Global Savory Snacks Market

Market Size in USD Billion

CAGR :

%

USD

285.85 Billion

USD

406.52 Billion

2024

2032

USD

285.85 Billion

USD

406.52 Billion

2024

2032

| 2025 –2032 | |

| USD 285.85 Billion | |

| USD 406.52 Billion | |

|

|

|

|

Savory Snacks Market Size

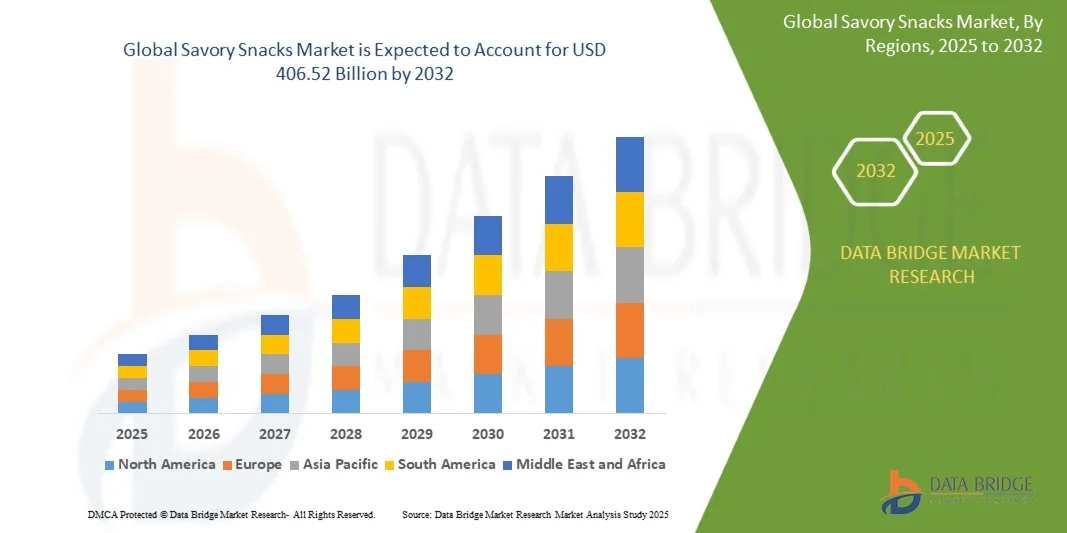

- The Savory Snacks Market size was valued at USD 285.85 billion in 2024 and is projected to reach USD 406.52 billion by 2032, growing at a CAGR of 4.50% during the forecast period.

- The market expansion is driven by shifting consumer lifestyles, rising demand for convenient and ready-to-eat food products, and growing urbanization, especially in emerging economies.

- Increasing health awareness has also led to a surge in demand for baked, low-fat, and organic snack alternatives, encouraging innovation and diversification across product lines and contributing to sustained market growth.

Savory Snacks Market Analysis

- Savory snacks, encompassing products like chips, popcorn, pretzels, nuts, and meat snacks, are becoming increasingly popular due to their convenience, taste variety, and suitability for on-the-go consumption across both developed and emerging markets.

- The growing demand for savory snacks is primarily driven by shifting consumer eating habits, an increasing preference for quick and portable food options, and the global rise in snacking culture among millennials and Gen Z.

- Asia-Pacific dominated the savory snacks market with the largest revenue share of 35.76% in 2024, supported by high snack consumption, a mature retail landscape, and strong brand presence. The U.S. leads the market with increasing innovation in healthier snacks and ethnic flavors tailored to evolving consumer tastes.

- North America is expected to be the fastest-growing region in the savory snacks market during the forecast period, owing to urbanization, increased disposable incomes, and rising demand for packaged foods in countries like China, India, and Indonesia, where traditional snacking habits are shifting toward modern, branded offerings

- The potato chips segment dominated the Savory Snacks Market with a market share of 43.2% in 2024, attributed to its widespread popularity, diverse flavor offerings, and continual innovation in healthier formulations such as baked and low-fat versions.

Report Scope and Savory Snacks Market Segmentation

|

Attributes |

Savory Snacks Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Savory Snacks Market Trends

“Product Innovation and Health-Focused Formulations Drive Consumer Appeal”

- A significant and accelerating trend in the Savory Snacks Market is the growing focus on health-conscious product innovation, including the development of snacks that are low-fat, high-protein, gluten-free, and made with natural or organic ingredients. This shift is transforming the category to meet the evolving preferences of modern consumers who seek indulgence without compromising on health.

- For instance, brands such as PepsiCo’s Lay’s have introduced baked and air-popped chips that offer reduced fat content, while Kellogg’s has expanded its savory snack portfolio with high-fiber and plant-based protein options under its Pringles and other sub-brands.

- Consumer demand for clean-label snacks—products free from artificial additives, preservatives, and GMOs—is pushing manufacturers to reformulate classic products and launch new offerings. Innovations such as vegetable chips, legume-based crisps, and ancient grain snacks are gaining popularity for their perceived health benefits and unique textures.

- The incorporation of functional ingredients like chickpeas, quinoa, lentils, and seeds not only adds nutritional value but also appeals to dietary trends such as keto, vegan, and paleo. These innovations allow consumers to enjoy familiar snacking experiences with added health benefits.

- Flavor diversification continues to be a key innovation area, with brands experimenting with globally inspired and bold flavor profiles—such as Korean BBQ, Thai chili, or Mediterranean herbs—to capture the attention of adventurous consumers.

- This trend toward more nutritious, flavorful, and innovative savory snack options is redefining consumer expectations, particularly among health-conscious millennials and Gen Z. As a result, companies like General Mills, Conagra Brands, and Hain Celestial are actively investing in R&D and marketing strategies to align with the growing emphasis on mindful eating and better-for-you snacking.

Savory Snacks Market Dynamics

Driver

“Growing Demand Driven by Changing Lifestyles and Snacking Habits”

- The increasing pace of urbanization, changing consumer lifestyles, and rising preference for convenient, on-the-go food options are significant drivers for the heightened demand in the Savory Snacks Market.

- For instance, in 2024, PepsiCo launched several region-specific savory snack variants in Asia and Latin America, aiming to cater to local taste preferences while promoting healthier formulations—demonstrating how major players are adapting to evolving global consumption trends.

- As consumers seek quick, tasty, and satisfying alternatives to traditional meals, savory snacks offer an ideal solution. Their versatility—ranging from chips and crackers to nuts and meat snacks—makes them suitable for various occasions, including school lunches, office breaks, and social gatherings.

- Furthermore, the influence of Western dietary habits, the expansion of retail chains, and increased availability through e-commerce platforms are making savory snacks more accessible across urban and rural markets alike.

- The rise of "snackification"—where consumers prefer multiple small meals throughout the day over three large ones—is particularly noticeable among younger demographics and working professionals, who prioritize portability, flavor variety, and convenience.

- Brand innovation, eye-catching packaging, and aggressive marketing campaigns are also playing critical roles in expanding consumer interest and loyalty. As companies focus on both indulgent and health-conscious product lines, savory snacks continue to capture market share across diverse consumer segments.

Restraint/Challenge

“Health Concerns and Regulatory Pressures on High-Sodium and Processed Ingredients”

- Despite growing demand, health-related concerns associated with high sodium, saturated fats, artificial additives, and calorie content in many savory snack products remain a major challenge for market growth.

- For instance, several governments, including those in the U.K., Mexico, and India, have introduced or are considering regulations such as front-of-pack labeling, sugar/salt taxes, and advertising restrictions targeting unhealthy snack consumption—particularly among children.

- The rising awareness of lifestyle-related diseases such as obesity, hypertension, and diabetes has led to increased consumer scrutiny over processed snack ingredients, pushing health-conscious consumers to limit or avoid traditional savory snacks.

- To address these concerns, manufacturers are investing in product reformulation, including reducing salt content, eliminating trans fats, and using natural preservatives. However, striking a balance between health benefits and taste appeal remains a significant hurdle.

- Additionally, the cost of sourcing healthier ingredients and complying with evolving food safety regulations can increase production costs, which may be passed on to consumers and affect price competitiveness—especially in price-sensitive markets.

- Overcoming these challenges will require transparent labeling, consumer education, and continued innovation in cleaner, healthier snack alternatives that do not compromise on flavor, affordability, or availability.

Savory Snacks Market Scope

The market is segmented on the basis of product, flavor, distribution channel, and category.

• By Product

On the basis of product, the Savory Snacks Market is segmented into french fries, potato chips, extruded snacks, nuts and seeds, popcorn, meat snacks, and others. The Potato Chips segment dominated the market in 2024 with the largest market revenue share of 43.2%, driven by their global popularity, wide availability, and continued innovation in flavors and healthier variants such as baked or reduced-fat chips. Easy scalability, long shelf life, and extensive distribution across retail and convenience stores further support this segment’s dominance.

The Meat Snacks segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for high-protein, on-the-go snacks among health-conscious consumers. Brands are innovating with clean-label jerky, artisanal meats, and low-sugar varieties to meet evolving dietary preferences. Rising awareness of protein-rich diets, combined with expanding product variety, is contributing to robust growth in the meat snacks segment.

• By Flavor

Based on flavor, the market is segmented into roasted/toasted, barbeque, spice, and beef. The Spice segment held the largest market revenue share in 2024, driven by increasing global demand for bold, adventurous, and regional flavor profiles. Consumer appetite for spicy variants such as chili lime, jalapeño, masala, and hot pepper is growing, especially among younger demographics in Asia-Pacific and Latin America. Brands leverage local spices to create differentiated offerings that resonate with specific regional tastes.

The roasted/toasted segment is projected to grow at the fastest CAGR from 2025 to 2032, as health-conscious consumers shift towards cleaner flavor profiles with minimal processing. Roasted snacks, often perceived as healthier and more natural, are gaining popularity across nuts, seeds, and even legumes. This trend reflects growing awareness of clean-label and minimally processed food options, pushing manufacturers to innovate with roasted formulations and subtle seasoning.

• By Distribution Channel

On the basis of distribution channel, the Savory Snacks Market is segmented into supermarket, independent retailers, convenience stores, specialty stores, online store, service station, and others. The supermarket segment dominated the market in 2024 with the highest revenue share, supported by broad product visibility, in-store promotions, and strong consumer trust. Supermarkets offer wide product variety and cater to impulse purchases, making them a preferred channel for savory snack sales globally.

The online store segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rise in e-commerce platforms, smartphone penetration, and changing consumer shopping behavior. Consumers are increasingly opting for doorstep delivery and subscription models, especially for health-focused and niche snack brands. Online platforms also allow for direct-to-consumer strategies, customized marketing, and easy access to product information, contributing to the rapid growth of this channel.

• By Category

Based on category, the Savory Snacks Market is segmented into baked, fried, and others. The fried segment accounted for the largest market revenue share in 2024, as fried snacks continue to dominate in terms of taste preference and variety across global markets. Traditional favorites like fried potato chips, namkeens, and extruded snacks remain staples in most regions despite increasing health awareness. Their crunchy texture and rich flavor continue to drive strong consumer loyalty.

The baked segment is expected to witness the fastest CAGR from 2025 to 2032, driven by a growing focus on health and wellness. Baked snacks are perceived as healthier alternatives due to lower oil content and fewer calories. Consumers seeking guilt-free indulgence are increasingly choosing baked chips, crackers, and vegetable snacks. This trend is reinforced by manufacturers launching baked versions of popular products and innovating with whole grains and natural ingredients.

Savory Snacks Market Regional Analysis

- Asia Pacific dominated the savory snacks market with the largest revenue share of 35.76% in 2024, driven by high consumer demand for convenient, ready-to-eat food products and a long-established snacking culture.

- Consumers in the region show strong preferences for variety, bold flavors, and healthier snack alternatives, including low-fat, baked, and organic options, aligning with growing health and wellness trends.

- This strong market position is further supported by a well-developed retail infrastructure, high per capita snack consumption, and continuous innovation from major brands, making savory snacks a staple in both everyday diets and on-the-go lifestyles across the region.

Japan Savory Snacks Market Insight

The Japan Savory Snacks Market is experiencing steady growth, underpinned by high demand for convenient, portion-controlled, and health-conscious snack options. Japanese consumers prefer snacks with unique flavors and functional benefits, such as low-calorie, high-fiber, or fortified products. Innovations in packaging and presentation also contribute to consumer appeal. Additionally, traditional snack types like rice crackers and seaweed snacks continue to perform well, while global snack brands are localizing flavors to capture market share. Japan’s aging population and growing emphasis on healthy lifestyles are shaping the development of new product categories within the savory snacks segment.

China Savory Snacks Market Insight

The China Savory Snacks Market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, a growing middle class, and strong digital retail infrastructure. China is witnessing high demand for both traditional and Western-style snacks, with spicy, bold flavors and meat-based snacks gaining particular popularity. A tech-savvy, younger demographic is contributing to growing sales through online platforms, aided by promotional campaigns on e-commerce giants like JD.com and Alibaba. Additionally, local players are innovating rapidly to cater to health trends, such as low-sodium and additive-free snacks, further supporting market expansion.

U.S. Savory Snacks Market Insight

The U.S. Savory Snacks Market captured the largest revenue share of 83% in 2024 within North America, driven by strong consumer demand for convenient, ready-to-eat food options and continuous innovation in snack flavors and formats. The rising trend of snacking between meals, coupled with a growing focus on health-conscious formulations, has led to the rapid expansion of baked, low-fat, and organic snack variants. Additionally, aggressive marketing strategies by major players like PepsiCo and Kellogg’s, along with extensive retail and e-commerce networks, support the dominant position of the U.S. in the savory snacks market. The popularity of on-the-go lifestyles and a diverse product range catering to various dietary needs further amplify market growth.

Europe Savory Snacks Market Insight

The Europe Savory Snacks Market is projected to grow at a substantial CAGR throughout the forecast period, fueled by rising consumer demand for premium and health-oriented snack options. Factors such as increasing urbanization, busy work-life schedules, and rising interest in plant-based and natural snacks are driving market expansion across the region. European consumers also show a strong preference for regional flavors and sustainably packaged products. Regulatory support for clean-label food and a growing number of health-conscious consumers are influencing product innovation and reformulation. Growth is especially notable in countries like the U.K., Germany, France, and Italy, where savory snacking is becoming an integral part of everyday diets.

U.K. Savory Snacks Market Insight

The U.K. Savory Snacks Market is expected to register a noteworthy CAGR during the forecast period, supported by increasing consumer preference for healthier snacks, such as baked crisps, low-fat popcorn, and vegetable-based alternatives. Rising awareness about obesity and dietary health is pushing brands to offer reformulated versions of traditional snacks with reduced salt and fat content. Moreover, the U.K.’s highly developed grocery and convenience store network, along with a strong online retail presence, provides widespread accessibility. The market is further bolstered by innovations in flavor combinations and clean-label products that appeal to health-conscious and younger consumers alike.

Germany Savory Snacks Market Insight

The Germany Savory Snacks Market is anticipated to grow at a considerable CAGR during the forecast period, supported by increasing demand for functional and organic snacks. German consumers are highly aware of nutrition and sustainability, leading to strong market traction for products made with natural ingredients, whole grains, and eco-friendly packaging. The demand for vegetarian and vegan snack alternatives is also growing, driven by shifting dietary habits and environmental consciousness. Germany’s robust retail infrastructure, combined with consumer willingness to pay for premium and innovative snacks, continues to make it a key player in the European savory snacks market.

Savory Snacks Market Share

Savory Snacks Market Leaders Operating in the Market Are:

- Unilever (U.K.)

- PepsiCo Inc (U.S.)

- Frito-Lay North America, Inc. (U.S.)

- Parle Products Pvt. Ltd. (India)

- Anji Foodstuff Co., Ltd. (China)

- ITC Limited (India)

- Arca Continental SAB de CV (Mexico)

- UNIVERSAL ROBINA CORPORATION (Philippines)

- Kellogg’s Company (U.S.)

- Fifty50 Foods, LP (U.S.)

- The Kraft Heinz Company (U.S.)

- Calbee (Japan)

- Conagra Brands, Inc. (U.S.)

- General Mills Inc. (U.S.)

- JFC International, Inc. (U.S.)

- Hain Celestial (U.S.)

- Blue Diamond Growers (U.S.)

What are the Recent Developments in Savory Snacks Market?

- In April 2023, PepsiCo Inc., a global leader in food and beverage, announced a major expansion of its savory snacks production facilities in India, aiming to meet the rising demand for localized snack products. The initiative includes introducing new flavors inspired by regional tastes and investing in sustainable manufacturing practices. This move reflects PepsiCo’s commitment to deepening its presence in high-growth markets and adapting its offerings to suit evolving consumer preferences, thereby reinforcing its leadership in the Savory Snacks Market.

- In March 2023, Kellogg’s Company launched a new line of plant-based savory snacks under its “Better Days” initiative, targeting health-conscious consumers in North America and Europe. The range includes lentil chips, chickpea crackers, and baked vegetable snacks, emphasizing clean-label, non-GMO, and gluten-free attributes. This launch underscores Kellogg’s strategic pivot toward wellness-oriented snacking and reflects the growing consumer demand for healthier alternatives in the savory category.

- In March 2023, Calbee, Inc., a major Japanese snack manufacturer, introduced a premium line of wasabi and seaweed-flavored chips targeting the Southeast Asian market. With the rising popularity of Japanese cuisine and flavors in the region, Calbee's new product line aims to capture the growing middle-class consumer segment seeking authentic yet modern snack experiences. The initiative aligns with Calbee’s regional expansion strategy and highlights the role of flavor innovation in driving growth across the Asia-Pacific savory snacks market.

- In February 2023, ITC Limited, one of India’s leading FMCG companies, announced the rollout of its ‘Mission Millets’ initiative under the Bingo! brand. This strategic move introduces millet-based savory snacks, aligning with the government's push toward millets as a sustainable and healthy grain. The launch is expected to drive greater health awareness among Indian consumers while supporting agricultural sustainability, positioning ITC as a leader in nutrition-forward product innovation within the savory snacks segment.

- In January 2023, General Mills Inc. unveiled an upgraded version of its Old El Paso tortilla chips, featuring new packaging, bold flavors, and cleaner ingredient labels in both U.S. and European markets. The rebranding initiative is part of a broader strategy to modernize legacy snack brands to better align with contemporary consumer values around health, transparency, and authenticity. This development underscores General Mills' focus on reviving classic snack lines to meet modern snacking trends and maintain its stronghold in the Savory Snacks Market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Savory Snacks Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Savory Snacks Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Savory Snacks Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.