Global Scheduled Bus Transport Market

Market Size in USD Billion

CAGR :

%

USD

3.36 Billion

USD

5.00 Billion

2024

2032

USD

3.36 Billion

USD

5.00 Billion

2024

2032

| 2025 –2032 | |

| USD 3.36 Billion | |

| USD 5.00 Billion | |

|

|

|

|

Scheduled Bus Transport Market Size

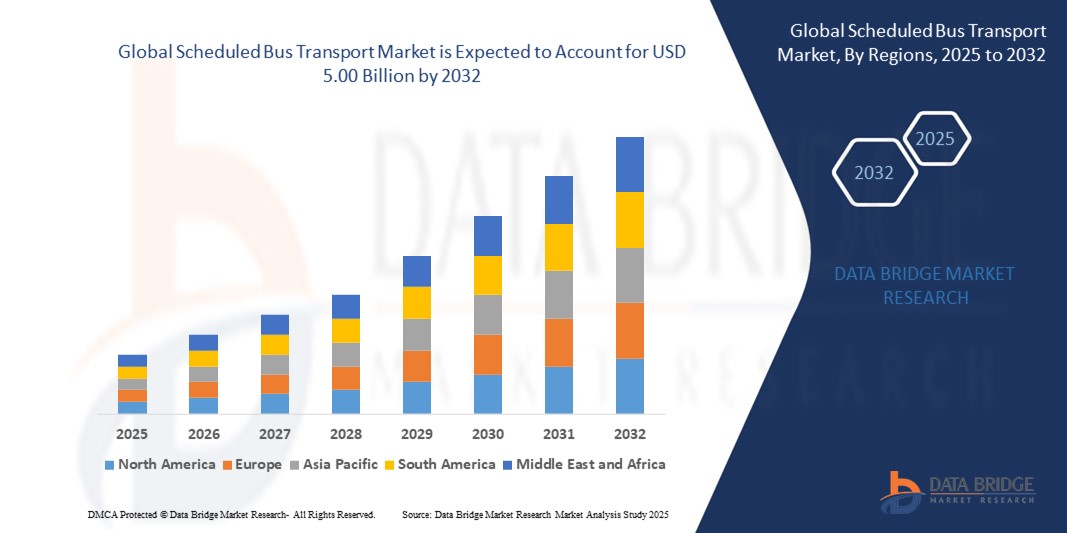

- The global scheduled bus transport market size was valued at USD 3.36 billion in 2024 and is expected to reach USD 5.00 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely fuelled by increasing urbanization, rising demand for cost-effective and reliable public transportation, and government initiatives to enhance road transport infrastructure

- Growing environmental awareness and adoption of eco-friendly buses, along with improved safety and convenience features, are further supporting market expansion

Scheduled Bus Transport Market Analysis

- The market is segmented by service type, route type, bus type, and region, enabling providers to address diverse passenger needs and operational requirements

- Intercity and long-distance routes hold significant revenue share, while regional and feeder bus services are witnessing rapid growth due to rising urban commuter demand

- Asia-Pacific dominated the scheduled bus transport market with the largest revenue share of 38% in 2024, driven by rapid urbanization, growing population density, and rising demand for organized public transport in countries such as China, India, and Japan

- North America region is expected to witness the highest growth rate in the global scheduled bus transport market, driven by government support for eco-friendly transportation and the integration of advanced fleet management and passenger convenience technologies

- The transit buses segment held the largest market revenue share in 2024, driven by the increasing demand for public transportation in urban areas, government initiatives to reduce traffic congestion, and rising adoption of organized city bus networks. Transit buses often offer high passenger capacity, scheduled services, and reliable connectivity, making them the preferred choice for daily commuters

Report Scope and Scheduled Bus Transport Market Segmentation

|

Attributes |

Scheduled Bus Transport Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Increasing Adoption Of Electric And Eco-Friendly Buses |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Scheduled Bus Transport Market Trends

Rise of Digital Ticketing and Smart Fleet Management

• The growing shift toward digital ticketing and smart fleet management is transforming the scheduled bus transport landscape by enabling real-time route monitoring and passenger tracking. The portability and speed of these solutions allow operators to optimize schedules, reduce delays, and improve service efficiency. This results in enhanced passenger satisfaction and higher operational profitability

• The high demand for contactless payments and mobile ticketing in urban and semi-urban areas is accelerating the adoption of smart ticketing platforms and mobile apps. These tools are particularly effective where conventional ticket counters are limited, helping reduce boarding times and ensuring smooth passenger flow. The trend is further supported by government initiatives to modernize public transport systems

• The affordability and ease of use of modern fleet management and ticketing solutions are making them attractive for small and mid-sized operators, leading to improved route planning and operational monitoring. Bus operators benefit from more efficient scheduling and reduced manual errors, which ultimately improves service reliability and safety

• For instance, in 2023, several regional bus operators in India reported improved on-time performance and passenger satisfaction after implementing GPS-enabled fleet management and mobile ticketing platforms. These solutions allowed real-time monitoring, better seat allocation, and faster ticket processing, reducing operational costs and improving service quality

• While digital solutions are accelerating operational efficiency and passenger convenience, their impact depends on continued technology upgrades, user training, and affordability. Stakeholders must focus on localized deployment strategies and scalable solutions to fully capitalize on this growing demand

Scheduled Bus Transport Market Dynamics

Driver

Rising Urbanization and Growing Demand for Cost-Effective Public Transport

• Increasing urbanization and traffic congestion are pushing governments and transport operators to prioritize scheduled bus services as an efficient public mobility solution. Growing commuter populations are driving the need for reliable, affordable, and frequent bus transport

• Passengers are increasingly aware of the cost and convenience advantages of scheduled bus services over private vehicles. This awareness has led to higher ridership across cities and regional routes. The shift is supported by the rising focus on sustainable and environment-friendly transport options

• Public sector efforts and infrastructure development have strengthened bus networks and service quality. From dedicated bus lanes to government subsidies for intercity routes, supportive frameworks are helping operators maintain regular and efficient services

• For instance, in 2022, several European countries expanded urban bus networks with priority lanes and digital ticketing systems, boosting commuter adoption and improving operational efficiency across the region

• While urbanization and government support are driving market growth, there is still a need to enhance last-mile connectivity, improve fleet modernization, and integrate technology into daily operations to ensure sustained adoption

Restraint/Challenge

High Operational Costs and Limited Infrastructure in Rural Regions

• The high cost of fleet acquisition, fuel, and maintenance makes scheduled bus transport less accessible for small operators, particularly in underdeveloped regions. Operational expenses remain a major limiting factor for market expansion

• In many rural and semi-urban areas, there is a lack of adequate road infrastructure and supporting facilities for buses. This limits service frequency, coverage, and reliability, affecting passenger convenience

• Market penetration is also restricted by logistical and regulatory challenges in remote areas, where consistent scheduling and maintenance support are not guaranteed. These regions often rely on informal or irregular transport, which is less efficient and increases travel times

• For instance, in 2023, regional transport authorities in Sub-Saharan Africa reported that over 60% of rural routes had no scheduled bus services due to high operational costs and poor infrastructure, leaving commuters dependent on informal modes of transport

• While technology and fleet solutions continue to evolve, solving cost and infrastructure challenges remains crucial. Stakeholders must focus on scalable bus models, route optimization, and decentralized transport solutions to bridge the rural transport gap and unlock long-term market potential

Scheduled Bus Transport Market Scope

The market is segmented on the basis of application and length.

- By Application

On the basis of application, the scheduled bus transport market is segmented into motor coaches, transit buses, and school buses. The transit buses segment held the largest market revenue share in 2024, driven by the increasing demand for public transportation in urban areas, government initiatives to reduce traffic congestion, and rising adoption of organized city bus networks. Transit buses often offer high passenger capacity, scheduled services, and reliable connectivity, making them the preferred choice for daily commuters.

The motor coaches segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for intercity and long-distance travel. Motor coaches are particularly popular for their comfort, amenities, and efficiency on longer routes, often serving as the primary option for regional and tourist transport.

- By Length

On the basis of length, the market is segmented into 6–8 m, 9–12 m, and above 12 m. The 9–12 m segment held the largest revenue share in 2024 due to its versatility in accommodating urban and intercity operations, offering a balance of passenger capacity and operational efficiency.

The above 12 m segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-capacity buses for long-distance routes and premium intercity services. Buses above 12 m are favored for their larger seating capacity, enhanced comfort, and ability to serve high-demand corridors efficiently.

Scheduled Bus Transport Market Regional Analysis

• Asia-Pacific dominated the scheduled bus transport market with the largest revenue share of 38% in 2024, driven by rapid urbanization, growing population density, and rising demand for organized public transport in countries such as China, India, and Japan.

• Passengers in the region highly value the convenience, affordability, and reliability offered by scheduled bus services, along with the adoption of mobile ticketing, real-time tracking, and smart fleet management systems.

• This widespread adoption is further supported by government initiatives to modernize bus networks, expand road infrastructure, and promote eco-friendly transportation, establishing scheduled buses as the preferred choice for urban and intercity mobility.

China Scheduled Bus Transport Market Insight

The China scheduled bus transport market captured the largest revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, increasing commuter demand, and government support for modernized and sustainable transport systems. Investments in fleet expansion, digital ticketing, and eco-friendly buses are driving growth, while rising disposable incomes are boosting ridership.

Japan Scheduled Bus Transport Market Insight

The Japan scheduled bus transport market is expected to witness the fastest growth rate from 2025 to 2032 due to high population density, urban commuter demand, and a cultural preference for punctual, safe, and reliable public transport. Adoption is driven by mobile ticketing, contactless payments, and GPS-enabled fleet management systems. The aging population is also expected to increase demand for accessible and convenient bus transport solutions.

North America Scheduled Bus Transport Market Insight

The North America scheduled bus transport market is expected to witness the fastest growth rate from 2025 to 2032, driven by demand for organized city transit, improved commuter convenience, and government initiatives to reduce traffic congestion and carbon emissions. Integration of digital ticketing and smart fleet solutions further supports market adoption.

U.S. Scheduled Bus Transport Market Insight

The U.S. scheduled bus transport market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for city transit and intercity bus services. The adoption of digital ticketing, mobile apps, and fleet management technologies, alongside government support for sustainable transportation, is enhancing operational efficiency and commuter convenience.

Europe Scheduled Bus Transport Market Insight

The Europe scheduled bus transport market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by urbanization, stringent emission regulations, and the rising preference for sustainable public transport. Smart ticketing, GPS tracking, and fleet management technologies are encouraging adoption across city and intercity routes.

U.K. Scheduled Bus Transport Market Insight

The U.K. scheduled bus transport market is expected to witness the fastest growth rate from 2025 to 2032, fueled by urbanization, increasing commuter demand, and government initiatives to improve public transport efficiency. Smart ticketing, GPS tracking, and real-time schedule updates are driving adoption across city and regional routes.

Germany Scheduled Bus Transport Market Insight

The Germany scheduled bus transport market is expected to witness the fastest growth rate from 2025 to 2032, driven by strong urban transit networks, government support for eco-friendly and sustainable transport, and rising adoption of digital ticketing and fleet management solutions. Efficiency, reliability, and passenger convenience remain key factors encouraging market growth.

Scheduled Bus Transport Market Share

The Scheduled Bus Transport industry is primarily led by well-established companies, including:

- Yutong Bus (China)

- AB Volvo (Sweden)

- Scania AB (Sweden)

- Tata Motors (India)

- Hino Motors, Ltd. (Japan)

- Mercedes-Benz (Daimler Buses) (Germany)

- MAN Truck & Bus (Germany)

- DAF Trucks (Netherlands)

- Iveco (Italy)

- Volvo Buses (Sweden)

- New Flyer Industries (Canada)

- Alexander Dennis (U.K.)

- Gillig Corporation (U.S.)

- Solaris Bus & Coach (Poland)

- BYD Auto (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.