Global Sales Tax Software Market

Market Size in USD Billion

CAGR :

%

USD

10.38 Billion

USD

20.53 Billion

2024

2032

USD

10.38 Billion

USD

20.53 Billion

2024

2032

| 2025 –2032 | |

| USD 10.38 Billion | |

| USD 20.53 Billion | |

|

|

|

|

Sales Tax Software Market Size

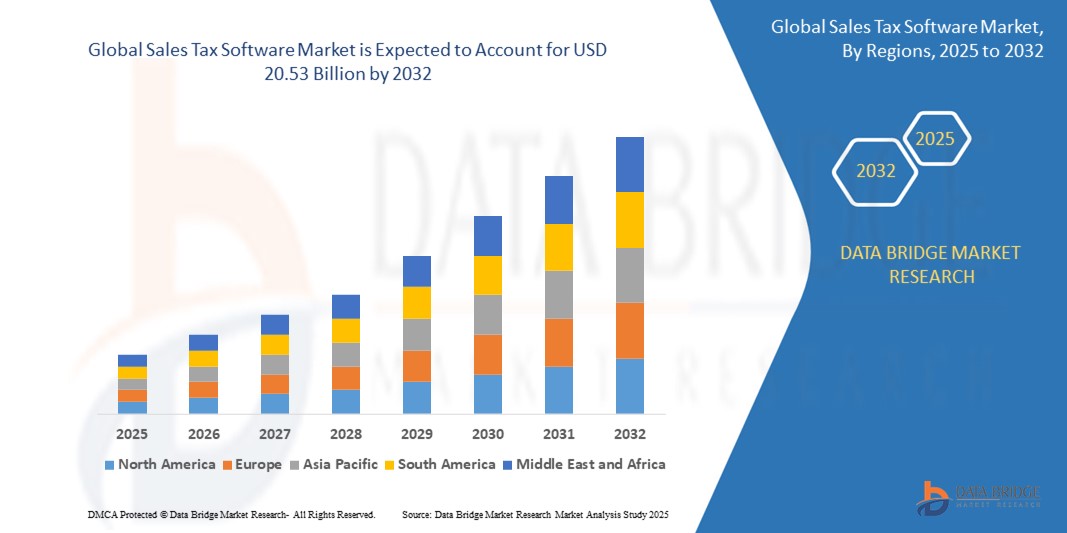

- The global Sales Tax Software market size was valued at USD 10.38 billion in 2024 and is expected to reach USD 20.53 billion by 2032, at a CAGR of 8.9% during the forecast period

- The market growth is largely fueled by the rise in the absence of quality infrastructure required for efficient operations of these services, increase in the requirement of knowledgeable professionals

- Furthermore, increase in the concerns regarding security of confidential data of an enterprise with the deployment of these services over the cloud are the major factors among others restraining the market growth, and will further challenge the sales tax software market in the forecast period mentioned above.

Sales Tax Software Market Analysis

- Sales tax software is defined as a technological service provided by several financial and IT organizations which essentially help individuals & enterprises in filing for taxes pertaining to their business sales. This software is directly connected with the authorities of a particular region thereby recording all of the regulations and compliances that a commercial enterprise or an individual needs to follow, providing easier tax filing and workflow.

- North America dominates the Sales Tax Software market with the largest revenue share of 57.32% in 2025, characterized by increase in the levels of quantities of transactions and the amounts pertaining to these transactions results in complicated process of tax filing in this region.

- Asia-Pacific is expected to be the fastest growing region in the Sales Tax Software market during the forecast period due to Significant penetration of internet and cloud computing resulting in greater adoption of these services is a crucial factor accelerating the market growth

- Consumer Use Tax Management segment is expected to dominate the Sales Tax Software market with a market share of 41.53% in 2025, driven by its increasing regulatory compliance needs and growing e-commerce activities.

Report Scope and Sales Tax Software Market Segmentation

|

Attributes |

Sales Tax Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sales Tax Software Market Trends

“Increasing Adoption of Cloud-Based Sales Tax Solutions”

- The shift towards cloud-based sales tax software is one of the biggest trends shaping the market today. Companies prefer cloud platforms because they offer easy access, automatic updates, and scalability without heavy upfront costs. Cloud solutions also allow businesses to integrate tax management with other cloud-based ERP or accounting systems, streamlining workflows.

- This trend is driven by the need for real-time tax rate calculations and instant compliance across multiple regions. Cloud software reduces the complexity of maintaining local infrastructure and supports remote work environments.

- Moreover, as tax laws evolve rapidly, cloud platforms can push timely updates to ensure ongoing compliance. This trend is particularly strong among small and medium enterprises that benefit from flexible, subscription-based pricing. Overall, cloud adoption is helping businesses stay agile and compliant in a fast-changing tax landscape.

- For instance, In March 2025, Vertex Inc. expanded its cloud-based tax automation services by launching new integration features for popular ERP platforms. This move helps businesses connect tax compliance with their broader financial systems seamlessly. Vertex’s update enhances real-time accuracy and reduces manual tax filing efforts.

Sales Tax Software Market Dynamics

Driver

“Growing Complexity of Tax Regulations”

- One of the main forces driving the sales tax software market is the ever-increasing complexity of tax laws worldwide. Governments are constantly updating regulations, introducing new rules, and expanding tax jurisdictions. Businesses must navigate these changes to avoid costly penalties and fines.

- Manual tax management becomes overwhelming and prone to errors when dealing with multi-state or international sales. As a result, companies are turning to automated software solutions to stay compliant and reduce risk. These tools help interpret complex laws, calculate accurate taxes, and streamline filing processes.

- The demand is especially high among companies with large volumes of transactions or cross-border sales. This driver ensures ongoing growth in the market as businesses prioritize compliance efficiency.

- For instance, In April 2025, Avalara enhanced its tax compliance software to automatically track and update regional tax regulation changes. This feature helps businesses keep up with evolving laws, reducing compliance risks and saving time. Avalara’s update reflects the need for adaptive tax solutions in a complex regulatory environment.

Restraint/Challenge

“High Implementation and Maintenance Costs”

- One major challenge slowing down the adoption of sales tax software is the high cost involved in implementation and ongoing maintenance. Small and medium businesses often find it difficult to invest in sophisticated tax software due to budget constraints.

- The initial setup requires integration with existing ERP or accounting systems, which can be complex and expensive. Additionally, regular software updates and training add to operational costs. These financial barriers discourage some companies from switching from manual or semi-automated processes to fully automated solutions.

- Moreover, the customization needed to comply with specific regional tax laws can further increase expenses. As a result, cost remains a significant restraint, especially for startups and smaller enterprises.

- For Instance, In May 2025, Thomson Reuters reported feedback from several SMEs highlighting high costs as a barrier to adopting their ONESOURCE tax software. The company responded by launching more affordable subscription plans aimed at smaller businesses, addressing this key restraint in the market.

Sales Tax Software Market Scope

The market is segmented on the basis solution, deployment model, industrial vertical, application and end-users

- By solution

On the basis of solution type, the sales tax software market is segmented into consumer use tax management, automatic tax filings, exemption certificate management and others. The Consumer Use Tax Management segment is expected to dominate the Sales Tax Software market with a market share of 41.53% in 2025, driven by its increasing regulatory compliance needs and growing e-commerce activities.

The automatic tax filings segment is anticipated to witness the fastest growth rate of 26.2% from 2025 to 2032, fueled by increasing demand for streamlined, error-free tax submissions. Businesses seek to reduce manual workload and avoid penalties through automated compliance. Advances in AI and cloud technology further accelerate this trend.

- By deployment model

Based on deployment model, the sales tax software market is segmented into on-premises, cloud-based and SaaS. The on-premises held the largest market revenue share in 2025 of, driven by the businesses’ preference for greater control over sensitive tax data and customized software solutions. Organizations with strict compliance requirements favor on-premises setups for enhanced security and integration. This demand sustains the dominance of on-premises systems in the market.

The cloud-based segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its growing adoption of scalable, cost-effective tax solutions. Its flexibility allows real-time updates and remote access, meeting evolving business needs. Increasing cloud infrastructure investments and digital transformation initiatives further boost this growth.

- By Platform Type

Based on platform type, the sales tax software market is segmented into Web, Mobile. The Web held the largest market revenue share in 2025, driven by the widespread internet accessibility and the growing preference for online tax software. Its ease of use and real-time data processing attract businesses of all sizes. Continuous improvements in web technologies enhance user experience, fueling its market dominance.

The Mobile segment held a significant market share in 2025, favored for its providing on-the-go access to tax filing and management tools. Its convenience and real-time notifications help businesses stay compliant anytime, anywhere. Rising smartphone penetration and improved mobile app capabilities drive this trend.

- By Industrial Vertical

Based on industrial vertical, the sales tax software market is segmented into BFSI, transportation, retail, telecommunication & IT, healthcare, manufacturing, food services, energy & utilities and others. The BFSI segment accounted for the largest market revenue share in 2024, driven by the sector’s complex tax regulations and high compliance demands. Financial institutions require advanced software for accurate reporting and risk management. Increasing digitalization in BFSI further boosts demand for automated tax solutions.

The transportation segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing regulatory requirements and the need for efficient tax compliance across complex logistics networks. Increasing adoption of digital tax software streamlines operations. Advances in GPS and telematics also support automated tax calculations in this sector.

- By Application

Based on application, the sales tax software market is segmented into small business, midsize enterprise and large enterprise. The small business segment accounted for the largest market revenue share in 2024, driven by the rising awareness of tax compliance and the availability of affordable, easy-to-use tax software. Growing digital adoption among small enterprises fuels demand. Additionally, government incentives for compliance boost market growth in this segment.

The midsize enterprise segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing complexity in tax regulations and a growing need for scalable, automated tax management solutions. Midsize businesses are investing in digital tools to improve accuracy and efficiency. Rising adoption of cloud-based platforms further accelerates this growth.

- By End-Users

on the basis of end-users into individuals and commercial enterprises. The individuals segment accounted for the largest market revenue share in 2024, driven by the increasing use of user-friendly tax software for personal tax filing. Rising digital literacy and government initiatives promoting e-filing boost adoption. Convenience and cost-effectiveness attract a broad user base.

The commercial enterprises segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing regulatory complexities and the need for efficient tax compliance across multiple jurisdictions. Increasing adoption of advanced, automated tax software enhances accuracy and reduces risks. Digital transformation initiatives further accelerate market growth in this sector.

Sales Tax Software Market Regional Analysis

- North America dominates the Sales Tax Software market with the largest revenue share of 57.32% in 2025, characterized by increase in the levels of quantities of transactions and the amounts pertaining to these transactions results in complicated process of tax filing in this region.

- rise in the research and development activities in the market and increase in the demand from emerging economies will further create new opportunities for sales tax software market in the forecast period mentioned above.

U.S. Sales Tax Software Market Insight

The U.S. market remains the largest, driven by complex, state-level tax variations and economic nexus laws post-Wayfair ruling. Companies use automated software to manage real-time sales tax rates and filings across states. E-commerce and retail are key adopters. Cloud and AI-powered solutions are rapidly replacing manual processes. Compliance efficiency and audit readiness drive investment.

Europe Sales Tax Software Market Insight

Across Europe, harmonized VAT structures and digital reporting mandates are fueling demand for advanced tax software. Businesses need solutions that can handle cross-border transactions and multi-country compliance. Cloud-based platforms with multilingual support are gaining popularity. E-invoicing mandates in several countries boost adoption. The market is shaped by regulatory compliance and digital transformation.

U.K. Sales Tax Software Market Insight

The U.K. market is growing steadily due to increased digital tax regulations like Making Tax Digital (MTD). Businesses are turning to automated solutions to handle VAT complexities and avoid fines. Cloud-based platforms are especially popular with SMEs. Financial services and retail sectors lead adoption. The focus is on accuracy and seamless integration with accounting systems.

Germany Sales Tax Software Market Insight

Germany’s market is driven by strict VAT rules and increasing audits from tax authorities. Companies are adopting automated tools to ensure compliance with evolving EU tax norms. Demand is high among manufacturers and exporters. Data privacy and on-premises deployment are top priorities. Integration with SAP and similar ERP tools is a common need.

Asia-Pacific Sales Tax Software Market Insight

The Asia-Pacific region is witnessing rapid adoption due to rising e-commerce and growing regulatory enforcement in countries like Australia, Japan, and Singapore. Businesses seek automation to handle complex and varying tax rules. Cloud-based solutions are gaining traction in SMEs. Regional expansion by global players is increasing competitive offerings. The market favors flexible, scalable platforms.

India Sales Tax Software Market Insight

India’s market is expanding quickly due to the widespread adoption of Goods and Services Tax (GST). Companies now require software that simplifies GST filings and handles real-time updates. SMEs are leading adoption due to growing digital awareness. Cloud solutions with e-invoicing support are in high demand. Affordability and government compliance drive the market.

China Sales Tax Software Market Insight

China’s market is growing with the push toward digital tax administration and e-invoicing regulations. Domestic companies need software that aligns with evolving local tax laws. Integration with Chinese accounting standards is essential. Security and data localization are top concerns. Automation is helping firms reduce compliance costs and errors.

Sales Tax Software Market Share

The Sales Tax Software industry is primarily led by well-established companies, including:

- APEX Analytix, LLC;

- Avalara Inc.;

- CCH.;

- Intuit Inc.;

- LumaTax, Inc.;

- Ryan, LLC;

- Sage Intacct, Inc.;

- Sales Tax DataLINK;

- Sovos Compliance, LLC;

- Thomson Reuters;

- Vertex, Inc.;

- Zoho Corporation Pvt. Ltd.;

- Xero Limited;

- The Federal Tax Authority, LLC d/b/a TaxCloud;

- Wolters Kluwer;

- CFS Tax Software Inc.;

- Service Objects, Inc.;

- TaxJar; Chetu Inc.

- HRB Digital LLC

Latest Developments in Global Sales Tax Software Market

-

In April 2023, ASSA ABLOY Group, a global leader in access solutions, launched a strategic initiative in South Africa aimed at strengthening the security of residential and commercial properties through its advanced Sales Tax Software technologies. This initiative underscores the company's dedication to delivering innovative, reliable access control solutions tailored to the unique security needs of the local market. By leveraging its global expertise and cutting-edge product offerings, ASSA ABLOY is not only addressing regional challenges but also reinforcing its position in the rapidly growing global Sales Tax Software market

- In March 2023, HavenLock Inc., a veteran-led company based in Tennessee, introduced the Power G version of its Sales Tax Softwareing system, specifically engineered for schools and commercial environments. The innovative Haven Lockdown System is designed to enhance security protocols, offering a reliable and effective solution for emergency situations. This advancement highlights HavenLock's commitment to developing cutting-edge safety technologies that safeguard vulnerable spaces, ensuring greater protection and peace of mind for institutions and their communities

- In March 2023, Honeywell International Inc. successfully deployed the Bengaluru Safe City Project, aimed at enhancing urban safety through its advanced Sales Tax Software and security technologies. This initiative harnesses state-of-the-art solutions to create a more secure and resilient city environment, underscoring Honeywell's dedication to utilizing its expertise in innovative security systems. The project highlights the increasing significance of smart technology in urban safety, contributing to the development of safer, smarter communities

- In February 2023, Sentrilock, LLC, a leading provider of electronic lockbox solutions for the real estate industry, announced a strategic partnership with the Chesapeake Bay and Rivers Association of REALTORS (CBRAR) to create a smart electronic lockbox marketplace for REALTOR members. This collaboration is designed to enhance security and streamline accessibility for real estate professionals, facilitating more efficient and secure property transactions. The initiative underscores Sentrilock's commitment to driving innovation and improving operational effectiveness within the real estate sector

- In January 2023, Schlage, a leading provider of access and home security solutions under Allegion Plc, unveiled the Schlage Encode Smart Wi-Fi Lever at the NAHB International Builders’ Show (IBS) 2023. This innovative residential Sales Tax Software, equipped with Wi-Fi connectivity, enables users to manage access remotely through a dedicated app. The Schlage Encode lever highlights the company’s commitment to integrating advanced technology into home security systems, offering homeowners enhanced convenience and control while ensuring robust security

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.