Global Ruminant Feed Mycotoxin Binders Modifiers Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

2.49 Billion

2025

2033

USD

1.89 Billion

USD

2.49 Billion

2025

2033

| 2026 –2033 | |

| USD 1.89 Billion | |

| USD 2.49 Billion | |

|

|

|

|

Ruminant Feed Mycotoxin Binders & Modifiers Market Size

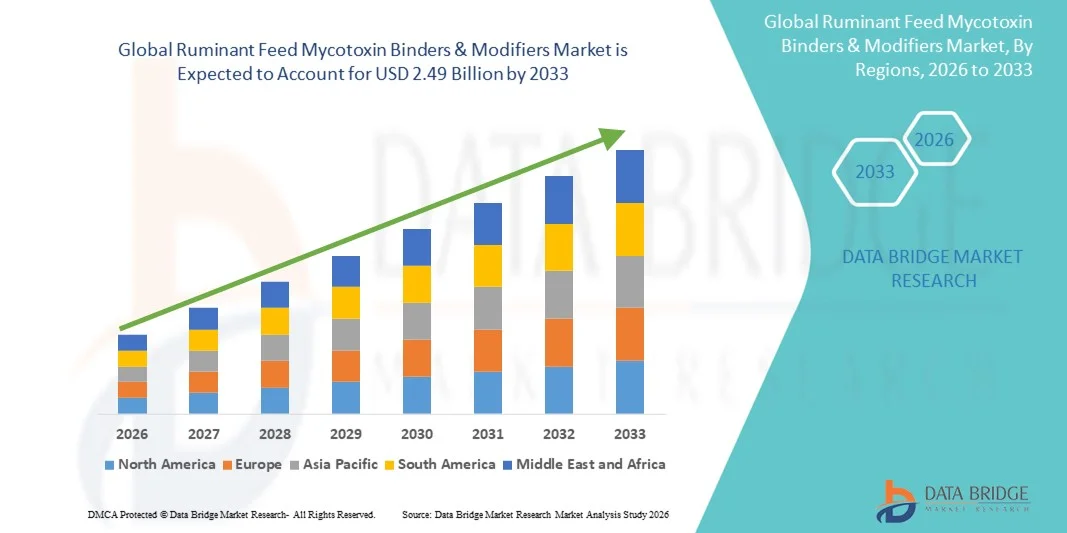

- The global ruminant feed mycotoxin binders & modifiers market size was valued at USD 1.89 billion in 2025 and is expected to reach USD 2.49 billion by 2033, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by the increasing awareness of mycotoxin contamination in livestock feed and the rising adoption of preventive feed safety solutions, leading to improved animal health, productivity, and feed efficiency

- Furthermore, the growing demand for cost-effective and scientifically validated mycotoxin binders and modifiers is establishing these products as essential components of ruminant nutrition programs. These converging factors are accelerating the uptake of advanced feed solutions, thereby significantly boosting the market’s growth

Ruminant Feed Mycotoxin Binders & Modifiers Market Analysis

- Feed mycotoxin binders and modifiers, which reduce the bioavailability of harmful toxins in ruminant feed, are increasingly vital for maintaining herd health, enhancing milk and meat quality, and improving overall livestock productivity in dairy and beef sectors

- The escalating demand for these solutions is primarily fueled by stricter regulatory standards for feed safety, rising awareness among livestock producers of mycotoxin impacts, and the preference for integrated feed additive programs that combine binders, enzymatic modifiers, and organic solutions to ensure safe and efficient ruminant nutrition

- North America dominated the ruminant feed mycotoxin binders & modifiers market with a share of 40.71% in 2025, due to rising awareness of mycotoxin contamination in livestock feed and the growing adoption of preventive feed solutions

- Asia-Pacific is expected to be the fastest growing region in the ruminant feed mycotoxin binders & modifiers market during the forecast period due to rising awareness of feed contamination, increasing livestock populations, and expanding commercial dairy and beef farming

- Feed mycotoxin binders segment dominated the market with a market share of 62.5% in 2025, due to their proven efficacy in adsorbing a broad spectrum of mycotoxins in the gastrointestinal tract of ruminants. Feed manufacturers prefer binders due to their consistent performance in preventing mycotoxin absorption, improving animal health, and enhancing overall feed efficiency. The segment benefits from wide adoption across dairy and beef sectors, supported by increasing regulatory scrutiny and awareness of mycotoxin contamination. Binders are often compatible with various feed formulations, making them an essential component of preventive animal nutrition strategies

Report Scope and Ruminant Feed Mycotoxin Binders & Modifiers Market Segmentation

|

Attributes |

Ruminant Feed Mycotoxin Binders & Modifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ruminant Feed Mycotoxin Binders & Modifiers Market Trends

Growing Adoption of Multifunctional Mycotoxin Binders

- The global ruminant feed mycotoxin binders & modifiers market is witnessing a growing adoption of multifunctional binders that target multiple mycotoxins simultaneously, improving feed safety and animal health. These advanced solutions are increasingly preferred by livestock producers aiming to enhance productivity, reduce toxin-related losses, and maintain nutrient absorption efficiency

- For instance, Kemin Industries, Inc. has developed TOXFIN® RD, a broad-spectrum binder that addresses several mycotoxins in ruminant feed, helping dairy and beef producers safeguard herd health while improving feed utilization

- Multifunctional binders are also being formulated to include enzymatic and organic modifiers, which further enhance their detoxifying capability and provide added nutritional benefits, encouraging higher adoption across commercial dairy and beef operations

- The increasing prevalence of mycotoxin contamination in grains and feed ingredients is pushing farmers and feed manufacturers toward comprehensive solutions that mitigate multiple risks in a single additive, ensuring consistent animal performance and product quality

- Companies such as Alltech are investing in research and development to create next-generation binders with improved efficacy and compatibility with various feed formulations, supporting the growth of multifunctional solutions in the market

- The rising demand for effective, all-in-one mycotoxin management products is establishing multifunctional binders as a standard in ruminant feed nutrition programs, contributing to sustained market growth and wider acceptance across both developed and emerging regions

Ruminant Feed Mycotoxin Binders & Modifiers Market Dynamics

Driver

Rising Awareness of Feed Contamination and Animal Health

- The increasing recognition of mycotoxin risks in ruminant feed and their adverse effects on animal health and productivity is a primary driver of market growth. Farmers and feed manufacturers are increasingly adopting preventive solutions to maintain herd performance and ensure food safety

- For instance, in 2024, Nutreco launched an educational campaign highlighting the impact of mycotoxins on milk yield and animal immunity, promoting the adoption of binders and modifiers in dairy and beef operations, which is expected to accelerate market uptake

- Growing regulatory focus on feed safety, combined with industry standards for toxin control, is encouraging livestock producers to integrate mycotoxin binders and modifiers into routine feeding practices, supporting animal welfare and consistent product quality

- Increasing consumer demand for safe dairy and meat products is pushing the industry toward enhanced feed safety measures, leading to higher investment in advanced binders and enzymatic modifiers to mitigate contamination risks

- The combination of regulatory pressure, heightened awareness of toxin-related losses, and focus on maintaining animal health is establishing mycotoxin management as a critical component of ruminant nutrition programs, reinforcing sustained market expansion

Restraint/Challenge

High Cost and Limited Availability of Premium Solutions

- The relatively high cost of advanced mycotoxin binders and modifiers, particularly multifunctional or enzymatic formulations, can limit adoption among price-sensitive livestock producers. This cost factor is more pronounced in developing regions with emerging dairy and beef industries

- For instance, premium binders from companies such as Biomin, which offer broad-spectrum toxin mitigation, are often priced higher than conventional single-target products, restricting access for small-scale or resource-constrained farms

- Limited availability of specialized products in certain geographies also poses a challenge, as supply chains for high-quality binders and modifiers may not be fully developed in all regions, leading to inconsistent adoption rates

- Addressing the cost and accessibility barriers requires companies to optimize production, scale operations, and expand distribution networks, ensuring wider availability and affordability of premium solutions

- Overcoming these challenges is crucial for increasing the penetration of advanced mycotoxin management solutions and supporting the long-term growth of the ruminant feed mycotoxin binders & modifiers market

Ruminant Feed Mycotoxin Binders & Modifiers Market Scope

The market is segmented on the basis of type, source, and form.

- By Type

On the basis of type, the ruminant feed mycotoxin binders & modifiers market is segmented into feed mycotoxin binders and feed mycotoxin modifiers. The feed mycotoxin binders segment dominated the market with the largest market revenue share of 62.5% in 2025, driven by their proven efficacy in adsorbing a broad spectrum of mycotoxins in the gastrointestinal tract of ruminants. Feed manufacturers prefer binders due to their consistent performance in preventing mycotoxin absorption, improving animal health, and enhancing overall feed efficiency. The segment benefits from wide adoption across dairy and beef sectors, supported by increasing regulatory scrutiny and awareness of mycotoxin contamination. Binders are often compatible with various feed formulations, making them an essential component of preventive animal nutrition strategies.

The feed mycotoxin modifiers segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand for enzymatic and microbial solutions that detoxify mycotoxins and restore nutrient availability. Modifiers offer targeted action against specific toxins, providing an advanced approach to managing feed safety in high-risk regions. Their growing popularity is also driven by the increased focus on sustainable and natural feed solutions, with several companies developing proprietary modifier blends to enhance animal immunity and performance. The integration of modifiers with precision feeding programs further contributes to their accelerated adoption across ruminant farms.

- By Source

On the basis of source, the market is segmented into inorganic and organic. The inorganic segment held the largest market revenue share in 2025, supported by the extensive use of clay minerals, bentonite, and aluminosilicates for their high binding capacity and cost-effectiveness. Inorganic binders are valued for their stability across different feed processing conditions and their proven track record in large-scale commercial operations. Feed manufacturers often rely on inorganic solutions for predictable performance and compatibility with other feed additives, making them a preferred choice in both dairy and beef ruminant sectors.

The organic segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the increasing use of yeast, probiotics, and plant-based materials that provide both binding and detoxifying functions. For instance, companies such as Alltech are developing organic mycotoxin binders and modifiers to improve gut health and immunity in ruminants. Rising consumer demand for natural and residue-free animal products is encouraging the adoption of organic sources, and their multifunctional benefits in nutrient absorption and toxin mitigation are contributing to strong market growth.

- By Form

On the basis of form, the market is segmented into dry and liquid. The dry form segment dominated the market in 2025, owing to its ease of handling, longer shelf life, and compatibility with pelleted and mixed feed formulations. Dry mycotoxin binders and modifiers are preferred by feed manufacturers for large-scale operations due to simplified storage, accurate dosing, and lower transportation costs. Their consistent performance and ability to mix uniformly with other feed ingredients make them a reliable solution in ruminant nutrition programs.

The liquid form segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for soluble, ready-to-use formulations that enhance toxin-binding efficiency during feed processing. Liquid solutions offer precise dosing and rapid action against mycotoxins, making them suitable for high-risk feeds and specialized farm operations. For instance, companies such as DSM are innovating liquid-based mycotoxin modifiers that can be directly incorporated into feed or water systems, supporting improved animal health and performance while minimizing handling challenges.

Ruminant Feed Mycotoxin Binders & Modifiers Market Regional Analysis

- North America dominated the ruminant feed mycotoxin binders & modifiers market with the largest revenue share of 40.71% in 2025, driven by rising awareness of mycotoxin contamination in livestock feed and the growing adoption of preventive feed solutions

- Livestock farmers in the region prioritize feed safety, animal health, and productivity, encouraging the use of high-quality binders and modifiers sourced from both inorganic and organic materials

- This widespread adoption is further supported by advanced livestock farming practices, higher disposable incomes, and stringent regulatory standards for feed safety, establishing mycotoxin binders and modifiers as essential components of ruminant nutrition programs

U.S. Ruminant Feed Mycotoxin Binders & Modifiers Market Insight

The U.S. market captured the largest revenue share in North America in 2025, fueled by extensive adoption of dairy and beef farming operations focused on improving feed efficiency and preventing mycotoxin-related losses. Farmers are increasingly prioritizing scientifically validated and cost-effective feed solutions, while the demand for both binders and modifiers rises due to proven efficacy. Strong research and development initiatives, along with the integration of organic and enzymatic formulations, are further driving market expansion, supported by growing awareness of mycotoxin impacts on milk and meat quality.

Europe Ruminant Feed Mycotoxin Binders & Modifiers Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by stringent feed safety regulations and increasing demand for contamination-free livestock feed. Countries such as Germany, France, and the Netherlands are witnessing strong adoption of both binders and modifiers to comply with regulations and improve livestock productivity. European farmers are also adopting organic and multifunctional solutions that enhance animal immunity and reduce chemical residues, and the market is expanding across dairy, beef, and small ruminant farms, with solutions integrated into both conventional and precision feeding programs.

U.K. Ruminant Feed Mycotoxin Binders & Modifiers Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of feed contamination and the need for sustainable and safe livestock nutrition solutions. Farmers and feed manufacturers are increasingly investing in technologically advanced binders and enzymatic modifiers to ensure animal health and maintain product quality. The country’s robust agricultural infrastructure, coupled with government support for livestock feed safety programs, continues to encourage adoption, while rising consumer preference for residue-free dairy and meat products further stimulates demand.

Germany Ruminant Feed Mycotoxin Binders & Modifiers Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, fueled by the demand for innovative and eco-friendly feed additives that improve animal health and productivity. Germany’s focus on sustainable farming practices, quality livestock production, and regulatory compliance promotes the adoption of both inorganic and organic binders and modifiers. Large-scale livestock operations increasingly integrate feed safety solutions, with farmers favoring multifunctional solutions that neutralize mycotoxins and support nutrient absorption and herd performance.

Asia-Pacific Ruminant Feed Mycotoxin Binders & Modifiers Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising awareness of feed contamination, increasing livestock populations, and expanding commercial dairy and beef farming. Countries such as China, India, and Japan are witnessing rapid adoption of both binders and modifiers due to growing concern over animal health, milk safety, and meat quality. Government initiatives promoting feed safety and domestic production of affordable mycotoxin solutions are fueling growth, while modernization of livestock operations and precision feeding practices further enhance demand.

Japan Ruminant Feed Mycotoxin Binders & Modifiers Market Insight

The Japan market is gaining momentum due to high standards for food safety, an advanced dairy and beef industry, and increasing awareness of mycotoxin risks in livestock feed. Farmers prioritize reliable, easy-to-use feed additives that ensure animal health and compliance with strict regulations. Integration of enzymatic modifiers and multifunctional binders in feed programs is increasing, with a focus on improving nutrient absorption and minimizing toxin-related losses, while the growing number of smart and connected livestock farms supports adoption in both dairy and beef sectors.

China Ruminant Feed Mycotoxin Binders & Modifiers Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, increasing livestock production, and rising awareness of feed safety. Both dairy and beef farms are increasingly adopting binders and modifiers to protect herd health and improve product quality. Government regulations, growing domestic production of feed additives, and availability of cost-effective solutions are key growth factors, while modernization of livestock feed practices and focus on food safety standards further supports market expansion.

Ruminant Feed Mycotoxin Binders & Modifiers Market Share

The ruminant feed mycotoxin binders & modifiers industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- ADM (Archer Daniels Midland) (U.S.)

- Bayer AG (Germany)

- Perstorp (Sweden)

- Chr. Hansen Holding A/S (Denmark)

- Kemin Industries, Inc. (U.S.)

- Nutreco (Netherlands)

- Alltech (U.S.)

- Novus International (Thailand) Co., Ltd. (Thailand)

- Biomin (Austria)

- Impextraco NV (Belgium)

- Norel S.A (Poland)

- Amlan International (U.S.)

- Olmix Group (France)

- Micron Bio-Systems (U.K.)

- Sibbiopharm Ltd. (Canada)

- Selko (Netherlands)

- FF Chemicals BV (Netherlands)

- Anfotal Nutritions Private Limited (India)

- Bentoli (Italy)

- Visscherholland (Netherlands)

- BONAVENTURE CHEMICALS, INC. (U.S.)

Latest Developments in Global Ruminant Feed Mycotoxin Binders & Modifiers Market

- In July 2025, Cargill made a binding offer to acquire Mig‑Plus, a family-owned animal nutrition company with a strong presence in ruminant feed. This acquisition allows Cargill to expand its mycotoxin binder and feed additive portfolio, particularly in Latin America, strengthening its market presence in high-growth regions. The deal provides access to proprietary formulations and region-specific solutions, supporting more effective feed safety programs and accelerating adoption of advanced mycotoxin management products across commercial ruminant operations

- In June 2025, dsm‑firmenich completed the sale of its Feed Enzymes Alliance stake, receiving about €1.4 billion net in cash. This strategic realignment enables the company to focus investments on other areas of Animal Nutrition & Health, fostering the development of advanced enzymatic modifiers and targeted feed safety solutions. The move is likely to enhance competitiveness, drive innovation, and encourage broader adoption of effective mycotoxin binders and modifiers in the ruminant feed market

- In February 2025, dsm‑firmenich sold its stake in the Feed Enzymes Alliance to Novonesis for €1.5 billion, strengthening Novonesis’s position in the global animal nutrition sector. The acquisition enables Novonesis to expand its portfolio of enzyme-based mycotoxin modifiers and enhance distribution networks, supporting faster innovation and higher adoption of integrated feed safety solutions. This transaction is expected to reshape market dynamics by increasing competitiveness and offering livestock producers more effective ruminant feed safety options

- In 2025, Kemin introduced TOXFIN RD, a broad-spectrum binder designed for ruminant feeds in high-risk regions with elevated fungal contamination, including Sub-Saharan Africa. The product effectively targets multiple mycotoxins, including deoxynivalenol (DON), supporting herd health, productivity, and feed efficiency. Its launch is expected to drive the adoption of advanced mycotoxin management solutions in emerging markets and encourage livestock producers to implement comprehensive feed safety programs, boosting overall market growth

- In 2024, Kemin launched TOXFIN® Dry, a mycotoxin binder formulated with a blend of activated minerals such as bentonite, designed to reduce mycotoxin bioavailability in the gastrointestinal tract of ruminants. This product enhances feed safety while maintaining nutrient absorption, enabling producers to protect animal health and productivity. Its introduction strengthens the availability of cost-effective and efficient feed safety solutions, increasing market penetration of mycotoxin binders and promoting preventive nutrition strategies in dairy and beef operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.