Global School Bus Market

Market Size in USD Billion

CAGR :

%

USD

1.34 Billion

USD

1.82 Billion

2024

2032

USD

1.34 Billion

USD

1.82 Billion

2024

2032

| 2025 –2032 | |

| USD 1.34 Billion | |

| USD 1.82 Billion | |

|

|

|

|

School Bus Market Size

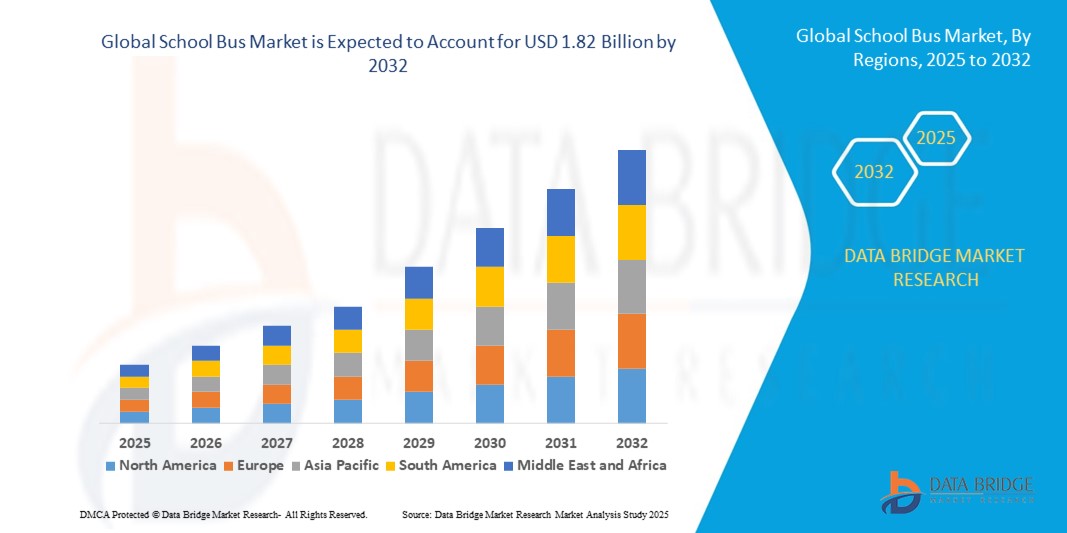

- The global school bus market size was valued at USD 1.34 billion in 2024 and is expected to reach USD 1.82 billion by 2032, at a CAGR of 3.96% during the forecast period

- The market growth is largely fueled by increasing demand for safe and reliable student transportation, coupled with government initiatives to modernize fleets with advanced safety and emission-compliant vehicles. Rising emphasis on student security, comfort, and sustainability is prompting school districts and operators to adopt modern school buses equipped with improved features and cleaner powertrains

- Furthermore, the accelerating push toward electrification, supported by government subsidies, emission reduction targets, and investments in charging infrastructure, is driving strong adoption of electric school buses. These converging factors are boosting fleet replacement cycles and significantly enhancing the overall growth of the school bus industry

School Bus Market Analysis

- School buses are purpose-built vehicles designed to transport students safely between home and school, with configurations ranging from conventional diesel-powered models to advanced electric buses. They integrate multiple safety features such as high-visibility designs, reinforced structures, and monitoring systems, ensuring compliance with strict regulatory standards across regions

- The escalating demand for school buses is primarily fueled by growing student enrollments, rising urbanization, and government-led electrification programs aimed at reducing emissions. A strong focus on safety, sustainability, and operational efficiency continues to establish school buses as an indispensable component of educational infrastructure worldwide

- North America dominated the school bus market in 2024, due to the strong presence of leading manufacturers, well-established school transportation systems, and government policies supporting safe student mobility

- Asia-Pacific is expected to be the fastest growing region in the school bus market during the forecast period due to rapid urbanization, rising disposable incomes, and government initiatives promoting safe school transportation

- ICE-powered segment dominated the market with a market share of 87% in 2024, due to its long-established infrastructure, cost efficiency, and widespread availability of diesel and gasoline fueling stations. Traditional ICE school buses are preferred by most school districts for their reliability, lower upfront costs, and well-developed servicing ecosystem

Report Scope and School Bus Market Segmentation

|

Attributes |

School Bus Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

School Bus Market Trends

Rising Adoption of Electric School Buses

- Increasing awareness of environmental sustainability and the push for reduced emissions are driving school districts worldwide to adopt electric school buses, which offer lower operating costs and improved air quality compared to traditional diesel models

- For instance, leading manufacturers such as Blue Bird Corporation, Lion Electric, and Thomas Built Buses are partnering with school districts and governments to launch electric school bus fleets with advanced battery technologies, long-range capabilities, and integrated telematics for safety and maintenance monitoring

- Expansion of public-private partnerships and government funding initiatives encourages the deployment of zero-emission buses, accelerating the replacement of aging fleets with clean energy solutions

- Technological innovations including smart energy management systems, fast charging infrastructure, and route optimization software enable efficient operation and charging of electric buses, supporting higher adoption rates in urban and suburban environments

- Growing emphasis on student health and safety drives investment in quieter, low-vibration electric buses that reduce exposure to traffic pollution and enhance the riding experience for children

- Integration of electric school buses into broader smart transportation networks supports data-driven fleet management, improved scheduling, and dynamic routing aligned with community needs

School Bus Market Dynamics

Driver

Growing Urbanization and Population Density

- Rising urbanization and increasing school-age population density in cities and metro areas generate strong demand for efficient, high-capacity school bus networks to address mobility and safety challenges

- For instance, rapidly expanding suburban and urban communities in regions such as North America, Asia-Pacific, and Europe are stimulating demand for modern school buses with enhanced safety features and real-time tracking, supplied by companies such as Tata Motors, IC Bus, and Yutong

- Infrastructure development and residential expansion drive the need for optimized transportation solutions that accommodate diverse route structures and student volumes. Integration of technologies such as GPS-based tracking, digital attendance, and remote security monitoring supports safe, reliable, and responsive school bus operations

- School districts and transportation planners are investing in coordinated bus logistics and innovative routing software to minimize transit times and maximize utilization amid shifting demographic patterns

- Urbanization trends also push for improved bus designs that balance accessibility, comfort, and operational efficiency for densely populated school zones

Restraint/Challenge

Budgetary Constraints in Public Education Systems

- Budget limitations in public school districts, compounded by rising costs for new vehicles, technology upgrades, and maintenance, restrict the ability to modernize and expand school bus fleets

- For instance, many school districts in the US and Europe delay purchasing new buses or transitioning to electric fleets due to inadequate funding—despite growing regulatory pressure and community interest in sustainable transportation

- High upfront costs for electric buses, charging infrastructure, and training create adoption barriers, especially in under-resourced districts or rural areas

- Maintenance, insurance, and compliance expenditures compete for limited resources and can force schools to extend the operating life of older, less efficient vehicles. Limited access to grants, subsidies, and financing programs slows procurement cycles and restricts fleet modernization, particularly for advanced technology solutions

- Budgetary constraints also impact service levels, with some districts forced to curtail routes or reduce coverage, challenging the accessibility and equity of school transportation

School Bus Market Scope

The market is segmented on the basis of powertrain type and type.

- By Powertrain Type

On the basis of powertrain type, the school bus market is segmented into ICE-powered and electric. The ICE-powered segment dominated the largest market revenue share of 87% in 2024, primarily due to its long-established infrastructure, cost efficiency, and widespread availability of diesel and gasoline fueling stations. Traditional ICE school buses are preferred by most school districts for their reliability, lower upfront costs, and well-developed servicing ecosystem. In addition, many fleet operators continue to rely on ICE-powered models as they support larger passenger capacities and longer routes without range concerns. The established supply chain and extensive dealer networks further strengthen the dominance of ICE-powered school buses in both urban and rural regions.

The electric segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by government mandates to reduce emissions, growing investments in sustainable transportation, and increasing incentives for electrification in school fleets. Electric school buses are gaining traction as they provide significant long-term cost savings on fuel and maintenance while aligning with carbon-neutral initiatives. Their quiet operation also enhances safety and comfort for students, making them appealing for districts in noise-sensitive areas. Rapid advancements in battery technology and charging infrastructure are addressing earlier limitations of range and charging time, creating a strong growth trajectory for electric school buses.

- By Type

On the basis of type, the school bus market is segmented into Type A, Type B, Type C, and Type D. The Type C segment dominated the largest market revenue share in 2024, driven by its versatile design, high passenger capacity, and suitability for both urban and suburban routes. Often recognized as the “conventional” school bus, Type C models are widely adopted by school districts across North America due to their balance of safety, durability, and affordability. Their adaptability to multiple fuel options, including diesel, CNG, and electric, further enhances their demand. The robust manufacturing base and long-standing trust among operators reinforce the dominance of Type C school buses in the market.

The Type D segment is projected to witness the fastest growth from 2025 to 2032, supported by its higher passenger capacity and favorable design that offers flat-front entry, maximizing interior space. Type D buses are increasingly favored in densely populated school districts that require transportation for large groups of students efficiently. Their engine placement at the rear or front also provides flexibility and improved driver visibility, making them suitable for longer routes. The growing trend toward fleet modernization and the adoption of electric drivetrains in Type D buses is further accelerating their uptake, particularly in urban regions with strict emission regulations.

School Bus Market Regional Analysis

- North America dominated the school bus market with the largest revenue share in 2024, driven by the strong presence of leading manufacturers, well-established school transportation systems, and government policies supporting safe student mobility

- The region benefits from large-scale adoption of conventional and electric school buses, particularly in the U.S. and Canada, where regulations mandate high safety standards and regular fleet upgrades. Growing initiatives toward electrification of school fleets and investments in charging infrastructure are also contributing to market expansion

- Rising concerns over student safety, combined with the need for reliable and eco-friendly transportation, reinforce North America’s leadership in the global school bus market

U.S. School Bus Market Insight

The U.S. school bus market captured the largest revenue share in 2024 within North America, supported by its vast school transportation network and government-backed programs promoting electrification. The U.S. has a long-established reliance on school buses, transporting millions of students daily, which sustains consistent demand. Federal and state incentives for electric buses, coupled with emission reduction targets, are fueling a shift in fleet procurement. The increasing emphasis on safety, comfort, and sustainability, along with rising adoption of advanced driver assistance systems (ADAS), further accelerates growth in the U.S. market.

Europe School Bus Market Insight

The Europe school bus market is projected to expand at a substantial CAGR during the forecast period, driven by stringent environmental regulations, rising urbanization, and growing investments in clean public transportation. European governments are actively encouraging the replacement of older fleets with low-emission or electric buses to reduce carbon footprints. Demand is also rising in both urban and rural school systems, where safety standards and sustainability goals are critical. The presence of strong automotive players and technological innovation in electric buses further supports Europe’s growth trajectory.

U.K. School Bus Market Insight

The U.K. school bus market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by increasing safety concerns, a growing push for electrification, and investment in modernizing school fleets. The government’s carbon reduction goals are encouraging adoption of electric buses, while rising urban populations are driving demand for efficient student transportation solutions. Integration of digital monitoring and safety systems is also contributing to adoption across both public and private schools.

Germany School Bus Market Insight

The Germany school bus market is expected to expand at a considerable CAGR, driven by its advanced automotive industry and emphasis on sustainable, eco-friendly transport solutions. The shift toward electrification is being supported by strong policy frameworks and local manufacturing capabilities. Safety remains a core focus, with demand rising for technologically advanced buses equipped with driver assistance and monitoring systems. Germany’s high standard of infrastructure also supports the adoption of modern fleets in both urban and rural regions.

Asia-Pacific School Bus Market Insight

The Asia-Pacific school bus market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and government initiatives promoting safe school transportation. Countries such as China, India, and Japan are leading adoption, with significant investments in fleet expansion to accommodate growing student populations. The region is also witnessing strong interest in electric school buses as part of broader clean mobility agendas. Local manufacturing strengths and cost-effective production further enable the accessibility of school buses to both urban and semi-urban school systems.

Japan School Bus Market Insight

The Japan school bus market is gaining momentum due to its strong culture of technological innovation and high emphasis on student safety. Demand is rising for buses with advanced safety features, compact designs for urban environments, and low-emission technologies in line with national sustainability goals. Integration with smart city initiatives and IoT-based safety systems is also driving adoption.

China School Bus Market Insight

The China school bus market accounted for the largest revenue share in Asia-Pacific in 2024, supported by its vast student population, rapid urban development, and large-scale adoption of smart mobility solutions. The government’s initiatives to improve school safety and its push for electrification are accelerating fleet modernization. Domestic manufacturers are playing a crucial role in offering affordable, innovative buses, making China a leading hub for school bus demand and production in the region.

School Bus Market Share

The school bus industry is primarily led by well-established companies, including:

- ASHOK LEYLAND (India)

- Berkshire Hathaway Inc. (U.S.)

- Blue Bird Corporation. (U.S.)

- Daimler Truck AG (Germany)

- Eicher Motors Ltd. (India)

- Ford Motor Co. (U.S.)

- GreenPower Motor Co. Inc. (Canada)

- Higer Bus USA (U.S.)

- JCBLGroup (India)

- Mahindra and Mahindra Ltd. (India)

- Mercedes Benz Group AG (Germany)

- REV Group Inc. (U.S.)

- Scania AB (Sweden)

- SML Isuzu Ltd. (India)

- Tata Motors Ltd. (India)

- The Lion Electric Co. (Canada)

- Trans Tech Bus (U.S.)

- Traton SE (Germany)

- Van Con Inc. (U.S.)

- Yutong Bus Co., Ltd (China)

Latest Developments in Global School Bus Market

- In May 2024, Blue Bird Corporation extended its exclusive clean school bus collaboration with Ford Component Sales and ROUSH CleanTech to 2030, reinforcing its long-term commitment to sustainable student transportation. This extension ensures continuity in developing and deploying propane- and electric-powered school buses, enabling districts across the U.S. to access advanced clean-energy fleets. The partnership strengthens Blue Bird’s position as a leading player in the zero- and low-emission school bus market while supporting federal and state-level emission reduction initiatives

- In November 2023, IVECO Bus secured a landmark contract to supply 7,100 new school buses to the Brazilian school transport system, significantly expanding its footprint in Latin America. This large-scale procurement highlights Brazil’s push to modernize its student mobility infrastructure while addressing growing demand in rural and urban regions. The deal enhances IVECO’s market presence and also underscores the increasing investments by emerging economies in school transportation modernization

- In March 2023, Thomas Built Buses introduced its Jouley electric school bus, offering a range of up to 135 miles on a single charge, further advancing the electrification of school fleets. This launch addressed growing school district requirements for reliable, zero-emission buses capable of daily route operations. By focusing on extended range and operational efficiency, Thomas Built Buses strengthened its competitive positioning in the evolving electric school bus landscape

- In February 2023, Blue Bird Corporation entered into a partnership with Lightning eMotors to co-develop and manufacture all-electric school buses, accelerating the transition toward electrified fleets in North America. The collaboration combined Blue Bird’s manufacturing expertise with Lightning eMotors’ EV technology, enabling the production of innovative buses that meet stringent environmental and operational standards. This move expanded Blue Bird’s electric product portfolio, boosting its role in the clean school bus market

- In August 2022, the Government of India sanctioned a substantial budget of USD 10 billion under the Clean Energy Scheme Limited (CESL) to procure 50,000 electric buses by 2030, signaling a transformative shift in the nation’s mobility landscape. As part of this initiative, the Delhi Transport Corporation (DTC) announced plans to induct 8,000 electric buses into its fleet by 2025, strengthening India’s position as a key growth driver in the global electric school bus market. This government-led push is fostering rapid adoption of eco-friendly transportation while opening significant opportunities for domestic and international bus manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global School Bus Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global School Bus Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global School Bus Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.