools, and IoT-enabled monitoring, boosting adoption among both individual and enterprise users

- This widespread adoption is further supported by government initiatives promoting digitalization, the growth of smart logistics hubs, and the presence of a strong manufacturing base for trailers, establishing Asia-Pacific as a preferred region for Roll Trailer operations

China Roll Trailer Market Insight

The China roll trailer market captured the largest revenue share within Asia-Pacific in 2024, fueled by rapid urbanization, high rates of technology adoption, and expanding logistics networks. The growing middle class, demand for affordable trailer leasing, and the rise of smart ports are driving market growth. Domestic operators offering flexible trailer solutions with digital monitoring and fleet management capabilities are further accelerating adoption across residential, commercial, and industrial sectors.

Japan Roll Trailer Market Insight

The Japan roll trailer market is witnessing steady growth due to high-tech adoption, advanced port operations, and consumer preference for smart, integrated logistics solutions. Increasing demand for IoT-enabled trailers, digital fleet management, and predictive maintenance systems is driving adoption among enterprise users. Japan’s aging population is also contributing to the demand for easier-to-handle, automated trailers suitable for both industrial and commercial applications.

Which Region is the Fastest Growing in the Roll Trailer Market?

North America is expected to register the fastest CAGR of 9.24% during the forecast period of 2025 to 2032, driven by rising investments in smart logistics infrastructure, adoption of digital fleet management tools, and increasing demand for flexible, scalable trailer solutions. The region’s focus on automation, predictive maintenance, and AI-enabled monitoring is accelerating Roll Trailer adoption among large enterprises and SMEs asuch as.

U.S. Roll Trailer Market Insight

The U.S. roll trailer market is expanding rapidly due to increasing automation in logistics, growing e-commerce volumes, and demand for cost-effective, scalable trailers. Enterprises are increasingly adopting trailers with IoT integration, real-time tracking, and digital fleet management solutions to optimize operations. The trend of subscription-based or leased trailer models, combined with strong infrastructure and regulatory support, is further propelling market growth across commercial and industrial sectors.

Canada Roll Trailer Market Insight

The Canada roll trailer market is experiencing strong growth, supported by investments in smart port operations, digital logistics platforms, and adoption of automated trailer solutions. Increasing urbanization, robust infrastructure, and the demand for efficient container handling are driving expansion. The availability of flexible trailer options, alongside predictive maintenance and monitoring tools, is encouraging wider adoption among both enterprise and SME segments.

Which are the Top Companies in Roll Trailer Market?

The roll trailer industry is primarily led by well-established companies, including:

- Triton International Limited (Bermuda)

- Novatech (U.S.)

- Seacom Trailer Systems GmbH (Germany)

- MAFI Transport-Systeme GmbH (Germany)

- Ace Brothers Equipment (U.S.)

- Qingdao CIMC Special Vehicles Co., Ltd. (China)

- Qingdao Phillaya International Trading Co., Ltd. (China)

- Buiscar Cargo Solutions BV (Netherlands)

- Schmitz Cargobull (Germany)

- KRONE (Germany)

- Wabash National Corporation (U.S.)

- Utility Trailer Manufacturing Company (U.S.)

- Hyundai Motor Company (South Korea)

- Randon Implementos (Brazil)

- ASHOK LEYLAND (India)

- Mammut Industrial Group (Iran)

- MaxiTRANS (Australia)

- Kässbohrer (Germany)

- Benlee, Inc. (U.S.)

- Roller Die + Forming (U.S.)

What are the Recent Developments in Global Roll Trailer Market?

- In February 2025, Range Energy secured USD 23.5 million in funding to accelerate the commercial rollout of electrified dry-van and reefer platforms, with full-scale production scheduled for 2025, marking a significant step towards sustainable transportation solutions

- In December 2024, Biocoop unveiled its first semi-trailer equipped with Carrier Transicold’s 100% electric Vector eCool unit as part of its plan to electrify 30% of its reefer fleet by 2030, reflecting a strong commitment to reducing emissions in logistics

- In May 2024, Range Energy and Thermo King launched pilot projects across the Americas to integrate electric trailer platforms with hybrid TRUs, targeting faster commercialization of sustainable reefers, highlighting industry collaboration for greener transport

- In May 2024, Carrier Transicold introduced the Vector HE 17 all-electric refrigeration unit, delivering over 16 kW of cooling with 30% lower fuel consumption than previous models, demonstrating notable advancements in energy-efficient refrigeration technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.