Global Sachet Packaging Market

Market Size in USD Billion

CAGR :

%

USD

10.34 Billion

USD

15.84 Billion

2024

2032

USD

10.34 Billion

USD

15.84 Billion

2024

2032

| 2025 –2032 | |

| USD 10.34 Billion | |

| USD 15.84 Billion | |

|

|

|

|

Sachet Packaging Market Size

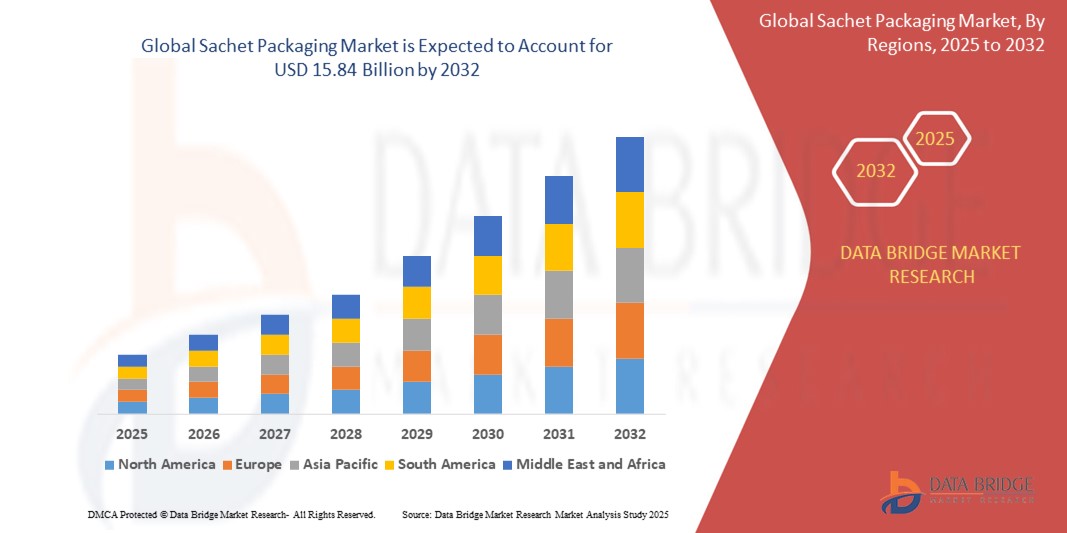

- The global sachet packaging market size was valued at USD 10.34 billion in 2024 and is expected to reach USD 15.84 billion by 2032, at a CAGR of 5.48% during the forecast period

- The market growth is largely fueled by the increasing demand for cost-effective, single-use packaging solutions across emerging economies, particularly in the personal care, food, and pharmaceutical sectors, where sachets offer affordability and convenience to low-income and on-the-go consumers

- Furthermore, rising focus on sustainable and lightweight packaging, coupled with advancements in form-fill-seal machinery and recyclable material innovations, is encouraging brands to adopt sachet formats for portion-controlled, hygienic, and eco-conscious product delivery, thereby significantly boosting the industry's growth

Sachet Packaging Market Analysis

- Sachet packaging is a type of flexible packaging that encloses small quantities of products, typically in single-use or portion-controlled packets. It is widely used for various items such as powders, liquids, and gels, providing convenience and extended shelf life. This packaging solution is popular in the food, pharmaceutical, and cosmetic industries due to its cost-effectiveness and portability

- The escalating demand for sachet packaging is primarily fueled by increasing consumption in emerging markets, growing demand for hygienic and portion-controlled packaging, and rising adoption of sustainable, lightweight materials by manufacturers and brands

- Asia-Pacific dominated the sachet packaging market with a share of 38.5% in 2024, due to high demand for low-cost, single-use packaging across personal care, food, and pharmaceutical sectors in densely populated countries

- North America is expected to be the fastest growing region in the sachet packaging market during the forecast period due to increasing demand for portion-controlled packaging in the food, beverage, and personal care industries

- Plastic segment dominated the market with a market share of 61.5% in 2024, due to its versatility, barrier properties, and cost-effectiveness

Report Scope and Sachet Packaging Market Segmentation

|

Attributes |

Sachet Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sachet Packaging Market Trends

“Increasing Consumer Demand for Convenience”

- A significant and accelerating trend in the global sachet packaging market is the growing consumer demand for convenience-driven packaging solutions that support on-the-go lifestyles, portion control, and hygienic usage across sectors such as personal care, food, and pharmaceuticals

- For instance, Amcor plc introduced its AmFiber Performance Paper heat-seal sachets targeting dry food and beverage applications, offering lightweight, easy-to-open solutions for instant coffee, spices, and powdered drinks. Similarly, Arcade Beauty launched its 80.0% Paper Packette as a mono-dose recyclable alternative to plastic sachets for cosmetic sampling

- This shift toward convenience-focused formats is enabling brands to offer trial sizes, reduce product waste, and provide cleaner, more controlled dispensing options. Many sachets are now designed with easy-tear notches, reclosable seals, or precision-dosed fills to enhance user experience. Companies such as Huhtamäki Oyj are leveraging these features to supply sachets that deliver maximum functionality with minimal material usage

- The integration of sustainability with user convenience is also influencing product design—sachet packs are being made thinner yet more durable, using paper-based laminates and recyclable mono-materials without compromising protection. For instance, Constantia Flexibles offers EcoLam sachets for food and personal care, which align with both environmental and practical user needs

- This rising emphasis on ease-of-use, portability, and hygiene is reshaping consumer expectations around everyday packaging formats. As a result, major players such as ProAmpac are continuously innovating sachet solutions that combine functional convenience with aesthetic appeal to meet evolving lifestyle demands

- The demand for sachet packaging that offers simplicity, portability, and quick access is surging across both developed and developing markets, as consumers prioritize ease-of-use and brands strive to deliver more accessible and sustainable product experiences

Sachet Packaging Market Dynamics

Driver

“High Growth in the Food and Beverage Sector”

- The high growth in the food and beverage sector is a significant driver for the rising demand for sachet packaging, as manufacturers increasingly adopt single-use, portion-controlled formats to meet evolving consumer needs for convenience, affordability, and hygiene

- For instance, Amcor plc expanded its AmFiber Performance Paper range in Europe to include heat-seal sachets for dry culinary and beverage applications such as instant coffee, drink powders, spices, and soups, targeting rising demand for quick-prep food options and sustainable packaging alternatives

- As consumers seek out lightweight, portable food and drink products that can be easily carried and consumed on the go, sachets provide a practical solution with reduced packaging waste and improved shelf stability

- The convenience of single-use sachets, combined with extended shelf life, portion accuracy, and resistance to contamination, makes them ideal for sauces, powders, and beverage mixes. Companies such as Huhtamäki Oyj and ProAmpac are delivering advanced sachet solutions that cater specifically to these functional and branding requirements

- In addition, the rise of e-commerce and home delivery services has increased the need for tamper-evident and easy-to-handle packaging formats in the food sector. As brands compete to offer differentiated consumer experiences, sachets are emerging as a preferred format, further boosting market expansion

Restraint/Challenge

“Consumer Preference Shifts”

- Shifting consumer preferences toward sustainable and environmentally friendly packaging pose a significant challenge to the sachet packaging market. Traditional sachets often rely on multi-layer plastic or aluminum foil structures, which are difficult to recycle and contribute to growing environmental concerns among consumers and regulatory bodies

- For instance, increasing consumer awareness and policy pressure have led several brands to reconsider their use of non-recyclable sachets, compelling packaging manufacturers to innovate with alternative materials. Companies such as Amcor plc and Huhtamäki Oyj are investing in recyclable or paper-based sachet solutions, but these options often come at a higher production cost and may offer different barrier properties compared to conventional formats

- Addressing these concerns through the development of recyclable mono-material sachets, compostable films, or paper-based alternatives is critical to maintaining consumer loyalty and meeting sustainability goals. However, scalability and cost-efficiency remain major hurdles, especially for small and mid-sized brands that rely on cost-effective flexible packaging

- In addition, aesthetic expectations and shelf-life requirements often make it challenging to replace traditional foil or plastic-based sachets with greener alternatives without compromising product performance

- To remain competitive, companies must balance sustainability with functionality and cost. Innovations such as Arcade Beauty’s 80.0% paper packette and ProAmpac’s sustainable flexible packaging lines represent key efforts to address evolving consumer expectations, yet widespread adoption will require broader material innovations, infrastructure upgrades, and consumer education on end-of-life disposal

Sachet Packaging Market Scope

The market is segmented on the basis of pack size, material, packaging machinery, and application.

• By Pack Size

On the basis of pack size, the sachet packaging market is segmented into 1 ml – 10 ml, 11 ml – 20 ml, 21 ml – 30 ml, and others. The 1 ml – 10 ml segment held the largest market revenue share in 2024, primarily driven by its extensive use in sample distribution and single-use applications across the personal care, pharmaceutical, and food sectors. Brands frequently utilize this size for promotional products, such as shampoo, ketchup, and medicinal gels, where low cost and portability are vital. The rising demand from developing regions, where small packs are favored due to price sensitivity, further reinforces its dominance.

The 11 ml – 20 ml segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its growing popularity in cosmetic and food applications. This size offers a balance between convenience and sufficient quantity, making it ideal for travel-sized personal care items and portion-controlled food condiments. Increased demand for skincare products in this volume, especially in Asia-Pacific and Latin America, supports its anticipated rapid growth.

• By Material

On the basis of material, the sachet packaging market is segmented into plastic, paper, aluminium foil, and others. The plastic segment commanded the largest market revenue share 61.5% in 2024, attributed to its versatility, barrier properties, and cost-effectiveness. Plastic-based sachets are widely used in food, cosmetic, and pharma applications due to their durability and ability to preserve product integrity. The continued use of multilayer laminates and recyclable plastic solutions by major companies such as Amcor and ProAmpac also supports its widespread adoption.

The paper segment is projected to register the fastest CAGR from 2025 to 2032, propelled by the global shift towards sustainable packaging. Growing environmental concerns and regulatory pushes for plastic reduction have led companies across sectors, particularly in cosmetics and dry food items, to adopt paper-based sachets. Innovations in paper coatings and compostable solutions further bolster the growth of this segment.

• By Packaging Machinery

On the basis of packaging machinery, the market is segmented into Vertical Form-Fill-Seal (VFFS) and Horizontal Form-Fill-Seal (HFFS). The Vertical Form-Fill-Seal (VFFS) segment held the largest market share in 2024, driven by its space efficiency and suitability for high-speed, high-volume production. VFFS systems are widely used in the food, pharma, and FMCG sectors due to their capability to handle a broad range of product types and packaging materials, particularly powders, granules, and liquids.

The Horizontal Form-Fill-Seal (HFFS) segment is anticipated to grow at the fastest rate from 2025 to 2032, due to increasing demand for packaging machinery that enables precise, high-quality sachet formation for personal care and cosmetic applications. HFFS systems offer advantages in terms of better product presentation, reduced wastage, and versatility in film types, making them ideal for premium and brand-sensitive packaging.

• By Application

On the basis of application, the sachet packaging market is segmented into food and beverage, pharmaceuticals, cosmetic and personal care, industrial, consumer goods, adhesives and sealants, lubricant and solution, tobacco, and others. The food and beverage segment led the market revenue share of 41.5% in 2024, owing to the growing use of sachets for single-serve condiments, drink powders, and sauces. This segment benefits from urban on-the-go consumption trends and portion control preferences in both developed and developing markets.

The pharmaceutical segment is expected to witness the highest CAGR from 2025 to 2032, supported by the rising need for unit-dose packaging for OTC medications, topical gels, and oral rehydration solutions. Sachets provide an efficient, hygienic, and portable method for medicine distribution, especially in rural healthcare and institutional settings. Government initiatives for accessible healthcare and the push for patient-centric packaging solutions further fuel growth in this segment.

Sachet Packaging Market Regional Analysis

- Asia-Pacific dominated the sachet packaging market with the largest revenue share of 38.5% in 2024, driven by high demand for low-cost, single-use packaging across personal care, food, and pharmaceutical sectors in densely populated countries

- Rapid urbanization, expanding middle-class income, and consumer preference for affordable, portion-controlled products are major contributors to regional growth

- In addition, strong FMCG growth, local manufacturing capabilities, and rising e-commerce activity are encouraging the adoption of sachet formats, especially among small and regional brands

Japan Sachet Packaging Market Insight

The Japan sachet packaging market is growing due to the popularity of compact, single-use formats tailored for personal care and pharmaceutical items. The aging population and demand for hygienic, easy-to-open solutions are boosting uptake. Manufacturers are focusing on high-precision filling machines and recyclable materials to meet both consumer expectations and sustainability regulations.

China Sachet Packaging Market Insight

China held the largest market share in Asia-Pacific in 2024, supported by a robust domestic production base and mass consumption of sachet-packaged condiments, shampoos, and over-the-counter medications. Government initiatives promoting waste reduction and the growth of domestic cosmetic and health brands are encouraging local innovation in sustainable sachet materials and packaging automation.

Europe Sachet Packaging Market Insight

The Europe sachet packaging market is projected to expand steadily over the forecast period, driven by consumer demand for eco-friendly alternatives to rigid packaging and growing applications in skincare, supplements, and organic food. Regulatory frameworks promoting recyclability and waste minimization are accelerating the transition to paper-based and biodegradable sachets, particularly in Western and Nordic countries.

U.K. Sachet Packaging Market Insight

The U.K. market is expected to grow significantly due to rising consumer inclination toward recyclable, compact, and travel-friendly packaging. Demand is particularly strong in personal care and health supplements. Regulatory pressures on plastic reduction and the emergence of D2C (direct-to-consumer) brands using sachets for trial sizes are further fueling market expansion.

Germany Sachet Packaging Market Insight

Germany’s sachet packaging market is expanding on the back of growing demand for sustainable packaging solutions and high adoption in the cosmetics and nutraceuticals sectors. Innovation in multilayer biodegradable materials, along with widespread use of VFFS machinery in local manufacturing, is supporting the shift from traditional bottles and tubes to space-saving sachets.

North America Sachet Packaging Market Insight

North America is projected to register the fastest CAGR from 2025 to 2032, driven by increasing demand for portion-controlled packaging in the food, beverage, and personal care industries. Rising consumer preference for convenience and hygienic, single-use formats—combined with the push for recyclable and compostable materials—is transforming the packaging landscape. Technological advancements in form-fill-seal machinery are also contributing to the region’s rapid growth.

U.S. Sachet Packaging Market Insight

The U.S. held the largest share in North America’s sachet packaging market in 2024, fueled by widespread use in promotional and sample packaging by major personal care and food brands. Growing popularity of functional beverages, organic skincare, and trial-size pharmaceuticals is boosting demand. Market players are focusing on eco-friendly packaging formats to align with national sustainability goals and evolving consumer expectations.

Sachet Packaging Market Share

The sachet packaging industry is primarily led by well-established companies, including:

- Amcor plc (Australia)

- ProAmpac (U.S.)

- Huhtamäki Oyj (Finland)

- Constantia Flexibles (Austria)

- CLONDALKIN GROUP (Ireland)

- Adcraft Products Co., Inc. (U.S.)

- Ultra Seal Corporation (U.S.)

- Unico I.T.C. dba (Italy)

- American Towelette, Inc. (U.S.)

- Giles & Kendall, Inc. (U.S.)

- Cedar & Hardwood (U.S.)

- DEVE-PACK (Italy)

- Daila srl (Italy)

- RCP Ranstadt GmbH (Germany)

- bagobag (Italy)

- BERNHARDT Packaging & Process (Germany)

- A E Adams (Henfield) Ltd (U.K.)

- Bemis Manufacturing Company (U.S.)

- Coveris (U.K.)

- EPOCA Products s.a. (France)

Latest Developments in Global Sachet Packaging Market

- In January 2025, Arcade Beauty introduced the 80.0% Paper Packette, a recycle-ready, single-dose sample sachet developed as a sustainable alternative to traditional plastic or foil sachets. Comprising 80% paper, the new packette is tailored for sampling in skincare, haircare, and color cosmetics

- In June 2023, Amcor plc expanded its AmFiber Performance Paper packaging line in Europe by launching heat-seal sachets designed for dry culinary and beverage products, including instant coffee, powdered drinks, spices, seasonings, and dried soups

- In July 2022, Unilever, the British multinational consumer goods company, partnered with Mondi, another British multinational specializing in packaging and paper. This collaboration focused on creating aluminum-free, recyclable paper-based packaging specifically for Colman's sauces and meal makers, aiming to enhance sustainability and reduce environmental impact

- In May 2021, Amcor launched a high-barrier plastic sheet sachet for packaging powdered chocolate in Colombia. This 25-gram sachet is notable for its environmental benefits, reducing carbon emissions by 50% and water consumption by 83% when recycled, thus promoting eco-friendly practices in the sachet packaging industry

- In April 2021, Constantia Flexibles acquired Propak, a major player in the European packaging sector. This strategic merger is significantly enhancing Constantia Flexibles' market position in the film packaging segment and strengthening its presence in the rapidly expanding European packaging market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sachet Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sachet Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sachet Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.