Global Ruthenium Tetroxide Market

Market Size in USD Billion

CAGR :

%

USD

1.55 Billion

USD

2.33 Billion

2024

2032

USD

1.55 Billion

USD

2.33 Billion

2024

2032

| 2025 –2032 | |

| USD 1.55 Billion | |

| USD 2.33 Billion | |

|

|

|

|

Ruthenium Tetroxide Market Size

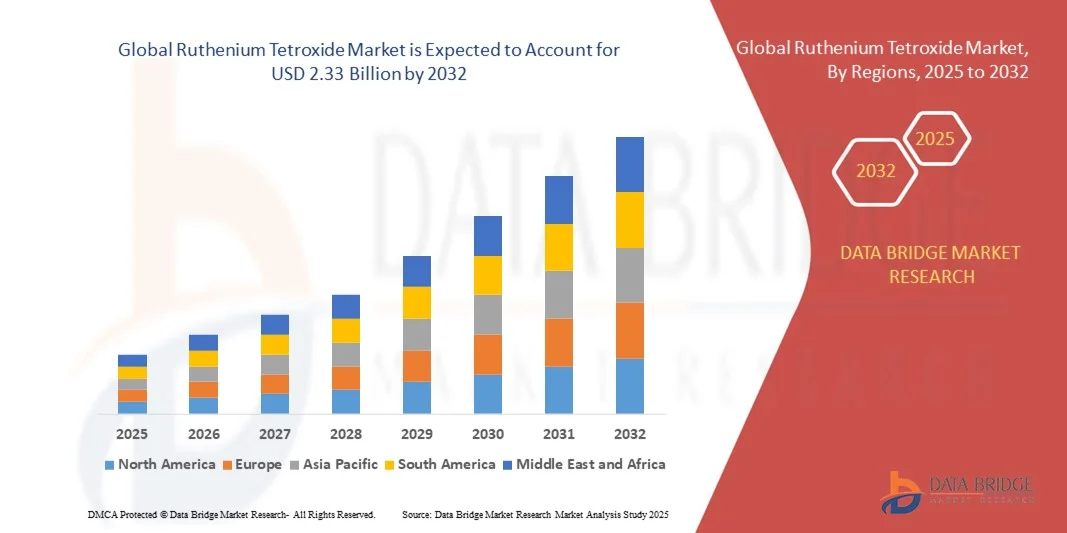

- The global ruthenium tetroxide market size was valued at USD 1.55 billion in 2024 and is expected to reach USD 2.33 billion by 2032, at a CAGR of 2.80% during the forecast period

- The market growth is largely fuelled by the increasing demand for ruthenium-based catalysts in chemical synthesis, electronics, and material science applications

- Rising utilization of ruthenium tetroxide in oxidation reactions and organic compound analysis across the pharmaceutical and research sectors is also contributing to market expansion

Ruthenium Tetroxide Market Analysis

- The global ruthenium tetroxide market is experiencing steady growth due to its extensive use as an oxidizing agent in organic and inorganic synthesis. Its effectiveness in converting alcohols to aldehydes and ketones makes it valuable in fine chemical production and laboratory research

- Growing innovation in semiconductor and nanotechnology applications, where ruthenium compounds are used for surface treatment and thin-film deposition, is further enhancing market potential

- North America dominated the ruthenium tetroxide market with the largest revenue share of 38.42% in 2024, driven by the growing demand for high-purity chemical reagents and advanced oxidation catalysts used in pharmaceuticals, electronics, and material science industries

- Asia-Pacific region is expected to witness the highest growth rate in the global ruthenium tetroxide market, driven by rapid industrialization, expansion of electronics and semiconductor sectors, and increasing demand for high-performance catalysts and fine chemicals

- The catalyst segment held the largest market revenue share in 2024, driven by the compound’s widespread application in oxidation reactions and organic synthesis across industrial and research settings. Ruthenium tetroxide’s high oxidative strength and selectivity make it a preferred catalyst in fine chemical production and advanced material development

Report Scope and Ruthenium Tetroxide Market Segmentation

|

Attributes |

Ruthenium Tetroxide Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ruthenium Tetroxide Market Trends

Rising Adoption Of Ruthenium Tetroxide In Advanced Material Research

- The increasing use of ruthenium tetroxide in advanced material synthesis and nanotechnology applications is reshaping the research and industrial landscape. Its strong oxidative properties make it an essential reagent in microscopy staining, organic synthesis, and catalyst preparation, supporting innovation in semiconductor and material science fields. Moreover, its role in oxidation-driven processes helps achieve higher purity and accuracy in developing functional materials and thin films, enhancing product efficiency and reliability across sectors

- The compound’s ability to provide high-resolution imaging and precise oxidation has gained attention from researchers focused on developing next-generation coatings, polymers, and electronic components. This growing utility in precision industries is fostering steady market demand across laboratories and R&D facilities. Furthermore, as nanostructured materials become increasingly important for microelectronics and biomedical engineering, ruthenium tetroxide is expected to remain a preferred reagent due to its superior analytical performance

- The push for cleaner and more efficient oxidation agents is also driving the replacement of traditional toxic chemicals with ruthenium tetroxide-based alternatives. As industries focus on sustainability and high-performance materials, demand for ruthenium-based compounds continues to expand globally. The compound’s ability to perform under mild conditions while delivering consistent results aligns with the ongoing global shift toward green chemistry practices and safer laboratory environments

- For instance, in 2023, several research institutions in Japan and Germany adopted ruthenium tetroxide for atomic-level imaging in semiconductor development, improving defect detection and process optimization. This highlights its critical role in advancing miniaturized electronic device manufacturing. The technology’s integration into modern analytical platforms has strengthened collaborations between academia and industry, leading to rapid advancements in surface chemistry and electronic materials research

- While the compound’s usage is broadening across material science and semiconductor research, its adoption depends on stringent handling protocols and cost-efficiency improvements. Manufacturers must prioritize safer formulations and scalable production to meet the rising industrial and academic demand. The development of low-toxicity ruthenium complexes and automated containment systems is expected to further ease adoption, opening new pathways for commercial and research applications

Ruthenium Tetroxide Market Dynamics

Driver

Expanding Demand In Catalysis And Organic Synthesis Applications

- Ruthenium tetroxide’s exceptional oxidation capability makes it highly valuable in organic synthesis, catalysis, and chemical processing industries. It is widely used to oxidize alcohols, alkenes, and other organic compounds with high selectivity and efficiency. The compound’s ability to operate under mild conditions reduces reaction time and energy consumption, promoting sustainable manufacturing and process optimization in the fine chemical industry

- The compound’s versatility in industrial chemical reactions has increased its adoption among manufacturers aiming to enhance process yields and reduce waste. This aligns with the growing trend toward green chemistry and sustainable industrial practices. It has also gained popularity in pharmaceutical and agrochemical manufacturing, where precision oxidation and controlled reaction environments are critical to ensuring high product quality and reproducibility

- In the electronics sector, ruthenium-based materials are increasingly utilized for thin-film deposition and electrode manufacturing. Their superior conductivity and stability make them ideal for use in semiconductor and solar cell applications. The rising demand for high-efficiency energy systems and electronic miniaturization continues to propel research and development of ruthenium-based coatings and functional materials

- For instance, in 2023, major European catalyst producers reported increased demand for ruthenium tetroxide in fine chemical production, citing its precision and performance advantages in oxidation reactions. This trend reflects the chemical industry’s shift toward using high-performance noble metal catalysts to enhance reaction outcomes and process scalability. As industrial processes evolve, the compound’s relevance in advanced catalysis is projected to strengthen further

- Although expanding industrial applications are driving the market, ensuring consistent supply and optimizing ruthenium recovery from secondary sources remain key factors for sustaining growth in the coming years. The establishment of efficient recycling systems for spent ruthenium catalysts is gaining traction as companies strive to mitigate raw material shortages. Furthermore, advances in extraction and purification technologies are expected to improve resource utilization and stabilize long-term supply chains

Restraint/Challenge

High Toxicity And Handling Limitations Of Ruthenium Tetroxide

- Ruthenium tetroxide is an extremely toxic and volatile compound, requiring specialized equipment and trained personnel for safe handling. This limits its widespread industrial use and increases operational costs, particularly in small and medium-scale facilities. Exposure risks and stringent safety requirements necessitate the use of advanced ventilation systems and containment chambers, further adding to maintenance and compliance expenses

- Stringent safety regulations and environmental compliance requirements add further complexity to production and transportation, restricting availability across certain regions. Manufacturers must adhere to strict protocols to prevent exposure and contamination risks. The requirement for specialized storage containers and controlled environments also limits mass production, slowing down market scalability and international distribution

- The compound’s instability under certain conditions also poses challenges for long-term storage and large-scale manufacturing. This has led to cautious adoption, especially in industries lacking advanced safety infrastructure. Frequent monitoring, temperature control, and containment measures are essential to minimize degradation, which adds operational complexity and increases production downtime

- For instance, in 2023, several laboratories in the U.S. and Europe implemented restricted-use guidelines for ruthenium tetroxide following safety audits, which temporarily reduced its utilization in material testing and organic synthesis research. This event underscored the need for stringent safety oversight in handling oxidizing agents, particularly those with high volatility. The resulting restrictions also highlighted the dependence of academic and commercial research on improved containment and substitution strategies

- While toxicity and handling constraints pose significant barriers, advancements in stabilization techniques and the development of safer derivatives could help overcome these challenges, expanding the compound’s practical and commercial viability. Research is increasingly focused on encapsulated ruthenium formulations that reduce volatility while preserving oxidative power. Such innovations are expected to improve safety, enhance usability, and unlock new applications across various industrial and research domains

Ruthenium Tetroxide Market Scope

The global ruthenium tetroxide market is segmented on the basis of function, application, and type.

- By Function

On the basis of function, the ruthenium tetroxide market is segmented into chemical intermediate, staining agent, resisting agent, catalyst, and others. The catalyst segment held the largest market revenue share in 2024, driven by the compound’s widespread application in oxidation reactions and organic synthesis across industrial and research settings. Ruthenium tetroxide’s high oxidative strength and selectivity make it a preferred catalyst in fine chemical production and advanced material development.

The staining agent segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its increasing adoption in electron microscopy and biological imaging. Its ability to provide superior contrast and detailed structural visualization has enhanced its demand in research laboratories and life sciences applications, supporting the expansion of high-resolution imaging technologies.

- By Application

On the basis of application, the ruthenium tetroxide market is segmented into electronic resistors, metal alloys, chemical, pharmaceutical, solar cells, and others. The chemical segment accounted for the largest market share in 2024, attributed to the compound’s critical role in oxidation processes, catalyst development, and high-precision synthesis. Its efficiency in controlled oxidation and compound transformation makes it indispensable in industrial chemical production.

The solar cells segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing focus on renewable energy and the integration of ruthenium-based compounds in photovoltaic technologies. Ruthenium tetroxide’s unique electronic properties enhance energy conversion efficiency, supporting its use in dye-sensitized solar cells and other advanced energy applications.

- By Type

On the basis of type, the ruthenium tetroxide market is segmented into over 99% and below 99%. The over 99% purity segment held the largest revenue share in 2024, as high-purity compounds are essential for applications in semiconductors, catalysis, and nanomaterial research where precision and performance are critical. Industries favor this grade for its consistent quality and effectiveness in sensitive chemical processes.

The below 99% purity segment is expected to record the fastest growth rate from 2025 to 2032, supported by increasing use in cost-sensitive applications such as bulk chemical synthesis and educational research. Its affordability and adequate performance in general laboratory use make it suitable for institutions and smaller-scale industries seeking economical alternatives without compromising basic efficiency.

Ruthenium Tetroxide Market Regional Analysis

- North America dominated the ruthenium tetroxide market with the largest revenue share of 38.42% in 2024, driven by the growing demand for high-purity chemical reagents and advanced oxidation catalysts used in pharmaceuticals, electronics, and material science industries

- The region’s strong research infrastructure, combined with a high concentration of chemical and semiconductor manufacturers, supports consistent demand for ruthenium-based compounds in R&D and industrial applications

- Moreover, the presence of leading technology and chemical firms, coupled with continuous innovation in nanomaterials and catalyst design, reinforces North America’s position as a key hub for ruthenium tetroxide production and utilization

U.S. Ruthenium Tetroxide Market Insight

The U.S. ruthenium tetroxide market captured the largest revenue share in 2024 within North America, propelled by its extensive use in organic synthesis, catalysis, and advanced microscopy applications. The country’s growing investments in semiconductor R&D and pharmaceutical formulation have further strengthened the market. The presence of key manufacturers and research institutions enables rapid adoption of ruthenium-based reagents for oxidation and imaging purposes. Furthermore, rising focus on high-precision chemical processes and sustainable catalyst development is enhancing domestic production and consumption of ruthenium tetroxide.

Europe Ruthenium Tetroxide Market Insight

The Europe ruthenium tetroxide market is expected to witness substantial growth from 2025 to 2032, driven by strong demand across the chemical, academic, and electronics sectors. The region’s emphasis on green chemistry, coupled with stringent quality standards for laboratory reagents, is boosting the adoption of ruthenium compounds in oxidation and catalytic processes. In addition, European research organizations and nanotechnology firms are increasingly utilizing ruthenium tetroxide for high-resolution material imaging and electronic component development. Collaborative research initiatives between universities and chemical manufacturers further support market expansion across Germany, the U.K., and France.

Germany Ruthenium Tetroxide Market Insight

The Germany ruthenium tetroxide market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the country’s leadership in advanced material research and chemical engineering. German industries are increasingly incorporating ruthenium compounds into oxidation catalysts, fine chemical production, and semiconductor coating applications. Moreover, the government’s strong support for sustainable manufacturing and R&D innovation is encouraging the development of safer handling practices and improved compound stability. The nation’s expanding focus on clean chemistry and high-value materials continues to create opportunities for both local and international market players.

U.K. Ruthenium Tetroxide Market Insight

The U.K. ruthenium tetroxide market is expected to witness notable growth from 2025 to 2032, driven by the expanding demand for high-purity reagents in pharmaceutical synthesis, nanotechnology, and advanced material research. The country’s strong academic network and well-established chemical manufacturing base support consistent adoption of ruthenium-based oxidation agents. In addition, increasing government funding for innovation in clean energy and sustainable chemistry is promoting the use of ruthenium compounds in catalyst development. The growing collaboration between universities, research centers, and private firms is further strengthening the U.K.’s position as a key European hub for specialty chemical advancement.

Asia-Pacific Ruthenium Tetroxide Market Insight

The Asia-Pacific ruthenium tetroxide market is projected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, expanding electronics manufacturing, and strong demand for advanced catalysts. Countries such as China, Japan, and South Korea are investing heavily in semiconductor production and specialty chemical synthesis, both of which utilize ruthenium tetroxide. In addition, growing academic and government-backed research in nanotechnology and sustainable chemistry is further boosting demand. The availability of cost-effective raw materials and rising domestic production capabilities are strengthening the region’s position as a key growth engine for the global market.

China Ruthenium Tetroxide Market Insight

The China ruthenium tetroxide market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by its thriving semiconductor, chemical, and pharmaceutical sectors. The nation’s strong industrial base and focus on self-sufficiency in advanced materials production are accelerating domestic utilization of ruthenium compounds. Increasing R&D investments in green chemistry and electronic materials are further promoting demand. In addition, collaborations between universities and industrial producers are enabling the development of innovative ruthenium-based catalysts and imaging agents, enhancing China’s role as both a major consumer and exporter in the global market.

Japan Ruthenium Tetroxide Market Insight

The Japan ruthenium tetroxide market is expected to grow rapidly from 2025 to 2032, driven by the country’s focus on precision manufacturing, material science innovation, and sustainable chemistry. Ruthenium tetroxide is increasingly used in high-end electronics, microscopy, and fine chemical synthesis in Japan’s advanced research institutions and industrial laboratories. The growing push for semiconductor miniaturization and next-generation electronic components is further expanding the scope of ruthenium-based compounds. In addition, Japan’s strong regulatory framework and emphasis on product safety are encouraging the use of stabilized formulations, ensuring consistent growth and reliability in industrial applications.

Ruthenium Tetroxide Market Share

The Ruthenium Tetroxide industry is primarily led by well-established companies, including:

• Shanghai Danfan Network Science & Technology Co., Ltd (China)

• J&K Scientific Ltd (China)

• ESPI Metals (U.S.)

• Nornickel (Russia)

• American Elements (U.S.)

• Aspira Chemical (U.S.)

• TCI Chemical Pvt. Ltd. (India)

• BOC Sciences (U.S.)

• Career Henan Chemical Co. Ltd. (China)

• FURUYA METAL Co., Ltd (Japan)

• Ceimig Ltd (U.K.)

• Johnson Matthey (U.K.)

• Reade International Corp. (U.S.)

• METAKEM GmbH (Germany)

• Johnson Matthey (U.K.)

• Career Henan Chemical Co. Ltd. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ruthenium Tetroxide Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ruthenium Tetroxide Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ruthenium Tetroxide Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.