Global Sample Collection Market

Market Size in USD Million

CAGR :

%

USD

636.56 Million

USD

1,354.63 Million

2024

2032

USD

636.56 Million

USD

1,354.63 Million

2024

2032

| 2025 –2032 | |

| USD 636.56 Million | |

| USD 1,354.63 Million | |

|

|

|

|

Sample Collection Market Size

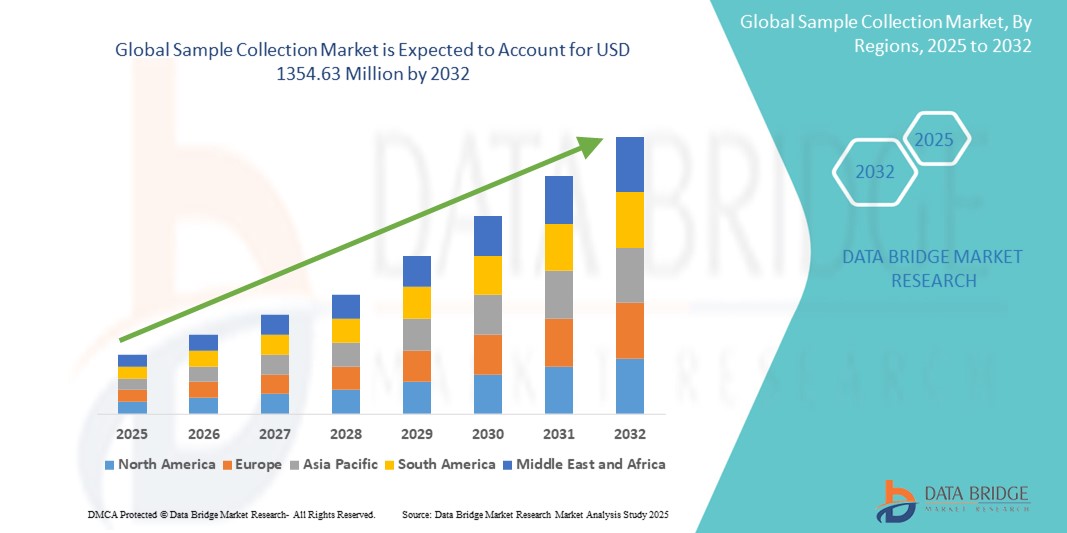

- The global sample collection market size was valued at USD 636.56 million in 2024 and is expected to reach USD 1,354.63 million by 2032, at a CAGR of 9.90% during the forecast period

- The market growth is largely driven by the increasing prevalence of infectious and chronic diseases, necessitating timely and accurate diagnostic procedures, which rely heavily on efficient sample collection systems in clinical settings

- Furthermore, advancements in diagnostic technologies, rising investments in healthcare infrastructure, and the growing demand for personalized medicine are reinforcing the importance of reliable sample collection methods. These aligned factors are propelling the adoption of innovative sample collection devices, significantly contributing to the market's upward trajectory

Sample Collection Market Analysis

- Sample collection, involving the acquisition of biological specimens such as blood, saliva, or swabs, is a foundational step in diagnostics, disease monitoring, and clinical research, and is increasingly enhanced by automation, improved transport media, and integration with digital health systems for improved traceability and efficiency

- The rising demand for sample collection is primarily driven by the growing prevalence of infectious diseases, chronic health conditions, and the increasing emphasis on early and accurate diagnostics across healthcare systems worldwide

- North America dominated the sample collection market with the largest revenue share of 38.8% in 2024, attributed to robust healthcare infrastructure, high testing volumes, and the presence of major diagnostics companies, with the U.S. at the forefront due to rising government support for public health screening and the expansion of decentralized testing models

- Asia-Pacific is expected to be the fastest growing region in the sample collection market during the forecast period due to a rapidly expanding healthcare sector, increasing awareness of preventive diagnostics, and growing investments in laboratory infrastructure

- Blood segment dominated the sample collection market with a market share of 53.1% in 2024, driven by its widespread use in diagnostic testing for a broad range of conditions and its critical role in routine health assessments and disease monitoring

Report Scope and Sample Collection Market Segmentation

|

Attributes |

Sample Collection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sample Collection Market Trends

“Advancements in Automation and Digital Integration”

- A prominent and accelerating trend in the global sample collection market is the growing adoption of automation technologies and digital health integration to improve efficiency, accuracy, and traceability in specimen handling across diagnostics and research applications

- For instance, Becton, Dickinson and Company (BD) has introduced automated blood collection systems integrated with electronic medical records (EMRs), reducing human error and enhancing sample integrity. Similarly, Greiner Bio-One offers vacuum-based collection systems with pre-barcoded labeling, improving workflow in high-volume clinical settings

- Automation technologies, such as robotic phlebotomy and smart collection devices, are transforming sample collection by minimizing manual intervention and reducing the risk of contamination or labeling errors. These systems also facilitate real-time tracking and data synchronization with laboratory information systems (LIS), ensuring transparency and accountability in sample handling

- Digital integration allows healthcare providers to better manage patient information and sample logistics, optimizing test turnaround times and resource allocation. Automated alerts and digital dashboards also help laboratories monitor collection performance, streamline processes, and ensure regulatory compliance

- This shift toward smart, connected sample collection systems is enhancing the reliability and speed of diagnostics, particularly in large-scale testing environments such as hospitals, diagnostics labs, and population health programs

- The increasing demand for faster diagnostics, improved patient safety, and operational efficiency is driving market players such as Qiagen and Roche Diagnostics to invest in next-generation sample collection innovations with integrated data solutions and user-friendly interfaces tailored for both clinical and at-home use

Sample Collection Market Dynamics

Driver

“Rising Diagnostic Needs Amid Chronic and Infectious Disease Burden”

- The growing global burden of chronic and infectious diseases, combined with the rising emphasis on early detection and preventive care, is a key driver for the increasing demand for reliable sample collection tools

- For instance, during global health emergencies such as the COVID-19 pandemic, the need for efficient sample collection surged, leading companies such as Thermo Fisher Scientific and Copan Diagnostics to ramp up production and innovate new collection kits and swab designs suitable for rapid and large-scale deployment

- As healthcare systems expand diagnostic capabilities to meet growing population health demands, accurate and safe sample collection is becoming essential

- This is further supported by initiatives in disease surveillance, personalized medicine, and widespread screening programs that rely heavily on robust sample acquisition methods.

- Moreover, with an increasing number of point-of-care and at-home testing solutions entering the market, user-friendly and minimally invasive collection devices—such as saliva and dried blood spot kits—are gaining popularity among both healthcare providers and consumers

Restraint/Challenge

“Sample Contamination Risks and Infrastructure Limitations”

- One of the major challenges faced by the sample collection market is the risk of contamination and sample degradation, particularly during transport or improper handling, which can compromise diagnostic accuracy and lead to false results or retesting

- For instance, in low-resource settings or during field sample collection, inadequate storage conditions and lack of standardized collection protocols increase the such aslihood of compromised samples, limiting the reliability of downstream testing

- In addition, infrastructure limitations in rural or underdeveloped regions can hinder proper sample transport and preservation, reducing the effectiveness of even the most advanced diagnostics

- Overcoming these challenges requires broader implementation of standardized collection procedures, staff training, and improved transport media

- Companies are addressing this through innovations such as temperature-stable media and integrated preservation technologies

- Moreover, variability in regulatory frameworks across regions for handling human biological materials presents compliance challenges for global suppliers. Continuous alignment with standards such as ISO 15189 and Good Laboratory Practice (GLP) is essential for maintaining quality and achieving global acceptance of diagnostic results

Sample Collection Market Scope

The market is segmented on the basis of sample type, method, application, and end user.

- By Sample Type

On the basis of sample type, the sample collection market is segmented into blood, stool, and urine. The blood segment dominated the market with the largest revenue share of 53.1% in 2024, driven by its critical role in a wide range of diagnostic tests, including routine health assessments, chronic disease monitoring, and infectious disease detection. Blood sampling is also integral to clinical trials, transfusion procedures, and hospital-based testing, making it the most frequently collected specimen globally. The demand for safe, efficient, and minimally invasive blood collection tools continues to rise, especially with the expansion of outpatient diagnostics and home-based health monitoring.

The urine segment is anticipated to witness the fastest growth from 2025 to 2032, owing to its non-invasive collection method, cost-effectiveness, and expanding use in screening for kidney function, metabolic disorders, and drug testing. Urine sampling is also increasingly used in point-of-care settings and for remote health monitoring, contributing to its growing share in decentralized diagnostic practices.

- By Method

On the basis of method, the sample collection market is segmented into manual and automated sample collection. The manual segment held the largest market share of 67.3% in 2024, primarily due to its widespread use across hospitals, diagnostics labs, and blood banks, particularly in emerging economies where cost constraints limit the adoption of automated systems. Manual sample collection remains the standard for routine phlebotomy and specimen acquisition in smaller healthcare facilities.

The automated segment is expected to register the fastest CAGR from 2025 to 2032, fueled by increasing demand for accuracy, standardization, and reduced human error. Automation also enhances workflow efficiency in high-throughput diagnostic settings, and the integration of robotics and digital labeling is helping to streamline sample handling processes and reduce contamination risks.

- By Application

On the basis of application, the sample collection market is segmented into diagnostics and treatment. The diagnostics segment dominated the market with a share of 74.5% in 2024, owing to the global rise in chronic and infectious diseases and the increasing emphasis on early detection and disease monitoring. Routine health screenings, prenatal tests, and pathogen surveillance heavily rely on timely and accurate sample collection, especially in population health initiatives.

The treatment segment is expected to witness fastest growth during forecast period, particularly in areas such as therapeutic drug monitoring, oncology, and regenerative medicine. Collected samples are often used to personalize treatment protocols or assess therapy response, making this segment important for precision medicine applications.

- By End User

On the basis of end user, the sample collection market is segmented into hospitals, diagnostic centers, blood banks, and others. The hospital segment led the market with the largest revenue share of 41.8% in 2024, supported by their central role in inpatient and outpatient diagnostic services, emergency care, and preoperative testing. Hospitals typically manage large volumes of patient samples and require a variety of collection tools tailored for different medical needs.

The diagnostic centers segment is projected to grow at the highest rate through 2032, driven by the increasing demand for outpatient laboratory services, at-home sample collection kits, and specialized testing services. The rise of independent labs and chains offering fast turnaround times and cost-effective diagnostics is accelerating growth in this segment.

Sample Collection Market Regional Analysis

- North America dominated the sample collection market with the largest revenue share of 38.8% in 2024, attributed to robust healthcare infrastructure, high testing volumes, and the presence of major diagnostics companies

- The region’s advanced healthcare systems and strong presence of leading diagnostic companies support widespread use of standardized and innovative sample collection solutions across hospitals, laboratories, and home-testing platforms

- In addition, favorable government initiatives, expanding telehealth services, and increased public awareness of routine health screenings contribute to the high demand for efficient and accurate sample collection methods, solidifying North America’s leadership in the global market

U.S. Sample Collection Market Insight

The U.S. sample collection market captured the largest revenue share of 82.4% in 2024 within North America, driven by the high volume of diagnostic testing and widespread implementation of preventive health programs. A strong presence of leading diagnostic laboratories and hospitals, coupled with increasing demand for personalized medicine and at-home testing solutions, is propelling market growth. Moreover, the U.S. continues to lead in adopting automated and digital sample collection technologies, improving efficiency and accuracy across healthcare settings.

Europe Sample Collection Market Insight

The Europe sample collection market is projected to expand at a substantial CAGR throughout the forecast period, supported by an aging population, rising chronic disease prevalence, and government investments in healthcare infrastructure. Demand for high-quality, standardized sample collection tools is increasing in both public and private sectors. Moreover, regulatory focus on laboratory quality and biosample traceability is driving innovation and adoption of automation in sample handling across hospitals, biobanks, and research institutions.

U.K. Sample Collection Market Insight

The U.K. sample collection market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by a growing emphasis on early disease detection and health screening programs. The National Health Service (NHS) plays a pivotal role in promoting routine diagnostics, driving demand for reliable and user-friendly collection tools. In addition, the rise of at-home testing services and private diagnostics labs is expanding market access and consumer engagement.

Germany Sample Collection Market Insight

The Germany sample collection market is expected to expand at a considerable CAGR during the forecast period, supported by a strong healthcare system and a high focus on quality diagnostics. With increasing research and clinical trial activity, demand for precision sample collection solutions is rising. The country’s adherence to strict regulatory standards and growing investment in automation technologies are contributing to increased adoption of advanced collection systems in both hospital and research environments.

Asia-Pacific Sample Collection Market Insight

The Asia-Pacific sample collection market is poised to grow at the fastest CAGR of 23.1% during the forecast period of 2025 to 2032, driven by a growing patient population, rising healthcare awareness, and rapid expansion of diagnostic infrastructure in countries such as China, India, and Japan. Increased government support for disease screening programs and the localization of manufacturing are making sample collection tools more accessible and cost-effective across diverse healthcare settings.

Japan Sample Collection Market Insight

The Japan sample collection market is gaining momentum due to its technologically advanced healthcare system and a strong emphasis on preventive diagnostics. With an aging population and high per capita healthcare spending, there is rising demand for minimally invasive and automated sample collection systems. Integration with digital health platforms and the country’s commitment to innovation in medical technology are further supporting market expansion.

India Sample Collection Market Insight

The India sample collection market accounted for the largest revenue share in Asia Pacific in 2024, driven by growing healthcare access, rising awareness of diagnostic testing, and strong government initiatives promoting health check-ups. The expansion of diagnostic chains, increased prevalence of non-communicable diseases, and the popularity of home-based testing solutions are key factors driving growth. In addition, domestic manufacturing and affordability of collection tools are enhancing adoption across urban and semi-urban regions.

Sample Collection Market Share

The sample collection industry is primarily led by well-established companies, including:

- Lucence Health Inc. (Singapore)

- Hardy Diagnostics (U.S.)

- ICU Medical, Inc (U.S.)

- BioNTech SE. (Germany)

- Thermo Fisher Scientific, Inc. (U.S.)

- Puritan Medical Products (U.S.)

- COPAN Diagnostics Inc. (U.S.)

- Preq Systems (India)

- Mitra Industries Private Limited (India)

- Medline Industries, Inc. (U.S.)

- Terumo BCT Inc. (U.S.)

- F.L. Medical S.R.L. (Italy)

- BD (U.S.)

- Kawasumi Laboratories (U.S.)

- Formlabs (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Laboratory Corporation of America Holdings (U.S.)

- AB Medical (U.S.)

- HiMedia Laboratories (India)

- Vircell S.L. (Spain)

What are the Recent Developments in Global Sample Collection Market?

- In March 2024, BD (Becton, Dickinson and Company) launched its next-generation BD Vacutainer UltraTouch Blood Collection Set, designed to improve the blood draw experience with enhanced needle technology that minimizes patient discomfort and improves first-stick success rates. This innovation reflects BD’s continued investment in user-centric design and addresses the growing demand for safe, efficient, and patient-friendly blood collection systems across clinical settings

- In February 2024, Roche Diagnostics introduced a fully integrated sample collection and transport solution for its cobas diagnostic systems, enhancing pre-analytical workflow efficiency and reducing contamination risks. This development strengthens Roche’s position as a leader in diagnostic precision and reliability, while supporting large-scale testing operations through seamless integration with laboratory infrastructure

- In January 2024, Thermo Fisher Scientific Inc. partnered with health departments across Southeast Asia to supply advanced sample collection kits for infectious disease surveillance and pandemic preparedness. These kits include viral transport media, swabs, and safety packaging designed to maintain specimen integrity in diverse environmental conditions, reflecting Thermo Fisher’s role in supporting global health resilience through robust diagnostic logistics

- In December 2023, Copan Diagnostics Inc. expanded its product line with the launch of the eNAT 2.0, an upgraded nucleic acid transport system that enables simultaneous sample stabilization and inactivation of pathogens. This system is tailored for molecular testing workflows and is particularly suited for remote and point-of-care collection, supporting the shift toward decentralized diagnostics and enhancing biosafety

- In November 2023, Qiagen unveiled its QIAreach Sample Prep System, a compact, automated device designed to standardize and streamline sample preparation processes in low-resource and decentralized testing environments. The device supports multiple sample types, including blood and swabs, aligning with the global trend toward point-of-care diagnostics and expanding access to accurate testing in underserved regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.