Global Rotary Agricultural Drone Market

Market Size in USD Billion

CAGR :

%

USD

2.93 Billion

USD

19.26 Billion

2025

2033

USD

2.93 Billion

USD

19.26 Billion

2025

2033

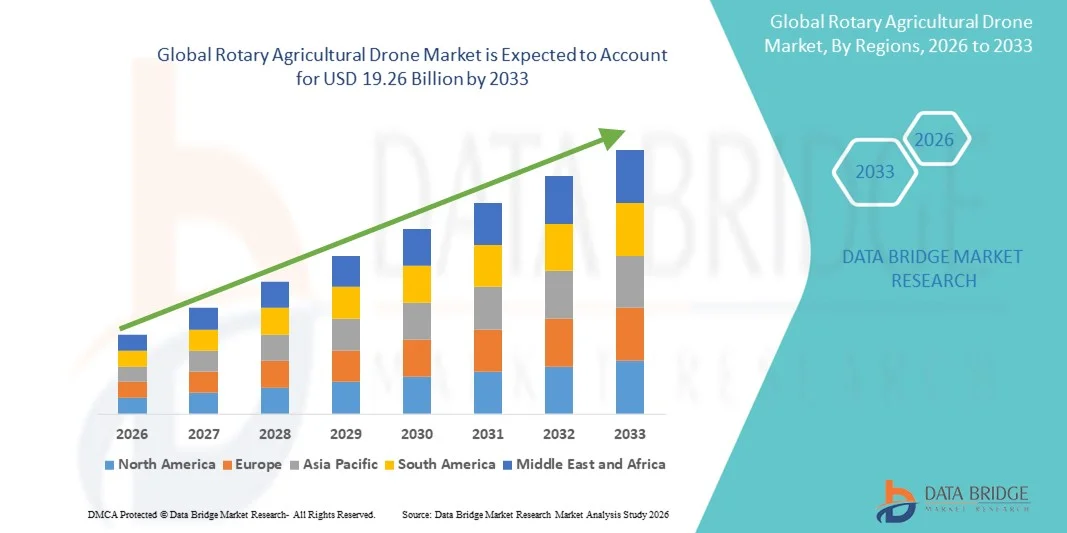

| 2026 –2033 | |

| USD 2.93 Billion | |

| USD 19.26 Billion | |

|

|

|

|

Rotary Agricultural Drone Market Size

- The global rotary agricultural drone market size was valued at USD 2.93 billion in 2025 and is expected to reach USD 19.26 billion by 2033, at a CAGR of 6.70% during the forecast period

- The market growth is largely fuelled by the increasing adoption of precision agriculture practices, rising demand for automated crop monitoring, and the need to enhance farm productivity and resource efficiency

- Growing awareness among farmers regarding time- and labor-saving technologies, coupled with government initiatives supporting smart agriculture, is further accelerating market expansion

Rotary Agricultural Drone Market Analysis

- Increasing emphasis on sustainable farming practices and efficient resource utilization is driving the need for rotary agricultural drones capable of reducing pesticide usage and optimizing crop yields

- Technological advancements in drone design, battery life, payload capacity, and automation features are enhancing operational efficiency, making rotary drones more accessible to farmers globally

- North America dominated the rotary agricultural drone market with the largest revenue share of 35.40% in 2025, driven by the growing adoption of precision agriculture and technological advancements in drone applications for crop management, field mapping, and spraying operations

- Asia-Pacific region is expected to witness the highest growth rate in the global rotary agricultural drone market, driven by rising agricultural mechanization, increasing farmer awareness about precision farming, and growing investment in drone-based technologies

- The battery segment held the largest market revenue share in 2025, driven by the increasing demand for long-flight drones capable of covering large agricultural fields without frequent recharging. High-capacity batteries enable extended operational time, supporting precision farming applications such as crop spraying, mapping, and monitoring

Report Scope and Rotary Agricultural Drone Market Segmentation

|

Attributes |

Rotary Agricultural Drone Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rotary Agricultural Drone Market Trends

Rise of Precision and Automated Crop Management

- The increasing adoption of rotary agricultural drones is transforming modern farming by enabling real-time monitoring, aerial mapping, and precision spraying of crops. The drones’ efficiency allows farmers to optimize input usage, reduce wastage, and enhance crop yields, resulting in improved productivity and resource management. In addition, they help in early pest detection, soil analysis, and efficient farm planning, supporting sustainable agriculture practices

- The high demand for drones in remote and large-scale agricultural regions is accelerating the use of autonomous and semi-autonomous aerial platforms. These drones are particularly effective in areas where manual crop monitoring is time-consuming or challenging, helping reduce labor dependency and ensure timely interventions. They also enable consistent monitoring under varying weather conditions, improving decision-making for large-scale operations

- The affordability, ease of deployment, and multifunctional capabilities of modern rotary drones are making them attractive across small, medium, and large-scale farms. Farmers benefit from aerial insights, precise spraying, and crop health monitoring without incurring excessive costs or operational complexity. Moreover, drones facilitate integration with farm management software for automated scheduling and reporting

- For instance, in 2024, several large farms in the U.S. reported a 20% increase in crop yield efficiency after integrating rotary agricultural drones for targeted fertilizer and pesticide application, highlighting the practical benefits of drone technology in agriculture. Farmers also observed reductions in chemical usage and labor costs while improving crop uniformity and quality

- While rotary drones are driving precision farming and operational efficiency, their full impact depends on ongoing innovation, user training, and regulatory compliance. Manufacturers must focus on localized solutions, software integration, and maintenance support to fully capitalize on this growing demand. The development of AI-enabled drones and modular payloads will further expand market opportunities

Rotary Agricultural Drone Market Dynamics

Driver

Growing Adoption of Precision Agriculture and Digital Farming Practices

- The rise of precision agriculture is encouraging farmers to integrate rotary drones for monitoring crop health, optimizing irrigation, and applying inputs accurately. This trend is accelerating investments in drone-based farming solutions. Advanced analytics from drone data also supports yield forecasting and risk mitigation, driving more data-driven farming decisions

- Farmers are increasingly aware of the financial and environmental benefits of precision drone applications, including reduced input costs, minimized chemical usage, and enhanced yield quality. This awareness drives the adoption of rotary drones across multiple crop types. In addition, drones improve compliance with sustainable farming practices and environmental regulations

- Government initiatives and agricultural technology programs promoting smart farming and sustainable practices are supporting the adoption of drones, particularly in regions with large-scale farming operations. Subsidies, grants, and training programs for precision agriculture technologies are making drones more accessible to commercial growers

- For instance, in 2023, European agricultural authorities launched incentives for drone-assisted crop management, boosting sales of rotary agricultural drones and associated software platforms across commercial farms. Adoption also resulted in improved monitoring of crop diseases and soil conditions, reducing environmental impact and increasing farm efficiency

- While precision agriculture adoption is fueling market growth, widespread utilization requires cost-effective solutions, training programs, and integration with farm management technologies. Interoperability with existing agricultural machinery and software platforms is crucial for maximizing operational efficiency

Restraint/Challenge

High Cost of Advanced Drones and Regulatory Limitations

- The high price of advanced rotary agricultural drones, including UAVs with multispectral sensors and automated spraying systems, limits adoption among smallholder and resource-constrained farmers. These solutions are often more accessible to large commercial operations with higher capital. In addition, maintenance and spare part costs can further restrict adoption in developing regions

- In many regions, regulatory restrictions on drone operations, airspace usage, and pesticide application hinder widespread implementation. Compliance requirements and licensing complexities add to operational challenges. Farmers must navigate local drone laws, which can delay deployment and increase operational overheads

- Limited availability of skilled operators and technical support for drone maintenance in rural or emerging markets further restricts effective utilization, reducing potential efficiency gains. Inadequate training programs and a lack of certified service providers create operational bottlenecks for small and medium-scale farms

- For instance, in 2023, small farms in Southeast Asia reported delayed adoption due to high drone costs and regulatory hurdles, limiting the technology’s market penetration. Many farmers also experienced downtime due to lack of repair services and training, reducing overall farm productivity

- While drone technologies continue to advance, addressing cost, regulatory, and operational challenges is essential to unlock broader adoption and long-term growth in the rotary agricultural drone market. Future development of low-cost drones, localized support infrastructure, and streamlined regulatory processes will further accelerate market penetration

Rotary Agricultural Drone Market Scope

The market is segmented on the basis of component, application, size, and battery life.

- By Component

On the basis of component, the rotary agricultural drone market is segmented into frames, controller systems, battery, propulsion systems, and others. The battery segment held the largest market revenue share in 2025, driven by the increasing demand for long-flight drones capable of covering large agricultural fields without frequent recharging. High-capacity batteries enable extended operational time, supporting precision farming applications such as crop spraying, mapping, and monitoring.

The controller systems segment is expected to witness the fastest growth rate from 2026 to 2033, driven by advancements in autopilot technology, AI-assisted navigation, and remote operation capabilities. Controller systems enhance drone performance, ensure precise route planning, and allow real-time data collection for effective farm management. These systems are increasingly integrated with mobile and cloud-based platforms for seamless operation across multiple farm applications.

- By Application

On the basis of application, the market is segmented into field mapping, crop scouting, variable rate application, crop spraying, livestock monitoring, and agricultural photography. The crop spraying segment held the largest share in 2025, fueled by the need for efficient and precise pesticide and fertilizer application. Drones reduce chemical wastage, improve crop health, and enable faster coverage of large areas compared to manual methods.

The crop scouting segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the adoption of high-resolution imaging, multispectral sensors, and AI-driven analytics. Crop scouting drones help farmers detect early signs of stress, disease, or nutrient deficiency, allowing timely interventions that improve yield and reduce losses.

- By Size

On the basis of size, the market is segmented into small, medium, and large. The medium-size segment held the largest market share in 2025, supported by its balance of operational range, payload capacity, and cost-effectiveness. Medium drones are suitable for most commercial farms, offering sufficient coverage without the complexity or cost of larger UAVs.

The small-size segment is expected to witness the fastest growth from 2026 to 2033, driven by its portability, ease of deployment, and suitability for smallholder and urban farms. Small drones are increasingly used for targeted applications, such as precision spraying, monitoring, and data collection in constrained spaces.

- By Battery Life

On the basis of battery life, the market is segmented into <30 minutes, 30-60 minutes, 60-100 minutes, and >100 minutes. The 60-100 minutes segment held the largest market revenue share in 2025, owing to its ability to cover larger fields per flight and support intensive precision agriculture operations. Longer battery life minimizes downtime, enhances operational efficiency, and allows farmers to manage multiple tasks in a single session.

The >100 minutes battery life segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising adoption of advanced UAVs with enhanced endurance for expansive agricultural landscapes. These drones are particularly beneficial for large-scale farms and regions with limited recharging infrastructure, enabling continuous monitoring and management.

Rotary Agricultural Drone Market Regional Analysis

- North America dominated the rotary agricultural drone market with the largest revenue share of 35.40% in 2025, driven by the growing adoption of precision agriculture and technological advancements in drone applications for crop management, field mapping, and spraying operations

- Farmers and agribusinesses in the region highly value the efficiency, automation, and data-driven insights offered by rotary agricultural drones, enabling better resource management, reduced labor dependency, and improved crop yields

- This widespread adoption is further supported by high investment in smart farming infrastructure, government subsidies for drone-assisted agriculture, and the increasing integration of drones with farm management software, establishing rotary drones as a preferred solution for modern farming operations

U.S. Rotary Agricultural Drone Market Insight

The U.S. rotary agricultural drone market captured the largest revenue share in 2025 within North America, fueled by extensive adoption of smart farming technologies and precision agriculture practices. Farmers are increasingly prioritizing aerial monitoring, automated spraying, and crop health analytics to enhance productivity and efficiency. The growing preference for drones equipped with multispectral and high-resolution imaging systems, combined with strong government support for agricultural innovation, is significantly contributing to the market's expansion.

Europe Rotary Agricultural Drone Market Insight

The Europe rotary agricultural drone market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the adoption of precision agriculture and sustainable farming practices. Stringent regulations on chemical usage and environmental sustainability are encouraging farmers to integrate drones for targeted spraying and crop monitoring. The region is experiencing rapid adoption across large-scale farms, agritech startups, and research institutions focused on smart agriculture and resource optimization.

U.K. Rotary Agricultural Drone Market Insight

The U.K. rotary agricultural drone market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising need for efficient farm management and real-time crop monitoring. Farmers are increasingly investing in drone solutions to improve yield quality, reduce operational costs, and comply with environmental regulations. The U.K.’s well-established agricultural technology ecosystem and increasing awareness of smart farming benefits are expected to continue to stimulate market growth.

Germany Rotary Agricultural Drone Market Insight

The Germany rotary agricultural drone market is expected to witness the fastest growth rate from 2026 to 2033, fueled by advanced technological infrastructure, precision farming initiatives, and strong emphasis on sustainability. German farmers and agribusinesses are adopting rotary drones for automated spraying, crop scouting, and field mapping to improve operational efficiency. The integration of drones with data analytics platforms and IoT-enabled farm systems is becoming increasingly prevalent, supporting optimized resource utilization.

Asia-Pacific Rotary Agricultural Drone Market Insight

The Asia-Pacific rotary agricultural drone market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid adoption of precision farming technologies, increasing agricultural mechanization, and rising awareness about crop management efficiency. Countries such as China, Japan, and India are investing in drone-based agricultural solutions to enhance productivity and reduce labor requirements. Government initiatives promoting smart farming, coupled with the region emerging as a manufacturing hub for agricultural drones, are expanding affordability and accessibility.

Japan Rotary Agricultural Drone Market Insight

The Japan rotary agricultural drone market is expected to witness significant growth from 2026 to 2033 due to the country’s advanced technological adoption, high-tech farming culture, and focus on operational efficiency. Japanese farms are increasingly utilizing drones for crop monitoring, precision spraying, and livestock management. The integration of drones with IoT-based farm management systems and AI-enabled analytics is driving adoption, while the aging farmer population is further encouraging automation and ease-of-use solutions.

China Rotary Agricultural Drone Market Insight

The China rotary agricultural drone market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s vast agricultural landscape, rapid mechanization, and increasing precision farming adoption. Chinese farmers and agritech companies are leveraging drones for field mapping, crop spraying, and variable rate application to optimize inputs and maximize yields. Strong government support, domestic manufacturing capabilities, and competitive pricing of drone solutions are key factors propelling market growth in China.

Rotary Agricultural Drone Market Share

The Rotary Agricultural Drone industry is primarily led by well-established companies, including:

- 3DR (U.S.)

- DJI (China)

- Aeryon Labs Inc. (Canada)

- Parrot Drones SAS (France)

- Aurora (Canada)

- Denel SOC Ltd (South Africa)

- Draganfly (Canada)

- Northrop Grumman (U.S.)

- Lockheed Martin Corporation (U.S.)

- Elbit Systems Ltd. (Israel)

- General Dynamics Corporation (U.S.)

- AeroVironment, Inc. (U.S.)

- Leptron Unmanned Aircraft Systems, Inc. (U.S.)

- PrecisionHawk (U.S.)

- YUNEEC (China)

- Trimble Inc. (U.S.)

- INSITU (U.S.)

- senseFly (Switzerland)

- Xiaomi (China)

- Sentera, Inc (U.S.)

- AiRXOS (U.S.)

- General Electric (U.S.)

- QUADROCOPTER (Germany)

Latest Developments in Global Rotary Agricultural Drone Market

- In 2023, two leading drone manufacturers completed a major merger to consolidate resources and expand technological capabilities. The merger strengthened their product portfolios, accelerated innovation in autonomous agricultural solutions, and enhanced global market competitiveness, benefiting large-scale and commercial farming operations

- In 2022, regulatory authorities in key markets implemented new guidelines for drone operations, including licensing, airspace usage, and safety protocols. These regulations ensured safer drone deployment, promoted compliance, and encouraged wider adoption of agricultural drones while maintaining operational standards

- In 2021, multiple drone manufacturers formed strategic partnerships to integrate aerial data with farm management software, aiming to enhance precision agriculture. This collaboration enabled farmers to optimize crop monitoring, irrigation, and input application, improving operational efficiency and yield outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.