Global Rubber Testing Equipment Market

Market Size in USD Million

CAGR :

%

USD

203.63 Million

USD

322.12 Million

2024

2032

USD

203.63 Million

USD

322.12 Million

2024

2032

| 2025 –2032 | |

| USD 203.63 Million | |

| USD 322.12 Million | |

|

|

|

|

Rubber Testing Equipment Market Size

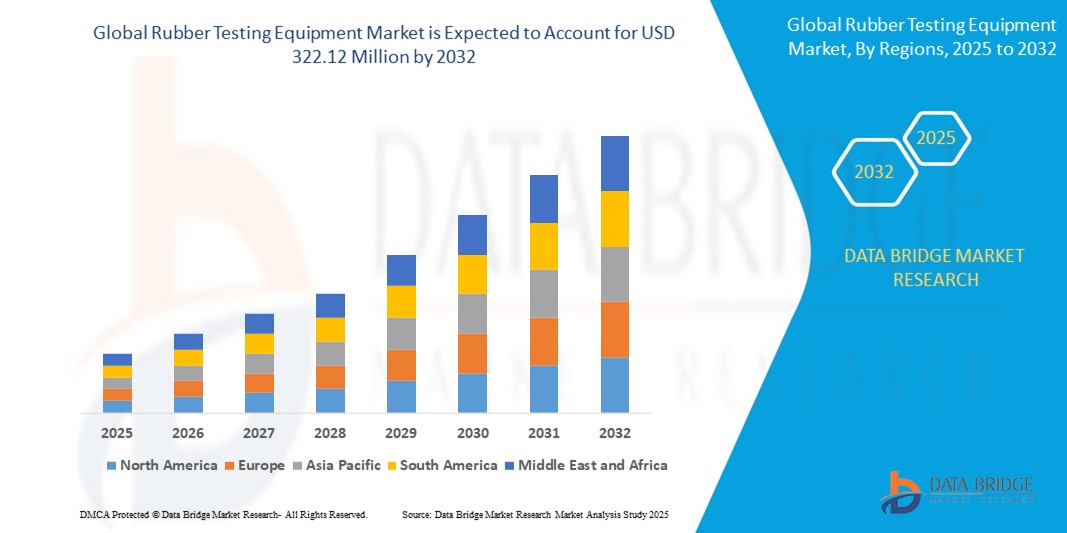

- The global rubber testing equipment market size was valued at USD 203.63 million in 2024 and is expected to reach USD 322.12 million by 2032, at a CAGR of 5.90% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance rubber components across automotive, aerospace, and industrial sectors, along with stringent quality and safety regulations driving the adoption of advanced testing solutions

- In addition, technological advancements in testing equipment, such as automation, real-time data analytics, and integration with digital platforms, are enhancing testing accuracy and efficiency, further supporting market expansion

Rubber Testing Equipment Market Analysis

- The rubber testing equipment market is experiencing steady growth as manufacturers increasingly focus on quality assurance to meet performance standards across industrial applications

- Growing emphasis on product consistency and safety in sectors such as automotive and manufacturing is encouraging the use of precise and automated rubber testing solutions

- North America dominated the rubber testing equipment market with the largest revenue share in 2024, supported by strong demand from the automotive, aerospace, and industrial sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global rubber testing equipment market, driven by rapid industrialization, expanding automotive production, and increasing demand for quality control solutions across emerging economies such as China, India, and Southeast Asia

- The viscosity testing segment accounted for the largest market revenue share in 2024, driven by its critical role in evaluating the processability and flow characteristics of rubber compounds. Manufacturers rely heavily on viscosity testing to ensure consistency in production and to meet the performance requirements of end-use applications

Report Scope and Rubber Testing Equipment Market Segmentation

|

Attributes |

Rubber Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Rubber Testing Equipment Market Trends

“Rising Demand for Automated and Digital Rubber Testing Solutions”

- The rubber testing equipment market is witnessing a noticeable shift toward automation and digitalization, driven by the need for increased accuracy, efficiency, and repeatability in quality testing

- Manufacturers are replacing manual testing systems with automated solutions that reduce human error and enhance consistency, particularly in high-volume production environments

- For instance, tire manufacturers in the automotive industry are increasingly adopting digital hardness testers and automated tensile strength machines to ensure uniformity across batches

- Digital interfaces and data integration capabilities are gaining traction, enabling real-time monitoring and analysis of test results across lab networks

- In another instance, companies producing industrial rubber components are leveraging cloud-connected testing equipment to streamline quality control and improve traceability across global supply chains

Rubber Testing Equipment Market Dynamics

Driver

“Increasing Demand from Automotive and Aerospace Sectors”

- The automotive and aerospace sectors are driving demand for rubber testing equipment due to the need for high-performance components that ensure safety, durability, and efficiency

- For instance, automotive manufacturers such as Continental AG conduct extensive rubber quality testing to meet performance and longevity standards

- Rubber testing tools evaluate critical properties such as tensile strength, elasticity, hardness, abrasion resistance, and aging, helping ensure component reliability under stress

- These tests are vital in producing rubber parts such as tires, seals, hoses, and gaskets that endure harsh conditions and long-term use

- In the aerospace industry, the need for precision and reliability means rubber materials must undergo strict testing, especially for sealing and insulation purposes

- The shift towards electric vehicles increases demand for rubber parts that can resist electrical and thermal stress, further supporting the need for advanced, standardized testing technologies

Restraint/Challenge

“High Initial Investment and Skilled Labor Requirement”

- High procurement costs for advanced rubber testing machinery such as dynamic mechanical analyzers and rheometers act as a major barrier for small- and medium-sized enterprises

- For instance, SMEs in developing countries often delay equipment upgrades due to limited capital allocation for quality control

- Specialized equipment requires trained personnel to operate software interfaces and follow complex testing procedures, which many firms lack

- Inaccurate results due to improper use of machinery can compromise product quality, making this restraint particularly critical in safety-sensitive sectors

- Continuous expenses related to calibration, servicing, and compliance with international standards increase the long-term operational burden

- In regions with limited access to skilled labor and technical education, the adoption of advanced rubber testing equipment becomes significantly more difficult

Rubber Testing Equipment Market Scope

The rubber testing equipment market is segmented on the basis of type of testing, technology, rubber type, frequency range, and application.

- By Type of Testing

On the basis of type of testing, the rubber testing equipment market is segmented into viscosity testing, density testing, hardness testing, flex testing, thickness tester, mechanical stability tester, impact tester, and aging oven testing. The viscosity testing segment accounted for the largest market revenue share in 2024, driven by its critical role in evaluating the processability and flow characteristics of rubber compounds. Manufacturers rely heavily on viscosity testing to ensure consistency in production and to meet the performance requirements of end-use applications.

The hardness testing segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for high-performance rubber components in sectors such as automotive, construction, and aerospace. Hardness testing provides accurate assessments of material resistance under pressure, ensuring the durability and reliability of rubber parts used in extreme conditions.

- By Technology

On the basis of technology, the market is segmented into Mooney viscometer, moving die rheometer, automated density tester, automated hardness tester, and process analyzer. The Mooney viscometer segment held the largest share in 2024, as it remains a widely accepted standard for measuring the viscosity of raw rubber and rubber compounds. Its simple operation and broad applicability make it a fundamental tool in rubber quality control processes.

The process analyzer segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for real-time monitoring of production parameters. Process analyzers enhance operational efficiency by reducing downtime and enabling data-driven decision-making, which is becoming vital in automated and large-scale manufacturing environments.

- By Rubber Type

On the basis of rubber type, the market is segmented into styrene butadiene rubber, EPDM rubber, butyl rubber, natural rubber, silicone rubber, neoprene rubber, nitrile rubber, and others. Natural rubber dominated the market in 2024, owing to its extensive use across automotive, industrial, and consumer applications due to its elasticity and mechanical strength. Its compatibility with diverse testing methods and availability across global markets further supports segment dominance.

The silicone rubber segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to its excellent thermal stability, electrical insulation properties, and rising use in the electronics and healthcare sectors. This material requires rigorous testing to meet stringent quality standards, fueling demand for specialized rubber testing equipment.

- By Frequency Range

On the basis of frequency range, the rubber testing equipment market is segmented into more than 4 Hz, 1 to 4 Hz, and less than 1 Hz. The 1 to 4 Hz segment held the largest market revenue share in 2024 due to its broad application across standard dynamic mechanical analysis and fatigue testing. This range is optimal for assessing performance under repetitive stress conditions in sectors such as automotive and footwear.

The more than 4 Hz segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its increasing use in advanced fatigue and impact testing applications. Equipment operating in this range enables faster testing cycles and higher precision, which is crucial for high-throughput industrial environments.

- By Application

On the basis of application, the rubber testing equipment market is segmented into tyres & automotive parts, industrial rubber products, rubber seals & O rings, shoe soles, conveyor belts, belts, rubber mats & carpets, and sports & fitness. The tyres & automotive parts segment accounted for the largest share in 2024, driven by the strict quality requirements and safety regulations in the automotive sector. Testing ensures components such as tires and bushings meet performance criteria for wear, pressure, and temperature resistance.

The conveyor belts segment is expected to witness the fastest growth rate from 2025 to 2032, supported by expanding industrialization and the need for durable materials in logistics and mining. Robust testing of mechanical properties and aging resistance is crucial to ensure long-lasting performance under continuous operation and abrasive environments.

Rubber Testing Equipment Market Regional Analysis

- North America dominated the rubber testing equipment market with the largest revenue share in 2024, supported by strong demand from the automotive, aerospace, and industrial sectors

- The region benefits from a well-established rubber manufacturing ecosystem and widespread adoption of advanced testing technologies for quality assurance

- Rising investment in material research, alongside regulatory emphasis on product safety and performance, is driving the uptake of precision rubber testing tools across diverse applications

U.S. Rubber Testing Equipment Market Insight

The U.S. rubber testing equipment market captured the largest revenue share in North America in 2024, propelled by the country’s leading position in automotive innovation and polymer research. Robust investments in research labs and tire manufacturing facilities, along with rising demand for high-performance rubber components, are supporting market expansion. Moreover, the presence of major testing equipment providers and early adoption of automated, digital testing systems contribute to strong market growth.

Europe Rubber Testing Equipment Market Insight

The Europe rubber testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, backed by stringent product quality regulations and strong industrial manufacturing activity. Countries such as Germany, France, and Italy are investing heavily in quality control processes across rubber goods production. The push toward sustainability and eco-friendly testing practices further encourages adoption of energy-efficient, automated testing equipment for enhanced precision.

U.K. Rubber Testing Equipment Market Insight

The U.K. rubber testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand from the tire and automotive components industries. The country's focus on innovation, paired with rising investment in R&D for advanced materials, is fostering market development. In addition, local manufacturers are adopting testing technologies to meet evolving safety standards and optimize production processes.

Germany Rubber Testing Equipment Market Insight

The Germany rubber testing equipment market continues to expand due to the country's strong engineering base and focus on industrial quality control. With major automotive and rubber product manufacturers operating within the country, demand for highly accurate, lab-based testing equipment remains strong. Emphasis on automation, precision, and data analytics in material testing further supports market growth in both the domestic and export segments.

Asia-Pacific Rubber Testing Equipment Market Insight

The Asia-Pacific rubber testing equipment market is projected to register the fastest CAGR from 2025 to 2032, driven by rapid industrialization, increasing R&D activities, and growing automotive production in countries such as China, India, and Japan. As the region becomes a key manufacturing hub, local and international firms are investing in high-performance testing systems to ensure product durability and compliance with global standards.

Japan Rubber Testing Equipment Market Insight

The Japan rubber testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country's leadership in precision technology and automotive manufacturing. Japanese firms prioritize material reliability, driving demand for high-end testing instruments across both academic and industrial laboratories. The integration of AI and automation in rubber testing is gaining traction, improving productivity and test accuracy in high-volume settings.

China Rubber Testing Equipment Market Insight

The China rubber testing equipment market held the largest share in the Asia-Pacific region in 2024, supported by its vast manufacturing sector and rising demand for rubber components across industries. The expansion of tire production and export, along with government initiatives for quality enhancement and smart factory implementation, is accelerating adoption of advanced testing technologies. Local players are also contributing to innovation through cost-effective, high-performance equipment solutions.

Rubber Testing Equipment Market Share

The Rubber Testing Equipment industry is primarily led by well-established companies, including:

- Alpha Technologies (U.S.)

- International Equipments (India)

- Asian Test Equipments (India)

- Elastocon AB (Sweden)

- Gotech Testing Machines Inc. (Taiwan)

- GÖTTFERT Werkstoff-Prüfmaschinen GmbH (Germany)

- Dak System Inc. (India)

- Gibitre Instruments (Italy)

- MonTech Rubber Testing Solutions (Germany)

- Ektron Tek Co., Ltd. (U.S.)

- H.W. Wallace & Co Limited (U.K.)

- Haida International Equipment Co., Ltd. (China)

- U-CAN DYNATEX INC. (Taiwan)

- Qualitest International Inc.(Canada)

- J.T.M Technology Co., Ltd. (Taiwan)

- Ueshima Seisakusho Co., Ltd. (Japan)

- Industrial Physics. (U.S.)

- TA Instruments (U.S.)

- PRESCOTT INSTRUMENTS LTD (U.K.)

- AML Instruments Limited (U.K.)

Latest Developments in Global Rubber Testing Equipment Market

- In September 2022, TA Instruments introduced a new powder rheology tooling as part of a product launch aimed at simplifying and accelerating rheology measurements. This innovation is designed to enhance the study of flow and deformation properties of various materials, offering increased efficiency and ease of use for researchers and industries. The development supports broader applications in materials testing and is expected to improve testing accuracy and throughput across sectors

- In April 2023, Qualitest completed the acquisition of Q Analysts, a U.S.-based quality engineering firm, as part of its strategic expansion. This move strengthens Qualitest’s capabilities in advanced quality engineering for emerging technologies and extends its geographic presence in the U.S. with new labs in California and Washington. It also reinforces its footprint in international markets such as the U.K., Madagascar, Switzerland, and India, supporting enhanced global service delivery in the rubber testing equipment market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF GLOBAL RUBBER TESTING EQUIPMENT MARKET

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- type of testing timeline curve

- MARKET APPLICATION COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- TECHNOLOGICAL ADVANCEMENTS IN RUBBER TESTING

- INCREASING GROWTH IN THE TIRE AND RUBBER INDUSTRY

- INCREASING INVESTMENT FOR THE DEVELOPMENT OF ADVANCED TECHNOLOGY AND PRODUCT

- RISING APPLICATIONS FROM THE AUTOMOTIVE INDUSTRY

- GROWING INDUSTRIALIZATION AND RAPID URBANIZATION

- INCREASING GROWTH OF SHOE INDUSTRY

- RESTRAINTS

- LIMITATIONS INVOLVED WITH THE TESTING EQUIPMENT DURING THE TESTING PROCESS

- THERMOPLASTIC ELASTOMER AS AN ALTERNATIVE TO NATURAL RUBBER

- OPPORTUNITIES

- INCREASE IN THE PRODUCTION OF SYNTHETIC RUBBER

- GROWING CONCERN TOWARDS QUALITY CONTROL

- RISING GROWTH IN THE SPORTS INDUSTRY

- EVOLUTION OF ADVANCED TIRE TESTING TECHNIQUES

- GROWING DEMAND FOR RUBBER PRODUCTS IN THE HEALTHCARE INDUSTRY

- CHALLENGES

- ENVIRONMENTAL PROBLEMS PERTAINING TO PRODUCTION AND DISPOSING OF RUBBER

- HIGH COST OF OWNERSHIP

- IMPACT OF COVID-19 ON GLOBAL RUBBER TESTING EQUIPMENT MARKET

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- global RUBBER TESTING EQUIPMENT MARKET, BY Type of Testing

- overview

- Viscosity Testing

- Density Testing

- Hardness Testing

- Flex Testing

- Thickness Tester

- Mechanical Stability Tester

- Impact Tester

- Aging Oven Testing

- Others

- global RUBBER TESTING EQUIPMENT MARKET, BY TECHNOLOGY

- overview

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- global RUBBER TESTING EQUIPMENT MARKET, BY Rubber Type

- overview

- Styrene Butadiene Rubber

- EPDM Rubber

- Butyl Rubber

- Natural Rubber

- Silicone Rubber

- Neoprene Rubber

- Nitrile Rubber

- Others

- global RUBBER TESTING EQUIPMENT MARKET, BY Frequency Range

- overview

- More than 4 Hz

- 1 to 4 Hz

- Less than 1 Hz

- global RUBBER TESTING EQUIPMENT MARKET, BY Application

- overview

- Tyres & Automotive Parts

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Industrial Rubber Products

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Rubber Seals & O Rings

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Shoe Soles

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Conveyor Belts

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Belts

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Rubber Mats & Carpets

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Sports & Fitness

- Mooney Viscometer

- Moving Die Rheometer

- Automated Density Tester

- Automated Hardness Tester

- Process Analyzer

- Others

- Others

- Global rubber testing equipment Market, by Region

- overview

- ASIA-PACIFIC

- China

- India

- Japan

- SOUTH KOREA

- Thailand

- Australia

- SIngapore

- MALAYSIA

- Indonesia

- Philippines

- Rest of Asia-pacific

- North America

- U.S.

- CANADA

- Mexico

- EUROPE

- Germany

- France

- Russia

- U.K.

- Italy

- Spain

- Netherlands

- BELGIUM

- Switzerland

- Turkey

- Rest of Europe

- MIDDLE EAST AND AFRICA

- Israel

- South Africa

- Saudi Arabia

- U.A.E.

- Egypt

- rest of Middle East and Africa

- South America

- BRAZIL

- ARGENTINA

- Rest of South America

- GLOBAL Rubber testing equipment market: COMPANY landscape

- company share analysis: GLOBAL

- company share analysis: NORTH AMERICA

- company share analysis: EUROPE

- company share analysis: Asia-pacific

- swot analysis

- Company profile

- ALPHA TECHNOLOGIES (A SUBSIDIARY OF ROPER TECHNOLOGIES, INC.)

- COMPANY PROFILE

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- MONTECH RUBBER TESTING SOLUTIONS

- COMPANY PROFILE

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- QUALITEST INTERNATIONAL INC.

- COMPANY PROFILE

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GOTECH TESTING MACHINES INC.

- COMPANY PROFILE

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ELASTOCON AB

- COMPANY PROFILE

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AML INSTRUMENTS LIMITED

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ASIAN TEST EQUIPMENTS

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- DAK SYSTEM INC.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- 8.3 RECENT DEVELOPMENT

- EKTRON TEK CO., LTD.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GÖTTFERT MATERIAL TESTING MACHINES GMBH

- COMPANY PROFILE

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GIBITRE INSTRUMENTS

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- HAIDA INTERNATIONAL EQUIPMENT CO., LTD.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- H.W. WALLACE & CO LIMITED

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- INTERNATIONAL EQUIPMENTS

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- J.T.M TECHNOLOGY CO., LTD.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- PRESCOTT INSTRUMENTS LTD.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- TA INSTRUMENTS

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- TESTING MACHINES, INC.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- UESHIMA SEISAKUSHO CO., LTD.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- U-CAN DYNATEX INC.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

Global Rubber Testing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rubber Testing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rubber Testing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.