Global Sauces Dressings And Condiments Packaging Market

Market Size in USD Billion

CAGR :

%

USD

10.81 Billion

USD

25.83 Billion

2025

2033

USD

10.81 Billion

USD

25.83 Billion

2025

2033

| 2026 –2033 | |

| USD 10.81 Billion | |

| USD 25.83 Billion | |

|

|

|

|

Sauces, Dressings and Condiments Packaging Market Size

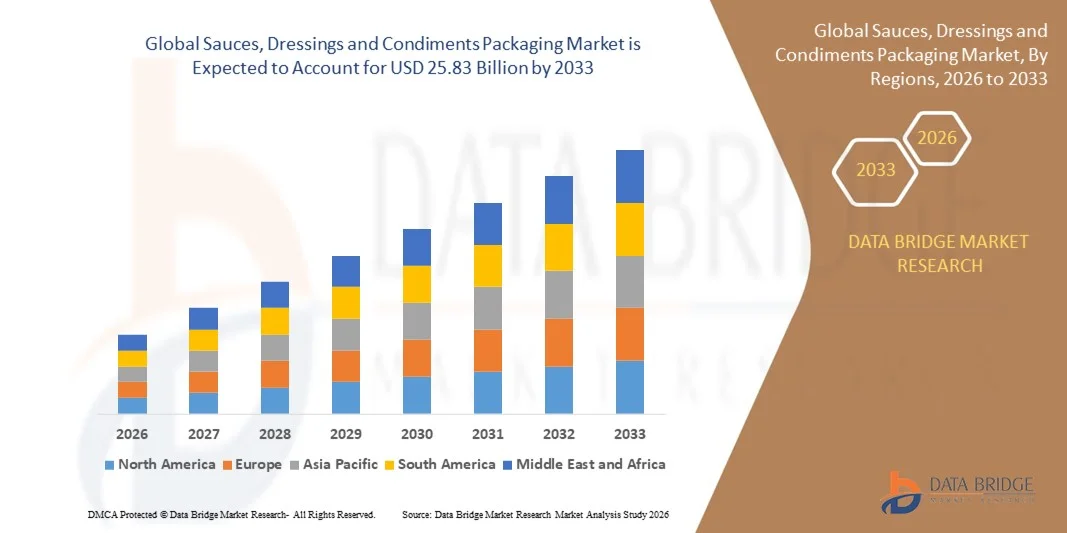

- The global sauces, dressings and condiments packaging market size was valued at USD 10.81 billion in 2025 and is expected to reach USD 25.83 billion by 2033, at a CAGR of 11.5% during the forecast period

- The market growth is largely driven by the increasing consumption of packaged and convenience foods, along with rising urbanization and changing dietary habits across both developed and emerging economies

- Furthermore, growing emphasis on product safety, extended shelf life, and sustainability is encouraging food manufacturers to adopt advanced and innovative packaging formats for sauces, dressings, and condiments, thereby supporting overall market expansion

Sauces, Dressings and Condiments Packaging Market Analysis

- Sauces, dressings and condiments packaging refers to materials and formats designed to store, protect, and distribute liquid and semi-liquid food products while maintaining freshness, flavor integrity, and hygiene across retail and foodservice channels

- The rising demand for these packaging solutions is primarily fueled by the expansion of organized retail, growth of e-commerce grocery platforms, and increasing preference for convenient, portion-controlled, and visually appealing packaging among consumers

- Asia-Pacific dominated the sauces, dressings and condiments packaging market with a share of 36.5% in 2025, due to high consumption of packaged food products, rapid urbanization, and the strong presence of food processing industries across emerging economies

- North America is expected to be the fastest growing region in the sauces, dressings and condiments packaging market during the forecast period due to strong demand for packaged food, product innovation in sauces and dressings, and high adoption of convenient packaging formats

- Glass segment dominated the market with a market share of 46.5% in 2025, due to its premium appearance, strong barrier properties, and ability to preserve flavor and product integrity in sauces, dressings, and condiments. Glass packaging is widely preferred for its non-reactive nature, which helps maintain product quality and prevents contamination. Its transparency enhances consumer trust by allowing clear visibility of the product, while its recyclability supports sustainability initiatives

Report Scope and Sauces, Dressings and Condiments Packaging Market Segmentation

|

Attributes |

Sauces, Dressings and Condiments Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sauces, Dressings and Condiments Packaging Market Trends

Rising Adoption of Sustainable and Recyclable Packaging Materials

- A key trend in the sauces, dressings and condiments packaging market is the growing shift toward sustainable and recyclable packaging materials, driven by increasing environmental awareness among consumers and stricter regulations on single-use plastics. Food brands are actively redesigning packaging formats to reduce environmental impact while maintaining product safety, shelf life, and visual appeal across retail and foodservice channels

- For instance, The Kraft Heinz Company has expanded the use of recyclable PET bottles and lightweight packaging across its ketchup and sauce portfolio, aligning its packaging strategy with global sustainability commitments. Such initiatives are influencing packaging suppliers to invest in recyclable plastics, paper-based cartons, and glass alternatives that meet food safety standards

- The demand for sustainable packaging is also accelerating innovation in flexible packaging solutions that reduce material usage while preserving barrier performance. Companies are focusing on mono-material structures and recyclable laminates to support circular economy goals and improve post-consumer recycling rates

- Premium and organic sauce brands are increasingly adopting glass and paper-based packaging to enhance sustainability credentials and appeal to environmentally conscious consumers. This trend is strengthening the perception of sustainable packaging as a value-added differentiator in competitive retail environments

- Foodservice operators are also shifting toward eco-friendly condiment packaging formats to meet corporate sustainability targets and regulatory requirements. This is expanding the use of compostable, recyclable, and refill-oriented packaging solutions across restaurants and quick-service chains

- Overall, the rising emphasis on sustainability is reshaping packaging design, material selection, and supplier partnerships, reinforcing sustainable packaging as a central trend shaping the future of the sauces, dressings and condiments packaging market

Sauces, Dressings and Condiments Packaging Market Dynamics

Driver

Growing Consumption of Packaged and Convenience Food Products

- The increasing consumption of packaged and convenience food products is a major driver supporting growth in the sauces, dressings and condiments packaging market. Busy lifestyles, urbanization, and rising demand for ready-to-use food products are boosting the consumption of packaged sauces and condiments across households and foodservice establishments

- For instance, Nestlé continues to expand its Maggi sauces and seasoning portfolio across multiple regions, increasing the need for efficient, scalable, and durable packaging formats. This sustained product expansion directly contributes to higher demand for bottles, pouches, and sachets that support mass distribution

- The expansion of organized retail and supermarkets is further reinforcing demand for visually appealing and shelf-stable packaging that enhances brand visibility and consumer convenience. Packaging plays a critical role in ensuring product differentiation and maintaining freshness across extended supply chains

- The rapid growth of e-commerce grocery platforms is also driving demand for leak-resistant and transport-friendly packaging solutions. Brands are adapting packaging designs to withstand logistics handling while maintaining product quality during last-mile delivery

- Collectively, the rising consumption of packaged food products continues to strengthen demand for advanced packaging solutions, positioning this driver as a key contributor to sustained market expansion

Restraint/Challenge

Volatility in Raw Material Prices and Packaging Costs

- The sauces, dressings and condiments packaging market faces challenges related to volatility in raw material prices, particularly for plastics, glass, and paper-based materials. Fluctuations in crude oil prices, energy costs, and supply chain disruptions directly impact packaging manufacturing expenses and pricing stability

- For instance, packaging suppliers serving companies such as General Mills have faced cost pressures due to fluctuating resin and paperboard prices, influencing packaging procurement strategies. These cost variations create challenges for both packaging manufacturers and food brands in maintaining profit margins

- Rising energy and transportation costs further intensify cost pressures across the packaging value chain, affecting production planning and long-term supplier contracts. Manufacturers must continuously adjust sourcing strategies to manage these uncertainties

- The challenge is more pronounced for smaller and mid-sized food brands that have limited pricing flexibility and lower bargaining power with packaging suppliers. Cost volatility can delay packaging innovation and limit the adoption of premium or sustainable materials

- Overall, raw material price volatility remains a key challenge that impacts cost predictability, pricing strategies, and investment decisions across the sauces, dressings and condiments packaging market

Sauces, Dressings and Condiments Packaging Market Scope

The market is segmented on the basis of product type and sales channel.

- By Product Type

On the basis of product type, the sauces, dressings and condiments packaging market is segmented into paper and board, plastic, glass, metal, and others. The glass segment dominated the largest market revenue share of 46.5% in 2025, driven by its premium appearance, strong barrier properties, and ability to preserve flavor and product integrity in sauces, dressings, and condiments. Glass packaging is widely preferred for its non-reactive nature, which helps maintain product quality and prevents contamination. Its transparency enhances consumer trust by allowing clear visibility of the product, while its recyclability supports sustainability initiatives.

The paper and board segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by increasing sustainability initiatives and regulatory pressure to reduce plastic usage. Brands are increasingly adopting paper-based cartons and composite board solutions for dry sauces and secondary packaging to enhance environmental credentials. Growing consumer preference for recyclable and biodegradable materials is accelerating innovation in barrier-coated paper and board structures. Improved printability and premium shelf appeal also make paper and board packaging attractive for differentiated and eco-conscious product positioning.

- By Sales Channel

On the basis of sales channel, the sauces, dressings and condiments packaging market is segmented into retail, e-commerce, and wholesale. The retail segment accounted for the largest market revenue share in 2025, driven by high consumption of packaged sauces and condiments through supermarkets, hypermarkets, and convenience stores. Retail-focused packaging emphasizes visual appeal, brand differentiation, and portion sizes suited for household consumption. Consistent product turnover and established distribution networks encourage packaging formats that balance durability, cost efficiency, and shelf visibility. This strong alignment with consumer buying behavior continues to support retail as the dominant sales channel.

The e-commerce segment is expected to register the fastest growth during the forecast period, driven by rising online grocery adoption and direct-to-consumer food brand strategies. Packaging for e-commerce prioritizes leak resistance, structural strength, and tamper evidence to ensure product integrity during transit. In addition, brands are optimizing packaging sizes and materials to reduce shipping costs while maintaining protection. The expansion of digital food platforms and subscription-based condiment offerings further accelerates demand for e-commerce-optimized packaging solutions.

Sauces, Dressings and Condiments Packaging Market Regional Analysis

- Asia-Pacific dominated the sauces, dressings and condiments packaging market with the largest revenue share of 36.5% in 2025, driven by high consumption of packaged food products, rapid urbanization, and the strong presence of food processing industries across emerging economies

- The region’s expanding middle-class population, growing preference for convenience foods, and increasing penetration of modern retail formats are accelerating demand for diverse and durable packaging solutions

- The availability of cost-effective manufacturing, rising investments in flexible and sustainable packaging materials, and supportive government initiatives for food processing are contributing to overall market expansion

China Sauces, Dressings and Condiments Packaging Market Insight

China held the largest share in the Asia-Pacific market in 2025, owing to its massive food manufacturing base and high domestic consumption of sauces and condiments. The country’s well-established packaging industry, strong supply chain infrastructure, and widespread use of plastic, glass, and flexible packaging formats support large-scale production. Continuous innovation in packaging design and increasing exports of packaged food products further strengthen market growth.

India Sauces, Dressings and Condiments Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rising demand for packaged and branded food products, rapid growth of the foodservice sector, and increasing urban lifestyles. Expansion of organized retail and e-commerce grocery platforms is driving demand for convenient, leak-proof, and cost-efficient packaging. In addition, growing adoption of sustainable and lightweight packaging materials is supporting long-term market expansion.

Europe Sauces, Dressings and Condiments Packaging Market Insight

The Europe market is expanding steadily, supported by high consumption of ready-to-eat foods, strong preference for premium packaging, and strict food safety and sustainability regulations. The region emphasizes recyclable and reusable packaging formats, encouraging innovation in glass, paper, and advanced plastic materials. Demand is further supported by the presence of established food brands and a mature retail ecosystem.

Germany Sauces, Dressings and Condiments Packaging Market Insight

Germany’s market is driven by its advanced food processing industry, strong focus on sustainable packaging, and high demand for premium and private-label food products. The country’s emphasis on recyclable materials, efficient packaging technologies, and compliance with environmental standards fosters continuous innovation. Germany also serves as a key packaging production and export hub within Europe.

U.K. Sauces, Dressings and Condiments Packaging Market Insight

The U.K. market is supported by high consumption of packaged sauces and condiments, growth of convenience foods, and increasing focus on eco-friendly packaging solutions. Retailers and brands are investing in lightweight, recyclable, and visually appealing packaging to align with sustainability goals. The expansion of online grocery shopping is also influencing demand for durable and transport-friendly packaging formats.

North America Sauces, Dressings and Condiments Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for packaged food, product innovation in sauces and dressings, and high adoption of convenient packaging formats. The region’s focus on portion control, extended shelf life, and premium branding is accelerating the use of advanced packaging materials. Increasing investments in sustainable and smart packaging solutions further support market growth.

U.S. Sauces, Dressings and Condiments Packaging Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its large consumer base, high consumption of processed and ready-to-use food products, and strong presence of leading food brands. Advanced packaging technologies, emphasis on food safety, and growing demand for premium and organic condiments drive consistent demand. A well-developed retail and foodservice network further reinforces the country’s leading position in the regional market.

Sauces, Dressings and Condiments Packaging Market Share

The sauces, dressings and condiments packaging industry is primarily led by well-established companies, including:

- Conagra Foodservice, Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- General Mills Inc. (U.S.)

- The Kroger Co. (U.S.)

- Hormel Foods Corporation (U.S.)

- Mars, Incorporated (U.S.)

- McCormick & Company, Inc. (U.S.)

- Del Monte Food, Inc. (U.S.)

- Kikkoman Corporation (Japan)

- Frito-Lay North America, Inc. (U.S.)

- Nestlé (Switzerland)

- Bolton Group (Italy)

- Edward & Sons Trading Co. (U.S.)

- Ken's Foods, Inc. (U.S.)

- Williams Foods (U.S.)

- Stokes Sauces Ltd. (U.K.)

- CaJohns Fiery Foods (U.S.)

Latest Developments in Global Sauces, Dressings and Condiments Packaging Market

- In May 2025, the implementation of the Nutri-Grade labelling scheme is expected to significantly influence the sauces, dressings and condiments market by encouraging manufacturers to reformulate products with lower saturated fat and sodium content. This shift is driving demand for advanced packaging solutions that can support reformulated recipes while preserving taste, shelf life, and product stability. As brands adapt to healthier formulations, packaging innovation becomes critical to maintain quality and consumer acceptance, thereby accelerating changes across the packaging value chain

- In March 2025, Epik Foods announced the merger of Sauce Capital, a leading Abu Dhabi-based food group with a strong presence in Saudi Arabia, strengthening its position across the Middle East sauces and condiments landscape. This strategic move expands Epik Foods’ brand portfolio to 15 labels and enhances regional production and distribution capabilities. The merger is expected to increase demand for scalable, regionally adaptable packaging solutions to support portfolio expansion and consistent brand presentation across multiple markets

- In November 2024, Graham Partners revealed its partnership with Tulkoff Food Products, a Baltimore-based manufacturer specializing in customized sauces, dressings, and dips, signaling growing investor interest in the sauces segment. The collaboration highlights a focus on operational efficiency and production optimization, which is likely to drive investments in high-performance and flexible packaging formats. This development underscores the role of packaging in supporting tailored food solutions for foodservice and industrial customers

- In April 2024, INAMED, in collaboration with SIG, launched El Boustane sauces in Algeria using innovative aseptic carton packaging, marking the country’s first adoption of this format for sauces. The use of SIG Small carton packs enables long shelf life without refrigeration or preservatives, improving product accessibility and reducing cold-chain dependence. This launch is expected to accelerate adoption of aseptic and carton-based packaging for sauces in emerging markets by demonstrating convenience, efficiency, and sustainability benefits

- In April 2024, Kari-Out Co. introduced the first plant-based, 100% compostable condiment packet, representing a major advancement in sustainable foodservice packaging. The TUV-certified, home-compostable packets address growing environmental concerns while maintaining product quality and shelf life. This innovation is influencing the broader sauces and condiments packaging market by pushing brands and foodservice operators toward eco-friendly alternatives that align with sustainability regulations and consumer expectations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sauces Dressings And Condiments Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sauces Dressings And Condiments Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sauces Dressings And Condiments Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.