Global Ruminant Feed Antioxidants Market

Market Size in USD Million

CAGR :

%

USD

218.36 Million

USD

324.09 Million

2025

2033

USD

218.36 Million

USD

324.09 Million

2025

2033

| 2026 –2033 | |

| USD 218.36 Million | |

| USD 324.09 Million | |

|

|

|

|

Ruminant Feed Antioxidants Market Size

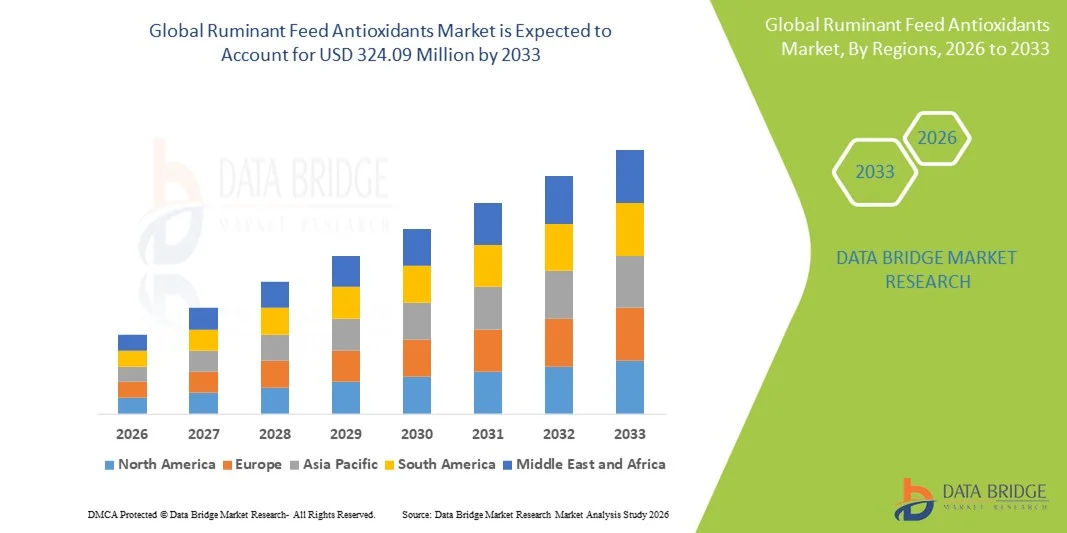

- The global ruminant feed antioxidants market size was valued at USD 218.36 million in 2025 and is expected to reach USD 324.09 million by 2033, at a CAGR of 5.06% during the forecast period

- The market growth is largely fuelled by the rising demand for high-quality animal-derived products and the increasing awareness regarding animal health management among livestock producers

- In addition, the growing prevalence of oxidative stress-related disorders in ruminants and the need to enhance feed efficiency are propelling the use of antioxidants in feed formulations

Ruminant Feed Antioxidants Market Analysis

- The market is witnessing significant growth due to the rising focus on improving the shelf life and stability of feed ingredients, which is essential to prevent nutrient degradation during storage and transportation

- The increasing global livestock population, particularly dairy and beef cattle, is driving the need for high-performance feed additives that support growth, immunity, and reproduction

- Asia-Pacific dominated the ruminant feed antioxidants market with the largest revenue share in 2025, driven by the rapid expansion of the livestock industry and the increasing demand for high-quality dairy and meat products. The region’s large ruminant population, combined with rising awareness of feed quality and animal health, is propelling the use of antioxidants in feed formulations

- North America region is expected to witness the highest growth rate in the global ruminant feed antioxidants market, driven by growing emphasis on animal welfare, rising preference for natural antioxidants, and increasing investments in feed innovation and preservation technologies

- The synthetic antioxidants segment held the largest market revenue share in 2025 due to their strong oxidative stability, cost-effectiveness, and proven performance in extending the shelf life of feed ingredients. Synthetic variants such as BHT, BHA, and ethoxyquin are widely utilized across commercial feed formulations for their high efficiency in preventing rancidity and nutrient degradation during storage and transportation.

Report Scope and Ruminant Feed Antioxidants Market Segmentation

|

Attributes |

Ruminant Feed Antioxidants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Cargill, Incorporated (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ruminant Feed Antioxidants Market Trends

Rising Adoption Of Natural And Plant-Based Antioxidants

- The market is witnessing a growing preference for natural antioxidants derived from plant sources such as rosemary extract, tocopherols, and green tea polyphenols. These ingredients are increasingly replacing synthetic antioxidants due to their safer profile and alignment with the clean-label movement in animal nutrition. This shift is driven by stringent global regulations limiting synthetic additive use and the rising consumer demand for naturally sourced livestock products that align with sustainability and traceability goals

- The demand for residue-free and sustainable feed solutions is driving producers to shift toward natural formulations. Livestock farmers are also becoming more conscious of feed ingredient quality, especially in dairy and meat production, where consumer scrutiny of food origin and safety is intensifying. The growing awareness of the environmental footprint of chemical-based additives is also motivating large feed producers to reformulate their offerings with eco-friendly, plant-derived antioxidants

- In addition, several feed manufacturers are investing in research to improve the stability and efficacy of natural antioxidants under different feed processing conditions. This has led to the development of novel encapsulated formulations that enhance absorption and shelf life. Technological advancements in microencapsulation and nanoemulsion are further improving antioxidant delivery efficiency, ensuring consistent feed quality even in high-temperature pelleting environments

- For instance, in 2023, European feed companies reported a significant rise in sales of natural antioxidant blends formulated for ruminant diets, driven by the region’s stringent regulatory environment and consumer preference for natural additives. These products not only helped in maintaining feed freshness but also contributed to improved animal performance and better immune response. The trend has also encouraged new product launches by local biotechnology firms focusing on green feed additives

- While natural antioxidants are gaining traction, their higher cost compared to synthetic counterparts remains a consideration. Continued innovation and scaling of production are expected to gradually reduce price gaps and enhance adoption across all livestock sectors. Moreover, increased collaboration between feed manufacturers, research institutions, and agricultural cooperatives is expected to accelerate cost efficiency and improve global accessibility to plant-based antioxidant solutions

Ruminant Feed Antioxidants Market Dynamics

Driver

Increasing Focus On Livestock Health And Feed Quality Enhancement

- The growing emphasis on animal health management and productivity improvement is a major driver of the ruminant feed antioxidants market. Antioxidants help protect feed lipids, vitamins, and other nutrients from oxidation, ensuring higher nutritional value and palatability for animals. This contributes to better feed intake, improved immunity, and enhanced growth performance, which are crucial for maximizing farm profitability and sustainability

- Rising global demand for dairy and meat products has prompted farmers to adopt feed additives that support animal performance and disease resistance. This trend is further reinforced by consumer expectations for consistent product quality and safety across animal-derived foods. Feed antioxidants are becoming essential for preventing nutritional degradation, thereby helping producers meet export-quality standards and minimize post-harvest losses

- In addition, governments and international organizations are promoting best feeding practices and quality standards to minimize nutritional losses and improve livestock efficiency. This has encouraged widespread use of antioxidants in commercial feed production. Subsidy programs and extension services in developing economies are also raising awareness about oxidative damage prevention in feed ingredients and stored silage

- For instance, in 2023, several Asian countries implemented quality control regulations for compound feed production, driving the use of approved antioxidant formulations to maintain stability and prevent spoilage during storage and transportation. Feed mills that adopted compliant antioxidant technologies reported higher customer satisfaction and longer shelf life for their finished products. This regulatory focus is expected to continue shaping market growth through enhanced feed safety protocols

- The growing focus on feed preservation, animal welfare, and productivity optimization is expected to sustain the demand for feed antioxidants in the years ahead. Rising investments by key industry players in advanced feed additive technologies are likely to further strengthen the integration of antioxidants into standard livestock nutrition programs. These developments collectively ensure that antioxidants remain an indispensable component of modern animal production systems

Restraint/Challenge

Fluctuating Prices Of Raw Materials And Dependence On Synthetic Additives

- The high volatility in the prices of raw materials used in antioxidant production, such as petrochemical-based ingredients and plant extracts, poses a major challenge for manufacturers. Cost fluctuations impact product pricing and profit margins, especially for small and mid-sized feed producers. Seasonal variations in the availability of natural raw materials and geopolitical supply chain disruptions further complicate cost predictability across global markets

- Despite rising interest in natural antioxidants, the global feed industry still relies heavily on synthetic variants such as BHT, BHA, and ethoxyquin due to their lower cost and stronger oxidative stability. This dependence limits the transition toward sustainable alternatives. In many developing countries, limited regulatory pressure and weak awareness of synthetic residue risks have sustained the use of these cheaper, chemical-based antioxidants

- In many developing regions, limited awareness of feed oxidation effects and lack of standardized testing further hinder adoption. Farmers often prioritize basic nutritional additives over specialized antioxidants, affecting overall feed quality management. The absence of training programs and diagnostic infrastructure to monitor oxidative degradation also limits proactive antioxidant use at the farm level

- For instance, in 2023, feed producers across Latin America reported increased production costs due to rising raw material prices and limited availability of natural antioxidants, constraining market growth potential. These fluctuations led to inconsistent feed quality, higher wastage, and increased dependence on imported synthetic antioxidants. Regional suppliers are now seeking local sourcing alternatives to stabilize costs and reduce import reliance

- Addressing these challenges requires strategic sourcing, technological innovation, and industry collaboration to ensure cost-effective antioxidant solutions that meet both performance and sustainability expectations. Public-private partnerships and investment in local production of botanical extracts could help minimize volatility and enhance supply chain resilience. Furthermore, educating farmers about the long-term economic and health benefits of antioxidants can drive more stable demand across markets

Ruminant Feed Antioxidants Market Scope

The market is segmented on the basis of type and form.

- By Type

On the basis of type, the ruminant feed antioxidants market is segmented into synthetic antioxidants and natural antioxidants. The synthetic antioxidants segment held the largest market revenue share in 2025 due to their strong oxidative stability, cost-effectiveness, and proven performance in extending the shelf life of feed ingredients. Synthetic variants such as BHT, BHA, and ethoxyquin are widely utilized across commercial feed formulations for their high efficiency in preventing rancidity and nutrient degradation during storage and transportation.

The natural antioxidants segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for sustainable, residue-free feed solutions and the growing regulatory restrictions on synthetic additives. Increasing consumer preference for naturally sourced animal products and advancements in plant-based formulations such as tocopherols and rosemary extracts are further accelerating the adoption of natural antioxidants in ruminant feed production.

- By Form

On the basis of form, the ruminant feed antioxidants market is segmented into dry and liquid. The dry segment accounted for the largest market share in 2025, attributed to its longer shelf life, easier storage, and compatibility with a wide range of feed types. Dry antioxidants are preferred by feed manufacturers due to their stability during high-temperature processing and ease of blending in premixes and compound feeds.

The liquid segment is expected to witness the fastest growth rate from 2026 to 2033, supported by its superior dispersion properties and faster absorption rates in feed formulations. Liquid antioxidants are increasingly used in feed mills and on-farm mixing systems for their convenience and uniform distribution capabilities, making them ideal for enhancing feed quality in both small-scale and industrial livestock operations.

Ruminant Feed Antioxidants Market Regional Analysis

- Asia-Pacific dominated the ruminant feed antioxidants market with the largest revenue share in 2025, driven by the rapid expansion of the livestock industry and the increasing demand for high-quality dairy and meat products. The region’s large ruminant population, combined with rising awareness of feed quality and animal health, is propelling the use of antioxidants in feed formulations

- Feed manufacturers across Asia-Pacific are increasingly investing in advanced feed preservation technologies to minimize nutrient losses and oxidation, ensuring improved productivity and profitability. Governments in emerging economies are also supporting feed quality enhancement programs, further boosting market growth

- The strong presence of feed production hubs in countries such as China, India, and Japan, coupled with a growing shift toward intensive livestock farming, continues to strengthen Asia-Pacific’s dominance in the global ruminant feed antioxidants market

China Ruminant Feed Antioxidants Market Insight

The China ruminant feed antioxidants market captured the largest revenue share in 2025 within Asia-Pacific, driven by its vast livestock base and expanding dairy sector. Rising consumer demand for safe, residue-free meat and milk has accelerated the adoption of feed antioxidants among Chinese producers. In addition, the government’s ongoing initiatives to promote feed efficiency and reduce waste have encouraged feed manufacturers to integrate both synthetic and natural antioxidants into commercial feed blends. Local production of feed additives and continuous innovation in plant-based antioxidants are further strengthening China’s market leadership.

Japan Ruminant Feed Antioxidants Market Insight

The Japan ruminant feed antioxidants market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s emphasis on premium livestock nutrition and stringent feed safety standards. Japan’s advanced feed manufacturing sector is integrating both natural and synthetic antioxidants to ensure long-term stability and quality of ruminant feed. The growing adoption of technologically advanced feed processing techniques and high-value antioxidant blends is contributing to market growth. Furthermore, Japan’s focus on sustainable and environmentally responsible farming practices is expected to encourage the use of plant-derived antioxidant solutions.

North America Ruminant Feed Antioxidants Market Insight

The North America ruminant feed antioxidants market accounted for a significant revenue share in 2025, driven by the strong presence of industrialized livestock farming and growing awareness regarding feed preservation. The region’s focus on animal welfare, nutritional quality, and the prevention of feed spoilage has made antioxidants an integral part of feed formulations. Technological advancements in encapsulated antioxidant delivery systems and the increasing shift toward natural feed additives are further supporting growth. High investment in research and the presence of established feed manufacturers ensure continuous innovation across the market.

U.S. Ruminant Feed Antioxidants Market Insight

The U.S. ruminant feed antioxidants market is expected to witness the fastest growth rate from 2026 to 2033, driven by the high demand for efficient feed preservation solutions and the country’s well-developed livestock industry. Farmers are increasingly adopting antioxidants to enhance feed stability, reduce wastage, and maintain nutrient content in stored feed. The growing adoption of sustainable feeding practices, supported by regulatory efforts encouraging cleaner production, is further driving the market. In addition, innovation in antioxidant formulation and the availability of customized feed additive solutions are expanding the market presence of key players in the U.S.

Europe Ruminant Feed Antioxidants Market Insight

The Europe ruminant feed antioxidants market is expected to witness steady growth from 2026 to 2033, primarily driven by stringent regulations on feed safety and the growing shift toward natural additives. European consumers’ increasing preference for organic and chemical-free animal products has encouraged producers to adopt plant-based antioxidant alternatives. Feed manufacturers in countries such as Germany, France, and the U.K. are focusing on sustainable sourcing and green chemistry approaches to enhance feed stability. Moreover, continuous investment in research and strict quality control standards are supporting market expansion across the region.

Germany Ruminant Feed Antioxidants Market Insight

The Germany ruminant feed antioxidants market is expected to witness the fastest growth rate from 2026 to 2033, driven by the country’s strong focus on animal nutrition quality and environmental sustainability. Germany’s advanced feed manufacturing infrastructure, combined with a preference for natural, high-performance additives, is promoting antioxidant adoption. The integration of innovative feed technologies, including precision feeding and digital monitoring systems, is also influencing market demand. Furthermore, collaborations between research institutions and feed producers are fostering the development of next-generation antioxidant formulations tailored to regional livestock needs.

U.K. Ruminant Feed Antioxidants Market Insight

The U.K. ruminant feed antioxidants market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising emphasis on feed quality assurance and sustainable livestock production. The growing demand for premium dairy and beef products, combined with strict regulations on feed safety and additive usage, is encouraging the adoption of both natural and synthetic antioxidants. Feed manufacturers are increasingly focusing on the development of residue-free formulations that align with consumer expectations for cleaner and safer food chains. In addition, the U.K.’s expanding organic livestock farming sector and investments in advanced feed preservation technologies are expected to further accelerate market growth.

Ruminant Feed Antioxidants Market Share

The Ruminant Feed Antioxidants industry is primarily led by well-established companies, including:

• Cargill, Incorporated (U.S.)

• BASF SE (Germany)

• Archer Daniels Midland Company (ADM) (U.S.)

• DSM (Netherlands)

• Nutreco N.V. (Netherlands)

• Kemin Industries, Inc. (U.S.)

• Adisseo (France)

• Perstorp (Sweden)

• Alltech (U.S.)

• NOVUS INTERNATIONAL (U.S.)

• BTSA Biotecnologías Aplicadas SL (Spain)

• Camlin Fine Sciences Ltd. (India)

• OXIRIS (Spain)

• BERTOL Company S.R.O. (Czech Republic)

• FoodSafe Technologies (U.S.)

• Caldic B.V. (Netherlands)

• Industrial Técnica Pecuaria, S.A. (Spain)

• DuPont (U.S.)

• Novozymes (Denmark)

• AB Vista (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.