Global Rubber Bonded Abrasives Market

Market Size in USD Million

CAGR :

%

USD

860.29 Million

USD

1,154.91 Million

2024

2032

USD

860.29 Million

USD

1,154.91 Million

2024

2032

| 2025 –2032 | |

| USD 860.29 Million | |

| USD 1,154.91 Million | |

|

|

|

|

Rubber Bonded Abrasives Market Size

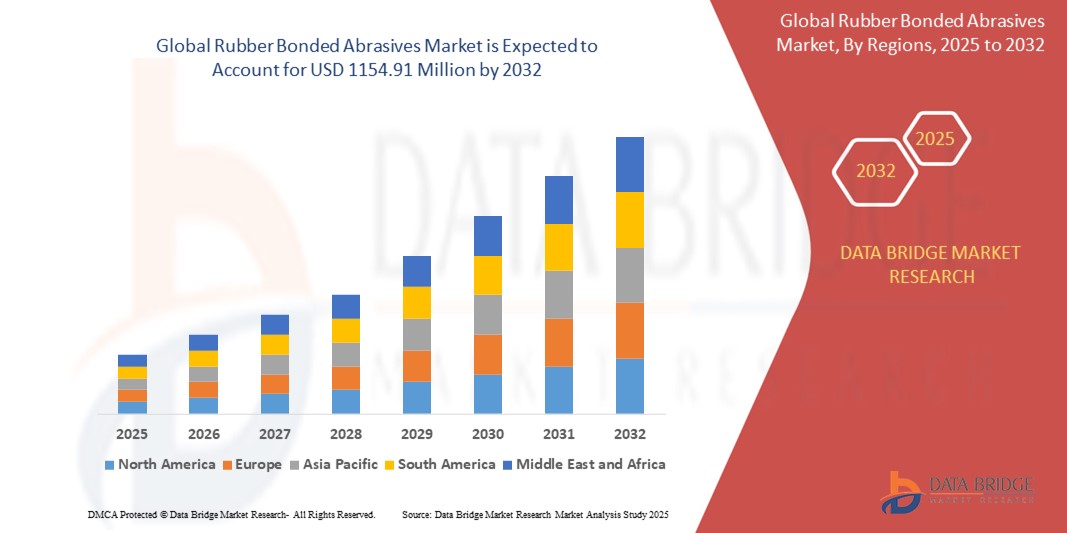

- The global Rubber Bonded Abrasives market was valued at USD 860.29 million in 2024 and is expected to reach USD 1,154.91 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 3.77%, primarily driven by rising demand in automotive, metalworking, construction, and precision engineering applications

- This growth is driven by factors such as increasing industrialization, infrastructure development, automotive production, and demand for precision surface finishing

Rubber Bonded Abrasives Market Analysis

- Rubber Bonded Abrasives are widely used in precision grinding, polishing, and cutting applications across automotive, aerospace, metalworking, and electronics industries to achieve superior dimensional accuracy, surface finish, noise reduction, and vibration damping. Their flexibility and resilience enable high-performance operations, fostering collaborations among abrasive manufacturers, machine tool producers, and OEMs to drive innovation and address evolving quality, efficiency, and sustainability standards

- The demand for Rubber Bonded Abrasives is significantly driven by increasing requirements for precision machining, reduced production downtime, and improved tool life. Growing demand from automotive component manufacturing, turbine blade finishing, semiconductor polishing, and metal fabrication boosts adoption. Additionally, technological advancements in abrasive grain materials, bond formulations, and process automation enhance productivity and cost-efficiency. Environmental regulations promoting cleaner manufacturing processes further support market expansion, alongside investments in sustainable abrasive solutions

- The Asia-Pacific region stands out as one of the dominant markets for Rubber Bonded Abrasives, driven by rapid industrialization, automotive production growth, expanding aerospace manufacturing, and increasing investments in precision engineering and metalworking sectors

- For instance, China leads in Rubber Bonded Abrasives consumption, supported by strong demand from automotive OEMs, large-scale industrial manufacturing, and government policies promoting high-tech industries and advanced manufacturing capabilities. Leading manufacturers collaborate with local distributors and end-users to optimize supply chains and meet evolving quality and efficiency standards

- Globally, the Rubber Bonded Abrasives market holds a vital position within the abrasives and precision machining industry, playing a critical role in improving product quality, enhancing manufacturing efficiency, extending tool life, and supporting sustainability initiatives across automotive, aerospace, metalworking, electronics, and other industrial sectors

Report Scope and Rubber Bonded Abrasives Market Segmentation

|

Attributes |

Rubber Bonded Abrasives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Rubber Bonded Abrasives Market Trends

“Increasing Demand from Automotive Industry”

- • One prominent trend in the advancement of Rubber Bonded Abrasives is the growing demand from the automotive industry, driven by rising global vehicle production and the increasing need for precision grinding in engine and transmission manufacturing

- Rubber Bonded Abrasives play a critical role by enabling high-precision finishing, superior dimensional accuracy, and enhanced surface quality of automotive components, thereby improving engine efficiency, durability, and overall vehicle performance

- For instance, as automakers shift toward more fuel-efficient and lightweight vehicles, precision grinding of critical components such as gears, crankshafts, and camshafts has become essential to meet stringent performance and emission standards

- The widespread adoption of advanced Rubber Bonded Abrasives in automotive manufacturing contributes to reduced production cycle times, lower defect rates, and improved operational efficiency, reinforcing the competitiveness of global automotive supply chains

- These developments are transforming automotive production processes, driving innovation in grinding technologies, and aligning with industry trends toward higher performance, lower emissions, and greater sustainability in mobility solutions

Rubber Bonded Abrasives Market Dynamics

Driver

“Growth in Metal Fabrication and Industrial Manufacturing”

- The expansion of metal fabrication and industrial manufacturing is significantly driving the growth of the Rubber Bonded Abrasives market, as these industries increasingly demand efficient finishing, deburring, and polishing solutions for precision-engineered metal components

- As manufacturers across metalworking, machinery, and fabrication sectors prioritize productivity, surface quality, and dimensional accuracy, Rubber Bonded Abrasives have become essential for achieving consistent, high-quality finishes on a wide range of ferrous and non-ferrous metals

- Rubber Bonded Abrasives are extensively used in grinding, polishing, and deburring applications for industrial equipment, metal structures, pipelines, and machinery components, offering superior conformability, reduced heat generation, and improved control in complex geometries

- These abrasives not only enhance the aesthetic and functional performance of fabricated metal products but also contribute to lower rework rates, extended tool life, and streamlined production workflows, aligning with industry goals for cost-efficiency and operational excellence

- As global demand for fabricated metal products rises—fueled by infrastructure development, industrial automation, and machinery investments—the adoption of advanced Rubber Bonded Abrasives is poised to accelerate, supporting innovation and competitiveness in metal manufacturing

For instance,

- In 2023, a leading metal fabrication company integrated Rubber Bonded Abrasive solutions in its automated finishing lines, achieving a 25% reduction in processing time and a 15% improvement in surface finish consistency across stainless steel components

Opportunity

“Shift Toward Sustainable and Eco-Friendly Abrasives”

- The growing emphasis on sustainable and eco-friendly manufacturing is driving demand for environmentally responsible Rubber Bonded Abrasives that offer low emissions, recyclability, and biodegradability

- These Rubber Bonded Abrasives enable manufacturers to meet stringent environmental regulations while maintaining high-performance grinding, polishing, and finishing outcomes across diverse industrial applications

- Additionally, the development of eco-friendly abrasives aligns with global trends toward greener production processes, reduced carbon footprints, and circular economy practices, supporting industries’ efforts to achieve sustainability certifications and regulatory compliance

For instance,

- In 2023, a leading abrasives manufacturer introduced a new line of Rubber Bonded Abrasives formulated with bio-based polymers and natural fillers, reducing volatile organic compound (VOC) emissions by 30% while maintaining equivalent grinding performance to conventional products

Restraint/Challenge

“Availability of Alternative Abrasive Solutions”

- While there is increasing demand for Rubber Bonded Abrasives in various sectors, the growing adoption of resin-bonded and vitrified-bonded abrasives is presenting a challenge to market expansion for rubber-bonded products

- Resin-bonded and vitrified-bonded abrasives offer benefits such as higher strength, durability, and resistance to wear, making them popular in industries that require precision and long-lasting performance, such as automotive, aerospace, and metalworking

- The shift towards these alternative abrasive solutions is limiting the growth potential of Rubber Bonded Abrasives, as manufacturers and industries prioritize cost-effective, high-performance materials that meet increasingly stringent application requirements

Rubber Bonded Abrasives Market Scope

The market is segmented on the basis of application.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

Rubber Bonded Abrasives Market Regional Analysis

“Aia-Pacific is the Dominant Region in the Rubber Bonded Abrasives Market”

- The Asia-Pacific region is a key growth driver in the Global Rubber Bonded Abrasives Market, fueled by rapid industrialization, rising automotive production, and increased demand for renewable energy solutions

- China, as a dominant player in the market, benefits from its booming automotive and wind energy sectors, where manufacturers are increasingly adopting lightweight Rubber Bonded Abrasives to improve product performance and achieve sustainability targets

- The region’s robust manufacturing base, coupled with significant advancements in aerospace, automotive, and construction industries, creates a conducive environment for the expansion of Rubber Bonded Abrasives, making it a focal point for innovation and market growth

- Additionally, the growing consumer demand for energy-efficient products, along with government policies supporting clean energy and low-emission technologies, further accelerates the adoption of Rubber Bonded Abrasives across key industries in Asia-Pacific

“North America is Projected to Register the Highest Growth Rate”

- The North American region is expected to experience steady growth in the Rubber Bonded Abrasives market, driven by the increasing demand for advanced manufacturing solutions and the automotive industry's shift toward lightweight, high-performance materials

- The U.S. stands out as a key market, supported by its strong automotive and aerospace industries, where Rubber Bonded Abrasives, including honeycomb structures and composite cores, are increasingly utilized to achieve fuel efficiency and meet sustainability objectives

- Canada, with its expanding renewable energy sector, particularly in wind power, offers substantial opportunities for the adoption of Rubber Bonded Abrasives in turbine blade manufacturing and other critical infrastructure projects

- The growing emphasis on sustainability and regulatory pressures to reduce emissions are accelerating the demand for eco-friendly, high-performance Rubber Bonded Abrasives in North America, fueling further market growth

Rubber Bonded Abrasives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abrasivos Manhattan S.A. (Spain)

- Artifex Solutions Ltd. (U.S.)

- Atto Abrasives Limited (Ireland)

- Buehler (U.S.)

- Buffalo Abrasives Inc. (U.S.)

- Cratex Manufacturing Co. (U.S.)

- Lowton Abrasives UK Limited (U.K)

- Marrose Abrasives (U.K)

- Pacer Industries Inc. (U.S.)

- August Rüggeberg GmbH & Co. KG (Germany)

- KGS Diamond Group (Switzerland)

- Saint-Gobain (France)

- Schwarzhaupt GmbH & Co. KG (Germany)

- Tyrolit Schleifmittelwerke Swarovski KG (Austria)

- Y. Ikemura & Co., Ltd. (Japan)

Latest Developments in Global Rubber Bonded Abrasives Market

- In 2024, Norton Abrasives introduced a new line of Rubber Bonded Abrasives designed for industrial applications. This range includes products tailored for rust, weld, coating, and paint removal, as well as surface blending, finishing, and polishing. These abrasives offer excellent cut rates and extended tool life, aiming to meet the increasing demand for efficient and durable solutions in heavy industry sectors

- In July 2016, Atto Abrasive introduced the new Atto Alpha Superfinishing range, which features bonded mounted points, quick-change disks, and polishing wheels. This product line is designed for applications such as surface preparation, deburring, and polishing

- In July 2016, Atto Abrasive unveiled the new Axiom range of polishing wheels specifically designed for the saw blade industry. Available in both rubber and cork bonds, this range comes in various grit types and sizes, making it ideal for polishing saw blades

- In June 2016, Saint-Gobain Abrasives introduced a new line of centerless grinding wheels. These advanced wheels are designed to reduce cycle time by up to 50%, improve stock removal by up to 30%, and extend wheel life

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rubber Bonded Abrasives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rubber Bonded Abrasives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rubber Bonded Abrasives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.