Global Roller Trailers Market

Market Size in USD Billion

CAGR :

%

USD

24.24 Billion

USD

31.94 Billion

2024

2032

USD

24.24 Billion

USD

31.94 Billion

2024

2032

| 2025 –2032 | |

| USD 24.24 Billion | |

| USD 31.94 Billion | |

|

|

|

|

What is the Global Roller Trailers Market Size and Growth Rate?

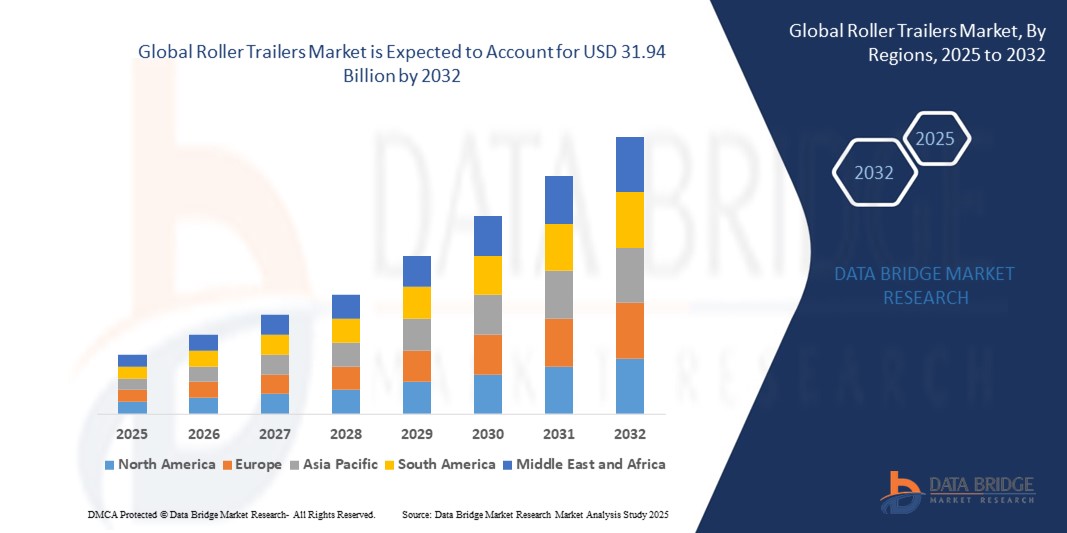

- The global roller trailers market size was valued at USD 24.24 billion in 2024 and is expected to reach USD 31.94 billion by 2032, at a CAGR of 3.49% during the forecast period

- The rise in roll trailer sales is attributed to their exceptional efficiency in facilitating cargo transportation. Significant government entities are actively exploring opportunities to develop industry-specific roll-on/roll-off trailers, experimenting with load capacities for enhanced operational efficiency and versatile applications. This initiative is expected to drive increased roll trailer sales across multiple markets

What are the Major Takeaways of Roller Trailers Market?

- The surge in global trade activities fuels a demand for streamlined transportation, leading to an increased adoption of roll trailers. Businesses seek efficient solutions to handle growing cargo volumes, making roll trailers integral for optimizing logistics and cargo management

- Global investments in port infrastructure underscore the necessity for advanced handling equipment. Roll trailers play a vital role in the modernization of port operations by providing an efficient and adaptable solution. As ports upgrade facilities, the demand for these trailers rises, contributing to market growth

- North America dominated the roller trailers market with the largest revenue share of 32.04% in 2024, driven by strong demand for heavy-duty cargo transportation, advanced logistics infrastructure, and the presence of leading trailer manufacturers

- Asia-Pacific roller trailers market is projected to grow at the fastest CAGR of 7.8% from 2025 to 2032, driven by rapid industrialization, expanding shipping and construction sectors, and increasing vehicle and machinery production in China, India, and Southeast Asia

- The below 30 tons segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the high demand for lighter trailers in small to medium logistics and construction operations

Report Scope and Roller Trailers Market Segmentation

|

Attributes |

Roller Trailers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Roller Trailers Market?

Automation and Digital Integration in Trailer Servicing

- A prominent trend in the global roller trailers market is the growing integration of automation, digital diagnostics, and connected technologies within trailer servicing equipment such as tire changers, wheel balancers, and alignment machines. These innovations are enhancing workshop productivity, accuracy, and safety

- For instance, Hunter Engineering’s automated alignment systems now include integration with vehicle ADAS calibration tools, reducing service time and improving precision. Similarly, Corghi’s “Artiglio” tire changers employ automatic bead-breaking and leverless mounting to reduce operator fatigue and prevent tire damage

- IoT connectivity enables trailer servicing equipment to send real-time performance data, maintenance alerts, and calibration reminders to technicians’ devices, promoting proactive upkeep and minimizing downtime. Certain systems feature AI-based diagnostics that tailor service parameters for different vehicle models

- Touchscreen interfaces and remote operation capabilities are streamlining workflows in both independent workshops and OEM-authorized service centers, allowing technicians instant access to vehicle specs, service histories, and training resources without leaving the workstation

- Leading companies such as Snap-on and John Bean are investing in digital ecosystems that integrate trailer service data with customer management platforms, facilitating faster, transparent, and more personalized service offerings

- This trend is fostering a transition toward smarter, connected, and operator-friendly equipment, positioning advanced trailer servicing tools as essential for modern automotive maintenance operations

What are the Key Drivers of Roller Trailers Market?

- The expanding global vehicle fleet, alongside increased demand for high-performance and fuel-efficient tires, is a key driver for Roller Trailers adoption

- For instance, in March 2024, Bosch Automotive Service Solutions expanded its workshop portfolio with high-speed wheel balancers and ADAS-compatible alignment systems to meet rising precision servicing demands

- The increasing use of larger and low-profile tires in passenger vehicles and SUVs is prompting workshops to invest in advanced changers and balancers equipped to handle complex wheel assemblies

- Regulatory mandates on tire safety and periodic inspections, particularly in Europe and Asia-Pacific, sustain demand for alignment, balancing, and tread depth measurement tools

- The surge in electric vehicle (EV) adoption further fuels market growth, as EVs require frequent tire maintenance due to higher torque loads, encouraging the adoption of EV-specific servicing equipment

- In addition, the rise of automated service centers and franchise quick-fit chains is accelerating equipment upgrades aimed at improving service speed, accuracy, and customer satisfaction

Which Factor is challenging the Growth of the Roller Trailers Market?

- The high initial costs of advanced roller trailers equipment remain a significant obstacle, especially for small and independent workshops in developing regions

- For instance, fully automated alignment systems with ADAS features can be substantially more expensive than basic equipment, leading to slower returns on investment for low-volume service providers

- The requirement for skilled technicians to operate modern equipment poses challenges, as improper use can cause inaccurate servicing or damage, deterring some businesses from upgrading

- Rapid technological advancements risk equipment obsolescence within a few years, raising concerns over long-term value and upgrade expenses

- Volatility in raw material prices, especially steel and electronic components, can increase manufacturing costs and consequently, equipment prices

- Overcoming these barriers will necessitate manufacturers offering flexible financing, modular upgrade options, and comprehensive training programs to broaden accessibility of advanced servicing solutions

How is the Roller Trailers Market Segmented?

The market is segmented on the basis of load capacity, attachment, industry, and sales channel..

- By Load Capacity

On the basis of load capacity, the roller trailers market is segmented into below 30 tons, 30-50 tons, 50-100 tons, and above 100 tons. The below 30 tons segment dominated the market with the largest revenue share of 38.5% in 2024, driven by the high demand for lighter trailers in small to medium logistics and construction operations. These trailers offer flexibility, easier handling, and cost-effectiveness, making them popular among various end users.

The 50-100 tons segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand in heavy-duty shipping and large-scale construction projects that require robust transportation solutions for oversized and heavy cargo.

- By Attachment

On the basis of attachment, the market is segmented into fixed gooseneck roll trailer and detachable gooseneck roll trailer. The fixed gooseneck roll trailer segment held the largest revenue share of 54.2% in 2024, favored for its durability, stability, and lower maintenance costs, making it a preferred choice for consistent heavy transport applications.

The detachable gooseneck roll trailer segment is anticipated to register the fastest CAGR from 2025 to 2032, as its versatility and ease of loading/unloading attract industries requiring frequent trailer reconfiguration.

- By Industry

On the basis of industry, the roller trailers market is segmented into shipping industry, construction industry, and others. The shipping industry segment accounted for the largest market revenue share of 45.7% in 2024, owing to the increasing volume of global maritime trade and the need for efficient cargo movement.

The construction industry segment is expected to experience the fastest growth rate over the forecast period, driven by rising infrastructure projects and the demand for heavy material transportation solutions.

- By Sales Channel

On the basis of sales channel, the market is segmented into direct sales and distributor. The direct sales segment dominated the market with the largest revenue share of 60.3% in 2024, benefiting from strong relationships between manufacturers and large industrial buyers who prefer customized solutions and after-sales support.

The distributor segment is projected to register the fastest CAGR from 2025 to 2032, supported by expanding dealer networks and the growing presence of distributors in emerging markets facilitating wider product reach.

Which Region Holds the Largest Share of the Roller Trailers Market?

- North America dominated the roller trailers market with the largest revenue share of 32.04% in 2024, driven by strong demand for heavy-duty cargo transportation, advanced logistics infrastructure, and the presence of leading trailer manufacturers

- The region benefits from well-established road networks, high industrial activity, and a growing preference for specialized roll trailers in shipping, construction, and heavy equipment transport

- Moreover, ongoing investments in fleet expansion and modernization across commercial and industrial sectors are further propelling market demand

U.S. Roller Trailers Market Insight

The U.S. roller trailers market captured the largest revenue share in 2024 within North America, fueled by the strong presence of industrial and construction companies, high adoption of advanced trailer designs, and stringent safety regulations. The demand for customized trailers for heavy machinery and cargo transport continues to drive growth, supported by local manufacturers offering specialized solutions.

Europe Roller Trailers Market Insight

The Europe roller trailers market is projected to witness significant growth over the forecast period, driven by increasing infrastructure development, stringent vehicle weight regulations, and growing demand for efficient cargo handling solutions. Rising industrial activity in Germany, France, and Italy, along with modernization of logistics fleets, is boosting market adoption.

Germany Roller Trailers Market Insight

Germany’s market is fueled by its position as a leading industrial and manufacturing hub, increasing investments in fleet modernization, and the adoption of technologically advanced trailers. The focus on efficiency, safety, and high-load capacity solutions is prompting strong demand in both domestic and export-oriented industries.

U.K. Roller Trailers Market Insight

The U.K. market is anticipated to grow steadily due to expanding commercial transport networks, rising construction projects, and increased demand for high-capacity trailers. Awareness of safety standards and regulations, along with the adoption of modern logistics solutions, is driving market growth.

Which Region is the Fastest Growing Region in the Roller Trailers Market?

Asia-Pacific roller trailers market is projected to grow at the fastest CAGR of 7.8% from 2025 to 2032, driven by rapid industrialization, expanding shipping and construction sectors, and increasing vehicle and machinery production in China, India, and Southeast Asia. Rising disposable incomes and government initiatives to improve logistics infrastructure are fostering the adoption of advanced roller trailers.

China Roller Trailers Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, attributed to booming industrial output, expanding infrastructure projects, and a growing network of logistics and transportation companies. The availability of cost-effective, locally manufactured trailers further accelerates market adoption.

Japan Roller Trailers Market Insight

Japan’s market growth is supported by its advanced industrial technology, high safety standards, and the adoption of space-efficient, multi-functional roller trailers. Compact urban and industrial spaces are driving demand for trailers optimized for flexibility, durability, and ease of maneuvering.

Which are the Top Companies in Roller Trailers Market?

The roller trailers industry is primarily led by well-established companies, including:

- Triton International Limited (U.S.)

- Novatech (Canada)

- Seacom Trailer Systems GmbH (Germany)

- MAFI Transport-Systeme GmbH (Germany)

- Ace Brothers Equipment (U.S.)

- Qingdao CIMC Special Vehicles Co., Ltd (China)

- Qingdao Phillaya International Trading Co., LTD. (China)

- Buiscar Cargo Solutions BV (Netherlands)

- Schmitz Cargobull (Germany)

- Bernard KRONE Holdings SE & Co. KG (Germany)

- Wabash National Corporation (U.S.)

- Utility Trailer Manufacturing Company, LLC (U.S.)

- Hyundai Motor Company (South Korea)

- Randon Implementos (Brazil)

- ASHOK LEYLAND (India)

- Mammut Industrial Group (Switzerland)

- MaxiTRANS (Australia)

- Kässbohrer (Germany)

- Benlee, Inc. (U.S.)

- Roller Die + Forming (U.S.)

What are the Recent Developments in Global Roller Trailers Market?

- In September, 2023 Triton International confirmed the successful completion of its acquisition by Brookfield Infrastructure. The transaction, announced earlier, delivers substantial value to Triton's shareholders, offering USD 68.50 in cash and 0.3895 BIPC class A exchangeable shares per Triton common share. With the support of Brookfield Infrastructure, Triton aims to leverage this strategic move to enhance its leadership position in the industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.