Global Sack Kraft Paper Market

Market Size in USD Billion

CAGR :

%

USD

5.55 Billion

USD

7.45 Billion

2024

2032

USD

5.55 Billion

USD

7.45 Billion

2024

2032

| 2025 –2032 | |

| USD 5.55 Billion | |

| USD 7.45 Billion | |

|

|

|

|

Sack Kraft Paper Market Size

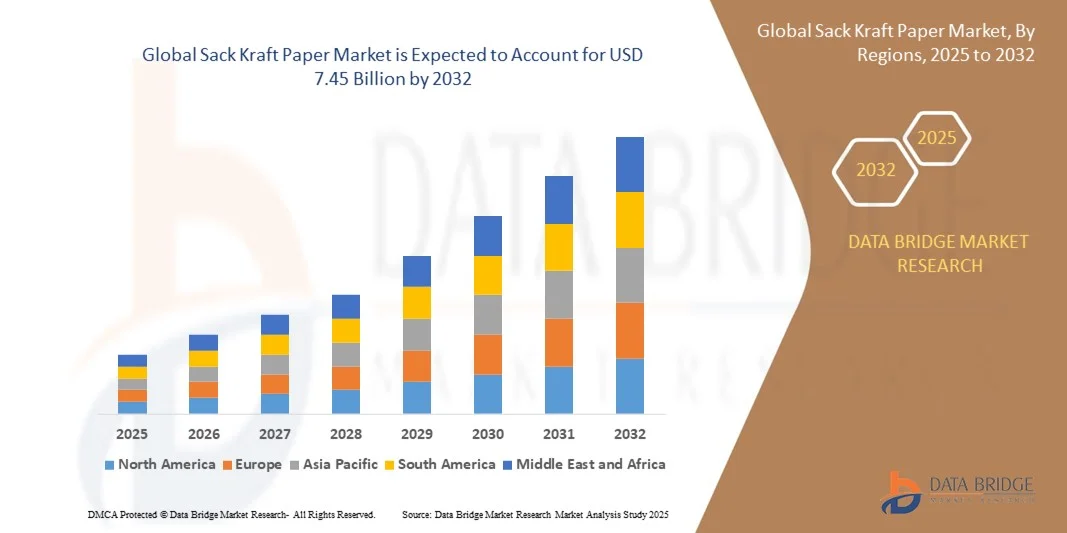

- The global sack kraft paper market size was valued at USD 5.55 billion in 2024 and is expected to reach USD 7.45 billion by 2032, at a CAGR of 3.75% during the forecast period

- The market growth is largely fueled by the rising demand for sustainable and eco-friendly packaging solutions, driven by global regulations restricting single-use plastics and the growing preference for recyclable materials in food, cement, and industrial packaging

- Furthermore, increasing construction activities, expansion of the e-commerce sector, and the need for durable, high-strength packaging for bulk goods are accelerating the uptake of sack kraft paper, significantly boosting the industry’s growth

Sack Kraft Paper Market Analysis

- Sack kraft paper is a high-strength, recyclable paper material used for manufacturing industrial bags and sacks for products such as cement, chemicals, animal feed, and food items. It offers exceptional durability, tear resistance, and printability, making it ideal for heavy-duty packaging and branding applications

- The escalating demand for sack kraft paper is primarily fueled by the global shift toward sustainable packaging, rapid growth in construction and infrastructure projects, and increasing use of eco-friendly materials in food and consumer goods packaging

- North America dominated the sack kraft paper market with a share of 35.5% in 2024, due to the strong presence of packaging industries, rising demand for sustainable materials, and the widespread adoption of kraft paper in food, cement, and chemical packaging

- Asia-Pacific is expected to be the fastest growing region in the sack kraft paper market during the forecast period due to rapid industrialization, rising urban populations, and expanding construction and food packaging industries

- Natural segment dominated the market with a market share of 62.5% in 2024, due to its cost-effectiveness, eco-friendly properties, and strong mechanical strength suitable for heavy-duty packaging. It is widely preferred in industries such as cement, chemicals, and agrochemicals due to its durability and resistance to tearing under high-stress conditions. Natural kraft paper also offers better recyclability and aligns with growing sustainability trends, which further boosts its adoption across multiple end-use sectors. Manufacturers favor natural kraft paper for its ability to handle bulk packaging and its compatibility with various coatings and lamination processes

Report Scope and Sack Kraft Paper Market Segmentation

|

Attributes |

Sack Kraft Paper Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sack Kraft Paper Market Trends

Growing Shift Toward Plastic-Free Recyclable Packaging

- The sack kraft paper market is witnessing a significant shift toward plastic-free recyclable packaging as industries and consumers prioritize sustainable alternatives. Increasing regulatory restrictions on single-use plastics combined with growing environmental awareness are driving adoption of sack kraft paper across diverse packaging applications

- For instance, Mondi Group has developed recyclable sack kraft paper solutions for food and industrial packaging while Smurfit Kappa has introduced sustainable paper-based sacks aiming to replace traditional plastic bags in agricultural and construction applications. These developments highlight the expanding role of recyclable paper packaging in a plastic-reduction environment

- Sack kraft paper offers biodegradability, recyclability, and high strength, making it a preferred choice for industries such as cement, chemicals, and food packaging. Its ability to reduce environmental footprint without compromising on performance supports the industry-wide transition to sustainable formats

- In addition, consumer goods companies are increasingly shifting to sack kraft paper-based packaging for premium appeal and eco-friendly branding. Enhanced printability and branding capabilities make it an ideal solution for businesses emphasizing sustainable identities to attract environmentally conscious consumers

- The growing momentum around circular economy principles is encouraging industries to adopt sack kraft paper packaging that integrates recycled fibers and supports closed-loop recycling systems. This alleviates waste challenges while reinforcing compliance with strict packaging sustainability regulations

- The ongoing shift toward recyclable, plastic-free solutions is reshaping the global packaging landscape. As sustainability becomes a critical purchasing criterion for industries and consumers, sack kraft paper is positioned as a strategic material solution that balances high strength, environmental responsibility, and branding flexibility

Sack Kraft Paper Market Dynamics

Driver

Rising Construction Activities Driving Cement Packaging Demand

- The rapid expansion of construction activities worldwide is a primary driver for the sack kraft paper market, as this sector remains the largest consumer of paper sacks. High durability and tear resistance of sack kraft paper make it an indispensable material for cement and building material packaging

- For instance, Nordic Paper produces high-performance sack kraft grades specifically designed for cement packaging, while Billerud has developed advanced sack kraft paper solutions that extend durability and resist moisture infiltration to protect cement during global transportation. These product strategies demonstrate commitment to serving the growing demands of the construction industry

- The rising urbanization in emerging economies and large-scale infrastructure projects are creating sustained demand for cement packaging solutions. Sack kraft paper fulfills durability requirements and also complies with increasing sustainability mandates in the construction sector

- In addition, the preference for lightweight but strong materials in packaging supports efficient logistics and handling of cement products. Sack kraft paper provides a balance between operational efficiency, strength, and eco-friendliness, making it ideal for this high-demand sector

- With construction spending projected to rise globally, the demand for cement sacks and associated sack kraft paper is expected to grow significantly. This ensures that sack kraft paper will maintain its role as a critical packaging material for building materials, strengthening its market position over the forecast period

Restraint/Challenge

Fluctuating Raw Material Prices Affecting Costs

- The volatility in raw material prices for sack kraft paper production poses a significant challenge to market stability. Dependence on wood pulp and other fiber supplies often exposes manufacturers to unpredictable cost variations tied to global supply-demand dynamics

- For instance, International Paper and WestRock have reported rising pulp procurement costs, impacting the overall profitability of sack kraft paper manufacturing and driving businesses to seek price adjustments. These fluctuations influence the final cost of packaging products, creating challenges for both manufacturers and customers

- Rising demand for pulp in multiple paper and packaging applications heightens cost pressures. Seasonal variations in timber supply, coupled with trade restrictions, add further uncertainty for producers attempting to stabilize their input expenses

- In addition, sustainability initiatives that prioritize certified or responsibly sourced wood introduce additional supply costs. While beneficial for global compliance, these certification requirements can narrow supply flexibility and add to operating expenditures

- Managing fluctuating raw material costs while maintaining competitive pricing necessitates continuous adaptation. Developing alternative fibers, enhancing recycling initiatives, and achieving greater production efficiency will be critical strategies to mitigate the impact of raw material volatility on sack kraft paper market sustainability and growth

Sack Kraft Paper Market Scope

The market is segmented on the basis of product, packaging type, and end-user.

- By Product

On the basis of product, the sack kraft paper market is segmented into natural and bleached. The natural kraft paper segment dominated the largest market revenue share of 62.5% in 2024, driven by its cost-effectiveness, eco-friendly properties, and strong mechanical strength suitable for heavy-duty packaging. It is widely preferred in industries such as cement, chemicals, and agrochemicals due to its durability and resistance to tearing under high-stress conditions. Natural kraft paper also offers better recyclability and aligns with growing sustainability trends, which further boosts its adoption across multiple end-use sectors. Manufacturers favor natural kraft paper for its ability to handle bulk packaging and its compatibility with various coatings and lamination processes.

The bleached kraft paper segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in food and consumer goods packaging where aesthetics and printability are critical. Bleached kraft paper provides a cleaner, smoother surface suitable for high-quality printing and branding, enhancing the product’s shelf appeal. Its superior whiteness and strength make it increasingly popular in premium packaging applications. The segment benefits from growing consumer preference for visually appealing, eco-conscious packaging solutions, especially in regions with stringent packaging standards.

- By Packaging Type

On the basis of packaging type, the sack kraft paper market is segmented into open mouth sack, valve sack, and others. The open mouth sack segment dominated the largest market revenue share in 2024, driven by its versatility, ease of filling, and suitability for bulk materials such as cement, chemicals, and animal feed. Open mouth sacks are preferred for manual and machine-based filling, offering cost-efficiency and strong performance during transportation. The segment also benefits from widespread adoption in industrial and construction applications due to its adaptability to various storage and handling conditions. Manufacturers favor open mouth sacks for their ability to maintain product integrity while ensuring efficient logistics.

The valve sack segment is expected to witness the fastest growth from 2025 to 2032, propelled by increasing demand in cement and powdered food industries for mechanized filling systems. Valve sacks allow faster and more secure filling of granular and powdered materials, reducing wastage and labor costs. Their compatibility with automated packaging lines and enhanced sealing capabilities make them attractive for large-scale production. The segment’s growth is further supported by rising infrastructure development and expanding processed food industries requiring high-volume, reliable packaging solutions.

- By End-User

On the basis of end-user, the sack kraft paper market is segmented into cement & building materials, chemicals, agrochemicals, animal feed & pet food, food, and others. The cement & building materials segment dominated the largest market revenue share in 2024, driven by the continuous growth of construction activities worldwide and the demand for robust, durable packaging solutions for bulk cement transport. Sack kraft paper provides strength, moisture resistance, and tear-proof performance, making it ideal for heavy materials that require secure handling. The segment benefits from large-scale infrastructure projects and the consistent need for packaging solutions that maintain product quality during long-distance shipment.

The food segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for packaged and processed food products, particularly in urbanized regions. Food-grade sack kraft paper offers safety, hygiene, and printability, which are critical for branding and compliance with regulatory standards. Growing consumer awareness around sustainable and recyclable packaging also drives adoption in this segment. The expansion of retail food chains and e-commerce platforms further amplifies demand for high-quality kraft paper packaging in the food sector.

Sack Kraft Paper Market Regional Analysis

- North America dominated the sack kraft paper market with the largest revenue share of 35.5% in 2024, driven by the strong presence of packaging industries, rising demand for sustainable materials, and the widespread adoption of kraft paper in food, cement, and chemical packaging

- The region benefits from stringent regulations on plastic use, which accelerate the shift toward eco-friendly paper packaging solutions

- High consumer awareness of environmental concerns and the expansion of construction activities further strengthen market growth

U.S. Sack Kraft Paper Market Insight

The U.S. accounted for largest share of the North American market share in 2024, fueled by a robust construction sector and growing adoption of recyclable packaging in food and agrochemical applications. Government initiatives promoting eco-friendly materials and a strong base of paper manufacturing companies strengthen market penetration. Rising e-commerce activity and demand for high-strength paper sacks for bulk packaging also contribute significantly to growth.

Europe Sack Kraft Paper Market Insight

The Europe sack kraft paper market is projected to witness substantial growth during the forecast period, supported by stringent environmental regulations, high recycling rates, and strong consumer preference for sustainable packaging. The region’s focus on reducing carbon footprints and advancing circular economy practices has increased investments in kraft paper production facilities. Industries such as cement, animal feed, and packaged food drive continuous demand for sack kraft paper due to its durability and excellent printability for branding. Growing urbanization and rising consumer spending on packaged food further enhance market opportunities across both industrial and retail sectors.

U.K. Sack Kraft Paper Market Insight

The U.K. market is anticipated to grow at a notable CAGR, driven by government bans on single-use plastics and rising demand for recyclable packaging in foodservice, retail, and e-commerce. Businesses are increasingly adopting sack kraft paper to meet consumer expectations for eco-friendly solutions, while modern production technologies ensure high-quality, lightweight, and durable paper sacks.

Germany Sack Kraft Paper Market Insight

Germany is expected to expand at a significant CAGR, supported by its advanced manufacturing infrastructure and strong recycling culture. Demand is rising from the chemical, food, and construction industries, where high-strength paper is preferred for heavy-duty applications. Continuous innovations in paper processing and coating technologies are helping manufacturers improve the moisture resistance and tensile strength of kraft paper, further boosting adoption.

Asia-Pacific Sack Kraft Paper Market Insight

Asia-Pacific is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, rising urban populations, and expanding construction and food packaging industries. Countries such as China, India, and Japan are key contributors due to increasing government support for eco-friendly packaging and the region’s cost-effective production capabilities. The growing need for cement packaging in large-scale infrastructure projects and the surge in demand for sustainable food and agrochemical packaging present significant growth opportunities. Affordable manufacturing and expanding export activities further enhance the region’s dominance in global sack kraft paper production.

China Sack Kraft Paper Market Insight

China captured the largest revenue share in Asia-Pacific in 2024, supported by massive construction projects, rapid urbanization, and a strong shift toward sustainable materials. The country’s large manufacturing base and competitive production costs enable high output of natural and bleached kraft paper, meeting domestic and international demand.

Japan Sack Kraft Paper Market Insight

Japan is gaining traction due to its premium food and consumer goods industries, where high-quality, lightweight, and recyclable packaging is essential. Strict environmental regulations and advanced recycling systems encourage manufacturers to invest in eco-friendly production processes. Demand is further driven by innovations in high-strength kraft paper that can handle industrial applications while maintaining excellent printability for branding.

Sack Kraft Paper Market Share

The sack kraft paper industry is primarily led by well-established companies, including:

- WestRock Company (U.S.)

- Nordic Paper (Sweden)

- BillerudKorsnäs (Sweden)

- Canfor (Canada)

- Segezha Group (Russia)

- Gascogne (France)

- Natron-Hayat d.o.o. (Bosnia and Herzegovina)

- Mondi (U.K.)

- Canadian Kraft Paper Ltd. (Canada)

- Georgia-Pacific LLC (U.S.)

- Smurfit Kappa (Ireland)

- International Paper (U.S.)

- Forest Company (U.S.)

- SCG PACKAGING (Thailand)

- Oji Holdings Corporation (Japan)

- Tokushu Tokai Paper Co., Ltd. (Japan)

- Fujian Qingshan Paper Co., Ltd. (China)

- COPAMEX (Mexico)

- Primo Tedesco S.A. (Brazil)

Latest Developments in Global Sack Kraft Paper Market

- In December 2023, Mondi expanded its range of saturating kraft paper and increased production capacity to reinforce its presence in high-performance industrial applications. This strategic expansion focuses on supplying kraft paper for external and internal building panels, worktops, and technical films—segments experiencing rising demand due to the global growth of the construction and interior design industries. By boosting capacity and diversifying its product portfolio, Mondi is better positioned to meet the needs of customers seeking durable, eco-friendly materials. This move strengthens Mondi’s market share and also supports the wider adoption of kraft paper in specialized industrial applications, driving overall market growth

- In October 2022, Mondi approved a EUR 400 million (~USD 390 million) investment in a new state-of-the-art paper machine at its flagship Štětí mill in the Czech Republic. Designed to manufacture approximately 210,000 tonnes of sack kraft paper annually, this large-scale investment responds directly to the booming demand for paper-based flexible packaging, particularly in e-commerce and other sectors transitioning away from plastic. The integration of this new machine with Mondi’s vertically aligned value chain enhances operational efficiency, reduces production costs, and ensures a stable supply of eco-friendly packaging solutions. This initiative significantly expands Mondi’s production capacity and strengthens its ability to serve the global market’s growing appetite for sustainable sack kraft paper

- In July 2022, BillerudKorsnäs unveiled its innovative Performance White Barrier sack paper, a groundbreaking product that replaces the traditional plastic film barrier commonly used in paper sacks with a specialized coating. This innovation provides equivalent shelf-life expectancy and performance while being fully recyclable and environmentally friendly, addressing regulatory pressures to reduce plastic use and meet consumer demand for sustainable packaging. By offering a product that delivers both high protection and eco-credentials, BillerudKorsnäs positions itself as a leader in sustainable packaging technology and accelerates the market shift toward plastic-free sack paper solutions

- In July 2020, Sabert Corporation introduced the Kraft Collection, an extensive range of paperboard and corrugated food packaging solutions made from compostable, recyclable, and post-consumer fiber content materials. This product line reflects Sabert’s longstanding commitment to sustainability and meets the escalating demand for eco-conscious packaging within the foodservice and retail industries. As regulatory bans on single-use plastics tighten and consumer preference for biodegradable packaging grows, the Kraft Collection strengthens Sabert’s competitive edge and drives market penetration of kraft-based food packaging products

- In February 2020, Mondi launched the Go2Sack mobile app, a digital tool designed to simplify and optimize decision-making for customers selecting sack kraft paper grades. The app provides easy access to product-related information, technical data, and recommendations for the most suitable paper based on various filling conditions, significantly reducing the time required to identify and order the correct product. By embracing digitalization, Mondi enhances customer experience, promotes efficient procurement, and reinforces its position as a customer-centric leader in the sack kraft paper market. This initiative supports greater market engagement and highlights the growing role of technology in modernizing the paper packaging industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sack Kraft Paper Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sack Kraft Paper Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sack Kraft Paper Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.