Global Sailing Jackets Market

Market Size in USD Billion

CAGR :

%

USD

164.50 Billion

USD

301.11 Billion

2024

2032

USD

164.50 Billion

USD

301.11 Billion

2024

2032

| 2025 –2032 | |

| USD 164.50 Billion | |

| USD 301.11 Billion | |

|

|

|

|

Sailing Jackets Market Size

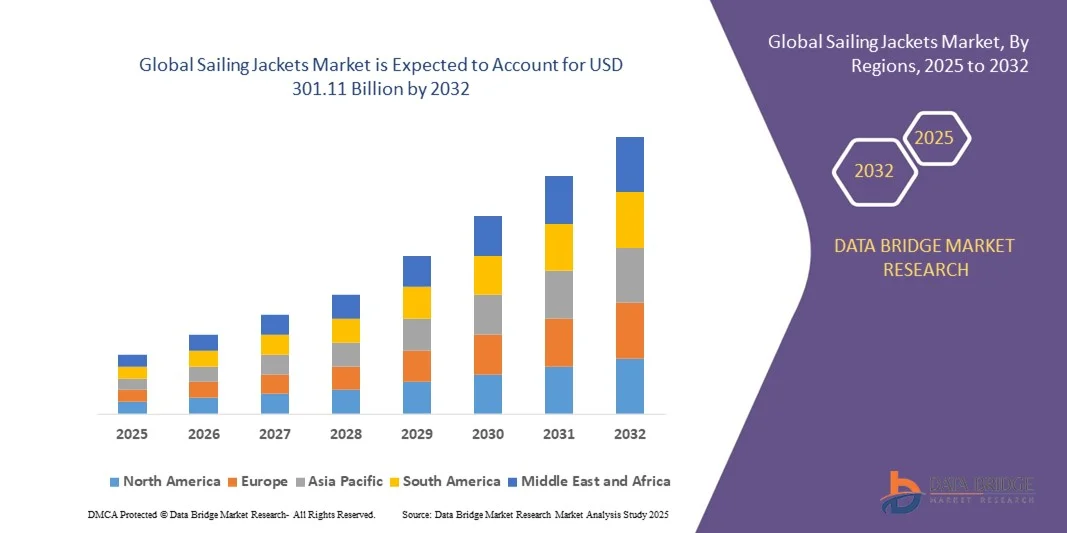

- The global sailing jackets market size was valued at USD 164.50 billion in 2024 and is expected to reach USD 301.11 billion by 2032, at a CAGR of 7.85% during the forecast period

- The market growth is largely fuelled by the increasing popularity of sailing and water sports, rising recreational boating activities, and growing awareness about safety and protective gear among enthusiasts

- Increasing investments in high-performance and premium sailing jackets with advanced materials and weather-resistant features are further driving market expansion

Sailing Jackets Market Analysis

- The market is witnessing innovation in lightweight, waterproof, and breathable materials that enhance comfort and performance for sailors

- Rising consumer preference for branded and technologically advanced sailing jackets is fueling demand, with manufacturers focusing on design, functionality, and safety features

- North America dominated the sailing jackets market with the largest revenue share of 38.45% in 2024, driven by a growing interest in recreational boating, competitive sailing, and adventure tourism, as well as increased awareness of safety gear and protective clothing

- Asia-Pacific region is expected to witness the highest growth rate in the global sailing jackets market, driven by rapid urbanization, rising adventure tourism, increased participation in competitive sailing, and government initiatives promoting water safety and marine sports

- The Mackintosh segment held the largest market revenue share in 2024, driven by its durability, water resistance, and suitability for professional and recreational sailing. These jackets provide reliable protection against harsh weather conditions while ensuring comfort and flexibility, making them a preferred choice among sailors

Report Scope and Sailing Jackets Market Segmentation

|

Attributes |

Sailing Jackets Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sailing Jackets Market Trends

Increasing Adoption of High-Performance Sailing Jackets

- The growing demand for high-performance sailing jackets is transforming the boating and adventure sports industry by enhancing safety, comfort, and protection in diverse weather conditions. Advanced materials and ergonomic designs allow sailors to focus on performance while minimizing exposure to harsh elements, improving overall user experience and satisfaction. In addition, innovations such as lightweight thermal insulation, moisture-wicking fabrics, and reinforced seam technology are further elevating jacket functionality across extreme and recreational environments

- Rising interest in recreational boating, competitive sailing, and water-based adventure tourism is accelerating the adoption of lightweight, waterproof, and breathable jackets. These jackets are particularly effective where durability, thermal insulation, and mobility directly impact safety and performance. Moreover, collaborations between sports gear brands and sailing associations are driving specialized product development for both professional and amateur sailors, enhancing market penetration

- The affordability and technological advancements in modern sailing jackets are making them attractive for both amateur enthusiasts and professional sailors. Companies can implement cutting-edge materials and features without significantly increasing costs, supporting wider market adoption. Furthermore, the integration of eco-friendly, recycled, and sustainable materials is appealing to environmentally conscious consumers, broadening the market’s consumer base

- For instance, in 2023, several sailing schools and yacht clubs in Europe and North America reported improved safety and user satisfaction after incorporating high-performance jackets for trainees and members, enhancing brand reputation and participation. These organizations noted reduced weather-related injuries and increased engagement in training programs, highlighting the practical benefits of investing in advanced gear

- While sailing jackets are driving enhanced safety and recreational experiences, their impact depends on continued innovation, regulatory compliance, and material quality. Manufacturers must focus on sustainable, weather-resistant, and application-specific solutions to fully capitalize on market growth. In addition, awareness campaigns and product education can help new users understand the importance of high-performance jackets, supporting long-term adoption and market expansion

Sailing Jackets Market Dynamics

Driver

Rising Participation in Recreational Boating and Adventure Sports

- The increasing popularity of recreational boating and competitive sailing is driving demand for high-quality sailing jackets. Safety regulations, adventure tourism trends, and lifestyle shifts are pushing manufacturers to offer jackets that provide protection and comfort simultaneously. In addition, rising disposable incomes and adventure-focused tourism are encouraging consumers to invest in premium gear, boosting market growth

- Manufacturers are seeking innovative, lightweight, and weather-resistant solutions to enhance user experience, leading to higher adoption of breathable fabrics, thermal insulation, and reflective safety features. Integration of smart fabrics with UV protection, anti-microbial coatings, and moisture regulation is expanding product functionality, attracting a wider range of consumers

- Government and sports bodies promoting water safety awareness are further boosting adoption. Initiatives encouraging proper gear usage during sailing events and training programs drive the integration of high-performance jackets in both recreational and professional settings. Partnerships between regulatory authorities and manufacturers are also helping standardize safety certifications, enhancing consumer confidence

- For instance, in 2022, several sailing competitions in North America mandated certified safety jackets, leading to increased orders from local distributors and retailers. This mandate also spurred innovation in design and materials, creating opportunities for specialized jacket lines tailored to competitive sailing and youth programs

- While demand is rising, ensuring consistent material quality, ergonomic design, and affordability remains critical for sustained growth in the sailing jackets market. Companies must focus on continuous R&D, compliance with international safety standards, and maintaining cost-effectiveness to achieve long-term market sustainability

Restraint/Challenge

High Cost of Premium Jackets and Limited Accessibility in Emerging Markets

- Premium sailing jackets with advanced materials and certifications often have a high price point, making them less accessible to casual sailors and budget-conscious consumers. Cost constraints can limit market penetration in emerging economies. In addition, import tariffs and local taxation can further increase final retail prices, restricting widespread adoption

- In many regions, lack of awareness regarding safety standards and appropriate gear reduces adoption. Limited availability of certified jackets in local markets further hampers widespread usage. Educational programs and campaigns to promote water safety and protective clothing are still in early stages in several developing regions

- Supply chain challenges for specialized fabrics, waterproof membranes, and thermal insulation materials may lead to delays and higher prices, restricting adoption in remote or underdeveloped areas. Shortages in advanced synthetic fibers and eco-friendly materials can also impact production timelines and profitability

- For instance, in 2023, sailing clubs in Southeast Asia reported limited access to certified jackets, forcing some organizations to use lower-quality alternatives that did not meet international safety standards. This often led to increased risk of weather-related injuries and reduced participation in events, emphasizing the need for better distribution networks

- While sailing jacket technology continues to evolve, addressing cost, accessibility, and awareness challenges is essential. Stakeholders must focus on affordable, durable, and widely distributable solutions to unlock long-term market potential. In addition, leveraging e-commerce and direct-to-consumer channels can help reach untapped markets, ensuring broader adoption and growth

Sailing Jackets Market Scope

The market is segmented on the basis of product type, application, and distribution channel.

- By Product Type

On the basis of product type, the sailing jackets market is segmented into Mackintosh, PU, and Others. The Mackintosh segment held the largest market revenue share in 2024, driven by its durability, water resistance, and suitability for professional and recreational sailing. These jackets provide reliable protection against harsh weather conditions while ensuring comfort and flexibility, making them a preferred choice among sailors.

The PU segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its lightweight, breathable, and cost-effective properties. PU jackets are particularly popular for casual and recreational use, offering ease of movement, quick-drying features, and enhanced water repellency, making them ideal for a broad consumer base.

- By Application

On the basis of application, the sailing jackets market is segmented into Men, Women, and Kids. The Men’s segment held the largest market revenue share in 2024, owing to higher participation in sailing and adventure sports. Jackets in this segment are designed for durability, thermal insulation, and ergonomic fit, supporting performance and safety in various weather conditions.

The Women’s segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising female participation in recreational boating, competitive sailing, and adventure tourism. Modern designs focusing on style, comfort, and safety are increasing adoption among women enthusiasts.

- By Distribution Channel

On the basis of distribution channel, the sailing jackets market is segmented into Offline and Online. The Offline segment held the largest market revenue share in 2024, driven by the presence of specialized sports stores, brand outlets, and retail chains offering in-store trials and expert guidance. Physical stores remain preferred for high-value purchases requiring proper fit and quality assessment.

The Online segment is expected to witness the fastest growth rate from 2025 to 2032, driven by e-commerce platforms, direct-to-consumer brand websites, and growing consumer preference for convenient, contactless shopping. Online channels are increasingly popular due to competitive pricing, wider variety, and doorstep delivery services.

Sailing Jackets Market Regional Analysis

• North America dominated the sailing jackets market with the largest revenue share of 38.45% in 2024, driven by a growing interest in recreational boating, competitive sailing, and adventure tourism, as well as increased awareness of safety gear and protective clothing

• Consumers in the region highly value the comfort, weather resistance, and performance-enhancing features offered by modern sailing jackets, which allow for safer and more enjoyable sailing experiences

• This widespread adoption is further supported by high disposable incomes, a strong outdoor lifestyle culture, and expanding participation of both amateur and professional sailors, establishing sailing jackets as essential gear for water-based activities

U.S. Sailing Jackets Market Insight

The U.S. sailing jackets market captured the largest revenue share in 2024 within North America, fueled by the popularity of coastal recreational activities, competitive sailing, and adventure tourism. Consumers are increasingly prioritizing jackets that enhance safety, comfort, and performance. The growing preference for premium, lightweight, waterproof, and breathable jackets, combined with demand for ergonomic designs and advanced materials, further propels market growth. Moreover, initiatives promoting water safety and proper gear usage significantly contribute to the market’s expansion.

Europe Sailing Jackets Market Insight

The Europe sailing jackets market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by a rise in recreational boating, yacht clubs, and sailing competitions. Increasing urbanization, disposable incomes, and awareness of safety gear and personal protection are fostering adoption. European consumers are attracted to jackets offering thermal insulation, breathability, and advanced weather resistance. The region is experiencing significant growth across men, women, and kids segments, with sailing jackets used in both leisure and professional settings.

U.K. Sailing Jackets Market Insight

The U.K. sailing jackets market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing popularity of outdoor water sports and growing safety concerns. The trend toward home-grown sailing schools and recreational boating clubs encourages adoption of certified high-performance jackets. The U.K.’s robust retail infrastructure and awareness of protective gear are expected to continue stimulating market growth.

Germany Sailing Jackets Market Insight

The Germany sailing jackets market is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising awareness about protective clothing, high-quality materials, and technological innovations in apparel. Germany’s well-developed sports and adventure tourism infrastructure promotes the adoption of high-performance sailing jackets. Increasing use of lightweight, breathable, and weather-resistant materials is aligning with consumer expectations for durability, comfort, and safety.

Asia-Pacific Sailing Jackets Market Insight

The Asia-Pacific sailing jackets market is expected to witness a steady growth rate from 2025 to 2032, driven by rising interest in recreational boating, adventure tourism, and water sports in countries such as China, Japan, and India. Government initiatives promoting outdoor activities and water safety are boosting adoption. Furthermore, the region’s emergence as a manufacturing hub for high-performance jackets enhances affordability and availability, expanding access to a wider consumer base.

Japan Sailing Jackets Market Insight

The Japan sailing jackets market is expected to witness significant growth from 2025 to 2032 due to the country’s strong boating culture, emphasis on safety, and adoption of innovative materials. Consumers increasingly demand lightweight, waterproof, and breathable jackets for professional and leisure use. Integration of ergonomic designs and functional features is fueling market growth. Moreover, Japan’s aging population and growing interest in water-based recreational activities are expected to further drive adoption.

China Sailing Jackets Market Insight

The China sailing jackets market is expected to witness steady growth from 2025 to 2032, attributed to increasing participation in recreational boating, sailing schools, and adventure tourism. Rising disposable incomes, urbanization, and awareness of personal safety gear are supporting adoption. The push toward technologically advanced and affordable jackets, combined with strong domestic manufacturing capabilities, is a key factor propelling the market in China.

Sailing Jackets Market Share

The Sailing Jackets industry is primarily led by well-established companies, including:

- Musto (U.K.)

- Helly Hansen (Norway)

- Henri Lloyd (U.K.)

- GILL (U.K.)

- Marinepool (Germany)

- Decathlon (France)

- Sail Racing (Sweden)

- SLAM (Italy)

- Burke Marine (U.S.)

- Magic Marine (Sweden)

- Zhik Australia (Australia)

- TBS (U.K.)

- Regatta (U.K.)

- Baltic Safety Products AB (Sweden)

- Mustang Survival ULC (Canada)

- Tommy Hilfiger Licensing LLC (U.S.)

Latest Developments in Global Sailing Jackets Market

- In June 2024, Musto introduced the Flexilite Cooling range as part of its dinghy collection, featuring advanced sailing apparel designed to regulate body temperature and keep athletes cool, dry, or warm according to weather conditions. This innovative line enhances comfort and performance for sailors, promoting greater participation in competitive and recreational sailing while reinforcing Musto’s position as a leader in high-performance sailing gear

- In April 2024, Zhik launched a high-performance, neoprene-free wetsuit range made from sustainable, plant-based Yulex rubber. The eco-friendly design offers thermal protection and flexibility for sailors while reducing environmental impact, strengthening Zhik’s market reputation for sustainable innovation and supporting the growing demand for environmentally conscious sailing apparel

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL SAILING JACKETS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL SAILING JACKETS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL SAILING JACKETS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 PRICE TREND ANALYSIS

5.4 RAW MATERIAL ANALYSIS

5.5 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.6 LIST OF KEY BUYERS

5.7 PORTER’S FIVE FORCES

5.8 VENDOR SELECTION CRITERIA

5.9 PESTEL ANALYSIS

5.1 REGULATION COVERAGE

5.10.1 PRODUCT CODES

5.10.2 CERTIFIED STANDARDS

5.10.3 SAFETY STANDARDS

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 IMPACT OF COVID-19 PANDEMIC ON GLOBAL SAILING JACKETS MARKET

7.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

7.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

7.3 STRATEGIC DECISIONS FOR MANUFACTUERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

7.4 PRICE IMPACT

7.5 IMPACT ON DEMAND

7.6 IMPACT ON SUPPLY CHAIN

7.7 CONCLUSION

8 GLOBAL SAILING JACKETS MARKET, BY TYPE

8.1 OVERVIEW

8.2 KEELBOAT RACING JACKETS

8.3 INSHORE YACHTING JACKETS

8.4 OFFSHORE YACHTING JACKETS

8.5 COASTAL YACHTING JACKETS

8.6 OTHERS

9 GLOBAL SAILING JACKETS MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 NYLON

9.3 POLYESTER

9.4 POLYAMIDE

9.5 OTHERS

10 GLOBAL SAILING JACKETS MARKET, BY FABRIC LAYER

10.1 OVERVIEW

10.2 SINGLE LAYER

10.3 DOUBLE LAYER

10.4 MULTI-LAYER

11 GLOBAL SAILING JACKETS MARKET, BY DESIGN

11.1 OVERVIEW

11.2 HOODED

11.3 NON-HOODED

12 GLOBAL SAILING JACKETS MARKET, BY PRICE RANGE

12.1 OVERVIEW

12.2 LOW

12.3 MEDIUM

12.4 HIGH

13 GLOBAL SAILING JACKETS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 OFFLINE

13.2.1 SUPERMARKETS/HYPERMARKETS

13.2.2 SPECIALTY STORES

13.2.3 OTHERS

13.3 ONLINE

14 GLOBAL SAILING JACKETS MARKET, BY END-USER

14.1 OVERVIEW

14.2 MEN

14.3 WOMEN

14.4 KIDS

15 GLOBAL SAILING JACKETS MARKET, BY GEOGRAPHY

15.1 GLOBAL SAILING JACKETS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.2 NORTH AMERICA

15.2.1 U.S.

15.2.2 CANADA

15.2.3 MEXICO

15.3 EUROPE

15.3.1 GERMANY

15.3.2 U.K.

15.3.3 ITALY

15.3.4 FRANCE

15.3.5 SPAIN

15.3.6 RUSSIA

15.3.7 SWITZERLAND

15.3.8 TURKEY

15.3.9 BELGIUM

15.3.10 NETHERLANDS

15.3.11 LUXEMBURG

15.3.12 REST OF EUROPE

15.4 ASIA-PACIFIC

15.4.1 JAPAN

15.4.2 CHINA

15.4.3 SOUTH KOREA

15.4.4 INDIA

15.4.5 SINGAPORE

15.4.6 THAILAND

15.4.7 INDONESIA

15.4.8 MALAYSIA

15.4.9 PHILIPPINES

15.4.10 AUSTRALIA & NEW ZEALAND

15.4.11 REST OF ASIA-PACIFIC

15.5 SOUTH AMERICA

15.5.1 BRAZIL

15.5.2 ARGENTINA

15.5.3 REST OF SOUTH AMERICA

15.6 MIDDLE EAST AND AFRICA

15.6.1 SOUTH AFRICA

15.6.2 EGYPT

15.6.3 SAUDI ARABIA

15.6.4 UNITED ARAB EMIRATES

15.6.5 ISRAEL

15.6.6 REST OF MIDDLE EAST AND AFRICA

16 GLOBAL SAILING JACKETS MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

16.5 MERGERS AND ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

18 GLOBAL SAILING JACKETS MARKET- COMPANY PROFILE

18.1 COLUMBIA SPORTSWEAR COMPANY

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT UPDATES

18.2 MUSTO

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT UPDATES

18.3 HELLY HANSEN

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT UPDATES

18.4 HENRI-LLOYD

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT UPDATES

18.5 GILL NORTH AMERICA INC.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT UPDATES

18.6 DECATHLON

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 PRODUCT PORTFOLIO

18.6.4 RECENT UPDATES

18.7 BURKE MARINE

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT UPDATES

18.8 NAVIS MARINE

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 PRODUCT PORTFOLIO

18.8.4 RECENT UPDATES

18.9 KOKATAT INC.

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT UPDATES

18.1 TH. MARTINEZ/SEA&CO

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT UPDATES

18.11 MOERDENG

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 PRODUCT PORTFOLIO

18.11.4 RECENT UPDATES

18.12 MARINEPOOL

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT UPDATES

18.13 ZHIK PTY LTD.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT UPDATES

18.14 MAGIC MARINE

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT UPDATES

18.15 WINDRIDER

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT UPDATES

18.16 DUBARRY

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT UPDATES

18.17 SLAM

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 PRODUCT PORTFOLIO

18.17.4 RECENT UPDATES

18.18 SPERRY

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT UPDATES

18.19 NAUTICA

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT UPDATES

18.2 REGATTA GEAR

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 PRODUCT PORTFOLIO

18.20.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 RELATED REPORTS

20 QUESTIONNAIRE

21 CONCLUSION

22 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.