Global Roofing Market

Market Size in USD Billion

CAGR :

%

USD

126.85 Billion

USD

194.67 Billion

2024

2032

USD

126.85 Billion

USD

194.67 Billion

2024

2032

| 2025 –2032 | |

| USD 126.85 Billion | |

| USD 194.67 Billion | |

|

|

|

|

What is the Global Roofing Market Size and Growth Rate?

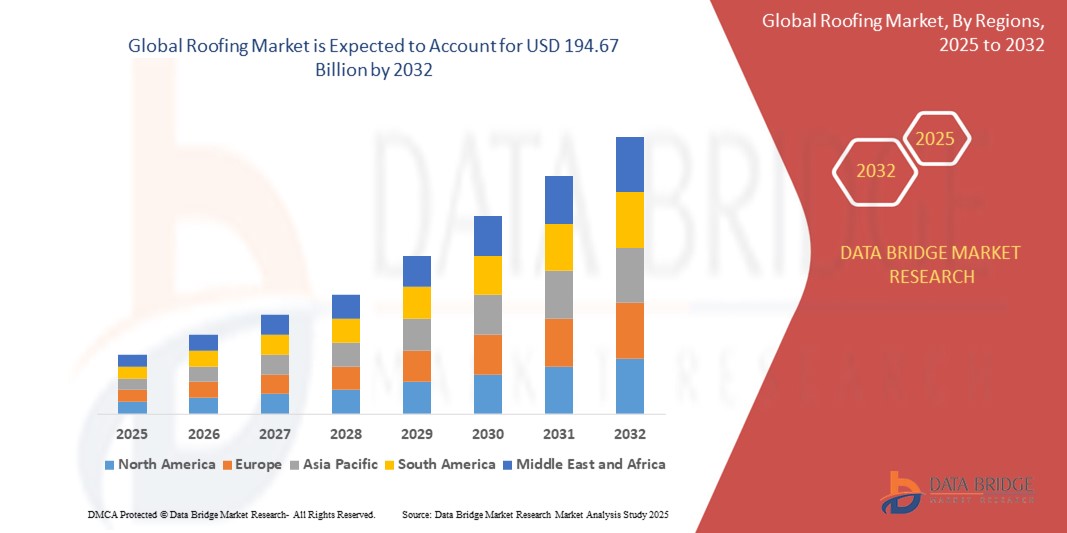

- The global Roofing market size was valued at USD 126.85 billion in 2024 and is expected to reach USD 194.67 billion by 2032, at a CAGR of 5.50% during the forecast period

- The roofing market is used in urban development projects, where roofing materials are utilized to enhance the functionality and aesthetics of buildings while also contributing to the overall urban landscape

- In the agriculture sector, roofing plays a crucial role in protecting crops and livestock from adverse weather conditions, providing shelter and maintaining optimal environmental conditions for agricultural activities

What are the Major Takeaways of Roofing Market?

- The roofing market serves the infrastructure sector by providing materials for the construction of transportation hubs, warehouses, and public facilities, ensuring structural integrity and safety for these essential societal assets

- Asia-Pacific dominated the Roofing market with the largest revenue share of 39.3% in 2024, driven by large-scale urbanization, growing construction activities, and rising demand for cost-effective and durable roofing solutions across residential and commercial sectors

- North America is poised to grow at the fastest CAGR of 23.1% during the forecast period (2025–2032), driven by increasing housing refurbishment projects, sustainable construction practices, and the popularity of energy-efficient roofing materials

- The materials segment dominated the Roofing market with the largest revenue share of 68.5% in 2024, driven by the widespread use of various roofing materials such as asphalt, metal, tile, and concrete in both residential and commercial construction

Report Scope and Roofing Market Segmentation

|

Attributes |

Roofing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Roofing Market?

“Sustainable and Smart Roofing Solutions Gaining Traction”

- A key trend transforming the global roofing market is the increasing adoption of sustainable roofing materials integrated with smart technologies such as solar panels, sensors, and energy-efficient coatings. Green building initiatives and energy codes are encouraging homeowners and commercial developers to invest in eco-friendly, high-performance roofing systems

- For instance, Tesla’s Solar Roof continues to gain attention for its integration of solar energy generation within traditional roofing aesthetics, while companies such as GAF Energy have developed nailable solar shingles compatible with conventional roofing materials

- Smart roofing systems now incorporate IoT-enabled sensors for leak detection, insulation monitoring, and real-time weather adaptation. These technologies provide predictive maintenance insights, extend roof lifespan, and reduce energy costs, especially for large commercial or industrial buildings

- The combination of environmental responsibility and digital intelligence is reshaping market expectations. Homeowners and businesses are increasingly seeking roofing systems that contribute to energy savings, offer climate resilience, and provide data-driven insights on performance and sustainability

- Leading players such as CertainTeed, Owens Corning, and Duro-Last are investing in R&D to create next-gen roofing that aligns with sustainability goals while enabling smart monitoring and control

- As global emphasis on carbon neutrality and building efficiency intensifies, the demand for smart and green roofing solutions is expected to drive market innovation and growth in the years ahead

What are the Key Drivers of Roofing Market?

- Rising demand for energy-efficient, durable, and weather-resistant roofing systems is a key driver, especially in regions facing extreme climate conditions. This is further fueled by global initiatives to reduce carbon emissions and promote green infrastructure

- For instance, in March 2024, Owens Corning launched a new line of cool roof shingles under its Duration® series, designed to reflect more sunlight and reduce indoor heat gain aligning with Energy Star compliance and increasing consumer interest in sustainable housing solutions

- The growth of the construction industry, particularly in emerging economies, is also fueling demand. Urbanization, rising disposable incomes, and the expansion of residential and commercial infrastructure are driving roofing installations across sector

- Government incentives, rebates for solar integration, and mandatory building energy codes are encouraging the use of advanced roofing materials, such as thermoplastic polyolefin (TPO), metal roofs, and solar-integrated tiles

- In addition, the demand for aesthetic and customizable roofing options has surged, as consumers seek architectural harmony without compromising on function or sustainability

Which Factor is challenging the Growth of the Roofing Market?

- High initial installation costs and limited awareness about long-term savings continue to challenge the adoption of advanced roofing systems. While innovative materials offer superior performance, their upfront cost can deter budget-conscious consumers and small-scale contractors

- For instance, premium roofing options such as solar-integrated systems or green roofs often cost significantly more than conventional asphalt shingles, limiting adoption in cost-sensitive markets

- Moreover, skilled labor shortages in some regions, especially in the installation of technologically advanced or specialty roofing systems, can cause delays, increase project costs, and affect quality

- Weather dependency in roofing projects also poses a challenge, particularly in areas with prolonged rainy or snowy seasons, leading to project delays and increased construction times

- Addressing these hurdles through government subsidies, financial incentives, public awareness campaigns, and training programs for skilled labor is crucial to boost adoption and expand the global roofing market sustainably

How is the Roofing Market Segmented?

The market is segmented on the basis of type, application, and product.

• By Type

On the basis of type, the Roofing market is segmented into materials and chemicals. The materials segment dominated the Roofing market with the largest revenue share of 68.5% in 2024, driven by the widespread use of various roofing materials such as asphalt, metal, tile, and concrete in both residential and commercial construction. These materials are essential for structural protection, energy efficiency, and aesthetic appeal, making them a foundational element of roofing systems across different climates and building types.

The chemicals segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by increasing adoption of advanced coatings, sealants, and adhesives that enhance waterproofing, UV resistance, and overall roof longevity. The rising demand for sustainable and energy-efficient roofing solutions is also contributing to the growing use of roofing chemicals in both new construction and retrofit projects.

• By Application

On the basis of application, the Roofing market is segmented into residential, commercial, non-residential, and others. The residential segment held the largest market share of 54.3% in 2024, driven by rapid urbanization, rising housing investments, and increasing consumer preference for durable and energy-efficient roofing systems. Residential roofing demand is also propelled by renovation projects and the rising popularity of smart and solar-integrated roofs in housing developments.

The commercial segment is expected to witness the fastest growth from 2025 to 2032, due to the increasing need for robust roofing systems in office buildings, malls, hospitals, and warehouses. The expansion of commercial infrastructure and the focus on long-term cost savings through energy-efficient and low-maintenance roofing solutions are key contributors to this growth.

• By Product

On the basis of product, the Roofing market is segmented into asphalt shingles, concrete and clay tile roof, metal roofs, elastomers and plastic roofs, tile roofs, bituminous roof, and others. The asphalt shingles segment dominated the market with the largest revenue share of 32.9% in 2024, owing to its affordability, ease of installation, and widespread availability. Asphalt shingles are particularly popular in residential applications due to their cost-effectiveness and aesthetic versatility.

The metal roofs segment is projected to record the fastest CAGR during the forecast period (2025–2032), driven by rising demand for durable, lightweight, and energy-efficient roofing materials. Metal roofs are gaining traction in both residential and commercial sectors due to their long lifespan, fire resistance, and increasing integration with solar panels and smart building systems.

Which Region Holds the Largest Share of the Roofing Market?

- Asia-Pacific dominated the Roofing market with the largest revenue share of 39.3% in 2024, driven by large-scale urbanization, growing construction activities, and rising demand for cost-effective and durable roofing solutions across residential and commercial sectors

- Countries such as China, India, and Southeast Asian nations are witnessing substantial infrastructure development, leading to higher demand for roofing products such as metal roofs, asphalt shingles, and bituminous membranes

- The region’s rapid population growth, rising disposable income, and expanding middle class continue to drive housing demand, boosting both new construction and renovation-based roofing installations

China Roofing Market Insight

China Roofing market held the largest revenue share in Asia-Pacific in 2024, driven by robust residential and industrial construction activity, government-backed urban housing schemes, and rising investment in smart city infrastructure. The market benefits from strong domestic manufacturing capabilities, which help in maintaining competitive pricing for various roofing products. In addition, the rising trend of green building certifications and demand for energy-efficient materials are influencing the adoption of advanced roofing solutions, including reflective and solar-integrated roofing.

India Roofing Market Insight

The India Roofing market is expected to grow at a notable CAGR during the forecast period, fueled by increasing government investment in affordable housing, smart cities, and rural development. Rapid urban expansion and climatic factors such as heavy rainfall and high heat have led to increased demand for durable and weather-resistant roofing materials. The adoption of modern roofing products such as metal sheets and bituminous membranes is replacing conventional clay and thatch roofs in both urban and rural areas.

Japan Roofing Market Insight

The Japan Roofing market is advancing steadily, supported by the country’s focus on earthquake-resistant construction, high urban density, and a preference for high-quality, long-lasting materials. Renovation of older buildings and the integration of roofing with solar technologies contribute to market growth. Moreover, the demand for aesthetic roofing materials such as clay tiles and metal panels remains strong in both traditional and modern architectural projects.

Which Region is the Fastest Growing Region in the Roofing Market?

North America is poised to grow at the fastest CAGR of 23.1% during the forecast period (2025–2032), driven by increasing housing refurbishment projects, sustainable construction practices, and the popularity of energy-efficient roofing materials. The region’s aging infrastructure and harsh weather patterns (snow, hurricanes, heat) necessitate durable and efficient roofing systems, fueling demand across both residential and commercial segments. In addition, rising awareness of green building certifications such as LEED and Energy Star is encouraging the adoption of cool roofs, solar shingles, and recyclable roofing products.

U.S. Roofing Market Insight

The U.S. Roofing market dominated the North American market share in 2024, supported by high homeownership rates, frequent remodeling activities, and strong adoption of technologically advanced roofing systems. Demand is increasing for asphalt shingles, metal roofs, and reflective coatings, especially in sunbelt states. In addition, government incentives and tax credits for energy-efficient and solar-integrated roofing systems are significantly contributing to market growth.

Canada Roofing Market Insight

Canada Roofing market is expected to grow at a healthy CAGR, driven by rising investments in infrastructure, new housing developments, and extreme climate conditions that demand superior insulation and weather resistance. Growth is also supported by the increasing adoption of green roofing practices in commercial and government buildings, particularly in urban centers such as Toronto and Vancouver. Moreover, policy support for sustainable construction and energy-efficient upgrades is encouraging the use of innovative roofing materials.

Which are the Top Companies in Roofing Market?

The roofing industry is primarily led by well-established companies, including:

- Owens Corning (U.S.)

- Duro-Last Roofing, Inc. (U.S.)

- BASF SE (Germany)

- 3M (U.S.)

- Dow (U.S.)

- DuPont (U.S.)

- Braas Monier Building Group (Luxembourg)

- Sika AG (Switzerland)

- Atlas Roofing Corporation (U.S.)

- Innospec (U.S.)

- ADEKA CORPORATION (Japan)

- Dorf Ketal Chemicals (I) Pvt. Ltd. (U.S.)

- PMC Specialties Group (U.S.)

- Afton Chemical (U.S.)

- The Lubrizol Corporation (U.S.)

- Clariant (Switzerland)

- LANXESS (Germany)

- Mayzo, Inc. (U.S.)

- Solvay (Belgium)

- Akzo Nobel N.V. (Netherlands)

- Arkema (France)

- Eastman Chemical Company (U.S.)

What are the Recent Developments in Global Roofing Market?

- In January 2024, Bessemer Investors' Legacy Restoration entered into a strategic collaboration with Southern Roofing and Renovations, aiming to expand its market presence and strengthen service offerings within the roofing industry. This move reflects a growth-oriented strategy that may lead to broader geographic coverage and enhanced operational efficiency

- In November 2023, CertainTeed, LLC announced the inauguration of a new roofing material manufacturing and distribution center in Texas, U.S., reinforcing its market footprint. This investment is poised to improve logistics and customer service across the southern U.S., solidifying the company’s leadership in the region

- In May 2023, Ruukki, a Finnish roofing firm, introduced its advanced Pohjalainen roofing sheet, a notable innovation in terms of performance and visual appeal. The launch marks a significant evolution in roofing solutions that caters to modern architectural and durability standards

- In February 2023, Holcim revealed its USD 1.3 billion acquisition of Duro-Last Roofing Systems, targeting the enhancement of its roofing product range. This acquisition positions Holcim to compete more effectively in the high-performance roofing systems segment

- In February 2023, TAMKO Building Products LLC launched its New Titan XT shingles, featuring asphalt coatings and modified sealants to meet Class 3 Impact Rating and UL 2218 standards. This product development demonstrates TAMKO's commitment to delivering durable, impact-resistant roofing materials to property owners and contractors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Roofing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Roofing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Roofing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.