Global Sailplane Market

Market Size in USD Million

CAGR :

%

USD

133.10 Million

USD

229.73 Million

2025

2033

USD

133.10 Million

USD

229.73 Million

2025

2033

| 2026 –2033 | |

| USD 133.10 Million | |

| USD 229.73 Million | |

|

|

|

|

Sailplane Market Size

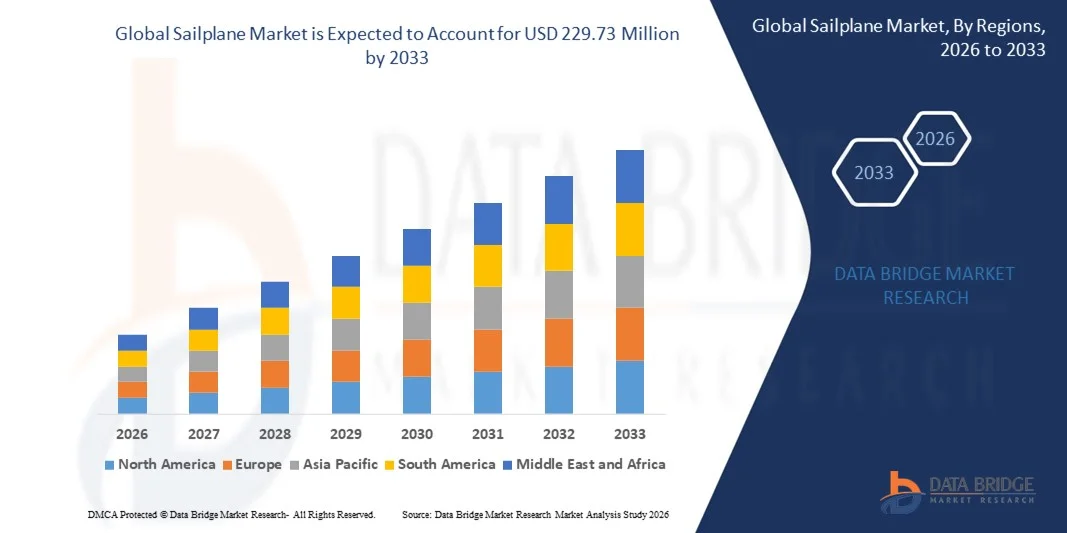

- The global sailplane market size was valued at USD 133.10 million in 2025 and is expected to reach USD 229.73 million by 2033, at a CAGR of 7.06% during the forecast period

- The market growth is largely fueled by the increasing popularity of recreational aviation, competitive gliding, and structured pilot training programs, leading to higher demand for high-performance and technologically advanced sailplanes

- Furthermore, rising interest in sustainable and electric-powered sailplanes, combined with the expansion of flying clubs and air sports events, is establishing modern sailplanes as the preferred choice for both leisure and professional aviation. These converging factors are accelerating the adoption of sailplanes, thereby significantly boosting the industry’s growth

Sailplane Market Analysis

- Sailplanes, offering unpowered or self-launching flight for training, sports, and recreational purposes, are increasingly vital in both competitive and leisure aviation due to their efficiency, aerodynamic performance, and pilot training applications

- The escalating demand for sailplanes is primarily fueled by growing participation in gliding sports, rising awareness of sustainable aviation technologies, and an increasing preference for high-performance, easy-to-operate aircraft among flying clubs, private pilots, and educational institutions

- North America dominated the sailplane market with a share of over 40% in 2025, due to a growing interest in recreational gliding, competitive sports, and pilot training programs

- Asia-Pacific is expected to be the fastest growing region in the sailplane market during the forecast period due to rising interest in recreational aviation, pilot training programs, and air sports in countries such as China, Japan, and India

- Single seater segment dominated the market with a market share of 63% in 2025, due to its widespread use in competitive gliding and training for experienced pilots. Single-seater sailplanes are preferred for their lightweight design, superior aerodynamics, and enhanced maneuverability, which allow pilots to achieve longer flights and higher performance. The segment also benefits from strong adoption in sports and recreational gliding clubs, where individual pilots seek optimal flight efficiency and handling. Manufacturers often focus on advanced composite materials and aerodynamic designs in single-seater models to enhance performance, reliability, and safety, reinforcing their market dominance

Report Scope and Sailplane Market Segmentation

|

Attributes |

Sailplane Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Sailplane Market Trends

Growing Adoption of Electric-Powered and Sustainable Sailplanes

- A significant trend in the sailplane market is the increasing adoption of electric-powered and environmentally sustainable sailplanes, driven by rising awareness of eco-friendly aviation and demand for low-emission flight options. This trend is elevating the importance of electric sailplanes as modern alternatives for both recreational and competitive pilots

- For instance, Pipistrel’s launch of all-electric sailplane prototypes demonstrates the industry’s commitment to reducing carbon footprints while maintaining performance and reliability. Such electric-powered sailplanes provide extended flight durations and quieter operation, appealing to flying clubs, training schools, and private owners

- The adoption of electric sailplanes is growing rapidly as improvements in battery technology and lightweight materials enable longer endurance flights, positioning electric propulsion as a critical factor in sustainable aviation

- Recreational aviation enthusiasts are increasingly seeking sailplanes that combine high performance with minimal environmental impact, which is driving innovation in aerodynamics, propulsion, and energy management systems

- Competitions and cross-country gliding events are integrating electric sailplanes, encouraging pilots to explore sustainable alternatives without compromising flight efficiency or maneuverability

- The market is witnessing strong growth in high-performance electric sailplanes that balance advanced aerodynamics, battery efficiency, and pilot comfort. This rising incorporation of sustainable technologies is reinforcing the overall transition toward greener aviation and more energy-efficient flight solutions across global sailplane operations

Sailplane Market Dynamics

Driver

Rising Participation in Recreational Aviation and Gliding Sports

- The growing popularity of recreational aviation and competitive gliding is driving demand for high-performance sailplanes, with clubs, schools, and private pilots seeking advanced aircraft for both training and sport. These developments enhance the adoption of modern sailplanes across multiple user segments and geographical regions

- For instance, the increasing involvement of flying clubs in Europe and North America has boosted orders for single-seater and double-seater sailplanes designed for training and competition. Such demand is fostering continuous innovation in design, materials, and onboard systems to improve safety, flight efficiency, and pilot experience

- The expansion of air sports programs and gliding events is creating greater exposure for sailplanes, encouraging both new and experienced pilots to invest in aircraft optimized for performance and sustainability

- Growing interest in adventure tourism and leisure aviation is further strengthening market demand, as pilots look for reliable, technologically advanced sailplanes capable of longer flights and easier handling

- The need for efficient pilot training and skill development is contributing to the increasing adoption of specialized training sailplanes, thereby reinforcing market growth and positioning sailplanes as essential assets for recreational and competitive aviation enthusiasts

Restraint/Challenge

High Manufacturing and Maintenance Costs

- The sailplane market faces challenges due to the high costs involved in producing and maintaining advanced sailplanes, which require precision engineering, lightweight composite materials, and specialized components. These factors increase production difficulty and elevate overall pricing for buyers

- For instance, companies such as DG Flugzeugbau and Schempp-Hirth utilize advanced carbon-fiber structures and precision assembly processes, which demand skilled labor and specialized manufacturing facilities. Such complex requirements raise production expenses and affect overall affordability for clubs and private owners

- Maintaining high-performance sailplanes involves stringent inspections, regular maintenance, and adherence to safety standards, which add to operational costs and limit broader accessibility

- The reliance on rare materials and sophisticated aerodynamics further increases supply-side vulnerability, impacting cost stability and delivery timelines

- The market continues to encounter constraints in balancing technological advancement with economic feasibility, as manufacturers strive to provide high-performance sailplanes while keeping them financially accessible to recreational, competitive, and training users

Sailplane Market Scope

The market is segmented on the basis of number of seats, power source, wing span, and end user.

- By Number of Seats

On the basis of number of seats, the sailplane market is segmented into single-seater and double-seater. The single-seater segment dominated the market with the largest market revenue share of 63% in 2025, driven by its widespread use in competitive gliding and training for experienced pilots. Single-seater sailplanes are preferred for their lightweight design, superior aerodynamics, and enhanced maneuverability, which allow pilots to achieve longer flights and higher performance. The segment also benefits from strong adoption in sports and recreational gliding clubs, where individual pilots seek optimal flight efficiency and handling. Manufacturers often focus on advanced composite materials and aerodynamic designs in single-seater models to enhance performance, reliability, and safety, reinforcing their market dominance.

The double-seater segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for training, instructional flights, and recreational tandem experiences. For instance, companies such as Schempp-Hirth have introduced advanced double-seater sailplanes with enhanced safety features, making them suitable for both training and leisure. Double-seater models provide an opportunity for instructors to accompany learners during flights, improving learning outcomes and pilot confidence. Rising interest in adventure tourism and tandem gliding experiences is further contributing to the growth of this segment. Design flexibility and enhanced comfort features also make double-seater sailplanes attractive for schools and flying clubs.

- By Power Source

On the basis of power source, the sailplane market is segmented into electric-powered and gasoline-powered. The gasoline-powered segment dominated the market with the largest market revenue share in 2025, driven by its established presence in the aviation sector and ability to deliver longer flight durations without dependency on battery recharging infrastructure. Gasoline-powered sailplanes are often preferred for cross-country flights and competitions due to their consistent power output and reliability under various weather conditions. The availability of a wide range of models with proven engine performance further strengthens their dominance in the market. Manufacturers continue to invest in fuel-efficient engines and lightweight materials to enhance operational efficiency and reduce environmental impact, reinforcing the preference for gasoline-powered sailplanes.

The electric-powered segment is expected to witness the fastest growth rate from 2026 to 2033, driven by growing emphasis on sustainability and zero-emission aviation solutions. For instance, Pipistrel’s electric sailplanes have gained popularity for their quiet operation, low maintenance, and reduced carbon footprint. Electric-powered sailplanes offer advantages such as instant torque, simplified engine management, and integration with renewable energy charging infrastructure. Rising environmental regulations and increasing awareness among flying clubs and private pilots are fueling adoption. Continuous technological advancements in battery efficiency and lightweight electric propulsion systems are further accelerating the growth of this segment.

- By Wing Span

On the basis of wing span, the sailplane market is segmented into less than 18 meters, 18 meters – 20 meters, and more than 20 meters. The 18 meters – 20 meters segment dominated the market with the largest market revenue share in 2025, driven by its optimal balance between performance, maneuverability, and handling in competitive and recreational gliding. Sailplanes within this range are highly favored for their ability to achieve high lift-to-drag ratios while remaining manageable for pilots across various skill levels. The segment is widely used in sports competitions, training schools, and leisure flying, offering versatility across different flying conditions. Manufacturers often prioritize precision engineering, aerodynamic efficiency, and lightweight composite materials in this category to meet pilot expectations and maintain performance standards.

The more than 20 meters wing span segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the rising popularity of high-performance sailplanes for competitive gliding and long-distance cross-country flights. For instance, DG Flugzeugbau produces large-span sailplanes designed to maximize glide ratio and flight efficiency over extended distances. Pilots and clubs seek these models for record-setting flights and advanced competition events, driving demand. Enhanced structural design, modern materials, and aerodynamic innovations contribute to superior flight performance. The segment’s ability to combine endurance, stability, and high efficiency makes it increasingly preferred among experienced pilots.

- By End User

On the basis of end user, the sailplane market is segmented into sports and leisure activity and military. The sports and leisure activity segment dominated the market with the largest market revenue share in 2025, driven by widespread participation in recreational gliding, training programs, and competitive sailing events. Private pilots, gliding clubs, and adventure tourism operators frequently invest in high-performance sailplanes to meet demand for recreational and sporting purposes. The segment benefits from innovations in lightweight materials, enhanced aerodynamics, and cockpit comfort, which improve the overall flying experience. Growing global interest in adventure sports and outdoor recreational aviation further reinforces the dominance of this end-user segment. Manufacturers also focus on ease of maintenance and accessibility, catering to both individual pilots and institutional buyers in the sports and leisure sector.

The military segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing utilization of sailplanes for training, reconnaissance, and surveillance purposes. For instance, the German Air Force has invested in advanced sailplane programs for pilot training and low-noise aerial observation missions. Military organizations benefit from the quiet operation, low operational costs, and high maneuverability of sailplanes for specific missions. Adoption is supported by ongoing developments in avionics, sensor integration, and reinforced structures for durability. Rising strategic interest in cost-effective training aircraft is further accelerating the growth of the military segment.

Sailplane Market Regional Analysis

- North America dominated the sailplane market with the largest revenue share of over 40% in 2025, driven by a growing interest in recreational gliding, competitive sports, and pilot training programs

- Consumers in the region highly value the performance, safety features, and advanced aerodynamics offered by sailplanes suitable for both sports and leisure applications

- This widespread adoption is further supported by high disposable incomes, a technologically inclined population, and the availability of flying clubs and training facilities, establishing sailplanes as a favored choice for enthusiasts and professional pilots

U.S. Sailplane Market Insight

The U.S. sailplane market captured the largest revenue share in 2025 within North America, fueled by the increasing popularity of gliding sports and pilot training initiatives. Consumers are increasingly prioritizing high-performance sailplanes with advanced control systems and superior flight efficiency. The growing trend of recreational aviation, coupled with the presence of established gliding clubs and competitions, further propels the sailplane industry, while innovations in lightweight composite materials and aerodynamics are significantly contributing to market expansion.

Europe Sailplane Market Insight

The Europe sailplane market is projected to expand at a substantial CAGR throughout the forecast period, driven by strong participation in competitive gliding, extensive pilot training programs, and increasing demand for high-performance sailplanes. The rise of flying clubs, air sports events, and a focus on safety and efficiency is fostering adoption, with modern sailplanes being incorporated into both recreational and professional aviation setups. Innovations in aerodynamics, materials, and cockpit systems are enhancing performance, contributing to significant market growth across sports, leisure, and training applications.

U.K. Sailplane Market Insight

The U.K. sailplane market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising popularity of air sports, recreational gliding, and pilot training initiatives. Emphasis on aviation education and a strong base of gliding enthusiasts encourages investment in high-performance sailplanes. The well-established flying infrastructure, coupled with innovative designs and safety-focused features, is expected to continue driving market growth in the U.K.

Germany Sailplane Market Insight

The Germany sailplane market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of competitive gliding, air sports, and sustainable aviation practices. Germany’s advanced aviation infrastructure, precision engineering expertise, and focus on innovation promote the adoption of high-performance sailplanes. Integration of modern safety systems, lightweight materials, and aerodynamic advancements is increasingly prevalent, with a strong preference for performance-focused and reliable sailplanes supporting market growth.

Asia-Pacific Sailplane Market Insight

The Asia-Pacific sailplane market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising interest in recreational aviation, pilot training programs, and air sports in countries such as China, Japan, and India. Growing disposable incomes, government initiatives promoting air sports, and expanding flying infrastructure are driving adoption. Furthermore, the emergence of APAC as a hub for sailplane manufacturing and training facilities is increasing accessibility to high-performance sailplanes for a wider consumer base, fueling market growth across the region.

Japan Sailplane Market Insight

The Japan sailplane market is gaining momentum due to the country’s high-tech culture, structured aviation training programs, and growing participation in recreational gliding. Emphasis on safety, efficiency, and performance is driving adoption, with increasing involvement in gliding clubs, competitions, and private ownership. Advanced materials, control systems, and government-supported aviation education initiatives are fueling growth in both recreational and professional segments.

China Sailplane Market Insight

The China sailplane market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising middle-class participation in air sports, and increasing awareness of recreational aviation. Sailplanes are becoming popular in flying clubs, schools, and private ownership, supported by expanding air sports infrastructure and domestic manufacturers. The growing interest in pilot training programs and competitive gliding is further propelling market adoption across China.

Sailplane Market Share

The sailplane industry is primarily led by well-established companies, including:

- Alexander Schleicher GmbH (Germany)

- DG Flugzeugbau GmbH (Germany)

- Jonker Sailplanes (South Africa)

- Williams Soaring Center (U.S.)

- AMS‑Flight (Slovakia)

- AIRBORNE AUSTRALIA (Australia)

- LAK (Lithuania)

- Schempp‑Hirth Flugzeug‑Vertriebs GmbH (Germany)

- Aeros Company (Ukraine)

- Windward Performance (U.S.)

- STEMME AG (Germany)

- Sonex Aircraft, LLC (U.S.)

- Europa Aircraft (U.K.)

- ANTONOV COMPANY (Ukraine)

- Diamond Aircraft Industries (Austria)

- Pipistrel Group (Slovenia)

- all-aero (Germany)

- Lange Aviation (Germany)

- HPH (Czech Republic)

Latest Developments in Global Sailplane Market

- In June 2025, Pipistrel d.o.o. launched a new all‑electric sailplane prototype aimed at cross‑country endurance flights. This development represents a strategic push toward sustainable aviation and longer-duration sailplane operations. The introduction is expected to expand the market for electric sailplanes, moving beyond short recreational flights to appeal to serious cross-country pilots and flying clubs seeking eco-friendly alternatives

- In April 2025, Schempp‑Hirth Flugzeugbau GmbH unveiled its new Ventus E sailplane with an improved fuselage, offering a more spacious cockpit and batteries with approximately 30% more power. This enhancement significantly increases climb altitude capability to around 3,000 meters, making electric self-launching sailplanes more attractive for competitive and recreational pilots. The launch strengthens the market for high-performance electric sailplanes and highlights a growing shift toward sustainable and efficient flight solutions

- In February 2025, Duo Distributors entered into a global distribution agreement with Schempp‑Hirth to enhance the international availability of high-performance sailplanes. This partnership broadens market access for flying clubs, private owners, and training schools worldwide, facilitating easier procurement and promoting the adoption of advanced sailplane models across diverse regions. The agreement is likely to accelerate market penetration and support growth in emerging sailplane markets

- In June 2024, Alexander Schleicher GmbH & Co. delivered production units of its new ASK 21 Mi gliders for a training program with the German Air Force. This move highlights institutional and military adoption of modern sailplanes for pilot training, signaling an expansion of the end-user base beyond recreational and competitive aviation. The development may encourage other organizations and flying schools to consider high-performance sailplanes for structured training, boosting demand across professional segments

- In April 2024, Schempp‑Hirth introduced the first production-ready version of the electric self-launching system on the Ventus‑3E model, offering emission-free, low-noise propulsion. This innovation makes sailplanes more environmentally friendly and accessible, particularly for clubs and private pilots focused on sustainable aviation. The launch reinforces the company’s position as a leader in electric sailplane technology and is expected to drive wider adoption of electric-powered gliders

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.