Global Sapphire Glass Market

Market Size in USD Billion

CAGR :

%

USD

13.50 Billion

USD

19.94 Billion

2024

2032

USD

13.50 Billion

USD

19.94 Billion

2024

2032

| 2025 –2032 | |

| USD 13.50 Billion | |

| USD 19.94 Billion | |

|

|

|

|

Sapphire Glass Market Size

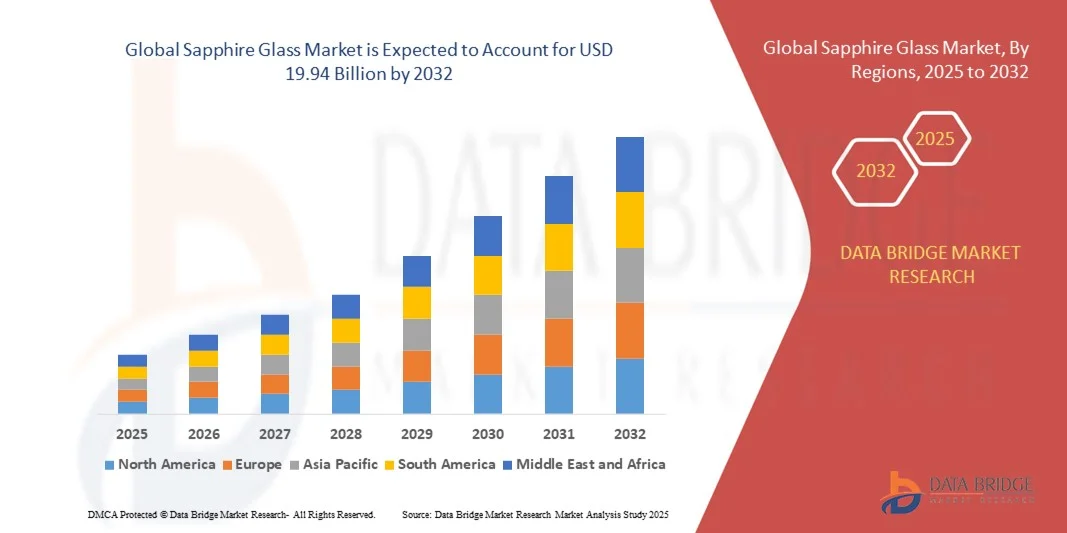

- The global sapphire glass market size was valued at USD 13.50 billion in 2024 and is expected to reach USD 19.94 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fuelled by increasing demand for durable, scratch-resistant, and high-performance materials in consumer electronics, optical components, and industrial applications

- Rising adoption of sapphire glass in smartphones, smartwatches, camera lenses, aerospace, and automotive sectors is further driving market expansion

Sapphire Glass Market Analysis

- Rising demand for durable and scratch-resistant materials in consumer electronics, particularly in smartphones, smartwatches, and high-end wearables, is driving the adoption of sapphire glass. Its exceptional hardness and transparency make it an ideal choice for protective screens and lenses

- Increased utilization of sapphire glass in optical components, camera lenses, and high-performance industrial applications is further contributing to market growth. Industries such as aerospace, defense, and automotive are leveraging sapphire glass for its thermal stability, chemical resistance, and optical clarity

- North America dominated the sapphire glass market with the largest revenue share of 38.5% in 2024, driven by the high adoption of premium consumer electronics, wearables, and industrial optical devices

- Asia-Pacific region is expected to witness the highest growth rate in the global sapphire glass market, driven by increasing electronics manufacturing, urbanization, and technological adoption in countries such as China, Japan, and Taiwan

- The High Grade Transparency segment held the largest market revenue share in 2024, driven by its superior optical clarity, hardness, and durability. This segment is highly preferred in premium consumer electronics, watches, and optical instruments, where product longevity and scratch resistance are critical

Report Scope and Sapphire Glass Market Segmentation

|

Attributes |

Sapphire Glass Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sapphire Glass Market Trends

Increasing Adoption of Sapphire Glass in Consumer Electronics and Industrial Applications

- The growing use of sapphire glass in smartphones, smartwatches, and wearable devices is transforming the consumer electronics landscape by offering durable, scratch-resistant, and high-transparency surfaces. Its robustness ensures longer device life and enhances user experience, particularly in premium segments. In addition, its high resistance to chemical corrosion and thermal fluctuations makes it ideal for high-performance devices used in harsh environments, further boosting market adoption. Manufacturers are increasingly promoting sapphire glass as a key differentiator for premium electronics, driving brand loyalty and consumer preference

- Rising demand for sapphire glass in optical components, camera lenses, and sensor applications is accelerating market adoption. These applications benefit from its chemical stability, hardness, and optical clarity, enabling high-precision performance in both industrial and commercial uses. Sapphire glass also allows for thinner, lighter, and more efficient designs in optical instruments, supporting miniaturization trends in electronics and medical devices. The material’s durability and optical excellence ensure reliability in critical applications such as aerospace, defense, and scientific instrumentation

- The cost-effectiveness and performance benefits of modern sapphire glass are making it attractive for electronics manufacturers and industrial users, leading to improved product reliability and consumer trust. Economies of scale in production, coupled with innovations in boule growth and slicing techniques, have reduced manufacturing costs over the years, making sapphire glass more viable for high-end and mid-range products. As companies increasingly market devices with sapphire glass components, consumer awareness and preference for durable products continue to rise, further supporting market growth

- For instance, in 2023, several smartphone and smartwatch manufacturers in Asia and Europe reported enhanced product durability and reduced warranty claims after incorporating sapphire glass into their displays and lenses. The use of sapphire glass has also led to fewer returns and customer complaints, positively affecting brand reputation and operational costs. Its integration into luxury watches, mobile devices, and camera modules has reinforced the perception of premium quality, contributing to higher adoption rates in both consumer and industrial markets

- While sapphire glass adoption is increasing, its market growth depends on continued innovation in production technologies, affordability, and integration into high-volume consumer products. Manufacturers must focus on scalable production and supply chain optimization to meet rising demand. In addition, research into hybrid materials and coating technologies that improve scratch resistance and reduce costs is expected to further drive adoption across multiple sectors, including electronics, defense, and healthcare

Sapphire Glass Market Dynamics

Driver

Rising Demand for Durable and Scratch-Resistant Materials in Electronics and Industrial Applications

- The demand for scratch-proof, durable materials in smartphones, wearables, and tablets is driving the adoption of sapphire glass, offering superior hardness and optical clarity compared with conventional glass. Its robustness reduces repair and replacement costs, enhancing consumer satisfaction. Moreover, the increasing popularity of premium and luxury devices globally is pushing manufacturers to adopt sapphire glass to maintain product differentiation and competitive advantage

- Increasing application of sapphire glass in optical and industrial instruments, such as watch crystals, camera lenses, and scientific equipment, is fueling market growth. These industries value its resistance to abrasion, high transparency, and chemical stability. In addition, sapphire glass supports miniaturization and precision engineering trends in sectors such as medical devices, aerospace, and defense, enabling high-performance yet compact solutions. The material’s durability ensures reliable operation in demanding environmental and industrial conditions

- Supportive government initiatives promoting advanced materials in defense, aerospace, and electronics sectors are further accelerating adoption, providing growth opportunities for manufacturers. Policies encouraging local production of high-performance materials and funding for R&D in innovative applications of sapphire glass are strengthening market prospects. Furthermore, collaborations between governments and private manufacturers are enhancing technological advancements, fostering faster deployment of sapphire glass across strategic industries

- For instance, in 2022, several electronics companies in North America and Europe integrated sapphire glass into high-end wearables, significantly improving product durability and customer trust. The successful incorporation led to measurable reductions in product defects and enhanced brand equity. In addition, consumer awareness campaigns highlighting the benefits of sapphire glass have driven greater acceptance and willingness to pay a premium for devices with enhanced durability

- While technological advancements and policy support are driving market expansion, continuous R&D and cost optimization remain crucial for broader adoption. Ongoing innovation in low-cost boule production, slicing, and polishing technologies is essential to make sapphire glass viable for wider commercial applications. Simultaneously, improving supply chain efficiency and availability of raw materials is critical to meet rising demand across multiple end-use industries

Restraint/Challenge

High Production Costs and Limited Manufacturing Capacity

- The high cost of producing synthetic sapphire glass, including energy-intensive crystallization and precision machining, makes it less accessible for cost-sensitive applications, limiting market penetration in mass-market consumer electronics. In addition, fluctuating raw material prices and high operational costs contribute to price volatility, which can deter small and mid-sized manufacturers from adopting sapphire glass

- Limited manufacturing capacity and complex production processes can lead to supply constraints, delaying product launches and impacting the adoption rate in emerging markets. Moreover, reliance on specialized equipment and skilled labor adds operational complexity, creating bottlenecks in meeting global demand for both consumer electronics and industrial applications. This limitation may slow down the growth of the market in price-sensitive regions

- Many regions also face challenges in accessing high-purity raw materials and skilled labor required for sapphire glass production, affecting quality consistency and scalability. Supply chain disruptions, geopolitical risks, and import dependencies further exacerbate the problem, leading to delays and increased production costs. As a result, manufacturers must invest in robust sourcing and training programs to maintain product standard

- For instance, in 2023, several electronics and optical component manufacturers in Asia experienced temporary supply shortages due to limited sapphire boule production, highlighting capacity bottlenecks. These shortages caused production delays and increased lead times for high-end devices, emphasizing the need for expanded local manufacturing capabilities and technological upgrades

- While production technologies are improving, addressing high costs, scaling manufacturing, and ensuring consistent quality remain key challenges for sustained market growth. Investments in R&D, automation, and alternative low-cost production methods are critical for overcoming these challenges and enabling wider adoption of sapphire glass across diverse industries

Sapphire Glass Market Scope

The market is segmented on the basis of product type, application, and distribution channel.

- By Product Type

On the basis of product type, the sapphire glass market is segmented into High Grade Transparency Sapphire Glass and General Transparency Sapphire Glass. The High Grade Transparency segment held the largest market revenue share in 2024, driven by its superior optical clarity, hardness, and durability. This segment is highly preferred in premium consumer electronics, watches, and optical instruments, where product longevity and scratch resistance are critical.

The General Transparency segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand in cost-sensitive applications such as industrial components, medical devices, and safety equipment. General Transparency Sapphire Glass offers an affordable yet durable solution, making it suitable for a wide range of high-volume and mid-tier applications, particularly in emerging markets.

- By Application

On the basis of application, the sapphire glass market is segmented into Smartphones, Watches, Optical and Mechanical Instruments, Safety Establishments, Medical Devices, and Others. The smartphone segment accounted for the largest market share in 2024, fueled by the growing adoption of scratch-resistant displays and premium mobile devices.

The watches segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer preference for luxury and durable timepieces. Optical and mechanical instruments, along with medical devices, are also expected to witness strong adoption due to sapphire glass’s chemical stability, hardness, and optical properties, enabling high-precision applications.

- By Distribution Channel

On the basis of distribution channel, the sapphire glass market is segmented into Online Stores, Specialty Stores, Retail Stores, and Others. Online stores accounted for the largest market share in 2024, owing to the ease of purchasing components and end-products globally and the rising trend of e-commerce platforms.

Specialty stores and retail stores is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing consumer awareness and direct access to high-quality sapphire glass products. Distribution through multiple channels ensures broader market penetration and convenience for both industrial users and end consumers.

Sapphire Glass Market Regional Analysis

- North America dominated the sapphire glass market with the largest revenue share of 38.5% in 2024, driven by the high adoption of premium consumer electronics, wearables, and industrial optical devices

- Consumers and industrial users in the region highly value the durability, scratch resistance, and optical clarity offered by sapphire glass, which enhances product longevity and performance

- This widespread adoption is further supported by strong manufacturing capabilities, technological advancements, and high disposable incomes, establishing sapphire glass as a preferred material for high-end electronics and precision instruments

U.S. Sapphire Glass Market Insight

The U.S. sapphire glass market captured the largest revenue share in 2024 within North America, fueled by rapid growth in smartphones, smartwatches, and optical instrument sectors. Manufacturers are increasingly prioritizing durability, scratch resistance, and premium product quality. The integration of sapphire glass in wearables, cameras, and medical devices, combined with rising consumer demand for high-end electronics, is significantly driving market expansion. Moreover, strong R&D and supply chain networks contribute to sustained adoption.

Europe Sapphire Glass Market Insight

The Europe sapphire glass market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by demand from high-end consumer electronics, luxury watches, and industrial optical instruments. The region's focus on precision, quality, and innovation is fostering adoption, while urbanization and technological advancements support growth. European manufacturers are increasingly incorporating sapphire glass into devices, enhancing product durability and performance.

U.K. Sapphire Glass Market Insight

The U.K. sapphire glass market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for durable and scratch-resistant materials in premium smartphones, wearables, and optical instruments. In addition, increasing awareness of product longevity and consumer preference for high-quality devices is boosting adoption. The U.K.’s strong electronics and luxury watch markets, along with e-commerce growth, further stimulate market expansion.

Germany Sapphire Glass Market Insight

The Germany sapphire glass market is expected to witness the fastest growth rate from 2025 to 2032, fueled by industrial applications, high-end consumer electronics, and medical device sectors. Germany’s emphasis on engineering excellence, innovation, and precision manufacturing promotes the use of sapphire glass in both industrial and consumer applications. Integration into industrial instruments, optics, and premium electronics is becoming increasingly prevalent, meeting stringent local quality standards.

Asia-Pacific Sapphire Glass Market Insight

The Asia-Pacific sapphire glass is expected to witness the fastest growth rate from 2025 to 2032 driven by rapid urbanization, increasing smartphone and wearable penetration, and expanding industrial applications in countries such as China, Japan, and India. Government initiatives supporting high-tech manufacturing and electronics innovation are further accelerating adoption. As APAC emerges as a manufacturing hub for sapphire glass, affordability, availability, and accessibility are improving for a wide range of industrial and consumer applications.

Japan Sapphire Glass Market Insight

The Japan sapphire glass market is expected to witness the fastest growth rate from 2025 to 2032 due to high-tech culture, strong electronics industry, and demand for premium watches and smartphones. The integration of sapphire glass into wearables, cameras, and precision instruments enhances product durability and customer satisfaction. Furthermore, Japan's aging population and emphasis on high-quality, long-lasting consumer products are expected to spur additional demand in both residential and industrial sectors.

China Sapphire Glass Market Insight

The China sapphire glass market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding electronics industry, rapid urbanization, and growing middle-class consumer base. China is one of the largest markets for smartphones, wearables, and industrial optics, and sapphire glass is increasingly adopted in high-end devices. Government support for high-tech manufacturing, domestic production capacity, and cost-effective supply chains are key factors propelling market growth in China.

Sapphire Glass Market Share

The Sapphire Glass industry is primarily led by well-established companies, including:

- Crystalwise Technology Inc. (Taiwan)

- Kyocera Corporation (Japan)

- Adamant Namiki Precision Jewel Co., Ltd (Japan)

- Precision Sapphire Technologies Ltd (Lithuania)

- Rubicon Technology, Inc. (U.S.)

- Monocrystal (Russia)

- Saint-Gobain (France)

- SCHOTT AG (Germany)

- Tera Xtal Technology Corporation (Taiwan)

- Rayotek Scientific Inc. (U.S.)

- Crystran Ltd (U.K.)

- Swiss Jewel Company (Switzerland)

- GTAT Corporation (U.S.)

- Surmet Corporation (U.S.)

- Morgan Advanced Materials (U.K.)

- II-VI Incorporated (U.S.)

- CoorsTek Inc. (U.S.)

- Hansol Technics (South Korea)

- Sense-tech Innovation Company (China)

- DK AZTEC CO. LTD (South Korea)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sapphire Glass Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sapphire Glass Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sapphire Glass Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.