Global Ruminant Animal Feed Market

Market Size in USD Million

CAGR :

%

USD

6.85 Million

USD

9.02 Million

2025

2033

USD

6.85 Million

USD

9.02 Million

2025

2033

| 2026 –2033 | |

| USD 6.85 Million | |

| USD 9.02 Million | |

|

|

|

|

What is the Global Ruminant Animal Feed Market Size and Growth Rate?

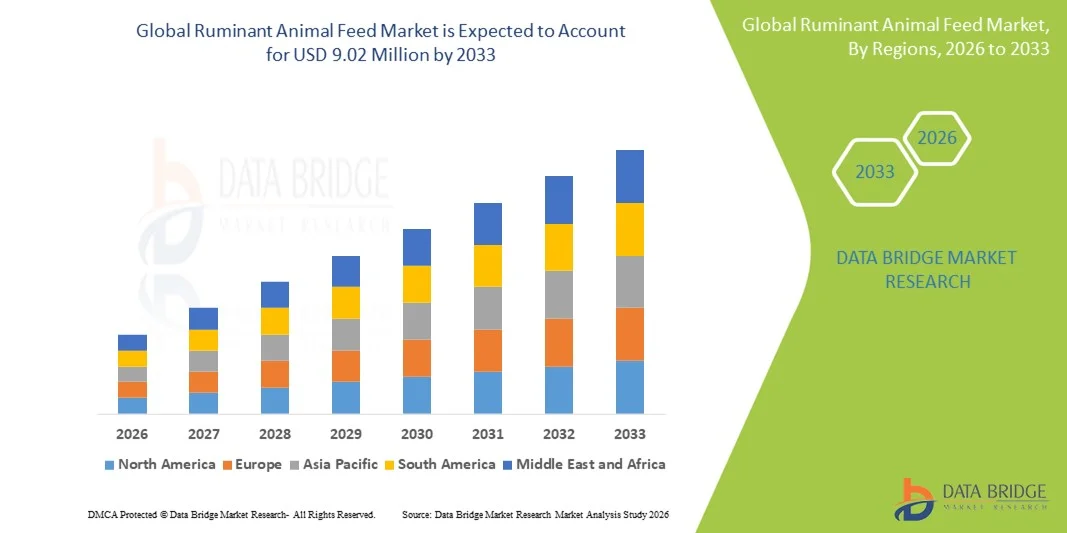

- The global ruminant animal feed market size was valued at USD 6.85 million in 2025 and is expected to reach USD 9.02 million by 2033, at a CAGR of 3.50% during the forecast period

- Rising livestock industrialization is the vital factor escalating the market growth, also rising demand for animal-based products among humans, rising focus on animal health, growing momentum of proponents of natural growth, increase in cattle farming, increasing consumer awareness of the benefits associated with the use of feed additives to reduce disease, increasing popularity of meat and meat related products and rising health problems in animals are the major factors among others driving the growth of ruminant animal feed market

What are the Major Takeaways of Ruminant Animal Feed Market?

- Rising investments in research and development (R&D) for improving food fortification processes and increasing technological advancements and modernization in the production techniques will further create new opportunities for ruminant animal feed market

- However, rising cost of raw materials and rising government regulations are the major factors among others acting as restraints, and will further challenge the growth of ruminant animal feed market

- Europe dominated the ruminant animal feed market with the largest revenue share of 43.2% in 2025, driven by the presence of established livestock farming, advanced feed manufacturing infrastructure, and rising demand for functional and fortified feed across Germany, U.K., France, and the Netherlands

- Asia-Pacific is projected to witness the fastest growth rate of 9.8% during 2026–2033, fueled by rising demand for dairy and meat products, expansion of livestock farming, and adoption of enriched feed formulations in China, India, Japan, and South Korea

- The Dairy Cattle segment dominated the market with a revenue share of 46.5% in 2025, owing to high demand for milk production, increasing dairy farming activities, and the need for optimized feed to enhance milk yield and quality

Report Scope and Ruminant Animal Feed Market Segmentation

|

Attributes |

Ruminant Animal Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Ruminant Animal Feed Market?

Growing Focus on Functional and Nutritional Animal Feed

- The ruminant animal feed market is witnessing a key trend of increasing incorporation of nutrient-rich and functional ingredients into ruminant diets to enhance growth performance, immunity, and digestive health. This trend is driven by rising demand for sustainable livestock production, improved feed efficiency, and the growing awareness of animal welfare and health among farmers globally

- For instance, companies such as ADM Animal Nutrition and Cargill have introduced fortified feed additives and probiotic-enriched ruminant feed formulations to support gut health, milk yield, and overall livestock productivity

- The increasing prevalence of metabolic and digestive disorders in ruminants is boosting demand for functional feed interventions

- Feed manufacturers are incorporating prebiotics, probiotics, enzymes, and plant extracts to optimize nutrient absorption and animal growth

- Ongoing research on rumen microbiota, feed digestibility, and synergistic health benefits is encouraging innovation in ruminant nutrition products

- As livestock producers focus on higher productivity and sustainability, functional and nutritionally optimized ruminant feed is expected to remain a central trend in the global market

What are the Key Drivers of Ruminant Animal Feed Market?

- Rising awareness among livestock farmers regarding the benefits of optimized nutrition, including improved feed efficiency, immunity, and milk/meat quality, is a major driver of the market

- For instance, in 2025, ForFarmers and Land O’Lakes expanded production of probiotic and enzyme-enriched feed formulations for dairy and beef cattle

- Growing demand for sustainable and high-quality animal protein, coupled with strict regulatory standards on animal health, fuels market growth

- Advances in feed additive technologies, including precision nutrition, fermentation, and bioactive extraction, enable higher-quality, consistent feed products

- Increased adoption of functional ruminant feed across North America, Europe, and Asia-Pacific to support livestock performance and profitability is driving market expansion

- As research, technological innovation, and sustainability trends continue, the global Ruminant Animal Feed market is projected to witness steady growth in the coming years

Which Factor is Challenging the Growth of the Ruminant Animal Feed Market?

- High costs of advanced feed ingredients, complex formulation processes, and variability in raw material quality limit large-scale adoption of functional ruminant feed

- For instance, during 2024–2025, fluctuations in supply of probiotics, enzymes, and plant-based additives impacted feed production volumes

- Stringent regulatory compliance for animal feed additives across different regions increases operational costs and market entry complexity

- Limited awareness among small-scale livestock farmers in emerging markets about the benefits of functional feed slows adoption

- Competition from conventional feed formulations and low-cost alternatives creates price pressure and affects market penetration

- To overcome these challenges, market players are investing in advanced feed technologies, strategic partnerships, and farmer education programs to ensure consistent, high-quality ruminant feed solutions

How is the Ruminant Animal Feed Market Segmented?

The market is segmented on the basis of animal type and ingredient type.

- By Animal Type

On the basis of animal type, the ruminant animal feed market is segmented into Dairy Cattle, Beef Cattle, and Other Animal Types. The Dairy Cattle segment dominated the market with a revenue share of 46.5% in 2025, owing to high demand for milk production, increasing dairy farming activities, and the need for optimized feed to enhance milk yield and quality. Dairy-focused feed formulations, enriched with proteins, vitamins, and minerals, are extensively used to support lactation, improve immunity, and maintain overall animal health.

The Beef Cattle segment is projected to grow at the fastest CAGR during 2026–2033, driven by rising global demand for high-quality beef, adoption of functional feed additives to improve growth rates, and increasing integration of precision feeding systems to enhance feed efficiency and meat quality. Continuous research in feed optimization for growth performance and sustainability further supports this segment’s expansion.

- By Ingredient Type

Based on ingredient type, the ruminant animal feed market is segmented into Cereals, Cakes and Meals, Food Wastages, Feed Additives, and Other Ingredients. The Cereals segment dominated the market with a revenue share of 44.8% in 2025, due to their high nutritional value, widespread availability, and ease of formulation into ruminant feed. Cereal-based feed is extensively used for energy provision, gut health improvement, and growth optimization in both dairy and beef cattle.

The Feed Additives segment is expected to witness the fastest CAGR from 2026 to 2033, driven by increasing use of probiotics, enzymes, vitamins, and plant extracts to enhance feed efficiency, animal health, and product quality. Rising awareness of sustainable livestock farming, government incentives for high-performance feed, and ongoing innovations in additive formulation are further supporting the growth of this high-potential segment.

Which Region Holds the Largest Share of the Ruminant Animal Feed Market?

- Europe dominated the ruminant animal feed market with the largest revenue share of 43.2% in 2025, driven by the presence of established livestock farming, advanced feed manufacturing infrastructure, and rising demand for functional and fortified feed across Germany, U.K., France, and the Netherlands. Increasing consumer focus on sustainable livestock practices, animal health, and nutrient-rich feed formulations has accelerated market penetration

- Enterprises in the region are investing heavily in research and development, precision feed technologies, and high-quality ingredient sourcing to enhance productivity and nutritional quality. The growth of integrated livestock farms, combined with regulatory compliance and export demand, strengthens Europe’s dominance

- Supportive government policies promoting animal welfare, feed standardization, and sustainable farming continue to position Europe as the global leader in the Ruminant Animal Feed market

Germany Ruminant Animal Feed Market Insight

Germany represents the largest contributor to the European ruminant animal feed market, supported by strong livestock production, high adoption of advanced feed formulations, and research on feed additives for improved digestion and growth performance. Companies are investing in high-quality cereals, cakes, and functional feed additives to optimize dairy and beef cattle productivity. Government initiatives promoting animal nutrition standards and livestock sustainability further reinforce Germany’s leadership in the region.

U.K. Ruminant Animal Feed Market Insight

The U.K. market is expanding steadily, driven by the increasing adoption of fortified and nutrient-dense feed for dairy and beef cattle. Domestic feed manufacturers are focusing on sustainable sourcing, enzyme and probiotic integration, and digital feed monitoring solutions. Growing awareness of animal health benefits and government support for precision livestock farming are accelerating adoption across both commercial and smallholder operations.

Asia-Pacific Ruminant Animal Feed Market Insight

Asia-Pacific is projected to witness the fastest growth rate of 9.8% during 2026–2033, fueled by rising demand for dairy and meat products, expansion of livestock farming, and adoption of enriched feed formulations in China, India, Japan, and South Korea. Investments in modern feed mills, feed additives, and animal nutrition research support rapid regional adoption.

China Ruminant Animal Feed Market Insight

China represents the largest contributor to the Asia-Pacific ruminant animal feed market, supported by growing livestock production, government initiatives for sustainable animal farming, and rising consumption of dairy and beef products. Companies are leveraging high-quality cereals, cakes, and feed additives to enhance livestock performance and health.

India Ruminant Animal Feed Market Insight

India is emerging as a key growth hub within Asia-Pacific, driven by increasing demand for nutrient-rich feed, expanding dairy and beef sectors, and supportive policies under programs such as “Make in India” and livestock development initiatives. Domestic feed producers are investing in advanced feed formulations, standardized ingredient sourcing, and additive integration to boost productivity and ensure high-quality animal nutrition.

Which are the Top Companies in Ruminant Animal Feed Market?

The ruminant animal feed industry is primarily led by well-established companies, including:

- ForFarmers (Netherlands)

- Land O’Lakes Inc. (U.S.)

- Adisseo France S.A.S. (France)

- Ajinomoto Co., Inc. (Japan)

- ADM (U.S.)

- BASF SE (Germany)

- Biomin Holdings GmbH (Austria)

- Cargill, Incorporated (U.S.)

- Chr. Hansen (Denmark)

- DuPont or its affiliates (U.S.)

- DSM (Netherlands)

- Elanco Animal Health (U.S.)

- Evonik Industries (Germany)

- Kemin Industries, Inc. (U.S.)

- Novozymes (Denmark)

- Novus International Inc. (U.S.)

- Nutreco N.V. (Netherlands)

- Amco Proteins (U.S.)

- Prinova Group LLC (U.S.)

- Covington & Burling LLP (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.