Global Rooftop Solar Photovoltaic Pv Market

Market Size in USD Billion

CAGR :

%

USD

96.71 Billion

USD

156.49 Billion

2025

2033

USD

96.71 Billion

USD

156.49 Billion

2025

2033

| 2026 –2033 | |

| USD 96.71 Billion | |

| USD 156.49 Billion | |

|

|

|

|

Rooftop Solar Photovoltaic (PV) Market Size

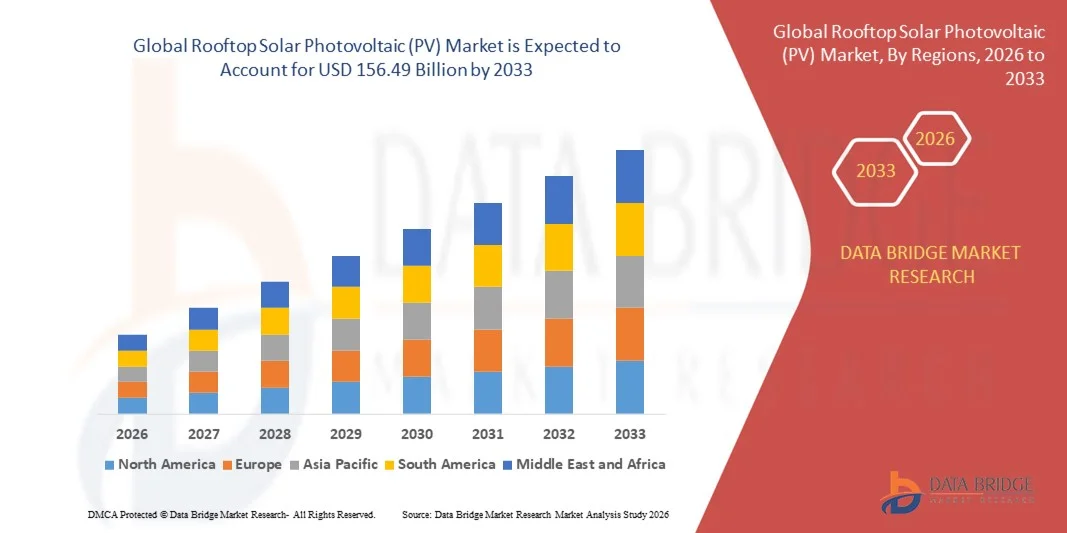

- The global rooftop solar photovoltaic (PV) market size was valued at USD 96.71 billion in 2025 and is expected to reach USD 156.49 billion by 2033, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the expanding adoption of renewable energy solutions and technological advancements in solar PV systems, leading to increased rooftop installations across residential, commercial, and industrial sectors

- Furthermore, government incentives, subsidies, and favorable policies promoting clean energy are driving higher adoption of rooftop solar PV systems. These converging factors are accelerating the deployment of solar panels on rooftops, thereby significantly boosting the industry’s growth

Rooftop Solar Photovoltaic (PV) Market Analysis

- Rooftop solar PV systems, offering decentralized electricity generation directly from building rooftops, are increasingly essential for meeting energy efficiency and sustainability goals in both residential and commercial settings due to their ability to reduce electricity costs, support energy independence, and integrate with smart energy management systems

- The rising demand for rooftop solar PV is primarily fueled by increasing electricity costs, growing environmental awareness, and advancements in high-efficiency solar modules. In addition, the decreasing cost of solar panels and availability of financing options are further enhancing adoption across diverse markets

- Asia-Pacific dominated the rooftop solar photovoltaic (PV) market with a share of 31.9% in 2025, due to growing solar energy adoption, government incentives for renewable energy, and rapid urbanization across developing economies

- North America is expected to be the fastest growing region in the rooftop solar photovoltaic (PV) market during the forecast period due to robust adoption of rooftop solar in residential and commercial sectors, government incentives, and rising electricity costs encouraging decentralized energy generation

- On grid segment dominated the market with a market share of 85.6% in 2025, due to rising adoption in urban residential and commercial sectors that are connected to centralized electricity networks. On-grid systems allow users to feed excess energy into the grid, often benefiting from net metering policies, which improves financial returns and encourages further adoption. The convenience of seamless integration with existing power infrastructure and the ability to offset electricity costs make on-grid systems the preferred choice for many households and businesses

Report Scope and Rooftop Solar Photovoltaic (PV) Market Segmentation

|

Attributes |

Rooftop Solar Photovoltaic (PV) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rooftop Solar Photovoltaic (PV) Market Trends

Growing Adoption of High-Efficiency and Bifacial Solar Panels

- The rooftop solar photovoltaic (PV) market is witnessing robust expansion with the rising adoption of high-efficiency and bifacial solar panels designed to maximize energy output and space utilization. These panels capture sunlight from both sides, significantly improving energy generation, particularly in environments with high reflectivity such as rooftops with light-colored or concrete surfaces. The growing need for advanced solar technologies that deliver better performance across limited spaces is transforming consumer and commercial choices in rooftop solar deployment

- For instance, LONGi Green Energy Technology Co., Ltd. has developed bifacial monocrystalline panels with improved light absorption and temperature tolerance, achieving greater energy yield for rooftop applications. Similarly, Trina Solar has introduced its Vertex series with high power density and dual-glass design to enhance durability and long-term efficiency for both residential and industrial users

- Advancements in solar cell technologies such as PERC, TOPCon, and heterojunction are further improving conversion efficiency and lowering the levelized cost of energy (LCOE). These innovations enable homeowners and businesses to derive more electricity from the same rooftop space, offering faster return on investment and reduced dependency on traditional grid power

- The integration of bifacial panels with smart inverters, energy storage units, and tracking systems enhances overall system performance and power management. This synergy allows for optimized energy harvesting during varying sunlight conditions, contributing to better energy stability and self-sufficiency for end users

- Manufacturers are increasingly focusing on sustainable production processes through the use of recyclable materials and improved module longevity. These efforts support global carbon reduction targets while ensuring that technological advancement aligns with environmental responsibility in the solar energy ecosystem

- The growing preference for high-efficiency and bifacial solar panels underscores the global shift toward maximizing renewable energy generation within constrained spaces. As urbanization intensifies and rooftop potential becomes a key source of distributed power generation, such innovations are expected to define the next phase of growth in the rooftop solar PV market

Rooftop Solar Photovoltaic (PV) Market Dynamics

Driver

Favorable Government Policies and Incentives for Rooftop Solar Installations

- The rooftop solar PV market is gaining substantial momentum due to strong policy frameworks, financial incentives, and regulatory support promoting the adoption of decentralized solar systems. Governments across developed and emerging economies are introducing subsidies, tax benefits, and net-metering schemes to accelerate residential and commercial solar adoption

- For instance, the Ministry of New and Renewable Energy (MNRE) in India launched the Rooftop Solar Programme Phase II, providing subsidies of up to 40 percent for residential installations. Similarly, in the United States, the federal Investment Tax Credit (ITC) continues to offer significant financial relief for homeowners and businesses investing in rooftop solar systems, driving large-scale deployment across states

- Supportive measures such as feed-in tariffs, zero-interest loans, and corporate sustainability programs are further propelling market expansion. These initiatives reduce the financial payback period for solar investments, making rooftop PV systems a financially viable energy alternative

- Global emphasis on achieving carbon neutrality and reducing dependence on fossil fuels is prompting public and private sectors to adopt rooftop solar systems as part of green building initiatives and corporate ESG commitments. This trend aligns with urban development goals promoting renewable energy integration across infrastructure networks

- Increased collaboration between policy makers, solar manufacturers, and financial institutions is fostering accessible financing models, enabling small and medium enterprises to participate in clean energy transformation. Strong regulatory frameworks and long-term policy stability remain critical in ensuring continued public participation and confidence in rooftop solar adoption

Restraint/Challenge

High Initial Capital Investment and Installation Costs

- Despite declining module prices, high upfront costs associated with rooftop solar PV installations remain a key barrier to widespread adoption, particularly for residential consumers and small-scale businesses. Expenses extend beyond panels to include inverters, batteries, mounting systems, and professional installation, making the initial investment substantial

- For instance, homeowners in Europe and Asia have reported that installation costs can represent nearly half of the total system expenditure, limiting affordability even with available subsidies. As a result, adoption rates among middle-income households tend to lag behind commercial and industrial segments with stronger financial capacity

- Challenges also arise from the need for specialized labor, electrical upgrades, and compliance with grid-connection regulations, which contribute to extended project timelines and added costs. These technical requirements deter many potential users seeking rapid deployment and limited maintenance involvement

- The lack of uniform financing structures and limited awareness about long-term economic benefits further exacerbate consumer hesitation. Some end users remain cautious about payback expectations and potential changes in energy tariff regulations that could affect return on investment

- To overcome these limitations, key industry stakeholders are promoting leasing models, community solar projects, and pay-as-you-save schemes to reduce entry barriers. As costs continue to decline due to scale economies and innovation, addressing affordability through accessible financing and streamlined installation practices will be crucial for sustaining market growth in the rooftop solar PV sector

Rooftop Solar Photovoltaic (PV) Market Scope

The market is segmented on the basis of technology, grid type, end-use, and deployment.

- By Technology

On the basis of technology, the rooftop solar PV market is segmented into thin film, crystalline silicon, and others. The crystalline silicon segment dominated the market with the largest revenue share in 2025, driven by its high efficiency, long lifespan, and well-established manufacturing base. Crystalline silicon modules are widely preferred by residential and commercial users due to their proven reliability and superior energy yield in various climatic conditions. The segment benefits from strong brand recognition and the availability of diverse module types, including monocrystalline and polycrystalline, offering flexibility for different installation requirements. Advanced power output and decreasing costs further reinforce its market leadership.

The thin film segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by its lightweight design and suitability for unconventional rooftops or flexible surfaces. For instance, companies such as First Solar are promoting thin film modules for large-scale commercial and industrial installations where low weight and easier integration with roofing structures are critical. The segment also benefits from better performance under low-light conditions and high temperatures, making it an attractive alternative for regions with challenging environmental conditions.

- By Grid Type

On the basis of grid type, the rooftop solar PV market is segmented into on-grid and off-grid systems. The on-grid segment dominated the market with the largest revenue share of 85.6% in 2025, driven by rising adoption in urban residential and commercial sectors that are connected to centralized electricity networks. On-grid systems allow users to feed excess energy into the grid, often benefiting from net metering policies, which improves financial returns and encourages further adoption. The convenience of seamless integration with existing power infrastructure and the ability to offset electricity costs make on-grid systems the preferred choice for many households and businesses.

The off-grid segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing electrification initiatives in remote and rural areas with limited grid access. For instance, companies such as Schneider Electric are deploying off-grid rooftop PV solutions in rural communities and commercial facilities where grid connectivity is unreliable or unavailable. Off-grid systems provide energy independence and reduce reliance on diesel generators, while also supporting sustainable development goals in emerging markets.

- By End-Use

On the basis of end-use, the rooftop solar PV market is segmented into residential and non-residential applications. The residential segment dominated the market with the largest revenue share in 2025, driven by growing awareness of renewable energy, government incentives, and the desire for energy cost savings. Homeowners increasingly adopt rooftop solar PV systems to reduce electricity bills and enhance energy security, with options for both net metering and battery storage integration. Residential adoption is further supported by aesthetic design improvements, compact system footprints, and user-friendly installation services provided by leading solar providers.

The non-residential segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by commercial, industrial, and institutional demand for large-scale energy savings and sustainability targets. For instance, companies such as SunPower are providing rooftop PV solutions to factories, warehouses, and office complexes to significantly reduce operational electricity costs. Non-residential adoption is also driven by corporate sustainability commitments, government green building certifications, and long-term return on investment from large rooftop installations.

- By Deployment

On the basis of deployment, the rooftop solar PV market is segmented into ground-mounted and rooftop installations. The rooftop deployment segment dominated the market with the largest revenue share in 2025, driven by limited available land in urban areas and growing utilization of existing building rooftops for clean energy generation. Rooftop PV systems provide an efficient way to harness solar energy without requiring additional land acquisition, making them suitable for densely populated regions. The segment is also supported by incentives for urban solar adoption and advancements in lightweight, modular panels that simplify installation on varied roof types.

The ground-mounted segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by large-scale commercial and industrial projects that require higher capacity systems. For instance, companies such as Canadian Solar are focusing on expansive ground-mounted PV installations for industrial parks and utility-scale solar farms. Ground-mounted systems offer flexibility in panel orientation and spacing, higher scalability, and easier maintenance access, driving their adoption in large-scale energy projects.

Rooftop Solar Photovoltaic (PV) Market Regional Analysis

- Asia-Pacific dominated the rooftop solar photovoltaic (PV) market with the largest revenue share of 31.9% in 2025, driven by growing solar energy adoption, government incentives for renewable energy, and rapid urbanization across developing economies

- The region’s cost-effective solar module manufacturing, increasing investments in clean energy infrastructure, and favorable policies supporting rooftop installations are accelerating market expansion

- Availability of skilled labor, declining PV system costs, and rising electricity demand in residential and commercial sectors are contributing to increased deployment of rooftop solar PV systems

China Rooftop Solar PV Market Insight

China held the largest share in the Asia-Pacific rooftop solar PV market in 2025, owing to its status as a global leader in solar panel manufacturing and renewable energy deployment. The country’s strong industrial base, supportive government policies such as feed-in tariffs and tax incentives, and extensive rooftop solar installations for both residential and commercial sectors are major growth drivers. Increasing investments in sustainable energy solutions and large-scale urban electrification projects are further boosting market expansion.

India Rooftop Solar PV Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing government initiatives promoting solar rooftop adoption, expanding residential and commercial rooftop installations, and rising awareness of clean energy. Programs such as the Rooftop Solar Scheme and incentives for net-metering are strengthening the market. In addition, growing electricity demand in urban centers and rising investments in energy-efficient infrastructure are contributing to rapid market growth.

Europe Rooftop Solar PV Market Insight

The Europe rooftop solar PV market is expanding steadily, supported by stringent environmental regulations, strong government incentives for renewable energy adoption, and increasing corporate sustainability commitments. The region places emphasis on high-efficiency solar modules and integration of rooftop PV with energy storage and smart grids. Rising investments in green buildings and efforts to decarbonize urban infrastructure are further enhancing market growth.

Germany Rooftop Solar PV Market Insight

Germany’s rooftop solar PV market is driven by its leadership in renewable energy adoption, advanced energy policies, and strong industrial support for solar installations. The country has well-established R&D capabilities and incentive programs encouraging both residential and commercial rooftop systems. Demand is particularly strong for integration with energy storage and smart home solutions, supporting sustainable energy consumption.

U.K. Rooftop Solar PV Market Insight

The U.K. market is supported by government schemes promoting solar adoption, growing investments in energy-efficient buildings, and an increasing focus on reducing carbon footprint across residential and commercial sectors. Academic-industry collaborations in renewable energy technologies and rising awareness of decentralized energy generation are contributing to market growth. The U.K. continues to play a significant role in high-efficiency rooftop PV installations.

North America Rooftop Solar PV Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust adoption of rooftop solar in residential and commercial sectors, government incentives, and rising electricity costs encouraging decentralized energy generation. Growing focus on sustainability, corporate renewable energy targets, and advancements in high-efficiency solar modules are boosting demand. In addition, increasing collaboration between utility companies and rooftop solar providers is supporting market expansion.

U.S. Rooftop Solar PV Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by strong residential and commercial rooftop solar adoption, federal and state-level incentives, and advanced solar manufacturing capabilities. The country’s focus on clean energy, smart grid integration, and sustainability goals is encouraging deployment of high-efficiency rooftop PV systems. Presence of leading solar companies and a mature supply chain further solidify the U.S.'s leading position in the region.

Rooftop Solar Photovoltaic (PV) Market Share

The rooftop solar photovoltaic (PV) industry is primarily led by well-established companies, including:

- JA SOLAR Technology Co., Ltd. (China)

- SunPower Corporation (U.S.)

- AGC Glass Europe (Belgium)

- Nippon Sheet Glass Co., Ltd. (Japan)

- HeckerGlastechnik GmbH & Co. KG (Germany)

- Euroglas (Germany)

- Emmvee Toughened Glass Private Limited (India)

- F solar GmbH (Germany)

- Taiwan Glass Ind. Corp (Taiwan)

- Xinyi Solar Holdings Ltd (China)

- Sisecam Flat Glass (Turkey)

- Guardian Glass (U.S.)

- Saint-Gobain Solar (France)

- Flat Glass Co., Ltd (China)

- Guangdong Golden Glass Technologies (China)

- Henan Huamei Cinda Industrial Co., Ltd. (China)

- Interfloat Corporation (U.S.)

Latest Developments in Global Rooftop Solar Photovoltaic (PV) Market

- In January 2025, Saatvik Green Energy Limited secured a contract valued at over ₹1,500 crore to supply 1 GW of N‑TOPCon solar PV modules, marking a significant expansion in its manufacturing and module supply capabilities for utility-scale and rooftop solar installations. This agreement highlights the company’s commitment to strengthening the domestic solar manufacturing ecosystem while enhancing supply chain resilience. By increasing the availability of high-efficiency modules, Saatvik is supporting cost-competitive deployments and accelerating the growth of the rooftop solar PV market in India and globally

- In January 2025, LG Energy Solutions announced a partnership with Aptera Motors to supply 2170‑series cylindrical batteries aimed at advancing solar-powered EV innovation and sustainable mobility in the U.S. This collaboration emphasizes the integration of solar energy with transportation solutions, supporting the expansion of rooftop solar generation for EV charging infrastructure. By leveraging its expertise in advanced battery technology, LG Energy Solutions is contributing to new consumption patterns that strengthen demand in the rooftop solar PV market

- In January 2025, A. O. Smith Corporation scheduled a conference call for the release of its Q4 2024 financial results, reflecting growing investor and corporate focus on the energy appliance and solar-related sectors. This initiative underscores the importance of transparency and market confidence, which indirectly supports adoption in the rooftop solar PV market. By demonstrating strong corporate governance and financial reporting, A. O. Smith is reinforcing investor trust and signaling potential growth opportunities in solar-connected solutions

- In March 2024, JA Solar Technology Co., Ltd. entered an agreement with PowerChina Huadong Engineering Corporation Limited to supply 480 MW of PV modules for the CEME1‑480 MW project in Chile, the country’s largest photovoltaic installation. This project showcases JA Solar’s capability to deliver large-scale, high-quality modules for international markets while promoting the deployment of both rooftop and utility-scale solar systems. By enabling high-volume installations, the company is enhancing cost efficiency and scalability within the global rooftop solar PV market

- In January 2024, Emmvee Photovoltaic Power Pvt. Ltd. announced a supply agreement with KPI Green Energy Ltd to deliver 300 MWp of bifacial MonoPERC solar panels for the 240 MW solar plant in Gujarat. This agreement highlights Emmvee’s focus on advanced, high-efficiency solar technology to maximize energy output and returns. By expanding the availability of innovative solar panels, Emmvee is supporting accelerated deployment and cost-effective growth of the rooftop solar PV market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rooftop Solar Photovoltaic Pv Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rooftop Solar Photovoltaic Pv Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rooftop Solar Photovoltaic Pv Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.