Global Ruminant Feed Binders Market

Market Size in USD Billion

CAGR :

%

USD

2.20 Billion

USD

2.90 Billion

2024

2032

USD

2.20 Billion

USD

2.90 Billion

2024

2032

| 2025 –2032 | |

| USD 2.20 Billion | |

| USD 2.90 Billion | |

|

|

|

|

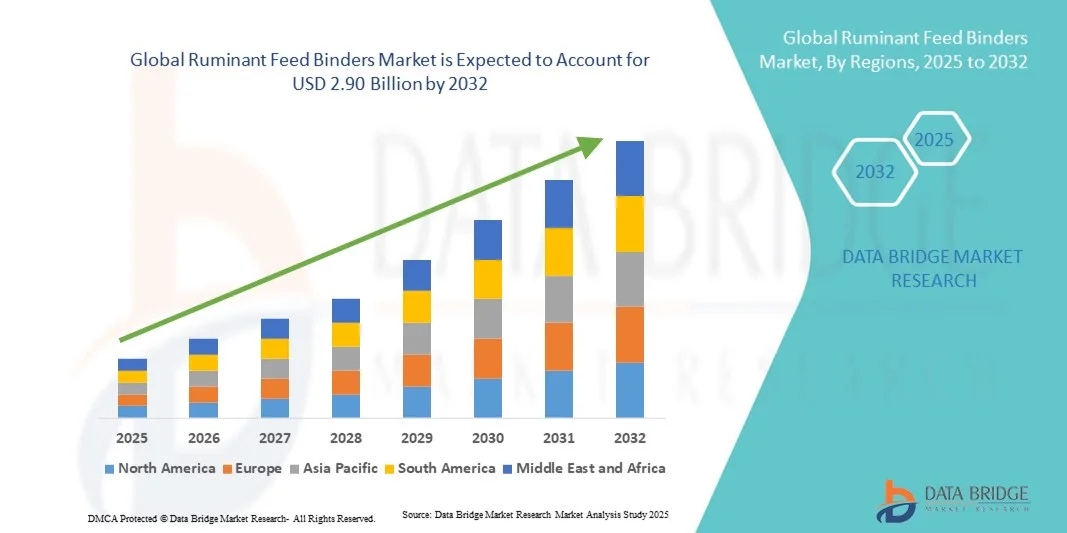

What is the Global Ruminant Feed Binders Market Size and Growth Rate?

- The global ruminant feed binders market size was valued at USD 2.20 billion in 2024 and is expected to reach USD 2.90 billion by 2032, at a CAGR of 4.20% during the forecast period

- The increase in consumption of meat among consumers across the globe and the growing inclination towards pelleted feed because of the rising awareness associated with the animal nutrition and animal health are the major factors driving the ruminant feed binders market

- The increasing emphasis on the ruminants, as they play crucial role in the food security application and act as the major suppliers of protein and nutrition in the form and milk and meat which accelerates the ruminant feed binders’ market growth. The rise in need to produce food in order to cater large requirement across the globe, expansion of compound feed industry and the growth in production capacity influence the ruminant feed binders market

What are the Major Takeaways of Ruminant Feed Binders Market?

- The collaborations between key players, growing number of research and development activities and availability of resources propel the ruminant feed binders market. In addition, the growing population worldwide, the rise in awareness regarding the health benefits of ruminant products, consumer preference towards healthy lifestyle and rise in disposable income positively affects the ruminant feed binders market

- Furthermore, the rise in popularity of natural solutions for pet food nutrition, strategic growth initiatives by manufacturers to enter untapped markets extend profitable opportunities to the ruminant feed binders’ market players

- Asia-Pacific dominated the ruminant feed binders market with the largest revenue share of 41.6% in 2025, driven by expanding livestock farming, growing awareness of feed quality, and rising meat and dairy consumption across developing economies

- North America is projected to register the fastest CAGR of 9.8% between 2026 and 2033, fueled by advancements in feed technology, sustainability initiatives, and rising consumer awareness about livestock nutrition and food safety

- The natural segment dominated the market with the largest revenue share of 64.2% in 2025, primarily driven by the rising demand for eco-friendly, clean-label, and safe animal nutrition solutions

Report Scope and Ruminant Feed Binders Market Segmentation

|

Attributes |

Ruminant Feed Binders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Ruminant Feed Binders Market?

Rising Preference for Natural and Functional Binder Ingredients in Livestock Nutrition

- The ruminant feed binders market is witnessing a strong shift toward natural, plant-based, and clean-label ingredients, driven by rising awareness about animal health, sustainable feed formulations, and stringent regulatory frameworks. Manufacturers are focusing on eliminating synthetic chemicals and antibiotics, replacing them with organic binders derived from starches, gums, and lignin sources to ensure safety and sustainability

- For instance, ADM (U.S.) and Roquette Frères (France) have launched eco-friendly, starch-based Ruminant Feed Binders designed to improve pellet durability while maintaining nutritional value. These launches reflect the industry’s transition toward clean-label feed solutions that enhance animal performance without compromising environmental safety

- The demand for functional binders with dual benefits—such as improving feed texture and supporting digestive health—is increasing. Producers are incorporating hydrocolloids, alginates, and lignosulfonates that act as binding agents and enhance nutrient absorption and gut integrity in livestock

- In addition, the rise of precision livestock farming is encouraging the use of feed binders with consistent particle size and binding strength to support automated feeding systems and reduce feed waste, aligning with smart farming trends

- Manufacturers are also adopting biodegradable and renewable raw materials to meet sustainability goals, improving their market image and compliance with global feed safety regulations

- Overall, the shift toward natural, sustainable, and multifunctional ruminant feed binders is reshaping the livestock nutrition landscape. As producers and consumers emphasize transparency, efficiency, and eco-conscious solutions, this trend will continue to drive innovation and competitiveness in the market

What are the Key Drivers of Ruminant Feed Binders Market?

- The growing global demand for high-quality animal protein and the need for improved feed efficiency are major drivers boosting the ruminant feed binders market. Feed binders enhance pellet quality, reduce dust formation, and minimize nutrient loss—key factors in optimizing ruminant health and productivity

- For instance, in 2025, Darling Ingredients (U.S.) reported increased sales of natural protein-based binders to European and Asian feed producers aiming to improve the digestibility and texture of ruminant feed. This underscores the market’s response to rising protein consumption and the growing emphasis on feed quality

- The expansion of the livestock and dairy industries, particularly in emerging economies, is fueling binder demand. Feed manufacturers are using binder technologies to maintain consistent pellet quality under diverse climatic conditions, ensuring better shelf life and feed performance

- Technological advancements in binder formulation—such as enzymatic modification and microencapsulation—are enabling improved binding efficiency and reduced feed wastage, aligning with the global push toward resource optimization in animal nutrition

- The increasing adoption of functional and health-promoting binders, which support gut health and immunity, further contributes to market growth. Products derived from natural polysaccharides and lignosulfonates are gaining traction for their dual role in performance enhancement and sustainability

- Overall, rising livestock production, innovations in binder technology, and the shift toward natural, efficient feed solutions are collectively propelling the growth of the global ruminant feed binders market

Which Factor is Challenging the Growth of the Ruminant Feed Binders Market?

- Volatility in raw material prices and limited availability of high-quality natural binders present significant challenges to market stability. Feed binder production depends on agricultural and agro-industrial by-products, the supply of which fluctuates with seasonal yields and commodity prices

- For instance, between 2023 and 2025, CIECH Group (Poland) and Ingredion Incorporated (U.S.) reported rising raw material and logistics costs, impacting binder production costs and reducing profitability margins across Europe and North America

- Stringent regulatory standards on feed additives, particularly in the U.S. and European Union, add complexity to product approvals and compliance, increasing operational costs for manufacturers

- Smaller producers face technological barriers in adopting advanced binder processing systems such as extrusion and hydrothermal treatment due to high capital investment. This limits scalability and competitive positioning against established multinational players

- Moreover, supply chain disruptions and energy cost fluctuations continue to affect binder manufacturing efficiency, especially in regions dependent on imported raw materials

- To overcome these challenges, industry leaders are investing in vertical integration, renewable feedstock sourcing, and process optimization to reduce dependency on volatile inputs and strengthen supply resilience. Such strategic measures will be crucial to ensuring long-term growth and stability in the ruminant feed binders market

How is the Ruminant Feed Binders Market Segmented?

The market is segmented on the basis of source, type, and ruminant type.

- By Source

On the basis of source, the ruminant feed binders market is segmented into natural and synthetic. The natural segment dominated the market with the largest revenue share of 64.2% in 2025, primarily driven by the rising demand for eco-friendly, clean-label, and safe animal nutrition solutions. Natural binders derived from starch, lignin, and plant gums are widely preferred for their biodegradability, non-toxicity, and nutritional compatibility. Increasing awareness of sustainable livestock production and regulatory restrictions on chemical additives have further accelerated the adoption of naturally sourced binders.

Meanwhile, the synthetic segment is projected to register the fastest CAGR during 2026–2033, supported by its superior binding strength, consistency, and cost-efficiency. Synthetic binders offer enhanced pellet durability and stability under extreme temperature and humidity conditions. Their use in large-scale feed manufacturing and performance-focused livestock operations is expected to fuel steady growth in the forecast period.

- By Type

On the basis of type, the ruminant feed binders market is segmented into Plant Gums and Starches, Clay, Molasses, Gelatin, Hemicellulose, Lignosulphonates, Wheat Gluten and Middling, CMC, and Other Hydrocolloids. The Lignosulphonates segment dominated the market with a 32.5% share in 2025, owing to its superior binding capability, cost-effectiveness, and compatibility with diverse feed formulations. Widely used in pellet manufacturing, lignosulphonates enhance feed stability, minimize dust formation, and improve handling efficiency, making them a preferred choice among large-scale feed producers.

The Plant Gums and Starches segment is expected to witness the fastest CAGR during 2026–2033, driven by the growing trend toward natural, biodegradable, and nutrient-rich binder alternatives. Starch-based binders improve feed cohesion and provide added nutritional value to ruminant diets. Increasing adoption of sustainable and functional ingredients across livestock farms will continue to strengthen this segment’s growth trajectory.

- By Ruminant Type

On the basis of ruminant type, the market is segmented into Cattle, Sheep, Goats, Buffalo, Deer, Elk, Giraffes, and Camels. The Cattle segment dominated the Ruminant Feed Binders market with the largest revenue share of 57.6% in 2025, driven by the high global demand for dairy and beef products. Cattle feed requires high-quality binders to ensure optimal pellet durability, nutrient retention, and digestibility, supporting herd health and milk yield. Expanding dairy operations, particularly in North America, Europe, and Asia-Pacific, are key contributors to this dominance.

The Goat segment is projected to grow at the fastest CAGR between 2026 and 2033, fueled by the increasing popularity of goat milk and meat in emerging economies. The segment benefits from rising awareness about high-protein, low-fat dairy alternatives and improved feed efficiency through natural binders. As sustainable small ruminant farming gains traction, this segment is expected to witness robust expansion.

Which Region Holds the Largest Share of the Ruminant Feed Binders Market?

- Asia-Pacific dominated the ruminant feed binders market with the largest revenue share of 41.6% in 2025, driven by expanding livestock farming, growing awareness of feed quality, and rising meat and dairy consumption across developing economies

- The region’s large cattle and dairy population, combined with growing investments in feed efficiency and animal health management, continues to propel demand for high-quality feed binders

- Government support for sustainable livestock production and the growing presence of local and international feed manufacturers further strengthen Asia-Pacific’s leadership in the global Ruminant Feed Binders market

China Ruminant Feed Binders Market Insight

China held the largest share in the Asia-Pacific Ruminant Feed Binders market in 2025, supported by large-scale cattle farming operations and rapid modernization of the animal feed industry. The government’s push for improved feed conversion efficiency and disease control has driven the use of quality binders in ruminant diets. Local manufacturers are expanding production of lignosulphonate, molasses, and starch-based binders to meet domestic and export demands. In addition, advancements in sustainable binder formulations and growing partnerships with multinational feed producers reinforce China’s position as a dominant regional hub for ruminant feed binders.

India Ruminant Feed Binders Market Insight

India is witnessing rapid market expansion, driven by a booming dairy sector, a growing middle-class population, and increasing awareness about animal nutrition. Feed binder usage in cattle and buffalo feed is rising to enhance pellet durability and nutrient retention. The government’s “National Livestock Mission” and initiatives promoting scientific feeding practices have accelerated the adoption of plant-based and natural binders. The country’s abundance of agricultural by-products such as starches and molasses provides cost advantages for feed manufacturers. India’s strong export capacity and growing number of organized dairy cooperatives make it a key growth engine in Asia-Pacific.

Japan Ruminant Feed Binders Market Insight

Japan’s ruminant feed binders market is expanding moderately, supported by the country’s focus on high-value dairy and meat production. Feed producers emphasize quality assurance, traceability, and sustainability in binder formulations. The adoption of lignosulphonates, hemicellulose, and plant-based gums is increasing as producers seek eco-friendly and efficient binding agents. Moreover, Japan’s aging farming population and strong technological integration in feed mills are driving demand for ready-to-use, high-efficiency binder solutions. Strategic imports and local RandD investment continue to sustain Japan’s competitiveness in the regional market.

Australia Ruminant Feed Binders Market Insight

Australia is emerging as a significant contributor to the Asia-Pacific Ruminant Feed Binders market, driven by large-scale cattle and sheep farming and strong exports of animal feed. The country’s focus on improving feed conversion ratios and pellet quality in dry feed formulations enhances binder demand. Local manufacturers are emphasizing biodegradable, lignin-based, and molasses-derived binders to meet sustainability standards. In addition, Australia’s integration of precision livestock farming and digital feed monitoring is promoting the adoption of performance-oriented binder solutions.

North America Ruminant Feed Binders Market Insight

North America is projected to register the fastest CAGR of 9.8% between 2026 and 2033, fueled by advancements in feed technology, sustainability initiatives, and rising consumer awareness about livestock nutrition and food safety. The growing use of lignosulphonates, starch, and clay-based binders in cattle feed supports improved pellet strength, reduced wastage, and enhanced digestibility. The region’s strong research infrastructure and investment in natural binder development reinforce its competitive edge in high-quality animal feed production.

U.S. Ruminant Feed Binders Market Insight

The U.S. held the dominant share of the North America market in 2025, driven by the presence of large-scale dairy and beef operations. Growing consumer demand for sustainable and antibiotic-free meat products is encouraging feed producers to adopt safe and natural binder alternatives. Key companies are integrating enzymatic and hydrocolloid-based binders to improve pellet quality and nutrient absorption. Furthermore, technological innovation in feed mill automation and ingredient standardization continues to strengthen the U.S. market position globally.

Canada Ruminant Feed Binders Market Insight

The Canada ruminant feed binders market is growing steadily, driven by expanding ruminant livestock populations and high demand for feed quality optimization. Government initiatives promoting safe animal feed practices and traceability are accelerating the use of approved, eco-friendly binder formulations. Local producers are leveraging starch-based and molasses-derived binders to improve feed texture and consistency. The increasing integration of automation in feed production and focus on cost-efficient formulations make Canada a key contributor to North America’s overall growth.

Europe Ruminant Feed Binders Market Insight

The Europe ruminant feed binders market continues to grow moderately, supported by strong emphasis on animal welfare, sustainable feed production, and strict EU regulations on feed additives. Countries such as Germany, France, and the Netherlands are leading adopters of plant-based and lignosulphonate binders. The market is also witnessing increasing demand for organic and non-GMO feed solutions. Technological advancements in binder extraction and drying processes, along with strong export trade in feed ingredients, contribute to Europe’s stable market position.

Germany Ruminant Feed Binders Market Insight

Germany remains one of the most prominent markets in Europe, driven by its well-developed livestock industry and strict feed quality regulations. Manufacturers are focusing on bio-based and environmentally friendly binder alternatives, enhancing pellet stability without synthetic additives. The increasing demand for clean-label animal feed and sustainable farming practices continues to shape product innovation. Germany’s strong feed manufacturing infrastructure ensures consistent supply and high-quality binder production, maintaining its leadership in the European region.

U.K. Ruminant Feed Binders Market Insight

The U.K. market is expanding as demand rises for high-quality animal feed aligned with sustainability and welfare standards. Feed manufacturers are focusing on starch, molasses, and cellulose-based binders to reduce dependency on chemical additives. Government-led initiatives promoting carbon reduction in livestock production further support natural binder adoption. In addition, the growing export of premium livestock products and adoption of traceable feed systems are positioning the U.K. as a dynamic growth market within Europe.

Which are the Top Companies in Ruminant Feed Binders Market?

The ruminant feed binders industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Roquette Frères (France)

- Darling Ingredients (U.S.)

- Ingredion Incorporated (U.S.)

- DuPont (U.S.)

- Kemin Industries, Inc. (U.S.)

- GELITA AG (Germany)

- Borregaard (Norway)

- J.M. Huber Corporation (U.S.)

- BENEO (Germany)

- Uniscope (U.S.)

- Avebe (Netherlands)

- IRO Alginate Industry Co., Ltd. (China)

- AF Suter and Co Ltd (U.K.)

- Bentoli (U.S.)

- BONAVENTURE ANIMAL NUTRITION (Canada)

- Cra-Vac Industries Inc. (Canada)

- Fuzhou Wonderful Biological Technology Co., Ltd. (China)

- Baltivet (Lithuania)

- ALLWYN CHEM INDUSTRIES (India)

- Vetline (India)

- Visco Starch (India)

What are the Recent Developments in Global Ruminant Feed Binders Market?

- In May 2024, Puratos, a leading multinational company specializing in baking, patisserie, and chocolate ingredients, introduced Sapore Lavida, the first fully traceable active sourdough produced in Belgium. This innovative ingredient is made from 100% whole wheat flour sourced through regenerative agriculture, enabling European bakers to meet the growing demand for locally-made and sustainable sourdough products. This launch reinforces Puratos’ commitment to sustainability and transparency across its bakery ingredient portfolio

- In March 2024, Royal Avebe and the University Medical Center Groningen (UMCG) secured approximately €1.4 million in European funding from the Just Transition Fund (JTF) for their Fibers Project. The initiative focuses on developing starch-based solutions that are both eco-friendly and health-promoting, supporting the transition toward more sustainable food systems. This funding highlights Avebe’s ongoing leadership in sustainable innovation and product diversification

- In November 2022, Dawn Food Products, Inc. launched a new vegan-friendly Vanilla Flavour Crème Filling, crafted without titanium dioxide. Designed for diverse applications such as donuts, pastries, muffins, and cake fillings, this product delivers a smooth texture and rich vanilla flavor while adhering to clean-label trends. This launch underscores Dawn Foods’ dedication to plant-based innovation and evolving consumer preferences in the bakery industry

- In September 2021, Dr. Oetker, a German packaged food leader, acquired Indian start-up Kuppies to strengthen its presence in India’s growing ready-to-eat (RTE) dessert segment. The acquisition included Kuppies’ manufacturing facility, innovation center, and brand assets to support Dr. Oetker’s RTE cake and dessert expansion in the Indian market. This strategic move enhances Dr. Oetker’s regional footprint and aligns with its global growth objectives in convenience foods

- In March 2021, Dawn Foods acquired JABEX, a Polish family-owned manufacturer renowned for its high-quality fruit-based bakery ingredients. The acquisition expanded Dawn Foods’ global manufacturing presence and strengthened its supply chain operations across Central and Eastern Europe. This strategic step enables Dawn Foods to better serve its customers and broaden its product reach within the European bakery ingredients market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.