Global Roof Coatings Market

Market Size in USD Billion

CAGR :

%

USD

6.58 Billion

USD

10.33 Billion

2024

2032

USD

6.58 Billion

USD

10.33 Billion

2024

2032

| 2025 –2032 | |

| USD 6.58 Billion | |

| USD 10.33 Billion | |

|

|

|

|

Roof Coatings Market Size

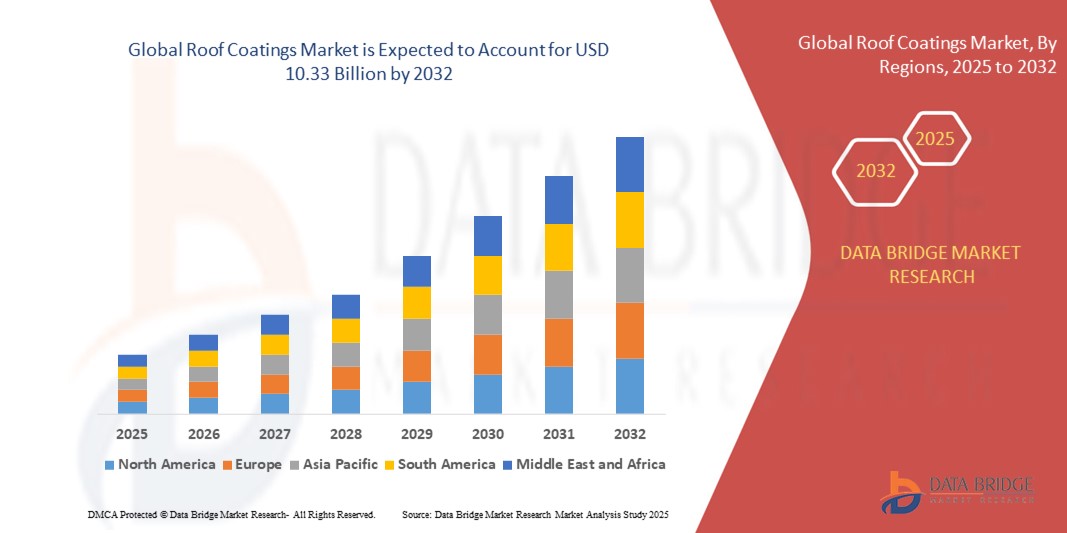

- The global roof coatings market size was valued at USD 6.58 billion in 2024 and is expected to reach USD 10.33 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fueled by the increasing focus on energy-efficient and sustainable building materials, rising demand for roof protection solutions, and growing construction and infrastructure activities worldwide

- Growing investments in R&D for advanced coating formulations to enhance performance, durability, and environmental compliance are further propelling market expansion

Roof Coatings Market Analysis

- Rising awareness regarding green building practices and stringent environmental regulations are accelerating the adoption of eco-friendly roof coatings

- Increasing demand for reflective and cool roof coatings to reduce urban heat island effects and energy consumption in commercial and residential buildings is driving market growth

- Asia-Pacific by dominated the roof coatings market with the largest revenue share of 41.2% in 2024, driven rapid urbanization, booming construction activities, and rising awareness regarding energy-efficient building materials. Government initiatives promoting sustainable infrastructure and increasing foreign investments in real estate further accelerate the demand for advanced roof coating solutions across the region

- North America region is expected to witness the highest growth rate in the global roof coatings market, driven by increasing awareness about preventive roof maintenance, adoption of green building certifications, and technological advancements in coating materials offering long-term durability

- The Acrylic segment held the largest market revenue share in 2024, driven by its cost-effectiveness, strong UV resistance, and ease of application across diverse roofing systems. Acrylic coatings are widely preferred for energy-efficient cool roofs due to their excellent reflectivity and weatherproofing properties

Report Scope and Roof Coatings Market Segmentation

|

Attributes |

Roof Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Roof Coatings Market Trends

Rising Demand For Energy-Efficient And Sustainable Roofing Solutions

- The increasing emphasis on energy-efficient construction is driving the adoption of roof coatings designed to reduce heat absorption and improve building insulation. These coatings significantly lower cooling energy demands in commercial and residential buildings, leading to cost savings and reduced carbon emissions. The growing focus on sustainability has made reflective and cool roof coatings a preferred choice among eco-conscious developers

- The growing preference for eco-friendly and low-VOC coatings is reshaping the roofing industry as governments impose stricter environmental regulations. Water-based acrylics and bio-based coatings are becoming popular as they minimize environmental impact while maintaining high performance. Manufacturers are now investing heavily in R&D to develop coatings with improved durability and compliance with green building standard

- The shift toward green building certifications such as LEED and BREEAM is accelerating the use of reflective and cool roof coatings that help reduce urban heat islands and carbon footprints. These certifications incentivize property owners and developers to choose sustainable materials, boosting market growth across industrial and residential projects

- For instance, in 2023, several commercial projects in Europe reported significant energy savings after applying reflective roof coatings. The use of these coatings not only lowered cooling costs but also improved thermal comfort for building occupants, highlighting their economic and environmental benefits

- While the adoption of sustainable roof coatings is increasing, wider market penetration depends on continued product innovation, cost efficiency, and the development of region-specific formulations. Manufacturers must address climate-specific challenges such as extreme heat, heavy rainfall, and snow to meet diverse regional demands effectively

Roof Coatings Market Dynamics

Driver

Growing Construction Activities And Rising Focus On Roof Protection

- The global construction boom, particularly in residential and commercial infrastructure, is driving demand for durable and weather-resistant roof coatings. These coatings protect roofs against UV degradation, water infiltration, and thermal stress, extending their operational lifespan significantly. The rising preference for preventive maintenance solutions is boosting market demand in both developed and emerging economies

- Builders and property owners are increasingly aware of the cost savings associated with preventive roof maintenance. Regular application of roof coatings reduces the frequency of expensive roof replacements and repairs, enhancing building sustainability. This awareness is fostering higher adoption rates among commercial property developers and municipal infrastructure projects

- Government-backed infrastructure programs and private real estate investments are boosting the use of high-performance coatings in both new constructions and refurbishment projects worldwide. Urbanization trends in Asia-Pacific and the Middle East are further accelerating the demand for advanced roofing solutions offering long-term protection

- For instance, in 2022, large-scale urban development initiatives in the Middle East incorporated elastomeric and polyurethane roof coatings. These coatings not only provided resistance to extreme heat but also improved building energy efficiency, supporting the region’s sustainability goals

- While construction activity and preventive maintenance awareness are key growth drivers, ensuring cost-effective and easy-to-apply coating solutions will be critical. Targeting smaller contractors and individual homeowners with simplified application products can open additional market opportunities

Restraint/Challenge

Volatile Raw Material Prices And Limited Awareness In Emerging Markets

- The fluctuating prices of key raw materials such as acrylics, bitumen, and polyurethane significantly impact production costs and final product pricing. Manufacturers face challenges in maintaining profit margins during periods of high raw material inflation, leading to potential price hikes for end-users and reduced competitiveness in price-sensitive markets

- In emerging economies, limited awareness about the long-term benefits of roof coatings often results in low adoption rates. Property owners and contractors sometimes prioritize short-term cost savings over energy efficiency and durability, slowing down market growth in these regions. Targeted educational campaigns are required to highlight the financial and environmental benefits of modern roof coatings

- Supply chain disruptions and uneven distribution networks further limit access to advanced roof coating products, especially in rural or remote areas. These regions often rely on conventional roofing materials that lack the protective and energy-saving properties of modern coatings, creating a significant untapped market potential

- For instance, in 2023, small-scale contractors in parts of Africa and Southeast Asia cited fluctuating prices and lack of product knowledge as key reasons for continuing with traditional roofing options. Expanding distribution channels and technical training programs can help overcome these barriers over time

- Addressing raw material price volatility through localized sourcing and expanding awareness campaigns in developing regions will be essential. Partnerships with regional governments and private distributors can help improve accessibility and affordability for end-users

Roof Coatings Market Scope

The market is segmented on the basis of coating type, substrate type, technology, application method, roof type, and end-user.

- By Coating Type

On the basis of coating type, the roof coatings market is segmented into Acrylic, Silicone, Polyurethane, Bituminous, Elastomeric, and Others. The Acrylic segment held the largest market revenue share in 2024, driven by its cost-effectiveness, strong UV resistance, and ease of application across diverse roofing systems. Acrylic coatings are widely preferred for energy-efficient cool roofs due to their excellent reflectivity and weatherproofing properties.

The Silicone segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior waterproofing capabilities and ability to perform well in extreme weather conditions. Silicone coatings offer long-lasting protection with minimal maintenance, making them ideal for commercial and industrial applications.

- By Substrate Type

On the basis of substrate type, the roof coatings market is segmented into Metal, Asphalt, Membrane, Concrete, Plastic, and Others. The Metal segment held the largest market revenue share in 2024 owing to the widespread use of metal roofing in industrial and commercial buildings requiring long-term corrosion protection. Roof coatings enhance the lifespan of metal surfaces while improving thermal performance.

The Asphalt segment is expected to witness the fastest growth rate from 2025 to 2032, supported by rising renovation activities in residential buildings with asphalt-based roofs and the growing popularity of cool roof solutions for heat reduction.

- By Technology

On the basis of technology, the roof coatings market is segmented into Water-Based and Solvent-Based. The Water-Based segment dominated the market in 2024 due to its eco-friendly nature, low VOC emissions, and compliance with stringent environmental regulations. Increasing demand for sustainable construction materials continues to favor water-based formulations.

The Solvent-Based segment is expected to witness the fastest growth rate from 2025 to 2032 as these coatings provide excellent adhesion and durability, especially in regions with high humidity and rainfall where water resistance is critical.

- By Application Method

On the basis of application method, the roof coatings market is segmented into Spray, Roll, Brush, and Others. The Spray segment accounted for the largest share in 2024, driven by its efficiency in covering large roof surfaces quickly and providing a uniform finish. The method is preferred in commercial projects to minimize labor costs and time.

The Roll segment is expected to witness the fastest growth rate from 2025 to 2032 as it offers precision in application for small- and medium-sized roofs, making it suitable for residential and localized repair works.

- By Roof Type

On the basis of roof type, the roof coatings market is segmented into Flat, Low-Steep, Steep, and Others. The Flat segment led the market in 2024 owing to the high adoption of flat roofs in commercial and industrial buildings, where coatings provide essential waterproofing and energy savings.

The Steep segment is expected to witness the fastest growth rate from 2025 to 2032 as urban residential construction projects increasingly incorporate steep-slope roofs requiring aesthetic and protective coating solutions.

- By End-User

On the basis of end-user, the roof coatings market is segmented into Residential, Commercial, and Industrial. The Commercial segment dominated the market revenue in 2024 due to the rapid expansion of commercial infrastructure and demand for long-lasting, energy-efficient roofing solutions.

The Residential segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising home renovation activities and the growing popularity of reflective coatings to reduce energy bills in hot climates.

Roof Coatings Market Regional Analysis

- Asia-Pacific by dominated the roof coatings market with the largest revenue share of 41.2% in 2024, driven rapid urbanization, booming construction activities, and rising awareness regarding energy-efficient building materials. Government initiatives promoting sustainable infrastructure and increasing foreign investments in real estate further accelerate the demand for advanced roof coating solutions across the region

- The region benefits from strong manufacturing capabilities, cost-effective product availability, and a growing focus on green building certifications. Expanding industrial and commercial infrastructure projects, along with rising disposable incomes, continue to support widespread adoption across residential, commercial, and industrial segments

- Technological advancements, coupled with smart city development programs in emerging economies, are further driving market growth and positioning Asia-Pacific as the global leader in roof coating adoption

China Roof Coatings Market Insight

The China roof coatings market captured the largest revenue share in 2024 within Asia-Pacific, supported by massive urban development projects, government-backed smart city initiatives, and strong domestic manufacturing capabilities. Affordable product availability and rapid adoption of energy-efficient building materials in residential, commercial, and industrial segments are accelerating market growth across the country.

Japan Roof Coatings Market Insight

The Japan roof coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s focus on energy efficiency, disaster-resilient building practices, and sustainable urban infrastructure. Reflective and waterproof roof coatings are gaining popularity as Japan continues to prioritize advanced construction materials for long-term durability and environmental compliance.

North America Roof Coatings Market Insight

The North America roof coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by the adoption of advanced roof coating technologies for preventive maintenance and energy efficiency. The U.S., in particular, leads the region with strong construction activity, stringent energy codes, and growing adoption of cool roof technologies in residential, commercial, and industrial buildings.

U.S. Roof Coatings Market Insight

The U.S. roof coatings market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid adoption of energy-efficient and reflective roofing solutions across commercial, industrial, and residential buildings. Increasing emphasis on sustainable construction practices, combined with stringent building energy codes, is accelerating demand for advanced roof coating technologies. The rising trend of re-roofing and renovation projects in aging infrastructure further supports market growth, with strong demand for water-based and silicone coatings offering long-term durability and performance benefits.

Europe Roof Coatings Market Insight

The Europe roof coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict environmental regulations and a strong emphasis on sustainable construction practices. Countries such as Germany, the U.K., and France are witnessing rising demand for reflective and weather-resistant coatings in both new construction projects and renovation activities.

Germany Roof Coatings Market Insight

The Germany roof coatings market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s strong focus on green construction materials and energy efficiency initiatives. Germany’s advanced infrastructure and commitment to sustainability standards are driving the adoption of innovative roof coating solutions offering waterproofing, thermal insulation, and low environmental impact. The commercial and industrial sectors are particularly witnessing high demand as businesses seek to align with stringent EU building regulations and carbon reduction targets.

U.K. Roof Coatings Market Insight

The U.K. roof coatings market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising trend of eco-friendly construction practices and the government’s focus on energy-efficient housing and commercial projects. Growing urban redevelopment activities and strict regulations on energy performance are encouraging the use of reflective and long-lasting roof coatings. The residential sector, in particular, is witnessing increased adoption as homeowners seek cost-effective and sustainable solutions to improve energy efficiency and roof durability.

Roof Coatings Market Share

The Roof Coatings industry is primarily led by well-established companies, including:

- Dow (U.S.)

- Wacker Chemie AG (Germany)

- The Sherwin-Williams Company (U.S.)

- PPG Industries, Inc. (U.S.)

- BASF SE (Germany)

- RPM International Inc. (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Sika AG (Switzerland)

- Kansai Paint Co.,Ltd. (Japan)

- Hempel A/S (Denmark)

- Nouryon (Netherlands)

- Westlake Royal Building Products (U.S.)

- Alltimes Coatings Ltd. (U.K.)

- Applied Graphene Materials (U.K.)

- Nippon Paint Holdings Co., Ltd. (Japan)

- ICP Group (U.S.)

- HITAC ADHESIVES & COATINGS (U.S.)

Latest Developments in Global Roof Coatings Market

- In April 2023, Everest Systems LLC has officially released a new, high-performance, field-applied topcoat called Fluorostar that restores and protects different types of roofing surfaces with long-lasting color. Fluorostar is a water-based, ultra-thin film roof coating created using Kynar Aquatec, a world-renowned polyvinylidene fluoride (PVDF) polymer resin manufactured by Arkema Inc. Fluorostar topcoat is suitable for use in commercial, municipal, and industrial applications on spray foam, TPO, PVC, EPDM, metal, masonry, and asphaltic products such as BUR and modified bitumen

- In March 2023, NanoTech Inc. introduced its flagship product, the Nano Shield cool roof coat, a coating designed for use on existing commercial roofs that reduces HVAC use in a building by 30-40%, considerably lowering energy expenditures while also decreasing scope 1 carbon emissions. Such as other coatings on the market, the Nano Shield cool roof coat is intended to repair and extend the life of a business roof by forming a watertight seal

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Roof Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Roof Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Roof Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.