Global Running Footwear Market

Market Size in USD Billion

CAGR :

%

USD

19.35 Billion

USD

35.81 Billion

2025

2033

USD

19.35 Billion

USD

35.81 Billion

2025

2033

| 2026 –2033 | |

| USD 19.35 Billion | |

| USD 35.81 Billion | |

|

|

|

|

Running Footwear Market Size

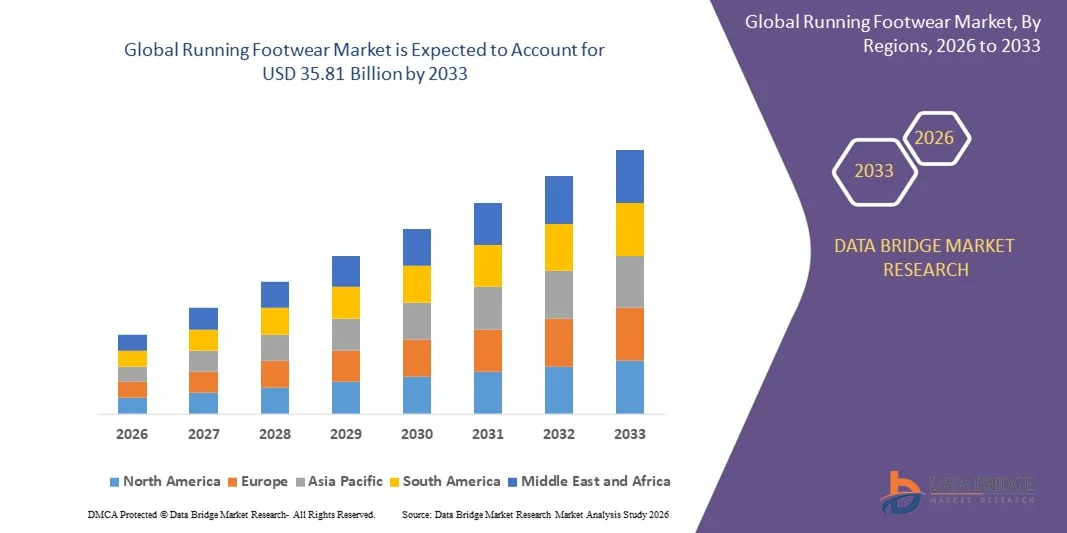

- The global running footwear market size was valued at USD 19.35 billion in 2025 and is expected to reach USD 35.81 billion by 2033, at a CAGR of 8.00% during the forecast period

- The market growth is largely fuelled by the rising adoption of sports and fitness activities, increasing health awareness, and growing participation in running events globally

- Rising demand for technologically advanced and performance-enhancing running shoes, coupled with the expansion of e-commerce and retail channels, is further driving market growth

Running Footwear Market Analysis

- Growing preference for athleisure and sportswear, blending fashion with functionality, is positively influencing the demand for running footwear

- Technological innovations, such as smart running shoes with embedded sensors, improved cushioning, and breathable materials, are enhancing performance and comfort, attracting a wider consumer base

- North America dominated the running footwear market with the largest revenue share of 38.50% in 2025, driven by rising fitness awareness, increasing participation in running events, and growing demand for technologically advanced and performance-oriented footwear

- Asia-Pacific region is expected to witness the highest growth rate in the global running footwear market, driven by expanding middle-class population, growing participation in running events, and rising adoption of performance and smart footwear technologies

- The traditional shoes segment held the largest market revenue share in 2025, driven by widespread adoption among recreational and professional runners for daily training and casual wear. Traditional running shoes are preferred for their versatility, durability, and comfort, making them a popular choice across different age groups and performance levels

Report Scope and Running Footwear Market Segmentation

|

Attributes |

Running Footwear Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• PUMA SE (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Running Footwear Market Trends

Rise of Performance-Enhancing and Smart Running Shoes

- The growing adoption of performance-enhancing and smart running shoes is transforming the running footwear landscape by offering improved comfort, injury prevention, and real-time performance tracking. Embedded sensors, AI-assisted gait analysis, and ergonomic designs allow runners to monitor pace, distance, heart rate, and biomechanics, enhancing training efficiency and reducing the risk of injuries during high-intensity workouts. The integration of smart features also enables long-term performance optimization and personalized coaching insights

- The high demand for innovative footwear in urban and semi-urban areas is accelerating the adoption of smart and customized running shoes. These technologies are particularly effective for professional athletes, marathon runners, and fitness enthusiasts seeking data-driven insights, and the trend is supported by increasing participation in global running events, fitness challenges, and digital running communities. Smart footwear also encourages brand engagement and customer loyalty through app-based ecosystems

- The affordability and availability of mid-range and premium smart running footwear are making them attractive for a broad consumer base. Consumers benefit from optimized performance, injury reduction, and enhanced comfort, while manufacturers gain competitive differentiation and increased profit margins through premium offerings. This broad adoption is driving investment in marketing, distribution, and innovative collaborations with fitness tech companies

- For instance, in 2023, several North American and European sportswear brands reported higher sales volumes after launching smart running shoes with AI-based gait analysis, enhanced cushioning, adaptive materials, and lightweight designs. These features improved runner safety, performance tracking, and overall satisfaction, reflecting growing consumer preference for technologically advanced and functional footwear. The success of these launches is encouraging other brands to accelerate smart footwear R&D

- While smart and performance-enhancing footwear are driving growth, their impact depends on continued innovation, material advancements, and effective digital integration. Manufacturers must focus on product personalization, wearable technology compatibility, software updates, and long-term durability to fully capitalize on growing market demand. Consumer education and after-sales support will also play a critical role in adoption and brand trust

Running Footwear Market Dynamics

Driver

Rising Fitness Awareness and Increasing Participation in Running Activities

- Increasing health consciousness and participation in recreational running, marathons, and fitness programs are driving demand for high-performance running footwear. Consumers are seeking shoes that improve endurance, comfort, shock absorption, and safety during workouts, boosting global market adoption. This trend is further reinforced by digital fitness apps, virtual coaching, and wearable integrations that highlight the benefits of smart footwear

- Urbanization and busier lifestyles are creating a need for multifunctional, durable, and stylish running shoes suitable for both sports and casual wear. Convenience, lightweight designs, and versatile footwear that doubles as everyday casual shoes are increasing market penetration across retail and e-commerce channels. Manufacturers are leveraging omni-channel marketing strategies to target fitness-conscious urban populations effectively

- Manufacturers are investing in research and development to introduce advanced cushioning systems, breathable fabrics, responsive midsoles, and embedded smart technologies that align with evolving consumer needs. These innovations foster brand loyalty, encourage repeat purchases, and differentiate products in a competitive market. Strategic partnerships with tech companies and fitness brands are accelerating adoption of intelligent footwear solutions

- For instance, in 2022, leading sportswear companies in the U.S. and Europe launched AI-integrated running shoes with real-time performance tracking, predictive injury analytics, and adaptive cushioning technologies. These innovations led to higher adoption rates, positive reviews, and reinforced premium product positioning in key markets, further encouraging global R&D investments in smart footwear

- While fitness trends and technological adoption are strong growth drivers, ensuring affordability, durability, adaptability to different running conditions, and compatibility with wearable devices is essential for sustained market expansion. Consumer education, app integration, and post-purchase support will play crucial roles in promoting long-term adoption

Restraint/Challenge

High Product Costs and Competition from Casual and Alternative Footwear

- The higher cost of performance-oriented and smart running shoes compared with conventional or casual footwear limits adoption among price-sensitive consumers, particularly in emerging regions. Advanced materials, embedded sensors, and AI-enabled software contribute to higher retail prices, making affordability a key challenge. Manufacturers must balance premium features with cost-effective production to reach wider demographics

- Intense competition from casual sneakers, lifestyle shoes, and alternative sports footwear restricts market growth. Consumer preference for multifunctional, budget-friendly, or brand-neutral options further influences purchasing decisions. In addition, local brands offering low-cost alternatives can erode market share for global premium players

- Supply chain challenges, including sourcing high-quality materials, managing inventory, ensuring timely delivery, and maintaining cold storage for sensitive materials, can affect product availability, quality, and launch schedules. Production delays or distribution inefficiencies may result in unmet demand, negative customer perception, and lost sales opportunities

- For instance, in 2023, several mid-sized footwear manufacturers in APAC faced disruptions due to material shortages, high logistics costs, and port congestion, leading to delayed product launches, lower market penetration, and increased production costs. These challenges emphasized the importance of resilient supply chains and localized manufacturing

- While innovation continues to advance, addressing cost, competition, supply chain efficiency, and consumer education remains critical for unlocking the full potential of the running footwear market. Brands must implement agile production strategies, expand digital retail channels, and focus on long-term consumer engagement to sustain growth

Running Footwear Market Scope

The running footwear market is segmented on the basis of product type, gender, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into barefoot shoes, low profile shoes, traditional shoes, maximalist shoes, and others. The traditional shoes segment held the largest market revenue share in 2025, driven by widespread adoption among recreational and professional runners for daily training and casual wear. Traditional running shoes are preferred for their versatility, durability, and comfort, making them a popular choice across different age groups and performance levels.

The barefoot shoes segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing consumer interest in minimalist footwear and natural running techniques. Barefoot shoes promote improved foot biomechanics and lower injury risk, appealing to fitness enthusiasts and athletes seeking performance optimization and enhanced sensory feedback during runs.

- By Gender

On the basis of gender, the market is segmented into men, women, and kids. The men’s segment held the largest revenue share in 2025, fueled by higher participation in running events, marathons, and fitness programs globally. Men’s running footwear offerings include performance-enhancing features such as advanced cushioning, stability, and smart sensors that track performance metrics.

The women’s segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing fitness awareness, growing participation of women in sports and running activities, and a rising preference for stylish and comfortable athletic footwear. Women-focused product innovations and marketing campaigns are further fueling adoption across urban and semi-urban regions.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into shoe stores, sports and athletic goods stores, supermarkets, hypermarkets, e-commerce, and others. The e-commerce segment held the largest revenue share in 2025, driven by the convenience of online shopping, wider product selection, and availability of customizable and performance-based footwear. Online platforms also provide user reviews and virtual fitting tools, enhancing purchase confidence.

The sports and athletic goods stores segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increased consumer preference for in-store trials, expert guidance, and immediate product availability. Retailers are focusing on immersive experiences, brand promotions, and loyalty programs to attract fitness enthusiasts and competitive runners.

Running Footwear Market Regional Analysis

- North America dominated the running footwear market with the largest revenue share of 38.50% in 2025, driven by rising fitness awareness, increasing participation in running events, and growing demand for technologically advanced and performance-oriented footwear

- Consumers in the region highly value comfort, injury prevention features, and smart tracking technologies offered by performance and smart running shoes, supporting consistent adoption across recreational and professional runners

- This widespread adoption is further fueled by high disposable incomes, a fitness-conscious population, and the increasing preference for stylish yet functional footwear, establishing running shoes as a favored choice for both sports and casual wear

U.S. Running Footwear Market Insight

The U.S. running footwear market captured the largest revenue share in 2025 within North America, fueled by the growing adoption of smart shoes and performance-enhancing footwear. Consumers are increasingly prioritizing shoes with advanced cushioning, lightweight materials, and AI-integrated performance tracking. The rising popularity of marathons, fitness programs, and home-based training, combined with strong e-commerce and retail availability, further propels market growth. Moreover, brand innovations and celebrity endorsements are significantly contributing to market expansion.

Europe Running Footwear Market Insight

The Europe running footwear market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing fitness trends, urbanization, and rising demand for sustainable and technologically advanced footwear. European consumers are attracted to the combination of performance, style, and eco-friendly materials. The region is experiencing significant growth across recreational running, professional sports, and lifestyle applications, with brands focusing on product innovation and premium offerings.

U.K. Running Footwear Market Insight

The U.K. running footwear market is expected to witness the fastest growth rate from 2026 to 2033, driven by the growing trend of fitness and running activities, along with a desire for improved performance and injury prevention. Consumer interest in wearable technology and personalized footwear is encouraging the adoption of smart running shoes. Strong retail networks, e-commerce penetration, and government initiatives promoting active lifestyles are expected to continue stimulating market growth.

Germany Running Footwear Market Insight

The Germany running footwear market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of health and fitness, demand for technologically advanced shoes, and eco-conscious consumer behavior. Germany’s well-established sportswear industry and infrastructure for running events promote adoption of performance and smart running shoes. Integration of lightweight, breathable materials, and smart sensors in footwear is becoming increasingly prevalent, aligning with consumer expectations for durability, comfort, and digital tracking.

Asia-Pacific Running Footwear Market Insight

The Asia-Pacific running footwear market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and increased participation in running and fitness activities in countries such as China, Japan, and India. The region's growing interest in fitness, coupled with government initiatives promoting healthy lifestyles, is driving adoption of smart and performance running shoes. In addition, APAC emerging as a manufacturing hub for innovative sports footwear is improving affordability and accessibility for a wider consumer base.

Japan Running Footwear Market Insight

The Japan running footwear market is expected to witness strong growth from 2026 to 2033 due to the country’s tech-savvy culture, increasing participation in sports and fitness activities, and focus on convenience and comfort. Adoption of smart running shoes integrated with AI and wearable tracking devices is accelerating. The country’s aging population is also likely to spur demand for injury-preventive, easy-to-use, and performance-oriented footwear for both recreational and professional runners.

China Running Footwear Market Insight

The China running footwear market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and increasing participation in running events and fitness programs. The country is a key market for both domestic and international footwear brands, with high demand for technologically advanced, performance-oriented, and smart running shoes. The expansion of e-commerce platforms and growing awareness of health and fitness trends are driving further market growth.

Running Footwear Market Share

The Running Footwear industry is primarily led by well-established companies, including:

- PUMA SE (Germany)

- ADIDAS AG (Germany)

- Alpinestars (Italy)

- Dainese S.p.A (Italy)

- Nike Inc. (U.S.)

- BATA INDIA LIMITED (India)

- Guccio Gucci S.p.A. (Italy)

- ZARA (Inditex) (Spain)

- Louis Vuitton Malletier SAS (France)

- C&J Clark International (U.K.)

- ASICS Asia Pte. Ltd. (Singapore)

- Wolverine World Wide, Inc. (U.S.)

- DECKERS BRANDS (U.S.)

- Under Armour, Inc. (U.S.)

- Anta Shop (China)

- Saucony (U.S.)

- SKECHERS USA, Inc. (U.S.)

- Hush Puppies (U.S.)

- FILA Luxembourg, S.a.r.l. (Luxembourg)

- SPARCO S.P.A. (Italy)

Latest Developments in Global Running Footwear Market

- In June 2023, ASICS, the renowned Japanese sportswear brand, launched the GEL-KAYANO running shoe, a performance-oriented stability shoe designed to provide adaptive support and exceptional comfort. This innovation helps runners enhance endurance, reduce fatigue, and improve overall running experience, appealing to both casual and competitive athletes. The launch strengthened ASICS’s presence in the high-performance footwear segment and reinforced its reputation for technologically advanced running solutions

- In November 2022, ASICS introduced the ASICS X SOLANA UI Collection, featuring limited-edition GT-2000 11 running shoes with an NFT integration, blending fashion and digital assets. This initiative targeted tech-savvy and lifestyle-focused consumers, driving brand engagement and creating a niche market for collectible and high-performance running footwear

- In 2022, Adidas expanded its global footprint by opening its largest offline retail store in India, covering 3,140 square feet. The flagship store showcases Adidas Originals shoes, apparel, and accessories, providing an immersive shopping experience. This move enhanced brand visibility, strengthened consumer engagement, and supported Adidas’s expansion in the fast-growing Indian athletic and lifestyle market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.