Global Rolling Stock Management Market

Market Size in USD Billion

CAGR :

%

USD

53.74 Billion

USD

77.37 Billion

2024

2032

USD

53.74 Billion

USD

77.37 Billion

2024

2032

| 2025 –2032 | |

| USD 53.74 Billion | |

| USD 77.37 Billion | |

|

|

|

|

Rolling Stock Management Market Analysis

The rolling stock management market has seen significant advancements in both technology and methods, driving its growth. One key development is the integration of IoT (Internet of Things) and AI (Artificial Intelligence) for predictive maintenance. IoT sensors installed on rolling stock collect real-time data on various parameters such as engine performance, wheel condition, and track wear, allowing for predictive analysis. AI algorithms process this data to predict maintenance needs, reducing downtime and enhancing efficiency.

Another technological advancement is the use of automated fleet management systems that enable efficient scheduling, monitoring, and tracking of trains. These systems use GPS and real-time data to optimize routes, ensuring fuel efficiency and on-time performance.

The growth in this market is further fueled by increased investments in smart rail infrastructure and the growing demand for urban mobility solutions. Governments and private companies are focusing on upgrading railway networks, leading to the adoption of these advanced technologies. The global shift towards sustainability and the need for cost-effective solutions continue to propel the market, making rolling stock management systems crucial for future growth.

Rolling Stock Management Market Size

The global rolling stock management market size was valued at USD 53.74 billion in 2024 and is projected to reach USD 77.37 billion by 2032, with a CAGR of 4.66% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Rolling Stock Management Market Trends

“Adoption of Predictive Maintenance Technologies”

One key trend driving the growth of the rolling stock management market is the adoption of predictive maintenance technologies. These systems use sensors and advanced analytics to monitor train components in real-time, detecting early signs of wear or failure. This reduces the likelihood of unplanned downtime, enhances operational efficiency, and cuts maintenance costs. For instance, Siemens Mobility’s Digital Train Lab uses AI-driven predictive maintenance to optimize fleet management and reduce maintenance expenditures. By leveraging IoT and big data analytics, operators can predict failures before they occur, allowing for timely interventions and minimizing disruptions, which significantly contributes to the market's expansion.

Report Scope and Rolling Stock Management Market Segmentation

|

Attributes |

Rolling Stock Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Bombardier (Canada), Alstom (France), GENERAL ELECTRIC (U.S.), Siemens (Germany), ABB (Switzerland), Hitachi, Ltd (Japan), MITSUBISHI HEAVY INDUSTRIES, LTD (Japan), Thales Group (France), Trimble Inc (U.S.), Tech Mahindra Limited (India), TRANSMASHHOLDING (Russia), Advantech Co., Ltd. (Taiwan), Toshiba Corporation (Japan), Indra (Spain), EUROTECH (Italy), BENTLEY SYSTEMS, INCORPORATED (U.S.), Stadler Rail (Switzerland), EKE-Electronics Ltd (Finland), and DANOBATGROUP (Spain) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Rolling Stock Management Market Definition

Rolling stock management refers to the process of overseeing and maintaining a railway system's fleet of vehicles, including locomotives, passenger cars, freight cars, and specialized equipment. This management involves tasks such as scheduling, maintenance, repairs, procurement, and tracking the utilization of rolling stock to ensure efficiency, safety, and cost-effectiveness. It includes managing the life cycle of the assets, monitoring performance, and ensuring compliance with safety regulations. Modern rolling stock management often utilizes advanced technologies such as IoT sensors and predictive analytics to optimize operations, reduce downtime, and improve overall fleet performance.

Rolling Stock Management Market Dynamics

Drivers

- Integration with Smart City Solutions

As cities embrace smart technologies, the integration of rolling stock management systems with other urban transport solutions is becoming a key driver in the market. This integration allows seamless communication between different modes of transport, such as buses, trains, and metros, optimizing scheduling, reducing congestion, and enhancing overall efficiency. For instance, the city of Singapore integrates its rail systems with smart traffic management tools, improving coordination and reducing delays. Such systems allow real-time data exchange, helping operators manage fleets dynamically and respond to congestion or disruptions swiftly. This not only enhances service delivery but also contributes to a more sustainable and efficient urban transport ecosystem, accelerating the adoption of advanced rolling stock management solutions.

- Growing Demand for Sustainable Transport

The shift towards sustainable and environmentally friendly transport solutions is a significant driver for the rolling stock management market. With increasing concerns about climate change, there is a strong push for energy-efficient rail systems that reduce carbon emissions. Rolling stock fleets are adopting electric-powered trains and hybrid systems, which require precise management to optimize energy consumption and reduce environmental impact. For instance, the implementation of energy-efficient trains by companies such as Alstom with their hydrogen-powered trains in Europe helps lower emissions while ensuring cost-effective operations. Effective rolling stock management ensures these systems perform optimally, supporting sustainability goals and enhancing operational efficiency, which in turn drives the market growth.

Opportunities

- Technological Advancements in IoT and AI

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) in rolling stock management is revolutionizing the market by enabling real-time monitoring, predictive analytics, and automated decision-making. IoT sensors embedded in trains and tracks collect vast amounts of data, which AI algorithms analyze to predict potential failures and optimize maintenance schedules. This reduces unexpected breakdowns, improves asset utilization, and minimizes downtime. For instance, Siemens' digital rail services leverage IoT and AI to offer predictive maintenance, significantly enhancing operational efficiency. The growing need for such intelligent, data-driven solutions presents substantial opportunities for market players to innovate and provide cutting-edge technologies in rolling stock management systems.

- Growing Freight Transport Demand

The growing global demand for freight transportation, driven by cross-border trade, e-commerce, and expanding logistics networks, is significantly impacting the rolling stock management market. With more goods being transported across regions, there is an increasing need for efficient fleet management to ensure timely and secure delivery. Advanced rolling stock management systems are being adopted to optimize asset utilization, reduce delays, and improve tracking. For instance, the expansion of the China-Europe freight rail corridors has led to greater demand for efficient rolling stock management to handle the increased freight volumes, ensuring seamless cross-border logistics. This trend presents a major growth opportunity for companies offering innovative fleet management solutions.

Restraints/Challenges

- High Initial Investment Costs

High initial investment costs represent a major restraint for the rolling stock management market. Purchasing locomotives, carriages, and the necessary infrastructure requires significant capital, which can be a barrier for smaller operators or those with limited access to financing. The costs associated with fleet expansion and upgrades can strain budgets, particularly for regions with limited public funding or private investment. In addition, maintenance and operational expenses add to the financial burden over the long term. This financial pressure can result in delays or inability to modernize fleets, limiting the market's growth potential and hindering the overall efficiency of rail operators, particularly in less economically developed regions.

- Data Management Complexity

Data management complexity is a significant restraint in the rolling stock management market. The vast amount of data generated by rolling stock assets, including maintenance schedules, real-time location tracking, fuel consumption, and sensor data, requires highly sophisticated systems for effective management and analysis. Without these systems, operators may struggle to derive actionable insights, leading to inefficiencies. Data silos, inaccurate tracking, and delayed updates further complicate decision-making processes. The inability to manage this data effectively can result in higher operational costs, increased downtime, and underutilization of assets. This complexity limits operational efficiency and hinders the ability of organizations to maintain optimal performance and cost-effectiveness in the rolling stock sector.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Rolling Stock Management Market Scope

The market is segmented on the basis of product, train type, type, rain management, infrastructure management, maintenance service and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Locomotive

- Rapid Transit Vehicle

- Wagon

Train Type

- Rail Freight

- Passenger Rail

Type

- Diesel

- Electric

Rail Management

- Remote Diagnostic Management

- Wayside Management

- Train Management

- Asset Management

- Cab Advisory

- Others

Infrastructure Management

- Control Room Management

- Station Management

- Automatic Fare Collection Management

- Others

Maintenance Service

- Corrective Maintenance

- Preventive Maintenance

- Predictive Maintenance

Application

- Station

- Automatic Fare Collection

- Others

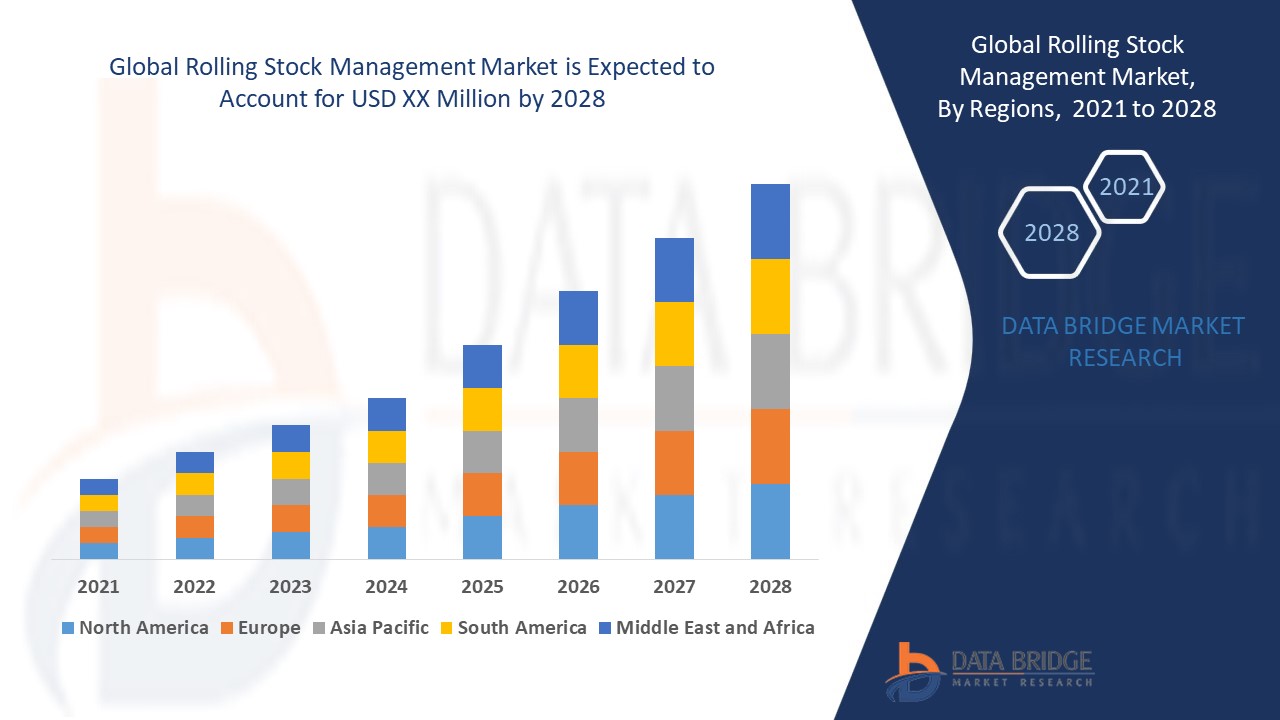

Rolling Stock Management Market Regional Analysis

The market is analysed and market size insights and trends are provided by product, train type, type, rain management, infrastructure management, maintenance service and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe is expected to dominate the rolling stock management market due to advancements in railway technologies and a strong focus on innovative solutions to extend the life cycle of rolling stocks. The region’s investment in modernizing rail infrastructure and adopting predictive maintenance technologies further drives the growth and adoption of rolling stock management solutions.

Asia Pacific is expected to show significant growth in the rolling stock management market due to rapid urbanization and economic development. With the largest high-speed rail network and extensive freight systems, the region emphasizes efficient management technologies to enhance connectivity, mobility, and sustainability, ensuring safe, reliable, and optimized transportation services.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Rolling Stock Management Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Rolling Stock Management Market Leaders Operating in the Market Are:

- Bombardier (Canada)

- Alstom (France)

- GENERAL ELECTRIC (U.S.)

- Siemens (Germany)

- ABB (Switzerland)

- Hitachi, Ltd (Japan)

- MITSUBISHI HEAVY INDUSTRIES, LTD (Japan)

- Thales Group (France)

- Trimble Inc (U.S.)

- Tech Mahindra Limited (India)

- TRANSMASHHOLDING (Russia)

- Advantech Co., Ltd. (Taiwan)

- Toshiba Corporation (Japan)

- Indra (Spain)

- EUROTECH (Italy)

- BENTLEY SYSTEMS, INCORPORATED (U.S.)

- Stadler Rail (Switzerland)

- EKE-Electronics Ltd (Finland)

- DANOBATGROUP (Spain)

Latest Developments in Rolling Stock Management Market

- In February 2024, Siemens Mobility launched a new leasing business, Smart Train Lease (STL), offering flexible, short-term rentals of its Mireo Smart trains across Europe. The leasing service includes battery, hydrogen, and electric versions of the multiple-unit trains, allowing operators to quickly scale up and meet dynamic transportation needs in different regions

- In March 2023, The Indian Central Railways (CR) announced plans to construct six new suburban railway stations in Mumbai, expanding the city’s local train network. This initiative aims to improve accessibility, ease overcrowding, and reduce congestion in Mumbai’s extensive suburban rail system. The total number of CR stations in Mumbai will increase to 86

- In February 2023, Stadler Rail AG partnered with ASPIRE Engineering Research Centre and Utah State University to develop a battery-powered passenger train based on the FLIRT Akku concept. This collaboration focuses on creating innovative, environmentally friendly transport solutions, marking a significant step toward sustainable rail systems that rely on clean energy sources such as batteries

- In January 2023, Siemens Mobility secured its largest-ever locomotive order from Indian Railways, receiving a purchase order for 1,200 locomotives, each with 9,000 HP. This significant order demonstrates Siemens’ commitment to strengthening India’s railway infrastructure and contributes to the country's modernization efforts, enhancing the capacity and efficiency of its vast rail network

- In March 2022, Saudi Arabia Railways (SAR) inaugurated the Al-Qurayyat passenger train station as part of its plan to introduce northbound passenger train services. This move is part of SAR’s broader strategy to expand its railway infrastructure, improving regional connectivity and providing more efficient transportation options for passengers traveling within northern Saudi Arabia

- In January 2022, Wabtec Corporation acquired MASU, a key player in the rail and automotive friction products sector. This strategic acquisition enables Wabtec to enhance its brake product portfolio and strengthen its presence in the rail industry. The move is expected to accelerate growth, expand its installed base, and improve the performance of rail-related technologies

- In May 2021, France’s SNCF, in partnership with Railenium, Thales, Spirops, Bosch, and Alstom, began testing a new autonomous regional train prototype. The customized Regio 2N train is being tested for integration into France’s rail network, marking a significant step towards autonomous transportation systems, promising improved efficiency, and sustainable operations for regional trains

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.