Global Saw Blades Market

Market Size in USD Billion

CAGR :

%

USD

15.74 Billion

USD

21.22 Billion

2024

2032

USD

15.74 Billion

USD

21.22 Billion

2024

2032

| 2025 –2032 | |

| USD 15.74 Billion | |

| USD 21.22 Billion | |

|

|

|

|

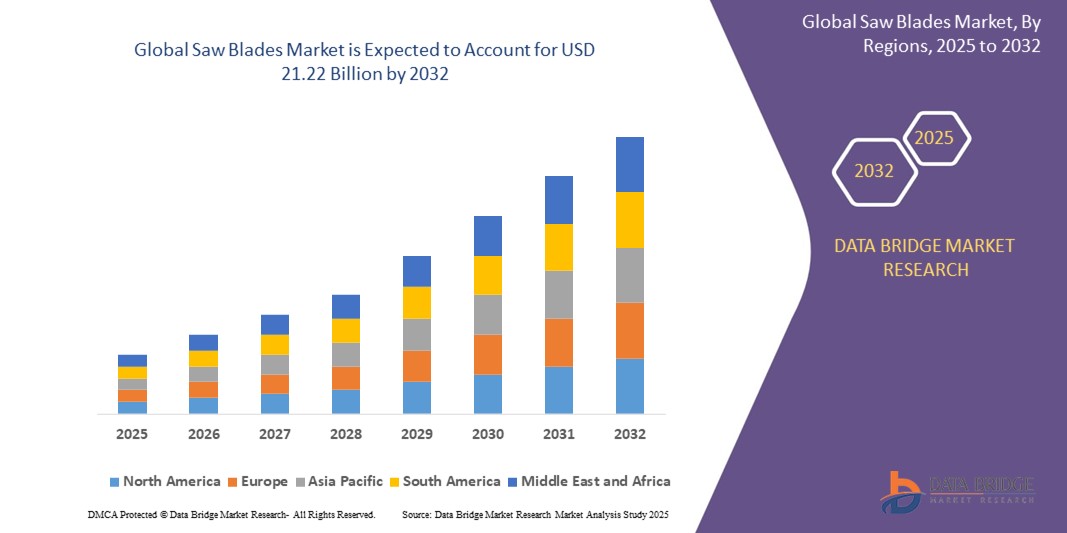

What is the Global Saw Blades Market Size and Growth Rate?

- The global saw blades market size was valued at USD 15.74 billion in 2024 and is expected to reach USD 21.22 billion by 2032, at a CAGR of 3.80% during the forecast period

- The saw blades market is experiencing robust growth, driven by increasing demand across various industries such as construction, manufacturing, and woodworking. As urbanization and infrastructure development projects rise globally, particularly in emerging economies, the need for efficient and high-performance cutting tools is escalating

- Innovations in saw blade materials and designs, such as carbide-tipped and diamond-coated blades, are enhancing cutting efficiency and longevity, thereby attracting more consumers. In addition, the trend towards DIY home improvement and the growing popularity of woodworking hobbies further bolster market demand

What are the Major Takeaways of Saw Blades Market?

- As urban areas expand and new construction projects are initiated, the need for precise and efficient cutting solutions becomes paramount. Saw blades are essential in various construction activities, including saw blades for tile, wood, metal, and stone. This surge in demand is particularly notable in developing regions where infrastructure development is a key priority

- Consequently, manufacturers are focusing on producing advanced saw blades that can meet the rigorous demands of modern construction projects. Rapid urbanization and large-scale infrastructure projects are significantly increasing the demand for high-performance cutting tools, driving growth in the saw blades market

- North America dominated the saw blades market with the largest revenue share of 39.58% in 2024, driven by extensive demand from the woodworking, metalworking, and construction industries across the region

- Asia-Pacific saw blades market is projected to grow at the fastest CAGR of 13.8% from 2025 to 2032, fueled by rapid urbanization, infrastructure expansion, and rising demand for high-precision cutting solutions across China, India, Japan, and Southeast Asia

- The Carbide saw blades segment dominated the saw blades market with the largest market revenue share of 49.6% in 2024, driven by their superior durability, high cutting efficiency, and ability to handle a wide range of materials, including wood, composites, and non-ferrous metals

Report Scope and Saw Blades Market Segmentation

|

Attributes |

Saw Blades Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Saw Blades Market?

“Rising Demand for Precision Cutting and Durable, Coated Blades”

- A significant and accelerating trend in the global saw blades market is the growing emphasis on precision cutting, extended tool life, and advanced coatings that enhance durability, reduce friction, and optimize performance across diverse industrial applications, including construction, automotive, woodworking, and metal fabrication

- For instance, in February 2024, Freud America Inc. introduced a new series of TiCo High-Density Carbide saw blades designed with anti-vibration technology and non-stick Perma-SHIELD coatings, delivering superior cutting accuracy, reduced material waste, and longer blade life, aligning with industry demand for operational efficiency

- The integration of advanced materials, such as tungsten carbide, diamond-tipped edges, and specialized coatings, is becoming increasingly common to ensure consistent performance in high-speed, high-volume cutting operations. These innovations reduce downtime and replacement costs for end-users

- Additionally, the market is witnessing growing adoption of automated sawing solutions, where digitally controlled saw blades are integrated with CNC machinery to enable precise, programmable cutting for complex designs in furniture manufacturing, aerospace, and automotive industries

- Companies such as Leitz GmbH, Kinkelder BV, and Stanley Black & Decker are leading advancements in high-performance saw blades that offer optimized tooth geometry, reduced heat buildup, and specialized designs tailored to specific materials like hardwood, composite panels, and metals

- The global push for increased productivity, material efficiency, and reduced operational costs is reshaping product development, with manufacturers prioritizing precision-engineered, durable saw blades that meet the rigorous demands of modern industries

What are the Key Drivers of Saw Blades Market?

- The growing demand for efficient, high-speed cutting tools across construction, metalworking, and woodworking sectors is a major market driver, as industries seek reliable, high-performance saw blades to support large-scale production and reduce operational downtime

- For instance, in January 2024, Kinkelder BV launched its new generation of circular saw blades optimized for cutting high-tensile steel pipes and profiles, offering increased tool life, minimal burr formation, and enhanced cutting precision, catering to evolving manufacturing needs

- Rapid urbanization, infrastructure development, and rising furniture production globally are further fueling demand for specialized saw blades that deliver clean cuts, improved finish quality, and reduced material wastage across wood and engineered panels

- In addition, the metal fabrication industry’s increasing focus on cutting harder, abrasion-resistant materials is driving the adoption of coated, carbide-tipped, and diamond-tipped saw blades that extend tool longevity and enhance performance under extreme conditions

- Technological advancements, including laser-cut blade bodies, anti-vibration slots, and heat-resistant coatings, are improving cutting precision, minimizing blade wear, and promoting long-term cost savings for manufacturers, driving market growth across various regions

Which Factor is challenging the Growth of the Saw Blades Market?

- High production costs associated with premium-grade saw blades, particularly those utilizing diamond-tipped edges, advanced coatings, or proprietary alloys, present significant barriers to adoption, especially among small- and medium-sized manufacturers with limited budgets

- For instance, despite offering superior performance and longer service life, the high initial cost of precision-engineered saw blades often deters widespread adoption in price-sensitive markets, particularly in developing regions

- Fluctuating raw material prices, especially for tungsten carbide, steel, and diamond grits, also impact manufacturing costs and final product pricing, posing challenges for both manufacturers and end-users seeking affordable yet durable cutting solutions

- Furthermore, technological challenges related to optimizing blade performance across different materials—while ensuring minimal heat generation, vibration, and blade wear—require continuous R&D investment, adding complexity to product development

- To address these challenges, market players are focusing on cost-effective manufacturing techniques, offering modular blade systems, and expanding their portfolio of durable, application-specific saw blades that balance performance, affordability, and longevity, supporting broader market penetration globally

How is the Saw Blades Market Segmented?

The market is segmented on the basis of type, product, and application.

• By Type

On the basis of type, the saw blades market is segmented into Carbide Saw Blades, Diamond Saw Blades, and Others. The Carbide Saw Blades segment dominated the saw blades market with the largest market revenue share of 49.6% in 2024, driven by their superior durability, high cutting efficiency, and ability to handle a wide range of materials, including wood, composites, and non-ferrous metals. Their extended lifespan and reduced replacement frequency make them a preferred choice in woodworking, construction, and metalworking industries.

The Diamond Saw Blades segment is anticipated to witness the fastest growth rate of 11.2% from 2025 to 2032, fueled by increasing demand for high-precision cutting of hard materials such as stone, concrete, ceramics, and glass. Diamond blades offer unmatched cutting performance, reduced material wastage, and enhanced surface finish, making them increasingly popular in construction and stone fabrication sectors.

• By Product

On the basis of product, the saw blades market is segmented into Circular Saw, Band Saw, Chain Saw, and Hand Saw. The Circular Saw segment dominated the Saw Blades market with the largest market revenue share of 41.8% in 2024, attributed to their versatility, high-speed cutting capability, and widespread use across woodworking, metal fabrication, and construction industries. Circular saw blades are favored for delivering accurate cuts, efficiency, and ease of use in both handheld and stationary machinery.

The Band Saw segment is expected to witness the fastest CAGR during the forecast period, driven by growing demand for continuous, precise cutting operations in wood processing, metalworking, and meat cutting applications. Their ability to produce intricate curves, smooth edges, and minimal material wastage makes them essential for specialized cutting tasks.

• By Application

On the basis of application, the saw blades market is segmented into Wood Cutting, Metal Cutting, Stone Cutting, and Others. The Wood Cutting segment accounted for the largest market revenue share of 53.2% in 2024, driven by robust demand from furniture manufacturing, construction, and woodworking industries globally. The growing trend of home improvement, interior remodeling, and prefabricated wooden structures further boosts the need for high-performance saw blades in wood applications.

The Metal Cutting segment is projected to witness the fastest growth from 2025 to 2032, supported by increasing industrialization, infrastructure development, and demand for precision cutting in automotive, aerospace, and metal fabrication sectors. Innovations in coated, carbide-tipped, and high-speed steel blades are further enhancing metal cutting efficiency, driving adoption across industries.

Which Region Holds the Largest Share of the Saw Blades Market?

- North America dominated the saw blades market with the largest revenue share of 39.58% in 2024, driven by extensive demand from the woodworking, metalworking, and construction industries across the region. The strong presence of advanced manufacturing facilities, rising home renovation trends, and significant investments in infrastructure development are fueling widespread adoption of high-performance saw blades

- Growing emphasis on precision cutting tools, energy-efficient machinery, and durable materials is supporting market expansion, particularly in the U.S. and Canada, where woodworking, furniture manufacturing, and metal fabrication industries are thriving

- Furthermore, advancements in blade technology, such as carbide-tipped and diamond saw blades, along with the rising need for efficient, high-speed cutting solutions, continue to strengthen North America's market position

U.S. Saw Blades Market Insight

U.S. saw blades market captured the largest revenue share within North America in 2024, fueled by the country's booming construction sector, expanding furniture industry, and the growing demand for precision cutting tools in automotive and aerospace manufacturing. The market is witnessing increasing investments in technologically advanced, energy-efficient saw blades, with a focus on durability, high cutting accuracy, and reduced waste, meeting the evolving needs of professional and DIY users alike.

Canada Saw Blades Market Insight

Canada saw blades market is experiencing steady growth, supported by rising residential and commercial construction activities and the flourishing forestry and wood products industries. The growing popularity of home improvement projects, sustainable building materials, and demand for efficient cutting tools in metal and woodworking sectors are driving market adoption across the country.

Mexico Saw Blades Market Insight

Mexico saw blades market is poised for significant growth, driven by the country's expanding construction industry, automotive manufacturing sector, and increased demand for affordable, high-quality cutting tools. The presence of manufacturing hubs and favorable government initiatives to promote industrial development are contributing to rising adoption of advanced saw blades across various applications.

Which Region is the Fastest Growing Region in the Saw Blades Market?

Asia-Pacific saw blades market is projected to grow at the fastest CAGR of 13.8% from 2025 to 2032, fueled by rapid urbanization, infrastructure expansion, and rising demand for high-precision cutting solutions across China, India, Japan, and Southeast Asia. The booming construction, automotive, and woodworking industries, coupled with increasing investments in modern manufacturing equipment, are major drivers of market growth in the region.

China Saw Blades Market Insight

The China saw blades market accounted for the largest revenue share within Asia-Pacific in 2024, driven by the country's extensive construction projects, growing furniture manufacturing sector, and rising demand for advanced cutting tools in industrial applications. The presence of strong domestic production capabilities and increasing adoption of high-efficiency saw blades are supporting robust market growth across China.

India Saw Blades Market Insight

The India saw blades market is witnessing significant expansion, fueled by rapid urban development, infrastructure modernization, and growing demand for efficient woodworking and metal cutting solutions. Government initiatives supporting manufacturing growth, coupled with rising investments in industrial equipment, are driving market adoption of high-performance saw blades in the country.

Japan Saw Blades Market Insight

The Japan saw blades market is experiencing stable growth, supported by the country's focus on precision engineering, technological innovation, and demand for high-quality cutting tools in automotive, construction, and electronics manufacturing. The growing preference for durable, energy-efficient, and high-speed cutting solutions aligns with Japan's advanced industrial landscape and commitment to product quality.

Which are the Top Companies in Saw Blades Market?

The saw blades industry is primarily led by well-established companies, including:

- AKE Knebel GmbH and Co. KG (Germany)

- AMADA Co. Ltd. (Japan)

- Continental Machines Inc. (U.S.)

- DIMAR GROUP (Israel)

- Freud America Inc. (U.S.)

- Illinois Tool Works Inc. (U.S.)

- Ingersoll Rand Inc. (U.S.)

- J.N. Eberle and Cie. GmbH (Germany)

- Kinkelder BV (Netherlands)

- Leitz GmbH and Co. KG (Germany)

- LEUCO AG (Germany)

- Makita USA Inc. (U.S.)

- Pilana Metal Sro (Czech Republic)

- ROTHENBERGER Werkzeuge GmbH (Germany)

- Simonds International LLC (U.S.)

- Snap On Inc. (U.S.)

- Stanley Black and Decker Inc. (U.S.)

- Stark Spa (Italy)

- The M. K. Morse Co. (U.S.)

What are the Recent Developments in Global Saw Blades Market?

- In February 2025, DoAll introduced the S-153 micro-benchtop saw, specifically designed for small workshops and mobile professionals. The compact saw offers portability, adjustable band speeds, and up to 60° miter cutting capabilities, making it ideal for precise, on-the-go applications. This launch reflects DoAll’s focus on innovation for space-efficient, high-performance cutting tools

- In October 2024, M.K. Morse unveiled its new spring-loaded Pen Drive Hole Saw Arbor, engineered to enhance drilling accuracy and operational efficiency for professional users. The advanced arbor design provides smoother operation and improved precision, reinforcing the company's commitment to user-friendly, high-performance cutting solutions

- In May 2023, Makita U.S.A. Inc. introduced its dual-thread band saws, offering increased versatility for professionals using cordless band saw tools. Available in three-piece packs with multiple tooth per inch (TPI) configurations, these blades cater to various cutting applications, showcasing Makita's dedication to providing durable, adaptable cutting solutions

- In September 2022, The M.K. Morse Company launched the fourth generation of its Metal Devil circular saw blade, setting new standards for metal cutting. The Metal Devil series delivers superior longevity, cooler cutting performance, and high-quality surface finishes across materials such as stainless steel, titanium, and non-ferrous metals, highlighting the brand’s continuous innovation in saw blade technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.