Global Sclerotherapy Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

2.03 Billion

2024

2032

USD

1.20 Billion

USD

2.03 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 2.03 Billion | |

|

|

|

|

Sclerotherapy Market Size

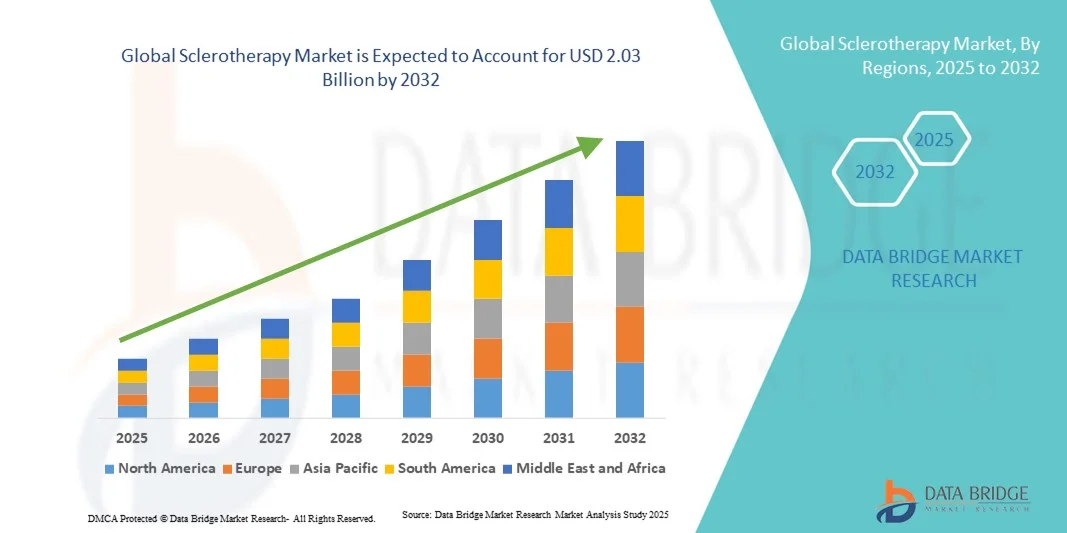

- The global sclerotherapy market size was valued at USD 1.20 billion in 2024 and is expected to reach USD 2.03 billion by 2032, at a CAGR of 6.85% during the forecast period

- The market growth is largely fueled by the rising prevalence of varicose veins and chronic venous disorders, along with increasing awareness about minimally invasive cosmetic procedures, driving higher adoption among patients

- Furthermore, advancements in sclerosing agents, combined with growing preference for outpatient procedures that offer reduced recovery time and improved aesthetic outcomes, are positioning sclerotherapy as a preferred vein treatment solution. These factors collectively are accelerating market adoption and significantly contributing to the industry's expansion

Sclerotherapy Market Analysis

- Sclerotherapy, a minimally invasive procedure for treating varicose veins, spider veins, and other venous disorders, is increasingly recognized as an effective and cosmetically favorable treatment option in both medical and aesthetic settings due to its efficiency, minimal downtime, and improved patient outcomes

- The escalating demand for sclerotherapy is primarily driven by the rising prevalence of chronic venous diseases, growing awareness of minimally invasive cosmetic treatments, and an increasing preference for outpatient procedures over surgical interventions

- North America dominated the sclerotherapy market with the largest revenue share of 45% in 2024, attributed to high patient awareness, advanced healthcare infrastructure, and strong presence of leading industry players, with the U.S. witnessing significant uptake in clinics and dermatology centers driven by innovations in sclerosing agents and combination therapies

- Asia-Pacific is expected to be the fastest growing region in the sclerotherapy market during the forecast period due to increasing incidence of venous disorders, expanding cosmetic treatment awareness, and rising disposable incomes

- Foam sclerotherapy segment dominated the sclerotherapy market with a market share of 42.1% in 2024, driven by its higher efficacy in treating larger veins, ease of administration, and favorable safety profile compared to liquid agents

Report Scope and Sclerotherapy Market Segmentation

|

Attributes |

Sclerotherapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sclerotherapy Market Trends

Advancements in Foam and Chemical Sclerosing Agents

- A significant and accelerating trend in the global sclerotherapy market is the continuous development of advanced foam and chemical sclerosing agents, which improve efficacy and reduce side effects for patients with varicose and spider veins

- For instance, polidocanol foam formulations have demonstrated higher success rates in treating larger veins compared to traditional liquid agents, providing better patient outcomes and faster recovery times

- Innovations in combination therapies and enhanced delivery techniques allow practitioners to target complex venous conditions more precisely, minimizing complications and improving overall treatment satisfaction

- The integration of image-guided technologies, such as ultrasound-assisted sclerotherapy, enhances procedural accuracy and safety, enabling more effective and personalized treatment plans

- This trend towards improved treatment formulations and delivery methods is reshaping patient and clinician expectations, leading to higher adoption rates of minimally invasive vein therapies

- Digital platforms and teleconsultation services are enabling broader patient education and treatment accessibility, contributing to higher adoption rates

- The demand for advanced and safer sclerotherapy solutions is growing rapidly across both cosmetic and medical sectors, as patients increasingly seek effective treatments with minimal downtime

Sclerotherapy Market Dynamics

Driver

Increasing Prevalence of Chronic Venous Disorders and Cosmetic Awareness

- The rising incidence of varicose veins, spider veins, and other chronic venous disorders, combined with growing awareness of minimally invasive cosmetic procedures, is a key driver of the heightened demand for sclerotherapy

- For instance, clinics offering targeted foam sclerotherapy treatments have reported significant growth in patient volumes, driven by both medical and aesthetic indications

- Patients increasingly prefer outpatient procedures that require minimal recovery time and offer improved cosmetic outcomes compared to surgical interventions, fueling adoption

- Furthermore, the expanding awareness of venous health and cosmetic treatments among middle- and high-income populations is encouraging more individuals to seek early interventions

- Growing collaborations between hospitals, dermatology clinics, and cosmetic centers are facilitating wider availability of sclerotherapy, expanding market reach

- Advancements in training programs for healthcare professionals are improving procedural expertise, enhancing patient confidence, and driving treatment adoption

- The convenience of office-based procedures, lower risk of complications, and ability to address multiple vein types simultaneously are further propelling the adoption of sclerotherapy in both medical and aesthetic practices

Restraint/Challenge

Potential Side Effects and Regulatory Compliance Hurdles

- Concerns regarding potential side effects, including skin irritation, hyperpigmentation, and allergic reactions to sclerosing agents, pose a challenge to broader market penetration

- For instance, reports of temporary localized swelling or mild pain post-treatment have made some patients hesitant to pursue sclerotherapy, despite its minimally invasive nature

- Regulatory compliance for the approval and safe use of newer sclerosing agents across different regions can delay market entry, limiting availability in certain countries

- Addressing safety concerns through clinical trials, physician training programs, and patient education is crucial to build trust and encourage wider adoption

- The relatively higher cost of advanced foam sclerotherapy formulations compared to traditional liquid agents can also be a barrier for price-sensitive patients, particularly in emerging markets

- Variability in insurance coverage and reimbursement policies for cosmetic and vein treatments may discourage patients from opting for sclerotherapy, especially in cost-sensitive regions

- Managing patient expectations regarding outcomes and potential side effects is essential to prevent dissatisfaction and negative word-of-mouth, which could hinder market adoption

- Overcoming these challenges through enhanced safety protocols, regulatory approvals, and awareness campaigns will be vital for sustained growth in the sclerotherapy market

Sclerotherapy Market Scope

The market is segmented on the basis of product, type, and application.

- By Product

On the basis of product, the sclerotherapy market is segmented into detergents, osmotic agents, and chemical irritants. The detergents segment dominated the market in 2024, driven by their proven efficacy in treating varicose and spider veins with minimal side effects. Detergent-based sclerosing agents, such as polidocanol, are widely preferred by clinicians due to their high safety profile and ability to produce consistent results across vein sizes. Strong adoption in both medical and cosmetic clinics, coupled with growing patient awareness of minimally invasive vein treatments, has reinforced its leading position. Detergent agents also benefit from extensive clinical research supporting their use, which encourages healthcare providers to recommend them confidently. Their compatibility with foam formulations enhances procedural efficiency and patient satisfaction. Consequently, the segment commands the largest revenue share and maintains a solid presence across global markets.

The chemical irritants segment is expected to witness the fastest growth from 2025 to 2032, driven by the development of novel formulations targeting larger or more complex veins. Innovations in chemical sclerosing agents, offering higher potency and enhanced vein closure rates, are encouraging adoption among dermatologists and vascular surgeons. The increasing preference for combination therapies, using chemical irritants alongside foam or detergent agents, supports faster market expansion. Rising patient demand for quick, effective, and minimally invasive treatments further fuels growth. Expanding awareness in emerging markets and broader availability of chemical agents in specialized clinics also contribute to the segment’s accelerating adoption rate.

- By Type

On the basis of type, the sclerotherapy market is segmented into ultrasound-guided, liquid, and foam sclerotherapy. The foam sclerotherapy segment dominated the market in 2024 with a market share of 42.1%, owing to its superior efficacy in treating larger veins and complex venous networks compared to liquid formulations. Foam allows better contact with the vein walls, improving the success rate of vein closure, which increases clinician preference. High patient satisfaction due to minimal discomfort and quicker recovery enhances adoption in both cosmetic and medical applications. The growing integration of foam sclerotherapy with ultrasound guidance for precise vein targeting has further strengthened its market dominance. Widespread use in outpatient clinics and hospitals, coupled with increasing awareness of its advantages over traditional liquid therapy, underpins its leadership position.

The ultrasound-guided segment is expected to witness the fastest growth during 2025–2032, driven by the increasing need for precision in treating deep and tortuous veins. Ultrasound technology enhances visualization, allowing clinicians to administer sclerosing agents accurately and safely. Rising adoption of minimally invasive procedures with real-time imaging support fuels growth, especially in advanced vascular centers. Patients benefit from reduced procedural risk and improved outcomes, boosting demand. Expanding availability of ultrasound equipment in emerging markets and training programs for clinicians further accelerates segment growth.

- By Application

On the basis of application, the sclerotherapy market is segmented into venous disease, gastrointestinal bleeding, bronchopleural fistula, cystic disease, and systemic diseases. The venous disease segment dominated the market in 2024, primarily driven by the high prevalence of varicose veins and spider veins globally. Rising patient awareness, coupled with cosmetic concerns and medical necessity for treating venous disorders, is contributing to the segment’s dominance. Sclerotherapy is increasingly preferred over surgical interventions due to its minimally invasive nature, shorter recovery times, and effective outcomes. Strong adoption in outpatient clinics, dermatology centers, and hospitals reinforces market leadership. In addition, ongoing clinical research and support from medical societies for minimally invasive vein treatments are promoting widespread acceptance.

The gastrointestinal bleeding segment is expected to witness the fastest growth during the forecast period, fueled by increasing awareness of endoscopic sclerotherapy techniques for treating esophageal varices and other gastrointestinal bleeding conditions. Advanced sclerosing agents specifically developed for GI applications improve treatment efficacy and safety. Rising prevalence of gastrointestinal disorders and improved hospital infrastructure in emerging economies are also driving growth. The segment benefits from higher adoption in specialized gastroenterology centers, coupled with increasing training programs for healthcare professionals. Patient preference for non-surgical interventions in critical care settings further accelerates demand.

Sclerotherapy Market Regional Analysis

- North America dominated the sclerotherapy market with the largest revenue share of 45% in 2024, attributed to high patient awareness, advanced healthcare infrastructure, and strong presence of leading industry players, with the U.S. witnessing significant uptake in clinics and dermatology centers driven by innovations in sclerosing agents and combination therapies

- Patients and healthcare providers in the region highly value the safety, effectiveness, and minimal downtime offered by sclerotherapy, making it a preferred alternative to surgical interventions for both medical and cosmetic purposes

- This widespread adoption is further supported by advanced healthcare infrastructure, high disposable incomes, and a strong presence of leading industry players, establishing sclerotherapy as a widely accepted vein treatment solution in outpatient clinics, hospitals, and cosmetic centers across the region

U.S. Sclerotherapy Market Insight

The U.S. sclerotherapy market captured the largest revenue share of 82% in 2024 within North America, fueled by the rising prevalence of varicose veins and increasing awareness of minimally invasive cosmetic procedures. Patients are increasingly prioritizing treatments that offer effective results with minimal downtime, discomfort, and scarring. The growing preference for outpatient procedures and non-surgical vein treatments, combined with robust adoption in dermatology and vascular clinics, further propels the sclerotherapy market. Moreover, ongoing advancements in foam and chemical sclerosing agents, alongside integration with ultrasound guidance, are significantly contributing to the market’s expansion.

Europe Sclerotherapy Market Insight

The Europe sclerotherapy market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of venous disorders and rising demand for aesthetic vein treatments. The region’s well-established healthcare infrastructure and high patient awareness are fostering the adoption of sclerotherapy. European patients are also drawn to minimally invasive treatments that reduce recovery time and procedural risks. The market is witnessing growth across hospitals, outpatient clinics, and cosmetic centers, with sclerotherapy being incorporated into both new patient care protocols and upgraded treatment offerings.

U.K. Sclerotherapy Market Insight

The U.K. sclerotherapy market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of cosmetic and minimally invasive vein treatments and increasing focus on patient wellness. In addition, concerns regarding venous health and the cosmetic impact of spider and varicose veins are encouraging patients to choose sclerotherapy over surgical alternatives. The U.K.’s advanced healthcare facilities, high patient awareness, and growing number of specialized clinics are expected to continue stimulating market growth.

Germany Sclerotherapy Market Insight

The Germany sclerotherapy market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of venous diseases and the demand for advanced, minimally invasive treatment solutions. Germany’s strong healthcare infrastructure, emphasis on medical innovation, and high patient safety standards promote the adoption of sclerotherapy, particularly in outpatient clinics and vascular centers. Integration with ultrasound-guided procedures and foam sclerotherapy methods is also becoming increasingly prevalent, with a strong preference for effective and precise vein treatment aligning with local patient expectations.

Asia-Pacific Sclerotherapy Market Insight

The Asia-Pacific sclerotherapy market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by rising prevalence of venous disorders, increasing awareness of minimally invasive cosmetic procedures, and expanding healthcare infrastructure in countries such as China, Japan, and India. The region’s growing inclination towards aesthetic and medical vein treatments, supported by government healthcare initiatives and urbanization, is driving adoption. Furthermore, as APAC emerges as a hub for medical device manufacturing and sclerosing agent production, the affordability and accessibility of sclerotherapy solutions are expanding to a wider patient base.

Japan Sclerotherapy Market Insight

The Japan sclerotherapy market is gaining momentum due to the country’s high patient awareness, advanced healthcare system, and preference for minimally invasive vein treatments. The market places a significant emphasis on safety, precision, and procedural efficacy, driving adoption in both cosmetic and medical applications. Integration of foam sclerotherapy with ultrasound guidance and targeted treatments for varicose and spider veins is fueling growth. Moreover, Japan’s aging population is such asly to spur demand for safer and easier-to-administer vein treatment solutions in both residential and clinical settings.

India Sclerotherapy Market Insight

The India sclerotherapy market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s growing middle class, increasing prevalence of venous disorders, and expanding healthcare infrastructure. India stands as one of the fastest-growing markets for minimally invasive vein treatments, with sclerotherapy gaining popularity in hospitals, outpatient clinics, and cosmetic centers. Government initiatives promoting healthcare access, the rise of urban medical facilities, and the availability of cost-effective sclerosing agents are key factors propelling the market in India.

Sclerotherapy Market Share

The Sclerotherapy industry is primarily led by well-established companies, including:

- LGM Pharma (U.S.)

- Troikaa (India)

- Omega Pharmaceuticals Pvt. Ltd. (India)

- Merz Pharma (Germany)

- Medi-Globe GmbH und ENDO-FLEX GmbH (Germany)

- Perrigo Company plc (Ireland)

- Medtronic (Ireland)

- AngioDynamics (U.S.)

- Boston Scientific Corporation (U.S.)

- Chemische Fabrik Kreussler & Co. GmbH (Germany)

- Cook (U.S.)

- MTW-Endoskopie W. Haag KG (Germany)

- Bioniche Pharma Group (Canada)

- Erbe Elektromedizin GmbH (Germany)

- Applied Biomedical, Inc. (U.S.)

- Stryker (U.S.)

- Smith + Nephew (U.K.)

- Abbott (U.S.)

What are the Recent Developments in Global Sclerotherapy Market?

- In February 2025, Aakash Healthcare Super Specialty Hospital in India, in collaboration with Medtronic plc, a major medical technology company, inaugurated the Aakash Vein Clinic. This new specialized center is North India's first dedicated clinic for comprehensive vein care, offering advanced, minimally invasive treatments for conditions such as varicose veins

- In January 2024, A clinical study was published in the Journal of NeuroInterventional Surgery in early 2024, reporting on the long-term effectiveness of bleomycin sclerotherapy for treating venous vascular malformations (VVMs) of the tongue. The retrospective review, which included data from 2004 to 2024, found that bleomycin sclerotherapy was an effective and well-tolerated treatment option for this challenging condition

- In September 2023, VVT Medical announced that the U.S. Food and Drug Administration (FDA) had cleared its ScleroSafe System. This platform, designed to deliver endovenous chemical ablation to treat superficial varicose veins, is notable for its non-thermal, non-tumescent approach

- In April 2023, VVT Medical, a medical technology company, announced the submission of a 510(k) premarket notification to the U.S. Food and Drug Administration (FDA) for its ScleroSafe System. The system is a non-thermal, non-tumescent device designed to treat varicosities in superficial veins

- In December 2021, Becton, Dickinson and Company (BD), a global medical technology company, announced its acquisition of Venclose, Inc., a provider of solutions for treating chronic venous insufficiency. This acquisition was a strategic move by BD to expand its portfolio in the venous disease space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.